Utah mayor is a T7X board member (Trusted Smart Chain fraud)

![]() Trent Staggs is and has been the mayor of Riverton, Utah since 2018.

Trent Staggs is and has been the mayor of Riverton, Utah since 2018.

In what is potentially an abuse of office with respect to conflicts arising from verifiable securities fraud, Staggs is also a member of T7X’s Board of Directors.

In his capacity as Mayor of Riverton, Staggs appeared on a Trusted Smart Chain marketing webinar on January 28th.

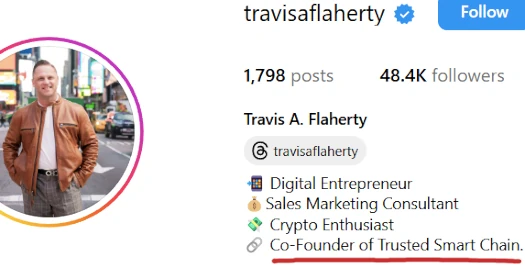

In this exclusive interview, Travis Flaherty sits down with Mayor Trent Staggs, former Trump-endorsed U.S. candidate, to dive deep into the political landscape of the blockchain industry.

Trent shares his insights on the future of tokenizing real-world assets (RWAs), and why he chose to take a key position on the board of T7x.

Ah shit, here we go again…

Before we get into Stagg’s marketing “interview”, I want to frame the interview by establishing where the concern lies with respect to T7X and Trusted Smart Chain.

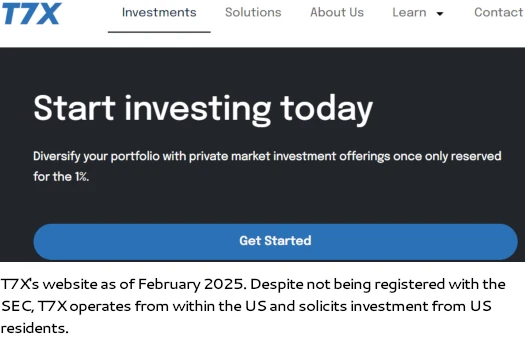

Trusted Smart Chain is an MLM opportunity tied to T7X, a purported “exchange specializing in real-world assets”.

This is from the FAQ section of Trusted Smart Chain’s website;

The founder of T7X also established and launched the Trusted Smart Chain (TSC) blockchain.

Practically speaking Trusted Smart Chain and T7X are the same entity run by the same people.

In violation of federal securities law, neither Trusted Smart Chain and T7X disclose company ownership on their respective websites.

In BehindMLM’s published Trusted Smart Chain review, we cited marketing material identifying Billy Beach, aka Mark Williams Schuler, as founder of Trusted Smart Chain and T7X.

Billy Beach’s ownership of T7X is hidden from consumers on its website. Beach is instead presented as T7X’s “VP of Business Development”.

Trusted Smart Chain’s MLM opportunity revolves around two investment opportunities built around its TSC token.

- investments of $2500 ro $125,000 are solicited on the promise of passive returns, paid in TSC tokens (cited as daily token rewards)

- invested in TSC tokens can be staked with Trusted Smart Chain on the promise of a share in 20% of passive returns paid out to investors

As per a previously filed securities fraud lawsuit filed by the SEC, pertaining to his involvement in the collapsed iX Global Ponzi scheme, Billy Beach is based out of Utah.

As of January 2025, SimilarWeb is tracking 100% of Trusted Smart Chain’s website traffic as originating from the US.

Despite being owned and operated from the US, efforts to conceal this from consumers include:

- T7X providing a corporate address in Prague, Czech Republic on its website; and

- Trusted Smart Chain failing to provide a corporate address whatsoever

Neither Trusted Smart Chain, T7X or founder Billy Beach are registered with the SEC.

Within the legal framework regulating securities (the Howey Test and Securities Exchange Act), Trusted Smart Chain and T7X are a clear-cut case of securities fraud.

Trusted Smart Chain’s answer to that is essentially “but we don’t guarantee anything”.

What Makes the TSC Node Exempt from SEC Registration?

TSC Nodes are independent software that must be installed and managed by a Node owner. There is no promise of return value or profit.

Nodes earn digital rewards in the form of TSC tokens for supporting and securing the blockchain. These digital rewards are not guaranteed to have a specific value, and no projections or promises are made regarding their worth.

This is a strawman defense that has no legal basis.

There is no “unregistered securities are OK if you don’t guarantee anything” carve out in the Securities Exchange Act. Likewise there’s no “but we don’t guarantee returns” exemption from the Howey Test.

I know that was a bit of a diversion from Mayor Staggs’ Trusted Smart Chain “interview”, but it’s crucial to establish what Staggs and host Travis Flaherty are promoting.

Staggs’ introduces himself in the Trusted Smart Chain marketing webinar as someone familiar with securities law in the US who absolutely should know better.

[1:10] I got an MBA. I worked in finance across a couple of different sectors but uh, having worked at Morgan Stanley, [I] held pretty much every securities license under the sun as a VP there and managing large teams.

[1:44] And then, [I] also have a little bit of a background into technology and of course the governmental space. Here in the last twelve years I’ve been in elected office, or going into my twelfth year now locally.

And, as you stated um, I ended running for the United States senate last year … we ended up not succeeding.

Stagg’s marketing interview is front-loaded with generalizations about cryptocurrency that have. It has nothing to do with Trusted Smart Chain’s investment opportunity or T7X.

It isn’t until eight minutes in that Staggs explains what attracted him to T7X.

[7:55] What drew me to it is the tokenization of real-world assets. Y’know um, having taken a company public, y’know the board of directors of that company, seeing the pain and the expense of paying for audits and for uh y’know, all the accounting and legal.

And then seeing once you are public, the level of manipulation and shorting and naked shorting and all the stuff that goes on. It really is, to me, problematic.

And I think the tokenization of real-world assets, seeing how that can really democratize, if you will, finance and allow everyday investors to go ahead and start participating in deals they wouldn’t otherwise be able to.

In summary, Staggs sees T7X as an unregistered, unaudited and unregulated alternative to the stock market for retail investors.

Unfortunately Staggs doesn’t elaborate on how an MLM company very much centralized under control of its founder constitutes “democratization” of investing in presented “deals”.

Again, in potential violation of federal securities law and the FTC Act, Staggs doesn’t disclose whether he’s been compensated by T7X or whether he’s invested.

But it sure does sound like it;

[26:20] Well I think the timing is pretty impeccable. I mean you’ve heard the expression that “there’s nothing as powerful as an idea whose time has come”.

And I really believe that that’s the case because we have such great tailwinds now, with the Trump administration coming in, with all the things that we’ve talked about, with this framework that’s being created. The strategic bitcoin reserves or others that are happening here.

And so I really feel like we are right there and we’re at a moment where um, where digital assets across the board… I mean it’s just going to take off.

We know that so many experts have hypothesized or guessed that we are going to hit y’know, sixteen trillion by, in tokenization of real-world assets by 2030.

Some are saying even much, much higher than that. Thirty trillion or more. I mean I’ve seen figures that have substantially exceeded the sixteen trillion estimation.

So all of that being said, and knowing that you’ve got a company and a platform like T7X, that is offering this ability to really focus on the tokenization of real-world assets.

And having this ecosystem with the Trusted Smart Chain, I think it’s just a great, great opportunity. A perfect time to be able to get involved and be right there.

On the flipside Travis Flaherty spells out why Staggs being involved is important to Trusted Smart Chain and T7X.

[22:04] It’s great to have individuals, y’know like yourself, that are here. That are helping steer the ship.

It’s classic “legitimacy via association”.

On Trusted Smart Chain and T7X committing securities fraud (and potential commodities fraud with T7X operating as an unregistered exchange dealing with the trading of purposed “real-world assets”), Staggs states;

[9:28] This is what really excites me. What I believe we are doing with the Reg A, with the Reg D filings with um, y’know the “EDGAR’ising” or making public of the audits and the financials, I think that is going to be the standard.

[9:52] To have a group that’s already recognized that and are willing to have and implement self-imposed, right?

That level of uh, regulation, of compliance if you will, transparency, that’s what’s really attracted me to it. And I think there’s a huge upside with respect to the T7X platform, in onboarding all of these assets that are already coming to us and asking to be tokenized.

[17:17] The big, big difference with T7X is the fact that we are imposing this requirement, through the Reg A and Reg D offerings, to go ahead and legitimize it.

List it as security, don’t try to hide around it, and publicly disclose financials and audits. Stand behind it.

As previously stated, neither Trusted Smart Chain or T7X are registered with the SEC. There are no Regulation A filings. There are no Regulation D filings. There are no filed audited financial reports.

Why Staggs is misrepresenting T7X and Trusted Smart Chain’s unregistered securities offering to potential investors is unclear.

It’s not like Staggs doesn’t know why existing securities law exists;

[17:57] My understanding and what I’ve seen, and I know other people on this call may have experienced with some other groups, is that um y’know, they weren’t doing what they said they were doing.

[20:30] And then, just the um, being able to vet all of the real-world assets that are going to come on-board the exchange … it’s very important these are well established.

That they have um, an enterprise value that you can realistically ascertain y’know, through a valuation, through the audit at the beginning. And that they’ve been around for a number of years and are putting out cashflow – that will come back in the form of a dividend, right? Through the TSC [token], through your layer one coin.

All that is incredibly important.

Indeed, which begs the question why Staggs is and continues to turn a blind-eye to neither Trusted Smart Chain or T7X being registered with the SEC and filing audited financial reports?

As for not “hiding” Trusted Smart Chain’s and T7X’s securities offerings, Travis Flaherty clearly has very different ideas to Staggs.

[22:12] Our nodes are software, not securities. There’s no guarantees of gains or claims to the contrary are false. And they’re not endorsed by Trusted Smart Chain Chain, T7X or Prosper Link.

So much for “standing behind” what Trusted Smartchain and T7X are offering.

And just so we’re 100% clear on what Trusted Smart Chain and T7X are offering, here’s Trent Staggs about a minute after Travis Flaherty’s securities offering denial;

[23:17] You’ve got um, you’ve got… you have these real-world assets that have y’know, tangible value. But they’re putting out a cash flow, as you indicated, dividends on a quarterly basis.

And so when you have that um, that scenario, where you have say, a hundred real-world assets that are paying, I’m just using random numbers here, but say five million dollars in um, in an annual distribution; y’know that’s five hundred million dollars worth of distributions that are going to be paid out in that TSC coin.

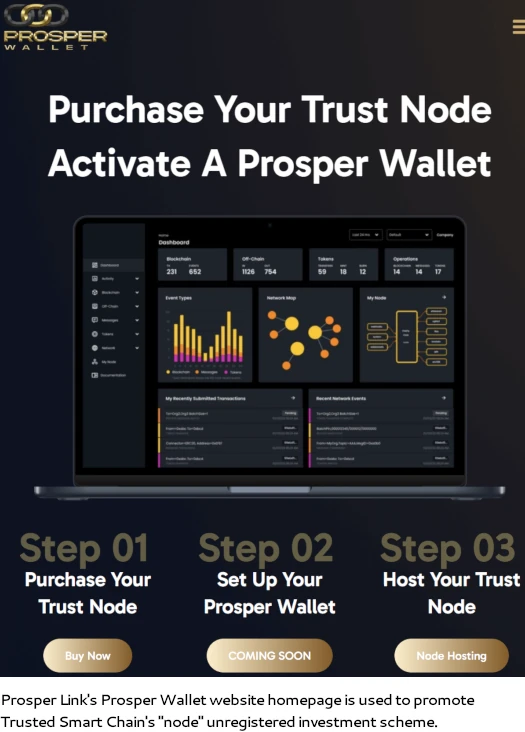

Also a sidenote; I hadn’t heard of “Prosper Link” before. Turns out Trusted Smart Chain recently came up with a name for its MLM compensation plan. A bit dorky but whatever.

Prosper Link has been set up as an LLC shell company that operates from the website domain “prosperwallet.io”:

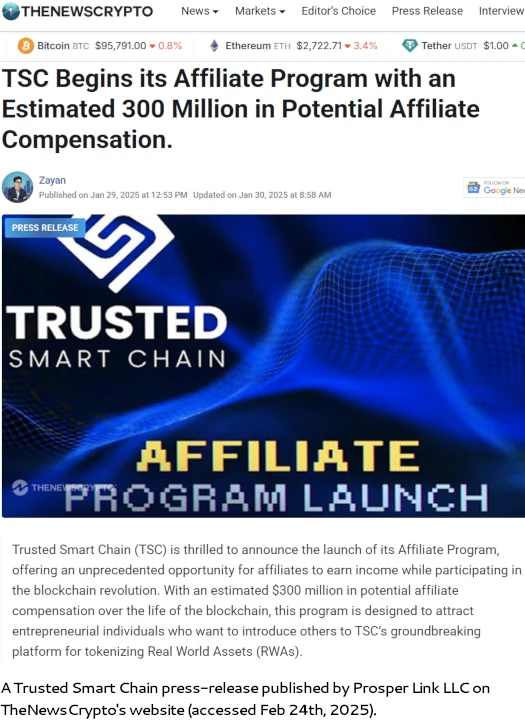

What’s eyebrow raising though is Trusted Smart Chain marketing its “Prosper Link” MLM opportunity as offering “an estimated $300 million in potential affiliate compensation“.

Estimated by whom? And what on Earth is that $300 million figure based on?

Certainly not audited financial reports filed with the SEC.

While it’s rare, US politicians attaching themselves to fraudulent MLM crypto investment schemes isn’t unheard of.

USFIA was an MLM crypto investment scheme built around “gemcoin”.

In researching USFIA in 2015, BehindMLM unearthed the involvement of former mayor and then Arcadia City councilman, John Wuo.

The SEC filed charges in September 2015, alleging USFIA was a $32 million dollar Ponzi scheme.

A month later Wuo, who originally denied having anything to do with USFIA, resigned in disgrace.

As the SEC’s case progressed and data was analyzed, USFIA victim losses climbed to over $180 million.

It would later be revealed Wuo received $1.8 million in undisclosed compensation from USFIA. A separate investigation by California’s Fair Political Practices Commission resulted in a $2000 fine.

Wuo never held public office again.

USFIA founder Steve Chen pled guilty to USFIA related criminal charges in 2020.

Chen was sentenced to ten years in prison in February 2022. Chen died in custody while serving his sentence in December 2022.

In addition to its own potential securities and commodities fraud charges, Trusted Smart Chain and T7X operate under threat of a second SEC iX Global lawsuit.

The first iX Global lawsuit was filed in August 2023 and alleged $49 million in fraud. Investigations by a court-appointed Receiver would see that figure rise to $110 million.

iX Global sold investment positions in Debt Box’s purported tokenization of real-world asset projects (sound familiar?).

As iX Global and Debt Box insiders, both Billy Beach and Travis Flaherty were named defendants in the SEC’s lawsuit.

Owing to SEC agents prosecuting the original case getting some dates wrong and not rectifying with the court once realized, the case was voluntarily dismissed at the request of the SEC in May 2024.

While there’s no excuse of the SEC agent’s conduct (the agents later resigned), key is the case being dismissed on procedural grounds.

The court explicitly noted in its dismissal order that the merits of the underlying fraud allegations remained unaddressed.

The SEC is understood to be preparing a second iX Global fraud case with different prosecuting attorneys. Originally defiant about the first case dismissed, iX Global founder Joe Martinez shut iX Global down upon learning a second case was looming.

To date a second iX Global fraud case hasn’t materialized. Over in India though, Joe Martinez remains a wanted fugitive on iX Global criminal charges.

India’s top iX Global promoter, Viraj Patil, has been in custody pending the outcome of his iX Global criminal case since December 2023.

Trusted Smart Chain and T7X are clearly reboot spinoffs of iX Global and Debt Box – and this is what Trent Staggs, in his capacity as mayor of Riverton, has attached himself to through “a key position on the board of T7x”.

To quote Staggs one more time on Trusted Smart Chain and T7X;

[18:20] Travis Flaherty: We know that utility is important when it comes to a project but also the people that are behind the project itself.

So I’d love for you to, y’know, elaborate a little bit on the infrastructure, or the team, or the people that are involved. I know that you’ve had interactions with the real-world asset managers, the founder of T7X you’ve known for quite some time.

Talk to me a little about the infrastructure. Do we have, do they have the ability to be able to really pull off something like this?

Trent Staggs: Yeah no great question, and that’s um, y’know people need to conduct their own due-diligence, right?

As it stands, this is what due-diligence into Trusted Smart Chain and T7X looks like. Pending any further updates, we’ll keep you posted.

Update 25th February 2025 – Within 24 hours of this article being published Trusted Smart Chain marked its Trent Staggs marketing video as private.

The video had otherwise been publicly available since publication on Trusted Smart Chain’s official YouTube channel on January 30th.

This article originally contained a link to the video. As Trusted Smart Chain has now disabled public access to the video I’ve disabled the previously accessible video link.

Ayo, wtf is “f’nance”?

Article updated to note within 24 hours of publication Trusted Smart Chain disabled public access to its Trent Staggs marketing video.

So much for transparency and “standing by” your claims.