LSSC securities fraud warning from Canada (NB)

LSSC, or Lightning Scooter Shared Company, has received a securities fraud warning from the Financial and Consumer Services Commission of New Brunswick (FCNB).

LSSC, or Lightning Scooter Shared Company, has received a securities fraud warning from the Financial and Consumer Services Commission of New Brunswick (FCNB).

As per FCNB’s June 24th LSSC fraud warning; [Continue reading…]

LSSC securities fraud warning from Canada (AB)

LSSC, or Lightning Scooter Shared Company, has received a securities fraud warning from the Alberta Securities Commission (ASC).

LSSC, or Lightning Scooter Shared Company, has received a securities fraud warning from the Alberta Securities Commission (ASC).

As per ASC’s June 19th LSSC fraud warning; [Continue reading…]

BNP Paribas USDT Review: Stolen identity “click a button” Ponzi

BNP Paribas USDT fails to provide ownership or executive information on its website.

BNP Paribas’ website domain (“catousd.com”), was registered with bogus details on June 12th, 2025.

Of note is BNP Paribas’ website domain being registered through the Chinese registrar Alibaba (Singapore).

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

Finance Pro Plus Review: Josh Felts reboots Pro Trade Club

Finance Pro Plus originally launched circa April 2024 on the domain “financeproplus.com”.

Finance Pro Plus originally launched circa April 2024 on the domain “financeproplus.com”.

That domain was abandoned, with Finance Pro Plus now operating from “financepropartner.com”.

“Financepropartner.com” was privately registered on January 3rd, 2025. Why Finance Pro Plus changed website domains is unclear.

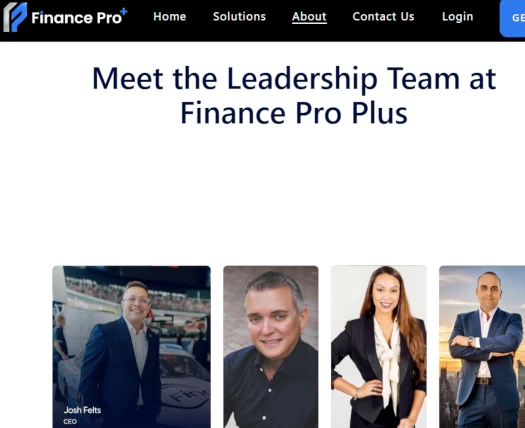

Heading up Finance Pro Plus is CEO Josh Felts.

BehindMLM first came across Josh Felts in March 2022 as co-founder of Manifest FX:

Manifest FX is a collapsed fraudulent investment scheme co-run with Jimmy Bennett.

Felts is understood to have bailed out of Manifest FX around the time BehindMLM’s review was published.

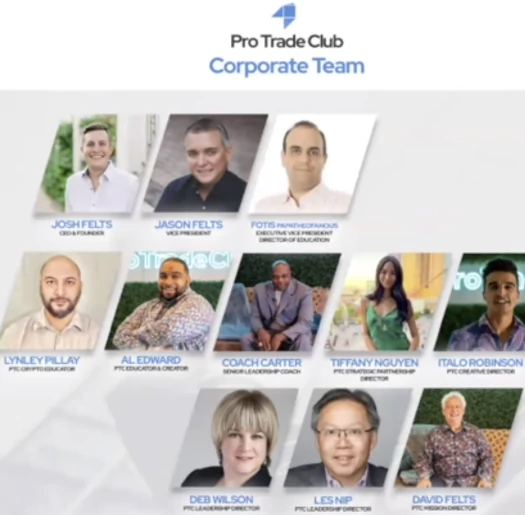

A few months later, in May 2022, BehindMLM noted Felts reappearing as CEO of Pro Trade Club.

In addition to Felts, Felts’ brother Jason Felts and Fotis Papatheofanous were named Pro Trade Club executives.

Although their respective photos appear on Finance Pro Plus’ website, neither Jason Felts or Fotis Papatheofanous are not named.

At time of publication Pro Trade Club’s website is disabled. For all intents and purposes, Finance Pro Plus appears to be a rename reboot of Pro Trade Club.

Given the website change, technically Finance Pro Plus itself has already been rebooted once.

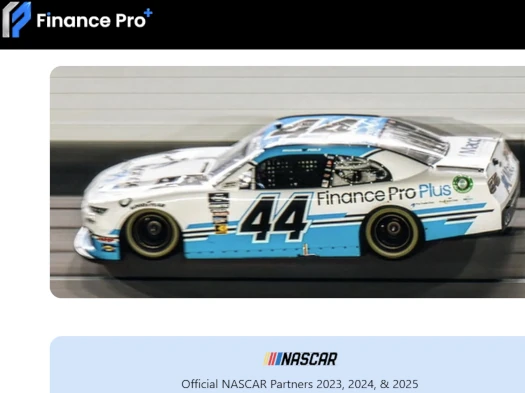

One thing that caught my eye was Finance Pro Plus claiming to be a 2024 NASCAR sponsor:

It doesn’t add any legitimacy to the company, but it does appear Finance Pro Plus sponsored car #44, run by NY Racing Team last year.

Prior to Manifest FX, Josh Felts promoted Silver Star Live and Epic Trading.

Silver Star Live’s founder was fined $15.6 million for commodities fraud in 2021. Epic Trading is a collapsed MLM pyramid scheme.

Both Finance Pro Plus and Josh Felts appear to be based out of Florida in the US.

Read on for a full review of the Finance Pro Plus MLM opportunity. [Continue reading…]

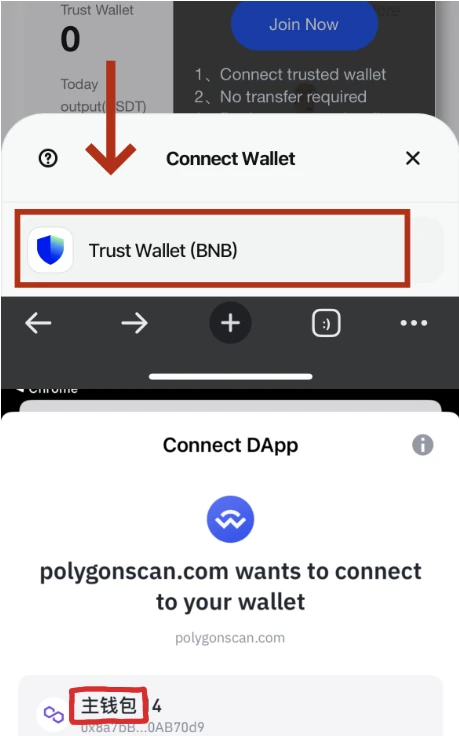

Dubai Holding USDT Review: Stolen identity “click a button” Ponzi

Dubai Holding USDT fails to provide ownership or executive information on its website.

Dubai Holding USDT’s website domain (“q.f1inwlu.cyou”), was privately registered on January 27th, 2025.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

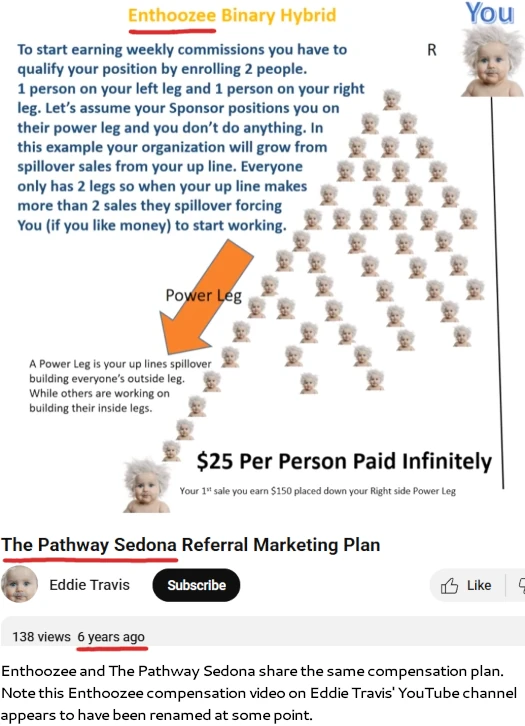

The Pathway Sedona Review: Enthoozee pyramid scheme reboot

The Pathway Sedona operates in the personal development MLM niche.

The Pathway Sedona operates in the personal development MLM niche.

The Pathway Sedona’s website domain (“thepathwaysedona.com”), was registered in February 2023. The private registration was last updated on January 20th, 2025.

Heading up The Pathway Sedona are Eddie Travis and a woman going by “Allison”.

Eddie Travis appears to be a long-time MLM fraudster. Six years ago Travis was running Enthoozee, an MLM pyramid scheme:

Enthoozee has long-since collapsed. Today Enthoozee’s website domain (“enthoozee.com”), redirects to The Pathway Sedona’s website.

As per “Allison’s” The Pathway Sedona corporate bio;

As per “Allison’s” The Pathway Sedona corporate bio;

I have had the privilege of aligning with Eddie’s visionary approach to life coaching since our paths first crossed in 2001 at a golf seminar in Southern California.

In 2017, I was honored with an invitation to join Enthoozee, further cementing my commitment to this field.

With a PhD in Clinical Psychology, I am thrilled to contribute my expertise to The Pathway Sedona Life Coaching Team.

The Pathway Sedona’s “Life Coaching” appears to be a baloney layer of attempted legitimacy;

The coaches learn how to use awareness, mindfulness, ego intuitiveness, movement understanding, human responsibilities, and a rigorous method of BRAIN WAVE PRACTICE to guide their clients to success and happiness.

I say baloney because, apart from the subject matter, The Pathway Sedona’s Life Coaching has nothing to do with its MLM opportunity.

The Pathway Sedona and Eddie Travis (right) appear to be based out of Arizona in the US.

The Pathway Sedona and Eddie Travis (right) appear to be based out of Arizona in the US.

With a claimed PHD in clinical psychology, it appears “Allison” might have too much to lose by disclosing her involvement in The Pathway Sedona.

Read on for a full review of The Pathway Sedona’s MLM opportunity. [Continue reading…]

CNB Mining Review: Crypto mining “click a button” app Ponzi

![]() CNB Mining fails to provide verifiable ownership or executive information on its websites.

CNB Mining fails to provide verifiable ownership or executive information on its websites.

CNB Mining operates from four known website domains:

- cnbmining.online (marketing) – privately registered on June 16th, 2025

- cnbmining.top (app) – registered with bogus details on June 19th, 2025

- cnbmining2.com (app) – privately registered on June 1st, 2025

- cnbmining.net (app) – privately registered on June 19th, 2025

If we look at CNB Mining’s official marketing material, we find Chinese:

This suggests whoever is running CNB Mining has ties to China.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

Another nine QNet arrests in Ghana (June 2025)

![]() Following a lull in QNet recruitment tied to human trafficking in Ghana, authorities have announced another seven arrests. [Continue reading…]

Following a lull in QNet recruitment tied to human trafficking in Ghana, authorities have announced another seven arrests. [Continue reading…]

Faraday Hosseinipour’s motion for I2G retrial reset

In line with co-defendants Richard Maike and Doyce Barnes, Faraday Hosseinipour’s appeal against her conviction denied.

In line with co-defendants Richard Maike and Doyce Barnes, Faraday Hosseinipour’s appeal against her conviction denied.

Curiously however, the Sixth Circuit has sent Hosseinipour’s motion for a new trial back to the District Court to be decided on again. [Continue reading…]

Richard Maike & Doyce Barnes denied I2G Ponzi appeal

Infinity2Global Ponzi scammers Richard Maike and Doyce Barnes have been denied appeals on their respective convictions.

Infinity2Global Ponzi scammers Richard Maike and Doyce Barnes have been denied appeals on their respective convictions.

In a fourteen page published opinion by the Sixth Circuit, the US Court of Appeals found; [Continue reading…]