Daisy launches “Blockchain Sports” NFT grift Ponzi

![]() Having exhausted its fictional trading Ponzi across at least three collapsed reboots, Daisy’s new Ponzi ruse is “Blockchain Sports” NFTs. [Continue reading…]

Having exhausted its fictional trading Ponzi across at least three collapsed reboots, Daisy’s new Ponzi ruse is “Blockchain Sports” NFTs. [Continue reading…]

Steven Chiang cops $3.3 million Nasgo fraud judgment

Following a Motion for Judgment filed on January 31st, Steven Chiang copped a $3.3 million judgment on February 1st. [Continue reading…]

Following a Motion for Judgment filed on January 31st, Steven Chiang copped a $3.3 million judgment on February 1st. [Continue reading…]

Troy Sutton settles Profit Connect fraud with Receiver

Following notice of a provisional settlement filed last November, Troy Sutton’s Profit Connect settlement has been approved. [Continue reading…]

Following notice of a provisional settlement filed last November, Troy Sutton’s Profit Connect settlement has been approved. [Continue reading…]

Bavarsis Review: Arbitrage ruse Boris CEO Ponzi scheme

Bavarsis fails to provide verifiable ownership or executive information on its website.

Bavarsis fails to provide verifiable ownership or executive information on its website.

Bavarsis’ website domain (“bavarsis.com”), was registred back in December 2022.

The private registration was last updated on September 29th, 2023. This ties into Bavarsis launched in October 2023.

In an attempt to appear legitimate, Bavarsis provides shell company details for Bavarsis PTY LTD (Australia) and Bavarsis Holdings Limited (Hong Kong).

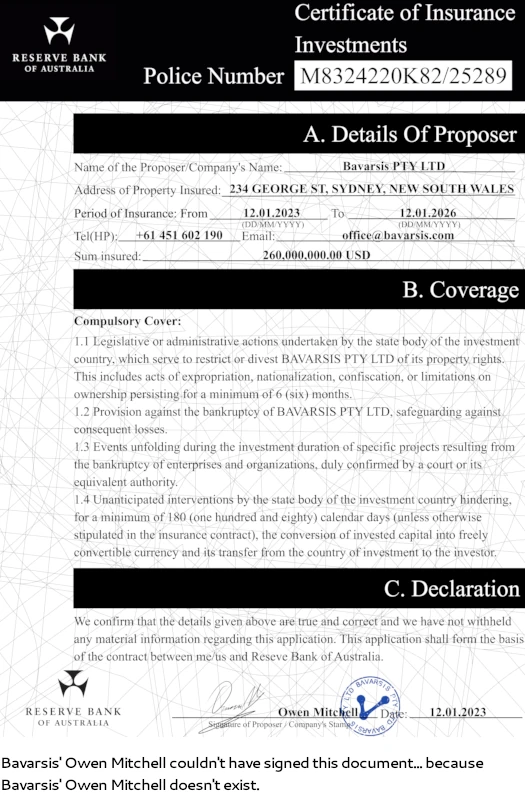

A fake Reserve Bank of Australia “certificate of insurance investments” certificate is also provided.

Australian shell company registration typically ties into registration with the Australian Securities and Investment Commission (ASIC).

ASIC are known for non-regulation of MLM fraud. Furthermore anyone can register a company with ASIC using whatever bogus details, there is no verification.

For this reason ASIC registration is favored by scammers residing outside of Australia.

With respect to MLM due-diligence, ASIC registration certificate as proof of legitimacy is therefore meaningless.

Also meaningless is Bavarsis registering a shell company in Hong Kong. For the purpose of MLM due-diligence, shell company registration in any jurisdiction is meaningless.

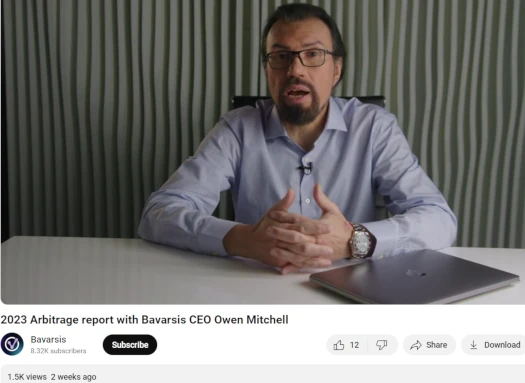

On its website, Bavarsis cites its CEO as Owen Mitchell. Mitchell of course doesn’t exist outside of Bavarsis’ marketing.

Over on Bavarsis’ official YouTube channel, Mitchell is played by an actor with an eastern European accent:

Boris CEO schemes are typically the work of Russian scammers.

Supporting this is SimilarWeb tracking Russia as the top source of Bavarsis’ website traffic for January 2024 (69%).

Promotion of Bavarsis has already caught the attention of Russian authorities. The Central Bank of Russia issued a Bavarsis pyramid fraud warning on February 15th.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

Arbimex Review: AI trading bot ruse MLM crypto Ponzi

![]() Arbimex operates in the MLM cryptocurrency niche.

Arbimex operates in the MLM cryptocurrency niche.

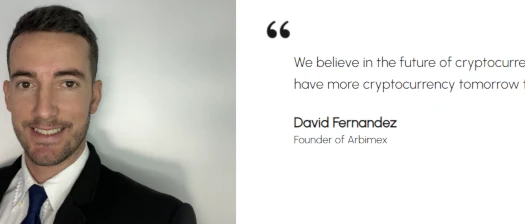

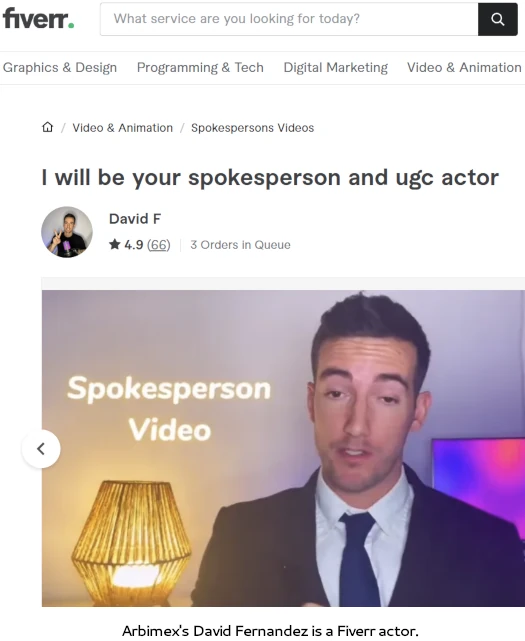

The company is purportedly headed up by “David Fernandez”:

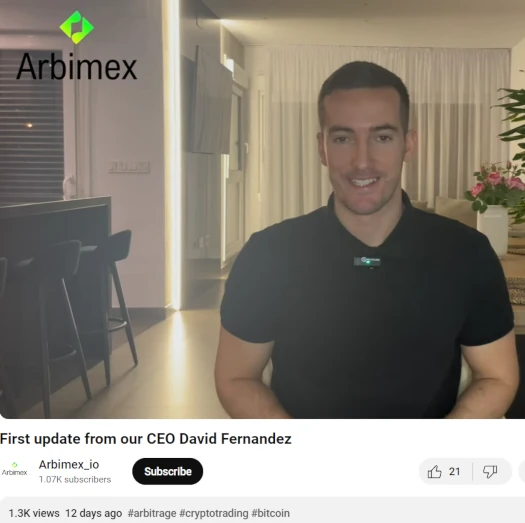

Over on Arbimex’s official YouTube channel, Fernandez introduces himself as “founder and CEO” of the company.

Arbimex does provide a corporate bio for Fernandez but its pretty vague:

David Fernandez is a Spanish entrepreneur and founder of Arbimex. He is also the mastermind behind Arbimex’s artificial intelligence software.

The reason for this is Fernandez is a Fiverr actor:

In an attempt to appear legitimate, Arbimex provides UK shell company details for Arbimex Limited.

Arbimex Limited was registered in the UK on October 27th, 2023.

An MLM company operating or claiming to operate out of the UK is a red flag.

UK incorporation is dirt cheap and effectively unregulated. On top of that the FCA, the UK’s top financial regulator, do not actively regulate MLM related securities fraud.

As a result the UK is a favored jurisdiction for scammers looking to incorporate, operate and promote fraudulent companies.

For the purpose of MLM due-diligence, incorporation in the UK or registration with the FCA is meaningless.

Who is actually running Arbimex remains unclear, but Boris CEO schemes are typically the work of Russian scammers.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

Xsignal Review: Web3 + AI grift MLM crypto Ponzi

Xsignal fails to provide ownership or executive information on its website.

Xsignal fails to provide ownership or executive information on its website.

Xsignal’s website domain (“xsignal.biz”), was privately registered on August 3rd, 2023.

As of January 2024, SimilarWeb tracked top sources of traffic to Xsignal’s website as Poland (46%) and Bangladesh (12%).

Neither of these figures is high enough to tie Xsignal ownership to a country, but gives you an idea of where recruitment is active.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

DynaMaxx Review: Supplements + autoship recruitment

![]() DynaMaxx fails to provide ownership or executive information on its website.

DynaMaxx fails to provide ownership or executive information on its website.

DynaMaxx’s website domain (“dynamaxx.com”), was first registered in 2009. The private registration was last updated on August 20th, 2023.

In sussing out Dynamaxx’s website I found three social media profile links to Gemini Network. Although the links still exist on Dynamaxx’s website, Gemini Network’s Facebook, Twitter and Instagram profiles have all been deleted.

In any event this led me to Jay Archer:

On LinkedIn Archer cites himself as owner of both Gemini Network and DynaMaxx. DynaMaxx appears to have been founded in 2009.

Why Jay Archer isn’t disclosed as owner and CEO on DynaMaxx’s website is unclear.

In April 2023 Full Alliance Group announced it was merging with DynaMaxx.

Full Alliance Group, Inc. operating in the health and nutraceutical space, as part of its plan to build organically and buy strategically, announces it has entered into a plan of merger with DYNAMAXX International LTD.

DYNAMAXX is a holding company operating in the direct selling channel with its main operations in the United States and Canada.

Full Alliance Group has its own website up, on which Dynamaxx is listed as one of “our companies”.

Gemini Network isn’t featured on Full Alliance Group’s website. Additionally, Gemini Network links I found redirect to DynaMaxx.

This suggests that Gemini Network collapsed sometime after launching in 2018.

Although no corporate address is provided on Dynamaxx’s website, on FaceBook Archer cites himself as a Florida resident. Full Alliance Group is also based out of Florida.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

Xcelerate Review 2.0: “Pay a fee for discounts” reboot

BehindMLM initially reviewed Xcelerate back in October 2022.

BehindMLM initially reviewed Xcelerate back in October 2022.

Back then Xcelerate was a simple MLM opportunity, built around reselling Renssli Corp fuel tabs. In October 2023 we noted Xcelerate had transitioned to marketing white labelled supplements.

Following compensation plan changes, a reader wrote in requesting an updated Xcelerate review.

Today we’re revisiting Xcelerate to see what’s changed. [Continue reading…]

VBit Technologies desist & refrain order from California

The collapsed VBit Technologies Ponzi scheme has received a desist and refrain order from California’s Department of Financial Protection and Innovation (DFPI).

The collapsed VBit Technologies Ponzi scheme has received a desist and refrain order from California’s Department of Financial Protection and Innovation (DFPI).

VBit Technologies associated companies cited by the DFPI in their January 31st order include: [Continue reading…]

My Daily Choice discloses data breach, then covers it up

On or around February 15th My Daily Choice pulled its website offline.

On or around February 15th My Daily Choice pulled its website offline.

The functioning website was replaced by a warning message, disclosing to consumers that My Daily Choice had suffered a data breach.

Less than 48 hours later, the message was removed – leaving affected consumers vulnerable and in the dark. [Continue reading…]