OneCoin scammers to launch Circle of Finance (Invicta)

Following their departure from OneCoin, Veselina Valkova and Habib Zahid are gearing up to launch a clone of their own.

Following their departure from OneCoin, Veselina Valkova and Habib Zahid are gearing up to launch a clone of their own.

Details on Circle of Finance (aka Invicta) are currently sketchy, but here’s what we know.

Details of Circle of Finance and Invicta first surfaced last November.

The company, the specific name of which we’re not sure of yet, is purportedly incorporated as TradeInvicta in Estonia.

Not that that means anything, as it’s a shell company registration that exists in name only.

TradeInvicta was set up by Heaven Invest, who offer all-inclusive company formation in Estonia starting at €1800 EUR.

The owners of TradeInvicta are Veselina Valkova and Habib Zahid.

Habib Zahid is a former top OneCoin Ponzi recruiter. Veselina Valkova is a much more murky figure.

Valkova (right) is believed to be among Ruja Ignatova’s OneCoin inner circle. She is believed to be one of the key figures behind OneCoin’s operation, especially after Ignatova went into hiding in October 2017.

Valkova (right) is believed to be among Ruja Ignatova’s OneCoin inner circle. She is believed to be one of the key figures behind OneCoin’s operation, especially after Ignatova went into hiding in October 2017.

Valkova prefers to operate scams from the shadows. You won’t find her on social media or on stage at marketing events.

Update 1st February 2020 – I’ve been informed Valkova wasn’t part of Ruja’s inner-circle. She worked for OneCoin corporate but wasn’t part of “senior management”.

This places her not much up the OneCoin food chain over Zahid. /end update

Since last November things have been quietly brewing. We’ve been holding off publishing anything till I felt this was more than another failed OneCoin resurrection.

At the time of publication we’re not sure whether Valkova’s and Zahid’s scheme will go by Invicta or Circle of Finance. At present both are being used interchangeably.

OneCoin had a boat load of shell companies attached to it, and Valkova appears to want to replicate that structure.

For the sake of simplicity we’ll go with Circle of Finance.

Twelve hours ago a video was published to the official Circle of Finance YouTube channel.

It’s mostly stock footage with a hired voiceover, but there are some nuggets.

At [0:26] we can see Circle of Finance encompasses forex, network marketing, e-commerce, payment processing and exchange & remittances.

These are all rehashed OneCoin ideas, with the exception of exchange & remittances.

The reason OneCoin never initiated a public exchange is because it would have prematurely killed off the Ponzi scheme.

The same is true of Circle of Finance, so treat it as nothing more than a marketing point for now.

It’s no secret anyone still left in OneCoin isn’t the brightest. Many of these investors have convinced themselves the launch of an exchange will magically allow them to recoup their losses.

Circle of Finance primarily targets these OneCoin investors. It’s the only reason an exchange is mentioned at all.

A public exchange takes some control outside of Valkova’s hands. Her time running OneCoin would have taught here it’s much easier to run a scam when you control everything, down to who pays what to who and when.

As for forex, that appears to be the ruse Circle of Finance plans to use to solicit investment.

Pretty standard for an MLM crypto Ponzi scheme.

Standing by to funnel victims into Circle of Finance are admins of one of the largest OneCoin Facebook groups.

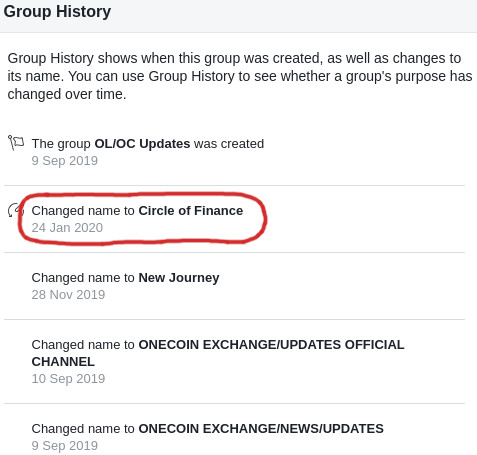

Boasting 26,388 members, the group “ONECOIN EXCHANGE/UPDATES OFFICIAL CHANNEL” was renamed “Circle of Finance” on January 24th.

Admins of the group include creator Habib Abdul Rehman (aka Habib Ur Rehman Zahid), Daniel Pérez Faustinelli, Faualii Sina Apineru, Damien Barnes, Quini Amores, Arto Ylitalo, Yourmos Pob, Dusan Torbica and Peter Hjelte.

Things haven’t quite taken off yet, as there’s only been three posts made to the group over the last thirty days.

If Zahid and Valkova manage to get Circle of Finance and Invicta off the ground, we’ll of course publish a full review to keep authorities and the public informed.

Pending the release of further information, stay tuned…

Update 1st Februar 2020 – Well that didn’t last long. As of January 29th TradeInvicta in Estonia is no more.

That doesn’t mean Zahid and Valkova aren’t going to launch Circle of Finance and Invicta, just that we’re spared from “but what about the Estonia license?” pseudo-compliance.

Update 4th April 2020 – BehindMLM has published a complete Circle of Finance review.

Shout out to Semjon and WhistleblowerFin who started this research back in November.

They don’t learn. Including the word “Finance” means it is regulated!

Let me add some other info, that investigators might find useful.

Veselina Valkova and Habib Zahid have also recently registered a company in Bulgaria called H&V CONSULTANT

Machine translation from Bulgarian business register:

The registry filing made by Elitsa Ivanova Stoyanova

The registered address appears to be the same as in this funeral home:

lonore.business.site

In addition, there were some possible traces to UAE/Ajman based comapny called Britfin Consultant:

https://behindmlm.com/companies/onecoin/onecoin-website-down-dns-record-under-investigation/#comment-418237

Now the “britfinconsultant.com” has: Site temporarily unavailable (451 error)

[The error code indicates legal problems. So the auhtorities already onto their schemes?]

Looks like Invicta imbeciles are restructuring their “corporate” tentacles. For some reason Habib Zahid cancelled their Estonian crypto & wallet licenses on January 29th:

mtr.mkm.ee/juriidiline_isik/268060?majandustegevusteated_staatus=teated_koik&backurl=%2Fjuriidiline_isik&tegevusload_staatus=load_koik

They didn’t have an Estonian VAT license to begin with, so the Estonian company probably was never intented to be more than a scam-prop license holder.

Additionally, the email in license revocation application confirms that BritFin Consultant was indeed their company:

imgur.com/a/0FHDmet

The pullback from Estonia and the britfinconsultant domain suspension for legal reasons might indicate that their OneCoin Original Sin is haunting them already. 😉

Estonia is not the light touch it used to be. Like with everything, it swings from one extreme to another.

It probably didn’t help that VV tried to use her previous surname, Zahid changed his name and a whole lot of attention went onto the Estonian authorities when they registered.

That seems to have changed, I just get a page from GoDaddy, saying:

I might point out that there is a major problem with that fairly new 451 error code. It was intended for hosting companies to indicate they had to take down a website, or part of it, on the orders of a court or a government, rather than having to return a generic “unavailable” error code.

That was in itself a good idea. (The number is a reference to Ray Bradbury’s book Fahrenheit 451, about book burnings.)

However, anyone can decide to use it whenever they want to. And a lot of US companies began abusing it to serve up when their sites are accessed from within the EEA, to protest against the EU’s GDPR rules.

They believe those violate their god-given right to make money from their website’s visitors personal information.

There is of course no court or government in Europe which has ever tried to stop those websites from being accessed from within the EEA, it’s silly pseudo-legal posturing from private US companies.

If their idea of what the GDPR does were correct, it would have shut down almost all of the internet in Europe.

So, GoDaddy can have temporarily used that error code 451 in an equally unjustified way, for some reason known only to themselves.

I have to say I remain completely mystified by what the Habib/Valkova spinoff are planning on doing. Are they simply hoping they can rerun the whole OC playbook, as if nothing had happened, and targeting the existing OC base?

Can we look forward to sham “educational packages” being sold rather than tokens, a DealShaker clone, and all the rest of it?

Some of the ‘leaders’ who actually made money the first time round might think they could do it a second time, but trying to fleece the same people who’ve just lost money on OC to do it again, with what will transparently be a copycat scheme, doesn’t seem terribly realistic.

Trying to find a whole new group of victims, untouched by OC, won’t be easy either. While flitting from one collapsed scheme to the next one is commonplace for MLM/Ponzi scammers, OC has been so high-profile that it’s hard to see how they could get rid of that baggage.

If they offered some way of supposedly transferring onecoins currently held to their new scheme, things would be different, but I don’t see how they could do that, either practically or above all financially.

Unless they’re actually sitting on a sizeable portion of the OC loot, so they can pay out some withdrawals for a while to make it seem legit. After all, there are still a couple of billions unaccounted for.

Thanks for the updates Semjon.

Hey guys, this circle of finance(COF) is totally different from OneCoin.

Firstly, COF has ecosphere and OC has ecosystem.

Secondly, COF has advanced learning systems and OC Has Oneacademy.

As you can see, the difference is like day and… hmm, later on that day…

It appears that “Invicta – Circle of Ponzi” have been trying to open Cashaa (a British “crypto-friendly banking service” ) account:

(from now deleted?, Google cached: help.cashaa.com/question/account-issues/high-risk-business-account-opening/)

They are truly a “high-risk customer” for any banking service provider. 😉

“exchangeinvicta.com” is one domain to follow if there is any progress in their “newly buid exchange business”.

That’s an interesting development. Got a copy of the Google cache.

No idea how you manage to dig some of this stuff up 😀

HI

THIS IS MAHDI

I WANT TO KNOW ABOUT THE THIS INVESTMENT . IS THERE ANYBODY HELP ME ABOUT INCOME AND MAKE SURE THAT I CAN GIVE BACK MY MONEY+BENEFIT OF THAT

THANKS

Ponzi schemes don’t give back your money. And your “benefit” doesn’t actually exist.

You had monopoly money in your OneCoin backoffice. Nobody is going to pay you out on that.

Sorry for your loss.

Circle of Finance = the company (OneLife)

Invicta = Ponzi points token (OneCoin)

I see that serial scammer Peter Hjelte who is a “top leader” (more like a useless cowardly leader) from Sweden OneLife is in the front row of this new scams team.

Announced a major Zoom webinar for tomorrow (2/9) at noon UK time, and I wonder if they will explain why Habib cancelled their Estonian crypto & wallet licenses on January 29th.

Hopefully it will have a YouTube video to watch, or a link will be provided on the Telegram Circle of Finance Group.

Anything based on the personalities of Habib and Veselina was bound to fail. The majority of staff in Sofia who followed them must be kicking themselves now.

The million dollar question, why was that Vaseline woman kicked out? By all accounts she was running things.

If you read the threads of the groups it seems that Habib was collecting cash and not giving it over. He is accused by Julian, who by some weird twist of fate, has a claim against him in France for doing exactly that.

What kind of unholy alliance did H & V form? There are even rumours that their relationship is not just platonic and based on being business partners. How much weirder can this get?

Don’t say that. The people in OneCoin will take that as a challenge and not as a rhetorical question.

I haven’t seen the Zoom webinar and can’t find it anywhere in public domain, so don’t know if there is more new info, but there was at least a new video published couple of days ago in which it’s stated that “Invicta Token” will be based on ERC20:

youtube.com/watch?v=A1upVtJbGwM

The low-effort ERC-20 route was very much expected. It might be this one that I’ve pointed out previously:

etherscan.io/token/0xc1Db8935c5FcCe5c478ea9601c139f77234f034b

PS. Another OneCoin “outgrowth” ByCoi seems to be undergoing its own dramas. Looks like Jan-Eric Nyman has made a coup d’état against Duncan Arthur and gone — surpirse surprise! — full MLM-Ponzi with his eComelize (ecomelize.com) project.

See: coincorner.se with docs inluding Duncan’s cease & desist letter against Nyman.

Bye-ByeCoin was initially planned to be a ponzi scheme by the leader of the Known Alcoholics Duncan Arthur..

He had his own agenda to betray Constantine and take over the network.

Ugh, this is a bit of a mess.

So we have Bycoi etc. which Duncan Arthur owns, and then this Ecomelize thing which is MLM – and apparently a OneCoin clone. But it uses Bycoi (???)

I guess I’ll add this headache to the review list.

@Semjon (#18)

Via email:

Based on a letter from Duncan Arthur found on the coincorner.se site mentioned (dated Feb. 8th), he thinks shares aren’t securities. Therefore, selling shares in his company through what he calls a “private equity placement” is “unregulated largely”.

Unlike selling what he calls “coins” directly, which he thinks are securities and therefore regulated. Despite the fact that

(a) these shares of his “potentially could be converted to a coin but otherwise would retain their worth at £ 1 and be refunded, or held as a share”;

(b) his supposed private equity placement appears to consist of offering his multifaceted shares for sale (at £ 1 each) to the general public.

Whether it’s ignorance or deliberate obfuscation, that does not bode well.

PassingBy. Do your homework. In England private shares aren’t securities. They are not regulated on the basis that if you buy them, you must know what you are doing.

It wasn’t the share for sale anyway, it was an option.

According to the UK government’s definiton I can find at gov.uk/hmrc-internal-manuals/capital-gains-manual/cg50220 (I think HMRC should know), shares in the UK are securities.

There is no special status for ‘private’ shares, by which I presume you mean shares not traded on a stock exchange. And that’s a matter for the UK as a whole, not for England.

In that letter, Duncan Arthur talks about selling shares, not options, I’m not responsible for his choice of terminology.

That what he is describing is something very strange, which can either be a proper share, or turn into a “coin” at some point through an unexplained process, or be sold back to him at the same price it was bought for, so essentially some kind of zero-interest bond, is a different matter.

I forgot to add to that: he also claims that “private equity placements (…) do not generate taxes.” That is a nonsensical statement, if by that he means ownership of the shares he’s selling (wat he is describing doesn’t actually seem to meet the definition of a private equity placement) cannot result in taxes having to be paid.

He cannot know in which countries the people buying his shares live, and it’s the tax laws of those countries which determine what is and isn’t taxable.

PassingBy, it’s good thing you forgot. You should have carried on forgetting. Firstly, it wasn’t him.

Secondly, it is an option. Thirdly, equity sales are taxed where the entity is based. That, from what I can gather is England. Try and keep up.

Of course there is ‘no provision’ for private equity in England – IT IS UNREGULATED, not that it matters because options were being sold that could be converted back to a £. You should buy a OL Powerpack.

I was in the army with Duncan Arthur. Potchefstroom, 1992, Danie Theron Combat School. I find it funny that he is now debated.

We were in Army Intelligence when national service happened to all wit ous. He’s definitely clever.

He thought everything was a big joke then. I bet he does now.

@PassingBy & StevCowl

What’s referred to in the Feb 8 th press release is probably sufficiently obscure and exotic that ordinary persons would be well advised to stay away from it — especially if they don’t have a good counsel to rely on to independently evaluate it & give second opinions.

To me Duncan’s proposal sounds like a some kind of convertible bond. It seems to desctibe somethign that has both debt (“be refunded”) and equity (“shares at £1 each”) like features, and if there are terms of conversion defined, it can make it also an option-like security.

@StevCowl:

So that letter signed “Duncan Malcolm Arthur”, which is the only thing I’ve been talking about, isn’t by him?

As I said, in that letter, he repeatedly calls the things he sells “shares”.

This is a letter addressed to, actual or potential, buyers. If someone buys something in a foreign country and brings it into their own, they are taxed according to the rules of their own country.

That the person or entity selling it isn’t paying any taxes on the transaction where they are based, is immaterial to a buyer.

For instance, if I buy something in a non-EU country and have it sent to me in the EU, I have to pay VAT on it (if it is above a certain, very low, value).

@PassingBy You really need a clue. The things, as far as I can tell were sold by an entity called “Gardor”. Please provide any evidence you have that he sold the the things.

It was an option. You have a completely warped understanding of tax law. Tax is due only in the country where the final beneficiary is based.

This would be income tax, not VAT. Please let the adults talk.

Shares, Options, Derivatives are all securities in nature, but may be regulated by different entities.

Even segregated funds (mututal funds backed by insurance) in some jurisdictions are considered securities but can be exempt based on relevant policy (Canada in particular excludes segregated fund contracts from being securities even though by nature they are).

There are further exemptions for private placement, small distribution (under 50 shareholders, etc) depending on how things are structured.

Doesn’t change the fact this is all ponzi and crap.

@SteveCowl:

My only source, as I already stated, is a press release put out by Duncan Arthur, which I found on the coincorner.se website. It’s got his signature on it.

Because it is a crap website it doesn’t allow a direct link, but it can be found under the label “7. Pressmeddelande från Duncan Arthur(8 feb)”. In this he states, i.a.:

Throughout this statement, he refers to the things he is selling through these “vehicles” as just “shares”.

Not according to Duncan Arthur it isn’t.

Sigh. I merely gave the example of a transaction where a tax is due in the country of the buyer, using VAT as an example because that is a tax that doesn’t exist in most countries outside the EU, and many people elsewhere in the world therefore aren’t even aware of.

It is therefore impossible for anyone who is selling anything (shares or anything else) to make a claim that this does not “generate taxes”.

Such a statement can only be made if all parties in a transaction are in the same tax jurisdiction. Since he appears to be selling them to all comers, that is not true in Arthur’s case.

If he merely means that he doesn’t have to pay taxes on what he gets from selling them, that could be true, but it’s completely irrelevant to any buyer, so why would he mention it?

If you want an example of how his shares can “generate tax”:

where I live there are legal entities which pay an annual tax on all assets they own, such as shares, even if those assets don’t generate any income.

On the other hands, such entities do not pay income tax, should these shares pay out dividends, since that only exists for private individuals.

If such an entity bought any of Duncan Arthur’s shares, they’d be paying tax on them at a fixed annual percentage of their assessed value, for as long as they own them.

rofl… coincorner.se is a shitshow put up and run by (x)onecoinscammer andreas åhlin,

Whit friends like that Duncans moniesgrabb scam will fail.

he rely should have stuck to teaching seniors the tango….

Maybe they should change name to Convicta ?? Or even Coinvicta…. Just thinking!!

*puts on cynic hat*

Can anyone make sense of this site?

(link removed)

First time I’ve come across that name (Heigo Pruuli) and email (removed) in connection with TradeInvicta.

@John

URL removed, that website asks for captcha and then dumps visitors on an “ID not found” error page.

Not sure why that is. Just google ‘tradeinvicta’ ‘pruuli’ and ye shall find.

A certain ‘Heigo Pruuli’ has been added as ‘management board member’ on 25-02-2020. It seems someone’s not quite willing to give up TradeInvicta in Estonia.

@John

I think it’s the opposite — everything points to Habib and Veselina burying the Estonian company.

They quit the management board of TradeInvicta Oü, and the company itself hasn’t paid any VAT/employer expenses indicating it has been inactive whole time:

(inforegister.ee/en/14844026-TRADEINVICTA-OU)

Heigo Pruuli who stepped in charge, appears to be in the business of “palliative care” for dying companies:

inforegister.ee/DEYCBHX-HEIGO-PRUULI

As you can see, Heigo is the person in charge in tens of troubled/inactive Estonian companies. (He is also in a companies in Finland and UK.)

Habib and Veselina hired Heigo (probably a random stooge from Estonian mafia) as a way to neatly abandon the company.

Though possible, it’s unlikely that they use Heigo as a more traditional proxy/front person — like Ignatov crime family uses bodybuilder/bodyguard Angel “Foxi” Boyadzhiyski as a front person for their Bulgarian companies.

Yes, that was my interpretation. What do you think would be the advantage of any ‘palliative care’ here?

Running what the website Semjon provided says through Google Translate, Pruuli’s main activity seems to be as a liquidator.

From this site: start-business-in-estonia.com/company-liquidation-in-estonia-eng.html?lang=en, that is a standard part of winding up a company in Estonia.

When a company goes into liquidation (voluntarily or not), a court appoints a liquidator, and decides what remuneration they will get.

This person then has to figure out what the remaining assets and liabilities are, sell off any assets, pay off liabilities if there is enough money left, and take care of all the legal formalities before a company is finally struck off the register.

Lawyers specialising in this kind of work exist in other European countries, and no doubt elsewhere in the world. But I’ve only ever heard of them being appointed when a company goes banktrupt, or is on the verge of doing so. Then, their job is to maximize the assets so that as many creditors as possible can be paid.

In Estonia, they’re apparently a standard part of winding down a company, even when it does so voluntarily, without leaving any debts.

Perhaps what is happening here is that they’ve already signed over the company to the person who will then formally take it into liquidation. Since there doesn’t appear to have been any kind of business activity, there would be neither assets nor liabilities, no employees, and no activities to either continue or wind down.

So for him to apply to the relevant court to also be formally appointed as liquidator of the company of which he is already the sole director, and offering to do that legally required job for free (since the former owners have already paid him), could be a mere formality.

It’s also quite probable that companies which sell easy incorporation packages in Estonia to foreign businesses, such as the one V&H used, have contacts with such professional liquidators.

Having all the administrative and legal hoops that have to be jumped through taken care of, should you decide to get rid of your Estonian company again, would be an obvious service to include in such an incorporation package.

If it’s same in Estonia as in Finland, dismantling a limited liability company (which oü refers to) can be suprisingly tricky.

A proper liquidation proceeding can have non-trivial costs and is an onerous hassle. (That’s why in Finland, if there is no bankrupcy, a common way to destroy LLC is to make it inactive and wait for 10 years until it gets automatically removed.)

If H & V want to quickly dissociate themselves from the company, they pretty much have to hand it over to someone else. If the stooge is a proper criminal, it’s a win-win situation, because he proabably has good uses for a new shell comapny anyay.

I found a new domain aasociated with the Invicta scam– tradeinvicta.eu

registrar: CSL GmbH Computer Service Langenbach d/b/a joker.com

According to EURID WHOIS they are using Finnish company Noisy Stream Oy / avaruus.net as the registrant agent.

I highly recommend looking at the source-code!!!

Ex-OneCoin Top Leader announced RESCUE PLAN for ONECOIN INVESTORS! it funny how they are seeking to scam twice the same people.

youtu.be/nc80wg7SZw8

Uh… how you gonna rescue Ponzi victims by funneling them into another Ponzi?

Logic 404 not found.

Samuel.

Mark must has some knowledge about who needs to be rescued and by how much. Was he the only Japan leader? Is this a new MLM?

Haven’t had time into it in more detail, but tradeinvicta.com is now live, including its “Whitepaper”.

There is also this launch webinar: youtube.com/watch?v=lrYP4o7xXoc

They also have trebleu.com, which is about selling what OneCoin called educational packages, and they’ve rebranded as “Advanced Learning Systems”:

I like how the tradeinvicta.eu site is titled “Trade Ivnicta”. And thank you to John for pointing out that the source code of that credits “Ruja Ignatova, Phd” as the author. Whose idea of a clever joke was that?

Everything is so subpar from graphical design to the confusing concept that I can’t see this scam gaining serious traction.

Perhaps indicative of their effort/investment is that Veselina Valkova made the ugly and crappy “Whitepaper” with ilovepdf.com free service (see the metadata). (For example DagCoin has much better “production values”, if you want to compare it to other scams that have sprung out of OneCoin.)

I can’t see any corporate entities in their T&Cs. Not even the Estonian entity. No info about licenses, although I think it was claimed in the webinar that they have some.

In the list of countries in which Invicta can’t be promoted is USA — along with such reputable countries such as North Korea, Syria, Iran and Cuba.

Pretty apparent that the only reason why USA is banned is that Habib and/or Veselina are likely targets of FBI.

Invicta token already has some transcations:

etherscan.io/token/0xb3ef897268c656fb090431845aae9341e416add4

The source code seems to be based on this token contract:

github.com/sefaakca/Dataset/blob/master/CoolDex.sol

So they bought their IT solutions from Australian company Espay Pty Ltd (espay.exchange). The visual/technical style seems to confirm that this is indeed their service provider. (Somebody should alert Austrialian authorities that this company is helping known fraudsters.)

To Frodo,

I don’t know how much leaders joined Mark Nishiyama’s new scam coin. As long as I know he is giving now INVICTA webinars to his former OneCoin group and telling them lies that there is a rescue plan for them and for the merchants.

Do you want to know Mark Nishiyama’s rescue plan?

It is to buy INVICTA educational packages and become member.

Yes! You need to spend more money! then sell packages for them.

This is like a joke. I can not stop laughing.

I wonder if there are fool people who would join this new big scam.

The simple answer is “YES” believe it or not. Happens in every Ponzi.

Some never learn until their 3rd or 4th time; and then some never learn. I know of people who went broke thinking “this one will be different” mantra. It’s the only way they could stop.

They forgot the old adage, “Fool me once, shame on you,” “Fool me twice, shame on me.”

Oz wrote:

Obviously, former OneCoin scammer Quini Amores is switching from one scam to the next. This “interview” was published on YouTube five days ago:

share-your-photo.com/e67f9dc4a4

share-your-photo.com/7baffde8ca

youtube.com/watch?v=UUbfCvgQUtE

In December 2019, the OneCoin fraudsters Quini Amores (left), Luca Miatton, Marco Agnelli, Cordel KingJayms James, Simon Le, etc. proudly had their picture taken in front of the fraud headquarters in Sofia:

share-your-photo.com/2a4b76436e

Quini Amores was so convinced of the OneCoin fraud that he posted this photo of his child with the OneCoin logo on Facebook:

share-your-photo.com/d70df261f6

During the fraud event in Barcelona in November 2019, this infamous fraudster claimed that the hypnotist Eduardo Sánchez, whom he had invited, brought some of the guests present into a state of mental programming!

share-your-photo.com/74646806cb

Please explain – veselinavalkova.com

Well, she has 12+ years of experience in PAYMENTS AND FRAUD ACTIVITIES

I am going to be very surprised if one of that large amount of documents the DoJ haven’t unsealed don’t relate to Veselina Valkova.

What she and Habib did with keeping the lie of an “exchange” alive throughout 2019 to push sales even after Konstantin was arrested is pure cynicism.

12 years of fraud activities would be unusually honest for her to admit except that she by all accounts can barely string a sentence in English together.

Also, 15+ years of experience in “legal proceedings related to cyber crime, identity theft, financial crimes, falsified documents”.

Both claims certainly sound plausible. But whether 12 or 15 years, that must mean she was at it long before OneCoin got started.

But perhaps Oz meant an explanation for what happened to me when I tried to look at that site with Firefox. I only got this:

From this one can only conclude that the technical savvy behind her website is on the same level OneCoin’s always was. There’s no earthly reason for this to happen if you’ve got a SSL certificate from a reputable source, and remember to pay for renewals (which for small personal websites like this is normally handled automatically by the website hosting company).

I tried a different browser which doesn’t seem to mind.

It’s certainly a very odd site. She seems to try and maintain the fiction that dealsinvicta.com, her DealShaker clone, is a functioning thing, not an online ghost town. (Oddly, out of the very few things listed as supposedly for sale I randomly clicked on, almost all seemed to be from small shopkeepers in Bali.)

There’s now even a “franchisee” thing attached to it, which at a quick glance appears to be the exact same thing as the DealShaker “country managers”.

I also spotted on amusing rant on her so-called blog, titled “„CATCH 22“ IN GLOBAL CDD REGULATIONS” (CCD stands for Customer Due Diligence).

From the bad English, that appears to be something she wrote herself, not copypasta. And she’s very, very angry about a great injustice:

Because, alas, companies these days check out people online:

Poor, poor Veselina, a victim of the big, bad internet which documents her fraudulent OneCoin past.

This actually confirms something I thought about at the time we first heard about her and Zahid trying to set up their personal OneCoin clone.

How on earth did these two think they’d ever be able to open a bank account, or get a credit card processor, given that anyone would as an obvious first step of due diligence type their names in Google, and find out about their past?

One would have to be slightly delusional to think people like them could simply start a new business, openly, using their real names, with a clean slate, just because they’ve managed to avoid criminal charges (so far). This little rant clearly shows that she actually was that delusional.

It does seem that Veselina picked up the victim mentality and feels sorry for herself. Veska appears to be the master of it. How dare the world misjudge Valkova and people like her for bending the rules and remember what they did!

Is that “Witch Hunt in the 21st Century” rant still live on the OL page? Either Valkova wrote it in the same faulty English on the new site or whoever did moved with her to her to New Scamsville.

Valkova controlled “Compliance” at OC apparently. That means collecting data for what might have been for resale according to some reports. Or the ever changing KYC process was a way of keeping people in line by having the ability to quickly freeze access. She’s a real gem that “Vese”.

Has anyone ever asked her why she didn’t go to the US with Konstantin?

@PassingBy

I’m not getting that SSL error on my end.

Very odd. Firefox gives me that error, on both Windows (v. 82) and Linux (v. 78). Opera on Windows, and Chromium on Linux, don’t. They show the certificate with that expiry date, issued by GoDaddy.

Perhaps Mozilla simply doesn’t like GoDaddy.

@Stevie

I cannot reach onelife.eu at the moment, but the press release from March 2019 is still available on onelifewallet.eu.

share-your-photo.com/ee0738cf7d

onelifewallet.eu/en/news/witch-hunt–in-the-21-century

The domain registration from December 12, 2019.

share-your-photo.com/06a986cad8

Veselina Marinova Valkova claims:

share-your-photo.com/1f9ace5e43

winbet.bg reminds me of the former fraud portal coinvegas.eu of the criminal Ruja Ignatova. Is Veselina Valkova the owner of the “Win Bet Online” EOOD (UIC 203294705)?

share-your-photo.com/5dfa9d3757

Veselina Marinova Valkova quotes John Lennon:

“YOU CAN SAY I AM A DREAMER, BUT I AM NOT THE ONLY ONE”

The quote should read like this:

“YOU CAN SAY I AM A CHEATER, BUT I AM NOT THE ONLY ONE”

share-your-photo.com/905e42f010

WINBET CASINO on YouTube:

share-your-photo.com/feb5596190

youtube.com/channel/UCCqtK7vu6xkS9otYxKrkJSA

WINBET CASINO on Instagram:

instagram.com/winbet_casino/

55-minute interview with Mark Nishiyama (left) from August 2020 with 164,231 views and 1,242 comments:

share-your-photo.com/f057c62304

youtube.com/watch?v=rTPUQHPMLks

His website, marknishiyama.com, does not reveal which scam he is currently working for.

His YouTube channel Future Masters Crypto Millionare:

youtube.com/c/FutureMastersCryptoMillionare/videos

Two serial scammers in one video – Mark Nishiyama and Udo Carsten Deppisch:

share-your-photo.com/c9a3ad4b3d

youtube.com/watch?v=AwyLTx01IYM

The video was uploaded by Mark Nishiyama on his second YouTube channel “Billionaire Marketer” in October 2020:

share-your-photo.com/c606f08777

youtube.com/channel/UCf6jhZaFsYGngHUsQilabSw/videos

Addition to comments #18, 22, 32 and 33.

The well-visited portal coincorner.se by Andreas Åhlin-Lietzow from Sweden no longer exists. In the WebArchive the website was last saved in September 2022:

web.archive.org/web/20220928051715/https://www.coincorner.se/

As of March 2016, Andreas Ählin-Lietzow was a very active promoter of the OneCoin scam. Later he became a critic, also quoting from BehindMLM and recommending the business opportunity of Duncan Arthur, who developed the NewDealShaker for OneCoin.

Here’s a screenshot of his YouTube channel CoinCornerTheONE, which still exists, with 182 videos and 1,350 subscribers:

share-your-photo.com/589deaea40

youtube.com/@CoinCornerTheONE/videos

Which wonder currency did Andreas Ählin-Lietzow use to pay for the Rolls Royce?

share-your-photo.com/c3b0889ccc

Addition to comments #62 and 63.

The website veselinavalkova.com is no longer accessible. In WebArchive the page was saved only once, but it is no longer displayed because Veselina Valkova has forbidden it. Why?

share-your-photo.com/23ade422e7

The winbet.bg website is not working properly. I have also tried with an IP from Bulgaria. I read all the time:

winbet.bg

If you want to win or lose money with winbet, this site from Belarus is the right one for you:

winbet-by.com/#/

vvalkova.com is still active.

you can read what a nice person she is, a legend in her own mind

@Stevie

Of all that Veselina Valkova writes about herself on her website, these two sentences are definitely true:

share-your-photo.com/1e094fe2ad

vvalkova.com/post/get-to-know-me