Future Multiverse Review: Metaverse ruse Dubai crypto Ponzi

Future Multiverse fails to provide ownership or executive information on its website.

Future Multiverse fails to provide ownership or executive information on its website.

Future Multiverse’s website domain (“futuremultiverse.com”), was privately registered on December 31st, 2023.

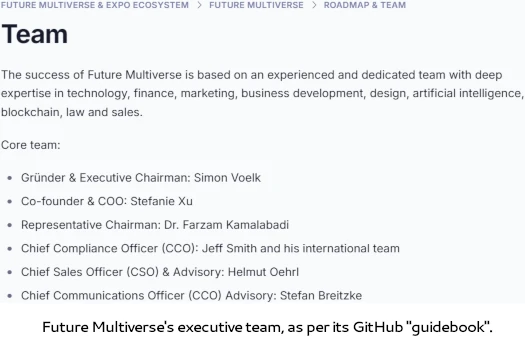

While most of the links of Future Multiverse’s website are non-functional, we did find one working link to a “guidebook” hosted on GitHub.

Here we are provided a list of the people behind Future Multiverse:

- Founder and Executive Chairman – Simon Voelk (aka Simon Volk)

- Co-founder and COO – Stefanie Xu

- Representative Chairman – Farzam Kamalabadi

- Chief Compliance Officer – Jeff Smith

- Chief Sales Officer and Advisory – Helmut Oehrl

- Chief Communications Officer – Stefan Breitzke

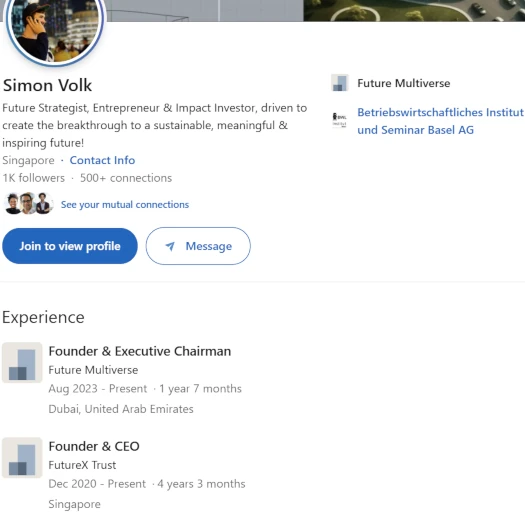

Simon Volk appears to be from Germany but, as per his LinkedIn profile, resides in Singapore.

No idea what Life Solutions was but FutureX is a collapsed crypto Ponzi built around FXTE token.

Of note is Future Multiverse’s Stephanie Xu also working with Volk on FutureX:

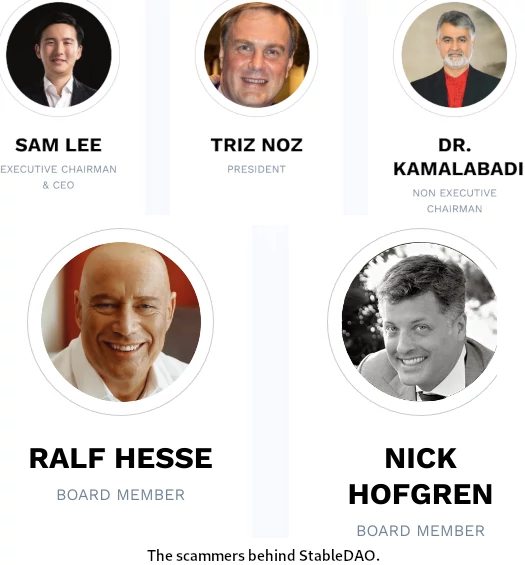

The only other name worth noting on Future Multivere’s executive list in Farzam Kamalabadi.

Kamalabadi popped up on BehindMLM’s radar through his involvement in Sam lee’ StableDAO Ponzi scheme.

As per the above marketing slide, Kamalabadi was a StableDAO non-executive Chairman. Kamalabadi also made regular appearances in StableDAO marketing videos:

StableDAO was a continuation of the MLM crypto fraud Lee started with HyperTech Group and HyperCapital. The largest HyperTech Ponzi was HyperFund, which collapsed in December 2021.

Kamalabadi’s involvement in StableDAO was tied to his part-ownership of the HOO crypto exchange, through which HyperTech investor funds are believed to have been laundered.

HOO disabled investor withdrawals in June 2022, roughly six months after HyperFund collapsed. Another six months later HOO collapsed.

HyperTech investor funds stolen through HOO remain unaccounted for.

Sam Lee was indicted and charged by the SEC in January 2024. At time of publication Lee remains a wanted fugitive hiding in Dubai.

Kamalabadi’s involvement in Future Multiverse appears to be through his company Future Trends Group.

We are connected to the Future Trends Group, led by Dr. Farzam Kamalabadi, through which a global network with around 400 million contacts is directly and indirectly connected to the Future Multiverse.

Kamalabadi’s LinkedIn profile places him in California. Kamlabadi’s Twitter profile lists his location as Beijing, China.

On its GitHub guidebook, Future Multiverse claims it’s run through “a Dubai-based corporate ecosystem”.

Due to the proliferation of scams and failure to enforce securities fraud regulation, BehindMLM ranks Dubai as the MLM crime capital of the world.

BehindMLM’s guidelines for Dubai are:

- If someone lives in Dubai and approaches you about an MLM opportunity, they’re trying to scam you.

- If an MLM company is based out of or represents it has ties to Dubai, it’s a scam.

If you want to know specifically how this applies to Future Multiverse, read on for a full review.

Future Multiverse’s Products

Future Multiverse has no retailable products or services.

Affiliates are only able to market Future Multiverse affiliate membership itself.

Future Multiverse’s Compensation Plan

Future Multiverse affiliates invest $200 to $500,000:

- Beginner Package – $250

- Newbie Package – $500

- Starter Package – $1250

- Explorer Package – $2500

- Adventurer Package – $5000

- Pioneer Package – $10,000

- Builder S Package – $25,000

- Builder M Package – $50,000

- Builder L Package – $125,000

- Builder XL Package – $250,000

- Creator Package – $500,000

- Super Creator Package – $1,000,000

- Ambassador Package – $2,500,000

- Partner Package – $5,000,000

- Senior Partner Package – $10,000,000

This is done on the promise of advertised daily passive returns.

Explorer Package tier investors receive $8.35 a day. Daily returns for the Marketing Adventurer and higher investment tiers are not disclosed.

Additional passive returns might be available through undisclosed “commission pools” and NFT investment.

From Future Multiverse’s Guidebook;

Corporate Rank NFT – Holding this NFT allows you to receive a share of the platform’s profits.

Hold a marketing package to receive a share of the platform’s commission pool.

Referral Commissions

Future Multiverse hides compensation details from consumers.

From Future Multiverse’s Guidebook however, we are able to confirm MLM:

Each marketing package contains a special affiliate link through which users can earn commissions by promoting Future Multiverse packages and services.

In particular, the Marketing Packages are aimed at individuals who want to earn commissions through network marketing.

The only specific referral commissions cited is 18% on recruitment of Makreting Adventurer Package tier investors.

Taken as is, the above suggests Future Multiverse uses a unilevel compensation structure.

Business Pool

Future Multiverse takes 7% of company-wide fees charged and places the funds into a Business Pool.

The Business Pool is shared among Marketing Builder M Package investors.

Staking Investment Scheme

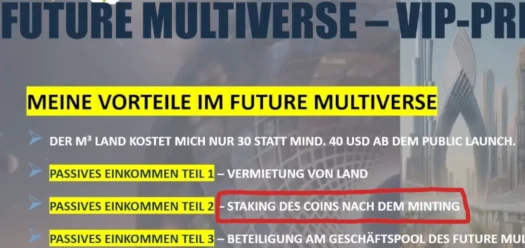

Future Multiverse affiliates invest in FXTE tokens (sometimes referred to as FXPO tokens).

- Beginner Package tier investors can invest in up to 50 FXTE tokens

- Newbie Package tier investors can invest in up to 100 FXTE tokens

- Starter Package tier investors can invest in up to 200 FXTE tokens

- Explorer Package tier investors can invest in up to 500 FXTE tokens

- Adventurer Package tier investors can invest in up to 1000 FXTE tokens

- Pioneer Package tier investors can invest in up to 2000 FXTE tokens

- Builder S Package tier investors can invest in up to 5000 FXTE tokens

- Builder M Package tier investors can invest in up to 10,000 FXTE tokens

- Builder L Package tier investors can invest in up to 20,000 FXTE tokens

- Builder XL Package tier investors can invest in up to 50,000 FXTE tokens

- Creator Package tier investors can invest in up to 100,000 FXTE tokens

- Super Creator Package tier investors can invest in up to 200,000 FXTE tokens

- Ambassador Package tier investors can invest in up to 500,000 FXTE tokens

- Partner Package tier investors can invest in up to 1,000,000 FXTE tokens

- Senior Partner Package tier investors can invest in up to 2,000,000 FXTE tokens

Once invested in, FXTE tokens are parked with Future Multiverse on the promise of an undisclosed passive return.

Passive income through staking the coin after it has been mined under the purchased land.

Returns are paid in FXTE, which must be converted to actual money through Future Multiverse.

Joining Future Multiverse

Future Multiverse affiliate membership is tied to a $250 to $10,000,000 investment.

From Future Multiverse’s GuideBook;

In addition to the Euro, Dollar, USD and other world currencies, there will also be the option to use BTC, USDT, Bitcoin and other cryptocurrencies.

Future Multiverse Conclusion

Future Multiverse is a continuation of the fraud Simon Volk and Stephanie Xu started with FutureX.

FutureX’s FXTE tokens have been carried over, with the fraudulent investment scheme given a new “metaverse” coat of paint.

Metaverse marketing ruses became a thing after FaceBook revealed development plans in 2021. In the crypto scam marketing ruse timeline, metaverses came after NFTs and have been preceded by AI.

What’s key here, before we even get into Future Multiverse, is that FutureX FXTE bagholders are the foundation of the company. That puts anyone who invests into Future Multiverse at an immediate disadvantage.

As for FXTE, as far as I can tell it’s a simple ERC-20 token. These can be created in a few minutes at little to no cost.

Specific to Future Multiverse we have a pyramid scheme compensation plan attached to two primary unregistered investment schemes:

- the metaverse land investment scheme; and

- the FXTE staking scheme (carried over from FutureX).

Future Multiverse’s metaverse investment scheme is tied into baloney about investing in virtual land and renting out.

The FXTE staking scheme sees affiliates invest in FXTE, park the tokens with Future Multiverse on the promise of a passive return, and hope to cash out subsequently invested funds.

Both of Future Multiverse’s investment schemes constitute securities offerings.

On the regulatory front, Future Multiverse fails to provide evidence it has registered its two primary securities offerings in any jurisdictions.

Future Multiverse attempts to tackle its regulatory non-compliance in its GitHub guidebook but, well… here’s how that went;

Instead of addressing its regulatory shortcomings, which constitute securities fraud, Future Multiverse is sending out legal threats.

After researching and documenting Fazam Kamalabadi’s “fraud, court cases and shady deals”, Danny DeHek received a cease and desist from the scheme’s Dubai shell company.

Looks like Future Multiverse L.L.C.-FZ doesn’t like being exposed. They’ve sent me a cease and desist letter through their legal team, trying to intimidate me into silence.

On February 8, 2025, I received an email from Jeffrey Smith, Managing Attorney at LawVisory PLLC, representing Future Multiverse L.L.C.-FZ. The letter accuses me of defamation, claiming I’ve made false accusations, misleading statements, and unfounded allegations about their company.

Their demands:

- Stop talking about Future Multiverse

- Delete my videos, blog posts, and other content

- Publicly retract my statements

- Promise never to speak about them again

And if I don’t comply, they threaten legal action for damages and defamation.

This isn’t the first time a company facing scrutiny has tried to silence criticism with legal threats. But here’s the problem—everything I’ve reported is backed by verifiable evidence.

While I can’t speak to Kamalabadi’s past prior to his involvement in Sam Lee’s HyperTech Ponzi schemes (it falls outside the scope of this review so I haven’t personally looked into it), I can attest to his repeated involvement in fraudulent MLM crypto investment schemes – the latest of which is Future Multiverse.

As it stands the only verifiable source of revenue entering Future Multiverse is new investment.

Using new investment to pay ROI withdrawals would make Future Multiverse a Ponzi scheme.

As with all MLM Ponzi schemes, once affiliate recruitment dries up so too will new investment.

This will starve Future Multiverse of ROI revenue, eventually prompting a collapse.

The math behind Ponzi schemes guarantees that when they collapse, the majority of participants lose money.

Since receiving the cease-and-desist letter from Jeffrey Smith, Managing Attorney at LawVisory PLLC, representing Future Multiverse L.L.C.-FZ, absolutely nothing has happened. No follow-ups, no legal action—just silence. It’s clear this was nothing more than an empty intimidation attempt.

The only thing of note since then has been a ridiculous video posted by Farzam Kamalabadi—who I like to call Dr. Aloysius Snuffleupagus—where he rambles on about Future Trends Group’s supposed expansion in Sri Lanka. For anyone who wants to see his latest nonsense, the video can be found on YouTube with the ID: Uraee1_cHgs

Beyond that, it’s just crickets from Future Multiverse.

Great article Oz good to see more than one crimefighter on the planet do you want a smashing job of exposing these bottom feeders who think they can keep flogging people into financial investment opportunities

Generic (probably AI generated) spam that doesn’t address anything. Namely Future Multiverse committing securities fraud because it’s running a Ponzi scheme.

Quote from the review.

Helmut Oehrl is a former OneCoin scammer. On Instagram, he now calls himself djindiansouthside_django, but he has changed his username three times since March 2019.

postimg.cc/RNv5KzWb

instagram.com/djindiansouthside_django/

A post by Helmut Oehrl aka “djindiansouthside_django” on Instagram from March 23, 2019, featuring OneCoin advertising.

postimg.cc/hz6S0Z73

instagram.com/p/BvXKxA2ldQh/

Helmut Oehrl on LinkedIn.

postimg.cc/BPPzG4n4 and postimg.cc/GTFzJQ3n

linkedin.com/in/helmut-oehrl-9164a11b2/

Helmut Oehrl is also a close business partner of former OneCoin fraudster Martin Feniuk from Ehingen, Germany. Both operate the website vffv.ulm.com with this imprint.

postimg.cc/bdJSNJkY

vffv-ulm.com/impressum

I have often mentioned German serial fraudster Martin Feniuk in connection with OneCoin / OneLife on BehindMLM. This screenshot from my archive shows former OneCoin scammers Martin Feniuk (left) and Martin Mayer from Liechtenstein in February 2020.

postimg.cc/8JKGDCkJ

Four OneCoin scammers in one photo. From left to right: Martin Feniuk, Konstantin Ignatov, Sabine (?) and Gunther Triebel.

postimg.cc/6yHX6WVK

Martin Feniuk with an old offer on dealshaker.com.

postimg.cc/6yHX6WVK

Currently, German serial fraudster Martin Feniuk is still promoting Erich Ely’s Trillant scam on his personal website.

postimg.cc/w3pyLVCv

mfeniuk-consulting.de/mein-angebot

This imprint on mfeniuk-consulting.de is obviously no longer valid, but fraudsters like Martin Feniuk like to hide behind false information.

postimg.cc/7GXpMwKN

mfeniuk-consulting.de

Martin Feniuk (left) and Helmut Oehrl (right) on Instagram. Who knows the man in the middle?

postimg.cc/s13Jtbc5

instagram.com/p/DBf9spQNkCd/

Another photo on Instagram with Martin Feniuk (left) and Helmut Oehrl (right).

postimg.cc/sQbGDQWB

instagram.com/p/DBf9Rx5NaUB/

Martin Feniuk on Instagram.

postimg.cc/4nVtWPtj

Martin Feniuk‘s Instagram account with 22 posts and 320 followers since August 2017. The username for this account has also been changed three times.

postimg.cc/XXBJLvMJ

instagram.com/martinfeniuk/

Simon Voelk has had an Instagram account since February 2018. The username of this account, which has 106 posts and 1,046 followers, has already been changed six times. Furthermore, this account is not public, but private.

postimg.cc/cv00mhS1

instagram.com/simonvoelk/

Stefanie Xu, a native Chinese living in Germany, promoted Enagic’s Kangen Water on YouTube in August 2018.

postimg.cc/34Jkc7QR

youtu.be/8Mvxl0glA10?t=860

Stefanie Xu‘s YouTube channel Golden Phoenix now only contains one video for Enagic’s Kangen Water from November 6, 2017, which is not listed. She forgot to delete the playlist with this video. All other videos since October 2013 are no longer available.

postimg.cc/N5v6G4LY and postimg.cc/njJ2zj4S

youtube.com/watch?v=68vKOPXW620&list=PLd1hTf1GelRKUf-3AEj5htEgHHGeH6Xu-

The Enagic review from September 2015.

https://behindmlm.com/mlm-reviews/enagic-review-kangen-alkaline-water-ionizers/

Stefanie Xu‘s Facebook account, which has 523 followers, has not been updated since June 2019.

postimg.cc/Vd95XScP

facebook.com/jialingstefaniexu/

Stefanie Xu‘s Instagram account, with 15 posts and 2,144 followers, is not public but private. The username for this account has been changed three times since July 2016.

postimg.cc/GB1YdPQV

instagram.com/steff_xu/channel/