Booster Review: Matt Ferk discovers AI-generated slop

Booster, aka Booster AI, Booster International Corp and Booster Lifestyle, fails to provide ownership or executive information on its website.

Booster, aka Booster AI, Booster International Corp and Booster Lifestyle, fails to provide ownership or executive information on its website.

Booster’s website address (“boosterapp.ai”), was privately registered on December 3rd, 2024.

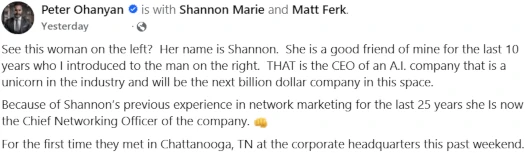

Further research reveals Booster marketing videos hosted by CNO Shannon Marie and “corp leader” Peter Ohanyan.

Ohanyan credits Shannon Marie with twenty-five years of network marketing experience. I wasn’t able to verify if any of that was at the executive level.

Peter Ohanyan is a serial promoter of fraudulent MLM investment schemes (NRGY, RB Global Crypto Bank, The Berlin Group, 3T Networks, GroceryBit, USI-Tech).

Over on Ohanyan’s FaceBook profile, we find a post citing Matt Ferk as “CEO of an A.I. company”:

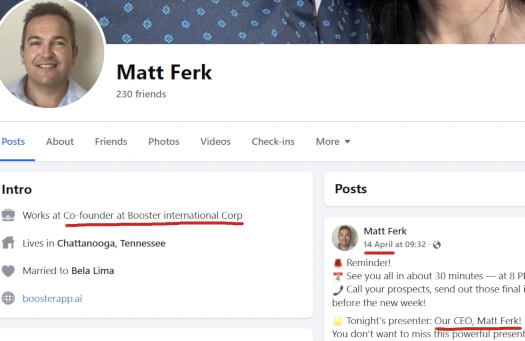

On Ferk’s own Facebook profile we confirm he is Booster’s co-founder and CEO:

Ferk appears to have made a name for himself in Lyoness (aka Lyconet, Cashback World and currently myWorld).

Ferk joined Lyoness in 2010. Ferk’s Lyoness run as a promoter lasted till around 2018. After Lyoness Ferk got into professional gambling.

In 2022, Ferk rejoined Lyoness as CEO of myWorld in the US.

Ferk claims he resigned from myWorld after “learn[ing] the real inner workings of” Lyoness. When exactly Ferk resigned is unclear bu the was still promoting myWorld mid 2023:

Why Booster executive information is not provided on Booster’s website is unclear. One possible reason is Matt Ferk, aka Matjaz Ferk, is a wanted fugitive.

In 2021 the DOJ filed a Complaint under seal. The complaint detailed Ferk’s status as a wanted fugitive in Slovenia.

Slovenia had sought extradition of Ferk from the US, prompting the DOJ’s Complaint.

Being a fugitive from the Republic of Slovenia, which has sought FERK’s arrest with a view toward extradition from the United States, pursuant to the extradition treaty between the United States and Slovenia, 18 U.S.C. § 3184, for committing commercial fraud and tax evasion in violation of the criminal laws of Slovenia.

As above, quoted from the DOJ’s Complaint, Ferk is wanted for commercial fraud and tax evasion.

As detailed in the DOJ’s Complaint, circa 2006 Ferk was running a debt collection fraud racket. Ferk’s company Palas was selling non-existent debts to victim companies.

The business records of PALAS, of Victim-I, and of the Purported Debtor Companies reflect that FERK used forged signatures and fake documents (bearing fake stamps, fake invoice numbers, and/or fake debtors’ statements) to cause Victim-I damages of approximately €621,645.766 in exchange for the supposed rights to collect these nonexistent debts.

FERK knew that the claims to the debts did not exist and were based on forged documents.

During the investigation, FERK admitted that he had forged the invoices and the notices of assignment of claim.

FERK also asserted that he used the money he obtained from Victim-I to repay outstanding loans to the mafia.

Ferk’s companies also failed to pay invoices pertaining to purchased construction materials.

Ferk was indicted in Slovenia in 2013 on business fraud charges. A District Court in Murska Sobota convicted Ferk on business fraud charges in April 2014. Ferk was sentenced to one year in prison.

Ferk appealed the sentence twice but the conviction and sentence were upheld. An international arrest warrant was issued for Ferk in March 2024.

In December 2014 Ferk was charged with tax evasion. Circa 2010, Ferk filed false tax assessments detailing fake services performed and corresponding invoices.

Concluding Ferk was “evading criminal proceedings”, Ferk’s indictment was refiled in May 2020.

Upon an investigation by United States law enforcement, FERK was found living in Hamilton County, Tennessee, within the jurisdiction of this Court.

The details of Ferk fleeing Slovenia and turning up in the US with an active international arrest warrant out on him are unclear.

The DOJ’s Complaint was filed under seal based on an investigation concluding “FERK likely will flee if he learns of the existence of a warrant for his arrest.”

Ferk was arrested on January 21st, 2021. Following payment of a $30,000 appearance bond, Ferk was released either late January or early February 2021.

In his opposition to extradition, Ferk argued that the extradition treaty between Slovenia and the US required extradition to take place within the statute of limitations of equivalent charges in the US (mail or wire fraud and tax evasion).

This was five years for business fraud and six years for tax evasion.

On February 1st, 2022, a District Court in Tennessee denied Ferk’s extradition.

On the business fraud charges;

Because the Republic of Slovenia requisitioned the United States to extradite Ferk, the United States’ limitations period applies to Ferk’s business fraud charge.

Thus, under the applicable five-year U.S. limitations period, the Slovenian government had until December 18, 2012, to file an indictment; however, Slovenian authorities did not file the indictment until October 8, 2013.

The United States’ Motion for Certification for Extradition is hereby DENIED WITHOUT PREJUDICE as to the business fraud charge under Article 234a of the Slovenian Criminal Code.

And for tax evasion;

The Republic of Slovenia alleges that, in January 2010, Ferk submitted false data in connection with a value-added tax assessment of approximately €51,000 EUR.

Local prosecutors then indicted Ferk for tax evasion on December 17, 2014. There is no question that the December 2014 indictment falls within the applicable six-year limitations period.

However, subsequent developments with respect to the Slovenian tax evasion charge complicate the timeliness issue.

This pertains to the refiling of Ferk’s tax evasion indictment in 2020.

Slovenian prosecutors waited nearly five years before indicting Ferk in 2014.

Three years later, in July 2017, a Slovenian Court dismissed the December 2014 indictment.

Applying 18 U.S.C. § 3288 for tolling purposes under Article 7, the Slovenians had six months to re-indict Ferk after the limitations period expired or file for tolling of the limitations period.

They did neither. Instead, they chose to resurrect the dismissed 2014 indictment in 2020, which placed Ferk’s prosecution outside the six-year limitations window under 26 U.S.C. § 6531(2).

Accordingly, Ferk’s charge of tax evasion is timebarred under Article 7 of the Extradition Treaty.

To the best of my knowledge Ferk remains a wanted fugitive in Slovenia through three filed criminal cases.

Coinciding with Booster’s launch, Ferk threatened OffshoreAlert with litigation for reporting on his extradition proceedings back in January.

In an email sent to OffshoreAlert, Ferk asserts its coverage of his extradition proceedings is “inaccurate and defamatory”.

The post in question alleges that I was being prosecuted in a 2021 extradition request. However, the claim is demonstrably false and misleading.

This case was finalized and closed in 2021 by the U.S. Federal Court in Tennessee, with a verdict of NOT GUILTY/NO EXTRADITION.

If the post is not removed before January 15, 2025, I will have no choice but to involve my legal counsel to pursue all available remedies, including seeking damages for defamation and reputational harm.

As of April 2025, OffshoreAlert’s posts on Ferk’s extradition proceedings remain available.

As per BehindMLM’s own research into Ferk’s extradition proceedings above, we can confirm there was no verdict and Ferk wasn’t found “not guilty”.

The DOJ’s requested extradition application was denied due to statute of limitations technicalities. Ferk has yet to serve prison time on his business fraud conviction, or answer for the underlying alleged tax evasion fraud charges.

Beyond Ferk, Booster’s other co-founders are not disclosed.

Update 20th April 2025 – In the twenty-four hours since this review was published, Booster appears to have made changes to their website.

When I was researching Booster yesterday the website was stuck on a “replicated for affiliates” page, as documented in the conclusion of this review. This was the page presented, irrespective of any links clicked on and opened.

Today Booster’s website provides a bit more information, including executive information.

Ferk is acknowledged as a co-founder of Booster. His Booster corporate bio acknowledges his criminal activity but deflects the conduct, which he admitted to as per the DOJ’s filings, as “fabricated charges” from politicians.

Ferk’s bio also falsely states;

A groundbreaking case in U.S. Federal Court examined the allegations and deemed them unfounded.

As per detailing of Ferk’s extradition case detailed in this review, at no point did the Tennessee District Court find Ferk’s criminal charges in Slovenia were “unfounded”.

Marko Kesteli (right), from Croatia, is listed as Booster’s other co-founder and COO.

Marko Kesteli (right), from Croatia, is listed as Booster’s other co-founder and COO.

Kesteli is credited with “15 years of experience in network marketing”, which I was unable to verify.

Finally it’s worth noting Shannon Marie is cited as a “preferred shareholder” of Booster.

Booster isn’t registered with the SEC so what Marie is a preferred shareholder of is unclear. /end update

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money.

Booster’s Products

Booster has no retailable products or services.

Affiliates are only able to market Booster affiliate membership itself.

Booster affiliate membership provides access to various AI-assisted tools of unknown origin.

Booster’s Compensation Plan

Booster pays commissions on shopping activity and AI service subscriptions tied to an unreleased app and services.

These commissions are paid via a unilevel compensation structure.

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

Booster caps payable unilevel team levels at ten. Commissions are paid as a percentage of subscriptions and fees paid across these ten levels as follows:

- level 1 (personally recruited affiliates) – 25%

- level 2 – 20%

- level 3 – 15%

- level 4 – 12%

- level 5 – 8%

- level 6 – 6%

- level 7 – 5%

- level 8 – 4%

- level 9 – 3%

- level 10 – 2%

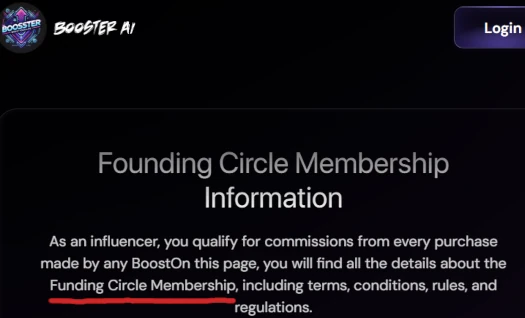

Booster also offers a “Founding Circle Member” membership, starting at $250.

Booster takes Founding Circle Member membership fees and pays recruitment commissions down four levels of recruitment:

- level 1 – 5%

- level 2 – 3%

- level 3 – 2%

- level 4 – 1%

In addition to recruitment commissions, Booster also distributes 11% of “registered (app) users” to FCM affiliates.

- pay $250 to $2999 in Founding Circle membership fees and receive a share of 7% of all company-recruited members “based on contribution amount”

- pay $3000 to $9999 in Founding Circle membership fees and receive a share in an additional 1% of all company-recruited members

- pay $10,000 to $24,999 in Founding Circle membership fees and receive a share in an additional 1% of company-recruited members

- pay $25,000 to $99,999 in Founding Circle membership fees and receive a share in an additional 1% of company-recruited members

- pay $100,000 or more in Founding Circle membership fees and receive a share in an additional 1% of company-recruited members

Joining Booster

Booster affiliate membership is free. Booster Founding Circle Membership starts at $250:

A member can upgrade to Founding Circle Member (FCM) – a paid membership with a minimum one-time contribution of $250 (no upper limit).

Booster claims to offer a “7-day full refund guarantee” on FCM membership payments, minus an 11% processing fee.

Payments within Booster are processed in USD and various cryptocurrencies.

Booster Conclusion

Booster can be described as yet another “over the hill” marketer discovering AI-generated slop and trying to make a quick buck.

Booster itself seems pretty half-assed. A visit to the company’s website reveals little to no information.

![]()

Instead of transparency, visitors to Booster’s website are presented with AI-avatar marketing videos. The videos don’t disclose crucial information such as products and pricing.

Matt Ferk also appears to be trying to get his own Lyoness “cashback” clone off the ground;

Shopping Volume Commission (SVC) … is earned based on the shopping volume generated within your organization.

Ferk’s Lyoness clone appear to be run through an undisclosed app.

That Ferk spent the 2000s committing fraud in Slovenia, after which he fled to the US only to sign up to promote the Lyoness Ponzi scheme is of significant concern. Ditto Ferk’s presumed still active fugitive status in Slovenia.

Coupled with Booster having been launched prematurely and the lack of disclosures, this one is an easy avoid.

Update 20th April 2025 – Matt Ferk has been in touch to confirm Booster currently has no retailable products or services;

We have just completed the Merchant Platform, which will be released this Monday along with the first six product modules.

Additionally, the Consumer App has just been finalized and is scheduled for release within the next 14-15 days.

Note this is at odds with Booster’s corporate website, which states;

The first version of the Booster App is expected to launch by June or July 2025.

Full development, including all planned features, may take 12 to 18 months, depending on various factors.

What concerns me on the MLM side of things is Ferk’s claim that, as of April 20th, Booster has

approximately 1500 affiliates – about 1220 are Booster Promoters, and around 280 are Booster FCMs.

With no retailable products, Booster has been running an MLM pyramid scheme built around its FCM membership.

There’s also potential securities fraud, pertaining to “no upper limit” FCM payments.

According to Ferk, FCM payments

help fund the ongoing development of the Booster platform, which is projected to reach a $25 million investment.

Booster also characterizes FCM membership payments as investments as per their termination policy;

Refund Process for Revoked Memberships:

Refunds will include the member’s initial investment, minus:

- All earnings received.

- 20% of total payments for distributed commissions.

Additionally it appears FCM membership was originally “Funding Circle Membership” but was changed to Founding Circle Membership at some point. You can still find references to “Funding Circle Membership” on Booster’s website(s);

Booster does clarify that FCM affiliates aren’t co-owners or shareholders…

Founding Circle Members are not co-owners of the company and do not hold company shares.

…but this raises three additional questions:

- why would anyone pay over the $100,000 minimum for maximum company-recruited member share?

- why is Booster using investment terminology with respect to FCM membership fees?

- does this tie into Shannon Marie being a “preferred shareholder”, and if so a “preferred shareholder” of what?

I can see someone paying $100,000 or more, getting company-recruited members, them not spending anywhere near enough to recoup that $100,000 “investment”, being pretty salty about their “investment”.

Apparently FCM members can request a refund at any time and only take an 11% hit? Where is that money coming from if FCM “investment” is used to “fund the ongoing development of the Booster platform”?

Ferk also claims Peter Ohanyan

is not in any way officially connected with Booster Corporation. He is simply one of over 1,500 independent affiliates.

This is clearly false when Booster marketing cites Ohanyan as a “corp leader” and has him fronting official corporate marketing presentations.

Rather than note individual updates to our originally published Booster review, I’ve gone through and made significant edits based on communications with Ferk.

This includes BehindMLM’s independent research into Ferk’s extradition proceedings.

Update #2 20th April 2025 – Matt Ferk has acknowledged Booster marketing material citing Peter Ohanyan as a “corp leader” is an error.

I agree it should not say corporate, but it should just say Leader that was just something that the marketing person did when he designed the slide and I will tell them that in future, it only needs to say Leader.

Ferk maintains Ohanyan is not part of Booster’s corporate team, but also argues that “corp leader” doesn’t infer a connection between Ohanyan and Booster corporate.

My response to Ferk on that argument is it’s a stupid argument.

Update #3 20th April 2025 – Matt Ferk has clarified Shannon Marie’s “preferred shareholder” status;

Booster International Corp is a privately owned company. At its formation, the company issued 10,000 shares. The current ownership structure is as follows:

-Matt Ferk: 49.5%

-Marko Kesteli: 49.5%

-Shannon Marie Rudderham : 1%

As we are a privately held corporation, we are not publicly trading shares and therefore are not required to register with the SEC.

As long as Booster’s shares aren’t publicly tradeable, Ferk is accurate in claiming Booster doesn’t need to register with the SEC.

I have suggested if Marie is going to be publicly cited as a shareholder, this private ownership structure should be clarified publicly wherever Marie is cited as such.

Significant updates to our Booster review have been added, including input and additional information from CEO Matt Ferk.

Interesting reading Oz – been appearing in my FB groups this month,

Oz, you’ll get a kick out of this — we actually did a 2½-hour live Zoom with Matt Ferk himself, going through your BoosterCorp AI review line by line.

It turned into a full-blown live investigation, complete with him accidentally confirming the 10-level MLM payouts, defending the Founding Circle “not an investment” buy-in, and making some wild claims like having “1,000 developers” (later walked back to outsourced third-party vendors).

We also dug into their refund policy, which is stacked to protect the company, and confirmed from U.S. court filings that Matt has an active extradition request from Slovenia for fraud and tax evasion.

The whole thing was bloody hilarious — he even gave us a guided tour of his Wix site while claiming they build “proprietary AI platforms.”

If you want to see it in action, the full review video is up now — it’s basically a live companion piece to your article, with extra red flags you might not have had at the time.

Public Statement for Verification

We have received information from a credible technical source with direct knowledge of BoosterCorp.ai’s operations alleging that the company’s much-hyped “Booster Nova” AI assistant — sold to customers for $19/month — is in fact a lightly modified version of an existing free tool, Google Gemini.

The source claims this “product” is essentially a rebranded template with a Booster logo and a handful of API keys, offering no unique AI capabilities beyond what is freely available from Gemini itself. If accurate, this would mean customers are paying for a crippled, restricted version of a free service.

We are calling on AI developers, software engineers, and technical analysts to help verify this claim. Our request is simple:

Inspect Booster Nova’s functionality compared to Google Gemini

Identify if the service offers any original AI models or proprietary features beyond branding and UI changes

Determine whether the $19/month fee is justified or simply a paywall around a free service.

BoosterCorp.ai’s CEO, Matt Ferk, has publicly claimed in Zoom presentations that they have “built their own ChatGPT” while also admitting in writing that the platform “uses Google Gemini 2.5 as its core AI source.” We believe both statements cannot be true without heavy qualification — and we want this clarified in the public interest.

If you have the skills or tools to test and compare Booster Nova’s backend, please reach out and share your findings.