Crowd1 Review: “Owner rights” virtual shares investment fraud

![]() Crowd1 provides no information on their website about who owns or runs the business.

Crowd1 provides no information on their website about who owns or runs the business.

Crowd1’s website domain (“crowd1.com”) was first registered back in 2007. The domain registration was last updated in October 2018.

Stelios Piskopianos of Crowd1 Network Europe Ltd is listed as the owner, through an address in Cyprus.

Cyprus is a scam-friendly jurisdiction with little to no MLM regulation.

According to his LinkedIn profile, Stelios Piskopianos has a financial services background.

A commercially aware, hands-on Senior Finance Professional with considerable experience of financial and business control across a broad spectrum including strong IT skills and extensive knowledge of computerised information systems.

Piskopianos (right) is currently Finance Director of AOS Fluency Limited (“business process outsourcing”) and Northfield Petroleum Limited (private equity investment firm).

Piskopianos (right) is currently Finance Director of AOS Fluency Limited (“business process outsourcing”) and Northfield Petroleum Limited (private equity investment firm).

Curiously, Crowd1 does not appear on Piskopianos’ LinkedIn profile.

Whether Piskopianos is working alone or with others to run Crowd1 is unclear.

Update 23rd March 2020 – Stelios Piskopianos appears to be a fall guy. Crowd1’s Spanish shell company records reveal Jonas Erik Werner is running the company from Sweden. /end update

Read on for a full review of the Crowd1 MLM opportunity.

Crowd1’s Products

Crowd1 has no retailable products or services, with affiliates only able to market Crowd1 affiliate membership itself.

Crowd1’s Compensation Plan

Crowd1 affiliates invest funds on the promise of advertised returns.

Crowd1 tracks and pays out returns through “owner rights” shares.

- White – invest €99 EUR and receive €100 EUR worth of owner rights shares

- Black – invest €299 EUR and receive €300 EUR worth of owner rights shares

- Gold – invest €799 EUR and receive €1000 EUR worth of owner rights shares

- Titanium – invest €2499 EUR and receive €3500 EUR worth of owner rights shares

Residual Commissions

Crowd1 pays residual commissions via a binary compensation structure.

A binary compensation structure places an affiliate at the top of a binary team, split into two sides (left and right):

The first level of the binary team houses two positions. The second level of the binary team is generated by splitting these first two positions into another two positions each (4 positions).

Subsequent levels of the binary team are generated as required, with each new level housing twice as many positions as the previous level.

Positions in the binary team are filled via direct and indirect recruitment of affiliates. Note there is no limit to how deep a binary team can grow.

Residual commissions are paid based on investment volume generated on both sides of the binary team.

Investment volume is tracked via points, which correspond with Crowd1’s investment tiers as follows:

- White – 90 points

- Black – 270 points

- Gold – 720 points

- Titanium – 2250 points

Crowd1 calculates residual commission using what they call a “1/3 balance” ratio.

A 1/3 balance ratio sees residual commissions paid out on investment volume generated on the weaker side of the binary team.

This volume is matched in triple against the stronger binary team side (assuming matching volume is available).

Once payable volume is tallied up, affiliates receive 10% of the total volume amount.

E.g. a recruited affiliate signs up at the White tier and is placed on your weaker binary team side.

This generates 90 points on the weaker binary team side, which is matched with 270 points from the stronger binary team side.

This calculates to 360 points in total.

A 10% residual is calculates on this point total, coming to €36 EUR.

Note that if 270 points doesn’t exist on the stronger binary team side, the system will try to match either double or an equal amount of points from the stronger binary team side.

If there isn’t enough to match the weaker binary team side, only 10% on the weaker binary team side points is paid out.

Matching Bonus

Crowd1 pays a Matching Bonus on residual commissions earned by downline affiliates.

The Matching Bonus is paid out via a unilevel compensation structure.

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

Crowd1 caps payable Matching Bonus unilevel team levels at five.

How many levels a Crowd1 affiliate earns the Matching Bonus on is determined by an affiliate’s personal recruitment efforts:

- invest at the White tier and recruit four investors = a 10% match on level 1 (personally recruited affiliates)

- invest at the Black tier and recruit eight investors = a 10% match on levels 1 and 2

- recruit twelve investors = a 10% match on levels 1 to 3

- invest at the Gold tier and recruit sixteen investors = a 10% match on levels 1 to 4

- invest at the Titanium tier and recruit twenty investors = a 10% match on levels 1 to 5

Streamline Bonus

The Streamline Bonus appears to be a way to increase owner rights share returns.

Crowd1 tracks the Streamline Bonus via company-wide recruitment. You sign up and everyone who joins after you falls in your Streamline Bonus.

There are “streamline levels” that correspond with how much a Crowd1 affiliate has invested:

- White tier affiliates receive three Streamline levels

- Black tier affiliates receive eight Streamline levels

- Gold tier affiliates receive twelve Streamline levels

- Titanium tier affiliates receive fifteen Streamline levels

Other than stating “all Streamline Bonus is payed out in exclusive limited Owner rights”, Crowd1 fails to explain how exactly the Streamline Bonus is paid out.

Fear of Loss Bonus

The Fear of Loss Bonus is a recruitment bonus, active during a newly recruited Crowd1 affiliate’s first fourteen days with the company.

During the Fear of Loss Bonus period, a Crowd1 affiliate earns

- €125 EUR per four White investment tier affiliates recruited

- €375 EUR per four Black investment tier affiliates recruited

- €1000 EUR per four Gold investment tier affiliates recruited

- €3000 EUR per four Titanium investment tier affiliates recruited

Gambling Residual

By convincing others to invest, Crowd1 affiliates can increase their share of company-wide gambling revenue.

The Gambling residual starts at 5% at the Team Leader rank (generate 500 points in weaker binary team volume), and increases to 10% for the Director (generate 500,000 points in weaker binary team volume) and higher ranks.

Joining Crowd1

Crowd1 affiliate membership is tied to a €99 to €2499 EUR investment.

- White – €99 EUR

- Black – €299 EUR

- Gold – €799 EUR

- Titanium – €2499 EUR

Conclusion

Crowd1 presents an open-ended investment MLM opportunity (no formal ROI structure), with pyramid recruitment to drive new investment.

Supposedly, Crowd1 generates revenue through online gambling.

Currently the most profitable industry is the gaming industry.

Crowd1 shall introduce our customer base to this industry in a

way that will create substantial recurring revenue for Crowd1

members without being a gaming company and without

arranging any payments to a gaming company.

Although it claims to generate external revenue through gambling activities, Crowd1 maintains it ‘must not be mistaken for a gaming or gambling company.‘

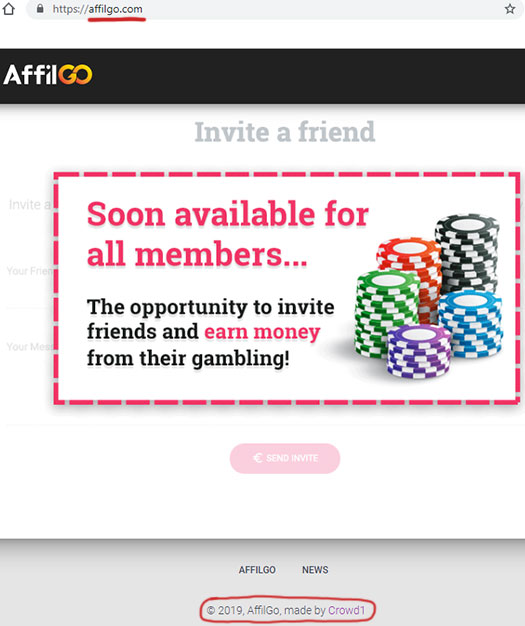

The gambling revenue is purportedly generated through third-party providers, which Crowd1 solicits through their Affilgo platform.

The Crowd1 customer base is then introduced to external partners through Affilgo, in the form of licensed gaming companies, where agreements are made for profit sharing.

As above, Crowd1 == Affilgo.

Naturally no information about any of the supposed gaming partners Crowd1 has is provided.

Yet despite that, the company simultaneously touts accumulated returns of 450%.

If we pull Crowd1’s business model apart, it quickly becomes apparent its a regulatory minefield on multiple fronts.

Gaming is strictly regulated the world over. Hence Crowd1 being shady about who their providers are, and clarification that they themselves don’t offer gambling services.

This is a regulatory concern in and of itself. With respect to the Crowd1’s MLM opportunity, the more pressing concern is the passive investment opportunity offered through “owner rights” shares.

The earlier you join during prelaunch, the more beneficial the Owner Rights program will be for you, as the Owner Rights will steadily increase in value.

All pioneers and members will be able to get a very good return on their Owner Rights since the user base will increase massively.

Crowd1’s owner rights investment opportunity is a securities offering, which requires registration with financial regulators.

Crowd1 provides no evidence it has registered with any financial regulator – namely in South Africa, the Netherlands and Colombia, which Alexa currently pegs as top sources of traffic to Crowd1’s website.

Having not registered with financial regulators, Crowd1 is thus operating illegally in every country it solicits investment in.

The only reason an MLM company would opt to operate illegally, is if it isn’t doing what it says it is.

In the case of Crowd1, that would be using external gaming revenue to pay out owner rights shares returns.

As it stands the only verifiable source of revenue entering Crowd1 is new investment.

Supporting the fact that Crowd1 has in fact no external revenue, is the 450% return claim weighed against the fact that Affilgo hasn’t even opened yet.

Using new investment to pay owner rights share returns to existing affiliates would make Crowd1 a Ponzi scheme.

On top of that you have recruitment commissions, adding a pyramid layer to the scheme (again illegal the world over).

As with all MLM Ponzi schemes, once affiliate recruitment slows down so too will new investment.

This will starve Crowd1 of return revenue, eventually prompting a collapse.

The math behind Ponzi schemes guarantees that when they collapse, the majority of participants lose money.

Hi some people say its this norwegian from Towah own this Mr. Tor Pettero and one swedish in Stokholm.

Wouldn’t surprise me. This one has Europe all over it.

Is this not a scam?

I’m not a financial expert but generally speaking investment fraud counts as a scam.

I really don’t care whether it a scam or not because i benefit a lots from crowd1 south african people are very very poorly so we will grabbing every opportunities (Ozedit: derails removed)

Thanks for being honest but don’t try to hide your scamming behind what the South African government is or isn’t.

You’re fine with stealing money from people who are doing very poorly because you are a morally bankrupt individual.

The least you can do for your victims is own your thievery.

Hi. May I know, after joining and recruiting two members, how and when am I going to be paid?

You’ll get paid when the two victims you’ve recruited hand over their money.

How? Who knows…

Can’t believe I been scammed. The ones who joined earlier have benefited a bit from it. Geez

To all fellow South Africans, this is how they make us eat each other in poverty.

Please learn to look past just your personal benefits in these types of schemes and think of the victims you recruit who will probably lead to ruined lives down the chain/pyramid.

I totaly understand that all this are not here to stay but I gerenally will beleive it when they open the South AFrican office in JHB on the 23rd this month.

and if its here to stay then lot will benefits from crowd1

Opening a bullshit office somewhere != “here to stay”.

A Ponzi scheme pays up for as long as new investors sign up. After that, kaboom.

Hi please get out of this scheme, it is not necessarily a scam but it is a pyramid.

No pyramid has ever lasted, they always fold – you will loose your money if you stay and you dont know when it will fold, not even the people at the top know that often.

Do people still get paid?

I’m sure they will, until new investment runs out.

My downliner bought white package problem he cannot login as for my manager is assist were not receiving emails while trying to change the password. please assist ive run out off a options.

Honestly there has to be a certainty guaranteed to investors or people who took the steps to join that they will get paid.

cause all in all crowd1 has to be a good story to tell not to make one to question him/herself.

Please assist how? You and your “downliner” invested in a Ponzi scheme and now your money is gone.

Sorry for your loss.

What are guarantees from scammers worth? They can give you any guarantee and you’ll then still lose money.

to people who have joined are there any changes since it was said that after affilgo launch your owners rights will be shares? or did affilgo launch yesterday?

I warned my mom to not get involved cos this Cloud1 thing just seems so off from the get go… She just wont listen.

This scheme is very shady guys, dont throw your money away for the hope of making a profit.

Stealing my money you will be cursed, for the rest of your lifes, here and in hell.

One of my tennents is so obsesed with this crowd 1 …i told her to stop depositing money in this scam but she didn’t listen she got angry ….

now lately shes so stressed and short tempered….i think she never get paid n lost a lot of cash.

So everybody here is talking abt hearsays…well I’m in crowd1 nd thr is no money I’ve lost but I’m making money… recently started my own little business wth crowd1 money.

Affilgo has launched, office in jhb has been opened…what more do u want loool.

CROWD1 Office has been established in Sandton. Crowd1 will grow and become bigger than big. As a South African I will take my chances because I have less chances of employment and an unstable economy ahead of me!.

What makes Crowd1 different to a pyramid scheme is that you can only register once off. The system will still operate without recruiting because members can sell and buy Owner Rights.

R1800 is a small price to pay when you have years of unemployment behind you and not much of chance of getting employed.

Crowd1 at least provides a bit of hope, and I can guarantee you it will be around long enough for people to make their money back!

There’s nothing hearsay about Crowd1’s business model, which is securities fraud.

Your only defense of Crowd1’s securities fraud is you’ve made money. As far as regulation goes, whether you’ve personally stolen money from those who joined after you is neither here nor there.

Yeah this has nothing to do with Crowd1 being a pyramid scheme. Crowd1 is a pyramid scheme because 100% of commissions paid out are tied to recruitment (no retail).

It’ll be a lot to pay once Crowd1 inevitably collapses.

Ponzi meltdown or regulatory securities fraud warnings, take your pick.

Hi, I have a friend who is obsessed about crowd1, I like MLM and this doens’t look like a legit bussiness to me.

I told him about the owner and he says that the founder is Jonas Eric Werner who appears in the Facebook page and a lot of videos.

My friend doesn’t speak english and we don’t have this information in spanish. So what do you think is the structure here? The owner, the founder? Very strange.

Securities fraud is securities fraud, doesn’t matter who’s running the company.

It’s a money game, pure and simple. Only a matter of time before it is deemed ‘not in the public interest’ and is shut down.

Until this time, I’m sure there’ll be high numbers of promoters earning good cash, which drives the greedy.

As suggested earlier, it is not a pyramid scam – the uneducated use this term all too often – a pyramid scam is where a price of product is inflated under contract through the chain of command (ie upline / downline) where it changes hands for a different price – but be in no doubt, this scheme is simple and open for any half brained individual to appreciate it’s a scam.

That’s a product-based pyramid scheme. You can also have a pyramid scheme in MLM when nothing is marketed and sold to retail customers. This is the case in Crowd1.

How come they are on top of the game, when you doubt them thats when they bring up something legit. openned office in manila and given SEC Certificate… isnt that legality enough already… next year they are openning offices in Malaga and London….

i have not joined but i still need more info on them so that i make informed decision. if at all im gonna get conviced to join them.

Nope. The Philippines isn’t even a top source of traffic for Crowd1’s website. That and it still means Crowd1 is illegal everywhere else (South Africa makes up just half of traffic to Crowd1’s website).

I can’t verify Crowd1 is even registered with the Philippines SEC at the moment because the search function is down.

By all means check to see if Crowd1 is registered to offer securities in your country.

All of you who are telling Crowd1 is a scam are sick. What do you have for us on offer while making noise to us about making a decision to join Crowd1.

“Blah blah Crowd1 is a Scam” yow chill & Shut da f*** up please.

Absolutely nothing. The world doesn’t owe you anything chief.

On a personal level nobody cares if you sign up and lose your money in Crowd1.

We’ll still be here when you pretend you didn’t know it was a scam but.

if you are not into it dont talk about it, do not try make people to hate what you hate. mind your business OZ.

I don’t know if hate is the right word when it comes to calling out scams.

Crowd1 is investment fraud. If calling it out makes your attempts at scamming others that much harder so be it.

I honestly couldn’t give a shit.

I seriously doubt the company has obtained a securities license in any country, and since they are promoting an investment, return on investment, shares, etc., without a securities license they would be violating securities laws in every country around the world with such laws in place.

Even if the company did have a securities license for a particular country, every person promoting the opportunity would be also need a securities license, just as a stockbroker needs one, and there’s no way that’s happening…

This is a blatant, illegal poniz/pyramid scheme that also happens to violate securities laws, making it doubling dangerous for those uninformed, misinformed, and misguided individuals who join, especially those in Africa.

The penalties for violating securities laws, as well as anti-pyramiding statutes, are severe, with Kenya, for example, hitting you with a jail term of several years and fine of $5,000 USD or more for first time securities violations, and a 10 year prison term and $100,000 USD fine for violating anti-pyramiding statutes…

It’s amusing, yet sad at the same time, to see some of the rationalizations that people in Africa use as their justification for joining and promoting such an obvious, illegal business opportunity.

Apparently they didn’t learn any lessons from the TelexFree and Zeek Rewards debacles and other similar programs that promoted investments and returns on investment…smdh (shaking my damn head)

SHAME …..you only make money by recruiting 4 people …..what kind of investment its this game the called dog eat dog ….. the guy came with this crowd1 hes mastermind …

just do calculation EUR99 PER PERSON TIMES BY 4 =EUR396 as you recruited them you get back ur EUR99.

what about those people they cant managed to recruit meaning you rob ur friends money or ur family YOU GONNA BE IN SHIT MY FRIENDS STAY AWAY FROM THIS SCAM.

scam scam scam until you loose ur last cents

We getting paid daily office is open affilgo has launched its running games n gambling.

guys fear of risk got u were u are today just man up get rich or die trying in trying u will lose it doesn’t mean u should not try again.

I understand Oz has been scammed too bad but the truth is crowd1 is here to stay n it’s making millionaire.

Whether you’re stealing money or not has no bearing on Crowd1 committing securities fraud.

If you have to make excuses up, you’ve already lost. See you when Crowd1 collapses.

Crowd1 has no clear education as they say they have an education package. I joined because they promised to pay us in December but it’s December now we have not been paid and there is no explanation.

They are taking an advantage of poor and vulnerable people.They are mostly in third world countries not prominent in these other rich countries.

I am in it but have a big question mark because they keep asking us to upgrade which means paying more money.

We need a clear explanation.

MLM + education package = scam.

Go look up securities fraud. You’re not getting paid because Crowd1 stole your money.

No new money = no payouts. You can work out what that business model is.

(Ozedit: derails removed) all the people you have convinced that Crowd1 is a scam, have now missed out their opportunity for joining soon one of the worlds most attractive Crowds.

Ponzi scheme or not? Jonas Eric Werner is right now creating the worlds number 2 affilate network after facebook. Every gambling or gaming companys in the world will pay billions for access to lets say 100.000.000 users.

I think that in the future you will not only see gaming or gambling platforms, but also commercials and other affiliate platforms. Commercials on the Crowd1 backoffice site, will be worth billions because members check their backoffice account several times a day.

OZ you dont have any visions at all. Worst of all you share your stupidity with people who maybe we will miss a big opportunity.

^^ Was going to spambin but decided I’d share the laugh.

If you have to pluck figures out of thin air, you’ve already lost. Furthermore South Africa and a few countries in Europe are all that’s keeping Crowd1 afloat.

There’s no 100 million users to sell personal data of, and there won’t ever be.

In any event, legitimate gambling outfits aren’t going to touch securities fraud Ponzi schemes with a barge pole. They don’t want that kind of heat.

Crowd1 has entered the flatline traffic phase now (Alexa), which means it’s only downhill from here.

Crowd1 can’t pull enough revenue out of Jonas Werner’s ass to pay you all, so sorry for your loss in advance.

See you when it’s time to pretend you had no idea Crowd1 was a Ponzi scheme.

Oz, Hi

1. Do you know for real if Crowd1 has securities or not in South Africa? I read you are very obsessed with securities.

2. I just bought a very detailed Real Estate learning materials from crowd1…so my 99Euros is back on this product.

On top of that I got somehow lucky to have been told that I had some 100 Euros to withdraw. I withdrew it for real.

I told my friend about this school and he also has a good story to tell. Do you honestly have a problem with that?

1. I assume you mean are Crowd1 registered to offer securities in South Africa.

The answer is no – you can verify here: fsca.co.za/Fais/Search_FSP.htm

Crowd1 isn’t registered to offer securities anywhere in the world.

Attaching a product to securities fraud doesn’t make it any less securities fraud.

You stealing money from people who invest after you doesn’t justify securities fraud.

Nope, couldn’t care less about you or your friend’s personal involvement in fraud. Best of luck with the scamming.

Thanks OZ,you have just opened my eyes before I could make a stupid mistake of my life (God bless you).

Sorry for your… oh wait. Thanks for the support!

The first time I heard about this, it seemed that all that keeps it going is attracing new members, as in new members ensure the older members get paid.

In the years since, I have not been convinced otherwise. At least in the past 9 months or so other people online seem to be reaching the same conclusion I did, so thank you for that.

It’s such a shame that those who are the worst off are getting conned into being worse off once this blows.

In every business or work you need to perform to get paid, where on earth have you sat home doing nothing and get paid? Scam or no scam, one has to work to get paid.

If you are in crowd1 do not sit and expect to be paid, you need to work like any worker or businessman. Sit and eat nothing. Work, recruit and get paid.

Nothing good comes from laziness, even at work if you do not perform you get fired n get no pay, Even proposing a woman you need to work hard, sacrifice, spend money until you get her.

So where is the difference, Crowd1 is your business make it work by recruiting new members.

Recruiting people into fraudulent investment schemes isn’t work. It’s fraud.

Your dumbass argument is the equivalent of insisting robbing banks, murder, assault etc. are work and therefore not illegal.

Stop making excuses for scammers.

Pure pyramid scheme definition. And I would not call pyramid scheme business, but scam.

All businesses go down if not well managed, so where is the difference.

All workers get hired and get fired for crumpling down the production, All owners of companies can decide to squander all money and close down companies making a lot of innocent people to lose their benefits and jobs, this is how other businesses chose to be.

Even if crowd1 falls as you say, it will be just like any other mismanaged companies. Where is your problem?

@kaMasoka

And pyramidscams are doomed to fail upon inception.

Where does the monies that crowd1 pays out come from? do you have any source, becuse if its a company surly there is accounting reports and “fisical year reports”, becuse companies have thoses, scams dont.

What’s your point? Or you so ignorant or… what?

Pyramid schemes are not businesses but scams. Full point.

All pyramid schemes are doomed to fail (sooner or later). Participants as group are in collective loss, because there is no added value, only money shuffled between participants (and part of this money is taken away by scam organisers).

Business may fail if selected and/or managed poorly. But well managed and reasonable business is sustainable and can be here forever (think e.g. about farming). There is a sustainable profit tied to the value added by business workers.

If you still did not get it: recruiting is not a work producing the added value.

This is the difference.

Except with Crowd1, though. Just search on “Crowd1 passive income”, and you’ll find tons of links to Crowd1 affiliates promising investors a passive income. That in fact seems to be their main selling point. Unless I misunderstand that term completely, it means being paid while sitting at home doing nothing.

Crowd1 itself disagrees with you. They tout themselves as “the number 1 Best Passive Income Investment”.

See: twitter.com/crowd_1/status/784798823604490240

But at least you’re refreshingly honest, admit that all that “passive income” guff is just marketing lies, and that’s it a pure pyramid scheme, with the only income coming from recruiting – until the pyramid inevitably collapses of course.

I’m crowd 1 member, there are empty promises about residual payout.

It was supposed to be in December, and it is postponed to February, now there is a special where you upgrade from white to gold.

I’m not sure if it will payout in February. Just like hedgefinity just vanished in a thin air with our money.it was promising heaven and earth just like crowd 1…. let me wait and see.

Crowd1 is a pure scam. Its sad people in Africa want get rich quick schemes by being lied to and promised owner rights they do not even understand or know.

I told my wife about this scam and she does not listen she is head deep in it.

Its quite sad its mostly the poor joining with their last pennies with hope of becoming millionaires as crowd1 promises to enrich their lives.

Hiya you all,

I’ve been really enjoying this ongoing conversation, some of you must rethink their purpose in life and be joining a group to convince.

Let me be clear, I respect everyone’s opinion but I was raised to learn before you join a conversation.

So I did.

If you look for transparency, you wił find it. Explanation on how to make money simple :fast cash flow but also long term… how it works even simpler, you can’t stop evolution of products.

Their partners, who are BTW very big wel known Names one is Codere headsponsor of Real Madrid for the last 7 yrs..!!! “Oz” you have an account please be so kind to provide the real info your not sharing.

And since you have been completely unreal and not honest, hear this: they have to work with all countries and uphold to their laws, as they are different everywhere.

They are real, have their shit together! it really works and because you have failed Doesn’t mean others wił do so to.

Even though you don’t like technology there is no stopping it.

(Ozedit: derails removed)

Hiding information do people have to go hunting for it is the opposite of transparency.

Money in, money out in returns. A simple Ponzi scheme is still a Ponzi scheme.

Legitimacy by association isn’t a thing. Who Crowd1 does or doesn’t partner with has no bearing on it being a Ponzi scheme.

Securities are regulated the same the world over. Either you’re registered in every jurisdiction you solicit investment in, or you’re operating illegally.

Crowd1 has no registered it’s passive investment opportunity with a single financial regulator.

I’ve shared what matters; a review of Crowd1’s business model, based on its compensation plan, which reveals it to be a securities fraud Ponzi scheme.

What “technology”? Crowd1 is a basic Ponzi scheme. It’ll stop when a regulator shuts it down or new investment runs dry.

BehindMLM is full of people crying about their Ponzi losses after the fact. They all go kaboom in the end.

Crowd1 owns Affilgo and AffilGO’s commission plan is unlike anything the i-Gaming industry has ever seen before with larger cash-backs and broader access to the most extensive entertainment industry.

How does it actually work? The company generously give back to all Crowd1 members.

If this was the case then Crowd1 would have no problem registering with financial regulators, and providing evidence to confirm use of external revenue to pay affiliate returns.

Instead it chooses to operate illegally in every country securities are regulated.

There’s a reason for that. It’s a Ponzi scheme.

South Africans always have negative comments. In this country there businesses operating illegally under the watchful eyes of the law. Let those researchers research how unemployment in this country will be eradicated.

I am answered by some who said no one is forcing anyone to join it’s a choice of an individual. All companies legit or not do close or retrench it will be no surprise if CROWD1 closes shop.

Let’s join to eradicate unemployment and poverty. You pay R1800 once off they recruit and earn money. Let us not be prophet of doom and end loosing out on an opportunity that could have generated income for some.

You’re not eradicating poverty by scamming South Africans through Ponzi schemes. If anything you’re contributing to it.

Honestly, the nonsense people have to come up with to justify stealing money…

what would anyone say about Johan Stael Von Holstein’s credibility in this regard of ponzi scum?

We fear sometimes, because as bit coin stall peoples money and disappeared, how are u prepared especially in Uganda Africa.

I’d say who is Johan Stael Von Holstein? (nuking in a few days if no answer provided)

Hi Oz Johan Stael Von Holstein is the face of crowd1 as we speak, apparently he is a CEO and I read in your report above here you mentioned a different name and different picture.

His profile is looking good What is your take on him.

Stelios Piskopianos is the owner of Crowd1 Network Europe Ltd and the company’s website domain.

This was when I wrote the review. Johan Stael Von Holstein was either in hiding or wasn’t on board yet.

My take is it doesn’t matter what his profile looks like, he’s running a Ponzi scheme.

Legitimacy via association isn’t a thing.

Crowd1 is a Ponzi schem as all of those we knew in the past. The only difference is that those others were paying 10% the tops (uplines) in cash but these are paying an air (electronic) money.

In same ways, with Novapago, they promised to pay cash since Feb 15th, 2020 but until today Feb 23, no any feedback.

Even if we expect the payments, they are not convincing. A Ponzi schem may pay even twice or more; but they will collapse at a point.

By definition, a Ponzi scheme is a form of fraud that lures investors and pays profits to earlier investors with funds from more recent investors.

This is all of Crowd1 is. At the end, the top will have money but those who will invest later will loose when the business will collapse.

This is starting to become a real wormhole. All management of WantageOne now is doing Crowd1.

After a complete failure, all jumped ship, starting with Udo Deppich & Kenny Nordlund, Björn Thomas, Hans Pasveer…. now they are probably merging the entire database of all members who lost money so they can lose some more.

Amazing to see how this progresses, this is the new One Coin scam, attracting all of the ponzi pimps from around the world, i will watch this play out, it will be just as ugly as one coin.

Ownerrighs = Air, and problems already started by management holding back payouts and convincing people to not sell. Because when sale starts it will poof everything.

Crowd1 have failed their chosen concept three times already, but good sales people manage to lure more fish to the hook and bait.

Be careful. I will stay here in Sweden and watch the office be raided.

I wonder when the might chicken Wahlroos will run , he talking crap again on FB.

People need to try anything to keep their families alive in a country that suffers from poverty. I think people from richer countries with better infrastructures speak to easily.

They don’t live among us to know the struggle. They don’t know that jobs in South Africa are as scares as rain in our own Kalahari desert.

They don’t know that you have to take what you can get to survive and keep your family secure and well and alive.

Yes maybe i made a R1850 mistake but at least i tried for my family so i can maybe give them a better life. And if i loose, that’s it i loose i will learn not to do it again.

JSvH was presented as CEO during the fall but when Norwegian media interviewed him in January, he backpedalled and claimed he was only brought in on consultancy basis. Crowd1’s Pitt Arens?

JSvH was a key player in the Swedish dot com boom. It all went bust but he got out well I guess.

Fellow South Africans.

This is a scam. From Sharemax to Miracle2000 to even a scheme in the 80’s where people were promised a reward for growing bacteria on milk powder?!

Let’s stop being so stupid. What is it that cuts across race and our backgrounds that makes us so gullible?

Here is a crash course in SA law:

1. Only banks, insurance companies and collective schemes are allowed to collect money. If they aren’t a deliberately unregulated stokvel for small amounts, stay away!

2. Anyone wanting your money, with the exception of people you trust in a stokvel, must be a registered Financial Services Provider with a number and license.

3. Wake the hell up

@Anna-mirrie

Please don’t try to justify Ponzi scamming with poverty. Absolutely shameless some of these Ponzi scammers.

Udo Deppisch seems to have indeed jumped to Crowd1 (instagram.com/p/B83LJOIAQT-/), but looks like Kari Wahlroos is still staying loayl to Wantage One: (facebook.com/KariWahlroosTheMightyEagle/videos/626907951465366/).

Not sure what happened, but Udo’s departure might be related to some problems in Wantage One that Kari vaguely refers to in the video above.

The Mightily Spun Eagle says that for the first time in company’s history, they made losses last week. Wantage One investors are clearly disappointed at something, and Kari admits that the implementation could be better.

I’d say that these are indications that Wantage One has collapsed.

Alexa shaws Wantage One has dropped from a ranking of 442,984 90 days ago to a rating of 994,579 today, leaving it sitting at 1,942,706 In global internet traffic and engagement over the past 90 days.

It has undergone an almost vertical drop in visitors over the past few weeks, so,

RIP Wantage

Deppisch off to Durban SA authorities need notifying.

I’ve just joined crowd 1 and I don’t see the reason to doubt since I’ve lost a lot of money gambling lotto and other so called legit marketing like selling products hoping to make it big only to be left wanting with no income.

When aligning yourself with this kind of business just be bold to risk cos it is a win loose situation. Go in with open mind and be wise to move.

I’ve lost thousands playing lottery so I’ll also take this as a game enjoy while still last.

Oz I’m not saying you wrong or right it your opinion. If you go to the deep for fish and you cash non its not your day. You have a choice, wash your nets ank badk in the sun or pray for a miracle second time around.

Everyone is at libarety to decide, I may get in and make millions or loose its my baby.

How about a woman who can’t pay madhonisa and loose her property isn’t cash loans scams. I’m going for it win or loose.

Your gambling addiction and shit marketing skills are not an excuse or justification for financial fraud.

A scam in which the majority of participants are mathematically guaranteed to lose money isn’t a game, it’s a scam.

I never gave any opinions. Crowd1 is a securities fraud Ponzi scheme. That is fact.

“How about” hypotheticals are not an excuse or justification for financial fraud.

Sorry for your loss.

That’s a really dumb ass logic!

WOW!

I had to read each and every comment here, I laughed, and almost cried. Its so sad how low people are willing to go just to make money.

As we speak, I have a relative who now hates me but putting on a face, only just. Why? Because I refused to join these ponzi schemes that she’s busy peddling on FB. I am so sick of it!!!

Initially I had fallen for some of her schemes that looked legit and I lost money and I learned a lesson.

She kept coming for more, I refused. And I am writing reviews on my website to warn other people.

I could go on and on but let me stop here.

Bottom line, Crowd1 is a ponzi scheme. Good luck to the stubborn heads!!!

I truely cannot believe all the crap i just read from fellow south africans.

I now see why scammers like the country so much because its so easy to scam people here.

Too stubborn to listen and jump into cult like behaviour quickly. And the most important, GREED.

Ive voiced my opinion on crowd1 on various social media platforms and got attacked. People from crowd1 font want to told that they promoting a scam, a very clear scam.

Ive done thorough research on their leaders and founder, its safe to say that crowd1 is indeed being operated by experienced scammers.

They planned thing pyramid scheme very well, try to make every look legit, targeting africans (especially south africans) because they know my fellow south africans like quick money.

Our people never learn, south africans are always attracted by these scams, when will they learn? Thats why these scammers targeted south africa because they saw an opportunity to scam the poor.

Once recruitment slows down in south africa, it’ll be the end of crowd1, because thats where majority of crowd1 steals money from, and soon, I mean very Soon South africans will be wanting their money back.

Hey All,

I was alos looking around and checking this company. I found very clearly visible that they are really scammers. I cannot believe how people are able not to see that.

What is always important from where the “stated” money is company. Crowd1 mentioned on all forums, that :

You will earn money with your phone.

This is totally bullshit, as they have “no product”, what is generating money via, phone. They only solution is an application, which is simple an WEBITE converted to an PHONE, so peopel think thjat this is “generating” money? Omg…. how?

Secondly, I was also checking all the mentioned partners :

SBA, LTECH and PremierBET.

All this menioned partners, are not PARTNERS..On their website, is never mentioned the AFFILGO or the CROWD1 as cooperation partner.

I wrote to all of them, an inquery email, hope to get some feedback from them. If yes, I will post this here also.

Thirdly, I would like everyone to check ALEXA…

alexa.com/siteinfo/crowd1.com

CROWD1 state, that they have worldwide 1.5 million members. How? If you look on the ALEXA stat, you will see only couple countries. The 2 million people cannot be… never…

I think, maximal 15.000 – 20.000 people are involved in this, but now I see also, an slowing down of the process.

Like in the previous mail mentioned, I’m also sure , that when the fog will disappear, people, also in outher countries will begin to want they money back.

Also, it’s an shame from the CEO, that he is participating in this. I was also looking all his videos, and was wondering how he do not recognize this, what big SCAM this is. I think, that was his last move on an business carreer.

Hope to avoid as much as possible people from this.

And here the official answer:

On Saturday, February 29, 2020 9:14 AM, SBA Customer Support wrote:

Screenshot please.

Yeah, what a surprise that the partnerships they are claiming to have don’t really exist. 😉

And in terms of MLM-Ponzi scamming script, I think gambling is not an ideal choice to begin with, because gambling is by definition a negative sum game.

No new economic value is created through gambling. (The opposite is more true — that gambling in fact destroys welfare because it too often leads to addiction that ruins lives.)

The gamblers’ money is just resuffled while “the house” takes a cut.

(Claiming to do arbitrage or AI bot trading, like many MLM-Ponzis claim to do, is much better scam script, because financial asset markets at least can be “positive sum games” and arbitrages do really exist.)

My understanding is that the return rate in online gambling platforms is usually somewhere around 95%.

It means that if 1 000 000 USDs are put in, “the house” will take a cut of 50 000 USD from that revenue, and resuffle the rest among the gamblers.

Affligo claims to be “profit sharing” 50% with various gambling platforms, so that would make 25 000 USD in Affligo “profits” if that million dollars was “invested” by the Crowd1 members.

Crowd1 further claims to divide that “profit” between Operational (20%), Owner Rights (40%) and Network (40%).

So the whole Crowd1 concept doesn’t make sense to me, even as a clear-as-day MLM-Ponzi.

@OZ, screenshot of what?

Your convo. You can remove any personal info (or leave it up to me if I decide to publish).

Here, the original email from SBA :

ibb.co/r7PpD3h

Thanks for that.

Welcome!

I’m waiting still for the answers of the other “BUSINESS PARTNERS”…. 🙂 When they arrive, I’ll post them also here.

Hi Folks,

Was thinking to share some important info to you all. As the CROWD1 – who want to change everything 🙂 – as they stated in they promotional video, uses as “income” GAMBLING sites. Sure, that could – I say could – sounds good idea, but as mentioned above, that this is really an stupid thing, as this should be also visible on the given site. As they promote this hard.

The idea is, that their massive client mass will go and begin to “play” to the connected sites. And from this sites the company is earning back.

With this the following problems are :

– First of all, if you look the mass of people who joined to the CROWD1 cloud, the age and type of people, are absolute not the “gamer” types. Okay, suerly, some could be, and then…

– The next problem is, if you try from the internal backoffice to go to the Affilgo site, and from their go to an “GAMBLING” site, which should be the MAIN INCOME (!!) for the whole system, you will be surprised!!!!

First of all, their is only 12 games possible, and the funny thing, that NONE OF THAT had any link to ANY SITE !!! you will see nice pictures, and explanations of the GAMES !!!

So, that means… NO GAMES… NO INCOME…. So, money only comes from the paying people….. We all know the names of THIS GAME !!!

I post here some internal pictures, what they use for advertising their NOTHING !!

I think, their promotional SENTENCE says also everythings…

IMPOSSIBLE IS NOTHING… sure, because this is NOTHING…

ibb.co/F4gyQQ8

ibb.co/55kfwcY

ibb.co/GpsSPyj

Sorry for the long story…

Most people who are joining this are not new to MLM they already know its a pyramid with makeup to look attractive and they know there is a point its going to fold but before it folds there is an opportunity to make money so as much as u want to convince people that its fraud or a scam they already know…

As long as u can recruit mothan 4 people u get much more than ur initial investment. so the brutal truth is if u are not ready to recruit dont join but if u can then join as long as it’s still paying you have more to gain than lose.

@.carter

BehindMLM identified Crowd1 as a Ponzi scheme in our review. We aren’t trying to convince anyone anything. Facts are facts.

If desperate schmucks weren’t trying to convince people it wasn’t a Ponzi scheme there’d be no discussion here.

Ah to own up to scamming people seems to be the new way to justify a scam in progress.

I often wonder does this apply to your own family would they count in your tally of people you scam first?

Or in this case as long as it pays you it isn’t a scam!!

Most people that join don’t know its a scam – that is how people get duped into these in the first place.

Ponzi scammer logic never fails to amuse.

I have spoken with serveral not so happy Crowd1 members that have put in for withdraws via BTC, and have been waiting over 2 weeks.

They have emailed support and the reply was waitng time is 3 to 4 weeks and increasing because they have 2.5 million regaitered members.

Support suggested they cancel withdraws and purchase a voucher and sell it as that would be quicker.

So here we go Oh Oh, Those of us the have been around block a few times, usually knows what that means?

Crowd1’s current promotion is an absolute doozey, purchase a pack and they will upgrade to the next highest pack FREE, including all the extra binary points which they have to pay out on & owners rights which are supposed to earn a profit share, sometime in future years.

This means they are paying out on double to three times the points on half to three times less the amount money/BTC recieved, (ah actually they are not paying) plus all the double and triple Owners rights.

Maybe their product is actually big conventions, seminars and cruises and supporting local car dealers in South Africa?

Buying cars with your MLM earnings is the most batshit stupid thing anyone could do, such a waste of money. Nice showy display good for the company, bad for the individual. They need to put that MLM money to work, then go buy a car with those profits.

Lottery and gaming MLM? Practically banned everywhere but all the big time earners are pimping Owners rights like the have some sort of immunity agreements with the authorites.

These people need to see the New MOBE judgement demand promoters pay back $41 Million in illgotten earnings. Oh and the Zeek rewards Case and dozens of others where propmoters had to pay back all they stole.

Looking over everything, Crowd1 websites, back office, video’s zoom calls, news releases, they appear to be oblivious to being complaint and having said that i dont think they ever can be compliant with their gaming and entertainment business model they promote.

The payout on enrollements/recruitment, the product they are promoting is not even launched yet, Owners right are a regulated security, the vale of the business education is what got Mobe shut down. They entice people to join with FOMO bonus and the list goes on. Over half a dozen govenment authorities are raling against Crowd1.

Then there is the managements recent reply to BON saying,

BON Wrong.

It sounds like ET Go Home. Totally idiotic.

They cant be serious, (thats just a saying) as it seems they are serious.

The low level of regard for authorities is astounding. Like OZ said right at the start of this thread and i will embellish a little, its has Eurpeon aggorance wirtten all over it, as it appears all the European MLM under belly is pimping Crowd1 like no tomorrow.

Every Red Flag you could think of is fying full mast on this deal,

i dont give a flying frizzbee, what management are saying and what all their so called credentials are, expescailly, MR 3 Unicorn man Stock market bell ringer, Johan Staël von Holstein Manglevortonova.

The whole thing is a dogs breakfast, the likes i thought i would never see again after OneCoin & CloudToken, Cyrpto888, Nano Club, Ormeus, Sitetalk, Uniaco, OPN,

Remember This,

Recently, the SEC has sued the alleged operators of large-scale pyramid schemes for violating the federal securities laws through the guise of MLM programs.

When considering joining an MLM program, beware of these hallmarks of a pyramid scheme:

-Properly run MLM programs involve selling a genuine product or service to people who are not in the program.

-No demonstrated revenue from retail sales. Ask to see documents, such as financial statements audited by a certified public accountant (CPA), showing that the MLM company generates revenue from selling its products or services to people outside the program.

Udo carsten deppisch in this now , got out of wantage one because not enough to scam. left the mighty chicken Wahrloos on is own.

What a pair of lying , cheating , scum.

Oz this has been brought to my attention.

UPDATE 2nd April 2020: The new Crowd1 head office is located in Spain and Crowd1 has registered under a new name:

Impact Crowd Tecnhology SL.

Does this company feature for you elsewhere per chance?

Also GDPR now comes into play.

Crowd1 have admitted they cannot open in the USA due to allegations of breaking the Wire Act and to quote their own PR piece issued last week:

‘In USA apparently some old legislation against organized crime (Wire Act 1961) is preventing them from moving on due to a technicality’

I wasn’t aware the law was a technicality? :o)

Sounds like they’re playing the shell company bank account game.

They need to go further back. The Securities and Exchange Act dates back to 1933.

alright oz, i stuffed up and didnt read this article before handing my money over and joining..

i like MLM and was actively looking for one to join during lock-down. i didnt realize how obvious of a scam this was due to the owner right fraud. the owner right and all the bonuses did sound way to good to be true and that is why i joined.

my initial thought was, there’s no way someone or a group could be pulling off such a scam/ponzi at this level of professionalism and mass, even now im still finding it hard to completely believe as the company continues to grow and update daily on their website.

what seems to be an opportunity to be apart of the future could now be another meme once again for me. but lucky for me i havent told or sold Crowd1 to anyone nor do i plan to so i aint got shit to explain to people when or if it does collapse. ill just take my $100 lesson and move on.

now im this massive crowd1 group on facebook where i see new members getting recruited daily by their own family members… all they talk about is the fact that they now can earn their money back from recruiting ex amount of people and getting this and that bonus. NO ONE TALKS ABOUT THE EDUCATION PACK!! I BET NONE OF THEM EVEN READ OR CARE ABOUT IT..

such a shame because MLM is meant to be people passionate about the product or service not the compensation plan or bonuses.! I’VE BEEN SCAM!!

If i may give my humble opinion on that,

Lets say that this was a scam…

if you think someone feels scammed because he may or may have NOT lost 99 EUR… (Ozedit: snip, see below)

Crowd1 is a scam because of its business model. How much people lose in a scam is irrelevant in determining whether or not a company is a scam.

Even if it is a scam? Say I take the opportunity (99euro) , Pay it forward because you have to spend money to make money?!

My 4 people.. they sort of take the same approach and pay it forward to the next ? (Not all 4 maybe 1 and half’s w 1) after that 14 day cycle and “receive the bonuses”.

At 14 days can I withdraw the money? Than my 4 after their 14 day but the pay it forward system Just keeps going I guess but we’ve taken out our “investments” and haven’t lost out?

My theory was if it is a scam? Sweet then let’s make it a scam but with the intention of building it up together (close ones, your 4) GET IT, GET OFF, GET OUT? And whatever after will be?!

You’re shit at math.

Crowd1 is gaining momentum in Kenya. Guys have started to target the peri urban centers where they hope to find easy, gullible prey for their indecency.

What are they selling? Nobody has an idea. Where are their officesaround here or contacts? It gets more comical, that this is virtual, they answer by making comparisons with Amazon or Facebook or locally, Jumia. Guys with remote knowledge of how such companies operate admire their masters with awe.

Greed.

Listen guys, basic things GIFTS.Greed, Indifference, Fear of loosing Out, The Jones theory, Sense of urgency, etc is the scammers cardinal approach.

They have satisfied all the above. Ruuuun.

Seems like this article is missed here in the discussion…

[NoLink]www.businessforhome.org/2020/02/crowd1-ceo-is-johan-stael-von-holstein-a-fair-short-review/

Now – Business for home is quite liberal when talking about MLM business – but now they have put down some really hard words…

“Is it Crowd1 legal and sustainable?

We believe Crowd1 CEO Johan Staël von Holstein is a fine entrepreneur, with a great vision, however we have our doubts if the opportunity is legal and sustainable. In the present form its a recruitment only opportunity, regulators in many jurisdictions do not like that at all…. We noticed in Namibia the opportunity is on 24 February 2020, banned by the Bank Of Namibia.”

Given the pay for comment nature of BusinessForHome and history of Ponzi promotion, I don’t take their reviews seriously.

Ted will take your money and put up a puff piece devoid of critical analysis.

Somtimes he’ll put something together worth reading in poor English. The rest of the time though it’s paid content and copy+paste press-releases.

At the latest when serial fraudsters like Udo Carsten Deppisch are involved, it is a rip-off and you will lose your money!

See OneCoin, The Crypto Group, Wantage One and many more in last time.

Im another Crowd1 Dummy! Signed up this week thinking i could learn to invest with a user friendly App to help me.. oh the trickery little fraudsters!

How dare they target auduence families through facebook group chat using zoom app…

Its all recorded on fb, no has digital invisible foot prints were stuffed at any moment once investigators, securities fraud are coming im scared now and its not my fault i was tricked so not fair for all of us that are not aware.

Im ashammed and now i need to notify the group im in and others, but will they listen? I need to tell my bank now far out!

Thank you for those willing to expose Crowd1 please keep going..

Check out Australia & New Zealand Crowd1 Facebook page groups this needs to stop ruining lives!!!

@Crowd1 Dummy2

Depends how deep they’re into it. The scammers earning money on referrals most likely won’t.

You’ll probably find yourself removed from the groups you’re in too.

I am surprice that the Bank of Namibia, which is the reseve bank, has clearly stated that promoters will be fined as these actions are against the law of Namibia, but the people believe they will easy pay these fines as they earn so much money and the fines are peanuts.

Secondly the Namibia government did not prosecute the promoters there yet.

If all this money is coming from the gambling community, I will not gamble any more as I cannot afford millions of people sitting on their computers to become members and share the profit the gambling companies are making. I will have to fine another entertainment to relax.

It’s not – https://behindmlm.com/companies/crowd1-gambling-partner-claims-no-cooperation/

What if it collapses? And government steps in… will I as a member who earned a lot of money and spent it.. be forced to pay back all the money I earned? Can this happen?

It can happen, yes.

Given Crowd1 is active in third-world countries, retaliation from those you scammed is also a possibility.

Here is the latest information about the company.

impactct.com

Taxes are paid to Europe as it is headquartered in Barcelona, Spain.

Taxes schmaxes. The “latest” on Crowd1 is that it’s still illegally offering unregistered securities.

There’s a reason Crowd1 isn’t registered with the CNMV or any other financial regulator, it’s a Ponzi scheme.

Nobody pays taxes to “Europe”. If you mean that word as shorthand for European Union: the EU doesn’t have tax-raising powers.

A company based in Spain obviously is subject to Spanish taxation. Plus to whatever taxes in other countries its business activities in those countries make it subject to. It is up to the tax authorities to see that they comply with that.

That is not the problem. The problem is that Crowd1, or Impact Crowd Technology as it’s started calling itself, sells securities. That requires registration, in each country where they’re selling them.

Interesting “latest information” would be a list of all such registrations Crowd1/Impact Crowd Technology has newly acquired. Because according to all information available so far, it doesn’t have any.

We are 3 million member registered in crowd1 as of april 26 2020.

We still earning and all transaction was legal. Any problem ? Why peopel like U want to rurn down business?

Infact this online gambliing business.

Please take note this onlinr gaming , a digital its mean gamble. Do u understand?

And?

Just that securities fraud and Ponzi schemes aren’t legal. Small problem when you’re a morally bankrupt scammers, I know.

Nope – https://behindmlm.com/companies/crowd1-gambling-partner-claims-no-cooperation/

I emailed the partnered companies myself yesterday and got an instant response that they ARE NOT AFFILIATED WITH Afilgo. I can forward those emails to anyone who wants to see.

But remember, if you’re an Affiliated Partner or Member with Crowd1, then you’ve signed up to Ts and Cs that state:

Basically, since you’ve signed their Ts and Cs, you can’t even check if they are BS’ing you.

And please, be careful, because, they can terminate your account at their discretion, at any time and without reason:

I have spent a fair amount of time just reading the Ts and Cs. It’s clear that Oz is doing you all a HUGE favour by showing you the truth behind this – and since it’s covered extensively, I’m going to add comments on Ts and Cs.

He’s absolutely right about everything. My only advice would be that if you’re outside your 14 day cool off period, please do not deposit any more money.

Accept what you’ve lost, but don’t lose anything more. Don’t recruit / entice any more people into this scheme as their losses will be on your conscience.

Read the Ts and Cs in FULL. If reading that doesn’t chill your blood, then you have a very high risk appetite. I’ll shortcut the 33 pages for you and tell you your rights: NONE.

1. You waive your right to sue (but you will have to sue Impact Global in Spain if you can afford it, and since Crowd1 sits in Cyprus, good luck with that if you have the ambition to go against the terms you willingly signed up to).

2. You waive your right to bring a claim of any kind (and their statute of limitations is 3 months! If you know how limitation periods work, then you know that you have a right in law (5 years in Spain), but also, from the time where you could reasonably have come to know of the issue).

3. You waive your right to refunds of any kind.

4. Your succession rights mean nothing – there is nothing to inherit (more specifically, your descendent mentioned in your will can continue holding the account and doing business but if they close, there is no refund, so yeah, they are prisoners without any payout)

5. If you close your account, you lose everything in your wallet.

6. They can close (at their sole discretion) or suspend (with a notice to your email) your account at any time. You can appeal, but their decision is final and there are no dispute resolution channels.

7. And the best one of all, my favourite is that you are nothing of them and in no way affiliated to them in any way. You are Independent. You’re not allowed to use their logo, talk about them, talk about potential revenue…nothing.

And if you do…you risk them suing you for copyright infringement, account suspension or termination. And of course, with that, you lose everything.

And please become a regulatory and taxation expert in the country in which you reside and/ operate…because this is on you too. It’s YOUR responsibility to make sure you absolutely comply with all rules.

If you haven’t read the fine print…please do so today: crowd1.com/static/documents/TERMS_CONDITIONS-Crowd1-V008-04.23.2020.pdf

The idea of a contract where one party signs away their right to take the other party to court if they don’t honour the terms of the contract is quite hilarious.

In fact, how can a document that one party can change entirely unilaterally, just by “posting on Company website” (p. 30), even be considered a contract?

But beyond all the other obvious illegality, there was this provision that caught my eye:

(p. 1), which they repeat at the end (p. 34) as:

This is a contract with Crowd Impact Technology SL, a Spanish company. All the legislation they’re subject to is in Spanish, any court case against them would be in Spanish. They even, quite unnecessarily, add that (p. 30):

Therefore, it would be entirely up to a Spanish court to decide whether or not T&Cs in English has any validity at all, or whether they can even be cited in court without being translated first.

It’s not something a company can unilaterally impose on a court. English doesn’t have any special legal status, and there is no requirement for any Spanish judge or any Spanish lawyer to know any English, AFAIK.

While there are no EU-wide rules about this, and some EU countries have no specific legal rules about languages used in contracts at all, there are a number of cases where website T&Cs only available in English have been ruled null and void by courts. And this document goes far beyond generic T&C stuff, this is a far-reaching business contract, 34 pages long.

Swindlers who have not yet paid dividends, they only promise to pay, but I do not do it …

This is another pyramid that simply collects our money and as soon as they lead us all by the nose.

I consider the case closed on CROWD1 and if you are still defending it your need to check your morals – businessinsider.co.za/namibia-bans-the-crowd1-as-having-no-product-other-than-new-members-2020-2

I made an account to confront and learn what they are trying to teach me what to do. All in all if you are oblivious towards these scams and a muddlehead you would really fall for crowd1.

I tried to evoke his conscience but damn he’s a fanatic at believing that it’s legit, he even sent me pictures of proof it was legit though our country informed the public not to engage with it.

They say that our government is “misinformed” about the situation. I kinda feel bad for my classmates who tried to poach me in doing illegal stuff since they’re ignorant about it.

Greed really transform someone in a way we can’t understand but can spell it to one word Idiot.

I’m from the Philippines it’s next target. Here some alibi from them.

mindanaotimes.com.ph/2020/05/04/crowd1-sec-was-misinformed-for-raising-flag-on-entity/

It’s always funny when scammers think they can preach regulations to regulators.

To all people who believe that Crowd1 is a legit business opportunity and nothing like a Pyramid scheme or a Ponzi scam because Crowd1’s business model does not fit the definition of these scams (according to Crowd1 bullshitter Christopher Healy on YouTube).

I say this – if you put 1% ham on a 99% shit sandwich, would you consider it as a ham sandwich and eat it? Crowd1 = 1% business model and 99% Pyramid/Ponzi model.

If you feel like you have become a victim of Crowd1 pyramid scam, please do report it to the relevant authorities in your respective countries.

In the U.K. please report it to ACTION FRAUD and in Australia please report it to SCAM WATCH.

My friend’s in the Philippines is trying to convenience people to join Crowd1. He is a firm believer, posting pictures of money he made so far.

He is talking about making more than 1000 Euro so far, posting handful of money pictures on social media.

I didn’t want to join and said i do not believe this is legit and he is not even talking to me since.

Did anyone really make money? I mean if he made his money back he invested, then more, I don’t think he really losing anything by joining.

Wouldn’t only the people on the bottom lose their money when it is about to crumble? Now they are making some. It will stop but now they are making money.

They don’t really care that they are taking money from people under them.

Until you can convince people to join you will make money. So am i correct that there will be some winners of this scam, the ones who join early? It is in the early stages in the Philippines.

Therein lies the rub. If you’re a scumbag with bankrupt morals, nothing is going to stop you stealing money from people through Ponzi scams like Crowd1.

Of course he is not talking to you. Your moral stand has revealed his immoral core, and he resents you for it. It is not your wrongdoing; it is his own guilt gnawing at him.

That, and the fact that you were not willing to turn your money over to him. Don’t be like that. You don’t want to exploit others for your own gain, and you certainly don’t want to turn money over to scammers.

My friend’s in the Philippines is trying to convenience people to join Crowd1. He is a firm believer, posting pictures of money he made so far.

It all started with friendship or a post with “earn 6-7k a month, pm is the key” or like posts however as the 14 days starts to end they’ll turn to group chats and private contacts.

Then if you entertain they’ll refer you to the group chat then some “expert” will teach you how to “scam” others.

The biggest catch is that these “experts” aren’t CPAs or people who with credentials to teach you regarding “investments” the person who “taught” me was a project development analyst. He doesn’t even know what solicit means.

They are caring to the people who joins and will not listen to people who have different opinions.

As far as they are concerned money coming from scams is still legitimate money.

facebook.com/lowell.fieldad

This guy is one of the scammers in Philippines.

LUKE,

Better REPORT THEM TO SEC PHILIPPINES. recruiters are consumed by their greed..

they dont care if its legit or not as long as they earn.. so better report them to authority for them to take legal action..

there is already sec advisory in the philippines.. next thing will be ceast and desist order..

lets pray to that..

Yes! Crowd 1 is still running big in philippine! Now is also kangot!

Crowd1 leaders keep recruiting members to kangot now. Report to sec.

Why do regulatory bodies allow such schemes to run for so long without intervention to save the ignorant desperate people?

Isn’t their job to protect innocents and prevent them from exploiting would be desperate citizens from even becoming more desperate?

Regulators won’t do squat until the number of complains not reached a certain treshold.

People waiting for the latest promised “profit” payout on the 15 of may. Yeah, 2048 May 15 maybe..

Hmmm I have been around in this world for quite a few years, not much though, but enough and I’ve learned about 2 things:

1: If you’re not born rich, it takes dedication and hard word to become rich, the legal way

2: If it sounds too good to be true then it is definitely too good to be true

There is no “get rich quick” scheme that is legal. So… if you’re investing in CROWD1 and it works out for you, well, I tip my hat to you and all the best.

I prefer to work hard to make a living. I have more surety that my way is more sustainable than MLM or any similar products.

So, people who joined to Crowd1, how is it working out for you? Are they doing everything they promise? Do they pay? Do you actually get real money out of it?

I think it’s hard to lose lots of money, eventually everyone will just lose their own money if they keep investing in it.

The people who join later, they will lose what they invest in it. They are all adults though and they have to know investments are never guaranteed. You should invest only if you don’t mind losing that money. Like in ANY investments.

Hard Worker says above, and it is so true: if it sounds too good to be true it probably is. That’s how I think about it. If they want to do it, and try their luck I won’t get butthurt. Their choice.

That’s fine on a personal level, I’m much the same. But it’s important not to diminish Ponzi schemes like Crowd1 are firstly scams and secondly illegal the world over.

Has Crowd1 stopped the withdrawal? Or having withdrawal delay?

I am rather disgusted by some of the justifications put forward here although I am not in the least surprised being South African myself and knowing how South Africans are.

After going through this entire thread and trying to find more info on the net, I came across a very distressing article that came out on 14 May in a well known publication in SA called Moneyweb stating that the National Consumer Commission is not investigating Crowd1 even though our neighbour Namibia found it to be a Ponzi scam.

The article also includes an official response from Crowd1 disputing the Namibian Reserve Bank’s findings and defended themselves (which was humorous to me) claiming they are not a Ponzi Scheme as they don’t have a sign up fee, they ‘sell educational materials’ and their income is 100% from the sales thereof.

I learnt in the article that according to our Consumer Protection Act, the National Consumer Commission takes precedence over the Reserve Bank, Financial Intelligence centre and tax authority over investigating Ponzi schemes.

It is worth noting that a complaint need not be made for them to do so and they have done so in the past.

Given that all that classic hallmarks of a Ponzi scheme are present here, the high prevalence of these types of schemes in SA and the fact that C1 opened an office here and that SA is notoriously one of the most corrupt countries in the world, I am convinced they must have been bribed but I also think that C1 is exploiting every loophole possible.

What people fail to realise here is that it is not just the $100 you stand to lose in the end, if you worked really hard and managed to recruit a lot of people, you stand to lose all the accumulated commission in your account when “investments” dry up and you are unable to withdraw it.

That being said, I think there is also reliance on the fact that not every recruit will be successful in recruiting people and will eventually give up trying.

For a majority of cash strapped, highly indebted and low earning South Africans $100 is a lot of money which they don’t just have lying around let alone having that kind of money to risk losing.

That being said, with the kind of returns promised, they will borrow it from family or make use of loan sharks if their credit record isn’t good enough.

It appears people are already having difficulty withdrawing their commissions as the process becomes increasingly delayed due to what the company is claiming is due to ‘high volumes’.

As somebody mentioned earlier somewhere in this thread, with these types of schemes you are able to withdraw your money at least twice but at some point you will be unable to.

Worth noting also is that SA has very strict Foreign Exchange regulations. All funds received from abroad must be reported to the Reserve Bank and the Revenue Service.

You may not hold foreign currency for more than 30 days so for example with PayPal you must withdraw the funds within that period.

I saw somewhere that affiliates receive their money in BTC which is obviously how C1 gets around all the exchange controls. At some point though, if you want cash you will have to withdraw that BTC from your wallet into your account which is when it will get flagged.

I can see a lot of people(especially South Africans) failing to disclose this income in their tax returns, in large part due to ignorance of tax regulations.

Below is a link to the article. FYI, before you even try to defend C1/yourself and attack me, note that I actually have a Degree in Economics and after considering all the facts and information my conclusion is that C1 is a textbook Ponzi scheme(not to be confused with scam).

Thanks for all your work and efforts to expose this OZ.

moneyweb.co.za/news/south-africa/consumer-commission-not-looking-into-crowd1/

South Africa is batting on par with Norway as far as regulators doing SFA against securities fraud.

As for what I am reading here I hear nothing but assumptions and speculations (Ozedit: snip, see below)

There is nothing to “assume” or “speculate” with respect to securities fraud. It is very real and regulated the world over.

If you want to accept Crowd1 is committing securities fraud and not address it, fine. But that’s not an excuse to go off your own tangent.

I cannot believe that there are so many people walking around with blinkers on.

Oz is 100% correct this is a Ponzi scheme that is under investigation in Europe (where they supposedly are so strong) for securities fraud.

They are banned in a number of countries (Including the Asian country that is supposed to be their regional office).

I am not an economist or have a degree in finance (or any other degree for that matter) but I am able to read, search the web and make educated decisions.

I am yet to find any scheme were one only gets paid when they they recruit other people who have to buy in and that is not deemed a Ponzi scheme.

If is very hard to recruit like what i am facing right now. Is this going to affect my payments as an individual. I am on black and still my affiliates are running away from me.

With Crowd1 being a Ponzi scheme, company-wide recruitment slumps then yes the company will have nothing to pay withdrawals.

Backoffice monopoly money however will likely continue as normal.

Hi..roumers tell that Philippine and India members not get paid for last 2-3 weeks all stand on pending….is it the end of Crowd1 ?

Could be. Although rumors don’t count for much.

Is it true? It’s still getting paid till now.

Hi @Oz

I’ve taken my time to read through comments here about Crowd 1 and its operations.

I’m an IE student in South Africa, and was sponsored into Crowd 1 last night by a good friend of mine.

I have participated in MLM’s such as Forever Living Products, and Longrich. I’m not familiar with security frauds, and would like to know why Crowd 1 is still allowed to operate irregardless of these allegations.

As compared to the other MLM’s, the noticeable difference is that Crowd doesn’t have tangible products. These include financial education materials which we can deem as E-books. I know Play store sells books of similar nature although they don’t come in packages but are redeemed individually.

C1 is definitely not the first Ponzi to hit an impulsive populous that willingly invests in MLM’s. SA is extremely social and gullible due to the economic imbalance between the wealthy and poor. C1 isn’t the only ‘legitimate’ scam that affects our country (and the world).