i-Payout defend handling TelexFree ewallet money

![]()

Following weeks of commission delays for non-Brazilian TelexFree affiliates just over a moth ago, ewallet provider Global Payroll Gateway (GPG) abruptly announced that they could ‘no longer support TelexFree‘.

The announcement was made in mid September, with GPG informing TelexFree’s affiliates that International Payout Systems (i-Payout) would be taking over the supply of ewallet services to TelexFree.

No official reason was given for GPG’s dropping of TelexFree, however on their website GPG state

GPG maintains strict accordance with the USA Patriot act and a wide variety of other international financial regulatory and banking regulations.

GPG is very careful to follow all international regulations and laws concerning Anti-Money Laundering, Identity Protection and Payroll in general.

TelexFree is currently under criminal investigation in Brazil, with pending charges of money laundering and embezzlement being touted by Public Prosecutors.

About a month after my article on GPG dumping TelexFree went live I received an email from i-Payout, with the company wishing to clarify a few things.

In addition to informing me that I’d used the wrong domain to calculate their comparative size to GPG, i-Payout also insisted that they had

done a complete due diligence on TelexFree, assessed its needs, and confirmed the product as compliant with all US laws.

“Complete due diligence” you say? Go on…

i-payout is providing its product and services to TelexFree’s US and global business outside of Brazil. TelexFree is a US corporation based Massachusetts and is a separate entity from the business in Brazil. The US business maintains the payouts to US and other worldwide members outside of Brazil.

i-payout has done a complete due diligence on TelexFree, assessed its needs, and confirmed the product as compliant with all US laws.

i-payout™ also verified every single TelexFree member by a submission of a valid ID. In all cases, and as with all clients, i-payout™ maintains the USA Patriot Act and international regulations concerning AML, Identity Protection, OFAC regulation.

IP security makes the program more than compliant with today’s industry standard for KYC (know your customer).

As you have stated in the blog post, GPG was providing payment solution services to TelexFree for both the US company and the separate TelexFree organization based in Brazil; however, when the US based TelexFree and GPG cut ties, i-payout was brought in to provide our services to all of TelexFree’s members (outside of Brazil).

i-payout™ takes great pride in that we are fully audited and SOC II compliant.

Again, it is important for us to reiterate that i-payout™ has never worked with the TelexFree organization in Brazil and has never offered any of its services to TelexFree in Brazil.

Additionally, we wanted to share with you some of the rigorous due diligence we follow with all clients:

1. Obtain and review Corporate documents

2. Review of shareholders agreements and verifying documents

3. Bank statements to prove historical availability of funds

4. EIN or other tax registration docs for international companies

5. Copy of government ID for all shareholders and their resumes

6. Customer support details for the compan (sic)

7. Login credentials to the member site to verify products are in line with business overview provided

For TelexFree i-payout completed extended Due Diligence:

1. Site survey – visited their site to ensure office, people, processes, etc.

2. Vendor proof – invoice and proof of payment for a vendor 3 months ago, 6 months ago

3. Organizational chart review

4. Random audit of several affiliates’ accounts: compensation plan are they on? How / when they get paid? Obtain confirmation of the sales, etc.

5. Proof of filing 2012 tax returns

6. Legal opinion for any open cases and review of documents relevant to closed cases.

As you can see, i-payout is very thorough in its evaluation of potential clients. We thank you for your interest and reporting on the industry and we welcome you to review our eWallet.

Well that was certainly an exhaustive list.

What immediately struck me however was the stressing that i-Payout had nothing to do with TelexFree’s Brazilian operations. Did they not know the company used the same $289 AdCentral investment model globally?

And as far as “complete due diligence” goes, why was there no mention of TelexFree’s business model? Seemingly, i-Payout’s purported “complete due diligence” could be summed up as

we viewed some documents, checked some IDs, rocked up to their virtual office and concluded that TelexFree management are a bunch of swell guys.

At a loss as to how anyone could claim to have conducted “complete due diligence” without mention of an MLM company’s business model and compensation plan, I sent off the following reply:

‘i-payoutTM is providing its product and services to TelexFree’s US and global business outside of Brazil.’

Does it matter? The company uses the same business model globally. Affiliates pay $289 (sic) for a position in the comp plan on the guarantee of a $20 a week ROI.

The company claims this is compensation for “posting ads” (to attract new investors), however I’m sure I don’t need to remind you that time and time again “posting ads” has been shot down as a Ponzi defence in US courts (AdSurfDaily being the most prominent example).

‘i-payoutTM also verified every single TelexFree member by a submission of a valid ID. In all cases, and as with all clients, i-payoutTM maintains the USA Patriot Act and international regulations concerning AML, Identity Protection, OFAC regulation.

IP security makes the program more than compliant with today’s industry standard for KYC (know your customer).’

Are you aware of TelexFree affiliates from Brazil publishing YouTube videos advising Brazilian nationals to sign up via US accounts? How do you think they are funding their accounts and getting paid commissions?

How do you think this is going to play out as the TelexFree investigation continues in Brazil and regulators follow the money? Currently TelexFree faces pending charges of money laundering and embezzlement charges.

Do you really think none of that money has/will pass through your ewallet systems?

‘Again, it is important for us to reiterate that i-payoutTM has never worked with the TelexFree organization in Brazil and has never offered any of its services to TelexFree in Brazil.

Additionally, we wanted to share with you some of the rigorous due diligence we follow with all clients:’

Looking at that list, it would appear you’ve done everything due diligence wise except go over the company’s business model and compensation plan.

TelexFree accepts $289 investments from affiliates, on the premise of a $20 a week guaranteed ROI for 52 weeks. ROIs are paid out of new affiliate investor money.

I can appreciate as a payment processor the limit of your due diligence not extending past covering your own ass as a business, however as a ewallet customer I’d expect the company I am a client of to go above and beyond protecting the integrity of not only my account but the company itself.

One need only look at the freezing of accounts in NXPay when shit hit the fan for Zeek Rewards to see the implications of providing ewallet services to obvious Ponzi schemes.

TelexFree is owned by the same three people globally, inclusive of the Brazilian operations. Brazilian courts have already recognised this in dismissing TelexFree’s bankruptcy application on the grounds of they can’t use their US operation to fund a Brazilian bankruptcy as it’s the same company.

Throwing your hands in the air and proclaiming “but we visited them at their offices and had a beer, they were swell guys!” doesn’t cut it. Ponzi schemes by nature are designed to deceive until a regulator starts up an investigation.

Once that happens, all that becomes relevant is the fact that affiliates invest $299 and receive a guaranteed $20 a week ROI, paid out of new investor money.

For the record, what is your company’s official stance on the above business model, which is what TelexFree have used globally since the company’s inception?

Full disclosure: I intend to publish an article on this in the near future using your response(s) to emphasise the culture of complicit complacency between ewallets and some of their more dubious clients.

Four days later I received the following reply:

Hi Oz,

Thank you for getting back to us. We appreciate and respect your opinions. As we have stated before, we would love to be a resource for you in relation to any and all factual information as it relates to i-payout. Feel free to reach out to us with any further questions regarding i-payout.

No kidding… that was it, the entire email.

For a company that reached out to me and insisted they’d conducted “complete due diligence” on a company they were providing ewallet services to, the response above was astonishingly inadequate.

In i-Payout’s first email, the company asserted that they’d sought a ‘legal opinion for any open cases and review of documents relevant to closed cases‘ and conducted a ‘random audit of several affiliates’ accounts‘, supposedly including the compensation plan.

What legal firm i-Payout are using (Yes Men Inc?) I have no idea, however even the most basic of due diligence reveals a thinly masked Ponzi schemes, with pending criminal charges in Brazil threatening to bring the whole operation down.

As an affiliate that’s worthy of some serious consideration, but as a payment processor… how nuts do you have to be to want a piece of that pie?

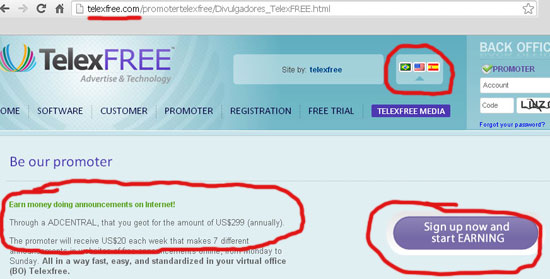

On their website TelexFree advertise their AdCentral investment scheme as follows:

Be our Promoter

EARN MONEY FROM ADVERTISING TECHNOLOGY VOIP Telexfree

Through a ADCENTRAL. MEMBERSHIP $ 50 (Partner) + Adcentral Kit U $ 289.00 (Central ad accounts 99Telexfree + 10) = U.S. $ 339.00 (Annual)

The promoter will receive an account 99Telexfree worth U.S. $ 49.90 each week to make 7 different ads on free ad sites on the internet, from Monday to Sunday.

Invest $289, post ads and bing-badda-boom $20 a week ROI guaranteed. And if you’re wondering where I got $20 a week from, here’s how TelexFree’s compensation plan explanation used to read (before they were busted in Brazil):

Be our promoter

Earn money doing announcements on Internet!

Through a ADCENTRAL, that you geot (sic) for the amount of US$299 (annually), the promoter will receive US$20 each week.

Despite changing the language used to describe the compensation plan, TelexFree failed to actually change the plan itself (referred to as MLM psuedo-compliance). TelexFree still pays out affiliates $20 a week after they’ve invested $299 and spam the internet with unsolicited ads.

Why is this significant?

In an investor alert issued not even a week ago the SEC reiterated, amongst other things,

Be wary if you are offered compensation in exchange for little work such as making payments, recruiting others, and placing advertisements.

How does TelexFree stack up?

-Making Payments? $289 AdCentral payments or bulk lots of “AdCentral Family” positions for $1156, check.

-Recruiting others? As per the TelexFree compensation plan, the company pays out $20 per AdCentral position and $100 per AdCentral Family position invested in by personally recruited affiliates, check.

-Placing advertisements? Spam the internet 7 days a week and TelexFree pay you your $20 a week ROI per AdCentral position invested in, check.

On one hand I can appreciate i-Payout’s due diligence being limited to covering their own asses should the SEC come down on TelexFree for selling obvious unregistered securities. However these guys went out of their way to contact me and profess their conducting of “complete due diligence”.

And then when I pushed them on it, totally caved in with a tin can autobot response that completely ignored my followup questions.

To date, i-Payout have not clarified what their official position on an MLM compensation plan that charges affiliates $289 a position and pays out a $20 guaranteed ROI, paid out of newly invested affiliate funds.

The failure to clarify their position comes despite my request they do so (after they contacted me) and i-Payout’s own reassurances that they would ‘love to be a resource for you in relation to any and all factual information as it relates to i-payout‘.

Should the SEC shutdown TelexFree in the future and all eyes turn on i-Payout over their complicit involvement in handling TelexFree’s financial transactions, let it be recorded that they have conducted

complete due diligence on TelexFree, assessed its needs, and confirmed the product as compliant with all US laws.

What typically happens in the event of a shutdown is an ewallet processor throwing their hands up in the air and declaring they had no idea anything shifty was going on.

When the $600M Ponzi scheme Zeek Rewards was shut down by the SEC, here’s what happened to their ewallet processor NXPay:

In addition to their business going down the toilet, funds were frozen across the company resulting in widespread chaos and confusion.

I have no idea what percentage of revenue TelexFree’s investment scheme makes up within i-Payout’s global operations, but here’s a snapshot of the level of financial activity currently taking place (published on a popular Ponzi promotion forum less than 24 hours ago):

Today, 2:47pm

i just joined too.. all the folks here in cali just heard about this and some are putting their savings.

Not even six months ago the widely used MLM payment processor and ewallet service provider Liberty Reserve was shutdown in a joint operation between US, Costa Rican and Spanish authorities.

Why?

(Arthur) Budovsky, a Costa Rican citizen of Ukrainian origin, has been under investigation since 2011 for money laundering using a company he created in the country called Liberty Reserve.

Money laundering, one of the same pending charges TelexFree are facing down in Brazil. With Carlos Wanzeler, James Merril and Carlos Costa owning TelexFree’s global operations (it’s the same company internationally), the risk that tainted money would have or is passing through US banking channels would appear to be extraordinary.

That doesn’t seem to bother i-Payout though.

Affiliate investors across America are dumping their life savings into TelexFree on the expectation of a $20 a week ROI paid out for every $289 invested with the company. But i-Payout would have you believe TelexFree is wholly compliant because they had a few beers with the owners down at their Massachusetts virtual office space.

Sounds bulletproof to me.

If all of the TelexFree “affiliates” and i-Payout account holders been subject to the same level of KYC scrutiny as i-Payout claims to have subjected TelexFree, this could turn out to be a bigger money laundering case than that of Zeek.

OK. Assuming the communication sent to Oz was authorized by International Payout Systems, INC and/or someone with executive authority at International Payout Systems, INC, of Hallendale Beach, Fla:

Is I-Payout talking about its own “product” or a TelexFree “product?” As described by one of TelexFree’s largest U.S. groups, one of the TelexFree “products” is a scheme by which one sends $15,125 to TelexFree and receives back at least $42,075 in a year — all for placing ads. It’s as though Zeek never happened.

Could Palm Beach’s Bernard Madoff or Fort Lauderdale’s Scott Rothstein avoided their Ponzi prosecutions by having the foresight to attach an “advertising” requirement?

Did U.S. Attorney General Eric Holder waste his January 2010 trip to South Florida in which he warned residents to be on the lookout for Ponzi schemes and their enablers in their own back yards?

On Facebook yesterday, someone was serial-spamming this:

Should I-Payout be concerned about this or is this TelexFree’s problem alone? It seems possible that someone with a TelexFree account is trying to cash it out via a different processor. Or maybe it’s a case of someone trying to dupe a TelexFree member into purchasing a nonexistent TelexFree account.

Yes — even as Ponzi/pyramid investigations are under way in multiple jurisdictions in Brazil and even as police are investigating alleged death threats against a Brazilian judge and a Brazilian prosecutor.

One could get the impression that South Florida-based I-Payout doesn’t mind walking straight into what’s obviously a PR disaster, if not a disaster of a worse kind for MLM and the payment-processing industry.

Wonder if I-Payout ever studied the James Bunchan/Seng Tan pyramid case in federal court in Massachusetts. It’s the case in which Bunchan ran an MLM affinity fraud aimed at Cambodian-Americans and was implicated in a murder-for-hire plot in which 12 witnesses and a federal prosecutor were discussed as targets.

One really has to wonder why Brazil seems to have been selected as the TelexFree launching ground, given that James Merrill appears to be an American.

TelexFree appears to have gathered a Zeek-like sum in the hundreds of millions of dollars worldwide. How many full- or part-time employees does TelexFree have in the virtual office it leases in Massachusetts? How about the one in Nevada?

Is it more or fewer than the number Zeek had at its TelexFree-like virtual office in Nevada and/or at its physical office and companion laundromat in North Carolina?

Is it more or fewer than the number AdSurfDaily had at its virtual office in Nevada and/or at its physical office in Florida in the old flower shop Ponzi schemer Andy Bowdoin rented from his wife?

Oh: Did I-Payout send anybody over from Hallendale Beach to conduct a site visit at the office of TextCashNetwork in Boca Raton to determine if the building REALLY had the name of TextCashNetwork affixed in large letters near the crown?

And did the OneX scammers who said they were switching to I-Payout ever successfully open an account at I-Payout — you know, so folks such as ASD Ponzi schemer and OneX pitchman Andy Bowdoin could get paid and so OneX/Zeek pitchman T. LeMont Silver could get paid?

Hope it wasn’t from Gerald Nehra, one of the TelexFree attorneys. He said ASD wasn’t a Ponzi scheme, before his own client later corrected him and pleaded guilty to wire fraud while confessing that ASD was a Ponzi scheme.

Sounds impressive. But a random audit is unlikely to detect the presence of former ASD and Zeek affiliates, including some who’ve instructed their recruits to make walk-in TelexFree deposits at Bank of America and TD Bank and then scan the deposit slips and email them to a Gmail address in the upline for “expedited” service.

That aspect of TelexFree is like ASD all over again.

Of course, there are posts online that say, “Steve Labriola, Director of Marketing for Telex FREE, Boston, announced via email earlier today that they are “pulling out of Bank of America.”

If it’s true, it follows a similar situation at Zeek (with two banks) and also at ASD. (In the ASD case, a bank closed an account because the account triggered Ponzi flags.)

PPBlog

its quite obvious its ponzi…affiliates buy 99 telex for $49 and get $44 back in comission so the company makes $5 profit and this $5 profit is enought to pay millions in comissions…phhttt.

the ad posting services used for speed dont actually go anywhere for real customers to see

You should check this old post about i-payout.com in known HYIP forum:

http://www.talkgold.com/forum/printthread.php?t=153901&page=436&pp=10

That’s for the first month only. They made it cheap so people could generate fake customers to qualify for commissions, or to generate new give-away accounts for marketing purposes ($5 is rather inexpensive if you use it correctly).

People can just ignore using the VOIP subscription. They only need to pay for the first month, and after that they can simply let the invoice remain “unpaid” (not using the service).

If people want to use the VOIP service, they will need to pay the full price (minus $5 in commissions). But I don’t think the service work in other countries than the initial ones (USA, Brazil, a few other countries).

Its own product, IMHO.

As long as participant’s not running afoul of money laundering statutes, embargoes, and what I would call obvious and deliberate deceptions on the part of the participant (and TelexFree haven’t done that) iPayout doesn’t exactly have a reason to ban them, other than “Brazilian operation is in court”.

It’s bad PR for them, sure, to be mentioned in the same breath as a suspected Ponzi, but that’s not unusual in terms of banks, credit card companies, and such.

i-payout is using fake pictures of their offices in their contact website i-payout.com/ContactUs.aspx

taken from flickr.com/photos/m_moser/6890538977/

Also in their front page the pictures of the people are all fake too like this one: dreamstime.com/royalty-free-stock-photo-businessman-using-tablet-image27225365

My feeling about this company is that they bussines are very similar to Liberty Reserve acepting any ponzy scam as their clients like Path 2 Prosperity and Telexfree now.

His president Edwin Gonzalez looks like he also does/did MLM-type stuff as an affiliate for YourTravelBusiness (YTB) and a couple of others.

i-PayOut “Our Offices” i-payout.com/ContactUs.aspx

“Our Offices” or “Google Image”?

See: facebook.com/Piramideiros/posts/226344694194338

When trying to login these couple days users get the following message:

Who knows what’s going on there

That’s not all, the said Promoter, get E-money on his Electronic account with telexfree, then a new person is interest in buying a membership, that promoter will enroll that person and use his e-money to pay for it.

In turn the new member will pay the promoter with real money, and voala, the promoter took some money out, free of taxes, or charges, other than what telexfree will take it later when he renew his yearly membership.

i-payout.com is now operating sort of “cloak and dagger” as globalewallet.com.

Be careful to put the e between global and wallet or you get a malware site just what you would expect from a real respectable company.