TranzactCard Review: Richard Smith returns with new card opp

![]() TranzactCard operates in the banking and cashback MLM niches.

TranzactCard operates in the banking and cashback MLM niches.

On its website, TranzactCard identifies its Founder and Chairman as Richard Smith.

On the corporate side of things;

TranzactCard LLC is a wholly owned subsidiary of TZT Holdings LLC. TZT Holdings owns the brand “TranzactCard” and the TranzactCard Financial Ecosystem.

On LinkedIn Smith cites himself as TZT Holdings’ Executive Chairman.

Long story short, Richard Smith owns and operates TranzactCard.

TranzactCard operates from two primary website domains; “tranzactcard.com” and “mytzt.com” – both first registered in April 2021, with private registrations last updated on April 29th, 2023.

Although we didn’t know it at the time, BehindMLM first came across Richard Smith’s MLM work with Divvee in mid 2016.

Instead of the fronting the company he was a co-founder of, Smith initially hid behind CEO Allen Davis.

Divvee’s original concept flopped and it was rebooted as Divvee Rank and Share in November 2016. Sometime after Smith and co-founder Troy Muhlestein became the face of the company.

By July 2017 it was apparent Divvee Rank and Share had also flopped. This prompted a pivot to forex trading securities and commodities fraud.

Update 7th November 2023 – Back in 2010 Smith was was criminally charged with securities fraud in Utah.

The charges pertained to Ascendus and FFCF, two Ponzi schemes that defrauded consumers out of around $10.9 million dollars.

In November 2012 a court-appointed FFCF Receiver secured a $3.2 million default judgment against Smith.

In January 2017 Smith pled guilty to one count of Pattern of Unlawful Conduct, a second degree felony.

Smith was sentenced to pay $200,000 in restitution of which he has paid $100,000 with the remaining $100,000 to be paid in monthly installments of $1,667 for the next five years, which is the period of his probation, plus 250 hours of community service.

Smith’s sentencing was recorded on page 3 of a meeting minutes filing from the Utah Division of Securities Commission. /end update

After Divvee we had Nui – a continuation of the aforementioned securities and commodities fraud.

Nui devolved into a bunch of crypto schemes led by Darren Olayan. The mess culminated in Texas issuing a securities fraud cease and desist in July 2018.

The Texas State Securities Board would go on to fine Nui $25,000 in February 2019.

I don’t know exactly when Richard Smith left Nui but he resurfaced with The Digital Vault and RevvCard in March 2019.

The Digital Vault and RevvCard were supposed to bring fiat banking services to Nui’s crypto fraud.

In April 2019 The Digital Vault relaunched as R Network. RevvCard still hadn’t launched and wasn’t due to launch for another eight months.

By mid 2020 the original concept for RevvCard had been scrapped. Smith began offering stock ownership in R Network, despite neither himself or the company being registered with the SEC.

What was left of R Network quietly died off after that. In March 2021 what was left of R Network was sold off to iX Global.

We didn’t hear anything further from Smith until TranzactCard surfaced on or around April 2023.

Read on for a full review of TranzactCard’s MLM opportunity.

TranzactCard’s Products

TranzactCard markets a VISA credit card.

TranzactCard is (a) the digital and plastic transaction card that carries the approved Visa bank card brand and can be used anywhere in the world that Visa is accepted, and (b) the public facing brand of the TranzactCard Financial Ecosystem.

TranzactCard’s website Terms of Service reveal the card is issued through CBW Bank.

This TranzactCard Visa Credit Card Agreement (this “Agreement”) constitutes a legal agreement between CBW Bank, Member FDIC (“Bank” and, together with Bank’s successors and assigns, “We”, “Us” and “Our”) and the individual (“You” or “Your”) that applied and qualified for the TranzactCard Visa® Credit Card (“Card”).

TranzactCard’s official FAQ adds another bank to the mix;

Evolve Bank and Trust, N.A. is the current bank during the soft launch of TranzactCard.

Functionality wise TranzactCard’s VISA card has daily and monthly caps in place:

Currently the security limits for your TranzactCard account are $5,000.00 per day with a maximum limit of $15,000.00 per month.

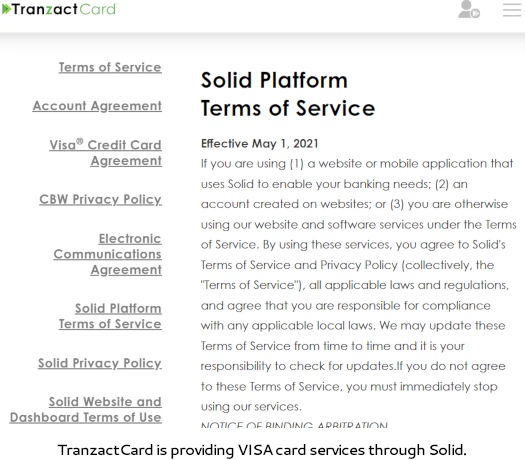

Update 24th June 2023 – Following a reader tipoff I was able to confirm TranzactCard’s VISA card is a whitelabel of Solid Financial Technologies, dba Solid.

Solid Financial Technologies, Inc. and our affiliates or subsidiaries is banking as a software (BaaS) layer between banks, and the financial technology platforms using our services.

We provide Platforms banking services (e.g. bank transfers or accounts) to you through Solid’s bank partners.

Payments and Card services are provided by Solid’s partner banks, that are members of the FDIC.

Solid launched in 2021 and are based out of California in the US. /end update

Both retail customers and recruited affiliates can sign up for a TranzactCard card.

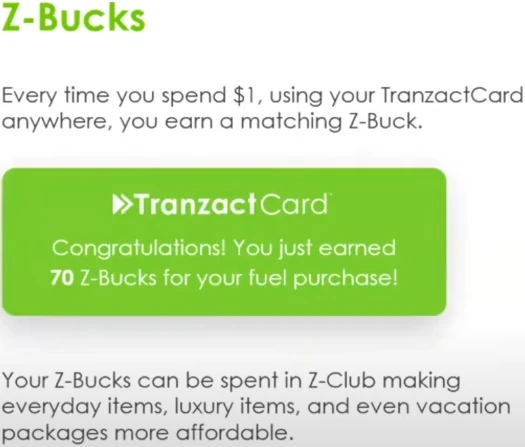

One of the selling points of TranzactCard’s VISA card is Z-Bucks.

Z-Bucks are awarded at a rate of $1 spent on the card = 1 Z-Buck.

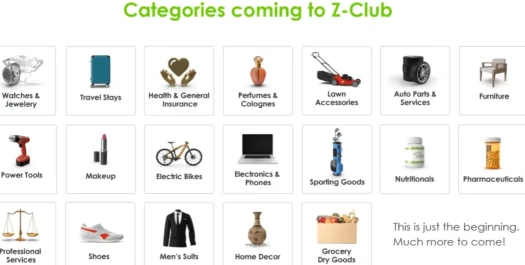

TranzactCard represents that Z-Bucks can be used to purchase products and services from an internal marketplace.

Note that actual money can be combined with Z-Bucks on internal TranzactCard marketplace purchases.

TranzactCard card membership is $25 for 12 months and then either $4.95 a month or $47.50 annually.

TranzactCard’s Compensation Plan

TranzactCard’s compensation plan pays on usage of the company’s VISA card by retail customers and recruited affiliates.

TranzactCard calculates commissions using “Basis Points”.

Basis Points (BPs) are specifically calculated on

transaction interchange fees, earnings from bank fees, bank incentives, product margins, ad vendor volume incentives.

These transactions are counted from referred retail customers and a TranzactCard’s recruited downline.

TranzactCard assigns Basis Points a 0.0001% percent value of each transaction in the categories above made.

With respect to commissions paid out, TranzactCard caps commissions earnable from TranzactCard usage by recruited downline affiliates at 30%.

If the actual amount is less than 30%, the payable ratio is lowered until a 30%/70% ratio between downline affiliate card usage and downline retail customers is reached.

TranzactCard Affiliate Ranks

There are six affiliate ranks within TranzactCard’s compensation plan.

Along with their respective qualification criteria, they are as follows:

- Digital Branch Office (DBO) – sign up as a TranzactCard affiliate, pay monthly fees and personally refer at least three retail TranzactCard members

- Manager – continue to pay monthly fees, generate and maintain twelve retail TranzactCard members across your downline and recruit and maintain three Digital Branch Offices or higher

- Senior Manager – continue to pay monthly fees, generate and maintain thirty-nine retail TranzactCard members across your downline, personally recruit and maintain three Managers or higher and generate and maintain a total downline of twelve DBO or higher ranked affiliates

- Vice President – continue to pay monthly fees, generate and maintain one hundred and twenty retail TranzactCard members across your downline, personally recruit and maintain three Senior Managers or higher and generate and maintain a total downline of thirty-nine DBO or higher ranked affiliates (at least nine must be Manager or higher)

- Senior Vice President – continue to pay monthly fees, personally refer and maintain six retail TranzactCard members, generate and maintain seven hundred and twenty-six retail TranzactCard members across your downline, personally recruit and maintain six Vice Presidents or higher and generate and maintain a total downline of two hundred and forty DBO or higher ranked affiliates (at least fifty-four must be Manager or higher)

- President – continue to pay monthly fees, personally refer and maintain nine retail TranzactCard members, generate and maintain one thousand and eighty-nine retail TranzactCard members across your downline, personally recruit and maintain nine Vice Presidents or higher and generate and maintain a total downline of three hundred and sixty DBO or higher ranked affiliates (at least eighty-one must be Manager or higher)

Required referred retail customers can either be personally referred customers or referred by recruited downline affiliates.

Note that to qualify towards rank qualification, referred retail customers and recruited affiliates must be paying monthly fees.

Retail Commissions

TranzactCard affiliates receive Basis Points off transactions generated by personally referred retail customers based on rank:

- DBOs receive 10 BPs per personally referred retail transaction or 5 BPs per transaction from a company assigned retail customer

- Managers receive 12 BPs per personally referred retail transaction or 6 BPs per transaction from a company assigned retail customer

- Senior Managers receive 14 BPs per personally referred retail transaction or 7 BPs per transaction from a company assigned retail customer

- Vice Presidents receive 16 BPs per personally referred retail transaction or 8 BPs per transaction from a company assigned retail customer

- Senior Vice Presidents receive 18 BPs per personally referred retail transaction or 9 BPs per transaction from a company assigned retail customer

- Presidents receive 20 BPs per personally referred retail transaction or 10 BPs per transaction from a company assigned retail customer

Residual Commissions

TranzactCard pays residual commissions via a unilevel compensation structure.

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

Residual commissions are paid as the sum total of Basis Points generated on up to ten unilevel team levels.

How many unilevel team levels a TranzactCard affiliate receives Basis Points on is determined by rank:

- DBOs are paid on up to five unilevel team levels, they get 5 BPs on downline referred retail customers, 10 BPs on personally recruited affiliates (level 1) and 5 BPs on downline recruited affiliates across levels 2 to 5

- Managers are paid on up to six unilevel team levels, 6 BPs on downline referred retail customers, 12 BPs on personally recruited affiliates (level 1) and 6 BPs on downline recruited affiliates across levels 2 to 6

- Senior Managers are paid on up to seven unilevel team levels, 7 BPs on downline referred retail customers, 14 BPs on personally recruited affiliates (level 1) and 7 BPs on downline recruited affiliates across levels 2 to 7

- Vice Presidents are paid on up to eight unilevel team levels, 8 BPs on downline referred retail customers, 16 BPs on personally recruited affiliates (level 1) and 8 BPs on downline recruited affiliates across levels 2 to 8

- Senior Vice Presidents are paid on up to nine unilevel team levels, 9 BPs on downline referred retail customers, 18 BPs on personally recruited affiliates (level 1) and 9 BPs on downline recruited affiliates across levels 2 to 9

- President – are paid on up to nine unilevel team levels, 10 BPs on downline referred retail customers, 20 BPs on personally recruited affiliates (level 1) and 10 BPs on downline recruited affiliates across levels 2 to 10

Rebate Check Bonus

When a TranzactCard affiliate qualifies at Manager they receive a $500 rebate check.

What a rebate check is isn’t clarified but it sounds like a credit against their Visa card spend.

Manager Development Grants

The Manager Development Grant is a bonus paid when downline when downline TranzactCard affiliates qualify at Manager.

- Managers receive a $50 Manager Development Grant across six unilevel team levels

- Senior Managers receive a $50 Manager Development Grant across seven unilevel team levels

- Vice Presidents receive a $50 Manager Development Grant across eight unilevel team levels

- Senior Vice Presidents receive a $50 Manager Development Grant across nine unilevel team levels

- Presidents receive a $50 Manager Development Grant across ten unilevel team levels

Leadership Bonus

The Leadership Bonus is a monthly bonus, paid on the amount of Manager and higher ranked affiliates in a TranzactCard affiliate’s downline.

- Managers receive $6 a month per recruited Manager or or higher across six unilevel team levels

- Senior Managers receive $7 a month per recruited Manager or higher across seven unilevel team levels

- Vice Presidents receive $8 a month per recruited Manager or higher across eight unilevel team levels

- Senior Vice Presidents receive $9 a month per recruited Manager or higher across nine unilevel team levels

- Presidents receive $10 a month per recruited Manager or higher across ten unilevel team levels

Matching Bonus

Senior Manager and higher ranked TranzactCard affiliates earn a Matching Bonus on Leadership Bonuses paid to personally recruited lower ranked Managers and higher.

E.g. if you’re a Vice President you’ll earn the Matching Bonus on personally recruited Managers and Senior Managers.

Power Save Account

TranzactCard offers a Power Save Account.

In a marketing video on the official TranzactCard YouTube channel, Eric H. Allen claims the Power Save Account provides a

fixed interest rate, higher than any bank you’ve ever seen. And the other part is going to be variable interest tied to our real-estate investment trust.

TranzactCard affiliates build their Power Save Account balance through three methods:

- 1% of Z-Bucks spent is contributed the Power Save Account

- a 2-4% cashback offered at retailers is sent to the Power Save Account

- every purchase made with a TranzactCard can be rounded up to the nearest dollar, with the rounded up amount sent to the Power Save Account; and

Joining TranzactCard

TranzactCard affiliate membership is $495 and then $150 a month.

TranzactCard Conclusion

If you take out the Power Save Account, TranzactCard is basically a cashback opportunity with an MLM compensation plan.

Your compensation, including bonuses, is solely dependent on the transactions of Members and annual card membership fees within your Digital Branch Community.

Compliance wise TranzactCard has a retailable product (the card), and there’s a decent effort to encourage retail customer referrals via hard personal and downline retail customer requirements.

To get into the Power Save Account we first need to look at Z-Bucks.

Z-Bucks are essentially cashback which can only be spent within TranzactCard. This isn’t unusual with card offerings although cashback is usually just returned as cash.

I wanted to clarify that because spending Z-Bucks seems to be a primary way to build a Power Save Account.

An official TranzactCard “Glossary of Terms” document defines the Power Save Account as

a long-term savings account that grows steadily and automatically, building financial momentum.

Compounding is mentioned in TranzactCard’s marketing, so this is very much an savings/investment account paying a passive return.

That side of the Power Save Account is definitely a security. Where I pause though is on how the funds get into the Power Save Account.

First, if you’re like me, you might be wondering whether it’s actual money or Z-Bucks that go into the Power Save Account.

As revealed by Eric H. Allen in the previously cited official TranzactCard marketing video, it’s actual money.

[5:32] 1% of all the Z-Bucks you burn is going to go in this Power Save Account.

So you burn 100 Z-Bucks, a dollar cash goes in your Power Save Account.

So we’ve established the Power Save Account is real money and not Z-Bucks.

As far as I can tell, there’s no direct way for a TranzactCard affiliate to deposit/invest into the Power Save Account. And, if I’m not mistaken, this is what Richard Smith is hinging TranzactCard’s securities compliance on.

What it basically comes down to, with respect to the Howey Test, is whether TranzactCard’s indirect funding of Power Save Account count as a deposit/investment?

I can’t directly answer that because this is the first time I’ve seen this specific type of set up. Honestly, I’m not 100% sure on making a securities fraud call either way.

Props to Richard Smith for throwing me a curveball.

After thinking about it for a bit, what I can provide is comparison to a pretty similar model – Zeek Rewards’ “VIP bids”.

Zeek Rewards was set up such that direct investment was also not possible. Affiliates had to invest in “VIP bids”, VIP bids were dumped on non-affiliate accounts, which generated “VIP Reward Points”.

VIP Reward Points were internally worth $1 each. Crucially to Zeek Rewards’ investment scheme, they were held in an account on which a daily ROI was paid.

The daily ROI could be compounded, in much the same manner TranzactCard’s Power Save Account does.

To better illustrate the similarities, here’s a breakdown:

Zeek Rewards:

- real money invested in VIP Bids (real money in)

- bids dumped on accounts (action)

- VIP Points generated based on 1:1 with VIP Bids dumped (action 2)

- passive ROI paid on VIP Point balance that can optionally be auto-compounded (ROI).

TranzactCard:

- real money spent on whatever and Z-Bucks generated (not quite the same as real money in but real money spent)

- Z-Bucks spent again on whatever internally (action)

- 1% of V-Bucks spent internally = $1 generated in Power Save Account, or cashback or rounding up (action 2)

- passive ROI paid on dollar amount in Power Save Account that can optionally be auto-compounded (ROI)

Like I said it’s not a 1:1 comparison but the general theme is there. I suppose a key difference is that Zeek Rewards took in real money paid for VIP Bids, whereas TranzactCard’s VISA card can be spent anywhere.

This does raise the question of how TranzactCard’s passive returns are going to be generated. TranzactCard claim it’s a “fixed interest rate” plus a “variable rate” from a “real-estate investment trust”.

No specific details about this have been made public. This might be violation of the FTC Act (disclosures), as well as a securities compliance issue in and of itself.

Remember, TranzactCard’s official marketing videos promise a “fixed interest rate, higher than any bank you’ve ever seen”. Not disclosing how is a problem.

I also might be suffering from a bit of “Ponzi brain” here. If TranzactCard’s returns are calculated annually and aren’t too outrageous, they could be legitimately generated.

I feel there needs to be regulatory filings though, especially with TranzactCard marketing Power Save Account as a comparable bank account.

Paid fees are an elephant in the room. Especially the $495 TranzactCard affiliate fee. What on Earth is that going towards?

Could there be recycling of TranzactCard’s membership fees on the backend? Maybe. Consumers can’t make an educated due-diligence call because TranzactCard doesn’t provide audited financial reports.

Bottom line? I’m not 100% on TranzactCard committing securities fraud but I’m smelling smoke. And that smoke is thick given Smith’s past brushes with securities fraud.

The last thing I’ll finish on is TranzactCard’s own income examples.

As above, in TranzactCard’s own income examples, affiliates are losing money. The above example provides a $12,000 spend coming to $12 a month in commissions.

This same affiliate would need to generate $150,000 a month in spend just to break even.

I’m not saying it’s impossible but is it realistic for your average TranzactCard affiliate?

Approach with caution.

Update 26th June 2023 – Shortly after this review as published, TranzactCard deleted the cited marketing video featuring Eric H. Allen discussing the Power Save Account.

In fact all previously public videos have been deleted. The one video TranzactCard serves on its website from its YouTube channel is now a non-searchable unlisted video.

A link to the cited Eric H. Allen video was originally included in the review. Due to TranzactCard deleting the video from their YouTube channel, I’ve now disabled the link.

Update 4th February 2024 – TranzactCard has collapsed. On February 3rd it was announced the company is rebooting as FinMore.

Update 13th April 2024 – FinMore has collapsed.

$150 a month to use a catalog card and shop in an Amway shopping center. Pathetic.

These leaders that are promoting this program. No one should ever join them again in anything. They will do anything to their teams.

No due diligence and the company is not even launched yet just like his last company.

No monthly fees when you reach Manager….

Condemed before investigation…

Some of the information presented here is not what the website states…

God Bless them as they try to make a difference in this tough world we are being forced to endure.

God Bless you all.

Monthly fees don’t go away just because commissions are redirected.

This review is based on TranzactCard’s official marketing material… which is hidden from consumers.

They are still putting the Franchise papers together, but 1% of swipes on card, lower than approximately 14-26% Franchise fees for most other projects.

Not hidden, everything is out and will be stated when they launch in November.

More materials will be added shortly, enjoy the ride!

Blessings to you all.

Question ?

If a Company is suppose to be built on Transparency ….. Then why would they HIDE Information from Consumers ??

Curious ???

Larry has a point.

I don’t blame Oz for not knowing this, it isn’t written down anywhere so you more or less have to watch the right video to find it out.

But to be a Digital Branch Office (DBO) you pay $495 one time and $150 a month.

But once you recruit 3 more DBOs you become a Digital Branch Manager (DBM). You receive $500 and instead of paying $150/month you only pay 1% of your monthly commissions.

This means instead of losing almost $150/month as near all DBOs will be, DBMs will be making slightly better than nothing (plus Z-Bucks).

Why am I so jaundiced as to the revenue potential of this opportunity? Look at the last graphic in Oz/s article.

The three Tranzactcard holders in “Erica’s” dowline spent $12,000 on their cards last month and Erica earned a grand total of $12 bucks off of it.

If Erica is a DBO she did in fact lose $138 last month as Oz pointed out but if she was a DBM she would have made a grand total of $11 dollars and 88 cents.

You need to sponsor hundreds if not more Tranzact Card holders to make any appreciable money in this deal.

And the structure here guaranties that there will be only one DBM (minor money maker) for every three DBOs (major money losers).

Yes but Z-Bucks what about Z-Bucks !!!

Here’s where Richard Smith’s reputation proceeds him. TranzactCard is only in “prelaunch.” Much like rNetwork was in near perpetual prelaunch, Tranzact Card wont “officially” launch till some time in November.

By that time all the “bugs” will be worked out the system and there will literally be “millions of SKUs” in the Z-Buck store.

All of Richard Smith’s pie in the sky promises happen later. Assuming they ever happen at all.

Shouldn’t this fall apart with the 30% recruited affiliate cap?

If all you’re doing is recruiting and you’re still getting paid, TranzactCard’s pyramid compliance is lip-service.

@Larry

If it’s not on the website it’s hidden. MLM companies hiding crucial information from consumers is a potential violation of the FTC Act.

Also if you’re recruiting/referring you’ve already launched. Pretending to be in prelaunch isn’t justification for a vaporware cashgrab.

Ask anyone who fell for R Network how that worked out.

This is exactly what the network marketing industry needs. People are fatigued slinging high priced 10-12x marked up products to their friends and family only to find out that there is similar products else where.

Most companies market directly to expired customers. Do you blame them. If you have the data and soon to expire inventory you’re going to market directly to anyone who will buy!

I have no respect for companies that sell on Amazon for 50% less the wholesale distributor pricing! Terry Lacore owns Jeunesse Global and they have been selling on Amazon for the past decade. There top 2 products can be found for 50% off.

Tranzact Card will be a great add to a dead team!

If they can truly double people buying power and not have to buy anything different then this will be a homerun! I personally got 3 pitch calls and finally after a respectful leader in the industry called I became a DBO.

I made 5 calls and became a Manger soon to be a Sr Manager. Refreshing to have so much interest.

Visa debit card fdic insured saving account disrupts the big bank monopoly! This is the last space to disrupt!

Would you use this card over your other cards?

No fees! No atm fees no transaction fees no monthly fees! And it’s a high yielding savings account!

This is going to be one of the biggest opportunities in 2023!

MLM companies will be smart and use this as a pay card and additional offering instead of another new me too product!

rNetwork was also going to “Disrupt” the industry. Lots of people lost money never to be reimbursed. They trusted Richard Smith when he shed the tears of a “Visionary with a heart” etc.

He never shed any tears about the money that he pocketed from the “Society” that he claims to have so much compassion for. Talk is so cheap. I

f Richard Smith is an honest man, then he will quit choking back tears, and publicly discuss his plan to repay the financial losses to the people he hurt in the past.

Remember……. the narcissist always places the blame on others………. “Who let him down”…….. LOL!

@Mark

Right. And where’s that money going to come from?

Also what happens if industry interest rates start going in the other direction again (unlikely presently but think long-term).

Richard Smith has a history of taking in money for promises and failing to deliver. TranzactCard hiding information from consumers isn’t confidence inspiring.

Someone once said, “Any man can make mistakes, but only an idiot persists in his error.”

all of these people shilling this soon to be next failed rcard venture on fb are all fools, most of them all broke fools.

they continue to make poor choices thinking it’s all about them and that they can build anything.

The things they try to build have no foundation, they will soon crumble and go to the next best thing.

The definition of insanity…

The mistakes they make are par for the course, just look at their history of poor choices.

This scheme will never come to fruition like his last rrevvcards, lol, there is a pattern and people need to learn to read them. Patterns beat analytics any day of the week just like in trading…

to anyone doing their dd, run, another great review oz, don’t know how you do it…

God bless people who can truly help others and not fraudulent.

Thanks Oz. Good, EXCELLENT information!

Just wait until the SEC gets ahold of this one!! Also, that is a lot of personal data being handed over to known people who have taken other peoples money and run.

Gullible and Desperate folks believe anything.

What is the end goal? To ditch the MLM once it is built, and sell list of cardholders to a reputable bank?

THIS IS FALSE INFORMATION.

ORLY?

tranzactcard.com/terms-of-service#credit-agree

Sit down please.

I will stand thank you. I was not referring to this statement of yours:

(Ozedit:derails removed)

That’s not my statement, you’ve quoted Tranzactcard’s Visa credit card agreement.

If you have a problem with Tranzactcard referring to their Visa credit card as a credit card take it up with them. I’m not interested.

Is it your review statement that TranzactCard markets a VISA Credit Card? Why did you not post my complete reply?

Lets see if you will post this statement:

To all the readers go to TranzactCard and see if you can get a VISIA credit card.

The statement is based on Tranzactcard’s own representation they are marketing a Visa credit card.

Problem? Take it up with Tranzactcard.

Review updated to note TranzactCard has whitelabeled Solid’s financial offering.

Is this statement based on Tranzactcard’s own representation? Just joking.

I am assuming that this statement is true, so is whitelabeling illegal or unethical? I think it is just all in the eye of the beholder.

Not illegal or unethical. I’ve added it for the sake of due-diligence completeness.

Minor Updates from a video earlier in the week.

During prelaunch the following will be true:

~ The Z-Store is not yet open. Only limited promotional “flash sales” are available to spend your Z-Bucks on.

~ DBOs (Digital Branch Offices) are limited to ONE TCM (TranzactCard Member) as they “scale the platform.” However the $150/month fee is waved during prelaunch. Eventually there will be a three TCM per DBO requirement.

~ Commissions on TCM transactions are expected to being on July 1st but this is may be subject to change.

~ The official launch is promised for November 11th (2023) but may be subject to change.

We already know you need a huge number of TCMs to make any money off commissions here so the linchpin of the whole deal is the Z-Store (which wont be open for a while).

They promise (with disclaimers) things like 50% off of name band shoes or more than 50% off on something like diapers.

If they can pull this off then the TranzactCard opportunity will not be a complete waste of time and money. Something that Richard Smith has never before been able to accomplish.

Here we go… hide the evidence!

Review updated to note cited marketing video featuring Eric H. Allen marketing the Power Save Account was deleted within a few days of this review going live.

If everything was above board and legal, why is TranzactCard deleting marketing evidence?

edit: TranzactCard’s entire YouTube channel has been wiped. They’re even trying to hide the company name by renaming the channel to “TZD”.

Have you discovered anything about their mytzt.com site being down too?

I wasn’t aware it was down.

Pretty odd that the backoffice is down but everything else is up. Also data centers have geo-redundancy.

How long will my txt.com be down?

I’m not able to update my account. I’m getting wrong credit card number against tranzactcard when buying.

(Ozedit: personal details removed)

The backoffice is still down? There goes the “our data center internet is down” excuse.

This isn’t MLM tech support but I’ll leave your comment up to track how long TranzactCard’s backoffice is down.

Definitely not part of normal business operations.

Backoffice came back up on Tuesday and with a new pre-launch offer. I am not having any issues at marketplace.

More minor updates:

~ The Power Save Account (TranzactUp, TranzactBack, Z-Forward and Compound Growth) will not happen till official launch. Still slated for November of this year.

~ If you sign someone up as a TranzactCard Member (TCM) during prelaunch their annual renewal fee (otherwise $47.50/year) is waved for life.

~ The TCM referral program has been delayed till launch.

~ National Influencers with “millions of followers” will be on board by launch.

~ The formula for determining TCM commissions is to multiply the total monthly spend of all your recruited TranzactCard Members by .0015. So if your total downline spends $10,000 in a month you make $15. Disclaimers about changing ratios apply of course.

So if you are a DBO (Digital Branch Office) at the time of launch you need $100,000 in monthly TCM downline volume just to break even on your $150/month fee.

Or you could just recruit three DBOs who in turn will lose money each month till they too recruit three more DBOs and so on and so on and so on.

So basically TranzactCard is a pyramid scheme with a bunch of “this time we swear!” promises for later in the year.

Dejavu++

this wont be the first time that Oz is reporting on this kind of a company. All companies that appear on this site is part of a pyramid which will collapse once funds dry up.

People make as if Oz is doing this for the first time. Name one company that has survived for longer than 1 – 3 years before crashing.

I was at one stage convinced that MTI and Hyperfund would outlast them all and that they were a legit company.

On paper it was the best. Every promoter either believed or is pretending to believe that the company that they are promoting at that time is the best company.

Some affiliates promote numerous companies simultaneously , in the event that one crashes, they can still cash out with the others.

It will be only a matter of time before this one suffers the same fate.

Stan: “It will be only a matter of time before this one suffers the same fate.”

Please indulge me Stan,

Spend equal time being positive and tell us how it would be if all DBO’s became managers and upwards. I have never been offered a VISA debit card with rewards so I am continuing on to the launch.

Is there any way to become a manager without recruiting three DBOs?

Because if there isn’t it is simply impossible for all DBOs to become managers.

Okay GlimDropper, I realize that it is an impossible situation, I just don’t heed the views of those who envision failure but can not envision success in an impossible situation.

Heeding facts based on who informs you of said facts is a fast ticket to getting scammed.

Also if you waste everybody’s time with another bullshit premise you know is bullshit, spam-bin.

Happened to have been on a ‘pre launch’ call recently w/ this outfit. Thought I’d see what you had to say. I am a fan of NWM (those that are squeaky clean that is).

I gotta say, I found your review to be surprisingly far more neutral than I would have thought given the backgrounds of the owner etc.

Too many red flags for me, but just wanted to let you know your review seems very level headed.

Every BehindMLM review starts off neutral. It’s the subject matter being reviewed that determines conclusions and opinions reached in the review.

it all depends on how you look at it , all i can say is continue to be ponzitive, it all works out exactly the same in the end, with maths winning everytime.

I’ve read this thread and I see both sides. The believers that are looking for something to get a little extra side-hustle residual income and the doubters that see history in one of the main founders.

I had a friend invite me to some zoom calls. I felt they were worthless and just a bunch of “this is great, look at me, it can be you, join, trust, hope, retire, franchise not mlm”, etc.

I got on a couple that went a little deeper and it seemed to make sense if everything fell into place. Problem is, things are not in place.

I see updates from “corporate” shaming people for their lack of trust, sticking it out through the “growing phase/pre-launch”, and basically selling “if you don’t see the vision like others do, this isn’t for you. We will welcome you once we iron things out” (fear of loss, basically).

I went on a friend’s z-club site and OMG!!!!! they took things out from a 70’s catalog and have very few items (and UGLINESS is putting it nicely for what they are offering).

Also, not ONE item in the Z-club equates to 50% off like is listed in their marketing. NOR are there ALL THESE NAME brands that they have on a banner in their videos… Adidas (crappy offerings) and Alfani are all I saw that I recognized a name for. NO other name brands like NIKE, REI, and the slew they tell you they have.

I know if my friend asks they will say “that is just a beta test and we will be ready to go at launch as we are signing contracts daily and will have millions of SKU’s earlier than we aniticipated”. It is, in part, false advertising IMO.

My friend is going to get out and is one of the initial 5000 people to join. He read a corporate update where Peter Rancie (one of the co-founders) shared that Tranzactcard LLC is willing to buy back the position at $1000 (thus providing a 200% ROI on initial investment).

The founding match from corporate sponsors is huge and it is an advantage and worth buying it back at that price. So, that says something as far as their belief in the “system” and what they have in place and working towards.

I’ve heard also where people are getting two accounts upon signing up with Solid Financial when the agreement specifically says a person can have only one account per their social security number. So, how did that happen?

Seems like the people they have in place don’t know how to conduct business and have checks and balances in place.

All in all, I think it is a CF (cluster F) of not being ready while trying fully sell it. My friend has a hard time selling it to close friends because he can’t show them the Z-club (they will laugh as they turn on some disco music and see that what they are trying to sell (should give away) in the current Z-club is sub-standard GARBAGE.

Sorry for the book. But, if I only had a brain.

I see this as having “market saturation” at some point with people not being able to get their 3 DBO’s below them and get their money back.

How many will have that happen to them and not get out in the 30 day money back time frame? Now, they will be straddled with $150/month fee with no money coming in.

Their upline will also suffer because their legs are now at a stall and they will have to generate additional people to try and get some momentum going.

It has the potential to implode from this scenario. If people are in it for the money, you need to be at Sr. VP or higher to start seeing any recognizable income stream.

The founders and TranzactCard team will tell you… “it isn’t about making money, it’s about changing people’s lives and doubling their purchasing power”.

For me, it’s about the money and if someone gets into things like this “just to help people”, God bless them… but, I’m not buying that situation.

Absolutely get out now. This is your chance to walk away without losing money.

I have a friend who has contacted Customer Service 3 time over the last 30 days requesting a full $495 DBO refund.

They immediately acknowledge that they received his message and that someone will respond within 48 hours but never get back to him. Nothing but silence. Crickets.

Have your friend ask the sponsor for the money back.

I have a few comments. First, everyone seems to be hung up on the $150/mo that starts in November. I get it. That sounds like a lot to a lot of people.

If a monthly fee of $150/mo is scary to run a business, then stay away from the business side and just be a happy card holder. $25 for lifetime membership is more than reasonable.

A few observations on the comments above. The average spend on a credit/debit card is $2500/mo. Remember, people are already spending this, no change in habits, and the only change is they are using a different card.

In the example used, $10,000/mo total spend in your group is 5 people. Please, please, if your goal in starting this business is to get only 5 customers to see the value in being able to spend their dollars twice for a one-time $25 outlay, then this opportunity is definitely not for you.

But, let’s assume that a DBO (business builder) works super hard at their business and eventually finds 5 people to spend a one-time $25 for the opportunity to double their buying power.

I understand this is an extreme example because that would be so very hard to do, but for argument’s sake, let’s say they did that; you have not mentioned that the company (through the influencer corporate pool) will give them a 2:1 match (at the DBO level) on their customers.

So, all that incredible effort they put in to get 5 customers, actually got them 10 more from the company. Their group magically turned into 15 customers.

I understand you aren’t breaking the bank at this point either, but let’s be real. If someone is going to step up and get a Digital Branch Office, they should be able to at least recruit a few other DBOs and a load of customers themselves and envision thousand of customers in their group over time.

No one should EVER start a business opportunity in anything, if they have NO skills, NO drive and extremely small goals. Those people should just be happy card holders.

Let the people who have vision and bigger goals become DBOs. Who would ever start any business, whether it be a brick and mortar or an MLM opportunity and strive to get only 5 customers. Ridiculous.

What’s actually ridiculous is ignoring R Network, spending $150 a month and planning to “at least recruit a few other DBOs and a load of customers themselves and envision thousand of customers in their group over time.”

Leave the marketing at the door, kthx.

There was a Monday breaking news call which pretty much failed to break news.

There was a claim that 65% of all bank KYC applications were processed successfully and user error were blamed for the rest.

But aside from that it was pretty much a nothing burger.

Except perhaps for the guys running the call. Jon McKillip and Eric Allen.

I could recount Mr. McKillip’s background but Oz did a good job of it here:

behindmlm.com/mlm-reviews/theclub-travel-review-jon-mckillip-launches-travel-opp/

In short, McKillip is a serial pyramid scheme promoter and Eric Allen seems to be one of his chief lemming wranglers. Which pretty much means that they have the perfect background to help run one of Richard Smith’s schemes.

Norm,

You will notice the font is different below… because it is a copy/paste from actually doing research and not taking someone’s word that “the average monthly debit card spend is $2500”.

Far from it. However, if DBO’s etc. are able to suggest a habit change in spending (i.e. paying their recurring things like cell phone, mortgage, car, other), then that $500ish amount could be quite higher.

What is happening though is that some companies are accepting the Tranzact card and others are not. Therefore, some can’t increase their “spending habits differently” even if they wanted to. Will that change over time as this grows. Potentially.

The monthly value of debit card transactions surpasses both credit cards and cash: $545.60 for average monthly debit card spending, compared to $473.10 and $310.20 for credit card and cash spending, respectively.

~85% of US citizens have a debit and/or credit card.

I’m not totally negative on this new MLM company. There is potential if this comes to fruition as suggested. They are currently giving $1000 to every VP person to go to a leadership summit in Utah (there are 30+ VP’s already).

They also have recently had other MLM companies approach them and are allowing them to jump in with all of their downlines as well. That is huge.

They are not offering these others anything extra to join. They come in like others although the others have asked for extras due to the fact they can help explode the business with an already built downline(s).

I had a friend of a friend get $1000 back from their initial $495 DBO purchase. This came from corporate.

That tells me that they value the original buyer’s position/corporate match and the value that came from it versus having just a “basic” corporate match.

Here is some interesting math:

The 30+ VP’s that I mentioned there are have 81 DBO’s (27 x 3) now needing to get their 3 DBO’s to get their money back.

Assuming statistics (95% or higher in MLM fail – many articles I have read say 99%, and some share varying statistics of “% lost, % broke even, % made a little, % made a good amount) – I will use 20% failure rate which is stretching that failure rate by a factor of 4:

81 (DBO’s needed on each VP’s next level) x 30 VP’s = 2,430 DBO’s needed for all of those VP’s to make their next level. If only 20% fail, 2,430 x .2 = 486 people not being able to get their 3 and “quit” or keep trying.

For every month they hang out trying to get their 3, those 486 create $72,900 each month in monthly fees (combined) – “for a back office” – lol. Note: that doesn’t account for the 20% along the way from other levels as well.

That is where I see MLM’s fall apart… lack of momentum, stalling on levels, part of the arms “not performing”. If I were to do a 3×3 MLM I would actually start with 5 or more on first level and have/help others to do the same.

That helps to maneuver around and overcome to an extent the high failure rate in general and have a higher potential to achieve the next levels.

For my math example above, now let’s assume all 30+ VP’s make Sr. VP. Now they have 243 needed to make the next level of VP. 243 x 30 = 7,290 DBO’s needed (combined).

That times 20% failure rate = 1,458 DBO’s x $150 = $218,700/mo. (for every month it takes until they get their 3 for that $150 to go away) in revenue for corporate “for a back office”, lol.

At some point there will be a HUGE amount of DB0’s needed (and failing as statistics over decades dictate a certain percent do) throughout all of the downlines and THAT will an AMAZING money grab. Better, possibly, than having invented bottled water.

Now IHUB Global is using their initial email user base to push tranzact card too.

A friend told me about it and I actually received an email stating that I had a person that signed up under me, join tranzact card so I needed to upgrade if I wanted to earn from them.

Ihub global never delivered on their promises of free stations so now they are using the email base to try and get tranzact card enrollees. What a JOKE!!

Thank you all for doing the math… crazy rediculous if people think they will earn alot of money with this.

Definition of Crazy. The review and reviews are in great detail.

This is another MLM perpetrated by the same ponzi crooks under the guise of being a franchise.

Had my account closed and money taken. Shame on me.

Thank you for the review. I was just approached aggressively by two friends.

They promised I would make my $500 back as soon as I enrolled three. That the $150 would be waived if I made manager.

They said this would be the new way of banking as so many community banks are begging to be involved as it’s bringing the banks new customers.

When I asked if I could see a link to what a zbuck could buy they said they couldn’t show me until the company launches. And for people who enroll in pre-launch they’re getting double zbucks which they can spend on cruises and travel later on.

Several red flags for me. Not to mention thoughts of Zeeks and of My Shopping Genie, both of which were scams and shut down.

Also, they mentioned that both the RNC and DNC are interested in promoting the card. Yet another red flag for me for many reasons.

Here’s the latest video they just sent me.

(Ozedit: marketing video removed)

Wait there’s more than one promoter making bullshit marketing claims?! I thought it was a one-off “ChatGPT, write me marketing lies about TranzactCard” thing.

Any chance you can ask your friends for proof of RNC/DNC interest? I did skim through the video link your provided, was just the regular marketing presentation.

Interesting review. Thank.

Anybody remember Koscot Kosmetics Interplanetary or The Airplane Game?

Good to see all the ways everyone is looking at this MLM.

As I see it, the worst that could happen is you invest the $500 get the card and and use it. Wait to see what happens in November (or later) then if it does not work out all you stand to loose is the $500 plus the $150 a month at launching (Nov. 2023) correct? Can cancel at anytime and get out. correct?

So, if you do NOTHING between now and lets say next March (2024) the MOST you can loose would be around $1000 (assuming the Z bucks are worth nothing). Right?

In my view, that is a very small investment to “see” if it works for you and any others that might want to just get the card or get in as a DBO. Am I correct on this?

Right from their website, is this not a fair warning?:

(Ozedit: snip)

You decide!

Investing in hopium isn’t how you launch a long-term MLM company.

Not when your reputation is already shot to pieces dating back to Divvee.

And? This review and the comments are due-diligence.

Or you could sit on your wallet till November and wait to see what the Z-Club turns out to be without spending a dime.

Remember, FOMO is lemming chow.

There is no revenue stream to account for the promised value of Z-Bucks.

The Z-Club does not promise but strongly suggests deals like 50% off on name brand shoes.

Where do these discounts come from?

Remember, they are competing against the Amazons of the world so there is no hope of out competing on volume discounts.

So the question remains why would Nike or New Balance sell shoes for half off their normal wholesale price through the Z-Club when they could charge more (and sell a hell of a lot more) through Amazon?

This is not an insignificant question, in fact it’s the linchpin of Richard Smith’s latest too good to be true MLM promise.

And if you’ve followed Richard Smith’s too good to be true promises back through his last several failed MLM opportunities you’d understand why I’m very much in “show me don’t tell me” mode when it comes to his opportunities.

GlimDropper and Oz good points

I don’t blame you as I had the revcard and it fell apart.

I am ok with the risk knowing I could easily loose my $500 plus the $150 per month starting in November. If you are NOT ok with the risk…. don’t take it!

Yes, you could wait until November as see if it launches as promised but know, as is the case with every MLM, if you don’t get in early the rewards will be much less.

This site has been very informative. Still not sure I am moving forward with the investment.

If you don’t get in, you won’t lose ANYTHING.

Maybe you need to tune-up your bull**** detector first.

Joe, most new businesses, including MLMs, fail. So paying into a mew MLM is even more risky than paying into an established MLM.

Most new MLMs fade away and your money is never seen again.

GlimDropper,

As I am sure you are aware digging into this MLM, they are touting buying the shoes etc. from Nike etc.

at what Amazon and others also do but not charging the 25-30% or more markup. Currently there is nothing in Z Bucks store worth purchasing nor is ANYTHING 50% off.

Joe,

There is a difference between loose and lose Lose is what over 90% of people accomplish in MLM’s (proven statistic over decades).

Loose is putting your money in an MLM as OZ has stated that has leadership fraught with failure. Therefore, your can be loose with your money and lose it most likely.

FYI, my friend of a friend that I mentioned in a previous post got $1000 check in the mail for her initial purchase of $495 DBO position as a founder.

That tells me they are good on their word for money back, but also recognize the value that the founding member would get (getting in early with a vastly bigger matching component from the corporate match).

That says something… not sure what (I am assuming belief they actually have something sustainable and able to plug along for several years before market saturation)… and then, as I said, will have a bottom up cascading effect of failure because all they are selling is 3 new people (well, that and CHANGING THE WAY BANKING IS DONE. ONE SWIPE AT A TIME).

Will be a huge money windfall when that happens.

Back in the day (when I had more straw and brain matter) there was a pyramid scheme going around called the Circle of Gold.

A list was created of 12 names (I believe I knew it to be 10 names). they were tasked to get 2 new people within a few days. Those 2 new people would give $50 to the person on the bottom and $50 to the person on the top.

They would then take the list and drop the person on top off, re-create the list moving everyone up 1 spot and inserting their name at #10 (on two lists of names).

This now went to 4 new people (2 lists getting 2 new people) and that continued. When the person that put themselves in new at #10 became the person being moved up over time to position #1, they were receiving 2,046 $50 cash ($102,300).

It was illegal and shut down (although some still did it for a while).

I thought, how can I make this “legal”?? My idea was to “sell a joke” for $50 and when every person “bought in” sending their $50 to the top and bottom positions they would also include a joke and/or send that joke to the new positions created.

“Something of value” was being offered instead of just sending money. I never acted on it, but in my University days we threw a huge party with that concept for 5ths of booze.

Made for some seriously big garbage cans full of jungle juice and those that “lost out” didn’t give a crap because they were too shit-faced to care. LOL

What about the Influencers? They claim that Lebron James, Garth Brooks, Lady Gaga and Make a Wish, President Obama and more have all signed contracts and will get a whitelabled debit card with their pictures on it. (Picture was posted with the debit cards of these and more)

Wouldn’t these celebrities have lawyers that would be protecting their reputations?

I couldn’t find any evidence of Lebron etc. having anything to do with TranzactCard. To the best of my knowledge their involvement doesn’t extend past TranzactCard’s own marketing (i.e. doesn’t exist).

I didn’t know they’d doctored up contracts though, if you screenshot those that’d be appreciated to document as evidence.

They sure do.

Rumor has it that the $150 per month “Franchise Fee” to be a DBO has been eliminated and replaced with 1% of their monthly earnings……….

And…… the $495 start up fee will soon be eliminated and replaced with a $50 per month option to become a DBO…….

It has always been and always will be a moving target if Richard Smith/rNetwork is any precedent?

I just got off this week’s corporate update call. No mention of what Johnny posted above but that doesn’t mean much either way.

Tickets for the company launch party in Vegas are on sale. They cost $250 + 250 Z-Bucks each.

This may be the first time Richard Smith tied himself to a concrete launch date.

Should be interesting.

See you in Vegas. 😉

TranzactCard Update

I wonder if the “negative posts” were related to TranzactCard or if they were from Smith’s victims from prior schemes (R Network, Divvee etc.).

I am open-minded, but going to be cautious. I want to believe in this concept, I really do.

I am not jumping in yet…… I have mentioned to some folks, but will let them know I have not committed yet.

Another Monday, another Corporate call.

I’ve lost count of how many MLM calls I’ve sat through but it always amazes me how much time it takes to say so very little.

The Tranzactcard Apple app has been approved (and there was much rejoicing).

The android app is soon to follow.

Expectations are being managed.

The prices in the current (beta?) version of the Z-Club do not compare favorably to Amazon.

This is a feature not a bug.

You see they need people to test the mechanics of the platform, they call these people “lab rats.”

But they don’t want too many many lab rats testing it so the prices suck.

Everyone is expecting 50% Z-Buck discounts but from what was said today they shouldn’t be.

An 80 (cash) / 20 (Z-Buck) ratio is still cool.,..right?

After all there are Flash Sales where a few lucky people buy selected merchandise only for Z-Bucks, that should even things out.,..right?

“Banking is hard” is an oft repeated phrase.

As of yet TranzactCard can not use ACH to issue member payments. It’s paper checks (above $25) only. They can’t even feed your commissions to your TranzactCard.

There are undisclosed issues at work here.

What’s the bet Z-Bucks winds up just being a percentage of regular affiliate commissions (ala voucher apps like Honey etc.)?

This is the big question, isn’t it?

The whole “double your buying power” sales pitch relies on the Z-Club being something better than a simple affiliate discount program.

If all along they had been boasting about the warehouses/fulfillment centers they were partnered with I could be tempted to believe they could buy enough shoes in bulk to pass on some sort of discount expressed in Z-Bucks.

But they haven’t been talking logistics at all and even if they were it isn’t just shoes, they are promising discounts on “millions of SKU’s (products).”

So those discounts have to be coming from some other, yet to be disclosed source.

Again, THIS is the ballgame. Even if they talk affiliates down from 50% to 20% discounts those discounts still have to be real.

Richard Smith is a wascally wascally wabbit. To date he’s only ripped off the people who believed in him and his previous MLM opportunities.

Maybe this time he fakes out the people who doubt him is what he desperately wants people to believe.

But to date Richard Smith and his small cohort of coconspirators have made their money by being at the top of short lived pyramid scams.

TranzactCard is already bigger than rNetwork ever was so it’s already a success for him and his hand picked few.

They tried to recruit me as a founding member, saying the Z bucks store was going to be the next Amazon. She put Richard on the confrence call to pull me in on my doubts.

The company is registered to a “front” lock box suite in Utah! When I mentioned I had called the SEC to get their certificate because it wasn’t on the SEC DATABASE he was ready to terminate the conference, he goes “hey guys if she doesn’t want to be apart of this, then let’s recruit happy people that want to be a part of this”. He hung up.

This is all fraud, he keeps moving this opening date back, the terms of service for the card.

Is filled with mis spelled words and, and VISA sent them a cease and desist using their name, because they couldn’t prove who licensed tranzact card.

Visa wanted to k ow the agent that licensed VISA to them to use the card and they couldn’t prove it, saying the bank they was using for processing was out of business….. lies the lies, but he has a faithful group of followers who have bought the ZBUCKS superstar story!

This guy is a serial MLM Birther! It’s fraud all FRAUD!!

Don’t suppose you have a copy of the alleged Visa cease and desist? That’d be worth reporting on (would also explain the “iT’s NoT a CrEdIt CaRd!” shills we had a while back).

When Dale Calvert does a program you know it’s a bust. The guy is the real life Bronx tale Mush.

William J. Andreoli is a MLM lifer. He was President of Youngevity into 2015 when he, Todd Smith and several top Youngevity leaders left to form Wakaya Perfection.

A spectacular lawsuit ensued:

behindmlm.com/companies/how-wakaya-perfection-and-todd-smith-gutted-youngevity/

Terry LaCore purchased what was left of Wakaya Perfection in 2019 and it was renamed Bulavita.

Bulavita didn’t last long and after a sale to Juuva fell through Andreoli rebranded it as Mfinity Global in 2021.

Less than a year later Mfinity Global was sold off to Kannaway with Andreoli serving as Kannaway’s President.

As Oz reported several weeks ago Kannaway’s e-mail list was sold off to TranzactCard and now William Andreoli is TranzactCard’s President of the USA Sales and Distribution.

Dude always lands on his feet or as some say, sh!t floats.

Lots of buzz about the New revenue plan, but no mention at all about the elephant in the room which is the problem of creating ACTUAL VALUE for the so called Z Bucks if/when applied to the non existent e-commerce platform…………. Cart before the horse stuff?

I’m no genius, but it also appears that Richard Smith is promising to pay out a lot more money than he will be taking in?

TranzactCard is no longer a MLM.

It’s a Franchise Offering with a multi level pay, oops sorry, a multi level Revenue plan.

So much happy horse crap.

DBO’s (now called digital branch operators) will no longer pay $150/month. That fee has been cut to $30/month with a $20/month tech fee. There is also a 10%/month royalty fee on swipes.

That sounds good but their swipe commissions ~seem~ to have been slashed from 15 basis points to 5 as well, so it may be a wash from a break even on investment point of view.

There is also a sub DBO level membership called a TranzactCard Go Member. Go members cost a one time $35 fee and $20/month membership fee and a $15/month tech fee.

Go members earn $2.50 per recruited TCM and an additional $2.50 on annual renewal. Go members also earn on their TCM’s swipes.

This comp plan, er sorry, revenue plan presentation was a mess. If taken literally Go members earn 20 basis points on swipes while Branch Presidents earn 10 basis points. I doubt this is the case but a various times Richard says exactly that.

They expanded the “grant” system but I’ll leave that to Oz to hash out. Suffice it to say that all one time and monthly grants are completely divorced from card swipe income and are solely derived from fees paid by recruits and are paid for the act of recruiting.

I still want to know where the money is coming from for them to pay a “matching” zbuck to get free items!!

There’s no way that they can get enough funds from swipes to recover those costs. How are they getting people to believe this is even possible?

The conference calls are not addressing the backbone of the whole gig… the store that accepts Z bucks… that seems to have gotten lost in the conversation which now focuses on how one is paid.

The problem is, no one is paid unless the engine that runs everything is robust and thus far…. there is no engine that I can see.

I am not from Texas but it reminds me of a popular Texas saying “All hat and no cattle”.

Maybe they will prove me wrong. But until they show they have a store with hundreds and thousands if not millions of desirable items at a decent price, not sure why anyone would spend a dime at this juncture.

My $2. (it used to be .02 but ya know…inflation! lol)

I don’t really want to touch TranzactCard again till November :D. It’s obviously going to keep changing and then flop.

I was given the link from a friend in this. Wow (if this is legit and comes to fruition).

Richard Smith shared the new compensation plan (OZ please verify my math and comments – or don’t, all up to you man).

Smith is saying that once you become commission qualified as a Manager you will be getting $500/month every month.

In addition, the interchange fees (I believe that is how they are getting their money – from Tranzactcard swipes) goes in to a pool.

Let’s say you have reached the level of VP (you have 39 DBO’s in your downline or a combination of that or roughly 40 TCM’s swiping – they did away with only having to get 3 to get 3 and so on), you could share in the commission pool and get “up to” $12,500 PER MONTH in commissions.

So let’s say you can’t get anyone to grab this concept and are in it. You buy your own and 39 DBO positions for your family and friends (40 x $500 = $20,000).

Keep in mind all of them need to become commission qualified by having at least 3 TCMs (but, YOU are commission qualified because you’ve done “your level by buying those positions).

You now have to wait 2-3 months only to get your $20,000 back. Now, the math after that initial outlay has happened, you have 10 months earning the $12,500/month commission.

That equates to $125,000 annual income (minus your monthly fees) and next year it will be $150,000 minus your monthly fees.

Then, you can sit on your ass and retire making six figures. This doesn’t include any other grant or income stream. What am I missing here?!

Why wouldn’t people do my scenario and cash in.

Oh to have such luxuries.

First off remember the disclaimer which Richard said was prepared by Kevin Grimes. It reads in part :

That is the only rational starting point for this discussion.

Next, Scarecrow is talking about the Community Bonus Pool. This is funded by “community memberships and transactions inside and outside the Z-Club.” Now what the hell does that actually mean?

They seem to be implying that the Z-Club is a revenue source here. Like in addition to the 50% discounts the company will still be selling at a profit and those profits will be shared.

Anyway the active weasel words with the Community Pool are “up to.” Managers can earn “up to” $250 a month (the $500 number is a one time first month “fast start” bonus). On the other end of the scale Presidents can earn “up to” $30K/month.

I still have no idea where these profits are coming from.

Don’t forget the $30/month marketing fee, the $20/month technology fee and the 10%/month royalty fee is applied to all DBOs and above.

This would add $2000/month to your equation plus 3 active TCMs per DBO to be “commission qualified” which kills the deal because you would need to apply for and to be granted 120 bank accounts. More in fact because manager ranks and above require more TCMs.

So your deal doesn’t work but I don’t think theirs does either.

Reader sent in a link to the latest corp video. It’s an hour and fifteen. Will go through it later today and go over the comments again.

Don’t really want to comment without seeing the source-material first as a lot of it is going over my head.

Alright so here’s my thoughts: It’s basically a bigger departure from card usage towards recruitment.

The nonsense about pretending not to be an MLM company is silly. TranzactCard is an MLM company with an MLM compensation plan that pays commissions and bonuses.

Probably the stupidest example of this was Randy Schroeder. Andreoli introduces Schroder as “someone who’s been doing this (MLM) for decades, million dollar earner for 28 straight years”.

And then after being given the mic, Schroeder goes;

Gentlemen, TranzactCard is an MLM company. Calling MLM a “franchise” doesn’t change what it is – and might also violate the FTC Act under deceptive marketing practices.

Franchises are a regulated business model that has its own set of laws, none of which apply to MLM companies. Not to mention the confusion you’re causing consumers and potential participants.

Comp plan:

Go Members are basically a cheaper pathway to the MLM side of the business. Why pay $495 when you don’t have a downline yet?

Income wise things look pretty dire with respect to card spend. One example in the comp plan is $2500 spend = a $1.25 to $2.50 commission.

My own example is the $495 DBO fee and then 11 months of $50. The equivalent retail card spend just to break even annually as a DBO is $1.04 million dollars.

This is problematic because these are retail commissions (and recruitment but that’s irrelevant given the grant bonuses).

TranzactCard’s “grants” are recruitment commissions. The catch on DBO recruitment is you don’t get paid till your fourth recruit.

I don’t have any hard statistics but over the years I’ve seen figures from here and there that suggest the majority of participants in MLM companies struggle to recruit two distributors, let alone three.

Grants being locked behind recruitment requirements the majority of distributors aren’t going to hit leaves them with piddly card commissions ($2500 spend = $1.25 commission at the low end).

The comparative math is a worry, as it further emphasizes recruitment over retail.

After three recruits you get $50 per DBO recruited and up to $10 a month. $25 was paid three upline levels too if I’m not mistaken (on the initial, not the monthly residual).

Over 2 months that’s $60 on recruitment alone. The retail card spend equivalent over the same two months is $30,000 a month.

Recruit one affiliate or get people to spend $30,000 a month – what do you think most people are going to qualify for?

I’m not saying $30,000 a month collective retail spend isn’t possible, I’m saying it’s a lot easier for people to just recruit one DBO.

One “grant” income example provided by Smith was $50,000 at the Vice President rank, with 10,000 people in your downline.

The retail spend equivalent on this is $50 million a month.

DBOs can also recruit four Go Members, for which they get $50 a month. The retail card spend equivalent here is $50,000 a month.

And now you can see how recruitment is taking centerstage of retail. Why bother building retail customers who have to spend tens of thousands a month when you can just recruit a few people and earn the same?

The Community Bonus is a monthly bonus pool based on company-wide revenue (membership fees and card transaction fee commissions). Nothing out of the ordinary here except it’s a pyramid scheme if the majority of revenue is sourced from distributors (participants in the MLM opportunity).

IIRC at some point Smith said he’d “asked the Presidents what they wanted” or something similar. It shows.

This comp plan is built for people with large downlines. Retail focus is non-existent and it’s very obviously going to operate as a pyramid scheme with little to no retail card spend volume company-wide.

There’s no financial incentive to focus on retail over recruitment commissions and bonuses. It’s also much faster to earn the same money if you recruit and ignore retail.

Z-bucks are still a big question mark. The royalty fee now feeds into the savings account. It’s basically just a ~10% clawback fee, with more going into the savings account (ratio) the higher an affiliate’s rank (i.e. lower ranked affiliates get screwed (the majority)).

I think I heard something about prelaunch Managers getting their $50 a month DBO fee waived? That’s a significant residual monthly source of revenue gone.

I have been contacted to become a part of this company. I will be meeti my with the dude that told me about it and his guy in charge.

I have been told there is a chance to earn 12,000$. I meet with them Friday. What questions do I ask to figure out if this is worth getting me and my family members into?

It seems pretty MLM to me but I’m skeptical about the company. Any questions I should be asking?

If they pitch you on Z-bucks, where is the money coming from?

Also wouldn’t hurt to ask if the $12,000 is from recruitment or retail card spend (non affiliates actually using the card). I already know the answer but if they actually confirm recruitment, you’ve just confirmed pyramid scheme.

In my opinion and what I’ve learned from this thread and friends…

Their pitch is “changing banking one swipe at a time”. They will say the $12,000 is from a combination of revenue streams and that TCM’s (tranzactcard members) are going to be a key component of revenue once the volume of them accumulate within “your business” and also now what accumulates “within the company as a whole” (the community pool bonus).

Ask them to fully explain where the community pool bonus comes from and how are they able to pay “up to” $250, $1,000, $12,500, $20,000, $30,000 PER MONTH from that community bonus pool.

Don’t let them convince you that you “are changing people’s lives” because you are considering this for what is in it for YOU, Friends, family. The “servant leader” doing it for the betterment of all is snake oil psychobabble.

Have them do some math with you and please take notes and share here. We are trying to figure out where the money to fund the grants, bonuses, commissions is coming from.

They are showing a commitment to making Z-Club into what they are touting it to become:

They must be contracted with Lebron and Trump and these other guys or Visa would never let them issue these cards and this Solidi Finance would never risk their business if it wasn’t real!

We’re what, almost ten weeks from launch and NOW they hire this guy?

The promises have already been made, that cake is baked.

So what’s this guy going to do, take the blame for when the shoes aren’t 50% off?

If he knows the first thing about due diligence how did he ever wind up signing on with the likes of Richard Smith?

@Jesse

First off legitimacy via association isn’t a thing.

Second, I can assure you Visa’s compliance dept don’t give a crap about celebrity endorsements. Let alone the fact they’ve never heard of TranzactCard.

This is the standard card issue through a shell company + dodgy merchant.

Also “they must be” isn’t due-diligence. To date there is no proof James, Trump or any other celebrity has anything to do with TranzactCard.

TranzactCard is very much “real”. The elephants in the room are now it has a pyramid centric compensation plan and Z-Bucks funding.

Tranzactcard is touting interchange fees as a way of funding the various revenue streams in its plan. Interchange fees are charged by the issuing card company to the merchant.

For a credit card, the charge ranges from 1% – 3% fee to the merchant. For a debit card, I believe I read where it is capped at 0.3%.

Solid Financial is the card issuer. They are “in bed” with Tranzactcard. Let’s assume that they are charging the 0.3% fee…

If 10,000 people use the Tranzactcard @ $250/month spend, Solid gets $7500/month every month. When Tranzactcard users grow, lets say to 100,000 users… that equates to $75,000/month every month.

That per spend/per month amount, I believe, is on the low end as the average for debit card spend in the U.S. is approximately $500/month (and is increasing as people are using debit cards more and more – because it is essentially plastic cash).

I assume they have contracted with Solid Financial to keep a portion of those fees as their contractual payment and Tranzactcard LLC takes their contractual amount.

This also leads me to believe why Tranzact is “helping the smaller banks” and not going with the big banks, because it is more beneficial for Solid to be the card issuer and small banks to gain accounts with no downside.

Bigger banks may not want to negotiate that fee or issue the cards because they have many expenditures that the interchange fees help pay for.

That is one way I’ve come up with on how they are paying out to people. The other is that they are no longer rebating DBO’s their initial buy-in of $495 once they get their 3 people.

Currently there are over 10,000 DBO’s. Assuming that those 10,000 get 3 people each, that will equate to 2 things:

1) $495 x 30,000 new DBO’s = $14,850,000 in revenue. (and that grows as more and more come in to the “business”.

2) $50/month fees to be a DBO x 40,000 (the 10,000 current + 30,000 new DBO’s) = $200,000 per month revenue.

In addition, let’s assume that, over time, 100,000 people become Tranzactcard debit card users. $25/year fee x 100,000 = $2,500,000 annual revenue. Again, this grows exponentially too as more come on board.

They have more than enough money to fund Z-bucks and payout all of the commissions and it will only continue to exponentially grow.

I forgot to also add this comment:

Oz, I’m not saying I am on board with TZT You can surmise that from my previous posts. I, like you, am trying to make cents (um, er, sense) of it all.

When you say it is or is becoming a pyramid centric compensation plan isn’t that what all MLM’s are?! A pyramid of 1 person on top and expanding an increasing level by level amount (i.e. forming a pyramid).

Remember, that Tranzact is no longer requiring people to get 3 new DBO’s to gain their next level. They are allowing those people to get “customers” (TCMs) instead.

That is a per month revenue swipe fee from my previous post from interchange fees gained.

They have always laid out in their compensation plan that there had to be a ratio of at least 3:1 (TCM:DBO). That keeps them from becoming a true recruitment only pyramid scheme, correct?

They are still enforcing that people must have at least 3 TCMs “with them” to become commission qualified, and as I mentioned, they no longer have to get 3 DBO’s but can get 10 TCMs for that same commission qualification and next level.

That appears to me to be them understanding that TCM’s in the long run, when that continues to grow, will be the driving revenue stream on a month-to-month basis from my calculations stated above.

They are currently going to make $500,000 per month in their 10,000 current DBO’s paying $50/month after launch.

Just throwing out what I am seeing and understanding and looking forward to your comments on such.

Remember the last video on funding the TranzactCard with the new and AMAZING banking platform… KAPOW!!!… look how fast I just deposited $25 into my account!!!… but wait, this AMAZING platform, just like the previous versions and whatever are now having this:

Says who?

Let’s not assume and Tranzact Card won’t have time. DBOs are going to rack up Z-Bucks and want to spend them as advertised.