Hyperverse withdrawal failures, MOF tanks 98.98% HDAO?

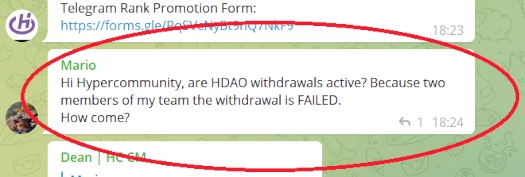

![]() Hyperverse affiliate investors are flooding official support channels with reports of withdrawal failures.

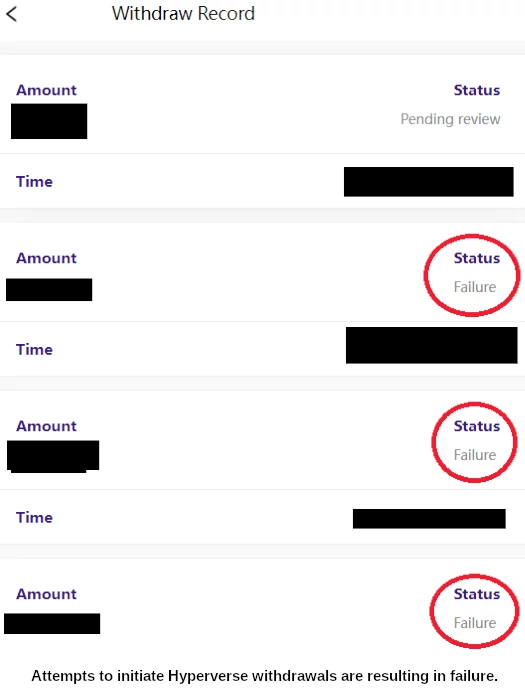

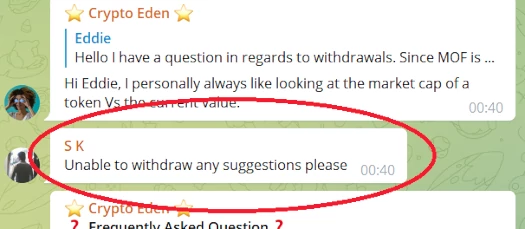

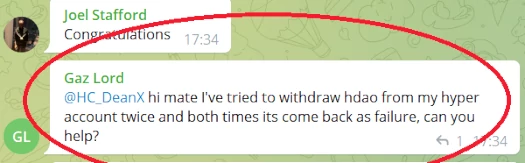

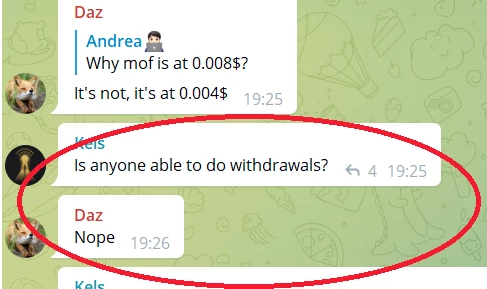

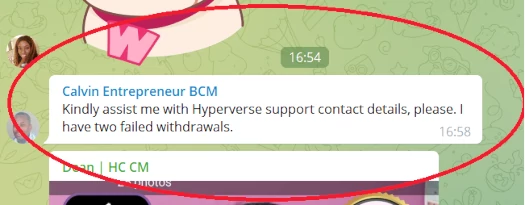

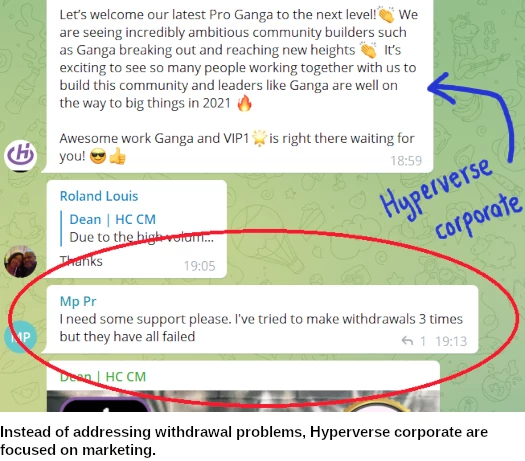

Hyperverse affiliate investors are flooding official support channels with reports of withdrawal failures.

Other affiliates are claiming HDAO is working for them.

The examples of reported withdrawal failures were sourced from one of Hyperverse’s official Telegram channels, all within the last 24 hours.

Prior to the Hyperverse disaster reboot, HyperFund affiliates invested actual cryptocurrency into HU Ponzi points.

HyperFund’s 300% returns were calculated in HU points, which are not publicly tradeable. When affiliate investors wanted to withdraw, they’d do so in MOF, a shitcoin created by HyperTech owners Ryan Xu and Sam Lee.

HyperFund affiliates would then sell MOF to realize a return on their investment.

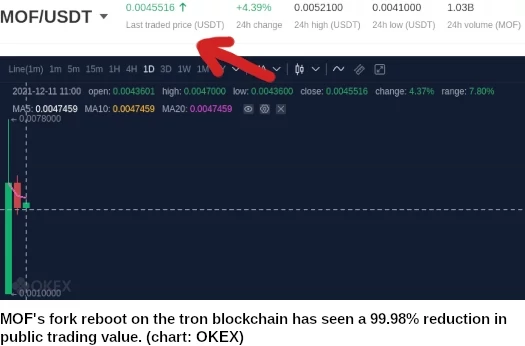

The Hyperverse reboot saw Xu and Lee also transfer MOF from the ethereum blockchain to that of tron.

This saw MOF’s total coin supple expand from 100 million to 100 billion.

Consequently MOF’s public trading value plummeted 98.98% from ~$2 to around $0.004, less than half a cent.

CoinMarketCap is recording ~$15,000 unverified trading volume on Bittrex, which has artificially inflated MOF’s chart value to just over a cent.

To facilitate the blockchain transition, MOF was removed from the Hyperverse backoffice as a withdrawal option.

BehindMLM understands that as at time of publication, MOF withdrawals remain disabled.

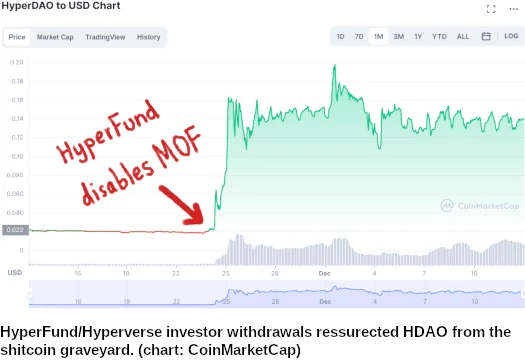

In MOF’s place is HyperDAO or HDAO, another shitcoin Xu and Lee launched in early 2020.

Hyperverse disabling MOF withdrawals saw the relatively dead HDAO spike in value on November 25th.

For the past three weeks, HyperFund/Hyperverse affiliates have been withdrawing through HDAO.

That stopped working sometime in the last 24-48 hours.

Since the prerecorded Hyperverse launch video went live last weekend, there have been no Hyperverse corporate announcements addressing ongoing withdrawal issues.

Hyperverse’s website remains mostly in the same unfinished state it’s been since it surfaced a few weeks ago.

There have been no further updates on the planned Hyperverse NFT Ponzi “game”. I’ve seen reports these plans have been since been abandoned but haven’t been able to verify.

HyperTech and Hyperverse owners Ryan Xu and Sam Lee fled to Dubai earlier this year. They are on the run from Blockchain Global investors in Australia, who are seeking to recover $48.9 million in losses.

Blockchain Global was the precursor to HyperTech, through which Xu and Lee went on to launch the HyperCapital, HyperFund and now Hyperverse Ponzi schemes.

Hyperverse’s “corporate presenters” have announced a webinar sometime today. Whether they address Hyperverse’s disaster launch and withdrawal problems is unclear.

Based on Alexa website traffic estimates, the majority of Hyperverse investors are believed to be in the US.

US authorities have yet to announce regulatory action against HyperTech, Hyperverse, its executives and/or promoters.

If it walks & talks like a ponzi, then it probably is a ponzi. The chances that you’ll ever get your money out of it is slim to none.

Hyper Inu (new shit coin) goes live today according to its Twitter and a minor exchange.

I should think this will come into play in the Hyper-non-existent-ecosystem somehow.

HyperInu is already full of bagholders crying scam on Twitter.

I couldn’t find any link between Hyperverse, Ryan Xu and/or Sam Lee and HyperInu.

Unless someone can provide evidence of a link I’m marking anything on HyperInu as spam (already had dumb fuck shills come on here trying to solicit investment).

Ah, my mistake: they make lots of references to the “Hyper Ecosystem” and I assumed it was the Hyperverse one.

All good. There is similar “hyper*” terminology used between them.

This is not actually true Greg. Thousands of people have already got their original money back and are now just withdrawing profits.

Of course it’s still theft and morally very wrong but to think people won’t get their money back is a misconception.

This is going to continue for some time yet due to the sheer fact people are getting their many back it’s an easier sell for new members. Of course hard to know how long that will be continue for and of course we know eventually thousands will lose their money.

I think they are being smart about it by encouraging people to buy the smallest membership but get other people on board to increase their rewards and also do rebuys.

That way when this does collapse whilst there will be thousands that have lost money. They wouldn’t have lost large amounts to try and take things further.

They talk about the company’s great success in the past as proof this isn’t a Ponzi scheme. That’s the part that amazes me the most.

The companys history is pathetic! You question them and they have an answer for everything or just ignore you.

I’ve heard anecdotal reports that withdrawals for those with “teams” and those with accounts that are linked with high profile affiliates are still working – it seems they may have cut the less “profitable” part/affiliates of the ponzi, to try and keep it alive I guess.

No, Greg is correct. And that doesn’t mean you are incorrect.

The chances of getting your money back out of a Ponzi are roughly 1%. 1% falls between slim and none.

It is perfectly possible that thousands of people have managed to steal more than they put in from Hyperverse, but for that to happen millions of people need to have lost money.

Whether Hyperverse actually has that many participants is inherently unknowable, unless we see criminal indictments. Ponzis always exaggerate how popular they actually are.

A lot of people claiming to already be net-winners are no such thing and are counting “numbers on a screen” instead of withdrawals in their hands.

You need to put on a show of making money in order to encourage other people to join under you and give yourself a chance to actually make the profits you’re pretending to have made. Fake it till you make it bro.

Looking at Etherscan of MOF it looks like they siphoned $30 Million (in $3000 increments) one day prior to stopping Withdrawals.

Is hyperverse fraudulent?

Hyperverse is a Ponzi scheme. All Ponzi schemes are fraudulent.

Mine went failure too. The reason is HDAO work in port ERC20 only and hyperverse now shifted to TRC20.

But no solution is there unless HDAO work in TRC20 or the company can give some time to withdraw in ECR20. I guess.

I’m so fed-up because I’m still trying withdrawal in hyperverse. But every time my withdrawal failed.

Not withdraw.