Eaconomy secures prelim injunction against Ali Saleh

![]() Eaconomy has secured a preliminary injunction against Ali Saleh.

Eaconomy has secured a preliminary injunction against Ali Saleh.

Saleh sued Eaconomy in 2023. Saleh claims Eaconomy owes him $150,000.

Eaconomy and owner Hassan Mahmoud filed a counterclaim against Saleh alleging defamation. As part of their counterclaim, Eaconomy and Mahmoud filed for a temporary restraining order and preliminary injunction in April 2024. [Continue reading…]

James Ward settles Apex Financial fraud with SEC

Pending court approval, James Ward has settled Apex Financial securities fraud charges brought against him by the SEC.

Pending court approval, James Ward has settled Apex Financial securities fraud charges brought against him by the SEC.

Apex Financial was an MLM crypto Ponzi launched in 2021. The scheme was built around APT, a token Ward created.

In its September 2024 Complaint, the SEC alleged Ward defrauded “at least 70 investors” out of “at least $852,000”.

A joint motion seeking approval of a consent judgment was filed by the SEC on March 19th. [Continue reading…]

Iqonic Review: Eaconomy collapses, AI trading reboot

Iqonic fails to provide ownership or executive information on its website.

Iqonic fails to provide ownership or executive information on its website.

Iqonic’s website domain (“iqonic.life”), was privately registered on March 1st, 2025.

A BehindMLM reader noted Eaconomy had disabled its website earlier this month.

As at time of publication, April 14th, 2025, that remains the case:

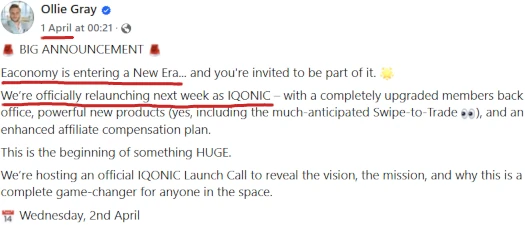

This prompted me to take a closer look, revealing Eaconomy promoters touting an Iqonic reboot circa April 1st;

Eaconomy social media accounts were was abandoned January 2025. Eaconomy owner Hasan Mahmoud’s last FaceBook post is dated November 28th, 2024.

In the post Mahmoud shills some crypto coin:

As far as I can tell, there doesn’t appear to be an official Iqonic reboot announcement.

Nonetheless, Iqonic marketing confirms Mahmoud is still running the company:

- Hassan Mahmaoud [sic] – founder and CEO Iqonic

- Edwin Hayes – President Iqonic

- Jarrod Wilkins – VP of Business Development

Mahmoud made a name for himself promoting Enagic water filters. His first appearance on BehindMLM was in 2019, as co-owner of SilverStar Live.

SilverStarLive was an unregistered MLM trading scheme. A CFTC investigation into SilverStarLive found the company and Mahmoud

acted as commodity trading advisors (“CTAs”) without being registered with the Commission as such, by exercising discretionary trading authority over the forex trading accounts of U.S. customers who were not eligible contract participants (“ECPs”).

Mahmoud settled the CFTC’s fraud allegations in 2019 for $75,000.

After SilverStarLive came Eaconomy, another trading themed MLM company. Eaconomy went on to collapse multiple times. A third and final reboot was launched in 2021.

Since launch, Eaconomy has received regulatory fraud warnings from Canada, Norway, New Zealand, Slovakia, the UK and Czechia.

In the lead up to Iqonic’s launch, Mahmoud sued My Daily Choice and owner Josh Zwagil back in January.

Zwagil retaliated by teaming up with Candace Ross, Mahmoud’s ex-wife and Eaconomy co-founder, to accuse Mahmoud of fraud.

Both lawsuits were dismissed on February 24th, suggesting a settlement was reached. No details have been made public.

Edwin Haynes popped up on BehindMLM’s radar in 2022, as founder and CEO of Axxces.

Axxcess was an MLM trading scheme built around crypto buzzwords and automated “social trading”.

Today Axxces’s website domain is parked. The company’s social media accounts were abandoned in February 2024.

Jarrod Wilkins is an Eaconomy executive carryover:

Considering Eaconomy ownership was a contention point in both January 2025 Eaconomy lawsuits, it remains unclear whether Candace Ross and Josh Zwagil have an ownership stake in Iqonic.

I was able to tie Zwagil (right) directly to Iqonic through the company’s apps. Iqonic uploaded its app to Google Play and Apple Store earlier this month.

Iqonic’s app developer is MLM Protec LLC, a Delaware shell company owned by Zwagil.

Zwagil isn’t disclosed as the owner of MLM Protec LLC on its website. Instead, somewhat deceptively, Zwagil features as a customer testimonial:

Whether Zwagil has an ownership stake in Iqonic or just owns the company developing its app is unclear. It’s extremely likely whatever the case, the details are part of the settlement reached in the January 2025 lawsuits.

Read on for a full review of Iqonic’s MLM opportunity. [Continue reading…]

BehindMLM’s State of the Scam 2025

On April 10th, 2024, BehindMLM turned fifteen. MLM news kept me from publishing this earlier but today we’re taking a look back on the past twelve months.

On April 10th, 2024, BehindMLM turned fifteen. MLM news kept me from publishing this earlier but today we’re taking a look back on the past twelve months.

Welcome to BehindMLM’s State of the Scam 2025. [Continue reading…]

Lufthansa MVP Review: Stolen identity “click a button” Ponzi

Lufthansa MVP fails to provide ownership or executive information on its website.

Lufthansa MVP’s website domain (“lufthansamvp.com”), was registered with bogus details on April 7th, 2025.

Of note is Lufthansa MVP’s website domain being registered through the Chinese registrar Alibaba (Singapore).

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

LoveBiome Review: Tahitian Noni autoship rebooted

LoveBiome fails to provide ownership or executive information on its website.

LoveBiome fails to provide ownership or executive information on its website.

LoveBiome’s website domain (“lovebiome.com”), was registered in September 2021. The private registration was last updated on September 20th, 2024.

Further research reveals Kelly Olsen cited as LoveBiome’s founder and CEO:

Why this isn’t disclosed on LoveBiome’s website is unclear. Especially considering Olsen is quoted in multiple LoveBiome website blog posts.

In one such post, dated June 22nd, 2022 and authored by Disraeli Rangel (?), Olson (right) explains why he “left retirement and started LoveBiome”.

In one such post, dated June 22nd, 2022 and authored by Disraeli Rangel (?), Olson (right) explains why he “left retirement and started LoveBiome”.

My story starts in August 2018, in Tokyo Japan.

After years of fighting to get our original Tahitian Noni brand and culture back on center stage, we held a convention in Tokyo that brought everyone back to the very best years of Morinda and Tahitian Noni International.

It was truly like going home. We had done it; we united our entire worldwide organization again with the story of Tahitian Noni.

Fast forward four months. In December 2018, I hosted a large group of our leaders in Tahiti. It was the perfect conclusion to our year. The spirit was so good, and everyone looked forward to a year of unity and growth.

It didn’t happen.

Arriving home in the Salt Lake City airport after that trip, I received a text message to meet my partner at his home immediately. I went. I arrived at 9 am.

It was there that I learned Morinda had been sold. I was an owner and partner, but the deal was done completely without my knowledge. I found out about it that morning.

I was in shock. The papers were prepared, and my partner put them in front of me with a pen and said, “sign them.”

One hour later I met the new CEO who had arranged the purchase of Morinda. Two hours after that, he gathered the managers of the company together to inform them. It all happened fast—like it had been rehearsed.

Morinda wasn’t sold for TNJ, our amazing workforce, Tahitian Noni, or our culture—all the things we were so proud of.

It was sold to become a platform to sell CBD products. The new management couldn’t have cared less about all those other things.

When the CBD idea flamed out, they continued to aggressively pursue the route of acquisitions and mergers with other companies.

You can see for yourself how that turned out. They took a profitable, united company—on the verge of a breakout year—and turned it into an unrecognizable mess. In just three years.

Following acquisition by NewAge in 2018, Tahitian Noni became “Noni by NewAge“.

The deal called for me to remain employed by the company for three years as a figurehead to help with the transition.

I had no role or responsibilities. I was there just to make people feel some continuity with the past. I hated every minute of it, but I felt I may be able to cushion the blow for our employees and distributors.

The three-year agreement lasted less than 18 months: I was asked to depart in March, 2020.

NewAge filed for Chapter 11 bankruptcy in 2022. The SEC sued former NewAge CEO Brent Willis for alleged fraud around the same time.

NewAge itself settled fraud allegations with the SEC and was sold off.

NewAge’s 2022 bankruptcy marked the end of Tahitian Noni. In 2023 NewAge rebranded as PartnerCo.

Kelly Olsen claims he founded LoveBiome “to try and keep the memories and culture of Morinda and Tahitian Noni alive” (Tahitian Noni rebranded as Morinda in 2012).

LoveBiome provides a corporate address in Utah on its website.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

Modere collapses, no notice to distributors

![]() Modere has collapsed. Earlier today the company published a goodbye message on its website.

Modere has collapsed. Earlier today the company published a goodbye message on its website.

It’s understood that Modere distributors had no prior notice of the collapse. That said, the signs were there. [Continue reading…]

QT Bot Review: Quantitative Trading “click a button” Ponzi

QT Bot fails to provide ownership or executive information on its website.

QT Bot fails to provide ownership or executive information on its website.

QT Bot’s website domain (“559aa.me”), was registered in November 2024. The private registration, which only reveals the registrant’s country as China, was last updated on March 26th, 2025.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

VTS Fund Review: Boris CEO MLM crypto Ponzi

The “VTS” in VTS Fund supposedly stands for “Vector Technology Solution”.

The “VTS” in VTS Fund supposedly stands for “Vector Technology Solution”.

VTS Fund fails to provide ownership or executive information on its website.

Further research reveals VTS Fund citing Stefan Herz as CEO and Andrew Skelzen as CFO:

Over on YouTube we find a rented office marketing video, in which Herz is played by a German-speaking actor in a wig with glasses:

Boris CEO MLM schemes are typically run by eastern European scammers (Russia, Ukraine and/or Belarus). To that end the actor playing Andrew Skelzen has a typical eastern European accent.

Update 14th April 2025 – The actor playing VTS Fund’s Andrew Skelzen has a history of playing fictional executives in Russian Ponzi schemes.

The same actor appeared as “Alex Kapperis” for Resonance Capital:

Resonance Capital was a Boris CEO MLM crypto Ponzi launched in 2017. Kapperis was presented as Resonance Capital’s “Chief Manager of Finance Projects”. /end update

In an attempt to hide its Russian origins, VTS Fund provides investors with a shell company certificates for the UK and Singapore.

Due to the ease with which scammers are able to incorporate shell companies with bogus details, for the purpose of MLM due-diligence these certificates are meaningless.

VTS Fund’s website domain (“vtsfund.com”), was privately registered on September 9th, 2024.

Despite not existing prior to September 2024, on its website VTS Fund falsely states it was “founded in 2023”.

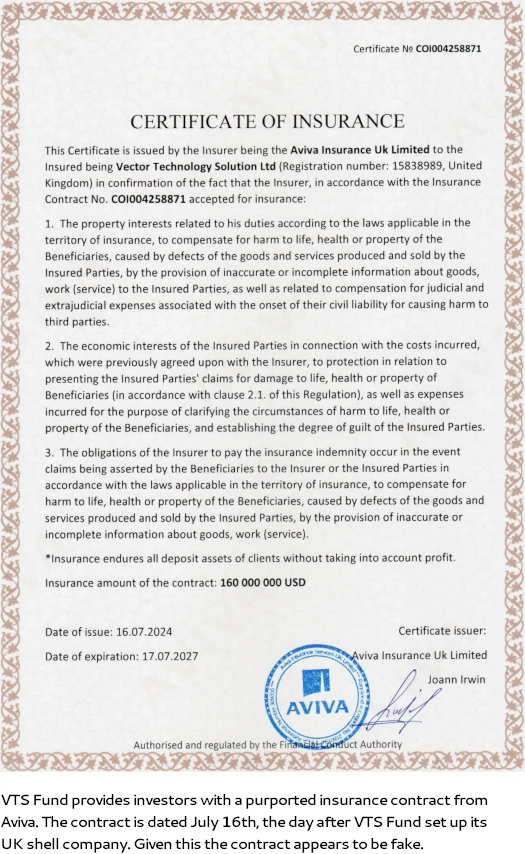

Of note is VTS Fund providing investors with a purported Aviva insurance contract;

Fake insurance contracts aren’t common but have been presented by Boris CEO Ponzi schemes before.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

Q-Research Review: Quantitative trading “click a button” Ponzi

Q-Research fails to provide ownership or executive information on its website.

Q-Research fails to provide ownership or executive information on its website.

Q-Research’s website domain (“q-research.vip”), was registered with bogus details on March 27th, 2025.

Of note is Q-Research’s website domain being registered through the Chinese registrar Alibaba (Singapore).

Q-Research has already attracted the attention of financial regulators. The Central Bank of Russia issued a Q-Research pyramid fraud warning on April 8th, 2025.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]