ShareNode Review: Nasgo NSG and SNP token securities fraud

![]() ShareNode provides no information on their website about who owns or runs the business.

ShareNode provides no information on their website about who owns or runs the business.

The ShareNode website domain (“sharenode.com”) was first registered back in 2006.

The domain registration was last updated in August 2018. Stephen Chiang is listed as the owner, through a PO Box address in the US state of California.

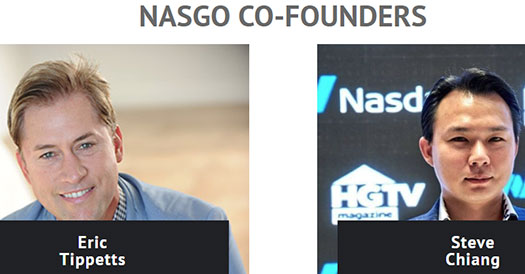

Further research reveals Chiang (who also goes by “Steve Chiang” and “Steve Jiang”) and Eric Tippetts cited as a co-founders of Nasgo.

On the ShareNode website the company advises it is “powered by Nasgo”.

A press-release dated October 3rd names James Hardy (right) as co-founder of ShareNode.

A press-release dated October 3rd names James Hardy (right) as co-founder of ShareNode.

Eric Tippets has been doing the rounds of the MLM training circuit for a number of years, primarily through his Rocket Recruitment app.

At least for a number of years, Nasgo appears to be Tippet’s first MLM venture as an executive.

Steve Chiang also appears to have a marketing background but is much more secretive about it.

This is from Chiang’s LinkedIn profile;

The first organization I created quickly became a 1000 member force using each others skill sets to succeed and create the template for future success.

That organization became the fastest growing organization in a US company and with those 1000 employees quickly became the #1 distributorship within a three month period.

Due to the generic nature of the name, I wasn’t able to specifically pin down Chiang’s MLM past.

James Hardy heads up eVantage Financial, some sort of insurance based income opportunity.

Alexa statistics for the eVantage Financial website suggest it has long-since collapsed.

Read on for a full review of the ShareNode MLM opportunity.

ShareNode Products

Nasgo markets NSG tokens, through which the company claims any company can launch a blockchain, digital assets and/or token instantly.

With NASGO, you can tokenize your company with no coding required.

Nasgo packages are pitched at third-party businesses as follows:

Nasgo Tokenize Basic ($995)

- blockchain registration on Nasgo platform

- token issue

- e-commerce platform (Amico) and rewards platform (VAPR)

Nasgo Tokenize Plus ($1495)

Everything in Tokenize Basic plus a published marketing press-release

Nasgo Tokenize Premium ($1995)

Everything in Tokenize Basic and Plus, plus a “preferred listing on ShareNode Business Directory”.

The ShareNode Compensation Plan

ShareNode affiliates receive commissions when they sell Nasgo’s “Tokenize” packages.

Commissions are paid out in SNG, NSG and bitcoin.

As previously mentioned, NSG is a token launched by Nasgo. SNG is a token launched within ShareNode. ShareNode uses bitcoin to pay quoted $USD commissions.

ShareNode pays commissions on NASGO Tokenize packages via a unilevel compensation structure.

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

Using this unilevel compensation structure, ShareNode pays commissions out as follows:

Tokenize Basic

- 1000 SNP and 100 NSG to the affiliate who makes the sale

- the first leader in the downline receives 500 SNP and 50 NSG

- the second leader in the downline receives 250 SNP and 25 NSG

- five Ambassadors in the downline receive 100 SNP to 10 NSG

Tokenize Plus

- $100, 1000 SNP and 100 NSG to the affiliate who makes the sale

- the first leader in the downline receives $50, 500 SNP and 50 NSG

- the second leader in the downline receives $25, 250 SN and 25 NSG

- five Ambassadors in the downline receive $5, 100 SNP and 10 NSG

Tokenize Premium

- $200, 1000 SNP and 100 NSG to the affiliate who makes the sale

- the first leader in the downline receives $100, 500 SNP and 50 NSG

- the second leader in the downline receives $50, 250 SNP and 25 NSG

- five Ambassadors in the downline receive $10, 100 SNP and 10 NSG

Note that ShareNode fails to provide leader and Ambassador qualification criteria in their compensation marketing materials.

Reinvestment Bonus

ShareNode affiliates who reinvest earned commissions into SNP receive the following bonuses:

- if an affiliate opts to reinvest 20% of earned commissions they’ll receive a 10% bonus in SNP tokens

- if an affiliate opts to reinvest 50% of earned commissions they’ll receive a 15% bonus in SNP tokens

- if an affiliate opts to reinvest 20% of earned commissions they’ll receive a 20% bonus in SNP tokens

SNP Investment Returns

After signing up, ShareNode affiliates are able to directly invest in SNP tokens.

ShareNode set the internal value of SNP tokens, with affiliates able to receive a ROI by cashing out through ShareNode’s internal exchange.

Joining ShareNode

ShareNode affiliate membership is tied to investment in a minimum of 1000 SNP tokens.

ShareNode affiliate membership is tied to investment in a minimum of 1000 SNP tokens.

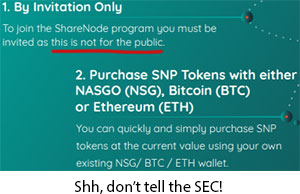

As per the ShareNode marketing slide on the right, this information is not shared with the public.

As such I was unable to pin down what ShareNode are currently selling 1000 SNP tokens for.

This is not how a legitimate MLM company operates.

Conclusion

Nasgo is basically marketed as a blockchain platform. In a nutshell they want business to pay them thousands of dollars to use their NSG and SNP tokens.

As I write this neither NSG or SNP are publicly tradeable, meaning the value and buying/selling of the tokens is centrally controlled through Nasgo and ShareNode.

As opposed to cryptocurrency, this reduces both tokens to Ponzi points.

ShareNode and Nasgo can set the price of SNP and NSG to whatever they want.

Naturally, to keep their affiliate investors happy, the company is likely to only ever increase the value.

Investment in NSG tokens allows an affiliate to park the points with ShareNode, in exchange for daily returns in SNP.

This is effectively how a ShareNode affiliate grows their investment balance until they want to cash out.

Cashing out sees ShareNode honor ROI withdrawal requests with invested funds.

ROI revenue is represented as coming out of companies who sign up with Nasgo Tokenize Packages, however there’s no provided auditing of this.

Not withstanding if there aren’t any companies signing up, ShareNode represents they’ll still honor ROI withdrawal requests.

If you ever want to sell your SNP tokens, you can. They are

yours to allocate where and when you want to.

Unless they’re withholding that selling is only possible if another SNP bagholder buys your tokens, the ROI withdrawal money has to come from somewhere.

That leaves new investment from affiliates (who invest in NSG, bitcoin or ethereum), closing the Ponzi cycle loop.

I’d also be very surprised if ShareNode weren’t paying referral commissions on SNP investment, but I wasn’t able to confirm if they were.

In any event it should be painfully obvious that NSG and SNP tokens are securities. ShareNode affiliates are investing in SNP on the expectation of a passive return, which is interwoven with SNG tokens.

ShareNode rewarding affiliates with bonus SNP if they opt to reinvest commissions into SNP demonstrates that, despite appearing as two companies, in reality ShareNode and Nasgo are controlled by the same people; namely Stephen Chiang, Eric Tippets and James Hardy.

All three appear to be based out of California in the US. Furthermore ShareNode and Nasgo are being actively promoted across the US.

Nasgo’s marketing material claims the company has ‘a network of 4,000 representatives.‘

Alexa also cites the US as the largest source of traffic to both the Nasgo website (34%). For the ShareNode website the US comes in at second (38%), behind South Korea at 53%.

To operate legally in the US, ShareNode and Nasgo have to register their respective tokens with the SEC.

At the time of publication neither ShareNode, Nasgo, Stephen Chiang, Eric Tippets or James Hardy are registered with the SEC.

This means that on a base level, ShareNode and Nasgo are committing securities fraud.

But Oz, what about all the companies investing in Tokenize packages?

Glad you asked.

NASGO was launched in early 2018 by serial entrepreneurs Eric Tippetts and Stephen Jiang and markets its services to small-to-medium enterprises through a network of 4,000 representatives.

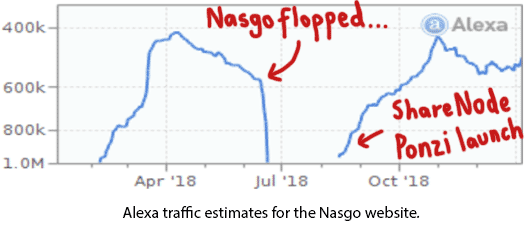

As above, Nasgo was launched in early 2018. Alexa traffic estimates reveal Nasgo on its own flopped:

It wasn’t until ShareNode took off in mid-August that Nasgo’s reversed an otherwise certain collapse.

What we learn from this is outside of SNP investment from ShareNode affiliates (primarily in South Korea and the US), not much is going on inside Nasgo.

Tokenize clients? What clients?

If Nasgo’s instant token platform was viable, there’d have been no need to launch ShareNode to prop it up.

As it stands ShareNode and Nasgo are one securities fraud cease and desist from shutting down.

South Korea has emerged as a hotbed for cryptocurrency fraud over the past few years (MLM and non-MLM). In the US ShareNode and Nasgo are just another fraudulent MLM cryptocurrency opportunity to throw on the pile.

True to form, ShareNode are also gearing up to spread into Vietnam, another notable hotbed for MLM cryptocurrency fraud (BitConeeeeeeeeeeeect!).

The only real money entering the companies is affiliate investment in SNP, which costs ShareNode and Nasgo little to nothing to generate.

The bitcoin and ethereum invested in SNP, sans bitcoin is paid out in commissions, is squirreled away by the three founders.

When ShareNode and Nasgo collapse or are shut down, SNP and NSG tokens evaporate and sorry for your loss.

Alternatively SNP and NSG are dumped on some dodgy public exchanges, although that seems unlikely given how hard Nasgo is pushing its token ecosystem.

Anyway even if does, nobody outside of ShareNode is interested in SNP tokens, so it’s still a sorry for your loss scenario.

The only winners here are those generating SNP and NSG tokens. A few early adopters will cash out through the internal exchange, but ultimately the majority of ShareNode affiliates will take a loss.

Update 29th April 2022 – The SEC filed a ShareNode/Nasgo fraud lawsuit on April 28th.

scammers ryan conley and frank calabro are in this. enough said.

FWIW, this guy appears to be a Taiwanese transplant to China. That would account for the two different spellings for his surname.

There is something in Steve Jiang’s Twitter feed about how they are known as “Amico” in China. But Amico in China is yet something else.

There is so much wrong with your article. You should really be more informed about how this works, what each company does and how the utility tokens work and what they do before you slander companies.

(Ozedit: Offtopic derail removed)

The NASGO coin goes live on bitforex.com 1-11-2019 NSG.

I sign up to ShareNode and invest in SNP points. I wait for ShareNode to raise the internal SNP value and then I cash out.

Nasgo flopped so it should be obvious where the majority of ROI revenue ShareNode is paying out is coming from.

Anything built around that is irrelevant, as evidenced by you crapping on about “so much wrong” yet failing to point out a single error.

Wonky 6 month old Chinese exchange. And the exit-scam begins…

1st off I am not part of the executive team at Nasgo or sharenode. I do own some NSG and SNP. I do not speak for either company and only for myself.

Wrong: You don’t need to purchase 1000 snp to join sharenode. You can join for free and earn BTC, NSG and SNP by helping to tokenize SME’s

Nasgo is a decentralized blockchain technology. Eric Tippetts and Steven Chang founded it. You can tokenize your brand or business without writing a single line of code. Many already have.

Wrong: Nasgo has not failed and is going strong in Asia and USA.

Look for more Nasgo updates soon. They are very public.

I’ve provided evidence of ShareNode’s own compensation plan material. There might be a free option but it’s pseudo-compliance.

Signing up as an affiliate is tied to the purchase of SNP, as per ShareNode’s own marketing material.

You can check the Alexa charts yourself. Nasgo flopped after it launched in early 2018.

Interest only returned after they attached and launched the ShareNode investment scheme. Investors in the US and South Korea are currently keeping the company afloat.

In both jurisdictions Nasgo and ShareNode are not registered to offer securities and are thus operating illegally.

@Kasey

Amico is the e-commerce platform bundled with the Tokenize packages, not a separate company AFAIK.

Oz I really can’t believe your reviews mate. You are incensed in destroying every MLM or affiliate company that comes onboard. Everything to you is a scam mate.

NASGO is a legal company and the founder was interviewed by Nasdaq and he has appeared in various TV shows and even appeared at the United Nations and even the Jackson Family have a high stake in this as Michael’s nephew has tokenised his record label.

Did you know they are sponsoring the Super Bowl, sponsoring the Sundance Film Award and also will competing with Netflix as they are also streaming movies as well.

(Ozedit: derails removed)

You can’t legitimize securities fraud via association.

I suspect Nasgo might have launched legitimately but as evidenced by their Alexa traffic rating, the concept flopped.

The launch of ShareNode marked Nasgo’s descent into securities fraud. None of the marketing waffle you’ve come up with changes that.

Oz you are (Ozedit: derails removed)

If Nasgo was a scam to you why in the world did you buy those tokens for in the first place? You said you will sell it straight away but I know that will not happened as we don’t know your real name how do we know that you will actually do that?

Oz you are (Ozedit: more derails removed)

What I am or am not doesn’t change the fact Nasgo and ShareNode are committing securities fraud.

Learn to read please.

Sharenode and Nasgo violate a number of Securities Violations, including paying commissions to reps on investments. They clearly have no legal counsel (if they do he/she should be fired).

There token sales meet every definition of a security and they have no registration, provide no qualification, sell to non-accredited investors, no KYC compliance, serve in a broker-dealer capacity on their own tokens as well as others, and pay commissions on the sell of securities to non-licensed agents, and pay commission in a MLM structure.

Their exposure doesn’t end with security violations, the whole thing is a money grab Ponzi scheme targeting U.S. investors (in addition to others in other countries).

The people sticking up for it are in the deal and drinking the juice, and unfortunately appear to be uneducated on security laws and will likely all be the victims at the end of the day.

They sold NASGO tokens based on a $2 Billion valuation (for those that took the time to do the math), which is probably why they then soon after started saying they would be worth a Trillion dollars, joining a short list of companies to achieve that (Amazon, and Apple).

They sold a lot of people on “if they are on TV and stages they must be legit”. The fact is those were all paid events, including the “Nasdaq” video they love to promote.

Many ICO owners paid to be featured on that niche show, that in fine print says “filmed on location at NASDAQ”, it’s not a NASDAQ event.

Oz is correct in that their NASGO ICO was largely a flop, but they were able to sell people on several million dollars of token sales. (evidenced buy their public wallet and token transfers).

When the ICO market dried up, and most avoided due to securities regulations, they went back to what they appear by background to know, and came up with a smoke & mirror MLM model proven that people can sell their friends and family anything, including tokens on the promise they will make money.

There Apps have never worked or been ready or do what they implied they would do. They spend their money on marketing the tokens and “opportunity”, and have found a lot of people willing to drink the juice.

It’s not too hard for anyone educated in business to see what’s going on. It’s a classic Ponzi with no real business model that is sustainable, and they whole thing will collapse as soon as investors start having a hard time pulling money out of the system.

It appears they do have a listing coming up, but do the homework on that exchange. It’s known by everyone in the industry to be a sham bots driven exchange, generating fake trading activity.

It’s illegal model in any country and is also an MLM if you look at details. Perfect match for them.

Word of advice to those in the deal, try pulling your money out a soon as you can. And real money, not these shiny tokens that are worthless but they made billions of to hand out like candy.

Let me get this right the company staged this elaborate hoaks like the NASDAQ interview, the morning TV show and other various TV programs, sponsoring the Super Bowl ( cost millions to run it), sponsoring the Sundance Film Festival, speaking at the United Nations, setting up offices in China and getting well known companies onboard the blockchain. Wow what a way to scam people which will cost millions and millions of dollars.

Ryan you are nothing more than a hater mate and tend to be this guru educated guy but at the end you are going to look like a fool.

Wait and see what happens at the Vietnam event but then Ryan will say it is all smoke and mirrors. You just can’t debate with haters.

Nasgo and ShareNode aren’t comitting securities fraud through PR campaigns, they’re doing so via their business model. Which you continue to ignore.

Again, you can’t legitimize securities fraud via association.

Until Nasgo and ShareNode register their securities offering with the SEC and file evidence of external revenue being used to pay NSG and SNP returns, they’re operating illegally in the US (ditto any other country with securities regulation).

This should have been done before ShareNode was launched mind, not after.

Gullible Vietnamese investors will be presented the Nasgo and ShareNode securities fraud opportunity. What else do you think is going to happen?

BitConneeeeeeeeeeeeeeeeeeeeeeeeeee!

@tony, you must have a lot at stake in deal.

Did you notice the Sundance is just a sponsored party, and one that they have “resold” to members to pay for and “share leads”.

You really think they sponsored Super Bowl? Read fine print, another party they will likely offset to members.

Look at member email updates on Sundance and see how they “offered” members a chance to “buy into” event and share leads.

Do you have any experience in these sports events? Anyone can sponsor a party, it’s money only, and in there case money they collect from members to pay.

verifiable proof please. not a scammer ryan conley video either who pulled this same shit lat year with the futurenet scam.

@tony-

I honestly am on your side and not against you. The tough job I have is telling a kid Santa Clause or Easter Bunny doesn’t exist. It sucks, not fun, and not something one wants to point out to someone who has money to lose if exposed.

I didn’t have the time today to explain in detail why Sharenode and NASGO is a total scam, I will tomorrow.

Bitforex 1.5 years old..one of the top ten. Sharenode is a 2 level affiliate program. NASGO is a decentralized platform…not touchable..

it’s tomorrow?

(Ozedit: Offtopic derail attempts removed)

My advocacy includes this – if you have nothing good to say of others’ business..just don’t say it… and mind your own business.. let us decide for ourselves and be accountable for own choices. We are old enough..we don’t need another naysayer in this world…there’s just too much hate in this world already. Peace, man!

And if you forgot that Nasgo is a DECENTRALIZED/ blockchain platform… who needs a physical address in the cloud, Oz? Are you really in your right frame of mind? you can’t even be consistent.. you contradict your very own “analyses”..!

In all that waffle you failed to address ShareNode and Nasgo offering illegal securities offerings. That should be where your due-diligence begins and ends.

Why, so it’s easier for you to scam people?

Any company that wants to offer securities and operate legally.

Decentralized my ass. All it’ll take is one securities fraud cease and desist and your SNP and NSG points disappear.

Stephen Chiang, Eric Tippets and James Hardy are real people. There’s consequences for real people who break the law.

From the Whois domain registration it shows that Bitforex.com was initially registered on March 26, 2013. From all practical purposes it remained on the shelf until about June of last year, and then the site was updated on December 13, 2018.

According to Alexa, there was zero activity on the website until late June of 2018. It peaked in October 2018 and has remained at or near the peak level since. It is most popular in Japan.

So this story that it is 1.5 years old is a lie. As Oz said it is a six-month old active site.

How about all you supporters start publishing factual truth instead of the made-up BS you all have been fed and regurgitate. You do your due diligence BEFORE you join a program.

The bottom line is they are operating illegally and have since their launch.

And if you believe (Ozedit: derails removed)

And where is your “due diligence” for not citing the actual SEC provision that will warrant a cease and desist?

Do you have any (Ozedit: more derails removed)

It’s called the Securities and Exchange Act. It was enacted in 1933.

Instead of chasing imaginary token riches why don’t you educate yourself.

@DSchwab-

I don’t think anyone is in on here hating. Quite the opposite, trying to point out facts to prevent more people handing over money to a scam.

1. NASGO business model failed because it was all smoke and mirrors anyway and it provides no benefit to companies. Unless said company wants a token to offer their own illegal security, but the market has wisened up and the ICO bubble has already died.

2. Sharenode and NASGO sell illegal securities, by every definition. It’s a security at its basic root by selling something to someone on implication it will go up in value, or provide income, without you having to do anything (passive). They mask this with this delegated proof of stake BS.

3. The daily ROI and stakes token value is a classic Asian MLM scam run for years, likely brought here by this Stephen Chiang guy.

4. On the calls you notice how James Hardy will never address questions to legality or securities? Refers to this “attorney” the have, no legitimate attorney would approve what they are doing (they don’t even have any paperwork of any kind of what you are buying, membership rules, KYC, nothing. This is wrong on all fronts)

5. They claim to run a billion dollar company but operate from their homes and a PO Box.

6. They are listing NSG on the dirtiest of all exchanges, google Bitforex for data on their fake trading volume bots, they payMLM commissions on trades (also illegal), and is run by another Asian scammer with a past.

7. Notice they never deliver anything on time, and after members paid for Sharenode tokens then it was “we can’t release them until VAPR launches, and VAPR can’t launch until we have 10,000 users). Read between the lines, this is all so slow down withdraws to keep more cash coming in than going out.

8. Do the simple math, up until 2 weeks ago they were still trying to get 100 businesses to tokenize, assuming they all paid the max price (which they don’t), that’s only $200k. James Hardy claims regularly the top leaders are making $100k/week. Explain that math to the rest of us not drunk on the juice.

9. Eric says they will be the next Trillion dollar company, behind guess who? Apple and Amazon. Amazing doing this from a PO Box and a couple of MLM junkies working from their houses. Trillion dollar company, how do you believe this??

10. Where do you think your money goes when you pass them money? James Hardy has said dozens of times it goes to Marketing. He’s right, more promotional speaking events and videos to get more people to give them their money. And some goes to paying out withdraws to keep they Ponzi going.

11. Vietnam is South Korea are hot beds for ROI MLM money scams, no surprise they are there. What’s amazing is they had the audacity to run this blatant of a scam in the U.S. targeting U.S. investors while two of the scammers are U.S. citizens.

12. It’s not a matter of if they will go down, it’s how long. It’s the musical chairs game with money, those at the top are cashing out while the newest victims will be left with nothing when the music stops.

lol. you’re not even trying to prove your claim he’s wrong.

(Ozedit: derail attempts and conspiracy theories removed)

Why did you join Sharenode in the first place? Apparently it looks like you got your facts wrong about the company’s business model.

What I heard is they are heavily counseled by attorneys who advised them on how to operate legitimately.

So, I would strongly suggest that you rewrite the entire article on Sharenodes business model. You’ve got everything wrong, purported pay structure, etc….even the token names wrong.

If not, I bet they’ll be coming after you for libel, Oz. Do your due diligence before spewing out false stuff that will potentially harm many good people. (Ozedit: more derail and conspiracies removed)

Please tell me how to locate this website address?? Can anyone confirm the address is an office or just a PO box? thank you. I believe this company is acting fraudulently!

@Diane

I didn’t. You don’t need to join an MLM company to review one.

Oh really? Prove it then.

For all the whinging not one ShareNode investor has provided an alternative compensation plan.

I didn’t just make up a business model to review. The compensation plan reviewed here is from ShareNode’s own marketing material.

I’ve even provided a screenshot of the source material when discussing the secretive nature of it.

Any remotely competent MLM attorney would have pointed out the glaring securities fraud ShareNode’s launched introduced.

@lulu

ShareNode fails to provide this information to potential investors. All part of the securities fraud package.

And take the risk they’ll have to explain how “legal” their operation is in front of a court ?

The next time that happens will be the first.

(Ozedit: offtopic derail attempts removed)

May I ask, have their been any complaints about this company? If not, then id like to ask, why do you take it upon yourself to find blood when there isn’t any?

About Sharenode, simply copy pasting their material doesn’t mean the other stuff you’re purporting about them is accurate. The pictures themselves are accurate but the rest of the stuff you’re claiming are wrong.

For example, you claim that they have their own internal exchange where they can trade/sell their SNPs. That is incorrect.

With Sharenode there is no exchange, period. First of all it’s a utility token and not an investment token.

Please educate us on the difference between the 2 and see which one makes a difference with the SEC. Also, Sharenode members’ earnings are mainly tied to the number of businesses that become tokenized, and from that process other ways of earning are generated.

Aware of the many fraudulent companies that sour the industry, this whole system was well thought out by the founders with the number 1 priority in mind being compliance.

If there is a need to further clarify their business model, please talk to them directly and im sure everything will be more clear.

This isn’t Facebook. If you post offtopic derail waffle that has nothing to do with ShareNode it’s going to either get nuked or edited if there’s enough of the comment to save.

No idea. We review any MLM company we come across with an English compensation plan.

In the instance of scams, typically by the time complaints have been filed they’ve already collapsed. Not much point publishing a review after the fact.

Same source material. From what you’ve posted you have a problem with semantics, as opposed to ShareNode’s actual business model.

Nasgo == ShareNode. You’re going to tell me Nasgo doesn’t operate an internal exchange?

Bullshit. I invest in SNP, ShareNode/Nasgo’s owners arbitrarily increase the value of SNP and I cash out through their internal exchange.

Paying a passive ROI in tokens/points isn’t exempt from securities regulation.

If that were true SNP and NSG would be worth $0. Nasgo flopped, remember?

Furthermore Nasgo and ShareNode can claim what they want. Unless they register with the SEC and provide revenue accounting audits and required disclosures that, if they lie in about they face serious legal repercussions, they are committing securities fraud either way.

And that “system” flopped. So now we have ShareNode which is just another fraudulent MLM crypto securities scheme.

DIANE DOLEMAN: Come on, seriously, the statement you made below, this whole system was well thought out by the founders with the number 1 priority in mind being compliance.

NO, the number 1 priority was scamming the victims, they knew they had to be in compliance with the SEC in the US.

If priority 1 was compliance, they wouldn’t of opened there doors and taken a penny from an investor until they were approved and registered by the SEC. THEY ARE COMMITTING SECURITIES FRAUD…..

For those of you who still believe that NAGGO/SHARENODE tokens are not a security, here is the definition of what the SEC constitutes as a security. It is called the Howey Test and it states, and I quote:

It makes no difference if you call it tokens, a loan, a widget, or whatever else you want to call it . If it meets the above conditions it is a security.

The Howey Test was the result of a 1946 Supreme Court Case involving the Securities and Exchange Commission versus W. J. Howey Company.

The court found that an investment contract is an investment of money or other tangible consideration in a common enterprise with reasonable expectations of profit derived solely from the efforts of others, i.e. investing money into a business where a profit is gained without effort on the investor’s part is a security.

NASGO/SHARENODE clearly meet the definition of a security. To claim otherwise you are being either disingenuous or ignoring reality.

By the way, can’t find NASGO/SHARENODE trading on Bitforex.com. Used the trading symbols NSG and SNP. Wonder why?

I would also be asking how many tokens did the co-founders and President of NASGO/SHARENODE offer for sale on launch. Might be seeing a classic pump and dump situation.

(Ozedit: From Lynn via email – “I just found the announcement on Bitforex that trading will be open on 1/18/19, thus why nothing found.”)

These guys just signed a deal with the goverment of china I dont think the chinese give a damn about your SEC.

Besides the SEC is shutdown because the U.S is broke. World is changing.

Naw dawg, I heard the deal was with the Easter bunny. We riding this lambo to the moon.

(looks like now ShareNode promotion in Asia has begun, here come the bullshit marketing claims…)

MOONAGE; What the hell are you smoking, deal with the government of China, seriously, you need to go see a nut doctor.

@Whip

Is this the same Ryan Conley who ran the OneCoinMillionaire.info website? Today the millionaire website is no longer available. 😀 Why?

share-your-photo.com/6b22353273

Ryan Conley + Frank Calabro + Moonage + NASGO/Sharenode + Chinese government

All we need now is a fairy godmother and a big bad wolf and we’d have a perfect fairytale.

Hi Oz,

In the spirit of open discussion, the back-and-forth here in the comments section feels like I’m sitting in a crowd watching a special kind of debate.

A really weird debate, in which one of the debate participants is able keep the audience from hearing statements of his opponent that he deems off-topic (or that he doesn’t want the audience to hear, or that, potentially, damage his own argument…?).

Rather than deleting them, why don’t you let them stand with a note that you feel they’re off topic? Or better yet, address them directly? Others might disagree with your opinion that they’re off-topic. This is a strikingly chicken-poop way to have a discussion, it seems.

If you cannot defend your position without selectively silencing rebuttals, your position has no value.

Will this comment survive? I doubt it.

my opinion this biz has a china mans chance if the lisk like blockchain works for real businesses.

@TexasPaul

Because nothing is worse than trying to find information on something and having to sift through waffle garbage to find it.

BehindMLM publishing a review and scammers rushing to defend it by posting anything they can think of to draw attention from a fraudulent business model has been going on since day 1. It’s nothing new, neither is my moderation of it.

As anyone can plainly see, comments that address a published review are mostly left intact and responded to. The derails ShareNode affiliates leave are either removed or edited out.

If you want to make conspiracy theories out of that, awesome. Still doesn’t change the fact that ShareNode and Nasgo are committing securities fraud.

@Oz

One single person deciding what is ‘waffle garbage’ (whatever that is) is exactly the same as one single person deciding what is ‘off-topic’. How does anyone reading this determine whether it’s ‘waffle garbage’ if they don’t ever get to see it? You’re making my point.

I can’t speak to what the SEC constitutes as a security. But I can speak to the fact that you have completely misrepresented the Sharenode compensation structure. There is nothing MLM about it, the diagram you’ve included here is patently false.

Between that misrepresentation and the fact that one side (you) gets to redact whatever element of a rebuttal that he chooses, I can’t see how anyone can take this discussion seriously.

Do what you want, it’s your website, but I wouldn’t blame those minds that aren’t changed by your approach.

Simple, if the comment has nothing to do with the content being commented on it’s off-topic. It’s not rocket science. I’ve run BehindMLM in this manner since day 1.

Don’t like it? Facebook and Twitter spam might be more up your alley.

Well then you have no business trying to argue that ShareNode’s Ponzi points aren’t a security then. Go and do some basic research first.

ShareNode rewards affiliates with tokens over multiple levels. That’s enough to make it an MLM opportunity.

Our review isn’t targeted at scammers already in ShareNode. Nothing short of time in prison will change their behaviour (Frank Calabro Jr. is a good example).

Rather our review is aimed at their unsuspecting victims, who might invest in the belief that ShareNode is a legitimate MLM opportunity.

As evidenced by yourself, there are plethora of potential investors in the MLM cryptocurrency space who are completely ignorant of securities law.

What makes it even more unbelievable is, despite not even understanding securities law and securities themselves, they’ll attempt to convince you their latest scam of the moment isn’t a securities offering.

“Herp derp I know fuck all about securities law and unregistered securities, but you’re totally wrong about ShareNode because you’re removing offtopic derail waffle”.

Case in point.

Anyway, you can either go learn what securities are and why ShareNode and Nasgo are breaking the law. Or continue to whinge about my moderation of offtopic waffle from salty scammers.

You’ve said your piece and I’ve responded. I’ll be marking anything further not directly related to ShareNode and Nasgo from you as spam.

The sad thing is that in a few days another ShareNode investor will rock up and trot out the same spiel. I’ll remove/edit the comment(s) and they’ll retreat to the Telegram/Facebook group circle-jerks “comment got deleted, free speech, MUH DEBATE OUTRAGE!” etc. etc.

Happens in every scam that gains traction.

I’ve done no such thing, please re-read my posts. I have only made the point that the compensation structure is misrepresented in your post. (Ozedit: derail removed)

Yes, two levels. The third level in your diagram is the misrepresentation that makes it look insidious.

(Ozedit: more derails removed)

The diagram is clearly provided as an example of the described unilevel compensation structure, which ShareNode uses to reward affiliates with.

The review also clearly states ShareNode’s use of a unilevel compensation structure is restricted to two levels (more than one level = multilevel = MLM).

Reading anything insidious into ShareNode’s use of compensation levels is on you.

Also note that securities fraud has nothing to do with how many levels a company uses to reward its affiliates.

Anyone in the Sharenode deal get today’s “latest announcements” and promotions?

Flat out money grab at this point. New tokens, discounted promises, still no paperwork on what you are investing in, and now this new claim they are in business with the China government (who by the way bans cryptocurrency).

This appears like the pressure to withdraw the ROI is competing with the cash coming in, so the offers get better, the claims get greater, and the disregard for rules and regs are required to keep the thebtrain on the tracks.

Start googling Sharenode MLM, Sharenode reviews, and you will see people who got sold on this sham by friends and family (the MLM model) and thought they could sell to learn they are in this weird ROI money game.

TEXASPAUL: I’m trying to figure out why your arguing any of the points with ShareNode, they never registered and were approved by the SEC which is a complete violation before accepting any funds from US residents.

Any due diligence and you would clearly know they have an MLM model and fits a Ponzi scheme model….Stop drinking the coolade and do your homework…..

I have done two things, and only two things:

1) I have pointed out that the Sharenode comp plan is misrepresented here

(Ozedit: offtopic derails removed)

False.

Thanks for making it clear you’re more interested in wasting time than educating yourself on securities law. I think we’re done here.

TexasPaul, I take it that reading comprehension is not one of your strongest suits.

Oz has explained it to you. Ryan has explained it to you. I have explained it to you how the tokens are unregistered securities and they are in violation of the SEC by not being registered with them.

They are not even in compliance with the FTC which governs the MLM Industry. by not having any retail customers, meaning people who are not part of NASGO/SHARENODE. This makes them an illegal pyramid scheme.

We can explain it to you but we can’t make you understand it, especially when you don’t want to understand it because you would know you’ve been had. And if I had to guess this isn’t your first rodeo either, and you have been scammed before.

Just an aside, but every time I see Steve Chiang, or as he is known on LinkedIn Steve Jiang picture, he reminds me of the actor in the Terminator Movie.

Can someone explain to me how a 2 Level can be a ponzi?

Ponzi schemes are built on money flowing to the top yet in ShareNode it is literally impossible… It’s 2 levels.

NASGO started almost 6 years ago funded privately with no ICO

ShareNode started because without businesses NASGO has no utilization.

You can join for free, invite one business and be an active sharenode member…

AMICO and VAPR are HUGE development projects of course it takes time and there are setbacks.. It’s not as easy to run a POS blog as yours… It has a bit more lines of code…

NASGO can’t flop if it hasn’t officially launched on an exchange. Bitforex will be the first of many. ShareNode is simply the marketing arm of NASGO. Two different companies working together.

SNP has utilization. It’s not a “hold and wait for the value to go up”. You need SNP to launch ads on other applications like AMIC, VAPR and all other applications that will launch. It is simply a advertising credit.

You spend your life shitting on companies and not doing your research… That is a sad life to live. ShareNode and NASGO are completely different companies. It’s your loss when you see everything that we will be doing.

Using newly invested funds to pay existing investors a ROI makes ShareNode a Ponzi, not how many levels referral commissions are paid out on.

A Ponzi scheme is investment fraud (new money to pay existing investors). You’re describing a pyramid scheme.

ShareNode is that too because it doesn’t have any retail sales within its compensation plan.

Actually it started because Nasgo on its own was a complete flop. Amico AND Vapr are entirely unknown outside of Sharenode.

Sure it can. Exchanges are full of flopped altcoin scams.

I invest in SNP, go masturbate in the corner and eventually withdraw a ROI through the internal exchange. SNP’s value is arbitrarily set by ShareNode, thus the ROI being entirely passive in nature.

Same owners. ShareNode == Nasgo.

Nah. The only sad thing here are the ShareNode scammers desperately avoiding the facts and coming up with excuses for financial fraud.

Always the same story with MLM crypto scams. “We’re gonna.. and then we’re gonna… wait till we…”

Stop marketing a fraudulent business model on bullshit promises and address the present reality: Nasgo and ShareNode are committing securities fraud and running a Ponzi scheme.

you wouldn’t need to be here trying to defend it if it wasn’t the scam that it is.

3 of the biggest scammers in this, conley, calabro, lawson, have all been saying this for years with all the other scams they’ve pushed.

how will this be any different since none of these 3 do ‘legitimate’?

Oz, Nasgo only just got launched (Ozedit: snip, see below)

Nasgo launched in early 2018 and flopped. Know your subject matter if you’re going to discuss it.

When you have an investment to lose if what you have been told by SHARENODE/NASGO members and promoters turns out to be false, you tend to only see one angle to their message and want to believe it.

To those who have been around the block before and seen these scams (in their various forms) it is blatantly obvious from a mile away what is taking place.

First off, research the owners of the company. All three are MLM junkies, even the Hardy guy claims to have built a successful insurance business, but that was also an MLM failure (disguised as a new business model for insurance).

Someone on this thread said (do you really think they got on TV, got on NASDAQ, got on whatever international council, all as this elaborate hoax to scam pepole for money). Answer is. Yes.

Everyone of those engagements, and their others were purchased air time and stage time. Every one of them. There is an industry of businesses, for a profit, that sell a “marketing package” to get you on camera and a stage to promote, while looking like you are as subject matter expert.

This is what they (and others) do to build “content” for Social Proof. And it worked, all of the pitches i see from members is “they are on NASDAQ, Councils, News, yada yada), instead of looking at the core of the business and the people running it. You got sold the smoke and mirrors.

As I have said before, use their own data they share on member calls. They tried to sign up 100 businesses (yet they never proved they did). This would have brought in $100k-$200k in revenue.

From that, in a normal MLM maybe the commission 50% to the field (assuming they had a legal product). That’s 50k. Then there is some profit, in this case they say they share with their investors. So you have $20k maybe.

James Hardy, on more than one occasion confirms top leaders (of the pyramid) earn $100k/month. From where does this money come from?

Where does the money come from for members to earn this daily ROI?

All over the web, their are people bragging about getting their friends to invest $5k, $10k, $25k, $100k in NASGO. Hmmm.

This weeks promotion was Token Offer in packages of $5k to $100k. Hmmmm

See where this is going? The money coming in is not revenue from sale of a product, it’s money coming in from token sales (aka investors money).

Let me ask you guys, what paper work did you get when you invested? From the comments on the web, most don’t even know what they were getting, all they know is they were investing in a company they were told was going to double in weeks, triple in a month, and be worth 100x their investment because it will be a Trillion Dollar company and you got in first.

Their own marketing materials say (image if you were in Amazon, Facebook, Uber, etc etc) the first month they launched, imagine…..

Okay, these companies all had real products, run by real management that were experienced, and did legal fund raising. These jokers are all MLM junkies running this scam from PO boxes and their homes.

Now, let’s look at these latest ridiculous claims. They signed a “deal with the China government”. What does that even mean people? So their Asian lead got on a stage with a pen with some other Asian and put on this big “ceremony signing”.

Now this week, days later, they signed a partnership with the Cambodia government? Anyone see anything odd with the video? Like they were all around this little office with guys obviously not from the government, Eric is wearing a golf shirt, there are no attorneys, not even government flags in this office.

Seriously people, it’s the movie Zoolander where I’m like “Is everyone on CRAZY PILLS here???”

To whoever said “you guys just watch what happens in Vietnam”.

yeah, what we watched is more outlandish claims, more stage signings, and immediately “special offers” on new token sales. If i was an original investor I would be pissed, because what I got then for $100k is half as much or less than what you get today for $100k.

To those of us that know better, we are watching a class Ponzi scheme already cracking at it’s foundation because their withdraw ROI is catching up with the new money coming in from new investors.

Maybe they get a little longer life because they are adding new investors in Vietnam and Cambodia, etc, but these Ponzi always crash.

Maybe Oz can post a link to the Saivian MLM. Same story, different day. Southern California guys starts Ponzi in USA preying on unsophisticated investors. Meets Asian. Takes it to China, makes a lot of money off of Asian MLM investors.

Program crashes. As they all do.

He thinks he got away with it, despite his trail and history from videos and social media posts all over the internet.

Was quiet for a while. Then BAM, government busts him for $165mm Ponzi scam.

The two Americans will go to jail (Tippetts and Hardy) and Stephen disappears in Asia. Thousands of Americans and Asians lose their money.

End of Story.

DANGER illegal ACT LAYS AHEAD: NASGO nor Sharenode DO NOT have an SEC lawyer on the team nor can prove in writing that they are in compliance with the USA LAWS and the Security Exchange Commissions SEC regulations.

They are clearly selling Crypto Currency packages with the promise of the coins going up in value – this makes their offering a Security and they are not registered with SEC NOR CAN sell security to general public, they have masked THEIR OFFERING JUST recently as selling advertising packages AND DIRECTORY LISTING but they are CLEARLY breaking the LAWS.

They are not USA Entities, A REGISTERED company or A corporations.

RED SCAM ALERT: Unlike Bitcoin, the NSG Coins and Sharenode Coins are not Minable Coins, this means NSG and Sharenode are Centralized and controlled by humans/founders and the “101 NODEs operators” in the case of NSG if that is even true.

This model has failed and was used by many ICO Scamming Companies such as Bitconnect, USITech, Bitqyck and many others to sell worthless digital tokens and coins (ShitCoins) to the public, yes these ruthless humans took the unsuspecting/uneducated investors’ money then closed shop and disappeared with millions of dollars of people’s money while laughing all the way to the bank.

So if you want to uncover a scam then follow the money trail, so I analyzed the NSG/Sharnode Tokenize Packages to see who’s pocket the REAL money goes into?

LEGENDS:

SNP Coins/Tokens = Sharenode Crypto Coin – Un-minable Centralized Coin

NSG Coins/Tokens = NASGO Crypto Coin – Un-minable Centralized Coin – 101 NODES HUMAN OPERATORS – MASKED AS BETTER than bitcoin – they actually call the NSG Godaddy of Blockchain 2.0 = WHICH IS Based on Bullshit Claims of Breakthrough Technologies that Don’t exist.

————–

Tokenize Basic Package – Sales Amount of $995

•1000 SNP Coins =$0 value and 100 NSG Coins@$.50=$50 to the affiliate who makes the sale – Sorry Affiliate You Just Screwed your Friend/Family out of $995.

•the first leader in the downline receives 500 SNP=$0 Value and 50 NSG@$.50=$25 – It takes a sucker to enroll a sucker

•the second leader in the downline receives 250 SNP=$0 Value and 25 NSG@$.50= $12.50 – It takes a sucker to enroll a sucker on 2nd level

•five Ambassadors in the downline receive 100 SNP=$0 Value and 10 NSG@$.50= $5xfive=$25 – It takes five suckers to enroll and screw the whole team of suckers.

SUCKERS involved in selling this Basic Package beware: none of you actually made any real money you just got NSG SHITCOINS that you can’t even off load for 90 days.

Total Payout to the entire team of suckers = $112.50 but NOT in CASH or even in Bitcoin but in NSG coins which at the current time is privately Valued by NASGO and Sharenode at $.50 but if NSG value actually drops to Zero in 90 days “the mandatory hold/lock period for selling any earned NSG” after the NSG gets listed on Bitforex Exchange then No one will make any money other than the Sharenode and the NASGO founders who received the $995 from the sucker number one and paid nothing to the other suckers involved. Now this is a nice SCAM.

=====================================================

Tokenize PLUS Package – Sales Amount of $1,495

•$100 in NSG or bitcoin,1000 SNP Coins =$0 Value and 100 in NSG Coins at $.50=$50 =$150 Total to the affiliate who makes the sale

•the first leader in the downline receives $50 in NSG or bitcoin, 500 SNP Coins =$0 Value and 50 NSG Coins at $.50=$25 =$75 Total

•the second leader in the downline receives $25 in NSG or bitcoin, 250 SNP Coins =$0 Value and 25 NSG Coins at $.50=$12.50 =$37.50 Total

•five Ambassadors in the downline receive $5 in NSG or bitcoin, 100 SNP Coins =$0 Value and 10 NSG Coins at $.50=$5 =$10 x five =$50 Total

Total Payout to the entire team = $312.50 So the Sharenode and NSG Founders line their pockets with $1,182.50 selling their NSG and NSP Shitcoins.

=====================================================

Tokenize PREMIUM Package – Sales Amount of $1,995

•$200, 1000 SNP and 100 NSG to the affiliate who makes the sale =$250

•the first leader in the downline receives $100, 500 SNP and 50 NSG = $125

•the second leader in the downline receives $50, 250 SNP and 25 NSG = $62.50

•five Ambassadors in the downline receive $10, 100 SNP and 10 NSG = $15 x five =$75

Total Payout to the entire team of suckers = $512.50 So the Sharenode and NSG Founders line their pockets with $1,482.50 selling their NSG and NSP Shitcoins.

=====================================================

At the Sharenode event in Vietnam that I attended in Jan 2019 they were also selling other packages as above packages: but bundled with more NSP and NSG coins along with other Shitcoins such as Movie Coins and Jerome Jackson Coins selling them to the Affiliates from $2,500 to $100,000 which is their Black ONYX package.

=====================================================

Crypto Word Lesson #1

FOMO TACTICS ALERT: DO NOT FALL FOR FOMO – which means Fear Of Missing Out = FOMO

If it sounds too good to be true then it probably is not legal. In the Crypto Currency World ICO scams – FOMO tactic is always used by the presenters and perpetrators in pressuring you to make a decision when you don’t have all the facts. NO TIME to Think or do proper due diligence.

FOMO, uses your fear of missing out brain (the un-logical part of your brain) to close you on scam deals based on emotions of missing out on an opportunity that’s being pitched. TRAIN YOUR BRAIN NOT FALL FOR FOMO TRAPS.

The tell-tell signs of scam trap are simple to detect: if you don’t understand the deal then don’t buy it, if there is inside circle of secrets, or limited time to act and a big push for you to buy right NOW then the sooner you walk away from the trap the better.

In Crypto world of scams usually the offerings/packages are also too complex and not easy to comprehend, and usually have many conditions, such as you must hold coins/contracts for 90 days or longer, recruit others to make money, and these layers are created on purpose to keep your logical mind busy as your emotional mind makes purchase decision – in this way the thieves will rob you clean and have the time to get away with the loot before your logical mind awakes.

These scammers use the same tactics as the street pickpockets use – they use the distraction tactics to get to your wallet.

Tru

Rather interesting. Bitforex said that trading was to start @ 10:00 am (GMT+8) on 1/18, and I just checked entering NSG nothing was found.

James Hardy is a blowhard hypster. On his daily “training” calls, he is fond of using superlatives (NASGO will be the biggest blockchain company in the world!”) and he spends his time haranguing affiliates about buying (ie, “investing in”) tokens and earning more by signing up businesses as clients.

They claim that 100 companies had signed up to be tokenized last summer at their event in Los Angeles, but there are a total of 70 companies on the “Businesses on ShareNode” directory on their member dashboard, and none have been added in over a month.

I just checked and NSG is now trading on Bitforex.com.

As of just a few minutes ago it was showing:

24h Low 0.00002000 24h High 0.00017500

Equal to 0.00014500 BTC

We were told to invest in this. Our shares were never given to us and are still with a broker or individual acting as an agent.

This was said to go public today but still nothing online to see the value of the coin.

The only way to get our money back is to try sell our shares to other individuals as we were advised by said agent.

The affiliate who recruited you dumped their points on you. Now the only way you can cash out is to dump your shares on other unsuspecting victims.

Classic Ponzi.

Curious what price the original investors got into NASGO at?

Seems like early round was $1/token. Later was $0.50/token, seems like their Bitforex listing was a quick dump for owners (most investors if they were lucky enough to actually receive tokens were locked up).

Price likely to go to $0.01, who’s going to buy on open market when the company keeps trying to offer better and better deals to buy direct from them.

Now they are throwing in every coin and the light lamp into the package to get more cash direct.

For those that said “wait and see what happens after Bietnam event”, why don’t you try selling some of your NSG on Bitforex just to see if it’s real.

These MLM amateurs leading this scam don’t know the first thing about how to run a real ICO.

I suspect the only volume sold were their own tokens while they locked up all the investors tokens that gave them money.

And all the poor charities they used for press releases about how they were changing the world and handing out their worthless tokens for “do good”.

Here is the latest trading figure for NSG:

Whether one agrees with the assessment that NSG and SNP are securities, there certainly is concern that the affiliate program is a Ponzi scheme.

There is a comment above that SNP “value” may change according to the whims of those in control of it. Right now, the “price” of SNP has been vastly increased from 10 cents to $1. However, SNP has zero value because it cannot be sold or exchanged for either NSG or BTC (another recent change).

The reason I think the affiliate program may be a Ponzi is because

1. You have to buy SNP to participate (certainly to be “paid” in all the available ways, you must pay to play);

2. What you buy (SNP), however, has no value because you can’t sell it or trade for anything; 3. To make “commissions,” you either recruit others to also buy something worthless or close to worthless (SNP), or you can sell an advertising package to businesses and be “paid” “commissions” primary in SNP.

One of the arguments above is that ShareNode is selling securities Because SNP is tradable internally for NSG. I don’t agree with that, but I have not fully evaluated it.

The irony — if SNP were really held at a “value” of $1 and not allowed to fluctuate and not changed arbitrarily by the company, and if people were allowed to withdraw or trade SNP for a real currency, then I think the affiliate program would be less likely charged as a Ponzi.

Right now, it appears to be illegal, but it easily could be changed to avoid this problem.

If ShareNode wants to survive legal attacks, it definitely has to “sell” affiliates something of real value (it does not do so today, but it is very difficult to assess value because of the lack of specificity and clarity).

It may even need to scrap the affiliate program and focus on the thing that it might be able actually to offer — tokenizing businesses for online advertising. Then, it must pay the salespeople in a real currency with real value (in other words, make SNP worth something or pay in something other than SNP).

Any other portions “paid” to affiliates for referring businesses are so low that there’s no incentive to do the work. Thus ShareNode focuses on the SNP as the commissions, which, again, is worthless.

There are some other things I’d like to know more about if anyone can answer —

1. No one has mentioned Henning Morales. What’s known about him?

2. What is the problem with delegated proof of stake?

3. What facts underlying the comment, “The daily ROI and stakes token value is a classic Asian scam.”

There’s one and only one reason ShareNode/Nasgo is a Ponzi scheme – newly invested funds are used to pay existing investors a ROI. Although from what you’ve said that’s now been canned (???)

That argument wasn’t made in the review. ShareNode’s SNP investment scheme is a security because affiliates are investing on the expectation of a passive return (ShareNode increases the internal exchange SNP value as they see fit).

If the value of SNP was fixed at $1 and SNP not exchangeable for any other type of currency/token, then it wouldn’t be a Ponzi scheme because there’s no investment.

That said ShareNode would have been DOA if that was the case because there’d be no reason to convert USD to SNP. That and ShareNode wouldn’t have any money to pay commissions with if it was a straight $1 –> 1 SNP conversion (assuming they planned on honoring all internal exchange withdrawal requests).

You can’t put the cat back in the bag when it comes to securities fraud. It’s already been committed so the best ShareNode/Nasgo can hope for is to either terminate the opportunity altogether and/or register with the SEC and provide legally required investor/public disclosures.

Neither of these options is a guarantee that the SEC won’t investigate and go after the company for already committed securities fraud.

No idea who that is.

Nothing as far as MLM and securities regulation goes.

Asia (Vietnam, Korea and to a lesser extent Malaysia and Hong Kong) have been hotbeds for MLM crypto Ponzis for a few years now.

None of the Asian countries Nasgo is targeting at the moment (Vietnam/Cambodia) are going to investigate it for securities fraud. That’s why they’re there.

Their mistake (besides the obvious of ripping people off) is they sold this scam on U.S. investors, they can’t undo that now.

The Saivian story a great example, EJ Dalius thought by refunding US investors their money with Asian investors money, would get him off the hook didn’t work.

They committed securities fraud and Ponzi scam in America, that will come back to haunt them when Americans lose money and file complaints. They can’t unwind that, no matter what they make off of Asia and try to pay off American investors.

Securities violations are civil suit by SEC, out right Ponzi scam gets FBI and criminal attention when the fraud is big enough. That will come down to how many people were scammed and howbmuch for.

Time will tell, but if you invest in this or promote thisbyou are in a dangerous territory.

The members who bought into this farce have to be totally disillusioned with the price the “NSG Tokens” are trading at since its launch.

But then this is what you get when you launch on an obscure exchange that has only been in operation for a little over 6 months.

You can bet your bottom dollar that management is trying its best to do damage control with these results.

Anyone have any current numbers of members and companies that bought into this Ponzi?

Great thread, following daily for updates as a friends is high involved in this.

Here is some latest articles.

Looks like they signed with Palau.

businesswire.com/news/home/20190111005071/en/Blockchain-Leader-NASGO-Celebrates-%E2%80%98The-Rise-Hunt

Another FilmCoin article:

businesswire.com/news/home/20190122005975/en/NASGO-Launches-%E2%80%98FilmCoin%E2%80%99-Tokenization-Blockchain-Films-Producers

Those are just press-releases pumped out by the company.

ORLY? So where’s the accompanying announcements from said governments?

I go the cinema to watch a movie. The flying fuck does blockchain have to do with anything?

Talk about an echo-chamber hype machine. You’ll likely be able to plot pumps in NSG each time they issue a press-release.

Gullible Asians love this sort of stuff (uFun Club was another MLM crypto Ponzi that thrived on constant press-releases).

fake ‘press releases’ = always funny.

This is turning into a classic pump and dump scheme.

This might have had some life to it if it had at least come on the exchange at a minimum of 1 cent, but not at thousands of a cent.

You can always tell when a Ponzi is in deep doo-doo, but the members don’t know it. It is when they trot out their fake press releases and oh come and take a look at our shiny new thing we are offering. All designed to keep them from focusing on the failure of all the other former shiny new things.

Beware of the Hidden TRAPs and TRICKS OF SharNODE and NASGO:

When a Business Tokenize with ShareNODE buying 1 Billion Tokens they have to give for FREE 250,000,000 of their tokens to ShareNODE – These tokens will be owned by James and Butch and supposedly by NASGO so these guys then become shareholder of every business that they tokenize through the FREE tokens that they receive. So if the business then put a value of $1 on their tokens then these guys will have $250,000,000 claim against that business. This can also crash that business, by them dumping all that 250,000,000 tokens whenever they want, or demand cash settlement or FREE goods and services from that business to live like Kings… after all they control the lion share of the tokens of that business 250,000,000. WOW!!!! now don’t you or your friends fall in their clever trap.

The sad part is my friend gets invited to these meetings at expensive hotels where Eric presents his progress and makes grand promises and then asks his audience for money in exchange for ‘more of this’ and ‘a bit of that’ and ‘some of this’.

Then as mentioned before, they use this money to charter planes and take vacations to these places and come back telling their gullible investors that this is a game changer and biggest disrupt-er in modern times.

I think they keep their investors locked in by the fake incremental increases of their investments.

I asked my friend to explain this investment and couldn’t get a straight answer, to the point where I felt bad for asking.

Suspension of NSG Withdrawal Announcement:

support.bitforex.com/hc/en-us/articles/360022133212-Suspension-of-NSG-Withdrawal-Announcement

How strange. There’s nothing about a wallet upgrade on the Nasgo website or their social media profiles.

Interesting since they didn’t stop people from putting money in. Oh wait, that’s how Ponzi’s work.

Notice how all the defenders of this have gone MIA. Speaks volumes doesn’t it.

The basic idea is that the bigger a lie you tell, the more likely people will be to believe it, since it’s difficult for the honest and gullible people to accept that someone could tell a lie that huge with a straight face.

1-Ask them where is their working Exchange Wallet? After all they’ve been at this developing for more than FIVE freaking years.

2-Proof of Stake My ASS…Ask them to show you who owns and runs the 101 Staking Nodes of NSG coins? These nodes even if they actually exist are most likely owned by the founders and owners of NASGO.

That means Centralized Coins, and that means NSG coin is not Decentralized so Runaway fast before you get convinced otherwise.

3-Ask them to show you the actual businesses and people transacting or using transactions on Amico marketplace or VAPR? Don’t buy into anything unless they can clearly demonstrate by actual users, otherwise that is coming is the same trap of the ICO Scam road-map.

4-Ask them to show you their Development TEAM – Each developer should have a public profile on Linkedin.com and Facebook and/or other platforms.

5-Ask them to show you that they have a written approval from SEC and SEC blessing for taking money from USA citizens for worthless Sharenode tokens?

6-Ask them why they have a 90 day lock on cashing the NSG tokens you can ear/receive? The only real reason is for them to prolong their Ponzi SCAM.

7-Ask them to show you their company/ies NASGO and Sharenode registration certificates, Licenses, Insurance, real business location and addresses?

8-Ask them to show you their banking information, in what country, what bank?

9-Ask them to show you one business that has successfully tokenized and is using NSG/SNP tokens in their marketing their business?

10-Ask them why they take 250,000,000 tokens from each business that they tokenize? What’s the real reason, why do they need this kickback?

11-Ask them about their refund policy?

12-Ask them why they must mask selling their worthless shitcoins NSP and NSG token packages as some sort of Directory listing or Advertising package offer?

13-Ask them to give all the answers to the above questions in writing on the letterhead of the company/ies signed by the owners/founders.

14-Ask them where is Sharenode worthless/Shitcoins SNP coins will be traded, on what public exchange, at what value – after all you will be receiving them as pay as you deceiving your friends and family, you can’t even sell/cash them without dumping them on another sucker you help to entrap?

15-Ask them if their God is Money or their GOD is GOD?

Tru

The basic idea is that the bigger a lie you tell, the more likely people will be to believe it, since it’s difficult for the honest and gullible people to accept that someone could tell a lie that huge with a straight face.

@TRU hit the nail on the head. It’s comical to watch their “breaking news announcements”. Partnerships with governments, SpaceX, United Nations, Larry King. Shit, I think Eric Tippetts last week in his “an entrepreneurs life” walk on the beach cameo said he partnered with Amazon.

So we’ve heard they will be worth $1 Trillion dollars, They are next Apple, next Microsoft, next Amazon, and the GoDaddy of Blockchain.

All of this with no management team other than 3 MLM junkies. No office. No IT staff (that they can show).

Anyone else notice that Eric Tippetts writes the social media posts in 3rd person like someone staff is writing them. Anyone else find that a bit psychotic ?

Anyone else find it odd that you just send Crypto, PayPal, or wire for token purchases to James Hardy? And no paperwork. Who does this, I seriously am blown away an adult over 18 years of age has fallen for this shit show.

Can any member show they sold their NSG tokens on the exchange? That exchange is known for shady trading, including fake volumes, pump and dumps, and lock-ups so that only they and the promoters can sell out their tokens while members who bought them directly from the company (some paying $1/NSG) are locked up and can only watch this spectacle.

Every member who promotes this and gets paid commission for selling their friends and family securities are breaking the law. Reality is only the ring leaders will likely go to jail, but who wants to make money selling their family and friends a Ponzi scam and watch them lose their money.

For the rest of us this is like watching a train wreck play out on social media, I assume after Chiang and Tippetts tokenize Hollywood this weekend @ Sundance they will tokenize the Border Wall before moving onto partnerships with NATO & the Pope. I’m waiting any day for Eric Tippetts to announce he’s been nominated for the Nobel Prize, but he’ll announce it in his 3rd person voice of their Social Media accounts he runs from his phone.

I have a question hope someone can answer: Can I tokenize my business directly with NASGO without joining ShareNode? If so what is the path and costs?

I am asking this questions because when I visit NASGO.com there is no mention of ShareNode but when I visit ShareNode.com I see it is powered by NASGO.

This isn’t a NASGO support group.

You need to put your question to the organizers of the securities fraud themselves

@Tru,

Perhaps you can email the SEC?

Can anyone at Sharenode or NASGO actually explain how that indie film “launched on this breakthrough Film Coin blockchain platform”?

The producer said he wrote and filmed this like a year ago, Film Coin launched two weeks before Sundance with a website and logo.

Anyone seen a white paper on Film Coin technology? Can anyone explain how it’s changing the movie industry?

Another shiny object to distract away from all the other shiny objects they used to take in money this past year yet have zero substance or tech behind them.

Here is the NSG trading stats for today:

24h Low 0.00016559

24h High 0.00021928

24h Volume 832. BTC

Please list all the Billion Dollar companies that have shares trading in this range please.

Rather interesting trading figures today for NSG. Now they are showing trading in USD, where before they were showing the value to Bitcoin. Still the trading is down almost 8% for today:

Does anyone know if that Amico app they said was going to be ready for download at the Dolby event last November is available today?

I couldn’t seem to find it in App Store and download link from website didn’t work.

Ryan you have been vocally critical of Nasgo Sharenodes and since day one you have been calling this a scam.

Let’s look at it in its prospective. The founders have been working on this for 6 or 7 years to get it launched. They have been doing the promotional rounds like getting on TV and the famous NASDAQ interview and according to you they paid those interviews.

They even went to the Sundance film festival to launch a new blockchain movie and were interviewed by a TV show about the movie, they even did a deal with China ( according to you is fake) and host a big event in Vietnam and even have the Jackson Family involved in this.

They are now sponsoring the Super Bowl and a basketball celebrity tournament and they have even launched the NSG token in Bitforex which is actually trading.

Ryan if all this is a scam according to you then it must be a scam that cost them millions and millions of dollars.

Would you mind explaining this to all the members in this forum.

1. How much money is used to promote a scam is irrelevant. A business model defines an MLM scam.

2. It hasn’t cost the owners of Nasgo/ShareNode anything. The recipient of the majority of funds invested into an MLM Ponzi scheme is always the owner(s) running it.

@Tony-

I assume you’re in your 20’s and haven’t seen your fair share of various investment scams or you are one of the promoters who know you are making money off your family and friends who took your advice and passed their money over which you shared in.

I’ve made plenty of comments above, If you don’t see how many things are illegal and just plain don’t make any sense I don’t know how else to explain to you and I don’t draw pictures very well.

I explained above the Sundance you say they sponsored they turned around and collected the money from members to “share leads”. The Super Bowl “sponsorship” was the same, an obscure party they passed the buck off to members while they promote themselves on social media attending.

If you think they are “the” Super Bowl sponsor, now has me second guessing if you are from Cambodia and have never seen the event to know that such a sponsorship doesn’t exist.

There is a link to Jaafar Jackson, nephew of (the) Michael Jackson in that his upcoming album will be “tokenized” by “Do Something Athletic”, which will use NASGO blockchain technology.

It’s basically a fancy fan-reward system. That’s not a “link to Jackson Family”.

it’s just another reward/membership tracking tech, albeit “now with ‘blockchain'”.

@Tony-

I’m surprised being “the” Super Bowl sponsor they didn’t want a commercial or name on any official NFL Super Bowl Ads.

They did have a cool logo display at a private event, which is what I said are a dime a dozen at these events (NBA All Star Weekend, Super Bowl, Sundance, SXSW).

Look up party sponsorships, they are $7500-$25,000. Not Millions as they lead you to believe. And even the small amount to sponsor a party they still passed that cost on to members, was in the emails leading up to the events.

Whoever chipped in got to share the investors leads captured at event.

Well, the Super Bowl is now history and you can imagine my shock and surprise that NASGO/ShareNODE was not mentioned as a “SPONSOR” of the Super Bowl.

Heck, they didn’t even run ONE COMMERCIAL. Rather odd don’t you think Tony after all the hype and your claim that they were “SPONSORING THE SUPER BOWL.”

Now tell me again how many millions of dollars they spent on SPONSORING THE SUPER BOWL?

You are about to learn a very expensive lesson. You had better hope that if law enforcement shuts this down you are not one of them they go after to charge in this Ponzi.

There was some footage of their VIP booth on Facebook.

There weren’t any celebs, it looked like just affiliates the company had comped in. Nobody seemed to be using VAPR.

Yooo, Oz

Hit me up, i wanna talk to you further about your findings. Ive been fortunate to be up close with sharenode and have confronted them with some red flags ive noticed.

They def didnt like what i found. Youre not wrong in this article.. theyre shaddy AF. Hmu at (removed)

Contact button is on the top right of every page.

Anyone having issues with accessing Bitforex.com website besides me?

It makes no difference which web service (IE or Google) I use, it shows the link is connected but all I can see is a blank white page with only the little light orange box on the lower left hand side of the home page, but the link for it does not work.

Wanted to check the current trading activity for NSG.

Working here. NSG is down 20%+ in the last 24 hrs.

Currently at 0.00012165 BTC

First attempt gave me the blank page with the orange feedback icon.

Second attempt gave me the regular page, but with a “Happy Lunar New Year” message preventing access to the page proper.

Third attempt gave me the normal page view

Likewise regarding 1st & 3rd attempt earlier today.

Kirs . . . I would love to know what red flags you told the StealNode, I mean ShareNode, people about.

Many things wrong in the article and from some from the positive responders but I did not have time to read everything.

Article says no ambassador criteria. WRONG.

This has been in the back office since 11-8 2018

ShareNode – Nasgo did not sponsor the Super Bowl. Management never said this, only affiliates wrongly relayed this event. They sponsored a charity event before the SB. They also paid a fee for retired NFL players to another event.

NSG has been listed on BitForex since Jan 11th and you should have know that was scheduled to launch at the time you wrote the article.