Tribunal finds OneCoin lawyer didn’t know about fraud

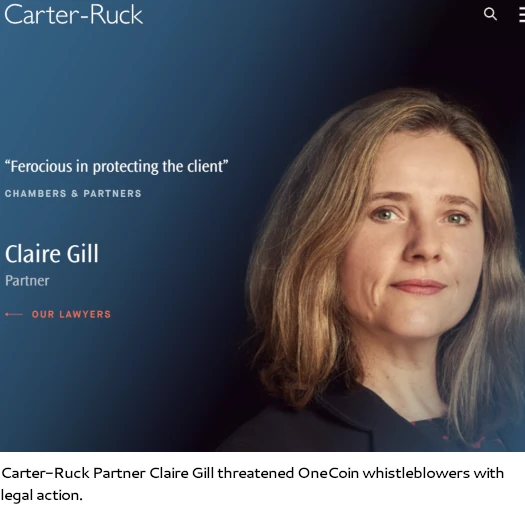

Carter-Ruck attorney Claire Frances Gill has been cleared of wrongdoing by the Solicitors Disciplinary Tribunal (SDT).

Carter-Ruck attorney Claire Frances Gill has been cleared of wrongdoing by the Solicitors Disciplinary Tribunal (SDT).

As reported by The Bureau of Investigative Journalism on December 12th;

Gill was cleared of all wrongdoing on Friday when the Solicitor’s Disciplinary Tribunal (SDT) found that the prosecution’s evidence was “plainly insufficient” and that the case was based on “hindsight not evidence of professional misconduct”.

Carter-Ruck has indicated it intends to seek costs from the Solicitors Regulation Authority, estimated to be around £1 million GBP.

Unfortunately the SDT’s finding removes all responsibility for lawyers to consider, before sending baseless legal threats, whether there is any merit to subject matter being targeted.

In fact Gill’s attorney went so far as to argue

Either [a solicitor] knows that his client’s factual case is false or he doesn’t… But if he doesn’t know his client’s factual case is false, he is bound to advance that case on behalf of his client whatever suspicions he may have.

This creates an obvious loophole where any lawyer charged with misconduct can pretend to not have not known whether claims made by their client are false. In other words, UK lawyers need do no due-diligence into their clients before sending out threatening letters on their behalf.

In response to today’s decision, Helen Taylor, deputy director of Spotlight on Corruption, said:

“By dismissing this case before it even starts, the tribunal appears to be giving the green light for libel lawyers to be used as guns for hire, allowing lawyers to disavow ethical responsibility for how their services are being abused.

In the case of OneCoin, Gill has successfully claimed she didn’t know it was a Ponzi scheme.

The legal threat Gill sent with respect to this case was sent in April 2017. By this stage action had been taken against OneCoin by authorities in Hungary, Finland, Bulgaria, Sweden, Latvia, Austria, Colombia, China, Germany, Bangladesh, Belgium, India, Poland, Norway, Vietnam, Italy, Hungary, Nigeria, Slovenia, Uganda, Croatia and Kazakhstan.

Perhaps most damning of all, UK authorities announced an investigation into OneCoin in September 2016.

All Gill had to do was spend a few minutes researching her client to at the very least raise suspicion. If I’m being honest she probably did, but none of that matters now that he SJT has absolved Gill of any liability.

Perhaps ironically, OneCoin had already collapsed by the time Gill sent out her legal threat. How much of the $4 billion stolen through OneCoin Carter-Ruck collected in legal fees is unclear.

The SJT’s finding is unfortunately only the latest example of UK authorities’ disastrous handling of OneCoin related fraud.

- the aforementioned UK investigation was dropped in 2019 without any action being taken;

- the FCA took down a OneCoin fraud warning in 2016, after Carter-Ruck and Chelgate contacted them;

- the UK hosted OneCoin’s biggest promo event at Wembley Arena in 2016;

- UK authorities returned £30 million in stolen investor funds to a OneCoin money launderer in January 2023; and

- a UK court refused to extradite the same money launderer to face criminal charges in the US in November 2023

Despite UK lawyers and companies having played an integral role in assisting OneCoin founder Ruja Ignatova, to date not a single UK resident has faced any repercussions.

At the very least UK victims might have found solace in a lawyer helping enable OneCoin fraud facing justice. The SJT decision has now extinguished that possibility.

Update 21st January 2025 – The SRA is set to appeal the SDT’s dismissal.

How can this be? I was told the UK authorities take Cyber-Crime very seriously; if not more so than the US and other countries.

I guess blackmail and extortion are now legal in the UK, as long as it is done by a solicitor.

I wonder if it was done to try and stop the floodgate if they were found to be complicit – as many many other cases would then have to be investigated, in an era where the SRA and SDT seem to be losing their edge.

That said, this is laughable in its decision. The outcome for Carter Ruck must surely be one that its staff either can’t, or deliberately won’t look into their clients “activity”. Can’t see that being a selling point for a lot of upstanding clients, and the inevitable footfall of “new” clients who will hear about the reputation of the firm will surely taint the name…..

Edgington

You assume and remember a lot. Maybe.

Let’s remember that you who apparently knew from the start sitting under your wood eagle crafted by some people who did too and gave you a special gift from whatever kindergarten;and you still can’t find her.

She probably upsets you most because she’s a woman, an east European, and she has gotten away with i.

Ruja might have been assimilated by the Borg. You have no clue. You have no means to answer that.

The rest of the world is reconciled to anything about Ruja being a taxi on stupidity. You’re so till paying. Tosser

A mind is such a terrible thing to waste. Give it up, You need to learn to quit while you are behind. You still have no clue who and what Eagle did, for if you did you wouldn’t be making such asinine statements. Not one word you wrote has to do with the subject being discussed.

As for Ruja, she isn’t that brilliant as you like to make her out to be. I know of many thieves who stole far more money than she did over the years and got away with it. She is not in some elite club or criminal. I could care less where she came from. A criminal is a criminal no matter where they came from. She was before OC and always will be a criminal.

This from a guy who went to work for her and could not tell that OC was a Ponzi/Illegal Pyramid Scheme. So much for what you know.

By the way, that wood eagle is a bronze eagle with copper tipped beak and claws. You’d think with someone so smart as you claim to be would know the difference. You should see my Lead Crystal Eagle with gold tipped beak, claws and wingtips in a petrified wood base. Stunning piece.

And after Ruja Ignatova disappeared without a trace, Duncan Arthur continued working with his “best friend” Konstantin Ignatov.

postimg.cc/cvJpBv3P

The way I understand it this “Solicitors Disciplinary Tribunal” is not an actual public court, but rather an internal lawyer-guild institution supposed to ensure the good conduct of lawyers in order to maintain their good image; my country of origin has some similar association, which is notoriously ineffective at investigating misconduct: in practice lawyers judging other lawyers will find them innocent and naïf.