Solidus Global Review: OneCoin scammers turn to gold mining

Solidus Global provide no information on their website about who owns or runs the business.

Solidus Global provide no information on their website about who owns or runs the business.

The Solidus Global website domain (“solidusglobal.com”) was registered on May 27th, 2018.

Chris Principe is listed as the domain owner, through what is assumed to be a virtual address in Saint Lucia.

Principe first popped up on BehindMLM’s as one of the marketing arms of the OneCoin Ponzi scheme.

In exchange for an undisclosed sum of money and/or position or positions within OneCoin, Principe promoted OneCoin through his Financial IT publication in early 2016.

Around the same time, Principe was also promoting the Skyway Capital Ponzi scheme.

In addition to appearing in Financial IT, Principe spoke at OneCoin events and presented himself as an insider.

OneCoin unofficially collapsed in early 2017. Principe, along with everyone else riding the OneCoin Ponzi train, distanced themselves from the scam throughout 2017.

In mid 2017 Principe sued prominent OneCoin critic Timothy Curry. Principe claimed Curry calling out his association questionable businesses cost him a Skyway Capital contract worth $75,000.

Yes, that’s the same Skyway Capital Ponzi scheme we referenced earlier.

It is widely believed Principe’s lawsuit was funded by OneCoin, as part of a proxy effort to go after one of their loudest critics.

Principe played this up, regularly referring to his lawsuit as “us vs. them” and a chance to “get the haters” at various OneCoin events.

Despite the bravado however, Principe quietly settled the lawsuit in April this year.

Another OneCoin figure involved in Solidus Global is former top investor, Juha Parhiala.

Another OneCoin figure involved in Solidus Global is former top investor, Juha Parhiala.

As we mentioned earlier, most of OneCoin’s top brass abandoned ship after the January 2017 collapse.

During OneCoin’s heyday, Ted Nuyten routinely celebrated Parhiala’s earnings on BusinessForHome.

Nuyten heralded Parhiala as the top MLM earner in the world, clocking in at around $24 million annually.

In late 2017 Parhiala emerged as the new owner of a bar in Cambodia.

2018 was mostly a quiet year for Parhiala, up until a September 3rd Facebook post;

Are you ready? This is my last project ever!

With Solidus Global we will did it one more time! With this opportunity are you willing to walk along with me one last time!?

Juha Parhiala | Independent Coach

In a letter accompanying the post, Parhiala confirms Chris Principe is the founder of Solidus Global. Solidus Global marketing material also cites Principe as CEO of the company.

On Facebook the official Solidus Global account credits Parhiala as the company’s “Grand Ambassador”.

Read on for a full review of the Solidus Global MLM opportunity.

Solidus Global Products

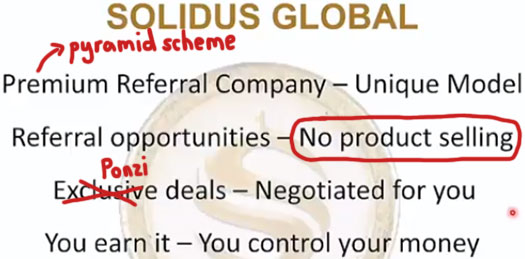

Solidus Global has no retailable products or services, with affiliates only able to market Solidus Global affiliate membership itself.

The Solidus Global Compensation Plan

Solidus Global affiliates invest in “gold mining contracts” on the promise of a ROI.

Commissions are paid when they recruit others who do the same.

Recruitment Commissions

Solidus Global affiliates are paid 10% of funds invested by personally recruited affiliates.

Residual recruitment commissions are paid out down three levels of recruitment (unilevel):

- level 1 (personally recruited affiliates) – 5%

- level 2 – 4%

- level 3 – 3%

Residual Commissions

Solidus Global pay residual commissions via a binary compensation structure.

A binary compensation structure places an affiliate at the top of a binary team, split into two sides (left and right):

The first level of the binary team houses two positions. The second level of the binary team is generated by splitting these first two positions into another two positions each (4 positions).

Subsequent levels of the binary team are generated as required, with each new level housing twice as many positions as the previous level.

Positions in the binary team are filled via direct and indirect recruitment of affiliates. Note there is no limit to how deep a binary team can grow.

Commissionable volume is generated via investment across the binary team.

At the end of each week Solidus Global tally up new investment on both sides.

Affiliates are paid 10% of commissionable volume generated on the weaker side of their binary team.

Paid volume is flushed, with leftover volume on the stronger side carried over.

Matching Bonus

The Matching Bonus is paid on downline residual binary earnings.

Solidus Global pay the Matching Bonus down three levels of recruitment:

- level 1 (personally recruited affiliates) pay a 10% match

- level 2 pays 3%

- level 3 pays 2%

Rank Rewards

Solidus Global reward affiliates for convincing others to invest as follows:

- Citizen (recruit and maintain two investing affiliates (1:1) and generate at least 3500 GV a month in downline investment volume) – receive a certificate

- Soldier (maintain two personally recruited affiliates (1:1) and personally generate at least 7000 GV a month in downline investment volume) – another certificate plus “Solidus brand package”

- Noble (recruit and maintain at least two Soldier ranked affiliates (1:1) and generate at least 16,000 GV a month in downline investment volume) – receive the value of an 11.66g 18k gold bar in USD

- Governor (recruit and maintain at least three Noble ranked affiliates (2:1) and generate at least 75,000 GV a month in downline investment volume) – receive the value of a 50g 18k gold bar in USD

- Consul (recruit and maintain at least four Governor ranked affiliates (2:2) and generate at least 300,000 GV a month in downline investment) – receive the value of a 117g 18k gold bar in USD

- Senator (recruit and maintain at least five Consul ranked affiliates (3:2) and generate at least 1,100,000 GV a month in downline investment volume – receive the value of a 468g 18k gold bar in USD

- Emperor (recruit and maintain at least six Senator ranked affiliates (3:3) and generate at least 3,500,000 GV a month in downline investment volume – receive the value of a 1kg 18k gold bar in USD

- Caesar (recruit and maintain at least seven Emperor ranked affiliates (4:3) and generate at least 15,750,000 GV a month in downline investment volume

Note that the ratios provided above are the minimum number of affiliates (ranked or otherwise) required on each side of the binary team.

Whether one number is on the left or right doesn’t matter, provided the other side has the required number of affiliates against the other.

GV stands for “Group Volume” and is volume generated via downline investment.

At the time of publication Solidus Global do not provide corresponding GV for specific investment amounts.

Joining Solidus Global

Solidus Global affiliate membership is $30.

Full participation in the Solidus Global MLM opportunity requires an additional $100 to $10,000 investment (estimated).

Conclusion

Even if you were to ignore Chris Principe and Juha Parhiala’s association and promotion of Ponzi schemes, Solidus Global raises red flags on face value.

Your first warning is Chris Principe boasting about Solidus Global not having any products to sell:

With nothing being marketed or sold to retail customers, 100% of Solidus Global’s revenue is derived from affiliate investment.

This investment is used to pay recruitment and referral commissions, rewarding those who bring in a large number of investors.

And here’s where things get (even more) murky.

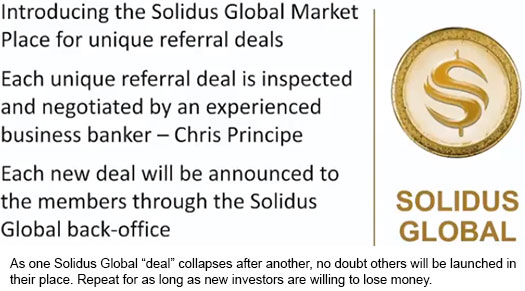

You won’t find any mention of it on the Solidus Global website, but behind the pyramid scheme front-end is a suspiciously Ponzi looking back-end.

Solidus Global affiliates are encouraged to invest in so-called “gold mining contracts”, purportedly based in Africa.

The current contract being pitched is “BanwaGold”, through which affiliates receive a 24 month ROI.

The current contract being pitched is “BanwaGold”, through which affiliates receive a 24 month ROI.

Marketing material suggests Solidus Global pay the ROI after 24 months, but owing to the secrecy of the opportunity I can’t say for sure (hence no inclusion in the comp plan analysis above).

What I can confirm is Solidus Global provide no evidence of any gold mining operations in Africa or anywhere else in the world.

At some point videos of machinery in a random field somewhere might surface, but that’s not a substitute for regulatory disclosure.

There’s no legitimate reason for Solidus Global to pretend it’s based in the Saint Lucia tax haven, other than planned evasion from authorities for as long as possible.

One thing OneCoin found it hard to do as awareness of the Ponzi scheme spread was maintain open banking channels.

By this stage the company’s own name had been flagged by major banking and financial institutions.

A temporary solution was to open accounts in the name of an endless parade of shell companies, however they too were shut down at an increasingly faster rate.

Two months ago Chris Principe interviewed Herve Lacorne, then CEO of WinstantPay.

The interview itself is nothing remarkable, but a few months later WinstantPay has emerged as Solidus Global’s payment processor.

Since then Lacorne appears to have been downgraded to WinstantPay’s Chief Innovative Officer.

How deep does the WinstantPay Solidus Global rabbit hole go?

According to Tim Curry, Herve LaCorne provided banking services to OneCoin and its leaders through his Trade Solutions Group company.

Pretty much every aspect of Solidus Global’s corporate and financial structure is an incestuous stew that, at some point or another, traces back to OneCoin.

To put it bluntly; Chris Principe and Juha Parhiala are now no more experts in gold and mining than they were in cryptocurrency with OneCoin.

What they are experts in however is observing how a Ponzi scheme can be used to dupe a ton of people out of a ton of money.

If Solidus Global’s ROI contracts truly don’t pay anything out until 24 months, that’s a ton of time for them to squirrel away invested funds.

The nature of Solidus Global’s business model lends itself to new ROI opportunities being presented as current ones cool. That is people are no longer investing in them.

Previously invested funds can (and will) be used to pay out existing ROI contracts, however a collapse is still inevitable.

One need only look as far as OneCoin to see Ponzi math and the resulting losses in action.

Outside of what is recovered in recruitment and residual commissions, the majority of Solidus Global affiliate investors will lose money.

Here’s a Solidus webinar with Chris Principe: youtube.com/watch?v=hAc8YZOAcIQ

– I believe there’s nothing new that wasn’t already mentioned in your post above. However, here’s Principe introducing himself as the founder.

solidusglobal.com no longer exists. (DNS_PROBE_FINISHED_NXDOMAIN)

Global Ambassador Juha Parhiala allegedly dead.

Where is the founder and CEO Chris Principe, who was also involved in the OneCoin scam, hiding?

share-your-photo.com/e413c68ca3

Solidus Global’s Instagram account still exists:

instagram.com/solidusglobalofficial/

In January 2021 solidusglobal.com was still online:

archive.org/web/20210122053723/https://www.solidusglobal.com/

My email to the support of solidusglobal.com could of course also not be delivered:

share-your-photo.com/4c649ed139

share-your-photo.com/1f6ea09954

youtube.com/watch?v=drRzTHzVbV4

share-your-photo.com/4b5b5ae6c5

youtube.com/watch?v=2rt1lEHjVVw

share-your-photo.com/e8fede4d0c

youtube.com/watch?v=uGvBhYKBO6M

What did criminal Ruja Ignatova pay Chris Principe for this cover story?

Chris Principe with the meanwhile arrested Muhammad Zafar and the German Florian Andris at a scam event in London in November 2016. This event was announced on the fraud portal diamonds-club.co.uk, which no longer exists:

share-your-photo.com/d558599c5d

The portal belonged to Muhammad Zafar, “UK’s First and Fastest Blue Diamond and Digital Currency Consultant”:

share-your-photo.com/4de02fb8fd

At that time, Muhammad Zafar gave the following contact details:

share-your-photo.com/98a64c0af4