uFun Club’s new payment processor is uPayCard

A while back now uFun Club lost their previous payment processor services.

A while back now uFun Club lost their previous payment processor services.

We’re not sure who they were using, but we do know the service was abruptly cancelled and affiliates were without a means to withdraw for months.

Last week we then started hearing about a new payment processor, specifically for uFun Club affiliates in western countries.

Initial announcements about the payment processor were pulled from Facebook in less than an hour, with affiliates threatened with their account being frozen if they discussed the processor in public.

Given the information blackout we didn’t initially have much to go on, but can now reveal uFun Club’s new payment processor is uPayCard.

Despite the name uPayCard appears to be an otherwise legitimate third-party payment processor.

As per their website,

We are partnered with three major companies in the United Kingdom to supply our best-of-breed prepaid payment products and services to our clients and customers.

Our Issuing Bank is a member of MasterCard International and is licensed to issue our MasterCard products.

Our Issuing Processor is licensed by both Visa International and MasterCard International to issue and process our MasterCard products and our card manufacturer, warehouser, personaliser and distributor is also licensed by Visa and MasterCard.

How is then a global $1.17 billion dollar Ponzi scheme has signed on with them then?

We have no idea. But one imagines uFun Club didn’t reveal the fraudulent nature of their business model when they signed up.

UPayCard provides businesses with a comprehensive multi-currency payment solution that can be used to pay business and sponsored individuals worldwide.

A business simply needs to contract with UPayCard for a Business Account.

Upon being provided a Business Account, the business can then pay other business or individuals that also have an Account on the UPayCard system.

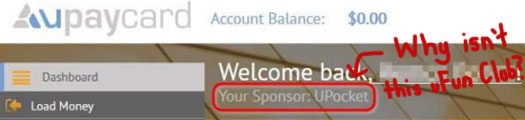

Whether uFun Club themselves signed up for a uPayCard business account or if they’re using someone else’s account is unclear.

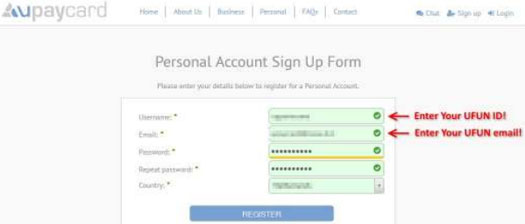

What we do know though is that affiliates must sign up to uPayCard via a link provided in their uFun Cub backoffice:

Once signed up, uFun Club affiliates then transfer funds to uFun Club’s “business account”.

This appears to be a separate bank account again, which uFun Club have hooked up to the uPayCard backend.

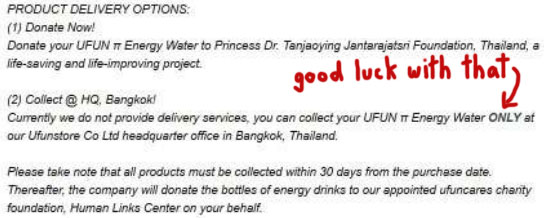

And for all the baloney talk about pre-IPO shares, for now it’s still very much business as usual. New uFun Club investors invest funds under the guise of purchasing bottles of water, and in exchange are given worthless uToken Ponzi points, which they are lead to believe hold a dollar value.

Even more amusing is that the uFun Club affiliate backoffice is still advising pickup is possible from uFun’s Thailand office, which was raided and shutdown last month.

Conveniently affiliates can also opt to donate their purchased water to some Thai charity, which I’m assuming is what everyone new signing up is currently clicking.

Given the regulatory attention uFun Club is currently getting in Thailand though, it’s a given that the bottles of water don’t even exist (Ponzi pseudo-compliance at its finest).

Need further proof?

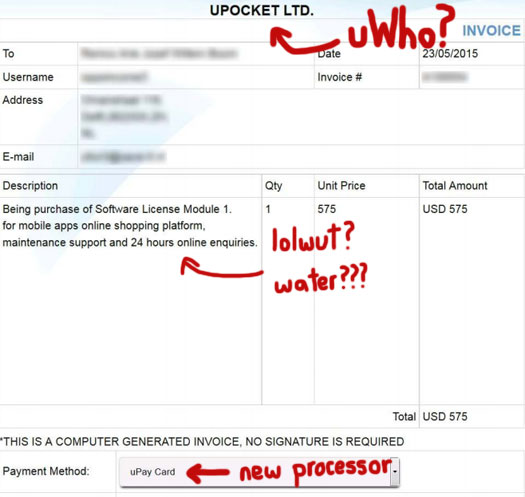

Here’s a copy of an invoice uFun Club send affiliates when they sign up:

A software license for “mobile apps online shopping platform”. Riiiiiiiiiight.

Funny how that wasn’t mentioned before.

Note the company name “uPocket LTD.”. Perhaps this is the bogus business name uFun Club have signed up to uPayNow with?

Another screenshot from the uFun Club’s uPayNow payment processor backoffice certainly seems to suggest so:

Quite obviously uFun Club aren’t selling bottles of water, nor are they selling software licenses.

The question is whether or not uPayCard are aware of the true nature of uPocket LTD. uFun Club’s business model.

To that end we’ve reached out to uPayCard for comment, and will publish an update if we hear back from them.

Business and Individual Accounts are provided by UPayCard LTD. UPayCard is licensed by the Financial Conduct Authority of the United Kingdom of Great Britain.

The MasterCard Cards are issued by Optimal Payments Limited pursuant to a license from MasterCard International.

Certainly if uPayCard are interested in maintaining those FCA and Mastercard licenses, doing business with a $1.17 billion dollar Ponzi scheme wouldn’t seem to be the smartest of ideas.

Meanwhile why uFun Club aren’t offering payment processor services to their Asian investors (who are easily the largest group of uFun Club investors), is unclear.

I couldn’t see anything on the uPayCard website barring Asian countries from using the processor services provided, leaving me at a loss to explain why only investors outside of Asia are being given access.

If any Asia-based uFun Club investors reach out to uPayCard and get an answer, feel free to share it with the rest of us in the comments below.

uPayNow does not have MSB registrations/licenses in each asian country as its required to serve its residents. FCA registration covers their operation in europe.

Alternatively, you should contact “Optimal Payments Limited” as those prepay cards are underwritten by them and get their response, I am sure they still want to remain on MC and Visa approved providers list 😉

Wow, things are getting very interesting, as it says in bottom of their page:

Is completely incorrect , as there is not a license of any sort issued by FCA to “UpayCard*”

However there is a e-money license from FCA issued to “Optimal Payments Limited”, if the license of a partner covers the processor activities or not is arguable, but i definitely can have a field day proving that NOT. A small lie but still a lie on processor part.

More info on the doctor nabbed today:

Doc claims he was sucked in by a patient and invested $1036 USD (2 star package). Scammed almost $800,000 from his downline though… dude was in deep.

But in the end he got scammed by the scammers…

Oh and money laundering too. Sweet.

Wirawit (guy on the run) got further shafted too:

Bye bye $300,000!

nationmultimedia.com/national/Police-interrogate-27th-UFUN-suspect-30261155.html

Oz, where did you get a reference to some “UpayNow” mentioned here so many times? I cannot find it anywhere.

I have read through the article and have done some searches on the internet. I believe the “Upaynow” mentioned in the article is a typo.

UpayCard is the payment processor.

Upocket is probably a UFUN company.

Upaynow seems to be a name used by many different entities (people and companies).

Yep, I insist that UpayCard is operating unlicensed as the license issued to their partner only covers the card operations and of course transactions inside of UpayCard are not disclosed to Optimal Payments Limited or Optimal Bank UK and of course not a single AML report on those transactions is filled with FCA.

Cards are fully optional there. UpayCard is providing an e-wallet and letting to do account to account transfers without involving cards of their partner therefore are money transmitter and in violation of AML act.

Or just read and laugh on their page and imagine eyeballs of FCA investigator when he sees UpayCard with a straight face talking about anonymous transactions 🙂

from their page at: upaycard.com/en/personal-account-to-account

Also this gem from their T&C:

Amazing, no chargebacks and anonymous, complaint my ass 😉

Sorry it’s uPayCard and uPayCard only. I was a bit tired when I wrote the article, my bad.

Received notification uPayCard that a support ticket has been opened (I sent an email to their media contact…), but nothing further yet.

More Wirawit loot seized:

nationmultimedia.com/breakingnews/Assets-of-26th-UFUN-suspect-seized-30261230.html

now26 TV has a short clip about the arrest of the doctor yesterday.

now26.tv/view/45652/POLICE-INTERROGATE-27TH-UFUN-SUSPECT.html

is it just me, or has now26 TV cooled off a bit about reporting about ufun, since the nafizuddin story.

The Now@Noon crew were in Europe for some convention last I checked. Probably back next week.

here is some info about upaycard LTD :

question: if upaycard is shifting funds around the world as a payment processor, how can its status be dormant. it will definitely be accruing costs and profits?

what does ” accounts submission requirement is categorised as DORMANT” mean???

datalog.co.uk/browse/detail.php/CompanyNumber/08491211/CompanyName/UPAYCARD+LTD

info on upaycard LTD:

bazille [british/french] and wheeler [american] were both appointed in mid 2014.

moreover the FB page of upaycard, has it’s earliest post in dec, 2014, and here it was announced that the website upaycard.com was ‘coming soon’.

so, the website and payment processing services of upaycard are quite recent, it is a very new company, and has no market standing to back its alleged legality, or any market presence of note.

the current office address of upaycard is very recent ie it was changed on may 8th 2015.

previously the address was :

this sheen lane, london address, was previously used by alan bazille for ‘soeasy technologies’, ugspay ltd, and global telecom billing ltd.

this is a consumers review about ugspay which was a previous payment processor of alan bazille:

upaycard is definitely a stinker!

in jan, 2015 alan brazille had been threatened by a ugspay client, tht he would be reported to the FBI IC3 division [internet crime complaint center]:

wonder what happened to that ^!

um, how is optimal payments ltd doing business with career crooks? optimal payments is a mastercard compliant service provider, as latest as may 18, 2015

Never heard back from uPay Card. Guess they’re in on it…

*!!jump and scream!!*

i received a REPLY to my email to FCA [financial conduct authority], UK, this morning [checked my mail just now!]

i wrote about how upaycard is claiming, on it’s website, to be licensed by the FCA. this is the FCA’s response:

the FCA has offered to redirect my mail to the correct division which deals with unauthorized e money services.

i will write back and follow it up. i have provided links to behindmlm articles about ufun and upaycard.

alain brazille! your upaycard website is a LIAR like you. you are NOT licensed by FCA as your website claims!!

Interesting. Let us know what the correct division states.

I’ve been receiving “how dare you!” emails from uFun investors after publishing the uPayCard article, so they’re not too happy about it.

hmm dato dan must have instructed his minions to ‘how dare’ you.

or maybe dato dan is writing to you himself for pissing on his processor! 🙂

well, now ufun investors have to trust two crooks with their money, dato dan and alain brazille.

which one will screw them over first?

I heard anjali screams echo somewhere.

Good job, can’t wait to hear the latest update from you regarding the uPay card.

anjali, thanks for doing more research into that money laundering outfit.

I ve been very busy last days , but I see you knew what to do.

people, this is way too much! i received another response from the FCA :

^^^ !!!!

if the FCA is so prompt in replying to emails, i feel they will be similarly prompt in taking some action against a company, upaycard, which is registered in britain, and is falsely claiming it is licensed by the british FCA to be in the emoney transfer business.

Now is my turn to scream……..

If only the Malaysia police is half as effective as the FCA, Malaysia will not become sweet havens to ponzi scammers.

the FCA has forwarded my email about ufun/upaycard/optimal payments to the correct divisions and the consumer contact center.

this email from FCA came today:

this is sooo cool.

From how they react, they serious about taking action as the upaycard will ruin their reputation.

Maybe they have been looking for alan brazille all this time.

Will have to wait and see

meet alain brazille:

in.linkedin.com/pub/alain-bazille/1/7a/5b9

there are three names directly linked to upaycard Ltd:

ALAIN PIERRE JACQUES BAZILLE

ALAN RICHARD GOSLAR

MARK WAYNE WHEELER

so, upaycard submitted an application to the FCA, and before getting a license, have announced on their website that:

upaycards IP location is in denmark.

the whois address provided for ‘owner’ is:

the denmark address above was the office address of UGSpay in denmark, which was managed by henry gomm, who is related to alain brazille.