MyAdvertisingPays abandon US, gear up for reboot

![]() The MyAdvertisingPays website domain was registered in June 2013, with the scheme launching a few months later.

The MyAdvertisingPays website domain was registered in June 2013, with the scheme launching a few months later.

As we approach the end of 2015, that brings us to the typical two-year lifecycle of online Ponzi schemes, after which time liabilities racked up truly spiral out of control.

Typically what we see with such schemes at this point is either a collapse, regulatory shutdown (following an investigation having been carried out for months) or a compensation plan change.

No doubt in an attempt to stave off a collapse, and possibly aware regulators are closing in on them in the US, October 13th saw MyAdvertisingPays announced “The Most Important Update Ever Released!”.

In the update, MyAdvertisingPays buried their abandoning of US operations towards the end of the update:

After careful consideration and extensive consultation with our Legal Team, MAP Executives, Tax Advisors, Financial Advisors and European MAP Leaders, we have unfortunately decided to completely pull out of the American marketplace.

The official reasons cited for terminating US operations makes little sense:

It simply isn’t profitable for us to remain engaged there. Over 90% of our business already comes from Europe, while we are catering to the US members by operating in US currency.

It doesn’t make good business sense to continue operating in a place and expending valuable resources in a market that’s steadily declining.

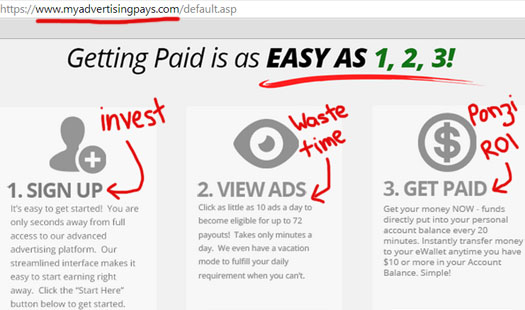

MyAdvertisingPay’s business model sees affiliates invest in $49.99 “credit packs”, which pay out an advertised $60 ROI.

The ROIs on credit packs are funded by subsequent investment, making MyAdvertisingPays a Ponzi scheme.

MyAdvertisingPays payment processors cited in the announcement include iPayout, SolidTrustPay and VX Gateway.

Soliciting investment from US affiliates through any of these processors does not cost MyAdvertisingPays anything extra.

Further evidence of this is the fact that MAPS US affiliates referral commissions remain intact:

Any American member with referrals will still earn referral commissions from those referrals purchases uninterrupted, according to your Membership Level.

Clearly paying US affiliates is not a problem, rather it’s the marketing of MAP’s Ponzi scheme business model in the US that they’re shutting down.

Meanwhile the inclusion of iPayout as a payment processor for MyAdvertisingPays is of particular concern.

iPayout have a US presence and were all too happy to provide payment processing services to TelexFree, later revealed to be a $3 billion dollar Ponzi scheme.

iPayout only suspended TelexFree’s processor services the day before the SEC shut the scheme down.

It seems iPayout learned little from that experience, with it still soliciting business from the MLM underbelly.

In early 2014 the processor did announce a compliance overhaul, but as evidenced of their continued affiliation with schemes committing financial fraud, that appears to have been little more than lip-service.

In an attempt to put as much distance between themselves and US regulators, MyAdvertisingPays have moved to segregate US invested funds from the rest of the scheme.

Current US members can no longer purchase credit packs.

If you are an American member, even though Profit-Share earnings are not guaranteed, your currently held credit packs will be paid off completely over an extended time-frame.

The extension will be due to the loss in profit we will obviously have from the American market.

The America profit-share system is now separated from the International profit-share system. The US-PS system will pay out profits according to advertising purchased by American participants.

Whether or not iPayout or MyAdvertisingPays themselves are aware of a US regulatory investigation into the scheme is unclear. But something clearly has them spooked.

The CEO and Founder of MyAdvertisingPays is Mike Deese, a US citizen.

Deese’s last known whereabouts was Mississippi in the US. Whether or not he’s still in the country is unclear.

One interesting addition to the MAPS announcement is an email from their Illionois based attorneys, David & Hart.

It has come to our attention that there exist multiple internet-based avenues being used for defamatory and libelous speech against MAP.

Through our research, we have found many, if not all, of these claims to be without merit.

What “research” David & Hart did is unclear, but they apparently have failed to identify the blatant Ponzi scheme staring them in the face.

Perhaps they could ask Gerry Nehra how that works out?

Turning a blind eye to the Ponzi fraud they represent as attorneys, Jonathan D. Herpy Sr. continues;

MAP would like to emphasize and reassure you that their decision to cease operations in the United States is in no way connected to the aforementioned defamation and libel claims.

Echoes of AdSurfDaily indeed.

With MyAdvertisingPays ROI liabilities having likely hit critical mass, here’s what non-US investors can look forward to:

Advertising Funds will not be in MAP 2.0. Once we transfer all current members to MAP 2.0, the new accounts will not have Advertising Funds.

Current product codes will not be transferred because the new advertising system will be completely different.

The provided ETA on these changes is about six months, with the changes themselves likely just to be a new coat of paint on MAP’s “use newly invested funds to pay off existing investors” business model.

Oh and expect a bunch of reboot marketing hype too, as existing investors scramble to make back what they realize they’ve otherwise lost in the scheme (no influx of new investors = no ROI payouts).

In an attempt to screw investors out of as much funds as possible, MyAdvertisingPays also announced the following:

Membership fees will not be refunded.

Anyone with a certain credit pack level (number yet to be determined), will have a small monthly account maintenance fee.

In the meantime, MAPS advises

If you are an International Member;

Absolutely nothing will change for you! You will earn profits based on International sales, which are tremendous!

The International Reserve Fund will be untouched for US payouts.

Stay tuned…

i’m sure david&hart are referring to behindmlm too in their statement. another pain in the ass has been the FB page ‘my advertising pays- scam’ which has been reporting on MAPS on a daily basis.

questions are being raised about how the MAPS business in the US can be non profitable, since the US is one of the largest online advertising markets in the world. i mean, how can nigeria be a better online advertising market than the US?!

it is obvious that the fear of US regulators has caused MAPS to withdraw from there. or maybe they are already under investigation in the US already.

people are also claiming that this MAPs ‘reboot’ is similar to the end-of-days announcements from banners brokers, a ponzi scheme which was promoted by simon stepsys who is now a top MAPs promoter.

stepsys meanwhile, is busy removing posts from disgruntled american MAPs investors from his FB page!

it’s the same template it’s predecessor banners broker used. Coincidentally most of the same scammers are in this too.

the people over at ‘my advertising pays- scam’, had notified the Companies House UK, about MAPs being a ponzi scam.

as MAPs had not filed its annual accounts statement with the companies house UK, it’s registration in the UK was scheduled to be struck off on oct 14, 2015.

this would have meant that MAPs was no longer a UK company, and would have made it difficult for UK regulators and MAPs investors to take action against it.

however, in response to the emails from ‘my advertising pays- scam’, the companies house UK has decided not to strike MAPs off the registry, and has instead forwarded the matter to the Insolvency Unit for investigation.

facebook.com/788704724492200/photos/a.788752914487381.1073741828.788704724492200/1151169811579021/?type=3

it is also possible that the impending MAPs ‘reboot’ may work as an excuse to not make payouts to members over the holiday season.

generally payment requests swell during the holiday season and obviously ponzi schemes will not have the funds to honor these requests. therefore, this a good time to announce ‘changes’ and ask everyone to ‘cooperate’ and wait ‘patiently’.

meanwhile, what are the UK regulators doing? there has been press coverage about the MAPs ponzi scheme, and so much noise on the internet, it’s surprising they have not acted as yet.

Yes people have been going on about the Limited Company in the UK, it looks like they never used it, they registered an offshore company. MyAdvertisingPays (MAP) Limited. Which is different to the UK company.

MAPs was registered in anguilla, a tax haven in the caribbean. the address used to be :

201 Rogers Office Building,

Edwin Wallace Rey Drive,

George Hill, Anguilla

however, this address is now missing from the MAPs website, so the status of their registration in anguilla is currently unknown.

tony booth, top UK MAPs recruiter has offered this advice to US members who just got dumped:

so, is tony booth suggesting that MAPs will continue working with US members ‘unofficially”?

maybe US members will be ‘advised’ to send money to MAPs via some offshore accounts?

MAPs has a recruitment event scheduled for the 20th october, at the ramada hotel in wrexham, UK.

i guess the guys at ‘my advertising pays – scam’ will be writing to the ramada hotel, informing them of the ponzi nature of the MAPs business. maybe they will attach the UK media coverage of MAPs too, to make a strong impression on the hotel management!

hotels have been cancelling MAPs events in the past because no one wants to play in ponzi mud, ramada is an international brand, they may want to preserve their reputation too.

What Americans missed about this is that Mike Deese is a veteran of USA and it was used to in sales pitches to strengthen his character.

I think if US Veterans knew this guys was using his service record to string people along in a ponzi scam they would smoke him out and it would be bad for him.

one reason I don’t believe the military claims.

Yeah, he is a disabled Vet, I saw him walking down a beach, with his dog, a cigarette and a can of beer. Must have blown his brain cell away.

Can he sue for that? We know the yanks sue for breathing!

Expect lawsuits to be taking a lot of people down pretty soon on this one. MAP is not going to take unfounded slander sitting down.

Let me give some very simple math to illustrate why MAP has bank accounts stuffed with cash right now and has no plans to hand it over to corrupt US ‘receivers’.

Simple put, if 100 people pay 100 dollars that is $10,000 of revenue and $12,000 in liabilities over 100 days (more or less). 95% of that is paid to Qualified viewing members.

Let’s imagine ALL (an unrealistic expectation) are qualified for revenue sharing. That would mean there would be be $9500 to cover $12,000 in liabilities for a 100 day cycle. Not sustainable right?

So, MAP needs to make how much extra income to just break even on these liabilities? $2500 right? $2500 plus $9500 is $12,000 to cover ALL liabilities in this example. Okay, so, let’s take just the membership fee.

To be able to be part of the revenue share requires a MINIMUM OF $25 a year.

So, 100 people times $25 is how much? $2500 right? So, just with the LOWEST cost membership fee all liabilities on these 100 member’s liabilities are covered.

Now that we are are break even for liabilities every else is GRAVY and goes into a RESERVE FUND. The owner makes most of his income from being a member as 5% is for company operations. So, what OTHER income is there?

To start,

1. Higher cost memberships, ($50 bi-annually and $100 bi-annually)

2. Banners bought by members or outside advertisers (all are outside revenue as no liability is attached)

3. Guaranteed Visitors (sold out in 7-10 minutes every time)

4. Spinning Wheel

5. MAPSense (coming and like Googlesense and will be ads published on sites like MINE which is more revenue for me and for MAP)

6. Vacation time: $5 a day

7. Credit Boosters $8 for 100 booster credits

All of the above is EXTERNAL income and sufficient to put this company in PROFIT every single day as memberships easily cover all current liabilities just in themselves according to my example.

The company operates on the 5%, the CEO earns mostly as a member like you and me, and WE get the bulk of all the revenue now and in the future when MAP is a MULTI BILLION company, and it will be.

So, where is the ponzi in this ONE level ‘pyramid’ scheme. Please correct me on my math if I am wrong. But, this is how I have analyzed the business model and what management tells me basically corroborates my thinking.

Disclosure: I am a member and I DO promote MAP because I do believe it will change a lot of lives for the better.

After is a multi-billion dollar company, who knows, it may consider venturing back into the USSA.

We shall see how uber communist the USSA is by then. It may be a permanent no go zone. 🙂

Oh please. MAPS won’t even operate in the US. They aren’t suing anyone there.

Discovery is a Ponzi scheme’s worst nightmare.

You can try to explain it anyway you want. All MAP does is take newly invested funds and pay off existing investors.

Mathematically they cannot pay out more than they take in from investors, yet they run a rolling $10 liability for every $50 invested.

Over time that liability spirals out of control. It’s basic math.

And please don’t waste our time with the usual ad-credit Ponzi promises of external advertising.

Legitimate third-party advertisers are not interested in advertising through Ponzi schemes.

Barf.

MAP will set off financial fraud alarm bells well before that comes to fruition. Not to mention the Ponzi liabilities make sustaining daily payouts required virtually impossible.

TelexFree had a million investors and were running a $3 billion Ponzi points scheme. Banks wanted nothing to do with them and they were on the verge of collapse when shut down.

No matter how you cut it, Ponzi math doesn’t add up.

You did not read or cannot use a calculator. I just explain why your logic is wrong and based on a fabricated reality in your head.

I have been doing online business for 20 years and have seen HUNDREDS of ponzis come across my desk, some that fooled me too. Most did not.

Telex Free was a Ponzi. I just explained why this is not. Get out your calculator and refute my numbers.

This is just how it works from what I can see and what I know. If you can PROVE to me differently then give it a go.

Also, I did not say WHERE the lawsuits would be happening. In any case, we shall see what happens.

At this point, it appears there will be lawsuits. But, until they happen we can only speculate.

My sources tell me there will some trouble for people who are making libelous claims without any evidence of substance. So, we will just wait and see on that one.

I would have to agree. But, (Ozedit: There are no buts here. Legit third party advertisers aren’t interested in advertising through Ponzi schemes to Ponzi investors)

What excellent news.

Currently there are hundreds, if not thousands of people across the globe who have their fingers and toes crossed, hoping it is them who is “sued” by the My Advertising Pays crack legal time.

Sitting down, or standing up, there is not a chance MAP or any other blatant ponzi is going to take the risk of appearing in a court to explain why theirs is the only business in the history of the planet which can make millionaires of people who click on ten advertisements a day.

IOW, only if your “sources” were “sauces” would they be worth having.

Nothing like a bit of mystery to spice up todays’ dose of MY Advertising Pays

KoolAidnonsenseMaybe you are right. This is OUR opinion based on what we know. However, what I presented above in plain math is FACT. This is exactly how MAP works in my experience.

I would like the NUMBERS to debated here to prove how this is a ponzi. Just ‘saying’ it is without explaining how my numbers are wrong does not hold much water with me.

I want to hear why my math is wrong, so I can correct, if wrong. If not wrong, then MAP is NOT a ponzi and will prove to be such over time as their bank accounts continue to fatten as they are fattening now. 🙂

Oh shutup.

$x in and greater than $x out = Ponzi fail.

There’s your problem.

Opinion doesn’t trump Ponzi math fail.

MAP cannot continue to pay out more than their investors invest.

$50 in, $60 out = eventual Ponzi collapse.

And remember kids, Wayne is a perfect example of why you don’t go off the Ponzi deepend.

Your numbers are nonsense, what is there to debate ???

There’s no point starting your hypothesis with “if” XXXX people did YYYY then ZZZZZ would be true.

You have no way of knowing if the numbers you’re being fed by MAP are true.

IF my aunt had testicles, she’d be my uncle.

Bottom line: she doesn’t, and no amount of theorizing will make it so.

What you’d “like” to happen is neither here nor there.

NOBODY gets rich clicking on ten ads a day or accruing “adpacks” or “banner impressions” or “penny auction” bids WITHOUT being in a ponzi / pyramid scheme.

Keep believing what you believe. I laid out the math. It works with 100 people or 100 million. I would stick around here if we could engage in an intelligent conversation. ‘Shut up!’ is not exactly how we get to the truth of any matter is it?

I supposed like global warming, this is ‘settled science’ as the world grows colder! This along with many other modern myths based on pseudo science, ad hominem attacks, and little facts or intelligent argument. You all have a number of false assumptions which lead to false conclusions.

Until you fix your assumptions and basic premises you will never be able to grasp what is going on around you.

I know EXACTLY what ponzi math. I have seen hundreds of them. I am the big sceptic when anyone brings something to my attention.

I was not sold on MAP in a 2 minute conversation. But, that is a long time ago as I am member #82 out of now 240,000 and growing.

So, you have my permission to carry on with your views. I will carry on with mine.

Let’s revisit this in about five years and see how things are standing. 🙂 Until then, I am out of here and wish you all the best.

Your legal logic is flawed. Membership fee will count as a part of the total money lost. You can’t use membership fee to balance the difference between investments and liabilities.

In ZeekRewards, even the purchase of retail bids counted as “money lost”. The bids could be used in auctions, i.e. they did have some value. But the auction did only act as a disguise for the Ponzi scheme, so it didn’t really have any real business function.

The income to cover a prospected ROI will need to come from a legitimate business venture — from external sources rather than from the participants themselves. A membership fee clearly comes from the participants themselves.

Paying for the right to participate in a revenue sharing program doesn’t really have any real, legitimate business function. It’s a part of the scheme itself, it’s not a legitimate source of revenue.

Given the fact MAP is in its’ death spiral, I think we can assume Wayne is not in the USA and, in any case, is unlikely to return any time soon to boast of his math skills.

hey wayne nash, what happened to all those huff&puff cease and desist emails that your boy simon stepsys sent out to his nemesis [the people over at ‘my advertising pays-scam’]??

have stepsys’ american lawyers initiated the lawsuit yet? let us know when stepsys wins will ya?

aw, dont run away.

And I replied to it, telling you that your legal logic was flawed.

We’re noth talking about “math excercises” here. The source of revenue must be legitimate, and you failed to point to a legitimate one.

How do you recognize that?

If you’re looking for “intelligent conversation”, then you must first have a method in place for how to recognize it. If you don’t have that then you will be unable to recognize it when you see it.

My suggestion is that you should aim for a lower standard. “Intelligent conversation” may not be the correct standard for you. 🙂

if MAPs has provable math, showing that it is not a ponzi scheme, why does it not register itself in the USA and the UK and do regular business like all other legitimate companies?

what is the fear? if the SEC comes knocking , you can just show them your ‘math’ and they will run away with their tail between their legs.

why are you here challenging us with your ‘math’? take it to the SEC. may i help you get an appointment with them?

uh, if nobody says ‘shutup’ he thinks its ‘intelligent conversation’.

@Wayne Nash

A lower standard can be “relatively meaningful conversation”. It will be easier to recognize than the “intelligent conversation” standard, so you won’t need to answer any difficult questions about your own ability to recognize it.

It will also be easier to live up to. You will have a fair chance to meet that standard yourself “with some practice”. 🙂

@Wayne

$50 in, $60 out does not work out.

how about you answer these questions [credit to my advertising pays-scam]:

– if MAPs has enough funds to cover ROI’s, why is it not paying these ROI’s to their US affiliates whom they have dumped? why are they only ‘promising’ to pay the initial investments back?

– if MAPs is choking over with excess funds why is it ‘promising’ to pay US affiliates in Two Installments? if they have the money ready and hopping, why not clear the accounts in one go?

don’t just present your spiel and run out. that is cowardly. stay and answer.

seeing as they should have started long ago, no. not gonna happen.

it seems MAPs is going to make it more and more difficult for US investors to get their money back:

if MAPs is shutting down its US business, why does it need US investors to contact them and ask for refunds?

why doesn’t MAPs just refund the money?

as i see it, they will keep creating ‘delays’ and ‘problems’ till everyone moves on.

now they need a call centre, tomorrow they may need a flock of pigeons to fly US refunds back. anything is possible.

and now, US affiliates Fight Back. MAPs offered US investors only 1/3 to 1/4 of their ROI’s earned in the MAPs business of recruitment.

US investors say this is a contravention of the contract signed between MAPs and themselves. MAPs cannot voluntarily withdraw from doing business in the US and onesidedly change the contract:

but, will a US court consider the request of investors to be paid their ROI’s in a ponzi scheme? do contracts have any value when the business itself is illegitimate?

nope

So begging for ponzi money won’t work.

Why not take what you can get and move on as MAPS sure is.

If the money is not there to pay all the usa members sounds like they will get nothing anyway.

So how long can they drag this out?

If it gets serious attention maybe the whole thing can get shut down for the scam it is in the first place.

Who gets refunded what then?

In all this what about trafficmonsoon, isnt that a ponzi too.

simon stepsys FB page has a post congratulating a new MAPs ‘diamond’ in malaysia, Dato Dr Zainul Bahrin.

bahrin was the former managing director of bank raykat in malaysia, which is a govt appointed post.

it is shocking to see that a politically appointed former director of a bank, can be actively promoting a fraud like MAPs to the extent of becoming a ‘diamond member’.

but again malaysia, as we have seen in the ufun/unascos ponzi schemes, seems to have its top businesspeople and politicos involved in and protecting ponzi schemes.

shame shame malaysia.

Talking about Traffic Monsoon they have moved to the next step and have been revoked by Paypal.

They are moving all the funds in Paypal to Payza and then to their own TM World Bank (JP Morgan) in Dubai.

I heard they were opening a TM bank, but where is the information they have been revoked by paypal?

MAPS recruitment is falling off the cliff:

facebook.com/788704724492200/photos/a.788752914487381.1073741828.788704724492200/1198834633479205/?type=3

tick tock tick tock