Incomation Review: $200K forex account for $2000?

Incomation fails to provide ownership or executive information on its website.

Incomation fails to provide ownership or executive information on its website.

Incomation operates from a subdomain hosted on Kartra (“incomation.katra.com”).

Kartra markets itself as “the greatest all-in-one platform ever”. Kartra is part of Genesis Digital LLC, a US company run by CEO Sarah Jenkins.

As far as I can tell, whoever is running Incomation is a client of Kartra’s – there’s otherwise no direct connection between the two companies.

Update 18th May 2023 – As of a few days ago Incomation’s Katra website went down.

As of a few hours ago, new Incomation front-end website has been set up on SamCart. /end update

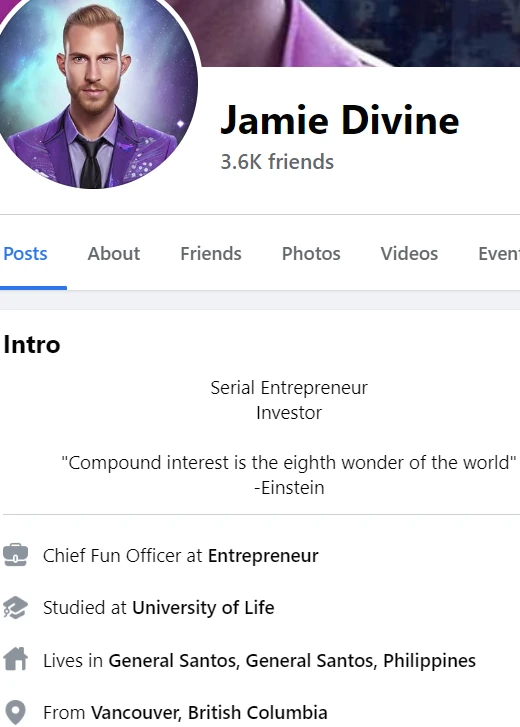

At the bottom of Incomation’s website are a series of links under the heading “Connect with our Founder”.

These links lead to various social media profiles of Jamie Divine.

According to his FaceBook profile, Divine is a Canadian national living in the Philippines.

Before he launched Incomation, Divine was an Eaconomy promoter.

Eaconomy launched in 2019. The company came about after Hassan Mahmoud and wife Candace split from convicted fraudster David Mayer.

Before Eaconomy the Mahmouds and Mayer ran Silver Star Live. Both Silver Star Live and Eaconomy were MLM companies built around an AI forex trading bot.

The Mahmouds settled Silver Star Live commodities fraud charges with the CFTC in 2019. In 2021 the CFTC secured a $15.6 million judgment against David Mayer, again for Silver Star Live commodities fraud.

Eaconomy collapsed in 2020. In 2021 there was a brief Eaconomy reboot through Jeremy Reynolds’ Beyond.

That lasted a few months before Beyond itself collapsed and was sold off to My Daily Choice.

In early 2021 Eaconomy was rebooted for a a third-time, with the same AI forex trading bot ruse.

Eaconomy’s website is still up as of April 2023 but there’s not much going on.

Here’s a quote from Jamie Divine as he was launching Incomation;

Are you done with building up projects just to have them crash and burn?

Are you tired of companies that don’t have your best interests at heart?

Sick of being used for your networks and then left in the dust?

Are you fed up with over-promising and under-delivering?

Well, I have some exciting news for you!

We are introducing a revolutionary new AI trading system that leverages prop firm funds, but with a heart for the clients AND affiliates.

I know that was a lot of backstory to get back to Incomation. I’ll go over why I took the time to cover Eaconomy’s origins in-depth in the conclusion of this review.

Read on for a full review of Incomation’s MLM opportunity.

Incomation’s Products

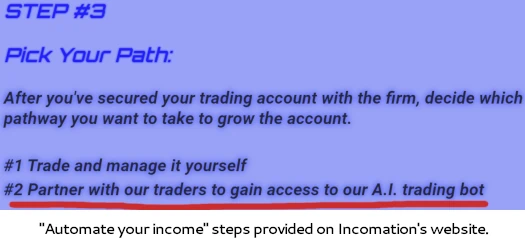

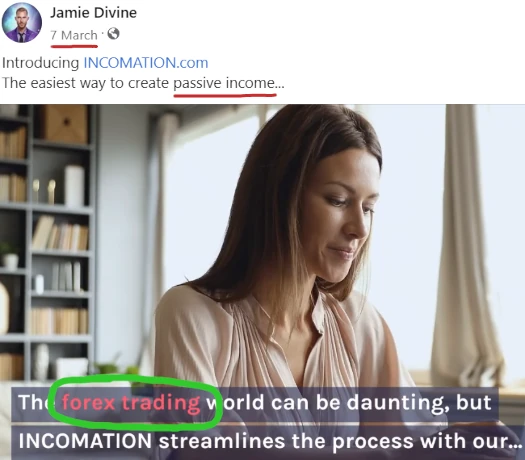

Incomation markets passive returns through an “A.I. trading bot”.

Access to the bot costs $1500 for a $100,000 funded account, or $2000 for a $200,000 funded account.

Funded accounts are primarily provided by Next Step Funded, with Incomation representing Next Step Funded will eat any losses.

Am I responsible for any losses on the account?

No, the losses are completely covered by the prop firm which is why they have such strict requirements to pass their challenges and maintain the accounts.

We’ll go over Next Step Funded a bit more in the conclusion of this review.

Incomation’s Compensation Plan

Incomation affiliates are paid on the recruitment of retail customers and affiliates who invest $1500 or $2000.

Referral Commissions

Incomation pays a referral commission on funds invested down two levels of recruitment (unilevel):

- level 1 (personally recruited affiliates) – 20%

- level 2 – 10%

This is a one-time commission tied to initial investment.

ROI Commissions

Incomation pays a commission on passive returns earned down two levels of recruitment:

- level 1 – 20%

- level 2 – 10%

This is a monthly recurring commission, tied to passive returns paid out each month.

Joining Incomation

Incomation affiliate membership is tied to a $1500 or $2000 investment.

The more an Incomation affiliate invests the higher their income potential.

Incomation Conclusion

Incomation sells access to $100,000 and $200,000 forex trading accounts for $1500 and $2000 respectively.

Subject to some “challenges”, apparently there’s a firm willing to let people blow up hundreds of thousands of dollars for a tiny outlay.

Do I need to point out this is an utterly stupid business model that makes no sense in the real world?

Next Step Funded provides no ownership, executive or regulatory information on its website.

Next Step Funded’s website domain (“nextstepfunded.com”), was only recently privately registered on October 9th, 2022.

And there’s this, from Next Step Funded’s website terms and conditions:

These Terms are governed by the laws of Saint Vincent and the Grenadines and each party irrevocably and unconditionally submits to the non-exclusive jurisdiction of the courts of Saint Vincent and the Grenadines.

St. Vincent and the Grenadines is a tax haven with no active regulation of MLM related fraud.

I also noted referenced to MDP Funding, which appears to be another funded trading account option.

MDP Funding is another company that doesn’t disclose anything about itself, other than it purportedly operates through Australian shell company Prop Trade Tech.

Like Next Step Funded, MDP Funding’s website domain (“mdpfunding.com”), was only recently privately registered on December 11th, 2022.

These are your first red flags when it comes to Incomation.

Having been an Eaconomy promoter, Incomation is just Jamie Divine copy and pasting the same A.I. trading bot model.

The problem with every trading bot MLM scheme is that if the bot actually worked long-term, there’d be no need for an attached MLM scheme.

Just run the bot, rake in infinity money and become one of the richest people on the planet.

On the regulatory front Incomation fails to disclose any information about its purported A.I. trading bot. With respect to regulatory licenses, the two at play here are securities and commodities.

Securities law covers any MLM company offering a passive investment opportunity. This is irrespective of how the investment opportunity is run or the medium (USD, cryptocurrency etc.).

Commodities laws kick in due to Incomation representing passive returns are derived via forex trading.

In the US, Incomation needs to be registered with the CFTC and SEC. Neither Incomation or Jamie Devine are registered with either regulator.

Next Step Funded doesn’t appear to be registered with any financial regulators either.

I did note this from Next Step Funded’s website FAQ;

Which Platforms Can I Use for My Trading?

You are permitted to trade your account with the MT4 platform which is provided by ASIC-regulated broker EightCap.

This is irrelevant. Incomation and Next Step Funded are both required to be registered with securities and commodities regulators in every jurisdiction they solicit investment in.

Unfortunately Incomation’s website doesn’t receive enough traffic for SimilarWeb to provide a geographical breakdown.

What I can provide you though is applicable regulators for admins of Incomation’s official FaceBook group:

- Jamie Divine – resident of Philippines, securities and commodities regulated by Philippine SEC

- Anfa Joy Samboa – appears to be resident of Philippines, securities and commodities regulated by Philippine SEC

- Will J. Galindez – resident of Illinois in the US, securities regulated by SEC and commodities regulated by CFTC

- Nicholas V. LoScalzo – resident of Kansas in the US, securities regulated by SEC and commodities regulated by CFTC

- Ollie Gray, resident of Worcestershire in the UK, securities and commodities regulated by FCA

None of these individuals appear to be registered with the applicable financial regulators.

What tends to happen in these dodgy trading bot schemes is the accounts inevitably blow up. Next Step Funded being around since late 2022 with anonymous ownership is testament to that.

With respect to losses, any money paid to Incomation is gone the moment it’s handed over.

This is from Next Step Funded’s website FAQ;

Do you offer refunds?

If you are purchasing an evaluation through Next Step Funded you are doing so in acknowledgement that you will not be refunded.

You’re basically hoping to recover your fees through the A.I. trading bot before the account blows up or Next Step Funded disappears.

Incomation’s regulatory shortcomings are reason enough to stay well-clear.

Look no further than Eaconomy for the inspiration behind Incomation, along with evidence that, even after four years, nobody has made long-term consistent money through trading.

Update 23rd December 2023 – Jamie Devine has popped up in the comments below to let us know Incomation, as reviewed here, has collapsed.

Hey there, I’ve followed your site for years and appreciate most of what you put out there. I understand you’re doing your best to protect your community and I can’t fault you for that. In most cases, I think you are pretty accurate.

I just wanted to offer some more information to hopefully clear things up for you and your readers.

1) The founder of Eaconomy is a good friend and even though they’ve had their challenges with bad partnerships and not fully understanding how to operate things properly in the beginning, with lots of trial and error and many bots that didn’t work long term, there’s actually plenty of evidence of their current bot working well since it was on-boarded November 2021, I can reference myfxbooks to back that up.

2) When I discovered prop firms last year I too was very skeptical about the model but there are dozens of firms paying out traders every month based on strict criteria to make it a win win.

The prop firm offers the challenge and the demo accounts as an educational service fee and there is no investment involved. Where the firm makes money is for the many people that attempt the challenge and fail, then the few that actually produce trading results the firm is able to copy the trading of that trader for using their platform to earn in the markets.

3) Incomation was 100% founded by myself and even though it was inspired by my experience of trial and error with Eaconomy, I went on quite a journey to put all the pieces together and in no way are they partnered or related. It’s not perfect but what we are doing is providing a service fee to clients and their demo accounts (aka play money) they receive from the prop firm.

There is no investment or returns on that money. What the client can do is license our bot to help them pass the trading challenge with the firm and then grow the account to qualify for payouts from the firm that again is paying them on a service contract for providing demo trading services that the firm can choose what to do with in the real market with a regulated and registered licenses forex broker by copying the trades.

I’m happy to provide follow up information and even do an interview with you for your community because as I said in the beginning I appreciate where you’re coming from and your intention to protect people.

You can reach me at [removed]

Hi Jamie, thanks for stopping by.

MyFXBook is meaningless. Results can easily be faked and, more importantly, it’s not a substitute for legally required audited financial reports filed with regulators.

Cool. It still makes zero sense for anyone with access to millions to be giving random plebs $100,000/$200,000 trading accounts to blow up.

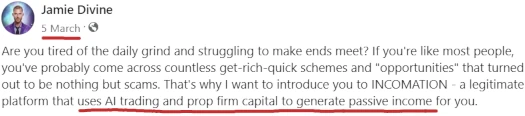

You’re marketing a passive investment opportunity. I’ve included screenshotted evidence of that in case you want to deny it (it doesn’t matter, even without the screenshots Incomation is still marketing passive returns).

MLM + passive returns = securities offering.

Not registering with SEC/CFTC (and/or financial regulators elsewhere in the world) = securities fraud.

Not registering passive returns scheme that utilizes forex = commodities fraud.

No need for an interview – other than “we’re not doing the thing we’re doing”, you haven’t addressed Incomation and your prop firms committing securities and commodities fraud.

1) You can fake fxbooks, but not through their verified measures of needing to attach their verification bot to the trading account, anyone with basic knowledge of forex can discern the difference but it’s best to talk to actual clients of the system for real experience.

When people are licensing software to use on their own trading accounts and able to control the settings it’s much different than a traditional hedge fund as far as investment or regulation goes.

2) You would need a basic understanding of prop firms and how they work, which is essentially a recruiting firm for traders and trading systems. Again 99% fail and then even if you pass they tend to not take the live trading risk on you for 3 months because 99% will not make it to a payout.

The other restriction in place is you can’t hit a certain loss target usually set at 5% or you lose the account. Again not risking 200K but actually only 10K.

The amount of leverage and funds they earn on the front end from people not passing and then not making payout can provide large amounts of funds, the few that make it through all the requirements can then be leveraged for them to earn in live markets leveraging the best traders and systems.

3) Incomation and prop firms don’t operate as MLM just a simple affiliate referral program with a percentage of the service fee. There is absolutely no real funds happening for the need to be regulated.

Only copytrading of demo accounts under the discretion of the firms on the backend. Incomation is not managing anyone’s funds, simply providing a software service to be used on demo accounts.

I don’t deny there are people receiving passive income, but it’s not an investment, it’s from the services rendered to the firms.

Also it was incorrect of you to mention the more the affiliate invests the more they earn because our affiliate program is completely free to sign up, there is no requirement to be a bclient and pay a service fee to be an affiliate and refer clients.

Bruh… cmon.

And still not a substitute for legally required audited financial reports filed with regulators.

As per Incomation’s marketing, pay a fee and get access to a $200,000 trading account that purportedly delivers passive automated returns.

What a ridiculous anti-consumer business model. I suppose that explains why the two I saw Incomation using have only been around for a few months, are attached to shell companies in dodgy jurisdictions and run by persons unknown.

Can’t speak for prop firms but Incomation very much is an MLM company.

MLM comp plan = MLM company.

There is absolutely no real funds happening for the need to be regulated. Only copytrading of demo accounts under the discretion of the firms …

So if only monopoly money in then monopoly money out? What on Earth am I paying $2000 for then?

Incomation charges for access to a passive investment opportunity. This is set up in a pooled fashion through third-parties. This satisfies the Howey Test.

Also any passive returns involving forex fall under commodities law. Not registering with the CFTC and commodities regulators = commodities fraud.

Cmon chief, you’ve already seen this with Eaconomy and the CFTC.

If I pay more to get access to the $200,000 funded account I’m earning more.

Money in –> more than you invested out = investment opportunity. “We’re not doing the thing we’re doing” pseudo-compliance doesn’t work here or with regulators.

Hey Oz, I really appreciate the dialogue and where you’re coming from, I’m sure you have a solid experience with traditional investing.

At this point I think it’s important for anyone interested to do their own research on how exactly prop firms operate legally without regulation.

1) Demo trading not a custodian to real funds

2) Service contracts hiring traders and paying for their skill or systems at their own discretion

The model isn’t perfect, but it is an opportunity to anyone that has real trading skill or access to systems that do.

Incomation simply provides the service to become a prop firm trader.

It’s a 2 tier affiliate system paying only on client services rendered and again the affiliate can sign up for free, no need to become a client.

As far as the history of the firms, while prop firms have been around for decades traditionally hiring and recruiting traders to manage funds, the virtual challenge is still a very new niche and model so many of the firms are within 2 years old.

And they can be registered in any jurisdiction, typically opting for places with supportive regulations like lower taxes.

I’m sure we can just agree to disagree at this point as we both have important things to do but thank you for the review and for being transparent with the discussion, I appreciate your intention to protect people.

Whether I do or not is irrelevant to Incomation and prop firms committing securities and commodities fraud.

Stop deflecting.

Both securities and commodities are regulated the world over. You cannot operate legally whilst committing securities and/or commodities fraud.

This is why Incomation’s prop firms are a few months old and operated through shell companies incorporated in dodgy jurisdictions.

No. Incomation and its attached prop firms are committing securities and commodities fraud. That’s the due-diligence.

Honestly I was just being nice for your lack of understanding and your incorrect assumptions and allegations

I think at this point it’s important for our law team to get in touch to clear things up, because those are serious statements you are making saying what we are doing is illegal and defamation of our company and misleading people with incorrect information needs to be addressed.

No worries. And I’ll tell your legal team exactly what I’ve told you.

I’m sure old mate Mahmoud thought he was being clever too. We know how that worked out.

BehindMLM is littered with the graves of company owners who thought they were above the law.

Thanks Oz, I do appreciate where you’re coming from and many times you are correct.

Hassan, Eaconomy, and Auvoria that you’ve called out for being illegal are still very much alive and operational years later so I don’t know what else could prove your evidence as incorrect better than that.

Our system isn’t even comparable to those, considering we aren’t even using real funds with prop firm challenges.

But thanks again for the openness of dialogue and transparency, I do enjoy reading your reviews, and I’m honoured you were called to write about us in only our 2nd month of operations.

Eaconomy had ~50,000 visits to its website in April 2023. Up from 30K in Feb. For an MLM company that’s borderline RIP.

Auvoria Prime’s website traffic is so low SimilarWeb doesn’t even track it. RIP.

In any event, whether a company has (again) been shut down by regulators or not isn’t evidence of legality. That’s not how regulation works.

You’re running an MLM company selling a passive income opportunity attached to a forex trading bot. With respect to the Securities and Exchange Act and Commodities Act, it’s exactly the same.

Just curious, what would you accept as evidence of the contrary? What would satisfy your concern for legality with respect to the securities and commodities? And if provided would you update the review with the correct information?

Again to clarify, the client is paying a service fee not making an investment. And income generated is paid as services rendered, not returns on any investment.

I do intend to do everything possible to not only satisfy your concern, but also insure a long term system for all involved.

There is no “evidence to the contrary”. The Securities and Exchange Act and Commodities Act are law.

If you want to operate legally register with financial regulators and start filing audited financial reports.

Disclosures are another issue I didn’t really get into but your prop firms being recently set up shell companies run by anons is a potential violation of the FTC Act. All of this information needs to be disclosed to consumers.

Failure to disclose crucial information often comes up in securities/commodities fraud regulatory lawsuits too.

MLM + passive income opportunity = securities offering.

MLM + passive income opportunity + forex = commodities offering.

Call it whatever you want. I dump money into Incomation on the expectation of an advertised passive return.

Do you have an example Oz of any MLM that does have a registration with the Securities and Commodities?

Also Oz, could you please provide your social media profiles so that we can know you too. (Ozedit: derails removed)

Reading between the lines.

“Hey stranger! Wanna pay me $2000 to play a pointless non-refundable financial sandbox sim game?”

“No? Crap.”

“Well…what if I told you it could make you lots and lots of money if you nudge nudge wink wink use it as financial advice? Gettit?? Passive income! But also not, if you’re a regulator reading this.”

“And since I’ve never claimed to be a financial advisor, if and when you lose all your money, it’ll be your fault for blindly trusting me. Plus I have your $2000, so thanks!

Authorities with years and years of experience uncovering financial scams and crimes will never be able to figure out what I’m up to.”

Investview comes to mind, although they aren’t as transparent about iGenius in their reporting to the SEC as they should be.

The vast majority of forex themed MLM companies are otherwise run like Incomation. Head honchos at the top that think they know securities and commodities law better than regulators.

Always falls apart when the SEC and/or CFTC come knocking. Just ask Mahmoud.

And BehindMLM doesn’t have any social media profiles. I get what you’re getting at. And you’d have a point if BehindMLM was soliciting funds from consumers on the promise of passive income.

But we’re not, so obvious derail is obvious.

Ok so basically nobody, got it.

Well I’m certainly open to being the first if it’s required

I reached out to a law firm specializing in Securities and Commodities and I reached out to the CFTC and NFA for further clarification

Thanks for bringing this to my attention, every owner of prop firms I have spoken with and regulated forex brokers as well as Metaquotes directly advised me that the most prop firms need to be licensed with them is financial activity on their Corporation registration depending on the jurisdiction.

Here is my email to NFA/CFTC and I’ll be sure to keep you and your community updated:

1. US government agencies don’t provide legal advice. I’d be surprised if you got a meaningful reply back but you might get lucky.

2. Incomation is marketing passive returns via forex. Incomation needs to be registered in the jurisdictions it solicits investment in.

I did note the prop firms seem to run their own schemes. They too need to be registered but that is beyond the scope of this Incomation review.

3. If you were being honest…

4. I suggest you go read Mahmoud’s CFTC complaint. It’ll either sink in or you’ll remain in denial.

1. If the government bodies themselves can’t tell me what I need to do, how can I expect some unknown person named Oz to give proper advice?

2. It’s very clearly a service fee on our side, to everyone except Oz apparently

3. I have been completely honest about exactly what it is and how it operates to everyone on every company call and to you and your community

4. I did reach out to Hassan for the connection to his legal team because clearly after 4 years running he hasn’t had any problems and despite your negative information and limited perspective he is operating a successful company with people all over the world that feed their families thanks to him taking risks everyday.

(Ozedit: derails removed)

They already have. The Commodities Act is publicly available.

I’m not giving you advice. I don’t personally care what you do either way but I will point out where you’re wrong when challenged.

I’ve reviewed Incomation and pointed out it’s committing securities and commodities fraud. This information is provided to consumers as part of BehindMLM’s regular publishing schedule.

Go read the CFTC’s complaint and Hassan’s settlement.

Last warning on derails. One more and spam-bin.

1) I’ll keep you posted on their response

2) I’m doing the same, pointing out where you are wrong as you started this challenge with limited information

3) Hassan settled a small fine of 75K in 2019 for being a consultant for a company who’s owner wasn’t operating properly as I mentioned before bad partnerships and trial and error in the beginning but since learnt how to operate on his own company and has had zero issues and millions of dollars in business, don’t you think he would be a prime target after that if he was doing anything wrong?

You didn’t read the complaint or the settlement.

Consultant my ass. Stop minimizing fraud.

Also, as previously stated, not getting shut down by regulators != legitimacy. That’s not how regulation works.

They consulted the company and very quickly the owner offered them positions because of how much they did, it was their first time with positions at a forex company.

That company was already operating for many years. They didn’t know how to run things as they were brand new to the industry.

Since then they’ve figured it out and had no problems.

The CFTC’s Complaint and Mahmoud’s settlement speaks for itself. Stop minimizing fraud.

It wasn’t. Mid 2018 to early 2019. I know this because I covered Silver Star Live from start to finish.

Eaconomy also commits commodities fraud – it’s the same business model and isn’t registered with the CFTC.

For the third-time, not getting shut down by regulators != legitimacy.

And I want to add if Eaconomy was all it’s cracked up to be, you wouldn’t have left. You realized running a forex scheme was where the money is and couldn’t give a toss about commodities law.

Own it.

1) Fraud and being fined for not registering are very different, and then following the guidelines and not being fined again after you’ve been “red flagged” and “warned” are important to note

2) If you dig deeper you will find Silver Star was ran by Pete for many years before that, just because you pull a couple articles doesn’t make you an expert on the situation.

3) I never left anything, I just found prop firms to help because even if a good forex bot could do 5% hypothetically, if someone only has $1000 to risk that’s only $50.

People know that forex and crypto markets are risky, and only to use what they can afford to risk in any avenue. I don’t do anything I can’t take full responsibility of losing.

If you can’t do that, maybe you should stick to giving your money to the banks or do nothing at all. (That’s not financial advice) Even venture capitalists get involved with companies knowing 9 out of 10 will fail. But not everyone can handle being an entrepreneur or investor and that’s totally fine.

PS NFA got back to me and referred me to CFTC for an exemption letter, I’ll keep you posted, thanks for promoting us

Bottom line, just because you lack understanding, don’t have a law team to verify and don’t like to take any risk, doesn’t make something a fraud or a scam

Not in this instance. Mahmoud was fined for committing commodities fraud.

Silver Star Live as an MLM company launched in mid 2018 and collapsed in early 2019. Whatever happened before that is irrelevant.

BehindMLM has published thousands of articles covering fraudulent MLM opportunities. We’ve also tracked and reported on dozens of regulatory lawsuits pertaining to securities and commodities fraud.

Suffice to say you’re not doing anything new. MLM + passive income + forex falls under the Securities and Exchange Act and Commodities Act. This is well-established law.

You can’t disclaimer your way out of securities and commodities fraud.

yOu JuSt DoN’t UnDeRsTaNd is a cop out.

MLM + passive income via forex = register with the CFTC and SEC

Failure to do so = securities and commodities fraud.

With respect to due-diligence there is nothing to understand beyond that.

cftc.gov/PressRoom/PressReleases/8071-19

The release clearly states, fined for not registering, nothing to do with fraud.

I respect your experience Oz, what I’m saying is you can’t paint every situation with the same brush at first glance, law is very particular and case by case.

1) 2 tier affiliate program

2) Income on service contracts from prop firms

3) Demo trading

Bruh… not registering your MLM passive investment through forex is commodities fraud. Violating the Commodities Act = commodities fraud.

Which is why this review isn’t one sentence long. I’ve done the homework, Incomation is committing securities and commodities fraud.

I was inclined to do this, but glad behindmlm painted the picture for me.

Truth is that this is a very deceptive opportunity that really makes no sense. Why do they need my money if the money is so good with the bot trading for me?

Why don’t they just keep it to themselves and make all the money they want.

Hey Dean,

1) We don’t need your money

2) The bot is good

There is no deception here

Do your due diligence on proprietary trading firms, yes I could have stuck to just using the bot on my own accounts but that is limited so I decided to help other people out, please don’t participate if you don’t fully understand how it works.

Oz, happy to update we have officially filed for our securities and commodities license, becoming our own prop firm and brokerage.

We confirmed it’s not needed right now while we refer to other prop firms but you pushed me to become the firm and broker by getting our license so thank you.

I joined with Incomation recently and so far everything is flowing exactly as described. I chose in because Jamie seems genuine and the opportunity makes sense to me.

Is it a bit nerve wracking to join when results haven’t been proven yet? Yes. No different than investing in a start up company.

I expect certain delays will come up as kinks work out because it’s booming.

From what I’ve experienced and witnessed via the communication channels- Jamie and his team are handling things efficiently and professionally.

I’ve started a company up myself so I guess my life experience helps me to be understanding.

As for what’s been said in this piece… I read Jamie’s first couple responses back and forth and it’s enough for me to still feel good about it.

The author of this page has a clear attitude and is not responding to Jamie’s clear explanations. Maybe stubborn, maybe doesn’t understand.. idk.

But Jamie’s response is clear to me. I used to get naysayers in my business too; it was those who had faith that won with me.

Grateful to be winning with you Jamie. Thanks for the opportunity.

Note: all investments have risks. Never invest what you can’t afford to lose. Also, never be talked out of good things by fear mongerers. Trust yourself and make the decisions that make sense to you. <3

@Jamie Good luck with it.

@Cherish

Maybe the law is the law. Maybe Jamie isn’t the first cowboy to come along and pretend his passive investment opportunity isn’t a passive investment opportunity?

Maybe it’s Maybelline? idk either.

Kartra page is down, the Facebook group has users questioning if anybody has actually managed to receive a pay out from any of their associated prop firms (NSF, MDP, Nova) theres no confirmations.. not a good look.

Looks like Kartra gave them the boot and now it’s SamCart.

Pretty obvious why Kartra gave Incomation the boot. SamCart represents it is based out of the US. Wonder how long before they do due-diligence on their newest signup client too…

In be4 kArTrA cOuLdN’t HaNdLe OuR vOlUmE?

And of course Next Step Funded is already having problems:

Actually we built our system on Samcart 1 month ago because as we got going Kartra didn’t allow manual edits for things like payments in crypto, Samcart allowed us to have a custom affiliate tracking system and is much more robust.

I literally built the Kartra funnel on my own, as we needed to help people understand the whole process.

We simply had to upgrade our systems because it didn’t allow us to do everything we needed.

Also we have confirmed we don’t need custodian financial licensing for prop firm accounts and the brokers are the ones needing registration.

Because we are in the process of becoming our own firm and brokerage, we began the process of securities and commodities with our legal team for both myself personally and the company.

We have began receiving our first wave of payouts from the firms because we are only 2 months old and the process to get a payout from a firm takes 6-12 weeks.

We have created strong relationships and partnerships to have full transparency with our model in the space so we are supported by the firms we deal with.

Again Oz, straight from the legal team here is the distinction when it comes to prop firms vs forex brokers

Prop firm accounts use the firms capital

Forex brokers accept clients deposits

It’s a distinct difference

Nextstep 10Xd their company thanks to us, ofcourse upgrades were in order.

Samcart built our whole funnel with their internal team, we are not hiding anything from anyone.

I do appreciate where you’re coming from, but you do need to do some more research.

I’ll call bullshit on the move because the site was throwing up a Kartra 404 for a few days. From one website owner to another, that’s not planned migration.

MLM companies offering passive investment opportunities need to be registered with financial regulators. There are no exemptions in either the Securities and Exchange Act or Commodities Act.

Brokers having to or not having to register doesn’t affect Incomation’s regulatory requirements as the offerer of a securities offering to consumers.

On another note, can you please clarify what the difference is between an MLM, a 2 tier affiliate plan and a Sales Manager receiving an override from his sales representative in any traditional business model??

Commissions paid on more than one level = MLM.

Offtopic waffle = spambin.

You’re arguing disingenuously using false equivalence

Simple. Why aren’t you registered for offering securities?

No need to waffle about

I second OZ on calling out this as a planned migration.

At best this represents terrible operational planning, especially considering this is being hap hazardly cold swapped at the inception of service, perhaps you could argue inexperience to give the benefit of the doubt? But this isnt your first rodeo Jamie…

My money would be on these clowns being booted off the platform. No prior thought/planning to place a banner/landing page? Come on……

Just checked this guys facebook out (Jamie divine).

The only person I’ve ever seen make a mothers day post all about himself… What a bellend.

yOu Do NeEd To Do MoRe ReSeArCh!

https://behindmlm.com/companies/eaconomy/eaconomy-securities-fraud-warning-from-qc-canada/

Dear OZ you are doing great job helping people from scams.

Jamie devine looks also honest But personally one of my friend paid fee to incomation+ Firm nextstepfunded.

After one month withdrawal he didn’t received payouts he received email violation trades.

Now Jamie offering new firm MDP what I believe MDP is also not gonna pay to members.

Now he introduced new firm ANTT his close friends. Only affiliates are getting commission weekly. But not residual income.

I didn’t see single post of any member got payout from Firm. 1800++ people joined incomation. In a week he changed prices three times $500 to $2000.

He raised I think 1.5 million plus traveling to Florida.

Jamie devine if you are honest legit then prove that only 1000 members from 1600 get payouts number not exact may me more.

Refund all money to members or help them so they can get payouts.

Thanks.

online i saw this opportunity attended some webinars zoom.

feels good to earn 4 percent monthy with firms capital so i paid fee to mdp for 200k account and paid fee to incomation.

since 7 days i didnt recived my mdp login cardentials.

they started new website: (removed)

migrating all data from kartra to postaffiliatepro.

there is a purple chat he hired some people to fix issues. also they are not helping.

few days ago (jamie devine and only ollie gray these both were in Dubai enjoying dinner.

i can feel this ollie gray is a 50% business partner with jamie devine because every where he is responding actively to other team members also he has a lot of time to help others people definately he is partner.

now they have a event in Florida with leaders. my upline is also going to visit him.

moral story people are joining this opportunity because of monthly profits but still i can not see anyone got withdrawals.

after this i hope they will post specific leaders withdrawal from MDP or ANTT.

some leaders stop promoting this waiting for results. but new ones are still promoting this because they do not know.

jamie devine looks like honest or very smart i am still confused that he is honest to helping people or just rugging smartly.

@Jim, our new site was built weeks prior we just had a glitch with the domain forwarding that’s all, we’re also building out our own stand alone system now too but you might just say we got booted from Samcart at that point.

@Paul, it was a message from my mother to inspire everyone to go through adversity, like trying to help people and getting non stop hatred from people that don’t even know you or what you’re doing.

@Oz, Eaconomy has nothing to do with our model other than getting me interested in Forex bots, people aren’t using their own capital on our bots

@crypto, iour first firm we started out with wasn’t supportive of us but we’ve paid out of pocket to replace anyone’s account that was hurt by them and have multiple supportive options now.

@jake, this journey has definitely proven to be harder than expected operationally compared to when I was just running a few of my own accounts but rest assured we’ll continue to do everything we can to make it work for everyone.

We’ve had people starting to get withdrawals and we will continue to be transparent with the results but it is a long process of passing challenges and trading on the accounts within all of the rules and guidelines from firms plus waiting for the firms to process the payouts who are going through their own operations challenges

I do appreciate each and everyone’s feedback here, I never understood how hard it was to run a company of this size until we were already in it and I’m just really grateful we’ve got this far and assembled such a strong team to go through all of the hurdle’s because there is definitely a lot and will continue to be.

I didn’t bring it up because of that, I brought it up to demonstrate you are clueless about regulation. See comment #23.

Whether “people aren’t using their own capital on our bots” or not is irrelevant to Incomation offering a passive income opportunity and not being registered with financial regulators.

With all due respect Oz, I never said I was an expert on regulation, there’s too much to know and too many countries to handle. But we do have a strong law team now and are in the process with our first few countries.

I do appreciate your experience and helping me put attention on that because it’s a very important part of doing things right and building a strong system for everyone.

I’ll be putting a strong emphasis on regulation moving forward, keep in mind we’re only in our 3rd month and 3 months ago I couldn’t never imagined how many people would want our help on this.

The great thing about financial regulation, with respect to MLM companies, is that it’s the same the world over.

MLM + passive investment opportunity = securities offering.

MLM + passive investment opportunity through forex = commodities regulation kicks in.

With respect to being “an expert”, I don’t refer to myself as one either. That said, I’ve been reviewing MLM companies and covering MLM regulation for 13 years.

When someone tells me I’m wrong about MLM regulation I’m pretty familiar with at this point, I assume they consider themselves an expert.

When a financial regulator confirms otherwise, I’ll point it out with a side of popcorn.

Glad to hear you’re taking regulation seriously though. Probably want to stop working with dodgy recently created shell companies run by persons unknown as a start.

In addition to registration with financial regulators, disclosure to consumers is also part of financial regulation. There are currently zero disclosures about anything on Incomation’s website.

I appreciate there is many similarities I’m sure. I’m also confused about the MLM piece because many people telling me if we are only 2 levels it’s not legally MLM until 3 levels so I’ll need further clarification on that.

I can only imagine how fun your job is at that point, many of these people you report on deserve to be taken down I fully agree.

Never meant to imply you were wrong either by the way, I’m just relaying what I’m getting from the law teams because I’m definitely not a lawyer or have the capacity to know everything in that department.

I’ll put attention on getting the disclosures we need thanks for pointing that out.

Any chance you’re open to being our Chief Compliance Officer?

Haha we do seriously need someone to handle all the lawyers in all the different jurisdictions, it’s so important to differentiate ourselves so people know we have honest and pure intentions.

Ya it’s tough in the prop firm game to find a company more than a couple years old at the moment because the virtual challenge model is such a new space but we just made a huge partnership with ANTT because the owner has a strong background running a forex brokerage for 8 years and it’s a bonus we’ve been friends for over 4 years too so I trust him.

Seriously let me know about the compliance position it would be an honor to have you on the team in that department, you’re a total ninja with this stuff lol.

BehindMLM keeps me (too) busy. I enjoy running it and there’s obviously consumer demand for this level of published research and reporting.

Thanks for the offer though.

Most definitely, keep up the great work and let me know if you have a connection.

I’d highly appreciate a recommendation from someone with your level of experience.

@jamie divine every month new excuse with new firm.

if you are legit then proove us here minimum 500 memebers get paid through firm MDP OR ANTT OR NEXTSTEP.

1k plus members i believe 500 must should get paid through firms this month so they can get thier capital back with some profits.

otherwise you are only making money.

i know you are expert replying answers can handle 1000+ people on zoom with your magicians answers.

moral of the story people should get back thier capital back.

can you confirm me how many people get paid through firms since 2 months those joined incomation.

focus on people results then you are honest.

i can bet since end of june also members will not get profits from Antt or mdp.

then you will start your own firm with all this money.

you are a networker bonus is you are getting lots of people data als0 promoting yourself.

you made millions.

hahah members don’t need honesty and pure intentions + magic words.

they need thier hard earned money they paid to you and firm back this month.

error and tech issues and firm issues and trading issues every week and month not a honesty.

lots of people are complaining thier trades are in minus i have lots of screen shot of people. mostly members trades are down minus.

just Focus on people trades tell your team reply on time solve people issues instantly plus main point withdrawal from firm.

i will reply end of june but i belive 100% nobody will gonna recieve only few people will recive withdrawals thats not performance also reply here smartly also not bring your intentions true come back here with results withdrawl lol.

because if members will recieve payments then you need to pay to affilaites also 20% and 10% residual thats why every month excuse and error.

i know you are world#1 guy who can handle everyone with your magicians hypnotics words you handle oz too lol.

people those know hypnotics tricks can handle anyone for thier benefits.

Honestly Jake it’s really hard helping people when you just get shit on like this.

If you have a problem with your account you can ask support to have it adjusted, most people are having a good experience but we’re definitely not perfect and we are only 2 months old.

If you saw our expenses for building this out for everyone you would realize we aren’t making much money and it would be a whole lot easier for me to take my top performing startegies to the firms and keep all the profits to myself without having to deal with the chaos that comes from trying to help so many people.

I would prefer to live my life with freedom from this but I’ve committed to helping everyone.

We have a call today with the representative of MDP and they are issuing the first wave of payouts.

I understand some people don’t have patience or vision and just want an instant return no matter what we say.

We’re doing our best to keep up with everyone’s demands, that’s all we can do.

@Jamie is your bot on MyFXBook?

For clarity on your second post, the MyFXBook verification of trade history can be faked.

@jamie devine why don’t you accept that your EAs are not working on every vps members device accounts you are installing?

thats why you caught always by nextstep and members are reciving consistency rules breached with trades.

cheap bot EA’s in telegram 300$ to 400$ unlimited and limited licenses.

you cannot be successfull this is new unique idea prop firms with other people money but honestly there is no money lol.

i will only believe if members will get withdrawal what you said on zooms calls 2 months no sucesss.

i am not against you but i wasted my money and time on your hypnotics words and sounds and hope that we will get our money after 30 days lol.

also your low salary hired philipine support does not answer on time only they are answering and solving leaders tiers.

@james he never showed trade history he is only showing someone bot history old lol.

let me give you advice if you are honest let’s stop recruiting more and solve till then you solved and fixed 1000 members tech isssues and withdrawal from firms and account login.

mostly members didnt recieved thier login details from Mdp and nexstep yet.

don’t blame members that they have not patience or vision they joined because you told them 7 to 14 days challenge passed and 30 days trading 2 months are u successfull not lol.

only you are making profits with service fee also you are increasing you fee always now you added more you did not lost single dollar you made 1million plus i bet 100%.

like i said results will speak after 20 days.

also you are taking more time to pass challenge for people lol.

hope all members live accounts trades will be in profit and they will get withdrawals but seems to impossible.

you are still printing money for your own firm 😉

June 6 no proof of withdrawal from Nextstepfunded, MDP, ANTT.

Lot of members trades didn’t start waiting for support to start Trade.

New members joined ANTT still trade didn’t start.

Bot is still not providing results.

Jamie devine is still in Florida enjoying and he is not active like he was in start like robot not sleeping lol.

No he is sleeping since 2 weeks.

Results speaks.

People are paying high fees to incomation + Firms to get profits at end of month.

But still no success.

Also they added skip line Fee.

Never saw a player like this before in MLM history.

Also some leaders Commission stuck they didn’t received.

SEC sues Binance.

SEC sues Coinbase.

SEC soon behind you @jamie devine & Ollie Gray both are partners.

I hope you that you can help members to get withdrawal and Thier tech issues.

I really appreciate all the feedback even though much is inaccurate and coming from a place of ignorance.

To be clear we have had payouts from NSF, we have had payouts from MDP and ANTT is still too early in the process.

We’re now at the point of over 100 accounts per day trading getting stopped to process payouts.

What many don’t understand is how long of a process it is to go through all of the hoops of passing prop firm accounts and then processing payouts from the firms.

Especially when many of us are still in start up phase and a lot of moving parts operationally.

It’s inaccurate that I’m getting much sleep yet and I’m also not in Florida yet but I am on my way as we are a top sponsor for the forex convention this weekend.

Feel free to come by and say hi.

Thanks for all the energy towards us, most very supportive and positive and some not so much but can still be helpful to see what to improve.

We’re building a massive machine and we’ll be here for the long haul reinvesting everything back into operations.

As most people have never experienced running a business or being a true investor it’s hard to understand from the outside but we’ll keep going anyways.

We are taking regulation seriously and happily comply with any and all authorities to build something solid and special for everyone involved.

It hasn’t been easy nor perfect, but real business always has real problems.

biggest lie @jamie devine lol

members are receiving email from nextstep third party managed accounts incomation members are posting.

i did not see any payout proof in group that incomation member recived payout from nexstep or mdp lol.

can you post your group members payout results here those recived from firm lol.

feel free to come by and say hi.

anyways also you are not doing zooms with members where are you dissapeared lol.

you also did not replied to stop recruiting new members till then you fixed all this if you are legit lol.

all trades bot are in minus.

i am in facebook group watch and read everthing.

you made 1 million plus still printing more with members fees.

some members are requesting for refund thier money why don’t you refund them also.

Thanks a lot jake for running this thread. Since this is under radar no one knows where to look for a review.

I know few who invested in this and still have not received any payments from past 2 weeks. They are using both platforms mdp and next step.

On the other hand people are leaving false information and deceiving other by leaving positive views on YouTube to rake in more members under them for bonus money.

well leaders are working hard for thier residual commissions

but leaders are innocent they dont know that they are not going to recive residual income lol

till then jamie devine will use them to bring more memebers so he can use capital more lol

well simple answer we need results payouts to members

and residual income to leaders ( no magic words defending strategy blah blah from jamie divine )

i have ton of pictures of members mdp is not sending login details of challenges + fundeded so how can they pay out to memebers lol

sec soon will after jamie devine

if you succeed to pay to members then i am happy if not till then i will expose you here with all facts no allegations

last date is 20 june today is 8 june let’s see

still you didnt replied if you cannot handle tech and withdrawal issues then stop recruiting and fixed 1k members first

you are also not doing zoom becuase you have no answers lol

This is such an absolute shitshow imo. I would say I feel sorry for anybody who has parted money with incomation but the writing really was on the wall with this.

Dodgy prop firms that appear to be shells, typical mlm rhetoric about easy passive income with little to no info regarding bots capability (or verified testing)!

There’s a reason these schemes are pitched to poor hapless souls, crypto/forex bros and gullible facebook idiots.

Do not trust peacocking affiliates whos MO will be to make a quick buck and then slither off to their next cash cow. (Then have the audacity to claim this is not a get rich quick scheme)…

spoiler alert, it likely is for the fat cat affiliates who seem to be the only ones getting payouts for commissions, not trades.

My friend has invested in this, and has been banging the same drum jake is in the facebook group.

Make no mistake, there’s alot of disgruntled investors who are kicking themselves over this.

Literally, anyone can create a trading bot with ChatGPT and a brokerage API key/password. The challenge is inputting the right signals/strategies.

Jamie didn’t work on Wall Street, he grifts MLM schemes. Why anyone in the world would trust this idiot to develop Forex strategies is beyond me.

The obvious answer is that he didn’t. He purchased the bot from someone with slightly more knowledge than himself.

I can assure you that it was not purchased from a Wall Street quant with decades in the industry, Divine doesn’t have the kind of money to purchase something like that.

Like every other script kiddy, he has a shitty bot and is just now realizing that the market changes and his bot won’t generate consistent profits… at least I hope.

The alternative is that he started Incomation with the intention to defraud people from the start.

Also likely, but I honestly believe that Devine is actually stupid enough to believe he could develop a bot that produces consistent returns.

yess lots of people selling Ea’s and hft on telegram,discord with cheap prices but no gurantee lol.

jamie devine is still in usa meeting with leaders dinner at steak house with gary wood and ryan farmer.

jamie devine is still silent because pop firms are not paying + mostly members accounts are in – minus and other members are waiting for to start trade lol.

and he is trying best to recruit more people in this incomation so he can make more more.

he printed 1 million plus enjoying lol.

soon SEC will after you.

i am still waiting for people payouts+residual income and jamie devine is creating new excuses lol.

results speaks not magic hypnotic words.

Just got booted from their Telegram for speaking about how terrible their customer service has been.

As soon as Jamie started raking in the money there has been 0 focus around customer support and even hosted affiliate training to onboard new users. Sounds like the MLM is starting to break already haha

Don’t let them fool you Ollie is also very close to Jamie as well but he just acts like he is a little affiliate.

They all will be getting served soon enough 🙂

Has anyone submitted a SEC refferal/tip about these guys yet? Seems super super shady and worth reporting.

Auston Clark yess i told many times that Ollie is partner with jamie devine and ollie always act like he is little affiliate lol.

jamie devine is no responding to top leaders also those worked hard build team now jamie devine is using leveraging leaders network he is so selfish.

today is 13 july still no payouts from firms to members.

jamie is collecting more money with new members.

should report to SEC about these guys.

ollie is in usa. jamie devine is in phillipine.

Here is a response from Incomation (Jamie?):

As mentioned, they are simply purchasing their bots from random people. This isn’t because they don’t have the technical skills to code one, they are very simple to code.

It is because they don’t understand the underlying Forex trading strategies so they can’t develop their own. Why would you pay for something if you had the knowledge to build it?

Since they promised returns and their bots are not producing said returns, they are scrambling to find a bot that works. They don’t have the time to properly backtest a new bot.

They would need to shut this whole thing down for well over a month (it should really be much longer than that) but if they did that, people would lose their minds. So, they are now in a death spiral of trying new bots over and over without enough time to properly test them.

Good luck.

@DOC i already told thier EA’s and HFT they are installing 0 value results just making fool people no results

now jamie devine and kam johal and ollie Gray in MIAMI enjoying with girls in beaches lol also attending meeting scam new people

automatically trades are stopped because of shit EA’s and hft new excuse lol

now they dont have time thier purple button also not working they hired now someone maria team lol new excuses

i don’t understand why people are investing in this shit

if anyone in USA they can file a complain against these guys so they can caught with red hands lol

Let’s get real here. Jamie Divine is so full of it I am surprised he can see to type. He’s a joke. He has no clue how to run a successful and legal business.

The only thing Jamie Divine is successful at his running his mouth and spouting BS. He’s not even a good conman.

For all of you who bought his BS, sorry for your loss. Some of you have more money than brains. If you had bothered to any kind of due diligence, you would have never, ever joined this Ponzi.

@Jamie Devine

Who are you really? You call yourself “Jamie Devine” but you called yourself “Jamie T Brock” for a decade. You also linked to an article from a previous employer where they referred to you as “Jamie Heggen”. Your Linkedin only lists your birthday as “February 7” – no year.

Not trying to be found? You’ve been a naughty boy Jamie!! It is only a matter of time.

@Jake

I’m in the USA. I’m not financially involved in this but I know 5 seniors (65+) that “invested” despite my warnings so now it is personal.

I personally know about a dozen federal prosecutors. Just trying to do some leg work prior to handing this off and seeing if they want to run with it.

Divine hires bottom of the barrel attorneys to incorporate his companies. It’s how he got burned in Newport Beach.

He effectively had no control of his alarm company because he likely never read the operating agreement, the attorneys were in control (as evidenced by the public corporate listing). He had to pack up and go home per his own admission on LinkedIn.

Incomation Inc itself is registered to unit in a shitty building that is located in Canadian shopping plaza. Several other shady companies are also registered in the building.

I bet he read the paperwork this time but he still hired another shit attorney. It’s not going to be hard for any competent prosecutor to nail him.

It’s interesting that Incomation Inc is registered to “Jamie Divine” rather than “Jamie T Brock” or “Jamie Heggen”.

I suspect that the latter isn’t even him. It wouldn’t be too hard for someone to call his perviously listed employers to confirm employment/name.

Tick tock.

Wow you guys are absolutely ruthless. All we’ve been doing is working our ass off to help everyone get their own prop account and for the most part have been helping most people not only pass accounts but also use our connections to EA developers that have produced great results.

We aren’t doing anything illegal, and I could have just stuck to passing my own accounts and using prop firm capital to keep all the returns for myself.

I suspect none of you have ran large operations before and I never meant to help this many people nor have no time freedom anymore because of the ridiculousness of running a system this size.

For anyone that cares, I was born Jamie Brock Heggen, my dad died when I was 2 and I never knew his family.

I met a numerologist in 2014 and changed my name based on her advice that the numbers didn’t align with my birth chart.

After a few years I worked with a spiritual mentor to raise my consciousness and the name Jamie Brock didn’t feel right any more. I decided Divine was a great fit because of the connection I now had to my Divine father.

I’m not hiding anything from anyone, nor have I ever done anything illegal. I incorporated the company without a lawyer, directly with the government of Canada.

We have not only delivered to our clients so far, we have done everything possible to protect them from other companies that didn’t have their best interests at heart like we do. At the end of the day, trading is extremely risky but we are doing our best to connect people to what’s been working for us so far.

I don’t expect everyone to understand what we are building, and I don’t expect to not take any hate or heat from ignorant people that rightfully so have trust issues. There’s a lot of fake BS out there.

The fact that we are getting this much hate, 3 months into this is a great sign that we are on to something special.

We will continue to persevere and do everything right to the best of our abilities no matter who wants to try and stop us. We’re just here to help, I live in the Philippines in a 2 bedroom house and drive a Toyota.

I reinvest all of the money back into the system because I could care less about making millions for myself. I just want to have freedom and help other people achieve the same.

If you have a better way, I suggest you focus on doing that instead of trying to rip apart what we’re doing with limited information.

Oh Jamie, we aren’t ruthless, we’re just not idiots. Let’s stick with the facts, the prosecutors certainly will.

You are attempting to walk back previous (and current, despite your poor attempts at disclaimers) marketing/public statements in order to reduce liability. Your website attempts to make the consumer believe that they can generate income with the help of “Incomation’s prop firms” AND “AI” trading bots.

Now you are saying that Incomation merely opens prop firm accounts and you happen to connect people to others that own income generating bots they can use. Today, you emailed all of your customers that you purchased new bots which will generate income for them. Which is it Jamie?

You aren’t being altruistic by deceiving people. Every person that I know invested because they thought Incomation would generate them income via prop firms and trading bots. That is due to your marketing/public statements.

Your bots aren’t generating income for anyone. Remember, I know multiple customers and every customer on this platform has said the same thing.

You are now claiming that you are merely giving customers the opportunity to leverage their money. I can do that with any brokerage.

Don’t give me that woe is me BS. I have run/owned significantly larger companies than Incomation. I don’t incorporate my own companies because I have a $1,000/hr attorney who owns the $20,000,000 building that his firm’s offices are located in. That’s what a legitimate business person does. Who’s address did you even use?

Well Doc, if you believe you can help us with your business experience I would appreciate connecting because we are growing extremely fast and could certainly use the expertise to help continue to support everyone

It hasn’t been perfect but if you go to our Facebook group you can see plenty of results it’s been working for most people

Please let me know how I can reach you if you’re open to connect, I’m not here to pretend I’m an expert at everything

Jamie, you already tried this exact flattery/avoidance tactic early on in the tread with Oz. I encourage any readers to scroll up and read those comments to confirm my statement. It is commonly used to deflect and avoid questions that expose you.

Address my statements. Why does a self-proclaimed altruistic person who “wants to help people achieve financial freedom” need so many disclaimers on their website. Perhaps it’s because they are attempting to appear altruistic while knowingly defrauding consumers?

Don’t just address this statement, address the statements in my previous post individually.

@ Jamie Divine

For those don’t want to scroll up, here is where Jamie made the same deflection attempt with @Oz

Jamie successfully avoided answering Oz’s statements here by flattering him and deflecting his statements.

Jamie, can you address my statements without defecting? I’m happy to provide a formal list of questions/statements if that format makes it easier you to answer.

That was a serious offer to both of you because we are growing at an amazing rate right now because of how successful we’ve proven to be so far

Clearly no matter what I say will be twisted so all good

I addressed the legal name change, the Newport Beach alarm company I started at 20 years old and had zero problems I just didn’t follow through with immigration and I decided on my own to leave America

The address is a mailing address

I’m going to have to move on now if you’re not interested in actually helping us, and you’re not actually a client, there’s no point to have this conversation

@Jamie Divine

Come on Jamie. Readers aren’t stupid, its ovvious to anyone reading this that you are (yet again) avoiding my statements regarding the model/marketing/fraud of your company. That’s rather un-altrustic of you.

You are insulting people’s intelligence here. You’d make a better politician than a con-artist, at least the former is legal.

Since you yet again attempted to avoid me, I will provide with a formal list of statements and questions that you can answer here. Sound good? Or would you rather try to deflect again?

You and ollie gray have had your chips Brock. Say good bye to the girls, sun and sand because the jig is up.

If you actually visited the facebook group you would realise ollie is trying (but failing miserably) to maintain the mirage and this and its now decended mostly into a lobby of dissapointment and anger.

Instead of doing whats right you have the gall to focus on “affiliate training”, swanning off to miami To dupe more hapless idiots and banning anybody who speaks out on discord. We aren’t naive enough here to believe your sob stories, nor do we care.

If your such a Saint/humanitarian then suck it up, grow a pair and take responsibility for this mess youve made.

I hope it keeps you and ollie up at night knowing the feds are coming…

@doc he is very smart with his hypotics tricks like he did with oz now with you lol ahahah

he is ignoring also leaders those work hard build team he is not replying to them i know those leaders with chat proof

today id 14 july still not memeber recived payouts from nextstep and MDP LOL HAHAH

HE DID NOT ANSWER MY QUESTION I ASKED THREE TIMES THAT HE SHOULD STOP RECRUITING PEOPLE TILL THEN HE FIXED ALL MEMBERS TECH AND PAYOUTS ISSUES

PEOPLE JOINED INCOMATION BECAUSE ON ZOOMS HE MADE FAKE PROMISES THAT AFTER PASSING CHALLENGES MEMBERS CAN MAKE 4% PER MONTH CAN WITHDRWAL STILL NO RESULTS

NO RESIDUAL INCOME

ONLY 80% HE IS PAYING COMMISIONS TO LEADERS

20% LEADERS DID NOT RECIVED COMMISSIONS BECAUSE CHALLENGES NOT PASSED TRICS TO HOLD

NOBODY KNOWS HIM HE IS JUST AFFILAITE NETWORKER

I KNOW ONLY 3-7 LEADERS THEY WORK HARD BUILD TEAMS UNDER HIM AND HE IS NOT RESPONDING TO THEM ALSO HAHAHAA

NEW FIRM ANTT IS MAKING EXCUSES STOPING TRADES

HE IS JUST USING MEMEBERS MONEY LEVERGING LEADERS NETWORK FOR HIS OWN PERSONAL USE

ALSO MDP AND PAPP DASHBOARD LOOKS SAME I BELIVE MDP IS JAMIE DEVINE FIRM

@Jamie Divine

I have access to months of emails from you and your affiliates, which are spouting promises of passive income via Incomation’s prop firms and bots. Incomation isn’t registered with the SEC.

What will your legal defense be? That you did not know that your own affiliates, whom you regularly met with, were making such claims?

Once they prove that you had the knowledge, they move to show that you were complicit by continuing to pay the affiliates to bring on more customers. They will ask you why you didn’t remove said affiliates when you knew what they were doing. What will your answer be?

What is your answer now? Why aren’t you removing affiliates that are making wild claims of passive income through Incomation’s products/services when you have knowledge of their claims?

I know what you are trying to do Jamie. You can’t try to divorce Incomation from the affiliates and plead ignorance. I’m no judge or a lawyer but I don’t think that it would go well in court for you.

Its always a trading bot these days now isnt it. Think Beurax and Q-bit then take a step back and watch how it collapses within a short space.

They usually are connected to other schemes that provide similar services, and then collapse shortly after one another remember Bruxis, OIS Capital, Rostex, Teqra, Twindax, the list goes on.

All promoted by the same telegram channels, all collapsed one after the other. And investors are told to never keep all of your eggs in one basket, then all the baskets get stolen at once.

Are you being serious now, seems as if you may have been duped or are at least aware that off the shelf software you purchased just reflects numbers on a screen and does not actually represent any value than just pixels.

I used to scan in hires artwork for many talented artists who were extremely pedantic about their work but they were bearable and sometimes nice but they knew what they wanted.

Out of all of those artists, there was one who was terrible and could not draw to save his life but somehow he convinced himself that his artwork would sell and that he was pretty good at it.

I found it strange that he would spend so much time and money at my company and even go so far as to demand that his reprints look exactly like the crappy original.

I always hated doing his work but entertained him while I was still there, because he was a paying customer. I tried to advise him as best I could, but was not getting anywhere as logic and reason were not his strongpoints, only the misdirected belief he had in himself that he could be a great artist.

I have never heard of him since and I doubt he has ever sold a drawing.

Even though he looked like an artist from the outside with clothes dirtied by paintbrushes, inside he was a conman, fooling himself and God knows who else foolish enough to take him seriosuly.

You can make a f.ck tonne of money selling your bot to large corporate trading houses. I think whatever you are charging is way too cheap for you to make any serious kind of money.

Even Dr Anna has convinced the affiliates from Daisy that her bot is outperforming the traders on Large exchanges which has daily traded volumes running into the billions.

Even her bot takes losing trades, if yours is running 100% then why not run it in MT4 on your own funded account and show us the trades.

Even MTI had they own bot and we all know that turned out to be one of the biggest scams in crypto MLM at the time it was running.

@stan

There is very good reason that the VAST majority of bot scams are Forex scams and not stock market scams.

The MT4 software is one of the most widely used Forex softwares. MT4 itself is legitimate, but it is not a brokerage. You cannot place trades on MT4 alone. To do that, you must connect MT4 to a brokerage.

The issue with MT4 is that once you connect it to a broker server, the “broker” is free to manipulate that data any way they see fit.

If you choose the wrong broker, they can make the software show that you’ve made millions of dollars, when in reality, your money with sent offshore the minute you wired it.

Jamie doesn’t have a profitable trading bot (his emails to customers yesterday stated as such) just like the MT4 scammers before him never had profitable bots/strategies.

Whereas MT4 scammers required irreversible wire transfers for payment, Incomation allows credit card payments.

IF ANYONE FEELS THAT INCOMATION HAS HAS LIED TO THEM, ISSUE A CREDIT CARD CHARGE BACK. If enough charge backs are issued, merchant banks will no longer work with Incomstion.

@stan daisy cofounders are greatest scammers first they launched crypto tiers people bought all minus since 2 years only they are paying to new memebers those joined forex tiers

lol thousands of people still waiting for crypto tiers profits and capital only leaders made money

jamie devine is also invested in daisy lol i know leader told me

point is today 15 jun still no payouts from all Firms

new members they are recruiting everyday to fool them with incomation monthly residual income

kam johal,ollie gray, jamie devine enjoying in USA with millions they recived from memebers

i pray for new members before investing they must read this thread so they do not invest

16 junly started still no payouts to members lol.

also Antt sending emails Fail challenges to members.

some members got rejected withdarwal from nextstep lol.

@jamie devine spending members money to open office in phillipine and support still not solving issues.

pay extra $500 to marias team to solve issue.

members need results payouts.

kam johal, jamie devine ,ollie gray hope you enjoyed alot in miami now get to work bring results to members so they can get back thier hard earned money.

june 17 today only one member got payout from 1200+ members lol

Ian Bannister got $3000 his sponser is Ollie Gray lol

still members are getting rejected by nexstepfunded and mdp and Antt for challenges lol

only close guys to founders like Ian bannister got payouts

after 3 months

imagine three months they are using members money lol

So you didn’t do ANY of the necessary legal preparation before launching your business?

Who starts a financial program intended to help others make money but doesn’t do the legal due diligence to protect itself and make itself compliant? To make sure you’re here helping people for the long term?

One of two options:

1) an absolute idiot of a business person who I would never follow nor invest with

2) someone who never intended to be here for the long term. Hmmm….

You want to know how to start a Ponzi? Hype people up on huge hypothetical profits, collect shit tons of cash upfront to fund the pending payouts, dribble out enough payouts to keep the fish on the hook.

Then keep making excuses when shit doesn’t work….a laundry list of semi-plausable excuses while people keep giving over their money.

And then at some point, either disappear or make up some reason why the Ponzi will no longer work and fold having pocketed millions.

Do you think we don’t see you?

Do you think we don’t know you?

You can’t hide bro

There’s 1000 lies and flaws in your stories. It’s not even worth repeating.

Have fun living a life always looking over your shoulder.

june 22 still no payouts to previous old members only got few payouts from close connections with founders.

also i found some affiliates did not recieved thier commissions from long time support is not working well kam johal and jamie devine enjoying in thailand.

hey congrats jamie devine you got baby and you made her future before entering to world with other people capital 🙂

hope now you become dad and you will not rugged people.

@doc what is MLM and Ponzi scheme online law in philippine becuase these jame devine, and kam johal are living in philippine now.

they are making fool more people with this scam incomation new people are joining and old people are still stuck also jamie is not replying to leaders and investors only he is talking with person bringing more sales.

any action or report in philippine to take an action to save more people.

or philippine is same like dubai for scammers to promote any ponzi.

@Jake

Not much different than Dubai, which is the obvious reason he lives there. There would need to be negative press coverage on the issue to force an indictment (see Romania/Andrew Tate) or political connections within the country.

Indicting him in the USA first would be the start of applying preassure on the Phillipne judicial system.

While the Philippines isn’t particularly active on the criminal side of things, they do have a relatively active civil securities regulator in the Philippine SEC.

If you wanted to report Incomation and Jamie Devine for securities and/or commodities fraud (they aren’t registered), the Philippine SEC would be the regulator to contact.

To give people here an update – I tried to test out Incomation through MDP Funding. It was only after I was referred by a friend and figured I would give it a try.

This was in April. It’s July 25th, and I’m sure you can imagine what I’ve received as a payout so far…NOTHING!!! LOL!!!

Let’s run through the sequence of events here, and then I will explain my recourse, as @Jamie and his team/MDP have done nothing but not respond to my emails, leave me on read in our chats, and ultimately remove my “negative” comments and ban me from every group they have available (facebook, telegram, messenger, etc).