SEC sues James Ward over Apex Financial fraud

James O. Ward Jr., an Alabama resident, has been sued by the SEC over fraud allegations relating to his Apex Financial investment scheme.

James O. Ward Jr., an Alabama resident, has been sued by the SEC over fraud allegations relating to his Apex Financial investment scheme.

As per the SEC’s September 10th, 2024 filed Complaint, Ward, through Apex Financial, defrauded “at least 70 investors” out of “at least $852,000”.

Ward set up Apex Financial in 2021 as a shell company in the British Virgin Islands. Ward’s partners in the venture were Jason Rose and Hitesh Juneja.

BehindMLM reviewed Apex Financial in April 2021, identifying it as a Ponzi scheme built around APT token.

The SEC identifies Apex Financial as a “private fund” Ward falsely represented was “an actual hedge fund”.

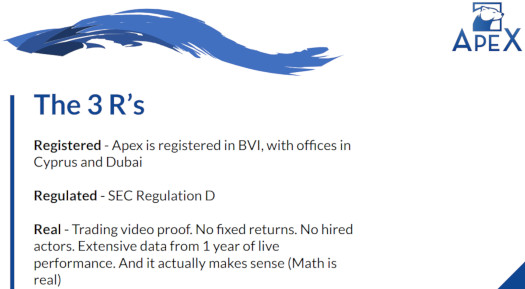

As identified by the SEC, false marketing claims Ward made include Apex Financial

- was regulated (registered) with the SEC;

- had $25 million in assets;

- “had successfully conducted a 12-month beta test of its trading strategies”;

- generated external revenue via “trading strategies that offered investors the opportunity to experience substantial gains without any risk of loss”; and

- had “several international offices”

In reality, while Apex hoped to open offices at some point, it never had any offices; rather, it was run remotely out of the homes of its three principals.

Below is an Apex Marketing financial slide presented by Ward, cited by BehindMLM in its 2021 review:

Further to his efforts to solicit investment by deception, Ward also lied about previous associations with fraudulent investment schemes.

Ward also touted his own credibility and integrity, telling prospective investors that he would never be involved in an illegitimate enterprise.

Yet he failed to disclose that he previously had engaged in a $20 million Ponzi scheme and directed accomplices to destroy documents after receiving a subpoena from the Federal Trade Commission (“FTC”) relating to that Ponzi scheme.

Ward settled with the CFTC in January 2023. The CFTC’s case tied Ward to JetCoin, an MLM crypto Ponzi launched prior to Apex Financial.

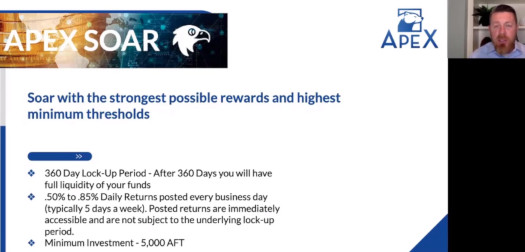

At the core of Apex Financial’s unregistered securities offering was Apex Financial Token (APT token).

A key component of Ward’s sales pitch was the “Apex Financial Token,” which Ward falsely claimed was pegged to the U.S. dollar.

In fact, there was no token. AFT … never existed and nothing about the fictitious token was pegged to the dollar.

As opposed to the marketing baloney Ward was feeding Apex Financial investors, here’s what actually happened;

Apex invested the majority of investor proceeds in third-party funds. From the outset, these investments sustained substantial losses.

In or around September 2021, Apex stopped accepting investments and subsequently began to wind down its operations.

The SEC notes in its Complaint that after Apex Financial collapsed, Rose and Juneja “used their personal funds to help repay investors.”

Ward did not contribute any of the money used to repay investors.

James Ward doubled down on fraud and went on to launch Full Velocity in March 2022.

Full Velocity collapsed in May 2022, generating upwards of 90% in losses for investors. Whether Ward will face fraud charges in relation to Full Velocity remains to be seen.

In the meantime, across three counts of fraud related to Apex Financial, the SEC has charged Ward with multiple violations of the Securities and Exchange Act.

The SEC is seeking a permanent injunction against Ward, prohibiting him from having anything to do with securities, as well as civil penalties.

Disgorgement isn’t specifically requested by the SEC has asked the court for “such other and further relief”.

It is unclear whether Jason Rose and Hitesh Juneja will be charged for their involvement in Apex Financial. I’m leaning towards “no” given the repayments and assumed cooperation with the SEC.

Stay tuned for updated as BehindMLM continues to track James Ward’s Apex Financial fraud case.

Update 10th October 2024 – James Ward filed his answer to the SEC’s Complaint on October 4th.

Later that same day Ward also filed a motion requesting a transcript of the SEC’s deposition of Hitesh Juneja.

From the motion;

I, James O. Ward, Jr., the Defendant in the above-referenced case, respectfully submit this motion to request access to the deposition transcript of Hitesh Juneja, which was taken in connection with this case.

The deposition of Mr. Juneja contains critical information directly related to my defense, particularly regarding the decision-making process within Apex Financial Institute.

As a 33% owner responsible primarily for marketing and presentations, I did not have any control over or access to the financial decisions made by Apex, nor did I manage the flow of funds. I believe that the deposition of Mr. Juneja will corroborate this fact.

A decision on Ward’s motion remains pending.

Update 13th December 2024 – No update on Ward’s motion above but the court has tentatively set a schedule that will the case go to trial in early 2026.

Jury selection is scheduled for January 6th, 2026, with actual trial dates to be scheduled at the final December 4th, 2025 pre-trial conference.

Update 15th April 2025 – James Ward has settled with the SEC.

Article updated with latest on Ward’s SEC case.

Where can I read Ward’s response and the current status? I was in Full Velocity and have no updates…

You can follow the case on Pacer. Failing which BehindMLM is covering the case but don’t expect “up to the minute” updates, there’s a lot of cases on the calendar.

Not expecting this one to go to trial but, based on scheduling, it looks like SEC v. Ward will go to trial in early 2026 if the case gets that far.

I was scammed by James Ward through Full Velocity. I live in the uk and would like any updates on any prosecutions and opportunities to get my funds back