Options Domination Review: ROIs for “a few minutes work”?

The folks behind Options Domination are the same crew that launched DS Domination. Unfortunately though you won’t find any information about that on their website.

The folks behind Options Domination are the same crew that launched DS Domination. Unfortunately though you won’t find any information about that on their website.

Despite Options Domination having recently officially launched, at the time of publication there’s currently no information about the owners and management of Options Domination up on their website.

The Options Domination website domain (“optionsdomination.com”) was registered on the 8th of May 2014, however the domain registration is set to private.

For reference, as per the company’s website, the co-founders of DS Domination are Hitesh Juneja, Roger Langille and Kevin Hokoana.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money.

The Options Domination Product Line

Options Domination has no retailable products or services.

Instead affiliates sign up via one of three available packages: Inheritance ($49.95 a month), Enterprise ($149.95 a month) and Legacy ($399.95 a month).

Basic Options Domination affiliates are capped at $900 in earnings.

Additional earnings can be achieved by submitting an “IA Form” to Options Domination. There doesn’t appear to be any additional cost for submitting this form.

As per the Options Domination website, what is included with each of these three affiliate levels is as follows:

Inheritance – Beginner to Intermediate trading education videos with strategies for analyzing markets and trades.

Members will also receive technical signals for short term trades.

Enterprise – Intermediate to Experienced trading education videos on advanced strategies for analyzing markets and trades.

Members will receive technical signals for short and long term market trades, as well as indicators for trading.

Legacy – Professional trading video education with advanced strategies for analyzing markets and trades.

Members will receive technical signals for short and long term market trades, as well as indicators for trading.

Members will directly receive Market Trade information from our professional market analysts on daily market news trends.

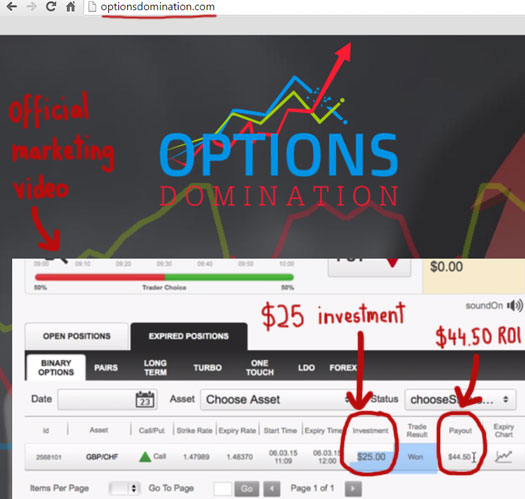

A marketing video on the Options Domination website represents the signals they send their affiliates as investments:

Text appearing in the video explains that, specific to the above investment, Options Domination affiliates can expect to make “$25 profit for a few minutes work”.

There is no disclosure on the Options Domination website advising from where their trading advice is sourced. Ditto any mention of Options Domination having registered with the SEC to provide investment advice to their affiliates.

The only information Options Domination divulge regarding the provided trading advice is as follows:

Options Domination cannot guarantee that you will earn any profits using the methods and provided signals.

The winning/earning potential and winning results are entirely depended on the trader/user and market movements. A lot of factors are included in your success on the binary options market.

The signals shouldn’t be referred as 100% success, or even majority success, not in any point.

There is no guarantee that you can replicate the success that is shown on this website.

The Options Domination Compensation Plan

At the time of publication, Options Domination do not provide a copy of their compensation plan to the general public.

As such, the following compensation plan analysis has been put together via various affiliate presentations and what appears to be official compensation plan material sourced via a third-party.

The Options Domination compensation plan revolves around signing up for between $49.95 and $399.95 a month and then recruiting others who do the same.

Matrix Commissions

Matrix commissions in Options Domination are paid out via three matrices, with regular affiliates and affiliates who sign an IA Form placed into the same matrices.

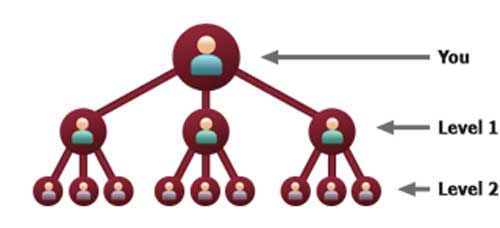

The first matrix Options Domination utilize is a 3×7. This matrix places an affiliate at the top of the matrix, with three positions directly under them:

This forms the first level of the matrix, with the second level created by each of the first three positions branching out into an additional three positions each.

The third level is created when second level positions branch out into another three positions each, and so on and so forth down a total of seven levels.

Commissions are paid out as positions fill in the matrix, with positions filled via direct or indirect recruitment.

How much of a commission is paid out depends on how much an affiliate spends on their Options Domination affiliate membership, as well as that of their recruited downline:

- $1 per recruited Inheritance affiliate

- $3 per recruited Enterprise affiliate

- $7 per recruited Legacy affiliate

Note that as affiliate fees are payable monthly, so too are the above matrix commissions.

The second matrix Options Domination use is a reverse of the first. Technically it’s not a matrix in and of itself (matrices don’t decrease in size as they expand), but rather a manipulation of an affiliate’s regular 3×7 matrix downline.

Affiliates are placed in the second matrix in chronological order, according to when they signed up.

Commissions wise this matrix pays out the same as the first.

Options Domination don’t specify the size of their third matrix (logically it would be a 3×7 though), but claim it’s a separate matrix populated with the

lowest income earners from M1 & M2 combined to ensure they make at least some income.

M1 and M2 being the first and second matrices described above.

Commissions in the third matrix once again appear to be the same as those paid out in the first and second matrices.

Points to note are that affiliates who don’t sign an IA Form are capped at earning $900 a month. Any additional commissions earnt are paid to their upline (the first affiliate who has handed in an IA Form).

Also affiliates are only able to earn based on how much they themselves have bought in for.

Eg. An Inheritance affiliate can only earn $1 per recruited affiliate in their matrix, irrespective of what membership level an affiliate in their matrix signs up for.

Finally, a matching bonus is also payable on the matrix earnings of recruited affiliates.

This matching bonus is paid out down five levels of recruitment, and is only available to Options Domination affiliates who hand in an IA Form.

- level 1 (personally recruited affiliates) – 25% match

- level 2 – 10% match

- level 3 – 5% match

- level 4 – 3% match

- level 5 – 2% match

Unilevel Commissions

Paid only to affiliates who hand in an IA Form, Options Domination’s unilevel commissions pay out down five levels of recruitment.

A unilevel compensation structure places an affiliate at the top of a unilevel team, with any personally recruited affiliates placed directly under them (level 1):

In turn, if any of these level 1 affiliates go on to recruit new affiliates of their own, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

As previously mentioned, Options Domination cap payable unilevel levels at five, with commissions paid out on affiliates placed within a unilevel team.

How much of a commission is paid out depends on how much a newly recruited affiliate spends on their membership, as well as the level of the unilevel team they are placed on:

- level 1 – 15%

- level 2 – 3%

- level 3 – 2%

- levels 4 and 5 – 1%

Note that as these commissions are tied to the monthly payment of Inheritance, Enterprise or Legacy affiliate fees, Options Domination unilevel commissions are monthly recurring.

Joining Options Domination

Affiliate membership with Options Domination is tied to the purchase of an Inheritance, Enterprise or Legacy membership:

- Inheritance – $49.95 a month

- Enterprise – $149.95 a month

- Legacy – $399.95 a month

An Options Domination affiliate can increase their income earning potential by handing in an IA Form. There does not appear to be any additional charge for doing so.

Conclusion

Putting aside the issues of offering investment advice and a lack of registration with the SEC, one can’t help but wonder why Options Domination have structured their opportunity around a two-tier affiliate offering.

The answer lies in the “customer” side of the business merely fronting as a feeder to full affiliate membership, which requires nothing more than the token handing in of a form.

It is the payment of either Inheritance, Enterprise or Legacy affiliate membership which qualifies an Options Domination affiliate for commissions.

As such you’re basically looking at a two-tier recruitment scheme, with the handing in of an IA Form unlocking unilevel commissions.

Even with earnings capped at $900 a month, participation in the MLM side of the business bars participants who don’t hand in an IA form as retail customers.

That means there’s nothing being marketed or sold to retail customers, meaning 100% of Options Domination commissions are paid out on the recruitment of new affiliates. Commissions paid out are also then 100% sourced from affiliates, which is again a compliance issue.

A pay to play element also exists within the opportunity, with affiliates only able to increase matrix earnings per affiliate recruited, by paying more for their affiliate membership each month.

This is irrespective of whether they find value in or intend to use the binary options advice offered at any given affiliate membership level.

As it stands, nothing differentiates Options Domination from a product-based pyramid scheme.

Specifically regarding the binary options trading advice being offered, as per an SEC investor alert issued in 2013:

Much of the binary options market operates through Internet-based trading platforms that are not necessarily complying

with applicable U.S. regulatory requirements and may be engaging in illegal activity.In addition to ongoing fraudulent activity, many binary options trading platforms may be operating in violation of other applicable laws and regulations, including certain registration and regulatory requirements of the SEC and CFTC.

For example, some binary options may be securities.

Under the federal securities laws, a company may not lawfully offer or sell securities unless the offer and sale have been registered with the SEC or an exemption from such registration applies.

For example, if the terms of a binary option contract provide for a specified return based on the price of a company’s securities, the binary option contract is a security and may not be offered or sold without registration, unless an exemption from registration is available.

If there is no registration or exemption, then the offer or sale of the binary option to you would be illegal.

If any of the products offered by binary options trading platforms are security-based swaps, additional requirements will apply.

At the time of publication, there is absolutely no information on the Options Domination website advising whether or not they have registered with the SEC, or whether exemptions apply to their business operations and if so, which exemptions.

In line with a lack of disclosure regarding the Binary Options advice provided, Options Domination also fail to disclose information about the company itself and their compensation plan.

Information about the company would be key in establishing the legitimacy of their binary options advice.

As for the compensation plan, it is simply not offered, discussed or presented until after an Options Domination affiliate has signed up:

Once an IA Agreement has been accepted by Options Domination, the benefits of the Compensation Plan and the IA Agreement are available to the new IA.

How Options Domination expect anyone to make an informed decision about their MLM business opportunity, let alone the legitimacy of the options advice being given, is a mystery.

Approach with extreme caution.

paging ‘former JAS member’!! urgent!!

why has hitesh juneja not ‘owned up’ to his ownership of OD??

you said OD was a’major company’, which major company do you know which is ownerless, and has whois tightly locked up.

OD is just a small bit ponzi company like the hundreds reviewed here, it will be lucky to survive an year.

binary options indeed! not even 0.5% members are going to trade using those trading tips. it’s all about monthly payments and commissions.

Big Fail, former JAS member!

Hitesh… From that Kingdom thing, right?

While it’s certainly NOT illegal to sell “signals”, and leave the actual trading to others, paying referral for people who buy these signals puts them into referral selling (prohibited) category.

Yerp… 2013 – https://behindmlm.com/companies/kingdom-craze-review-virtual-estates-tributes/#comment-155360

Once again, Oz fails to do his/her homework. The owner of OD is right on the OD website. (Dr. Jason Rose)

Also, the compensation plan is also clearly there as well.

You folks said all the same crap about DSD nearly two years ago and it’s still going strong.

You’re just mad that your dumb blog doesn’t stop people from success and these guys run circles around you. They actually have NADEX coming to them to help members set up their NADEX accounts.

Allow me to educate you. NADEX IS a USA legal & registered trading exchange. Do your homework before being made to look like a fool!

@Mind

Have you tried logging out of your affiliate account?

There’s currently nothing on the OD website except a marketing video talking demo’ing Binary Options investment and a sign-up link.

Comp plan is also nowhere to be seen. Did you even read the review, I quoted the OD website itself which clearly states only affiliates are given the comp plan.

Not an OD affiliate? You don’t get to find out how you’ll be paid until after you hand over your money.

Nothing suss…

You’re going to deny that DS Domination affiliate recruitment isn’t in decline? Come on son…

NADEX isn’t mentioned anywhere on the Options Domination website. Does it address the SEC registration issue and lack of retail sales?

Didn’t think so…

Allow me to educate you since I actually took some classes on Finance.

You should be real experienced stock broker to go into option only trading. Ideally, option trading done to mitigate risk on regular stocks. That what they were designed for.

Trading them by themselves or expecting to make high profit from them by themselves or in tandem with stocks is at least illogical.

Who gets rich on options? Google it.

You will find people who get rich on options are not traders but companies who sell tools to trade options(trading platforms, seminars, books and underwriters).

It is well known fact on Wall street that you are better off investing in stock of Options Underwriter than in options themselves.

Can you clarify which field Dr. Jason Rose is working/educated in? If he is PhD in Economics/Finance where are his papers/educational credentials?

I am trying to Google him and having real difficult time. There are few prominent medical doctors by this name, but otherwise I am coming up empty.

OD dominations has a tie up with nadex, to provide the trading platforms, and to make the trades for a commission.

nadex is registered with the CFTC [commodity futures trading commission].

this does not make OD ‘registered’ or ‘legal’.

OD is not registered with the SEC/FINRA to give investment advice.

OD’s business model makes it a pyramid scheme.

binary options trading is a new ‘fad’, it is more akin to ‘betting’ than trading on fundamentals.

it is not easy to make money in options trading, you need experience, the idea of common folk joining up a trading MLM and becoming options traders overnight, is amusing at best.

OD’s FB pages are overflowing with ‘hitesh juneja’. yet he avoids accepting ownership of OD. this drips and overflows of dishonesty.

there is no physical contact address for OD. major company indeed!

who is dr jason rose? JAS & mindstopper are invited to formally introduce us to dr rose [while you’re at it copy/paste hitesh’s response to stolen signals which shows the date]

According to the D$Domination webpage: NOLINK: dsdomination.com/show/page/aboutUs

Jason Rose is a doctor of chiropractic as well as president of D$D

the dsdomination.com/show/page/aboutUs page informs us about co founder kevin hokoana:

however the rules for governing ‘outside activities’ of airforce personnel, clearly prohibits such commercial activity:

since hokoana embarked upon his MLM career, while in airforce service, it is extremely possible he was recruiting fellow servicemen.

unethical servicemen, ownership denying pyramid schemers, who provide no physical contact address, but purport to supply unbelievable options signals, without stating their source, and expecting people to join up, with no knowledge of the compensation plan. a very honest and transparent set up, indeed!

I am really looking forward to the day when people realize they have been duped by the leaders of this scam and they start to lose all their money!

Have a nice wait…they will just move on to the next scam like they always do.

And that makes him expert on options? If you put Dr. in front of the name, your degree should be relevant to the business. This is just as stupid as as I expected.

From an Options Domination marketing pitch (published less than 24hrs ago):

Unregistered securities ahoy!

there’s a new face in OD management team:

i could not find an ‘OLMS FUNDING AND UNDERWRITING’ anything.

but josh oncken is a chiropractor according to his linked in profile:

the other ‘founder’ of OD is jason rose who is also a chiropractor.

so, are chiropractors the best options traders in the world?

i mean, the next time someone wants to do trading in options, should they just contact their friendly neighborhood chiropractor?

it’s embarrassing how they have introduced management on the OD website:

jason rose: aka FLEX LUTHOR

josh oncken: aka UBERMENSCH

hitesh juneja: aka BRAINIACLE

too much carriedawayness??