FinUp: Fourth Mavie Global Ponzi spinoff

FinUp is the fourth spinoff of the Mavie Global Ponzi scheme.

FinUp is the fourth spinoff of the Mavie Global Ponzi scheme.

Through FinUp, Mavie Global has jumped on the launched an “ai crypto trading” fraud bandwagon.

FinUp sees Mavie Global pitch investors on passive returns, purportedly derived via AI crypto trading.

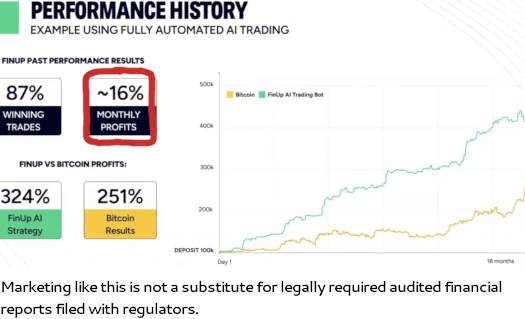

Through its AI trading offering, Mavie Global claims FinUp can generate monthly returns of around 16% for investors.

On the money side of things, Mavie Global affiliates purchase FinUp licenses costing between 100 and 30,000 tether (USDT).

The more a Mavie Global affiliate spends, the more they can invest and fee amounts are reduced.

Commissions on fees paid to access FinUp are paid out through Mavie Global’s MLM opportunity.

FinUp’s “safe and automated AI trading” purportedly takes place through Binance.

Binance is a cryptocurrency exchange in decline with an uncertain future.

Binance was sued by the SEC in June 2023. In its complaint, the SEC cited Binance as “the largest crypto asset trading platform in the world” and alleged its

crypto asset trading platform, Binance.US; and their founder, Changpeng Zhao, [have committed] a variety of securities law violations.

Changpeng Zhao, aka CZ, was criminally charged with money laundering in November 2023.

Zhao pled guilty in November 2023 and agreed to surrender $4 billion in ill-gotten gains.

Binance’s founder and chief executive officer (CEO), Changpeng Zhao, a Canadian national, also pleaded guilty to failing to maintain an effective anti-money laundering (AML) program, in violation of the BSA and has resigned as CEO of Binance.

Binance became the world’s largest cryptocurrency exchange in part because of the crimes it committed – now it is paying one of the largest corporate penalties in U.S. history,” said Attorney General Merrick B. Garland.

Zhao was sentenced to four months in prison earlier this month. The light sentence prompted speculation Zhao provided US authorities with valuable intelligence on accomplices.

Heading up FinUp is Jay Hao, former CEO of the OKX cryptocurrency exchange.

OKX is set up as a shell company in the Bahamas. To avoid prosecution for fraud in the US, OKX purportedly does not allow US residents to sign up to its exchange.

Nonetheless as of February 2024, South Korean authorities are investigating OKX for securities fraud.

As to FinUp’s regulatory failings, the offer of passive returns derived via automated trading constitutes a securities offering. Automated trading also requires FinUp to adhere to commodities regulations.

Both FinUp and Mavie Global are not registered to offer securities or act as a commodities broker in any jurisdiction.

Outside of FinUp’s securities and commodities fraud we have “pro education” and “market insights”.

These appear to be shallow attempts at pseudo-compliance. Bundling additional products and services does not legitimize a primarily fraudulent investment offering.

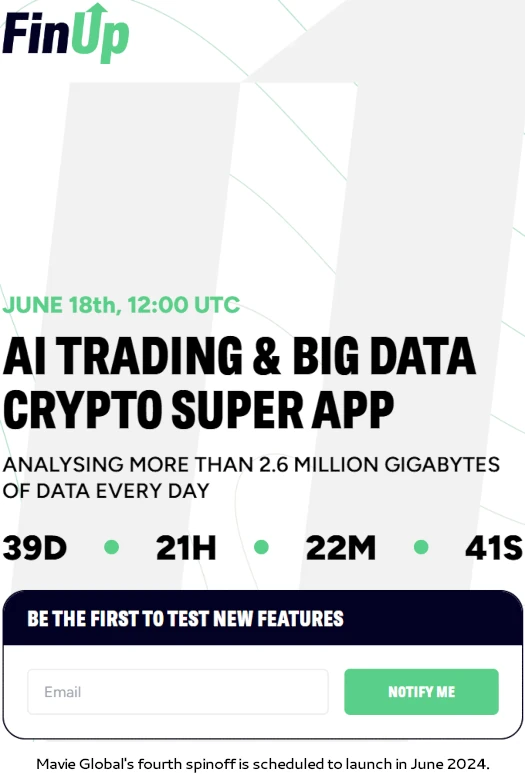

FinUp operates from the website domain “finup.ai”. A visit to FinUp’s website reveals the scheme is set to launch on June 18th.

One last note is that serial fraudster Jonathan Yelemian Sifuentes Saucedo has emerged as a FinUp promoter:

Sifuentes is best known in the MLM industry for defrauding investors through his Xifra Lifestyle and Decentra Ponzi schemes.

Sifuentes fled to Dubai as Xifra Lifestyle was collapsing in 2022. While he hasn’t been held personally accountable for Xifra Lifestyle and Decentra, Sifuentes did face the music over his involvement in My Trader Coin.

Like FinUp, Mavie Global, Xifra Lifestyle and Decentra, My Trader Coin was an MLM crypto Ponzi scheme.

In 2020 the Arizona Corporation Commission sued Sifuentes for being a My Trader Coin promoter. Sifuentes settled the ACC’s charges for $85,000 in September 2022.

It seems whilst still hiding out in Dubai, Sifuentes has now hitched his wagon to Mavie Global and FinUp.

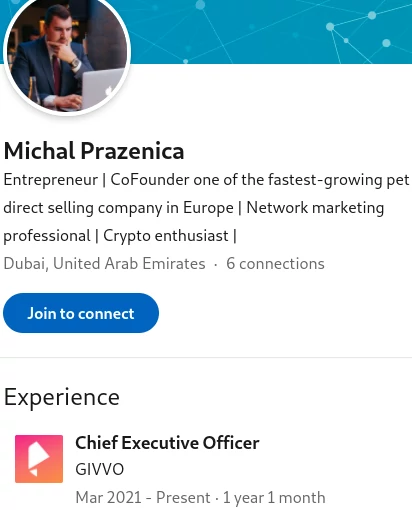

Mavie Global is also based out of Dubai. The fraudulent investment scheme is headed up by former Givvo Ponzi scammer Michal Prazenica.

As noted in the title of this article, FinUp is Mavie Global’s fourth spinoff. The original Ponzi was built around ULX and stalled some time ago.

Since then Mavie Global has spun off

- Lottoday (NFT grift Ponzi) – launched mid 2023 with ~16,000 monthly website visits as of April 2024 (SimilarWeb)

- 369X (VIBRA and 369T token Ponzi) – launched late 2023 with website traffic too low for SimilarWeb to track and

- FlipMe (NFT grift Ponzi) – launched early 2024 with ~30,800 monthly website visits as of April 2024 (SimilarWeb)

Through the constant launch of spinoff scams, Mavie Global did manage to reverse a 2023 decline in website traffic. SimilarWeb tracked ~212,000 monthly visits to Mavie Global’s website for April 2024, up from ~110,400 in February 2024.

It remains to be seen how many spinoffs Mavie Global launches in an attempt to keep its dying ULX token Ponzi scheme afloat.

MaVie Global and FinUp is being promoted in New Zealand and Australia. Linda Jackson advertised a workshop in Melbourne Australia on May 4th.

CZ was sentenced to 4 months in prison.

Ack, I meant months. Thanks for catching that. 4 years would have still been too light mind you.

Amen just keep exposing the scam scammer like Carl Linda is in Carl’s team.

Michal Prazenica has announced that Mavie Global as from next Monday (July 1) will definitely ceased sells of Staking Hubs of Ultron coin (ULX) and Payment Hubs of Flipme.

It seems they are preparing the end of this MLM scam.

Thanks for the update. Makes sense if you’re going to pump out reboot Ponzis every few months that eventually you shutter the earlier launched ones.

What’s that, you invested in ULX and FlipMe? Oh well, sorry for your loss.

It’s really interesting that you’re talking about this without a properly research. Could you explain to me if you even did a research? (Ozedit: snip, see below)

What’s there to explain? Scroll up and read the “properly research” yourself.

Sorry for your loss.

Everything you mentioned are part true and part lies. So that gives your research kind of veracity. (Ozdit: snip, see below)

Feel free to point out any lies. Ponzi marketing nonsense and/or butthurt will be marked as spam.

You’re one of those that believes anything you read on the internet aren’t you?