Hyperverse exit-scam continues with dogecoin pools

![]() Hyperverse has added dogecoin pools as part of ongoing efforts to reduce withdrawal liability.

Hyperverse has added dogecoin pools as part of ongoing efforts to reduce withdrawal liability.

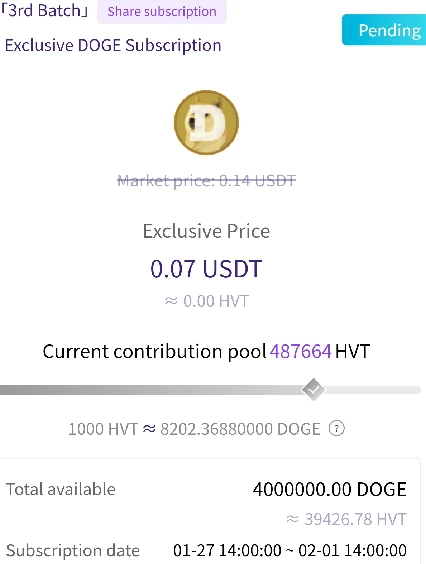

Hyperverse’s first dogecoin pool was added on January 27th. The pool allows Hyperverse investors to exchange HVT for a share in 4 million DOGE.

As of yesterday the pool held 487,664 HVT. DOGE is currently trading at 14.2 cents.

This results in each HVT share paying $1.17 each.

HVT is currently publicly trading at $6.88. The result is Hyperverse slashing its HVT withdrawal liability by 82.9%.

Due to ongoing withdrawal restrictions since HyperFund’s collapse last December, Hyperverse investors are willing to take whatever they can get for their HVT.

Hyperverse has exploited this desperation by offering similar withdrawal liability reductions in BTC, punishing investors who don’t recruit with non withdrawable GNX tokens, or simply blocking withdrawals altogether.

Dear User,

Risk notification of the account.

Your account asset consists of abnormality! HyperVerse has stopped your payment of bonus income and restricted temporarily the transfer and withdrawal, with a risk of number theft there may be.

Please finish the identity authentication as soon as possible to resume your normal capital transaction and guarantee fund security.

This stops both withdrawals and daily monopoly money ROI accrual in the backoffice.

Hyperverse owners Ryan Xu and Sam Lee fled to Dubai last year. They are on the run from liquidators in Australia and haven’t been seen in months.

i have invested a few thousand dollars into Hyperverse and already withdrawn $2000.00. And will continue to do so at $50 per day. How safe is my money.

Safe until someone else withdraws it. Or Hyperverse makes you jump through hoops or arbitrarily cuts you off.

Once you invest in a Ponzi scheme your money is gone. What you’re really asking is “how long can I continue to steal someone else’s money?”

There’s no definitive answer to that, other than “until Hyperverse collapses”.

Highly unsafe! And what is being paid out is not your money. Ponzi scams like Hyperverse steal money from Peter to pay Paul. You are effectively stealing money from others.

When the Ponzi scams runs out of new investors (new victims) or when the scammers decide to shut it down and run away with the remaining cash, people will be left out of pocket.

Sorry for your forthcoming financial losses.

On a related note, I do wonder how many “investors” declare their source of income when they try to cash it into fiat currency? I do wonder how many realise they are subject to capital gains tax, anti-laundering legislation, etc.?

Good point about tax and financial regs. There’s quite a few people that have ‘recruited’ heavily and are still in the UK that they could go after if they choose to do so.

Wonder if it’s worth some whistleblowing ?

When top leaders jumping in other projects it is time to leave the boat.

Bitcoin Rodney one of the first that joined Hyperfund (he earns $100k – $200k daily) launching his own exchange and trading bot.

“earns”… not taking a shot at you at all here, but that word in this context gives me shivers.