William Apostelos indicted on 13 counts of wire fraud

Following the disappointment of an FBI affidavit revealing Genesis Acquisitions affiliates have “no chance” of recovering invested funds, some respite today with the news William Apostelos is facing criminal charges.

Following the disappointment of an FBI affidavit revealing Genesis Acquisitions affiliates have “no chance” of recovering invested funds, some respite today with the news William Apostelos is facing criminal charges.

Apostelos, who with his wife Connie orchestrated a $70 million dollar Ponzi scheme through WMA Enterprises and Midwest Green, was indicted on thirteen counts of wire fraud. [Continue reading…]

Crowdfunding, MLM & the SEC

To date the crowdfunding MLM niche has been nothing more than a front for cash gifting.

To date the crowdfunding MLM niche has been nothing more than a front for cash gifting.

Affiliates sign up, gift participation fees to their upline (the affiliate who recruited them), which in turn qualifies them to receive participation fees (gifting payments) from subsequent participants.

This is usually wrapped around “donating to a cause” or some such, when in reality the funds “donated” are paid to earlier participants, in true cash gifting fashion.

In an attempt to curb the lack of regulatory clarification such schemes operate in, the SEC earlier today announced the introduction of specific rules pertaining to crowdfunding investment. [Continue reading…]

Options Rider warning issued by New Zealand’s FMA

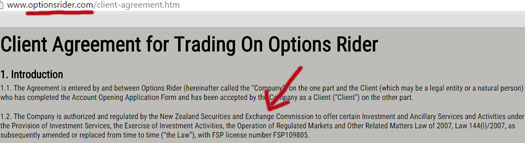

When Options Rider first launched, the company claimed to be ‘authorized and regulated by the New Zealand Securities and Exchange Commission‘:

When Options Rider first launched, the company claimed to be ‘authorized and regulated by the New Zealand Securities and Exchange Commission‘:

This turned out to be a load of baloney, primarily because there is no New Zealand Securities and Exchange commission.

The securities regulator in New Zealand is the Financial Markets Authority, who play a ‘critical role in regulating capital markets and financial services in New Zealand’.

In responding to a query asking whether or not Options Rider were indeed registered as a financial services provider in New Zealand, the FMA responded that Options Rider

is not registered on the Financial Service Providers Register (FSPR) or regulated as a financial service provider in NZ.

Evidently that clarification wasn’t enough, with the FMA publishing an official Options Rider warning on their website. [Continue reading…]

SEC’s DFRF Enterprises civil case stayed

Earlier this month the Department of Justice had requested that the SEC’s civil litigation against DFRF Enterprises be stayed.

Earlier this month the Department of Justice had requested that the SEC’s civil litigation against DFRF Enterprises be stayed.

The SEC didn’t oppose the motion, but took no position either way.

Now, in orders issued a few days ago, we can reveal that the SEC’s civil litigation against DFRF Entprises has indeed been stayed. [Continue reading…]

Where do you get your MLM news from?

![]() “Why can’t you be more like BusinessForHome?”

“Why can’t you be more like BusinessForHome?”

About once a month, sometimes more, sometimes less, I get asked the above question or a derivative of it.

The implication behind the question is that I tend to focus purely on what is perceived to be “negative” viewpoints, which is reflected in the content published on BehindMLM.

And that’s a fair call.

While I don’t perceive information strictly in a positive and negative sense, by far the bulk stories we cover would probably fall in the latter category.

I assure you however this isn’t by design. I’m far from running around the internet intentionally digging up stories that paint the MLM industry in the worst light possible.

Rather that’s the nature of a free press. It’s “news”, it’s what we report on. Information that goes deeper than what’s evident on the surface is what people want to read about.

As an MLM blogger I see my role in the industry as keeping readers informed. To me personally, that doesn’t equate to republishing spammy press-releases or working in cahootz with MLM companies to publish advertising material.

I wish I could say the same about other bloggers in the MLM niche. [Continue reading…]

AdMatrixProfits Review: $2 matrix-based Ponzi investment

![]() There is no information on the AdMatrixProfits website indicating who owns or runs the business.

There is no information on the AdMatrixProfits website indicating who owns or runs the business.

The AdMatrixProfits website domain (“admatrixprofits.com”) was registered on the 26th of October 2015, however the domain registration is set to private.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

CashTime 1 Review: $60 to $1000 hourly ROI shares

There is no information on the CashTime 1 website indicating who owns or runs the business.

There is no information on the CashTime 1 website indicating who owns or runs the business.

The CashTime 1 website domain (“cashtime1.com”) was registered on the 6th of September 2015, however the domain registration is set to private.

Further research suggests CashTime 1 is being operated out of Brazil.

For starters the first language offered on the CashTime1 website is Portuguese, represented by a Brazilian flag. YouTube videos on the CashTime 1 YouTube channel mention a “global meeting” in Rio de Janeiro a month ago, with most of the other videos uploaded being in Portuguese.

Additionally, Alexa currently estimate that 76.8% of all traffic to the CashTime 1 website originates out of Brazil.

Given this, it is extremely likely that the admin(s) of CashTime 1 are also based in Brazil.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

Court denies Vemma’s revised compensation plan

![]() Frustrated with the FTC’s “all or nothing” interpretation of the court-ordered preliminary injunction, Vemma sought to bypass regulatory approval through a court filing.

Frustrated with the FTC’s “all or nothing” interpretation of the court-ordered preliminary injunction, Vemma sought to bypass regulatory approval through a court filing.

Whereas the FTC maintained that no commissions should be paid out unless 51% of affiliate sales are to retail customers, Vemma instead wanted to adopt a pro-rata model.

This would see affiliates who failed to generate 51% retail sales volume paid pro-rata based on whatever percentage their retail volume was.

The problem as I saw it with this model was that it technically would permit Vemma to continue running a product-based pyramid scheme, based on revenue flowing into the company.

If on average say only 40% of affiliate sales revenue was retail, Vemma as a company would still be sourcing the majority of company revenue from affiliates as opposed to retail customers.

And this is pretty much the same way the FTC saw it:

The FTC objects to Vemma’s proposed compensation plan on the grounds that it still incentivizes recruitment of Affiliates over retail sales in violation of the Preliminary Injunction and the FTC Act.

Specifically, the FTC argues that the 51% Rule is an insufficient anti-pyramiding safeguard because it provides an Affiliate significant compensation even if most of the Affiliate’s sales are to downstream Affiliates, not Customers.

A broader issue is also that Vemma’s revised compensation plan potentially sees the company operate against the spirit of the preliminary injunction, which sought to eliminate recruitment revenue beating out retail.

The matter went to court on October 21st, with Judge Tuchi reserving his judgment.

That judgement was published earlier today, with Tuchi ruling in favor of the FTC. [Continue reading…]

SwisCoin Review: $100-$11,000 crypto Ponzi points scheme

![]() There is no information on the SwisCoin website indicating who owns or runs the business.

There is no information on the SwisCoin website indicating who owns or runs the business.

The SwisCoin website domain (“swiscoin.com”) was registered on the 15th of September 2015, with Kathrine Harbor listed as the owner. An address in Dublin, Ireland is also provided.

Further research reveals this address belongs to Regus, who sell virtual office space. As such it would appear SwisCoin have no actual physical presence in Ireland.

As for Kathrine Harbor, outside of the SwisCoin domain registration, her name doesn’t appear linked to SwisCoin.

I’m flagging this as highly suspicious, with there being a big question mark as to whether or not Harbor actually exists.

Update 30th July 2016 – The SwisCoin website now claims ‘SCN SERVICES LTD is the company who has launched the SWISCOIN as an official from DUBAI.‘

The CEO of SCN SERVICES LTD is Mr. Dmitrii Zubarenko who is the expert person for the administration of mega companies.

Zubarenko doesn’t appear to have any MLM industry experience. /end update

Read on for a full review of the SwisCoin MLM opportunity.

[Continue reading…]

Robert Craddock sentenced to 6 months jail

Despite pleading to be spared any jail time just over a week ago, Robert Craddock has been sentenced to six months in prison.

Despite pleading to be spared any jail time just over a week ago, Robert Craddock has been sentenced to six months in prison.

The sentence is in connection to two counts of wire fraud, which Craddock plead guilty to back in June. [Continue reading…]