LSSC securities fraud warning from Canada (QC)

LSSC, or Lightning Scooter Shared Company, has received a securities fraud warning from Quebec’s Autorite des Marches Financiers (AMF).

LSSC, or Lightning Scooter Shared Company, has received a securities fraud warning from Quebec’s Autorite des Marches Financiers (AMF).

As per AMF’s July 4th LSSC fraud warning; [Continue reading…]

Homnifi securities fraud warning from Australia

Homnifi has received a securities fraud warning from the Australian Securities and Investments Commission (ASIC).

Homnifi has received a securities fraud warning from the Australian Securities and Investments Commission (ASIC).

ASIC added Homnifi to its Investor Alert List on June 30th, 2025. [Continue reading…]

LSSC securities fraud warning from Canada (SK)

LSSC, or Lightning Scooter Shared Company, has received a securities fraud warning from Saskatchewan’s Financial and Consumer Affairs Authority (FCAA). [Continue reading…]

LSSC, or Lightning Scooter Shared Company, has received a securities fraud warning from Saskatchewan’s Financial and Consumer Affairs Authority (FCAA). [Continue reading…]

Cryptex fraud warning from Germany

Cryptex has received a fraud warning from Germany’s Federal Financial Supervisory Authority (BaFin).

Cryptex has received a fraud warning from Germany’s Federal Financial Supervisory Authority (BaFin).

As per BaFin’s July 4th Cryptex warning; [Continue reading…]

Andreas Kartrud sentenced to six years in prison

Serial fraudster Andreas Kartrud has been sentenced to six years in prison.

Serial fraudster Andreas Kartrud has been sentenced to six years in prison.

Norwegian authorities arrested Kartrud in late 2024. Kartrud, who holds dual Norwegian and Swedish citizenship, was then promptly extradited to Sweden. [Continue reading…]

Alex Morton consents to Iyovia preliminary injunction

Former top Iyovia promoter Alex Morton has consented to a preliminary injunction.

Former top Iyovia promoter Alex Morton has consented to a preliminary injunction.

Morton, one of nine defendants sued by the FTC and State of Nevada in May, stands accused of misappropriating over $76 million through Iyovia (formerly iMarketsLive and IM Mastery Academy). [Continue reading…]

OmegaPro’s Mike Sims & Carlos Reynoso arrested

![]() OmegaPro’s Michael Shannon Sims and Juan Carlos Reynoso have been arrested. [Continue reading…]

OmegaPro’s Michael Shannon Sims and Juan Carlos Reynoso have been arrested. [Continue reading…]

Nueva Review: Modere promoters scramble to keep downlines

Nueva, aka Nueva Life, fails to provide ownership or executive information on its website.

Nueva, aka Nueva Life, fails to provide ownership or executive information on its website.

Nueva’s website domain (“nuevalife.com”), was first registered in 2005. The private registration was last updated on April 14th, 2025.

While Nueva’s website doesn’t disclose ownership or executives, it does state the company is a “reinvention of Social Retail”.

The business we built… the community we nurtured… the income we created — all disappeared overnight.

“Social retail” was a marketing campaign of Modere. Modere collapsed in April 2025, which coincides with Nueva’s website domain being registered the same month.

In a June 2025 video titled, “Nueva scam exposed: They don’t want you to see this Zoom meeting“, Julie Anderson comments on an official Nueva marketing webinar:

Left to right and clockwise we have; DJ Barton, Tony Zolecki and John Melton.

- DJ Barton – co-founder of Levarti

- Tony Zolecki – former Modere promoter

- John Melton – former Modere promoter

Pending Nueva disclosing ownership and/or executive details (failing to do so is an ongoing violation of the FTC Act (disclosures)), Barton, Zolecki and Melton appear to be the face of Nueva for now.

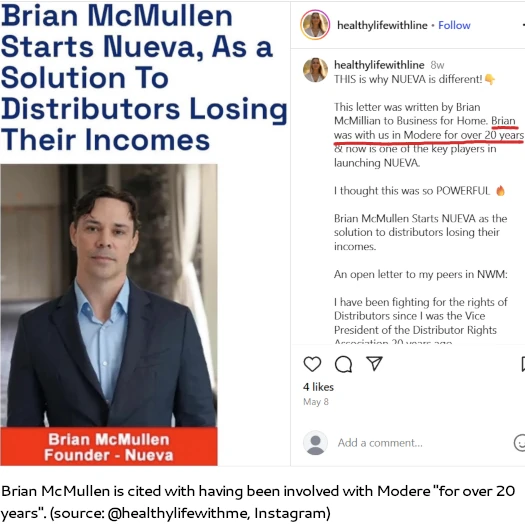

Update 9th July 2025 – A May 2025 article from BusinessForHome names Brian McMullen as Nueva’s founder.

This is supported by a May 2025 FaceBook post from Mullen, stating he “was asked to buy Modere” but “turned them down”.

A marketing brief for a 2018 Association of Network Marketing Professionals event cites McMullen as an “influential network marketing leader for 25+ years”.

Mr. McMullen has business interests all over the world, both inside and outside of network marketing, financed by the earnings he has generated over his 25-year career in the profession.

McMullen’s previous MLM ventures aren’t disclosed but we do know one of them is Vemma:

McMullen was part of Alex Morton’s “Young People Revolution” Vemma downline. From the cited video above’s description;

Brian McMullen is a YPR leader who earns over than 1 million per year today, but his life was kind of a misery before he joined YPR.

No body thought he can become as successful as he is now, but YPR movement gave him an opportunity to start over and his life really totally changed because of YPR.

The FTC filed suit against Vemma in 2015. The federal regulator alleged Vemma was a $200 million pyramid scheme.

Vemma settled the FTC’s case for $238 million in 2016. As part of the settlement, Vemma agreed to cease operating as a pyramid scheme.

After Vemma McMullen appears to have followed Morton over to Jeunesse. Truth in Advertising cites McMullen as a former Monavie promoter (Jeunesse acquired Monavie in 2015).

Social media discussion around Nueva suggests McMullen also has a long history with Modere;

Why McMullen isn’t disclosed as Nueva’s founder on its website is unclear. /end update

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money.

FBI seeking information from OmegaPro Ponzi victims

![]() The FBI is seeking information from victims of the OmegaPro Ponzi scheme. [Continue reading…]

The FBI is seeking information from victims of the OmegaPro Ponzi scheme. [Continue reading…]

TSSB’s Billionico/Auratus fraud order dismissed

![]() The Texas State Securities Board’s Billionico and Auratus emergency fraud order has been dismissed. [Continue reading…]

The Texas State Securities Board’s Billionico and Auratus emergency fraud order has been dismissed. [Continue reading…]