Bait & switched TranzactCard DBOs denied refunds

TranzactCard DBOs who were duped into paying $495 are being denied refunds.

TranzactCard DBOs who were duped into paying $495 are being denied refunds.

As part of TranzactCard rebooting as FinMore, DBOs were told they’d be entitled to refunds. This claim has been publicly parroted by promoters of the scheme.

While TranzactCard DBO refunds are available in some instances, unfortunately there’s a major catch.

By now it’s pretty clear anyone who signed up as a TranzactCard DBO based on the marketing has been bait and switched.

If we look back on TranzactCard’s original offering, prospective DBOs were pitched on

- a TranzactCard VISA card

- Z-Bucks worth $1 in Z-Club and earned 1:1 per dollar spent with the TranzactCard VISA card

- access to Z-Club, populated with “everyday items, luxury items and even vacation packages”

- access to a Power Save Account that provides a “fixed interest rate higher than any bank you’ve ever seen”, funded by spending of Z-Bucks in Z-Club and use of the TranzactCard VISA card

FinMore instead offers access to Flourish subscriptions, offering discounts to various third-party service providers.

If you’re happy with what FinMore offers despite what you mgith have been pitched on with TranzactCard, more power to you.

Logically though (and legally), anyone who signed up for $495 based on what TranzactCard was pitching should be entitled to a refund.

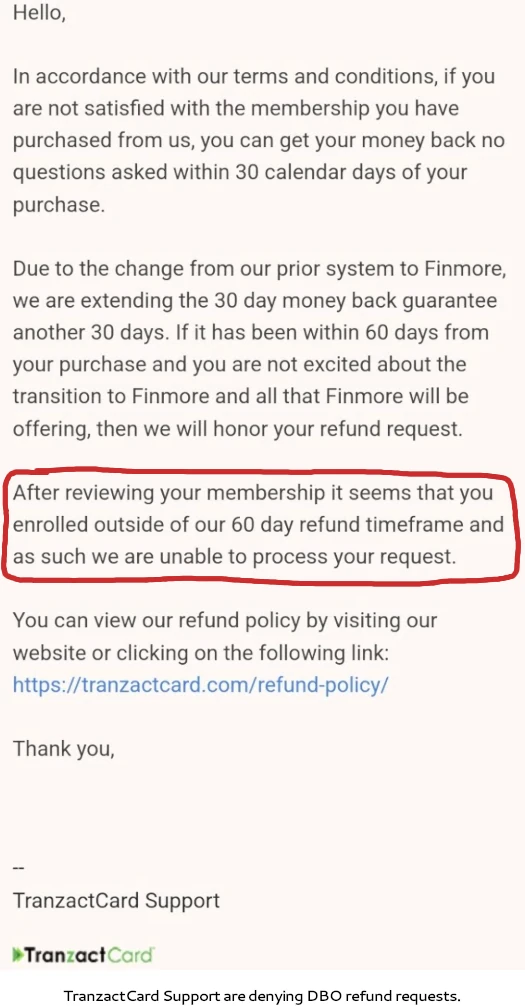

Instead, when one BehindMLM reader reached out for a refund, TranzactCard support told them they weren’t legible.

Despite the obvious bait and switch, TranzactCard is sticking to its stated refund policy.

Said refund policy locks a TranzactCard DBO out of a refund if 30 days have passed. FinMore has extended that period by another 30 days, but this particular DBO still falls outside that range.

Is this reasonable?

FinMore was revealed on February 3rd, 2024. If we dial the clock back 60 days, we arrive at December 5th, 2023.

To recap, at this time TranzactCard was still signing up DBOs based on their original marketing representations.

TranzactCard did lose their US banking services in September, but figured they’d be able to dupe banks by pretending Richard Smith didn’t own the company by having him “resign” in November (note Smith still owns TranzactCard and is believed to also own FinMore).

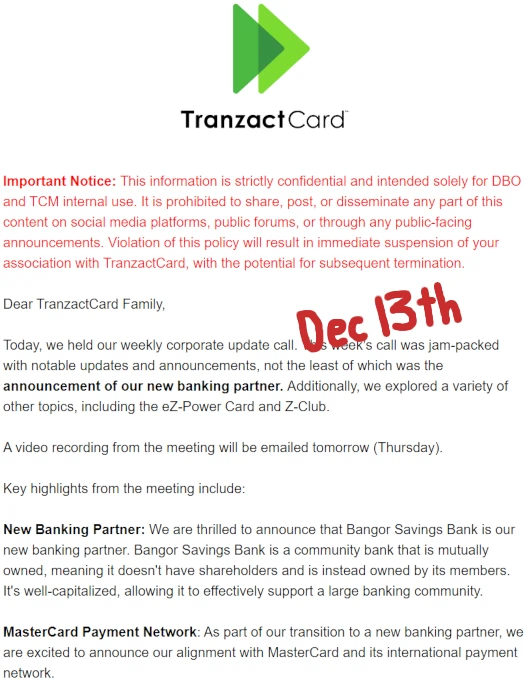

On December 13th, TranzactCard announced Bangor Bank as its new banking partner.

This is literally a week into the sixty-day FinMore bait and switch refund deadline.

Notwithstanding Bangor Bank going on to deny partnership with TranzactCard, during this time DBOs were very much being recruited on TranzactCard’s original and ongoing marketing representations.

Those DBOs paid $495 and are now being told, even if none of TranzactCard’s original marketing representations apply to FinMore, they aren’t entitled to refunds.

Forget about potential legalities and FTC Act violations, how do you justify that as ethical?

If you prelaunch an MLM company, charge people $495 for months and then bait and switch, the bare minimum you should be doing is offering a full refund to anyone you duped.

Whatever the underlying reasons are for you completely failing to deliver what people bought into, you don’t just to keep the money. That’s fraud.

If I had to guess, TranzactCard DBO recruitment probably peaked around the time they lost their US banking services.

In the wake of losing US banking services, TranzactCard corporate were adamant they would be quick to replace the lost partners. No doubt those misleading representations encouraged new DBOs to continue signing up, despite the obvious glaring red flags.

With each passing day TranzactCard’s extended 60-day refund window cuts more and more DBOs off from a refund.

The total number of bait and switched TranzactCard DBOs ineligible for a refund is unknown.

Curious what would happen if DBOs denied refunds asked their credit cards to reverse the $495 charge?

Would credit card companies also not do reversals for something too far in the past?

The Tranzact VISA card never existed. As soon as VISA found out that TZT was illegally using the VISA name & logos, VISA issued TZT a C&D and asked to remove all logos pertaining to VISA from their website.

This whole Tranzactcard fiasco smelled fishy from the beginning…

After I signed up to become a DBO, I was beyond disappointed at the level of support that we actually received.

After I was a DBO for a short time, I decided based upon the lack of transparency, support personnel, the lack of items in the ZClub compared to what was presented, the computer systems that went down so services were unavailable and it was and is being treated like it’s something funny.

It is not funny, this is people’s money, I have lost all confidence in the company, I cannot in good conscience promote this product.

This has created a financial burden for me, because of my time investment as well as financial investment in preparing to go to market with this product.

I want a refund and to cancel my position as a DBO. On top of that fruadulant charges were stolen from my deposits of over $6,000+ dollars…. my bad for depositing so much money, your bad for NOT protecting the depositors.

*Yes, eventually I did get the funds back, and got the DBO sign up fee back, but it took four months!!

Makes sense that Richard (shhh…) owns the spinoff as well.

That would be a sensible guess but this is a MLM we’re talking about.

Real growth continued, peaking with the official launch in November.

The fact that basically nothing launched at launch kinda sucked some air out of the Tranzact balloon. New affiliates did join in December but not nearly the same rate as they did in October for example.

Off topic but I’m listening to a recording of a “Monday Momentum” FinMore call. Peter Rancie officially denied being hacked. While he didn’t address credit cards directly he did state that no data was stolen. Take that for what it’s worth.

Just do a chargeback with your local credit card company and they will get your money back for you through Visa and MasterCard through the clawback clauses you have up to 180 days and some up to 12 months to do a clawback.

Call your bank right away and get your $495 back since it’s clearly fraud..

Randy Schroeder’s public You Tube admission detailing massive corporate fraud by Richard Smith, Rancie and Tranzact Card’s rat management should put these crooked charlatans behind bars.

Scamming 46,000 consumers for $520 each with lies, illegal claims and unlawful deception cannot go unpunished.

Same fate for Schroeder and the other co-conspirator ‘promoters’ who’ve pushed this illegal Pyramid scheme daily on the masses for 10 months.

Thank the Lord for You Tube.

great reporting OZ, thank you! SB

That’s interesting. Can’t help but wonder if it’s a “I have no idea so we didn’t get hacked” or actual confirmation.

Could be bad if there’s a regulatory investigation that proves otherwise.

Peter Rancie’s only verifiable banking ‘experience’ is the creation of the United States Bankers Association in 2023 to bolster the credibility of TranzactCard.

The website is a shell and no bank claims membership.

I purchased into Tranzact in November as a Digital Branch Office for $497, and I just requested a full refund and was denied.

Saying per Terms & Conditions, that I had a 30 days + 30 additional since they changed to FinMore.

The FTC might want to be notified of this company of scammers, but are there any laws that protect consumers in this situation?

@Jen

Dispute the charges with your credit card company. It really is your only hope.

TranzactCard utterly and completely failed to deliver what they promised and as such they defrauded you. You deserve your money back.

Explain that to your credit card company.

Do you have a link for that Utube??

Schroeder’s deleted his more spicy TranzactCard videos.

The corporate advisory team for FinMore now has rolled over into a new company called NeloLife. This includes Mick Sorensen, Eric Allen and Larry Lane plus the “Big O” which you have covered in regards to TranzactCard.

The thing that I find interesting is the corporate office location for FinMore is in Wyoming and now the corporate office for NeloLife is also in Wyoming.

I signed up with NeloLife so I could see my back office and it is an absolute IDENTICAL clone of the TranzactCard/Finmore website for back office.

They have had over 6000 people from FinMore rollover and sign up with them again under Nelolife. Would be very interested to see if Richard Smith or Peter Rancie are actually involved in this also besides the supposedly corporate co-owners.

I cancelled my membership immediately and waiting for my refund from NeloLife. No drinking the Kool Aid ever again!

And what happened to the “TRUST” they established and that the company could never be sold. Did any money ever make the trust? How can we follow the money?

NOTICE!! Please make new post about this if this is legit, but my friend sent me this that they got from Evolve Bank … (Ozedit: snip, see below)

The Evolve Bank data breach was disclosed back in June:

reuters.com/sustainability/boards-policy-regulation/arkansas-based-evolve-bank-confirms-cyber-attack-data-breach-2024-06-26/

Not really MLM related in and of itself.

My friend was in TranzactCard and got the email TODAY and Evolve was the bank used to fund her account.

It IS MLM related and this is the first they heard of the data breach. Warn people on here if you wish. Thought you would like to.

If affected Evolve Bank customers are receiving emails, who exactly would BehindMLM be warning within the context of MLM?

True! My mind wasn’t in the “logical” state posting those. The wonder of aging… let’s go with that.

I would like a full REFUND including for all of the members that joined as part of my team and per my referral of what posed as a legitimate business. These SCAMS must end.