Hyperverse slash withdrawal liability with BTC pools

![]() Targeting investors desperate to cash out any way they can, Hyperverse has set up a series of BTC pools.

Targeting investors desperate to cash out any way they can, Hyperverse has set up a series of BTC pools.

Payouts from the pools will see deposited HVT pay out cents on the dollar.

Dubbed “early bird subscriptions”, Hyperverse has created BTC pools it’s funded with 8 BTC.

Affiliate investors can dump accumulated HVT into the pools, in exchange for a pro-rata share of the 8 BTC.

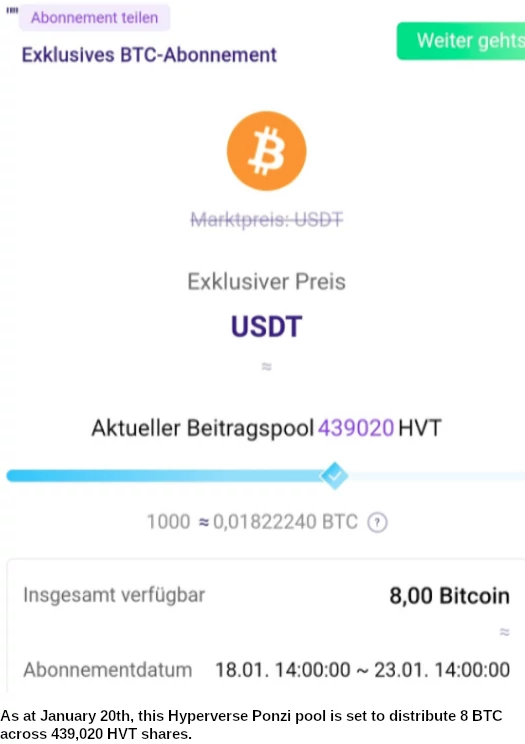

A Hyperverse backoffice screenshot, taken roughly 24 hours ago, reveals one pool has 439,020 HVT in it.

After a disastrous launch last month, HVT pumped but has been in a downward spiral for most of January.

HVT is currently sitting at $9.25. As I write this, 1 BTC is trading at $39,089.

If we multiple $39,089 we get a pool value of $312,712.

Divide $312,712 by 439,020 HVT and we get… 71 cents per HVT.

Compared to the public trading value (which is heavily restricted due to rejected withdrawal requests), that’s a 92.3% reduction in Hyperverse’s withdrawal liability.

Instead of paying out $9.25 per HVT through public trading, Hyperverse is paying out cents through its BTC pools.

Hyperverse affiliates are able to continue dumping HVT into the 8 BTC pool until January 23rd. The more HVT in the pool, the less everyone gets per HVT.

Adding to the downward pressure are one hundred 100 HVT airdrops, purportedly given out randomly. This will add another 10,000 HVT to the pool.

BTC continuing to fall will of course also reduce payment per HVT.

That will of course only matter to Hyperverse if they’re buying the 8 BTC on Jan 23rd. If they’ve already committed 8 BTC the financial hit will be taken by affiliates when they cash out.

Update 21st January 2022 – With 1 day and 17 hours to go, the 8 BTC pool has climbed to 580,309 HVT shares.

Using the same $39,089 BTC value, this comes to 53.8 cents per HVT.

Update 29th January 2022 – I don’t have a final pool figure but close to the end there was 631,426 HVT in it.

On January 23rd BTC was about $35,100. This comes to 44 cents per HVT in the pool.

Realizing Hyperverse affiliates are desperate to withdraw anything they can, the company has launched another pool.

This time it’s 30 BTC and runs from January 21st to February 8th. As of January 23rd there was already 103,465 HVT in the pool.

Update 2nd February 2022 – The 631,426 HVT amount quoted above is the final pool value for the original January 18th BTC pool.

The second 30 BTC pool’s balance now stands at 959,786 HVT.

Based on BTC’s current $38,637 trading value, this comes to $1.20 per HVT share.

This value will drop further, as more HVT is dumped into the pool between now and February 8th.

Update 10th February 2022 – The 30 BTC pool closed on February 8th with 4,506,514 HVT in it.

Based on BTC’s current $44,303 trading value, this comes to 29.4 cents per HVT share.

Hyperverse was also running a 200 ETH pool that closed on February 8th.

The ETH pool held 872,609 HVT. Based on ethereum’s current $3225.48 trading value, this comes to 73.9 cents per HVT share.

HVT is currently trading at $6.09 on the open market, however getting HVT out of Hyperverse continues to be severely restricted.

“sO fAr It WoRkS aLl FiNe!”

–Hyperverse dumbass literally 15 mins ago

They now say on fb that the pool is 30btc (15hrs ago):

Good to see Ryan Xu and the gang are reading BehindMLM.

I’ll run the math when the pools close.

Judging by how few Hyperverse devotees have been trying to discredit your reviews Oz, I’d say they’ve realized just in how much shit they actually are.

The recent Crypto crash is probably also not helping either.

Yeah Hyperverse has really died down over the past month.

Guess that’s what happens when you exit-scam reboot yourself to nowhere.

Nah they are still going strong. I feel much better since being removed from the whatsapp group though. It was making me sick.

I’ve got all my money back now.

Added the final figures for the 8 BTC pool. If you cashed out your HVT, you got ~44 cents equivalent in BTC for each HVT.

I don’t think anyone invested at 44 cents per HVT so everyone took a loss.

Seeing as desperate investors are willing to cash out what they can, a new 30 BTC pool has been launched.

Added 30 BTC and 200 ETH pool figures.

Desperate Hyperverse investors trying to cash out continue to get rekt. Everyone else is happy receiving numbers on a screen returns.