DataBank Review: Tom McMurrain’s SuperWallet CMDX reboot

2019 wasn’t a good year for Tom McMurrain.

2019 wasn’t a good year for Tom McMurrain.

In March 2019 CMDX was on the verge of collapse, prompting McMurrain to beg for $100,000.

Then in August CMDX was dumped from the only public exchange McMurrain was able to get it listed on.

After that CMDX went into stagnation and effectively collapsed.

On June 1st 2022, McMurrain acquired the domain “databank.me”.

On August 2nd CMDX’s old website domain was redirected to DataBank, and McMurrain rebooted his failed crypto grift.

Read on for a full review of DataBank’s MLM opportunity.

DataBank Corporate

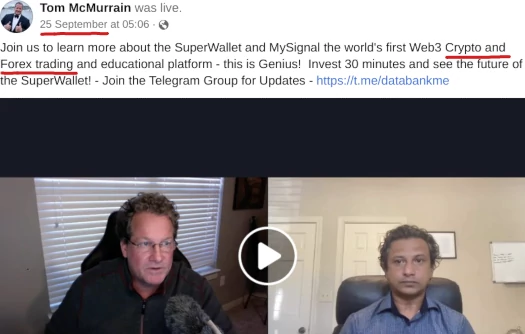

Tom McMurrain (right) is a convicted felon who’s MLM claim to fame is being a top US earner in OneCoin.

Tom McMurrain (right) is a convicted felon who’s MLM claim to fame is being a top US earner in OneCoin.

OneCoin was a $4 billion Ponzi scheme. It is considered one of the most notorious MLM scams of all time.

Being a top US earner (OneCoin’s stint in the US was brief), McMurrain sits mid-tier among OneCoin’s scammers.

The Ponzi side of OneCoin collapsed in January 2017. McMurrain quickly abandoned ship and by May had launched CoinMD.

CoinMD’s business model was essentially:

- give Tom McMurrain money for worthless CoinRewards Ponzi points

- something something healthcare

- everybody loses money except Tom McMurrain

CoinMD collapsed in March 2019, prompting McMurrain to reboot as CMDX. Now the grift was “monetizing personal information”.

CoinRewards were replaced by CMDX and U$D tokens, otherwise the business model was the same:

- give Tom McMurrain money for worthless CMDX tokens

- something something personal information

- everybody loses money except Tom McMurrain

CMDX collapsed much quicker than CoinMD did. McMurrain let it sit idle until a few months ago, which brings us to DataBank’s launch on or around July 2022.

DataBank’s Products

DataBank doesn’t have a retail offering but does offer a free tier.

Users sign up for free, complete a “HealthStyle profile” and receive $280 worth of DataRewards (DBME) tokens after 12 months.

The MLM side of DataBank has no retailable products or services.

DataBank’s Compensation Plan

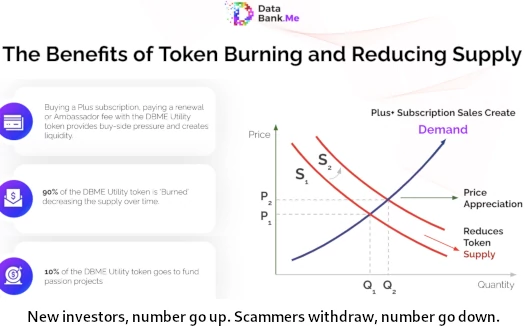

DataBank affiliates sign up and purchase DBME tokens. DBME tokens are then used to pay for subscriptions.

DataBank don’t disclose the internal DBME conversion value but do price their subscriptions in USD equivalents:

- Prime – $75 annual subscription, receive $550 worth of locked DBME over 11 months

- Bronze – $550 annual subscription, receive $1260 worth of locked DBME over 10 months

- Silver – $1100 two-year subscription, receive $3070 worth of locked DBME over 9 months

- Gold – $3300 three-year subscription, receive $8210 worth of locked DBME over 8 months

- Platinum – $5500 five-year subscription, receive $13,350 worth of locked DBME over 6 months

Note that DBME obtained through subscriptions is locked for the term of the subscription (12 months to 5 years).

The MLM side of DataBank pays on recruitment of subscription fee-paying affiliates.

Recruitment Commissions

DataBank affiliates are paid in USD and DBME when they recruit new affiliates.

Specific rates aren’t disclosed but here’s the two examples DataBank provides in their compensation documentation:

- recruit a Prime affiliate and receive $75 plus $50 in DBME (note $75 is the total subscription amount paid, I’m not sure if that’s a typo in the documentation)

- recruit a Silver affiliate and receive $550 plus $50 in DBME

Going off Silver, recruitment commissions appear to be 50% of subscription fees paid and $50 or more of DBME.

Residual Commissions

DataBank pays residual commissions via a binary compensation structure.

A binary compensation structure places an affiliate at the top of a binary team, split into two sides (left and right):

The first level of the binary team houses two positions. The second level of the binary team is generated by splitting these first two positions into another two positions each (4 positions).

Subsequent levels of the binary team are generated as required, with each new level housing twice as many positions as the previous level.

Positions in the binary team are filled via direct and indirect recruitment of affiliates. Note there is no limit to how deep a binary team can grow.

Every Monday DataBank tallies up new subscription volume on both sides of the binary team.

Affiliates are paid 10%, capped based on how much they’ve paid in subscription fees:

- Prime tier affiliates earn up to $250 in residual commissions a week

- Bronze tier affiliates earn up to $550 in residual commissions a week

- Silver tier affiliates earn up to $1100 in residual commissions a week

- Gold tier affiliates earn up to $3300 in residual commissions a week

- Platinum tier affiliates earn up to $25,000 in residual commissions a week

Once paid out on, volume is matched against the stronger binary team side and flushed. Any leftover volume on the stronger binary team side carries over.

Matching Bonus

DataBank pays a Matching Bonus on residual commissions earned by downline affiliates.

The Matching Bonus is paid out via a unilevel compensation structure.

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

DataBank caps the Matching Bonus at four unilevel team levels.

The Matching Bonus is paid out on residual commissions earned across these four levels as follows:

- Bronze and Silver affiliates earn a 10% match on level 1 (personally recruited affiliates) and level 2

- Gold affiliates earn a 10% match on levels 1 and 2 and 20% on level 3

- Platinum affiliates earn a 10% match on levels 1 and 2, 20% on level 3 and 25% on level 4

Note that to qualify for the Matching Bonus, a DataBank affiliate must have earned at least $400 in residual commissions for the week.

This requirement locks out Prime tier affiliates from the Matching Bonus.

Joining DataBank

DataBank affiliate membership is tied to a subscription:

- Prime – $75 for 12 months

- Bronze – $550 for 12 months

- Silver – $1100 for 2 years

- Gold – $3300 for 3 years

- Platinum – $5500 for 5 years

The more a DataBank affiliate spends on their subscription the higher their income potential.

DataBank Conclusion

Not surprisingly, DataBank’s business model can be summed up as:

- give Tom McMurrain money for worthless DBME tokens

- something something personal information

- everybody loses money except Tom McMurrain

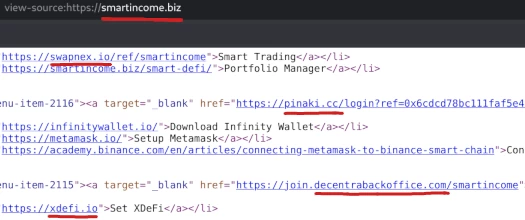

Whereas CMDX and U$D were ERC-20 tokens, for DBME McMurrain has migrated over to BEP-20.

Be it ERC-20 or BEP-20, these tokens take a few minutes to set up at little to no cost.

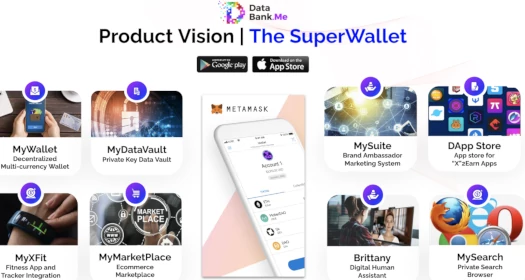

Although “personal information” is still the grift, outside of the token investment scheme free users and affiliates can receive more DBME by completing various tasks.

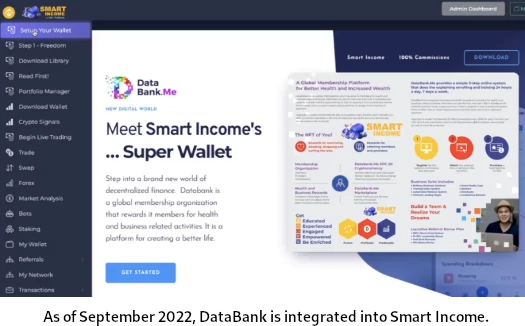

This side of DataBank is grouped under “SuperWallet” branding.

Considering McMurrain generates DBME at little to no cost on demand, “tasks for DBME tokens” is essentially busy-body work.

On the back-end McMurrain locks up acquired DBME, meaning the only money to be made is via recruitment of new affiliates. This is your classic pyramid scheme.

As we’ve seen with CoinMD and CMDX, there’s nothing to cash out when tokens are released because the tokens themselves are worthless.

To that end DataBank appears to be set up to help McMurrain’s CoinMD and CMDX victims offload their token bags onto new victims.

When a new affiliate signs up, they pay an existing token bagholder through DataBank’s backoffice. The bagholder affiliate then transfers tokens from their own stash to the new recruit.

As to the actual value of DMBE, on a recent DataBank webinar McMurrain bemoaned one of his victims selling 50 million tokens for $38 ($0.00000076).

On the probability DataBank will flop once the window to dupe new victims with a name-change dries up, McMurrain is already setting up his next grift:

Crypto and forex trading, over a shady Telegram group… groan.

“MySignal” will be available to Silver and higher tier DataBank subscribers.

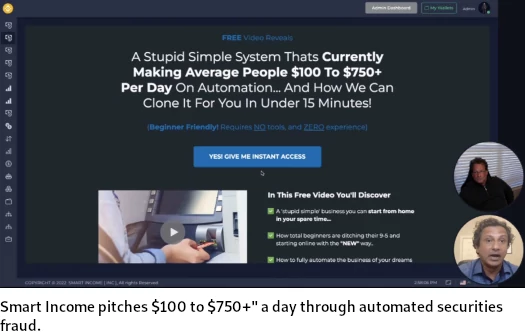

MySignal funnels DataBank affiliates into Smart Income, a crypto and forex trading platform with its own marketing plan.

Not surprisingly, Smart Income also offers investors access to automated trading bots.

Smart Income is set up through a shell company in Connecticut. Tom McMurrain and Smart Income owners Eric Kipperman and Che Shiva are all based out of the US.

Neither DataBank, Tom McMurrain, Smart Income, Kipperman or Shiva are registered with the SEC.

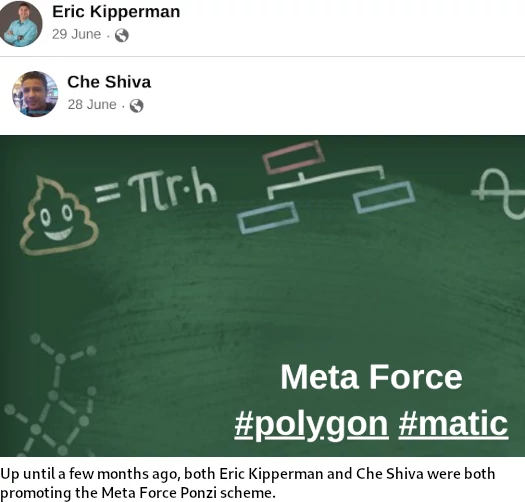

Interestingly enough in researching Smart Income I came across the company promoting Meta Force.

Meta Force is part of Lado Okhotnikov’s Forsage Ponzi schemes.

The SEC filed suit against Okhotnikov and ten Forsage scammers for securities fraud back in August.

The SEC filed suit against Okhotnikov and ten Forsage scammers for securities fraud back in August.

MetaForce collapsed last month. Last I checked in Okhotnikov is trying to get some MetaForce NFT nonsense off the ground.

Under the ruses of “”smart contract”, smart trading” and “smart staking”, Kipperman and Shiva funnel Smart Income participants into various crypto scams:

- Swapnex is a collapsed Boris CEO Ponzi scheme

- Pinaki is a collapsed “trading” Ponzi scheme

- Decentra is a Dubai based Ponzi scheme run by Mexican national Jonathan Sifuentes (Sifuentes is laying low following a securities fraud settlement with Arizona last month)

- XDefi is a “staking” crypto Ponzi scheme built around XDEFI tokens

Be it straight investment into DBME tokens or indirect investment into Ponzi schemes through Smart Income, math guarantees the majority of participants in Ponzi and pyramid schemes lose money.

Having done zero research and just playing a hunch, Tom McMurrain is primarily targeting the developing world with his scam.

Not that there aren’t enough gullible people in the US etc. but ripping off a US resident for a few hundred bucks is not a life changing event.

A few hundred bucks is likely a life’s savings for people in Ghana or Pakistan.

Tom knows people in the developing world are far less likely to complain to authorities when they’ve been defrauded. And their home countries are astronomically less likely to take action against him.

He doesn’t care how much damage he does to his victims. Why should he? Tom McMurrain is a serial scam artist and his victims are just collateral damage.

What I don’t get about McMurrain is that he has already been convicted and done time once. At least. He isn’t a Ricketts who has gotten away with it for decades. He isn’t a James who did time for something else. And he certainly isn’t an Ignatov.

What drives someone like a Tom McMurrain or Jan-Eric Nyman to keep trying even when it’s obvious that they are complete grifters who are never going to make the big time, nobody is going to taken them seriously and this will burn eventually?

The OneCoin third-world downline McMurrain started CoindMD with has long-since moved on.

The ones that couldn’t offload their bags at a discount probably just wrote off their losses.

As of September 2022 traffic to DataBank’s website is 73% US ad 27% UK.

Hmm, so DataBank has thus far only penetrated English speaking countries but I wonder for how long.

So I finally looked Tom up on facebook and here’s something I found:

imgur.com/a/5ASVogl

I did guess two out of three for what that’s worth.

Lol Ghana, Singapore and Pakistan “leaders”. I think McMurrain means bagholders with the heaviest bags who haven’t sold yet.

Gotta remember he’s having Databank bagholders directly offload their tokens onto new bagholders as a withdrawal mechanism.

Because even small-time and nano-time scams taking in 7, 6 or even just five figures a year still beat stacking shelves for £15,000 a year.

To scammers, a prison sentence is just another “learning experience” to work into the backstory.

That guy I’ve not really had confidence in him and his coin. What really surprise me is having to pay a yearly subscription or face my account being archived.

I’ve never paid any subscription because I don’t know why I should pay subscription for a coin when people don’t even pay subscription for Bitcoin or ethereum.

RIP WeWe Global?

Kalpesh Patel x Tom McMurrain – player.vimeo.com/video/818066515

Oz wrote:

That’s not a problem. Tom McMurrain is rich. Very rich!

Podcast (45 minutes) from November 2015:

share-your-photo.com/587686f2bf

youtu.be/tOxz75glFhs?t=156

Article from October 12, 2005.

bizjournals.com/atlanta/stories/2005/10/10/daily23.html

21 videos from May 2015 to March 2023 on this channel from Tom McMurrain:

share-your-photo.com/8dd301924f

youtube.com/c/JoinOneCoin/videos

In this short video from June 2017, serial fraudsters Tom McMurrain (left) and “Dr.” Muhammad Zafar are celebrated.

share-your-photo.com/6c9ec0ba5d

Unfortunately, the uploader Md Abu Sufian from Bangla Desh does not mention where the fraud event took place.

youtube.com/watch?v=cbay7HZimoo

A fantastic offer on AMAZON.

share-your-photo.com/c1381487b7

amazon.de/-/en/Thomas-McMurrain-ebook/dp/B017JDMJJK

Who owns the YouTube channel Cryptocurrency 4Life? It contains 36 videos, eight of them with Tom McMurrain. An example:

share-your-photo.com/4afc3b3a73

youtube.com/watch?v=ldmX6FJe-lQ

Mohammad Asad Kibreya was a Blue Diamond, GLG and Inner Circle member in the criminal OneCoin organization.

youtube.com/@cryptocurrency4life411

Asad Kibreya was also a participant in this podcast (38 minutes) from June 22, 2019:

youtube.com/watch?v=wgmyXK6bM9I

Asad Kybrea and Ruja Ignatova in November 2016:

share-your-photo.com/9f33a81ac8

Normally when Kalpesh Patel starts promoting another Ponzi scheme the old Ponzi scheme crashes shortly after and the fact that he is in breach of their terms and conditions is quite a crack up.

The last Ponzi scheme he was promoting was GSPartners, that lasted two weeks!

Steve Condo brought OneCoin into New Zealand and Australia just sent you a recent photo of Steve Condo, Kalpesh Patel, Tony Mark-Seymore the notorious Goran Hemstrom taken in Dubai two weeks ago.

I’m just wondering if Tom McMurrain (top US earner in OneCoin) if that is the connection with Kalpesh Patel and DataBank

GSPartners was such a flash in the pan I completely forgot Patel promoted it.

McMurrain owns DataBank so Patel has to be in bed with him to promote it.

Sharon James (Traffic Monsoon) sighting.

I caught a Databank.me zoom call today and there she was. She didn’t speak on the call but she was in the audience.

Tom McMurrain is a boring speaker. Flat monotone droning on and on.

Blah blah, own your own data, blah blah.

Tom just launched MyCommunity, it’s like Facebook without all the things he doesn’t like about Facebook. Also without the user base but hey.

“I want to show you that you don’t need to be a shyster, you don’t need to be a conman to make money in crypto.” – Tom McMurrain

But in Tom’s case it sure does help.

I’m not offering this as commentary, I’m shareing a video title and a link:

“DataBank.Me Update – Re-focusing – Re-tooling – Re-thinking – Re-Launching 100% Decentralized – NOT going out of Business.”

vimeo.com/902568907

New company, new jurisdiction?

RIP DataBank. With kids out of the nest, is this the start of McMurrain’s Dubai villain arc?