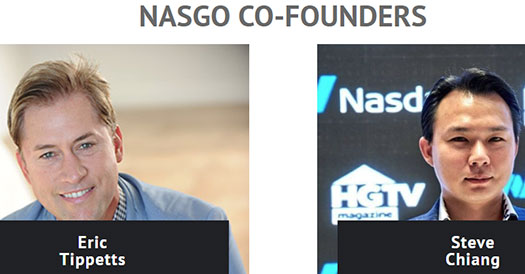

SEC sues Chiang & Tippetts for Nasgo & ShareNode sec. fraud

The SEC has filed suit against Steven Chiang (aka Cyrus Kong), Eric Tippetts, James Hardy and Maurice “Butch” Chelliah.

The SEC has filed suit against Steven Chiang (aka Cyrus Kong), Eric Tippetts, James Hardy and Maurice “Butch” Chelliah.

As alleged by the regulator, the defendants scammed consumers out of millions through their Nasgo and ShareNode Ponzi schemes.

Stephen Chiang began Nasgo and NSG token development in 2015.

He and Tippetts, who Chiang met in 2012, launched Nasgo in December 2017.

Nasgo was your typical crypto shitcoin cash grab that went nowhere.

Chiang and Tippetts claimed that early investors would receive automatic, consistent payments in NSG tokens that would increase in value as demand for NSG tokens increased, that tens of thousands of clients would be signing up every day, and that the number of new clients would grow to millions per day in two years.

Chiang and Tippetts marketed Nasgo as the “world’s first trillion dollar blockchain”.

Nasgo’s flop culminated in 1 BTC or 25 ETH “Founding Delegate” positions. At the time this came to $16,625 and $20,475 respectively.

In exchange for purchasing a Founding Delegate interest, Chiang and Tippetts promised that Founding Delegates would receive 25,000 NSG tokens upfront and that they would receive an annual pro rata share of 8.5 million NSG tokens.

Basically suckers who bought into NSG early, hoping to scam those who invested after them.

Nasgo flopping culminated in Tippetts lying about sold out Founding Delegate positions.

On May 4, 2018, Tippetts published a YouTube video in which he claimed the Founding Delegate interests were sold out.

There were 1000 Founding Delegate positions available.

Tippetts knew, or was at least reckless in not knowing, this claim—that the Founding Delegate interests were sold out—was false.

He knew that, in reality, NASGO only sold approximately 40 Founding Delegate interests in the United States—4% of what he publicly claimed—which raised no more than $837,000.

Tippetts knew this, among other things, because he was responsible for sending invitations for a July 2018 Founding Delegate call that he hosted.

Tippetts sent only 42 email invites for that call – a far cry from 1,000 Founding Delegates he had promised.

Despite that knowledge, on the July 2018 call, Tippetts again falsely claimed that all 1,000 Founding Delegate interests had “sold out very quickly.”

Around this time ShareNode was introduced. It was through ShareNode that BehindMLM became aware of Nasgo.

ShareNode saw Chiang and Tippetts bring James Hardy (right), and associate Maurice Chelliah on board.

ShareNode saw Chiang and Tippetts bring James Hardy (right), and associate Maurice Chelliah on board.

Sharenode purported to be “the marketing arm of NASGO” and “powered by NASGO.”

Tippetts, along with Hardy, who possessed significant multi-level-marketing (“MLM”) experience, worked together to market and sell Sharenode’s unregistered digital asset security—the SNP token.

ShareNode was your typical Ponzi scheme. Affiliates invested in SNP tokens on the promise of passive returns, paid in SNP and NSG tokens.

All in all ShareNode took in over $10 million from affiliate investors.

One of the problems MLM crypto Ponzis face is dump pressure on their token due to selling off.

ShareNode’s business model countered this through planned Ponzi style manipulation. Or at least that was the initial plan.

From the outset, the value of the SNP token was fabricated by Tippetts and Hardy, and the represented increase in value never materialized for investors.

In fact, within the first few months of the June 2018 launch, without any announcement to investors, Tippetts and Hardy stopped increasing the price at which they sold SNP tokens.

Manipulation of SNP tokens was possible because

Sharenode stored all SNP token transaction data in a database stored on a single server.

Sharenode’s outside web developers, as well as Hardy, knew that SNP token transactions were not recorded on any blockchain. Chelliah was at least negligent in not knowing that SNP token transactions were not recorded on any blockchain.

Similarly, NSG returns also didn’t actually exist.

Although Sharenode investors could see their NSG token balances increasing, those transactions were not recorded on the NASGO blockchain.

As opposed to an actual blockchain, where anyone can sell if there’s a buyer, ShareNode/Nasgo withdrawals had to go through Tippetts.

Investors could not withdraw or sell their purported balance of NSG tokens without approval from Tippetts, who had to manually authorize any NSG token distribution process, with rewards paid out of a wallet that Tippetts controlled.

As the math behind ShareNode and Nasgo inevitably spiralled out of control, Tippetts and Chiang initiated a public exchange exit-scam.

This saw the pair bribe BitForex, a dodgy Chinese exchange run by CEO Jason Luo, with “at least 100 BTC” for a listing (then ~$615,000).

Unbeknownst to Sharenode investors, Tippetts and Chiang used at least 50 bitcoins from Sharenode investors to pay BitForex to list the NSG tokens.

In theory, this listing would allow NSG token holders to sell and trade their digital securities with other market participants.

I’m not sure what happened but for some reason BitForex was only paid 50 BTC.

After the exchange listed NSG, Chiang and Tippetts spent another 83 BTC of ShareNode investor funds to manipulate its value.

Chiang and Tippetts often communicated via WeChat. In those WeChat exchanges, Chiang explained to Tippetts what he

meant by “market making.”For example, on January 26, 2019, Chiang wrote to Tippetts:

I have market making team of 4 people. They work 24hrs shift [sic] to do it dude…Right now our market cap is abt 300-400m usd so it will be top 20…We have to constant [sic] keep this for 100 days then we can get into coinmarket cap

Chiang further explained on January 26, 2019:

With the market making, soon more and more people in the public then the world will see the numeric value of NSG…so with us maintaining at the current price range…market should start buying NSGs and compete for deloegates [sic]

Thus, Tippetts knew that Chiang controlled and manipulated the price and volume of NSG tokens.

Tippetts also knew that Chiang and his market makers were the “biggest players” in transacting NSG tokens on BitForex, yet no one associated with NASGO ever told investors that the overwhelming majority of NSG token trading on BitForex was done by Chiang and his team.

NSG did in fact pump upon listing in January 2019. NSG’s pump didn’t attract enough new suckers though, and so came the inevitable dump.

A key component of Tippetts’s, Hardy’s, and Chelliah’s Sharenode sales pitch was the purported opportunity to earn NSG token rewards,

which could be monetized by selling them on BitForex.In early April 2019, after some SNP token holders began selling their NSG tokens on BitForex, Chiang sent a WeChat message to Tippetts berating him for allowing these sales.

These sales flooded the market with so many NSG tokens that Chiang’s market makers could not absorb the NSG tokens while still maintaining the price of NSG tokens.

After getting repeatedly “pounded” by Chiang as their Ponzi scheme fell apart, Tippetts offloaded to Hardy.

On April 4, 2019, Tippetts wrote to Hardy:

Just spoke to steve [Chiang]…he is very concerned we don’t have the funds to stabilize NSG as the NSG we are sending out

people are selling at approx $150-$300k a day.Steve’s running out of money and can’t pay developers and keep market moving up.

On April 22, 2019, Tippetts sent an iMessage to Hardy stating:

Steve pounded me again last night on still pushing withdrawals and keeps crashing NSG. They are basically selling and it’s

coming out of Steve’s pocket from market makers.I have to send smaller chunks.

Ponzi math is Ponzi math though, and on May 3rd 2019 ‘Chiang and Tippetts halted all NSG token withdrawals from the wallets of SNP token holders.’

BehindMLM documented the ShareNode and Nasgo collapse five days later on May 8th.

Across three claims of relief, the SEC is suing Steven Chiang, Eric Tippetts, James Hardy and Maurice Chelliah for securities fraud.

Specifically violations of

- Section 10(b) of the Exchange Act (Chiang, Tippetts and Hardy);

- Section 17(a) of the Securities Act (all defendants); and

- Section 5(a) and (c) of the Securities Act (all defendants)

The SEC is seeking a permanent injunction against the defendants, as well as digorgement of ill-gotten gains and civil penalties.

BehindMLM reviewed ShareNode and Nasgo in January 2019, approximately five months before it collapsed.

The conclusion of our review was ShareNode, Nasgo and its executives were engaged in securities fraud.

It should be painfully obvious that NSG and SNP tokens are securities. ShareNode affiliates are investing in SNP on the expectation of a passive return, which is interwoven with SNG tokens.

To operate legally in the US, ShareNode and Nasgo have to register their respective tokens with the SEC.

At the time of publication neither ShareNode, Nasgo, Stephen Chiang, Eric Tippets or James Hardy are registered with the SEC.

This means that on a base level, ShareNode and Nasgo are committing securities fraud.

There are 399 comments on BehindMLM’s ShareNode review as I write this. Many are from ShareNode/Nasgo investors, who at the time were adamant I was wrong.

Oz? Are you really in your right frame of mind? you can’t even be consistent.. you contradict your very own “analyses”..!

As happens in every MLM Ponzi scheme, here’s what happened to funds invested in Nasgo and ShareNode.

Ultimately, Chiang, Tippetts, Hardy, and Chelliah would line their pockets with investor funds to use for various personal expenses.

Sharenode and NASGO never had dedicated corporate bank accounts.

Instead, millions of dollars from investors flowed into numerous bank accounts and cryptocurrency wallets directly controlled by Tippetts, Hardy, Chelliah, and others, as well as Hardy’s PayPal account.

An analysis of the activity in these accounts reveals that Tippetts received at least $1.5 million of proceeds from Sharenode and NASGO investor funds, Hardy kept at least $1.3 million, and Chelliah kept over $200,000.

They used these misappropriated funds for mortgage payments, car purchases and leases, credit card payments, personal loan payments, and various living expenses.

Additionally, Tippetts caused the transfer of hundreds of bitcoins to wallets purportedly controlled by Chiang.

In WeChat messages dated December 15, 2018 and January 17, 2019, Chiang acknowledged receiving more than $1 million of Sharenode investor funds from Tippetts.

The rest was paid out to various insiders and promoters of the Ponzi scheme.

After scamming consumers out of millions, Eric Tippetts tried to rebrand himself by hiding behind children’s charity.

Steven Chiang fled to Asia (the SEC cites Chiang as a US visa holder residing in Singapore). There he went on to launch the Global Sponsorship Network Ponzi scheme in late 2020.

As of mid 2021 Global Sponsorship had collapsed twice. The third reboot doesn’t appear to have taken off.

James Hardy hired a lawyer to threaten anyone who complained about ShareNode and Nasgo investor losses.

It is through correspondence between Hardy’s lawyer and BehindMLM reader in late 2019, that we learned the SEC was investigating.

As cited by the SEC in their complaint;

In 2019, Hardy pled guilty to felony fraud in California for misappropriating investment funds from an elderly client, as part of an unrelated scheme.

I went looking for details on this case to plot a timeline against Hardy’s lawyer’s threats. Oddly enough I couldn’t find anything.

Maurice Chelliah (right), who also goes by Butch Chelliah, seems to have kept a relatively low profile after ShareNode and Nasgo.

Maurice Chelliah (right), who also goes by Butch Chelliah, seems to have kept a relatively low profile after ShareNode and Nasgo.

Again, as cited by the SEC in their complaint;

From 2001 through 2013, Chelliah held Series 6, 26, and 63 securities licenses and was associated with several registered broker-dealers from 2000 to 2010. In 2013, the Financial Industry Regulatory Authority (“FINRA”) barred Chelliah for mishandling investor funds.

Go figure.

I’ve added the SEC’s Nasgo/ShareNode case to BehindMLM’s calendar. Stay tuned for updates…

Update 11th May 2022 – On May 2nd the SEC filed two motions for judgment, one against Maurice Chelliah and the other against Eric Tippetts.

The motions were stricken from the record due to issues with local rules regarding the filings. Something about consenting to “Magistrate Judge jurisdiction”, which wasn’t done.

As at the time of the update there have been no further filings. I’m assuming at some point the SEC’s judgment motions will be refiled with the correct signatures.

Unfortunately as the motions were stricken, I don’t have access to the original filings to see the consented to judgments (effectively settlements).

Update 12th September 2022 – Eric Tippetts has settled the SEC’s fraud charges against him.

As of August 31st, Steve Chiang has been served via his New York attorney.

Update 24th December 2022 – The SEC has secured judgment against Maurice Chelliah.

Pending ongoing settlement discussions, Steve Chiang has been given till January 27th to file a response to the SEC’s Complaint.

Update 28th January 2023 – Steve Chiang filed his answer to the SEC’s Complaint on January 10th.

This is every MLM crypto token/coin company. They are all the same.

Nasgo and ShareNode fraud dates back 4+ years ago. We’re going to be seeing more and more of these types of lawsuits over the next decade.

Hopefully the DOJ steps up and couples money laundering and wire fraud criminal charges to the majority of them.

Article updated with news of motions for judgment and filing errors.

Is there any legal action taken upon them for those who invested?

SEC filing a lawsuit = legal action.