Will TelexFree’s ads hold up against the SEC?

![]()

I think we can all agree at this point that TelexFree’s new compensation plan has been hastily put together in direct response to the recently revealed Massachusetts Securities Division investigation.

Nobody seems to really understand it, the information that has leaked out thus far raises more questions than it answers and for reasons known only to themselves, the company has thus far failed to provide affiliates with any official documentation.

Acknowledging the confusion surround their new plan, TelexFree themselves just announced they are going to be holding “corporate training” event to explain the plan. The company expects affiliates to pay $169 each to attend the event, failing which they presumably are expected to remain in the dark about it.

Looking at the bigger picture, it’s not uncommon for a Ponzi scheme to try and re-invent itself once US regulators begin an investigation. The most recent and simultaneously infamous example being that of Zeek Rewards.

In the months leading up to the shutdown of Zeek Rewards, management were touting a merchant shopping network as a way to boost the then non-existent retail activity within the opportunity.

Similarly and in addition to announcing a new compensation plan, TelexFree is now promising to launch some sort of mobile app they’re calling “TelexApp”. What the app does or how it integrates into affiliate purchasing VOIP investment positions is currently unclear, but it’s a clear attempt by the company to shift focus away from the $20 a week ROIs they pay out on each AdCentral investment position.

Using Zeek Rewards as an example and keeping in mind the current SEC investigation into TelexFree, I think something being overlooked is the fact that when push comes to shove, any changes made to a Ponzi scheme after the fact simply don’t matter.

Driving this point home is the fact that in all of the court documents I’ve pored over relating to the Zeek Rewards case, I don’t recall seeing a single mention of their touted merchant shopping network. As far as the regulators are concerned, anything that was promised or planned to take place after the launch of the Ponzi scheme side of the business simply did not matter.

Given this, we can put aside TelexFree’s new compensation plan and app as neither of them are likely to be the focus of the SEC’s investigation. Instead, we’ll focus on what has been the company’s business model over the past two years.

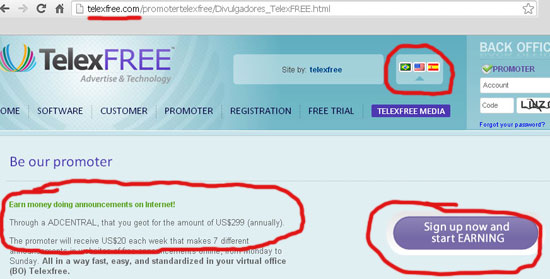

Under the guise of having their affiliates advertise the business, TelexFree accepted $299 deposits from affiliates and in turn guaranteed them a $20 a week ROI for 52 weeks.

A quick Google search reveals that there are 92,400 results for the search term “get paid to post ads telexfree”:

A simpler search for the term “post ads telexfree” returns 707,000 results.

Indeed, it was only up until recently that TelexFree’s own website proclaimed:

The promoter will receive US$20 each week that makes 7 different announcements in websites of free announcements online, from Monday to Sunday.

“TelexFree Ads”, a website which claims to be “the best for TelexFree ads” and has over 155,000 or so TelexFree advertisements published on it, spells out this ad-posting requirement a little clearer:

The Telexfree Ads site was created to make life easier for promoters of Telexfree who need to post daily advertisements for the dissemination of the products and services of the company.

Simply put, no spammy ads – no $20 a week.

Now, given that the SEC have issued subpoenas commanding several individuals connected to TelexFree to appear before them this Wednesday, one might wonder what position US regulators take on having affiliates publish daily ads to collect an otherwise passive ROI.

Zeek Rewards had a similar daily ad-posting requirement to that of TelexFree. In exchange for a 0.8 – 1.5% daily ROI, Zeek Rewards mandated that their affiliates spam the internet daily with an ad promoting the business.

Affiliates were told to merely copy and paste free ads created by ZeekRewards into a free digital classified ad website. Affiliates then submitted the ad’s internet link to ZeekRewards to verify that they had placed the ad.

Sound familiar?

Courtesy of some documents recently filed in court by the Zeek Rewards Receivership (working in conjunction with the SEC), some insight into precisely how regulators view an ad-posting requirement can be gleaned:

In an unsuccessful effort to avoid the obvious legal infirmity of Affiliates simply buying points in return for the expectation of a share of the profits (like a stock purchase), ZeekRewards told Affiliates that in order to supposedly “earn” their points, they were required to place a short, free digital ad each day on one of the many free classified websites available on the internet.

The ad process was intended to be very simple and was widely advertised as taking only 3-5 minutes each day. For example, Burks routinely told Affiliates: “Placing an ad takes three to five minutes a day and can be done from anywhere there is an Internet connection.”

In reality, the ads were just an attempt to manufacture a cover for what was nothing more than the investment of money by Affiliates with the expectation of receiving daily “profit” distributions.

And there you have it. Make no mistake, should TelexFree officials rock up to the Massachusetts Securities Division this Wednesday and start harping on about how TelexFree isn’t a Ponzi scheme because their affiliates post daily ads, what happens next is a no-brainer.

That of course begs the question as to what exactly are TelexFree going to tell the SEC on Wednesday?

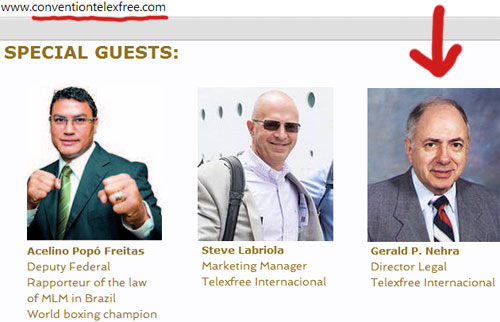

As observed earlier today by Patrick Pretty, despite his presence as a “special guest” being heavily marketed by the company, MLM attorney Gerry Nehra was a no-show at the recent TelexFree event in Spain last weekend.

After being billed as headliners, neither Brazil-based TelexFree executive Carlos Costa nor American MLM lawyer Gerald Nehra appeared on the stage to accept awards.

U.S.-based TelexFree marketing executive Steve Labriola walked onto the stage to accept Nehra’s award.

“This is for Jerry,” he said. “I was asked to come up and receive this for Jerry.”

Labriola did not say who asked him to accept the award on Nehra’s behalf.

Nehra does “most of our corporate law,” Labriola said. “He’s a great man. And he also works long hours, like all of you out there, and I [will] be honored to give this to him.”

Whether or not Nehra was busy working on handling the SEC subpoenas issued to his client is unclear. However if he was, comparisons between TelexFree and Zeek Rewards get eerily full-circle.

In a secret meeting held in 2011, Zeek Rewards mastermind, CEO and owner Paul Burks fielded the following question from one of his assembled top affiliate-investors:

How tight it the relationship with Nehra? What are the couple (Gerry Nehra and Richard Waak) putting in legally?

Burks replied,

When we started this in January, we put the program together in a way that I thought was solid, completely solid. And we discovered, early on, that there were some lightning rods in there that had caused other companies to have problems.

That’s when we initially contacted Gerry Nehra. Nehra had done some legal research for me in the past with “Free Store Club” years ago.

Seven of our key players in Zeek Rewards had a relationship with him and wanted to get him involved, cuz he’s, he’s probably the number one MLM lawyer in the world.

Just having him on retainer and having him on our team, it goes a long way from keeping anybody from launching an attack. Because generally when Gerry Nehra is involved, the Feds know that he’s cleaned up the act really well.

A year later in 2012, the SEC shut down Zeek Rewards for being a $600M Ponzi scheme.

Prior to Zeek Rewards, Nehra testified that another advertising-related Ponzi scheme shutdown by the SEC, AdSurfDaily, was “not a Ponzi scheme”. A Judge later ruled that AdSurfDaily was indeed a Ponzi scheme. Its owner, Andy Bowdoin, was later sentenced to 78 months in federal prison.

Back in February of last year Nehra issued BehindMLM with a cease and desist, claiming that

The TelexFREE business model in the USA is NOT an investment, uses NO investment language, and pays ONLY on the sale of its VOIP long distance product.

Nehra demanded BehindMLM “retract (its) statements to the contrary”. He then went on to give TelexFree his “legal blessing” later on in the year.

Whether or not TelexFree will be “third-time lucky” or “three strikes and your out!” for Nehra remains to be seen. Speaking in a “private conversation” with a TelexFree affiliate-investor at the recent Madrid event, co-owner Carlos Wanzeler declared he “has no concern” over the SEC’s TelexFree investigation.

Stay tuned…

Just an aside, the Telex App and TELEX Mobile are not new and were not developed in response to the alleged MA SEC investigation (if such exists as my independent efforts to verify this through the Office of the Secretary of the Commonwealth failed).

Both products were long in development and talked of for some time (as were allusions to others), at least as long as the company started its MLM operations in the US. However, Telexfree has been very slow in the roll outs.

For instance, MAC mentioned long after rolled out first because it was another company’s product and the partnership with Telexfree only required it to perform distribution. It is still working the “setting up” kinks out.

TelexFREE is primarily a tech company trying to do something disruptive in advertising trying to use the MLM model which might or might not work.

Was there any talk before April 2013 when the SEC allegedly first requested documents from TelexFree?

Seems to have progressed quick smart since January (the second SEC document request).

Orly? So uh… what “tech” do they have? The only tech I see are those Voxbras marketing videos Costa keeps putting out…

Wow. So they’ll be scheming $169 from the affiliates to attend an event where promises of the future will be heard. Hope they serve some good hors d’oeuvres, food, and drinks for that amount.

No sense being hungry AND let down at some corporate event.

Heck, even Rippln (now Vapt) only charged $10 for its Las Vegas reveal event. 🙂 Harbinger?

Do you think SEC is going to shut down telexfree tomorrow? or in a couple of months?

been there and done that nonsense. zeek rewards and then hourlyrevshare and i through in the 10 dollar tshirt rilin gave me in vegas.

these things never cease to amaze me and just reaffirms my core dedication to only involve myself in rock Soiled Programs liKE Penny Matrix and next level. Once a looser…always a dud as murphy would say!11

take care BUDDY!!!!

Guess TelexFunk’s gotta squeeze as much cash out of the reps before the big fall.

@Charles

No idea.

I heard of some planned staged protest tomorrow in front of the SEC from a group of Telefree investors seeking to have the SEC not to shutdown Telexfree.

People will start to show up at 9:30 sharp and they are requiring to wear Brazilian shirt and Brazilian flags.

I hope this last forever I really like working 15 min a day and having the free time to spend on my school work and my body in the gym..This company is doing more for the economy then the government is…(Ozedit: Offtopic spam removed)

@ shy Danielle: There are rumors that Telexfree will be partning with a French micro car industry to launch a compressed air vehicle capable of carrying 4 adults with grown issues and on diet and the product will be called Telexcar and will give a hefty commission and will be so profitable as thousands of these units will be sold in US.

I also heard today that Telexfree have decided to issue the form 1099 income reporting to all investors and they will announce that on the upcoming meeting on the March 9th.

I always thought that the deadline for issuing the 1099 is January 31th!!!

Great blog I follow it every day and people attack me because they say that Brazilian government pay me to talk bad about telexfree…

Lol, however, there’s a way to have some official documents regarding sec investigation?

KUDOS for this post, OZ!

All information compiled in one place! No way Telexfree can claim affiliates didn’t make money “posting ads”. Internet’s “memory” is eternal…

Oz,

A mind made up; but to answer your question YES. Now, are you going to move the ball again.

I do think $169 price the is over the top; especially where the company is already flush with cash. I guess they may have spent a lot on the cell company but damn.

Do you think the founders/owners have good intentions even if wrong vehicle or do you think they intended to do ill?

@Roberto

Not until the SEC release them.

@Shy

So what was being discussed prior to April 2013? I wrote my TelexFree review in 2012 and don’t recall anything except AdCentral investment and the VOIP facade being pushed.

Intentions are irrelevant. What you do and how you do it is all that matters. TelexFree’s original compensation plan is straight-up Ponzi.

Independent confirmation of Massachussetts investigation was obtained by Globo.

http://economia.ig.com.br/telexfree/2014-03-05/sede-da-telexfree-nos-eua-esta-sob-investigacao.html

To K. Chang, Oz.. and all the negative info/rumor givers:

Where do you guys get your info?

Is it rumor, do you have some kind of agenda…?

I am not trying to bash your opinions, it is just that you guys seems like you have something personal against this company.

Just heard from Steve Labriola’s own mouth that he did not go to no meeting with Massachusetts SEC today.

Why all the bad hype about this company, seems like everyone I speak to is happy, they found a company that is finally making them a pretty good income selling product, and placing ads?

As for the placing ads; Why is it so bad or illegal to be paid for placing ads for the intention to sell a product?

Thanks in advance for your feedback.

People usually know what they’re doing when they’re organizing a business. Minor mistakes will be corrected rather than disguised if the intensions are the right ones.

TelexFree is clearly fraudulent. It has copied and modified fraudulent parts from other programs, e.g. SpeakAsia and Mister Colibri. The $299 / $1,375 investment part and the $20 / $100 binary matrix commission have been used in other successful frauds earlier.

I was able to use technical knowledge from SpeakAsia to identify some back office functions without having seen them. I could simply describe the functions and ask people about them, and they filled in a few details I was missing (minor corrections, TelexFree is a newer version).

People don’t “accidentally” start a Ponzi scheme. They must have fraudulent intentions right from the start, from when the business model is being planned.

@Anon

@Kasey

That’s iG, Globo are a different media company :).

@Anon

Oh, Gosh, I feel so much better knowing Steve didn’t lie to everyone when he said there was no investigation going on in the USA…..I wonder if he know’s about the investigation in Brasil yet or do ya think they kept that from him too?

You heard from Steve Labriola’s own mouth that he didn’t know anything about the SEC? Um I think his credibility is…..Negative ZERO!!!

You expect people to beleive the words out of the mouth of a man who’s been running around “the world” selling his scheme to poor people? Next thing your going to tell us is he really didn’t know it was a scam. Really?

He know’s the **** has hit the fan like a tornado through a trailor park.

@Dorothy

Did you make it down to Massachusetts today?

Unfortunatly I wasn’t able. I was planning to but then “my job” got in the way. (damn, if I worked for Telex I could have done my 5 minutes and been on the road)

I’m going to try to go to the next circus. It’s not that far of a trip for me. I guess other than Labriola’s declaration of ignorance there’s no word on what happened?

I haven’t heard anything further on my end. Apparently some affiliates were going to rock up and “protest”. Maybe we’ll see something on social media, although US affiliates might be more weary of splashing photos around on social media than their Brazilian counterparts.

Does anyone happen to have any screen shots or links that demonstrate TelexFree International reps signing up people in Brazil and circumventing the Court order in Brazil?

Let’s just say I have a few people that would love to see that info!

If Oz permits me leaving my email address, please send to me as soon as possible!

kenstewartcalling@hotmail.com

By the way, Anonymous! Who said anything about Steve Labriola having been subpoenad to appear? He’s not one of the principals! It’s far more likely that Wanzeler, Merrill, and Costa would have been required to appear!

If TelexFree supporters showed up, they should certainly have been able to see who walked in the front of the building!

Frontier (from Brazil) might have some, or he may have a list of where he have found information.

A comment where he states that he HAS collected information was all I was able to find now …

I might have some information about dates and types of material, e.g. one TYPE was Brazilian TelexFree leaders posting “How to bypass the registration if you live in Brazil”. But I didn’t collect material like that myself.

Internal search for “Telexfree bypass registration Brazil” gives some hits (in comments or articles) in July, August and September 2013, and in December/January (when Carlos Costa was fined).

Some of the back office training videos contained indirectly information about how to do it, but most of them were removed in August or September 2013.

I have watched detailed videos about how to register fake user information and get the system to accept it.

Carlos Costa made a statement about Brazilians bypassing the registration in late August 2013, that he and Ympactus was NOT responsible for that. It was around August 28, +/- one or two days.

Ken Stewart,

As soon as we have some time, we’ll start sending info to your email.