SEC slam Sloan’s porky pie “nonsense”

![]() Two days ago Faith Sloan filed a motion with the District Court of Massachusetts, asking the court to grant her until June 29th to file a reply to the SEC’s preliminary injunction against her.

Two days ago Faith Sloan filed a motion with the District Court of Massachusetts, asking the court to grant her until June 29th to file a reply to the SEC’s preliminary injunction against her.

Trouble is that injunction was granted three weeks ago, so asking for an extension to reply to it now seemed rather pointless. Not withstanding Sloan already has until June 18th to reply to it in anycase.

For someone who has systematically been ignoring the SEC’s litigation against her since mid April, is an extra ten days really going to make a lick of difference?

Even the reasons Sloan cited in support of her motion were comically confusing.

Sloan (right) claims that

Sloan (right) claims that

- she did not have actual notice of the filing of Plaintiff’s Complaint until Tuesday, May 27, 2014 and that

- the process-server served Antoinette Sloan (her mother), and that ‘Sloan is 54 years old and does not fit the description of Sloan’s “Mom”‘

Again, coming from a defendant who has gone out of her way to ignore the proceedings against her (she hung up on the SEC when they initially called her back in April), the plea now for a time-extension was a bit rich.

Not surprisingly, the SEC signalled that they too have had enough of Sloan’s time-wasting and were quick to file an objection to Sloan’s motion.

Is Sloan guilty of perjury? The SEC certainly seem to think so… [Continue reading…]

BurnLounge appeal denied, still a pyramid scheme.

Shut down in 2007, BurnLounge was just before my time covering the MLM industry.

Shut down in 2007, BurnLounge was just before my time covering the MLM industry.

For those unfamiliar with the company, launched in 2004, BurnLounge consisted of affiliates (Moguls) purchasing ‘music-related merchandise, and packages of music-related

merchandise‘, primarily to qualify for commissions.

BurnLounge affiliates recruited new affiliates who did the same, and long story short in 2007 the FTC shut them down for being a pyramid scheme.

Mogul package sales drove 92.6% of BurnLounge’s revenue in 2006, its one full year of operation, while music sales during the same year only amounted to 4.9% of revenue.

BurnLounge lost the case against them in court,

The defendants were also ordered to pay in aggregate about $17 million towards consumer redress – of this BurnLounge and Juan Alexander Arnold are to pay $16,245,799, John Taylor $620,138 and Rob DeBoer $150,000.

On February 29, 2012 an order was issued barring the defendants from operating a pyramid scheme and ordering them to pay some $17 million in damages. (Wikipedia)

The district court described BurnLounge’s bonus system as “a labyrinth of obfuscation.” It found there was a 93.84% failure rate for all Moguls, meaning 93.84% of Moguls never recouped their investment.

The district court also found that BurnLounge’s marketing focus was on recruiting new participants through the sale of packages.

BurnLounge appealed and yesterday saw the United States Court of Appeals for the Ninth Circuit hand down their decision. [Continue reading…]

Merrill: Carlos Wanzeler “fled” US to “avoid prosecution”

![]() Resentment over TelexFree co-owner Carlos Wanzeler’s escape to Brazil and leaving of his partner-in-crime James Merrill to take the fall, might finally be starting to show.

Resentment over TelexFree co-owner Carlos Wanzeler’s escape to Brazil and leaving of his partner-in-crime James Merrill to take the fall, might finally be starting to show.

As it became clear regulators were going to move in on Wanzeler’s $1 billion Ponzi scheme empire, the night before his house was raided he jumped in a car with his daughter and fled across the Canadian border.

After lying low for a few days (Wanzeler is believed to have bunked with some of his top investors), Carlos then jumped on a plane and escaped to Brazil. Shortly after touching down, Wanzeler used some of the stolen investor money he had stashed away to hire the services of high-profile lawyer, Antonio Carlos de Almeida Castro.

How much Wanzeler had to pay Castro to convince him TelexFree wasn’t a Ponzi scheme is unclear, but Castro was quick to draft and report a fictional account of the circumstances Wanzeler fled to Brazil under.

Castro claimed Wanzeler was not a fugitive because he escaped “before an arrest warrant was issued”. He also claimed that Wanzeler was born in Brazil and simply wanted to return home, which was “perfectly natural”.

When it was evident nobody outside of a few Brazilian TelexFree YouTube heroes were buying his story, Castro tried a different approach and adopted a tone of motherly protection:

(Carlos Wanzeler) will definitely stay in Brazil. (I will) not let (Wanzeler) go to a country that does not respect individual rights, as (we have) seen when they arrested his wife (Katia Wanzeler), (when she) hasn’t even been accused of anything.

Wanzeler’s wife Katia was arrested after she was also caught trying to flee the US for Brazil. She has subsequently been released and, to the best of my knowledge, remains in the US.

James Merrill, Wanzeler’s partner in the $1 billion TelexFree Ponzi scheme was apprehended early last month and, along with Wanzeler, is facing wire fraud criminal charges.

After being denied bail, Merrill has remained in custody for approximately three weeks. Now he wants out. [Continue reading…]

EMSquared Review: Mannatech charity opp spinoff?

The company name “EMSquared” is derived from the concept of “eradicating malnutrition”, using the “squared” efforts of a group. And with the name explained, you’re pretty much getting the thrust behind the EMSquared opportunity.

The company name “EMSquared” is derived from the concept of “eradicating malnutrition”, using the “squared” efforts of a group. And with the name explained, you’re pretty much getting the thrust behind the EMSquared opportunity.

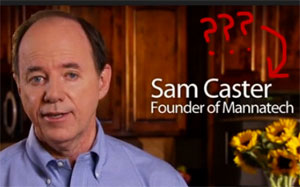

EMSquared are based out of the US state of Texas and headed up by Sam Castor (right), who is credited as CEO and Founder.

EMSquared are based out of the US state of Texas and headed up by Sam Castor (right), who is credited as CEO and Founder.

Castor founded Mannatech in 1993 and served as CEO until his resignation in 2007.

It should be noted at this point that Castor was credited as “Samuel L. Caster” (or just Sam Caster) during his time at Mannatech. Typo or not I can’t say, but he’s being credited as “Sam Castor” in all the EMSquared promotional material I’ve seen.

Castor resigned from Mannatech in 2007, amidst ongoing legal and regulatory controversy.

Castor resigned from Mannatech in 2007, amidst ongoing legal and regulatory controversy.

Mr. Caster suggested his own resignation so he could focus on company marketing, said (Mannatech board member) Mr. Larry A. Jobe. Mr. Jobe said the board wasn’t displeased with Mr. Caster, but that the lawsuits gave members ‘a lot of concern.'”

Paperwork filed with the SEC indicate disagreements between Caster and the board of directors were the reason for Caster’s resignation.

The lawsuits mentioned above include a class-action lawsuit filed in 2005 against Mannatech by stock holders. The lawsuit alleged that Mannatech had made

a series of material misrepresentations; specifically: failing to control its sales associates and allowing them to make false claims concerning the efficacy of Mannatech products.

Separately in July 2007, after an investigation that began in October of 2006, Mannatech and Sam Castor were charged by the Texas Attorney General for

operating an illegal marketing scheme in violation of state law.

Mannatech settled the civil complaint on February 26, 2009 by agreeing to pay $4 million in restitution to clients who purchased products and $2 million to the state to cover its costs in the case.

In addition, Sam Caster agreed to pay a $1 million civil penalty.

Castor was no stranger to regulatory action from the Texas AG, with his first two major business ventures having previously attracted their attention too:

Sam Caster’s first major business venture, Eagle Shield, was an insulation product that claimed to utilize new technology developed by NASA and could reduce heating and cooling costs by up to 40%.

The Attorney General of Texas concluded that the product’s technology long predated NASA and did not reduce consumers’ bills in the amounts advertised.

Caster’s second product, the “Electrocat,” was sold as a pest control device. The Electrocat reportedly emitted pulsed vibrations that repelled rats, crickets, snakes, ticks, spiders, mosquitoes, and scorpions.

However, in January 1991, the Attorney General of Texas investigated the product and found that the Electrocat emitted no vibrations whatsoever.

The Attorney General declared, “The device is a hoax, and stands on the same scientific footing as a perpetual motion machine.”

Following his resignation, Castor continued on as an “independent consultant” to Mannatech. In the years that followed, Mannatech went through multiple CEO resignations. Subsequently, net income and affiliate numbers also plummeted:

Publicity over the company’s lawsuits began to damage the balance sheets and stock performance.

After profits of $32 million in 2006 and $6.6 million in 2007, Mannatech reported a $12.6 million loss in 2008 and a $17.3 million loss in 2009. By mid-year 2010, one quarter of Mannatech’s sales were gone.

2010 losses were $10.6 million. As the company’s market capitalizations continued to fall, S&P Indices dropped it from the S&P 600 Index, stating “They are no longer representative of the small cap market space.”

Recruiting efforts continued dropping in 2011, widening company losses to 20.6 million.

Fast forward to 2013 and things seem to have turned around (net-income was $300,000), largely on the back of increased affiliate recruitment in Asia and Europe and net sales increases in Asia, the US and Europe.

Net sales for Asia/Pacific increased 16.4% to $20.6 million as compared to $17.7 million in the fourth quarter 2012 due to a 21.8% increase in the number of active associates and members in the region.

Net sales for North America increased 5.9% to $21.7 million as compared to $20.5 million in the fourth quarter of 2012. The increase in revenue was due to a 13.7% increase in the revenue generated per active associate and member.

Net sales for Europe, the Middle East and Africa increased 2.4% to $4.2 million as compared to $4.1 million in the fourth quarter of 2012. This increase was primarily due to a 13.9% increase in the number of active associates and members.

We reported net income for 2013 of $3.2 million, compared to net loss of $1.4 million in 2012.

In addition to his $1 million civil penalty, Castor

was barred by the attorney general of Texas from serving as a director, officer, or employee of Mannatech for five years—from February, 2009 until February, 2014. Caster was also barred from taking a role in any other multi-level marketing programs during that time.

In March 2014, a month after his MLM ban lapsed, Castor began appearing in Mannatech promotional videos as Mannatech’s “founder and visionary.”

A few months later again, and now Castor looks set to return to the MLM industry with EMSquared.

Read on for a full review of the EMSquared MLM business opportunity. [Continue reading…]

Gold4Change Review: 1,000,000 EUR gold investment?

![]() There is no information on the Gold4Change website indicating who owns or runs the business.

There is no information on the Gold4Change website indicating who owns or runs the business.

The Gold4Change website domain (“gold4change.com”) was registered on April 5th 2011, but only lists “Gold4Change LLC” as the owner.

Gold4Change LLC is a company registered in Delaware, with details provided on the Gold4Change website itself.

GOLD 4 CHANGE LLC is a global company based in the U.S. since Aug. 28, 2011.

Gold 4 Change LLC

910 Foulk Road, Suite 201

Wilmington, New Castle County

Delaware 19803

U.S.A.

Using the file number “5027856”, one can look up Gold4Change LLC at the Deleware Division of Corporate website, however no information is revealed as to who owns or runs the company.

It’s worth noting that the US registration of Gold4Change appears to be in name only. All currencies listed on the website are in EUR, the Gold4Change domain uses European name-servers, a European payment-processor is used, the website is hosted in Germany and Spanish, French and English are the languages offered on the website (note that the English used is littered with grammatical errors).

Putting all of this together suggests that whoever is running Gold4Change is in actuality based out of Europe and not the US.

As always, if a MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

Banners Viewer Review: $21,250 cloud storage? Cmon.

There is no information on the Banners Viewer website indicating who owns or runs the business.

There is no information on the Banners Viewer website indicating who owns or runs the business.

The Banners Viewer website domain (“bannersviewer.us”) was registered on October 22nd 2013, however the domain is registered only to the company itself.

An address in Boca Raton, Florida is provided, however a Google search reveals this to be a residential location. Whether or not Banners Viewer actually do any business out of the address they list in the domain registration is unclear.

Further research reveals corporate marketing videos that name an “Edward A. Cocchiola” as Banners Viewer’s CEO

Why this information is not provided on the Banners Viewer website is a mystery.

Despite being credited with “many years experience in the business world and network marketing” by Banners Viewer affiliates on social media, Cocchiola’s MLM history appears to be non-existent.

I was unable to find Cocchiola’s name attached to a prior MLM opportunity as either an affiliate or corporate. To this end it would appear Banners Viewer is Cocciola’s first MLM venture as an executive.

It’s worth noting that in the company’s Florida business registration (listed as “Banners Viewer LLC”), an authorised member (AMBR) by the name “BANNERSVIEWER S.A.” appears.

The address provided for this entity is in Panama, a widely recognized tax-haven. What the story is there I can’t say.

Read on for a full review of the Banners Viewer MLM business opportunity. [Continue reading…]

First Zeek Rewards payments to go out September 30th

On the 28th of May, the Zeek Rewards Receivership filed a Motion to “authorize first interim distribution” of payments to Zeek Rewards victims.

On the 28th of May, the Zeek Rewards Receivership filed a Motion to “authorize first interim distribution” of payments to Zeek Rewards victims.

The Motion is specifically limited to payments being made under what the Receivership refers to as “Class 3” claims, which the Receivership defines as

the Claims of Affiliate Investors and subrogees of Affiliate Investors on account of losses based on the investments they made in the ZeekRewards Scheme.

As I understand it, if you lost money in Zeek Rewards and there was no disputes or discrepancies over the amount, your claim is classified as a Class 3.

Payments will naturally vary from affiliate to affiliate, but these first payments are claimed to guarantee a payout of ‘at least 40% of the amount of their Class 3 Allowed Claim‘. [Continue reading…]

TelexFree want MacMillan retained as bankruptcy mole

![]() Two days ago saw the latest TelexFree bankruptcy hearing take place, with the outcome being the almost certainty that TelexFree’s management and owners would lose control of the company.

Two days ago saw the latest TelexFree bankruptcy hearing take place, with the outcome being the almost certainty that TelexFree’s management and owners would lose control of the company.

In their place a Chapter 11 Trustee would be appointed, which would effectively put TelexFree in the control of US regulators (specifically the Department of Justice).

Initially TelexFree, or at least their lawyer Joseph Davis, welcomed the decision:

A lawyer for TelexFree said at the hearing that the company wouldn’t object to the trustee’s appointment.

“We agree that it makes sense to put in place a Chapter 11 trustee,” said Joseph Davis, a lawyer for TelexFree. “I understand why control of the company should not remain in the hands of management that preceded the bankruptcy.”

At the time, I didn’t quite grasp the punchline behind that last statement. TelexFree do indeed not object to the appointment of a Trustee. But as with all things TelexFree, turns out there’s a catch.

One of the side-effects of a Chapter 11 Trustee being appointed is that Carlos Wanzeler and Stuart MacMillan lose control of the company. They are shut out completely and have no voice in any decisions made.

As evidenced by TelexFree’s latest filing in the bankruptcy court, this isn’t a prospect they’re too happy with. [Continue reading…]

Amway India CEO arrested (again)

Following a complaint filed in August last year against Amway, its Indian CEO, William Pinckney, has once again been arrested.

Following a complaint filed in August last year against Amway, its Indian CEO, William Pinckney, has once again been arrested.

The latest complaint was filed in the Indian state of Andrhra Pradesh, with

Kurnool Superintendent of Police Raghurami Reddy (saying) they had been collecting a lot of documentary evidence leading up to the arrest.

Pinckney and Amway have been charged with violating the Prize Chits and Money Circulation Act, and whereas Pinckney was granted bail the last time he was arrested (almost exactly a year ago in a different state), this time bail was denied. [Continue reading…]

SEC destroy TelexFree VOIP argument, expose lies

![]() Broadening the scope of their complaint against TelexFree to include it being a Ponzi scheme, the SEC have filed an amended complaint on the 27th of May.

Broadening the scope of their complaint against TelexFree to include it being a Ponzi scheme, the SEC have filed an amended complaint on the 27th of May.

The initial complaint restricted the definition of TelexFree to that of an “illegal pyramid scheme”, with the new complaint kicking things up a notch. Much of the amended complaint reads the same as the original complaint (filed on April 17th), however there is some new information that’s worth going over.

One of Carlos Costa’s favourite arguments, and indeed that of the company’s top investors and those they continue to lie to, is that TelexFree was a bastion of retail activity surrounding VOIP service sales.

In their amended complaint, armed with actual facts and figures, the SEC completely destroy this argument once and for all. [Continue reading…]