Ruby Ribbon announces MLM closure

![]() Ruby Ribbon has announced it is closing. The MLM company posted a “heartfelt goodbye” on its website late last week. [Continue reading…]

Ruby Ribbon has announced it is closing. The MLM company posted a “heartfelt goodbye” on its website late last week. [Continue reading…]

Pruvit “employees” class-action filed in California

A class-action filed in California alleges Pruvit distributors are in fact employees.

A class-action filed in California alleges Pruvit distributors are in fact employees.

Plaintiff Jennifer Carrera filed the suit in Contra Costa’s Superior Court on February 13th, 2025. [Continue reading…]

LSSC securities fraud warning from Canada (BC)

LSSC, or Lightning Scooter Shared Company, has received a securities fraud warning from the British Columbia Securities Commission (BCSC).

LSSC, or Lightning Scooter Shared Company, has received a securities fraud warning from the British Columbia Securities Commission (BCSC).

As per BCSC’s June 23rd LSSC fraud warning; [Continue reading…]

JetCoin’s Dwayne Golden sentenced to 8 years in prison

JetCoin Ponzi admin Dwayne Golden has been sentenced to eight years in prison. Eight years was the maximum range the DOJ sought in pre-sentencing filings.

JetCoin Ponzi admin Dwayne Golden has been sentenced to eight years in prison. Eight years was the maximum range the DOJ sought in pre-sentencing filings.

As per a judgment filed on June 27th, Golden was also ordered to pay $2.46 million in forfeiture. [Continue reading…]

Vincent Mazzotta pleads guilty to Mind Capital fraud

Vincent Anthony Mazzotta Jr. has pled guilty to conspiracy to obstruct justice and money laundering. [Continue reading…]

Vincent Anthony Mazzotta Jr. has pled guilty to conspiracy to obstruct justice and money laundering. [Continue reading…]

My Crypto Consult pivots to node fraud with GlamJet Nova

My Crypto Consult is an MLM crypto Ponzi built around GLAM tokens. Launched in 2019, My Crypto Consult is and has been dead for a while.

My Crypto Consult is an MLM crypto Ponzi built around GLAM tokens. Launched in 2019, My Crypto Consult is and has been dead for a while.

As of April 2025, SimilarWeb was tracking just over 6000 monthly My Crypto Consult website visits. That grew to around 9000 for May, coinciding with the transition to crypto node fraud. [Continue reading…]

IBM USDT Review: Stolen identity “click a button” Ponzi

IBM USDT fails to provide ownership or executive information on its website.

IBM USDT’s website domain (“ibm.hbdfqz.com”), was privately registered on May 8th, 2025.

IBM USDT has already attracted the attention of financial regulators. The Central Bank of Russia issued an IBM USDT pyramid fraud warning on June 18th, 2025.

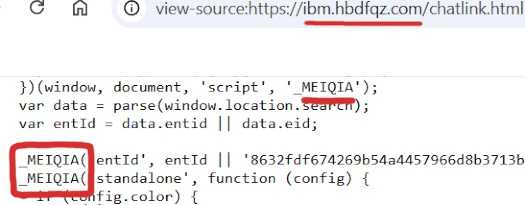

If we look at the source-code of IBM USDT’s website support, we find it runs on the Meqia platform:

Meiqia is a Chinese software company based out of Beijing. This suggests whoever is running Visionary AI Cinema has ties to China.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

DareVita Review: Lactigo supplement autoship recruitment

DareVita fails to provide ownership or executive information on either of its website.

DareVita fails to provide ownership or executive information on either of its website.

DareVita operates from two known website domains:

- darevita.com – first registered in 2012, private registration last updated on May 11th, 2025

- mydarevita.com – privately registered on November 18th, 2024

DareVita’s official FaceBook page was created in September 2024. Thus it appears DareVita went live in late 2024.

DareVita’s website terms and conditions suggests it is run through DareVita International Inc., a Wyoming shell company.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

HB 162 MLM bill passes Delaware House of Reps

HB 162 MLM “house bill” has passed Delaware’s House of Representatives. [Continue reading…]

HB 162 MLM “house bill” has passed Delaware’s House of Representatives. [Continue reading…]

Nexa Evergreen Ponzi scammers make off with $309M

Nexa Evergreen Ponzi founders, Subhash and Ranveer Bijarani, have made off with Rs. 26.7 billion (~$309 million USD). [Continue reading…]

Nexa Evergreen Ponzi founders, Subhash and Ranveer Bijarani, have made off with Rs. 26.7 billion (~$309 million USD). [Continue reading…]