Apex Financial: James Ward’s APT Ponzi token scheme

Apex Financial operates in the cryptocurrency niche.

Apex Financial operates in the cryptocurrency niche.

The company’s website domain is “theapex.app”, which was privately registered on January 12th, 2021.

Apex Financial provide a number of executives on their website. The only person who actually seems to exist is James Ward.

Rather than disclose ownership of Apex Financial, Ward has set himself up as Head of Marketing.

James Ward is the face of Apex Financial and hosts the company’s marketing videos:

James Ward (right) first popped up on BehindMLM’s radar in 2010, as the CEO of LGN Prosperity.

LGN Prosperity marketed travel vouchers, with each voucher generating a position in a matrix 2×2 cycler.

Following months of affiliates not getting paid, in mid 2011 LGN Prosperity morphed into LGN International.

This name-change brought on the addition of commissions paid on travel services booked through LGN.

LGN International eventually collapsed in mid to late 2013, with Ward heading up iBizWave as CEO and co-founder in early 2014.

In 2015 Ward launched 2SL Start Living, which saw him return to the travel MLM niche.

2SL Start Living was short-lived, prompting Ward to launch Pangea in 2016.

Pangea’s original business model was a matrix cycler hiding behind travel.

By early 2017 Pangea had collapsed. Ward rebooted Pangea with a new compensation plan.

The only material difference was the cycler expanded to three tiers, so it’s not surprising that Pangea 2.0 also didn’t last long.

In late 2019 Ward resurfaced with Sports Trading BTC, a crypto Ponzi scheme.

Sports Trading BTC collapsed by December 2019, prompting Ward to reboot the scheme as Global Credits Network.

As per website traffic charts provided by Alexa, Global Credits Network collapsed in or around April 2020.

In late June 2020 Ward launched his first smart-contract Ponzi scheme, Lion’s Share.

One can safely assume that the launch of Apex Financial means Lion’s Share has or is on the verge of collapse.

In an attempt to appear legitimate, Apex Financial bangs on about incorporation and having registered with the SEC.

For the purpose of MLM due-diligence, basic incorporation anywhere is meaningless.

Incorporation in jurisdictions chosen specifically for their lack of MLM securities fraud regulation is even more meaningless.

The BVI, Cyprus and Dubai are all scam-friendly jurisdictions.

To evaluate Apex Financial’s SEC regulation claim, I hit up the SEC’s Edgar database.

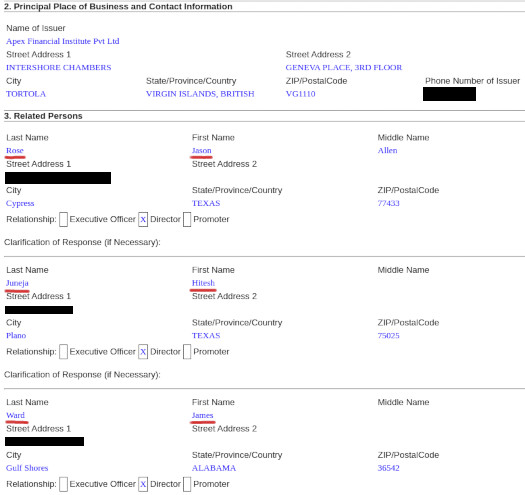

Apex Financial Institute filed a FORM D Notice of Exempt Offering of Securities on March 16th, 2021.

There is nothing about Apex Financial’s passive investment opportunity in this filing.

What the filing does confirm is James Ward is a co-owner of the company. Apex Financial’s other two owners are Jason Rose and Hitesh Juneja.

The last time we came across them Rose and Juneja were launching Rise Network. This was back in November 2019.

Rise Network’s website is still active, however Alexa traffic estimates reveal a collapse beginning mid 2020.

Why James Ward is the only Apex Financial owner mentioned on the company’s website (and even then Ward isn’t credited as an owner), is unclear.

Read on for a full review of Apex Financial’s MLM opportunity.

Apex Financial’s Products

Apex Financial has no retailable products or services.

Apex Financial affiliates are only able to market Apex Financial affiliate membership itself.

Apex Financial’s Compensation Plan

Apex Financial affiliates purchase AFT tokens from Apex Financial.

Apex Financial sells AFT tokens to affiliates at a 1:$1 exchange rate.

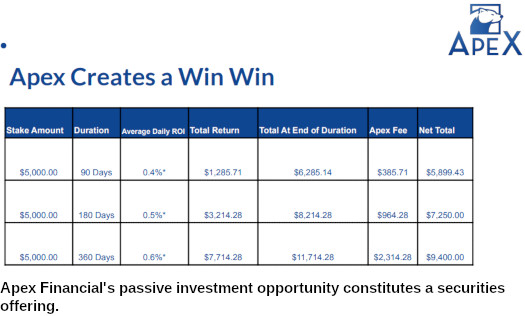

Once acquired, AFT tokens are parked with Apex Financial on the promise of advertised returns:

- Apex Rise – invest 500 AFT or more and receive 0.3% to 0.6% a day, paid over 90 weekdays

- Apex Scale – invest 2000 AFT or more and receive 0.4% to 0.7% a day, paid over 180 weekdays

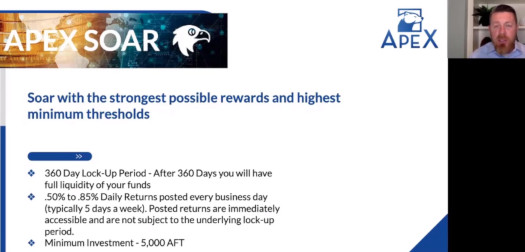

- Apex Soar – invest 5000 AFT or more and receive 0.5% to 0.85% a day, paid over 360 weekdays

Note that for the duration of each Apex Financial investment contract, tokens are locked until maturity.

Apex Financial takes a 30% cut of returns paid out.

Apex Financial affiliates are able to withdraw AFT tokens to ethereum, bitcoin or litecoin through an internal exchange.

Referral Commissions

Apex Financial pays referral commissions via a unilevel compensation structure.

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

Apex Financial caps payable unilevel team levels at twenty.

Referral commissions are paid out as a percentage of funds invested into AFT tokens across these twenty levels as follows:

- level 1 (personally recruited affiliates) – 2.5%

- levels 2 to 5 – 1%

- levels 6 and 7 – 0.5%

- levels 8 to 14 – 0.25%

- levels 15 to 20 – 0.125%

Performance Bonus

Of the 30% AFT tokens paid out as daily returns that Apex Financial withholds, 90% are used to pay the Performance Bonus.

The Performance Bonus is paid using the same unilevel team structure as referral commissions (see above).

- level 1 – 25%

- levels 2 to 5 – 10%

- levels 6 and 7 – 5%

- levels 8 to 14 – 2.5%

- levels 15 to 20 – 1.25%

Joining Apex Financial

Apex Financial affiliate membership is free.

Full participation in the attached income opportunity requires a minimum $500 investment in AFT tokens.

Apex Financial solicits investment in bitcoin, ethereum and litecoin.

Conclusion

AFT token is a regular ERC-20 Ponzi shit token. These take a few minutes to create at little to no cost.

AFT token is a regular ERC-20 Ponzi shit token. These take a few minutes to create at little to no cost.

Apex Financial affiliates hand over bitcoin, ethereum or litecoin and receive worthless AFT tokens.

They park them with Apex Financial on the promise of advertised returns, also paid in AFT tokens.

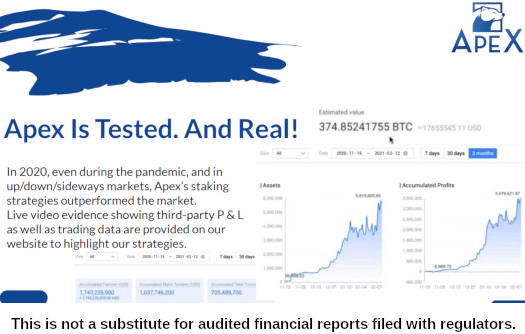

Supposedly there’s trading going on behind the scenes to fund withdrawals, however in true Ponzi fashion no evidence is provided. At least nothing credible that can be verified (financial reports filed with regulators).

As such Apex Financial is able to pay withdrawals through its internal exchange, as long as there’s still new investment to steal.

Previous funds invested into Apex Financial are referred to as “liquidity”.

What happens if AFT loses value?

AFT is not a speculative token. It is staked at a stable value fixed at 1 USD per token. This value does not fluctuate and is underwritten by Apex’s liquidity.

No liquidity (invested funds to steal), no withdrawals.

Being a passive investment opportunity, Apex Financial constitutes a securities offering.

Neither Apex Financial, James Ward, Jason Rose or Hitesh Juneja are registered to offer securities in the US.

This is critically important, because Alexa currently estimates that 92% of traffic to Apex Financial’s website originates out of the US.

As with all MLM Ponzi schemes, once affiliate recruitment dries up so too will new investment.

This will see Apex Financial unable to pay withdrawal requests, eventually prompting a collapse.

The math behind MLM Ponzi schemes guarantees that when they collapse, the majority of participants lose money.

Apex Financial’s exit-scam of choice appears to be the public exchange route:

Where can I purchase Apex tokens?

Currently, Apex tokens may only be purchased from the official Apex website.

Upon achieving 100m tokens in active circulation, we will pursue token listing with major defi and non-defi exchanges.

This will see APT tokens hyped up and pumped, prior to listing on some dodgy exchange.

The initial pump will allow James Ward, Jason Rose and Hitesh Juneja to steal even more money by cashing out pre-generated APT tokens.

Top recruiters and early investors will also cash out as this stage.

What follows is the inevitable dump to $0, leaving the majority of Apex Financial affiliates bagholding yet another worthless Ponzi shit token.

Update 11th September 2024 – The SEC sued James Ward. In a September 10th filed Complaint, the SEC alleges multiple counts of fraud related to Apex Financial.

Thank you for this review. I was impressed with one You Tube on this company, however watched another and noticed that these ‘investment packages’ were for ‘accredited’ USA investors ONLY.

I have emailed the company a few times to confirm that they are NOT open to the public and so far there there has been no response.

As a platform for accredited investors, it gives the opportunity another level of comfort or respect as a secure platform. (false) But it rules out most of the public participation looking for a side gig yet it could be a bigger scam by preying on the true USA investors.

I didn’t see anything about accredited investors in my research. Apex Financial is soliciting investment from the public.

Hello, I was looking into this and tried to join. It stopped me as they require you are an accredited investor as per the SEC. But you are saying it is allowed and we can join? thank you and please clarify.

Their website says it is for accredited investors only as well.

Hi Oz,

I was interested in this so your review has come on time. I also attended 2 webinars with them and asked some of the items above.

However, I think there are some mistakes in the review above.

You say they pay out 30% daily but they are saying 30% is the performance fee they charge on the returns generated (like any hedge fund).

There is also no mlm commission on referring users, I checked on site and also wrote them. There is only commission on performance fee IF they generate any returns.

They also have P &L and reports with video evidence of past trading on due diligence page.

My US referrals were blocked because they were not accredited. They require documentation confirming anyone from US is accredited (changing VPN IP did not work for it).

They say they are a registered pooled hedge fund and use the AFT just as the medium to track everything. It is not speculative so no one is expecting the return to come from selling tokens on exchanges etc.

The token value doesn’t go up or down or anything. If I remember right they said to think of it like gift card on amazon, it’s just used to track things internally and is not going to increase in value to generate return.

Please confirm these items I don’t want to put capital in the wrong source and my initial impressions were very positive.

@Barry

The word “accredited” does not appear anywhere on “theapex.app”.

Let me be clear, passive returns offered through a token is a security. This requires registration with the SEC and filing of disclosures regardless of whether sale of the security is limited to accredited investors or not.

@Merriam

Apex Financial’s compensation plan details two residual commissions. One is paid on returns as detailed in the review. The other has to be invested funds, what else is it paid out on?

This is quoted directly from Apex Financial’s official marketing material:

Directly under this is the ROI match commissions. Again I’ve detailed both in the review.

Putting aside there’s no mention of accredited investors on Apex Financial’s website or marketing materials, what makes you think committing securities fraud against offshore victims is legal?

Alexa currently pegs 92.2% of traffic to Apex Financial’s website as originating from the US. You gonna tell me those are all accredited investors?

Social media marketing is meaningless. It’s also not a substitute for audited financial reports, both filed with regulators and made available to potential affiliate investors.

I didn’t say anything about speculation in the review.

MLM + passive investment opportunity = securities offering

MLM + unregistered securities = securities fraud

MLM + securities fraud = Ponzi scheme

You invest in AFT tokens. You then park them with Apex Financial literally on the pitch of generating returns.

You cash out more AFT tokens then you invested in. There’s your return.

That return is paid out of subsequently invested funds, making Apex Financial a Ponzi scheme.

Can confirm. A Google search string “site:theapex.app accredited” returns no hits. You’d think an important thing like that would show up under “terms and conditions” at least, but nope.

The site has slick animations and crap, but bells and whistles do not a solid company make. (Personally, I find them rather annoying.) Between Ward’s extensive scamming history and the ridiculous claims of more than 0.75% ROI per day, I mean, come on, people, don’t throw your money at this thing.

How apt that the logo of this predatory company is an apex predator.