Crowd1 now selling shares in new UK shell company

![]() Crowd1’s virtual shares scheme has come full-circle, with the Ponzi scheme now spruiking virtual shares in a UK shell company.

Crowd1’s virtual shares scheme has come full-circle, with the Ponzi scheme now spruiking virtual shares in a UK shell company.

Crowd1 launched in mid 2019. The original Ponzi concept was affiliates investing in “owner rights” for virtual shares.

Since then Crowd1 has launched one ruse after another, in an attempt to convince affiliates their virtual shares were worth something.

Crowd1’s owner rights have consistently paid peanuts. Clearly most of the money pumped into the scheme has been retained by its owners.

This culminated in former Crowd1 CEO Johan Stael von Holstein cashing out and doing a runner in December 2020.

Prior to disappearing, Holstein spent 2020 pitching a ‘3 to 5-year plan to bring Crowd1 into the NASDAQ and become a publicly-traded company.’

For most of 2021 Crowd1 has been drifting along. None of the company’s previously launched ruses have generated any significant profit.

Crowd1’s latest ruse was an attempt to cash in on the short-lived NFT fad.

Planet IX was announced back in April. It went nowhere and has been quickly forgotten about.

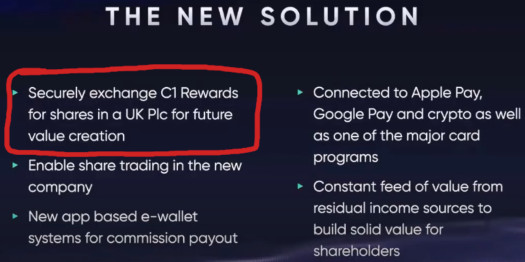

Now Crowd1 is pitching “shares in a UK PLC for future value creation”.

PLC stands for “public limited company”. As of yet Crowd1 hasn’t revealed the company name.

UK as the selected shell company jurisdiction shouldn’t come as a surprise. Companies House has been synonymous with corporate fraud for years.

So the pitch goes, at some point Crowd1 affiliates will be able to worthless “ownership shares”, for equally worthless virtual company shares.

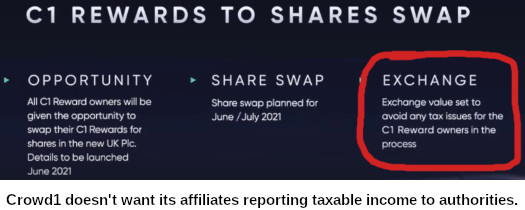

As per the marketing, the “share swap (is) planned for June/July 2021”. Interestingly, Crowd1 is also pitching their new ruse as a tax loophole.

The primary reason Crowd1 wouldn’t want affiliates to report taxable income is because it’s a Ponzi scheme.

Believing a virtual shares scheme “avoid(s) any tax issues” is a risk Crowd1’s affiliates take without any legal support from the company.

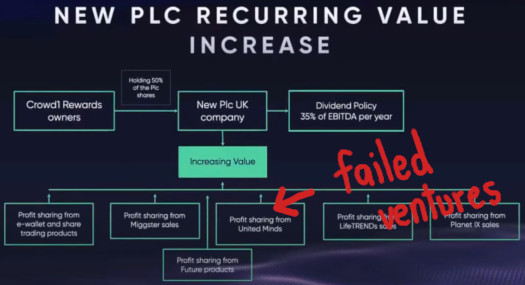

What’s amusing about Crowd1’s new share opportunity is that, on paper, it’s no different to failed virtual ownership scheme.

As above, you’ve got the same failed ruses being touted as providing “increasing value”.

EBITDA stands for “earnings before interest, taxes, depreciation, and amortization”. 35% of EBITDA will be set aside to pay Crowd1 affiliates who have invested in virtual shares.

The kicker is we already know these ventures aren’t generating profit, because historically Crowd1’s ownership shares have paid peanuts.

This is the same failed investment scheme, repackaged to pitch to new investors.

Soliciting new investment is Crowd1’s only significant source of revenue – and has been since day one.

Looking further down the track, Crowd1 is pitching its own stock trading platform as “Multiwallet”.

Presumably this will be run through the yet to be launched UK shell company. Or it could just be run illegally, with Crowd1 who knows.

What we do know is none of this will be launched with Crowd1’s own company name.

To date Crowd1 has attracted regulatory attention in no less than thirteen countries; Peru, New Zealand, Mauritius, South Africa, the Philippines, Norway, Namibia, Paraguay, Gabon, Vietnam, Cote d’Ivoire, Slovakia, Hungary and the Czech Republic.

On its website Crowd1 represents it is based out of a PO Box in Dubai.

With no active regulation and practically no extradition treaties, over the past few years Dubai has emerged as the MLM scam capital of the world.

The last time an MLM Ponzi scheme used a UK shell company to commit financial fraud, it took the FCA eight months to shut it down.

How long Crowd1’s UK shell company survives remains to be seen.

Update 13th October 2021 – Crowd1 has unveiled the name of their UK shell company as Digital Partners Network.

The FCA seem to be the kind of regulator who do more good by staying in bed rather than reporting for work

New PLC, swapping Ponzi points for shares… So, isn’t this an IPO exit scam?

A bit like these same “Scandinavian Ponzi Vikings” pulled off successfully with Unaico/OPN/Sitetalk & tried but failed with OneCoin.

It’s their trademark, so perhaps they should consider patenting it. 😉

*swapping Ponzi points for virtual shares.

I don’t think they ever intend to issue actual shares. Even UK authorities aren’t that slow.

I suppose the exit-scam could be

“Oh look they shut down our

shell companytotes legit company.Oh well, your shares are gone now. The UK govt has them. Our hands are tied.

Time to join von Holstein on a private island somewhere!”

No doubt any company related to Crowd1 will find becoming an Electronic Money Institution in the UK a breeze, effectively enabling it to take deposits into the suddenly vanishing e-wallets.

You dump. Do you even know how crowd1 is operating. Don’t go behind the affiliates who could be mis-selling or mislead.

On the first page of any presentation it says its not an investment and not selling shares! Are you deaf? Or are you even blind? (Ozedit: derails removed)

Yup. Morons such as yourself invest and those who joined before you steal your money.

Yet Crowd1 solicits investment and illegally offering shares is exactly what they are doing.

Ponzi scammers lie. Welcome to sorry for your loss.

This just emailed, Oz, your thoughts please? It’s obvious that

a. The PLC is nonsense

b. Any inactive or angry victims won’t swap so all of their liabilities get washed away

c. Nonsense exchange rate means an even worse deal for the victims of the scam

d. It’s not like it matters anyway, because the PLC is never going to work, it’s never going to pay out on the shares and will probably never exist.

e. Even if this PLC exists and even if they actually launch on a tiny stock exchange, there won’t be any value at all in these shares.

The whole shtick of Crowd1’s Ponzi was “we’re generating from the bullshit launches we have every few months”.

It’s obvious there isn’t enough new money coming in, so returns plummeted. Whether that’s through “rewards” positions or virtual shares is irrelevant.

The point is there’s not enough money to withdraw, as happens in every Ponzi scheme.

Also you can’t have a “working title” company registered with regulators. So all that’s happened is “virtual rewards positions” –> virtual shares. Both worthless if there’s no new investment coming in.

Hopefully UK regulators will shut this crap down once the shell company name is leaked. Not holding my breath though.

scammer everywhere God will punish them.

It is the “multi wallet” that is scary.

Jonas Werner and fellow parasites effectively becoming unlicensed deposit takers needs to be stopped in it’s tracks. Before hackers run off with all the crypto.

Crowd1 is very quick to launch products that are going to make people pay, but they delay processes which will make withdrawal to become fast.

They started by crowd1 pay cards but they disappeared with no traces, now they are promising people multi wallet.

It’s now September but still no proper date for a launch of this multi wallet thing. They are people who withdrew money in January but still pending.

They pay affiliates by business points which they don’t want them back to purchase their products which shows us that these business points are welthless.

If they wealth something than why don’t they allow their affiliates to use them back???

What are the odds that there will be some “administrative fees” for swapping your C1 rewards to shares?

That’s how Ponzi schemes work.

The name of Crowd1’s UK PLC was revelead:

DIGITAL PARTNERS NETWORK PLC

find-and-update.company-information.service.gov.uk/company/13532707

source:

youtube.com/watch?v=eOr7W0xwFX8

Yup. Looks like an exit-scam to me.

Crowd rewards is free to collect every wednesday since crowd1 started in january 2019 and as a pioneer member of Crowd1, all i have to do is patiently wait for the rewards to share conversion, because they only give the rewards for “free”.

And the rewards lead nowhere. They weren’t free, you had to invest. Sorry for your loss.

Good day,

Please when is our shares going to be paid into a Nigeria currency, and when I checked the swap information.

Nigeria as a country is not included not to talk of the banking, so when are we going to be paid, mercies are loosing hope, make this hope happen.

You’re not getting paid. You the rest of Africa paid for Europeans to live it up in Dubai.

Crowd1 is a Ponzi scheme. Sorry for your loss.

Everybody my downlines asking me when we get crowd1 shares. nobody invest in cargo because of they are not getting money in crowd1 shares.

They are telling first complete one then we invest. dont delay to release crowd1 shres thank you.

You and your downline don’t seem to have grasped your money is gone yet.

See those lavish productions coming out of Sweden and Dubai? You and your downlines paid for that. You also funded and continue to fund the lifestyles of Crowd1’s top scammers.

Even if virtual shares are issued, they are worthless. You’ll be no better off than you are now.

Something something hey look over there! Planet IX NFTs nobody gives a fuck about…

Probably at the same time as the OneCoin exchange finally opens…

We like to see the PLC shares price to crowd1 members to be paid in profit.

What you’d “like to see” doesn’t matter. You invested into a Ponzi scheme and your money is gone.

Your PLC shares were never worth anything. Sorry for your loss.