Ignatova does it again, another fake magazine cover?

In their own words, Financial IT are

In their own words, Financial IT are

a cutting edge financial technology magazine.

The publication provides a unique and valuable forum for people involved in the change process to learn and exchange ideas and knowledge – as technology cements its pivotal role in supporting the financial markets.

The magazine was first published in 2012, is printed four times a year and has a circulation of ‘over 2,000 print and digital copies‘.

Advertising features heavily in the publication, with Financial IT pitching the magazine as the ‘perfect media vehicle to extend global reach of your print advertisement and brand awareness campaigns‘.

We help FinTech companies to generate genuine leads and to improve their SEO rankings.

We provide an online platform, video production, content marketing, listings, reviews and rankings.

According to their media-kit, “full editorial coverage” in Financial IT will set you back £1999 or £2999 a year. Basic coverage via a “long-form editorial article” is £999 a year.

So, what does any of this have to do with OneCoin you ask? Well, yesterday OneCoin Founder and CEO Ruja Ignatova announced that she would be gracing ‘the cover of the winter issue of Financial IT‘:

The announcement was originally made on Ignatova’s personal “CryptoQueen” Facebook account. It was then republished on the OneCoin corporate Facebook account.

The photo of Ignatova super-imposed on the Financial IT cover is from her corporate sponsorship gig at the EU-Southeast Europe Summit late last year:

Accompanying the Facebook announcement was a PR video, directing viewers to “get your magazines today”.

Here’s the thing though… a few hours ago Financial IT unveiled the actual cover of their 2016 edition.

See if you can spot the difference:

Unless Ignatova recently underwent radical surgery and changed her name to Gareth Richardson, we don’t know where she is either.

Now, without even the slightest verification, OneCoin’s PR video has been plastered all over Facebook and YouTube.

Now, without even the slightest verification, OneCoin’s PR video has been plastered all over Facebook and YouTube.

OneCoin affiliates are even quoting Financial IT’s Chris Principe as saying:

When I first heard about OneCoin, I thought it was either a scam or a pyramid scheme.

After researching further and getting an opportunity to interview Dr. Ignatova, I was absolutely impressed with the technology backing OneCoin and their block chain, as well as excited about their vision for today’s economy.

On their website Principe is credited as Financial IT’s publisher. Why he’s issuing public statements about content appearing in Financial IT is unclear.

Reminiscent of the Forbes debacle, it appears OneCoin have misrepresented whatever agreement with Financial IT they may or may not have.

Either way, it’s pretty obvious OneCoin paid for any published or unpublished coverage in Financial IT. Really, it’s little more than a glorified advertisement.

Actual media coverage of OneCoin that doesn’t see money change hands is far less flattering.

Shortly after it was published, Ruja Ignatova and OneCoin took down their Financial IT announcements. No explanation has been provided on either Ignatova or OneCoin’s Facebook pages.

I’m aware of at least one BehindMLM reader who has reached out to Principe for comment, but as at the time of publication they haven’t heard back.

I myself have sent this article to Principe’s Financial IT email address with a request for comment and/or clarification. I’ll publish a response if we receive it.

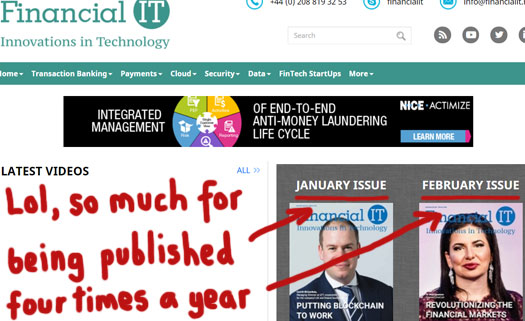

Update 22nd February 2016 – Chris Principe has yet to reply to my email, but someone over at Financial IT has been busy.

Since publication of this article Financial IT have issued another tweet, this time for a “February edition” of their magazine:

Additionally, the Financial IT website has been updated to showcase both a January and February edition of the magazine:

This is particularly amusing, because Financial IT maintain on their “about us” page that the magazine is ‘published 4 times a year‘.

How much OneCoin paid for a special Financial IT February edition cover and advertorial is unclear.

After reading this, I thought about doing a photoshop of Ruja on the cover of Swank, but I remember how that sort of thing works out here =(

The actual cover of Financial IT’s Winter 2016 Issue was revealed quite some time ago, 22 Jan to be exact. The cover has been visible also on their twitter for several weeks. (They maybe modified the post since it seems like being added just yesterday.)

So it’s very strange that onecoiners have been bragging about this fake cover all this time. Don’t they even bother to check out the magazine’s home page?

The actual Winter 2016 Issue has the same article teasers than the fake cover is showing, so it’s not likely that the Onecoin article was supposed to be in the Spring 2016 Issue.

Still no respond from Chris Principe. Maybe he’ll get more motivated into answering after getting such publicity for their magazine.

The actual winter edition is available online (the whole magazine) on the Financial IT website.

No mention of Ignatova or OneCoin anywhere in it.

I already asked that 8feb

NO ANSWER! nor by the e-mail nor the contact form.

—————————————————

The newspaper is ridiculously unknown.

NOLINK://www.rank2traffic.com/financialit.net

NOLINK://website.informer.com/financialit.net

Owner: Muzaffar Karabaev (Finnet Limited)

Hosting company: Amazon.com, Inc.

—————————————————

NOLINK://www.youtube.com/watch?v=8HrvyrPje3I

NOLINK://benzmith.tumblr.com/

—————————————————

Ruja ignatovas Facebook post…(currently deleted)

NOLINK://s8.postimg.org/nsv67v0lw/hehe.jpg

—————————————————

Place where I first spotted the cover:

NOLINK://s14.postimg.org/sc8bw363z/UGLYFACE.png

You should make an article about the Onecoin exchange. This week not a single sell!!

NOLINK://s2.postimg.org/baa8h90p5/paska.png

NOLINK://www.youtube.com/watch?v=cOL89bXiyV4

The explanations of the support:

Interesting dodge. It essentially forces everybody to wait 5 days to trade OneCoins, and then it can be denied for no particular reason, i.e. “nobody wanted it”.

Someone should setup an experiment… One side buys, other side sells, both put in within minutes of each other. See if either one goes through.

Chances are there is no exchange. Someone was manually updating the site and approving transactions just to keep up appearances.

That will not work.

Normally the trades are not happening like buyers=sellers….Normally it always last 1-2 days to see a trade go through. Almost never the same day. (I can’t remember any going through the same day so far)

Ignatova’s workstuff is “accepting” trades manually, or it depends on how many new accounts there are coming in and a percentage of money is set for buying purposes.

In the beginning Tommi Vuorinen said 55% goes to the bonuses. 45% to Ignatova (never officially confirmed).40% of bonuses should go to mandatory accounts. There you buy Onecoins (or tokens but it’s the same)

So in the beginning the price was low and people can start selling onecoins 80 days after the mining begin. Most of people wait for the split(s). But the number of members able to sell onecoins is growing and growing fast.

Now the price is 400% higher than in May and new accounts? Watching the ticker it’s 2000-3000 per day. But I don’t believe it. I’m watching my networks BV and it has been very low volume whis year.

So low new number of new accounts + higher price + more people able to sell = no money for Onecoin sellers. Or if all selling would be accepted = Ignatova would start bleeding money.

NOLINK://benzmith.tumblr.com/post/138796920521/soruja-is-buying-a-small-amount-of-onecoins

Almost all trades went through to October 2015. Then in November we had KYC and first in January people that had no KYC accepted could sell Onecoins again.

In January I sold 2 onecoins (20%) but this week? NONE! (0%)

Maybe Ignatova is cashing out? Pulling out the plug? This is also possible.

Yeah, cuz that doesn’t spell out Ponzi scheme at all.

Withdrawals are dependent on the amount of newly invested funds, so they will be processed when there are enough newly invested funds.

As far as selling onecoins, from what I’ve seen, one member gives cash to another member and gets their onecoins in exchange.

Does anyone know if a member has actually sold their worthless onecoins to the “company” and got cash wired or sent to their bank account?

seen what? you can’t see anything on the exchange

sell 1 5.171 € pending

sell 1 5.171 € pending

sell 1 5.171 € pending

sell 1 5.171 € pending

sell 1 5.171 € pending

sell 1 5.171 € expired

sell 1 5.144 € executed

this is everything that you can see in the exchange.

no volume from whom to whom etc.

I have cashed out once 70-80€ once…. ex. 15€ fee

This is entertaining (in a sick way). Just how much more disgusting can these jerks get? Time will tell.

I’m saying that I have seen one poor sap (who thinks he is buying useful onecoins, hand another person cash for their onecoins (which, I guess were transferred from their account).

So, that person sold their onecoins. But what I’m asking is, has anyone sold them back to the company and received real cash?

Thanks

Here’s a close up of the fake cover revealing it to be “Winter 2016” issue:

youtube.com/watch?v=50ssom-lsK4

Yeah,,, whats the word for that? Mmmmmm FRAUD?

Let me use this scenario:

5 people come to my house and I show them to a table where they can play monopoly, but each person hands me $100 dollars to play. I just keep score and write down who is winning.

The monopoly money is the onecoins, which I lie to the players and tell them it will someday be worth money.

Well, one of the players takes his wallet out and buys some monopoly money from another player for real cash. So, that member recouped a little back from the money that they lost to play the game, but the other guy is even more financially negative.

But me, like Ruja, has $500.00 and don’t plan on ever giving it back to the players.

Is that how it works when someone has a pending sale? It is just pending some member electronically buying it? or does the company ever give back that ill-gotten money?

Thanks

Sent an email to them requesting more information….

dont worry guys. ken labine, rujamama’s loyal lapdog should step in soon enough with an [im]plausible explanation.

something like, when ruja realized that the financial IT had a circulation of just 2000 copies, she warned them to pull her from the cover of their winter issue, because y’know onecoin is second only to bitcoin and cant grace the cover of some piddly magazine.

LMAO…. Some people will just never learn!!

This page contains a picture of the article inside the magazine:

onecoin-oneworld.com/nyheter.html

The article also claims that interview will be available at the webpage of Financial IT.

According to Business For Home.org, a Juha Parhiala of OneCoin has surpassed The Yagers and Holton Buggs in the 2016 top earner list. That’s blasphemy! Nobody passes the Yagers and The Buggs in the top earners list.

Although, I’m curious to know how much Juha paid to get on that list. At the very top.

realscam.com/f9/onecoin-eu-ponzi-scam-3368/index4.html#post98023

Important read (because we have personal contact with the chief editor of the magazine)

If you paste the pictures webadress on:

fotoforensics.com/

you get this result:

fotoforensics.com/analysis.php?id=ec9c6ba82caec9db0dcdfcc7404b850725343b39.62731

Here you can read how to spot if the picture is manipulated:

fotoforensics.com/tutorial-ela.php

If you look att det result of the Onecoin-picture you see that the text and photos are more bright then the rest of the newspaper.

Looks like it is manipulated.

A website that allowed their “CEO of the year” to be leader of the most widespread Ponzi scheme based in the US, aka Zeek Rewards…

It’s pretty obvious they report whatever the companies want to be heard, not real news. It’s no more valuable than press releases. Ted had fallen much in the years. Integrity ain’t profitable.

So uh what, Financial IT themselves don’t know what their Winter edition cover will look like? They posted the cover on their official Twitter account…

Christ OneCoin investors are desperate.

No amount of “reliability” can trump OneCoin using newly invested funds to pay off existing investors. It’s a Ponzi scheme through and through.

And what does that have to do with OneCoin being a Ponzi scheme? Paying for coverage in a magazine doesn’t negate using newly invested funds to pay off existing investors.

Winter issue of FinancialIT is here: financialit.net/content/financial-it-winter-issue-2016 (click download this issue)

No mention of OneCoin anywhere in the publication.

If OneCoin have paid to be in the next edition, that’s a different story. But anyway, an ad is still an ad.

OneCoin’s business model pretty much ensures the only “positive” coverage they’re going to get is that which they pay for.

the cover IS FAKE!!!!

…look to the left! NOT “Spring 2016” or any other time, -no, “Winter 2016”!!!

woba-conligus.com/crypto-queen-dr-ruja-ignatova-mit-titel-interview-im-magazin-financial-it/

Onecoin’s top scammers must be really desperate to gamble with another fake cover.

Maybe that’s why they picked out a low profile magazine. They were probably betting on that nobody would notice the real deal for a while and the fake cover would cause a badly needed cash injection to the pyramid.

Onecoin’s Facebook post clearly said that the cover story would be in the Winter issue. They also promised a newsletter to be posted to all members about the article today.

It would appear that Chris Principe is American. That item was NOT written by a native speaker of American English.

More likely written by someone from Bulgaria maybe? 😉

Hi all.

According to the website of Financial It, Ruja will be on the cover of next issue of the magazine.

The big question is still? Is it paid for 😉

Where exactly on the website does it say that?

FinancialIT are pretty transparent about their content being paid advertising campaigns. I don’t even think they do non-paid content.

NOLINK: financialit.net/sites/default/files/styles/184×258/public/ruja_cover_image.jpg?itok=Q7puJSdn

Yeah but is that like a Forbes “pay us and we’ll give you a magazine cover you can market with” type thing or the actual cover of the Spring edition?

HeHe,

Coincidence ????

Lol: twitter.com/financialit_net/status/701667213862952960

“February edition”? 😀 I thought thay published only four times a year.

Chris Principe from Financial IT has still not responded to my email sent last Friday. Apparently he does not care to respond to Oz as well.

However it looks like he took the money and had an an extra issue published for Onecoin. This only emphasizes what a joke Financial IT is.

He could have returned the money but instead he chose to have the magazine become a sleazy part of a ponzi scheme.

Lol, I wonder how much a “February edition” of Financial IT costs.

If you go to the Financial IT website at the moment, they hilariously have a “January edition” and “February edition” side by side on the right.

They might want to change their “about us” page, as it’s clearly out of date. In light of OneCoin buying a February edition of the magazine, it should read:

The headlines on the February issue look very familiar 😉 There’s for example “KYC across global platforms”. That was already published in Winter/January issue.

Also the article about Sibos and “Trade Solutions Group” are there. So the February issue is nothing more than the January issue with the addition of Onecoin article.

…asked them on the Financial IT – facebook-account, how can it be. 😉

-wait for the answer. 😀

Onecoin claims that they a have 13.200 print copies of the February issue that members can order free of charge.

That’s over six times the amount Financial IT normally prints their issues. No wonder that this bad-excuse-for-a-magazine is so willing to obey the dark side.

She didnt have to pay anything. She is Teds upline. 🙂

According to Onecoin more than 80% of banks and financial institutions subscribe to Financial It. Yet they only produce 2.000 magazines which are send out via email or in print versions. In the US alone there are more than 8.400 banks and financial institutions.

Also it seems that most of the articles in the magazine are sponsored, meaning that companies pay for editorial. As Financial It puts it, you can pay for the following:

• a two page article which can either be treated as an expert opinion or a corporate statement

I am well connected in the Financial sector, and no one that I know of have ever heard of the magazine.

Let us dig some more 🙂

Its a shame Ted isn’t more transparent.

Well, there you go. Apparently, he’ll be on the safe side when that house starts to collapse.

“…wasn’t directly involved in recruiting. Merely providing a platform for the company.”

They must mean 80% of banks and financial institutions… in Bulgaria!

What is your expectation?

Are you up OneCoin 100 euro price in the year 2018?

Here it is, the copy of January issue with Ruja’s face on it:

yumpu.com/en/document/view/55007056/revolutionizing-the-financial-markets/29

– Also a poorly written two page article included. I have no clue why Juha Parhiala’s face is in one of the pictures. It is not explained at all which makes his appearance in the article bizarre.

The article itself is all about why Onecoin is a solution for poorer countries and migrant workers will praise Ruja’s name in the future.

This issue is just a copy of the official winter issue, the OneCoin article is the only difference.

The article is very general, mostly about cryptocurrency as a mean of payment for poor people working in foreign countries. OneCoin is barely mentioned. The ironic part is that OneCoin doesn’t provide the services mentioned in the article.

Paid content, OneCoin supplied the photos and script. Financial IT collect the money and publish.

Well I was just wondering the strange choice of picture. The nature of the magazine is all clear to me.

By the way, the copy in the link seems to be the first edit of the Ruja’s magazine. It still has “Winter 2016” texts in it. Those texts were later replaced with “February 2016”.

Same reason they used the Economist event photo of Ignatova.

This article isn’t really meant for the general public, OneCoin bought it as a marketing tool for their investors. Ruha in it gives them a talking point: “See that guy, he makes $4 million a month (in OneCoins)! You can too!”

Whether OneCoin’s supplied photos align with the marketing pitch they’ve supplied evidently doesn’t concern them.

linkedin.com/in/chris-principe-8aaa959

That is Chris Principe’s LinkedIn.

(I also sent a message both to the “info@” and to his personal email, simply voicing my concern about Financial IT’s Due Diligence on the matter and the implication of such affiliation/ future reputation. I have received no response yet.)

The thing that gets me is that Onecoiners view us as “haters” simply spreading FUD. They do not realize that many of us have seen a similar ball of wax hit the sunlight and quickly melt into oblivion!

Dr. Ruja “The CryptoQueen” Ignatova seems to be held in such high regard by affiliates, despite every single revelation or new “announcement” being its own can-of-worms and quagmire, that it is just befuddling!

Ruja has become the L. Ron Hubbard of the crypto/MLM space, and the cult instigates only the highest levels of indoctrination (ie., “do not pay attention to logic,” “war is peace,” “ignorance is strength,” etc…).

Want a good laugh?

Check out this website about a Bulgarian university offering a class about OneCoin:

softuni.bg/trainings/1322/onecoin-revolutionary-cryptocurrency

I’m sure it will be revised soon. If not, God help us.

A student posted some critical questions and was blocked:

softuni.bg/forum/8450/onecoin-one-ponzi-scheme-and-softuni

Got published – financialit.net/content/february-issue in FEBRUARY ISSUE 🙂 payed content? Well

“appropriate accreditations” indeed.

Nolink://benzmith.tumblr.com/post/139868938996/so-noone-is-writing-about-rujaso-she-has-to

The content is the same in January/February copies. Only 2 pages with Ruja added…and 2 pages of ads gone…

Ruja…I Billion in revenue (Sold worthless tokens) and no newspapers want to write a story about you? Poor woman.

Well, The Daily Mirror did.

The Daily Mirror? You mean the Tabloid, nah.

Lol, so how much has the lecturer “Иван Кашукеев” invested then? Even if it’s a 2bit university, can’t believe management signed off on a recruitment drive.

OneCon reps are just Coin Artists.

Hear, hear!

I also deem it extremely likely that she has used some of her criminal gains to buy (at least part of) the authorities in Bulgaria that could (should) shut her “business” down.

So I suppose only after an international outcry will Ruja be on the run / go to jail.

Until that happens, many, many more people will be defrauded.

Promoters only care when they got caught double-dipping.

Remember Troy D? EMPLOYED by Zeek, while deflecting any and all criticism levied online, on his own website AND here. Advocate… for which side?

Please correct me if I am wrong. In Onecoin I can invest € 1.000 and start mining. I can also split the money and over time my amount of Onecoins will grow. Furthermore the currency rate of my coins will go up.

As of now Onecoin is a 100% closed system and the currency is not traded publicly. So how on earth can the currency rate rise, when it is a closed system and out of the blue 1 suddenly becomes 2.

And then the plan is to take it public later. But how can the Onecoin have any value by then, when it cannot be used anywhere and therefore it is very likely that there will be no buyers, once it goes public.

By then the currency rate could drop to zero i no time, which of course does not matter that much to the founders, since they have cashed out selling monopoly money.

It just does not make sense at all, and I simply do not understand why people cannot see it. Guess hype and money makes people blind.

Or am I missing something?

@Fightmal

Yes you actually are missing something.

You dont get OneCoins with your 1 000 Eur, but you get tokens, which eventually change into OneCoins.

Your OneCoins wont double, but tokens will.

The price of OneCoins keep rising in sense that first the price to get one OneCoin was 4 tokens or something, while now it is something like 25 tokens (i dont actually know the current pricing).

What I have missed is upon which the price of OneCoin is based upon, for logically pricing would be based upon number of tokens, ie.

There are 100 OneCoins to be distributed, and there are 500 people with total of 1 million tokens waiting for them.

therefore price for one OneCoin would logically be: 1 million / 100 = 10 000 tokens for one OneCoin.

However, it seems like they (or at least some promoters of OneCoin) are claiming the pricing of OneCoin to be based upon the price of how much it costs to make one OneCoin, which they claim to be based upon electricity cost.

This sounds very odd to me, first of all, because if this is true, then only certain amount of Tokens can ever be sold, versus, you can sell as many Tokens as you ever like, and value of each token simply gets less when there are more tokens waiting for OneCoins, which would also be partially deciding value of each OneCoin.

For if you could buy 5 000 tokens for thousand euros, and then get only one OneCoin, then naturally you would need to value one OneCoin to be at least thousand euros to buy it.

This would also mean that someone else could decide that he would value one OneCoin to be worth at least 2 000 euros, and hence he would be willing to buy plenty of those 1 000 euro packages, as he (in his mind) is essentially buying 2 000 euros for only 1 000 euros, and this would once again lift the price up based upon free market principles.

But this electricity cost? That sounds quite weird. Granted that mining one BitCoin is pretty costy nowadays, but how many really want to pay the price for one OneCoin that they need to pay at end part of mining?

And in addition this would also mean that OneCoin wouldnt necessarily be making much profit even, since essentially it would be using all that money coming from people for electricity bills.

In this case it would probably be smarter move from OneCoin to actually buy for themselves one power plant instead of banks to save some electricity cost especially at end part of mining.

What that price rising on the other hand is based upon, in my opinion, is based upon clever trick they often do in these kind of things in MultiLevelMarketing schemes.

Things is, when you recruit people, you get some price.

As example, recruit one who invests 1 000 Euros, and you get 500 euros (this is not real example, just imaginative example).

Now, instead of you actually getting that 500 euros in cash, there comes the trick. You wont get 500 euros in cash, but instead, you will get half of it as cash, and other half you need to use to buy OneCoins first.

After that you can sell your OneCoins for cash and finally get it at cash.

Basically this is even good thing for a recruiter as long as it works, for what essentially happens is that as long as amount of new investments keep growing each month, as they usually do when MLM is successful since there are more people recruiting more people and also more success stories to show it works.

It means there will be less people selling OneCoins (previous months recruiters that were fewer than this months recruiters) than there are buyers (this months recruiters), and that essentially means that since this months recruiters absoulutely have to buy OneCoins to get their commissions become cash.

The sellers can sell those OneCoins for any price they want, as long as there is shortage of OneCoins, but not cash.

As example.

Lets say last month there were total of 100 euros of commissions buying OneCoins, and they ended up getting 50 OneCoins in total. That would essentially mean, that one OneCoins price had been 2 Euros.

This month, these same people are wanting to change their OneCoins into cash by selling them. And this month, there are 200 Euros of Commission money buying them.

As there are only those 50 OneCoins in sale in total, that means that these OneCoins are now worth 4 Euros each (200/50 = 4).

And if they sell all their coins, then they essentially got double the amount of cash based upon the original “forced to buy OneCoins” amount.

This is bit simplified example, but this is the principle upon which it works, and which is the reason why the price of OneCoin keeps rising up, as they are artifically doing things that will make the value go up as long as the system doesnt crash.

When system fails, for example for there not being enough new recruiters commissions to buy all the OneCoins in sale by previous months Commissions, Or people just otherwise decide to sell their Coins in huge amounts (christmas presents), then the system crashes very heavily, as pricing wasnt based upon reality, but upon artificial factors that only work during certain conditions.

Of course this could happen in other areas too. Superman issue 1 is worth million only when there is only one of them in sale at a time.

If all those Superman issue 1:s would come in sale at same time, then their pricing would probably be much more reasonable, as there would be more people willing to sell them, than there are willing to buy them for that high a price.

The very idea of “super computers” mining onecoins is laughable. What Ruja/Onecoin has is only a database of the Onecoin members and their so called possessions.

There is no point using massive computer power to mine coins in a centralized system. You don’t need that to have a database of 1.2 billion coins – let alone to have computer spending years to calculate it.

Because there are so few buyers for onecoins, the members have already started questioning in Onecoin’s Facebook page about the poor demand for their coins in the market.

The situation is only getting worse – there are more and more people trying to sell their coins and also the ones that had no buyer are cycling in the market over and over again.

Ignoring the fact that there’s no actual demand for the coins onecoiners still continue believing in magical Ruja coins and their price rising forever.

@Fightmal

Like Paul Burks and Zeek’s daily Ponzi point value, OneCoin management just assign an arbitrary OneCoin value.

The only parameter is that it doesn’t go down in value, otherwise they’re entirely free to assign whatever value they want.

If funds run out, they just deny withdrawal requests under the guise of buy orders outstripping sell supply (read: not enough new recruits pumping money into the scheme).

Putting the two magazine covers together I understand where the concern is coming from. But for a moment, lets consider a paradigm shift from One Coin and focus on the winter issue with Gareth Richardson appearing on the cover of Financial IT.

Whether One Coin goes belly up OR brings value to the market, one thing is VERY VERY EVIDENT. The global banking industry recognizes that the future of payment is not in fiat currency. (Ozedit: Cool, but it’s not in Ponzi schemes either. Offtopic waffle about the banking system removed.)

TL;DR — they are making **** up as they go along. Typical of suspect Ponzi schemes that makes no sense when you look closer, like “Gemcoin, backed by amber” or “ZeekRewards, back by penny auction”.

You buy tokens, which goes into some black box, and out comes some OneCoins they say is worth something.

Remember, Zeek used to have you buy directly a “profit share”. It’s not until 2010 that they shifted language (probably thanks to Keith Laggos, the Ponzi anti-expert) that you buy BIDS, which entitles you to profit share.

Same idea here, just different names. You buy something, which automagically turns into promised profits.

Kevin Foster and Carl Wilt are traveling all over the USA conducting Opportunity Meetings for OneCoin.

I thought OneCoin postponed their launch in that States.

Also, I see the Forbes Magazine with Ruja Ignatova on the cover being used as a credibility piece. They know the so-called article was nothing more than a Paid Advertisement. I wonder if they bother to mention that fact to the audience?

IMO, this is not going to end well for a lot of people.

OneCoin Facebook Page – Customer Service Issues

CONVERSATION BETWEEN ONECOIN INVESTOR AND ONECOIN STAFF ON FEB 26th 2016:

How is it the Top 9 Income Earners with OneCoin are earning almost $10 Million Per Month and these poor Investors can’t get out anything?

So sad. I just read a post on Facebook by one of the Top USA OneCoin pumpers whose account is worth over One Million Dollars.

He talks about friends and relatives who HAVE RETIRED because of their OneCoin investments.

If they only knew what is ahead for them.

Again, in my opinion, this is not going to end well for a lot of people.

I feel sorry for the Asian people who don’t even have much English skills to dig out proper information about this scam.

However I think it’s safe to say that the number of Asian people involved is highly exaggerated. Onecoin is most likely adding up made up figures from other countries as well.

They seem to be some what embarrassed about their Facebook likes, because the tickers don’t show numbers likely to be found in a Facebook page of MLM company with 1.4 million members. That’s why Onecoin has bought Facebook likes.

Check out one of their recent updates with over 18 thousand likes 😉 That stands out with their normal ticker counts of 100-200 likes.

What about OC-websites shutting down? I heard a Norwegian and a Finnish site were closed yesterday. What seems to be the main website is still open.

I am curious how the police investigation in Sweden will go. A conviction in Sweden could be the beginning of the end…

As far as I know the Finnish site was just a promoter’s site. So it was not directly connected to Onecoin Ltd.

However, its disappearance was still surprising because the site presented itself as an information channel for Finnish onecoiners and about Onecoin in general.

Well, the Finnish site is online again:

onecoin-finland.webnode.fi/

– Apparently the site belongs to “Jammu” and “Elaine”, two unknonwn dimwits marketing Onecoin.

onecoin-finland.webnode.fi/ota-meihin-yhteytta/

No it is not:

onecoin-finland.com/

It’s the same site, just slightly different URL.

I have tried withdrawing my cash account but until todate (more then 2 weeks now) there is still no sign of money in my bank’s account.

Secondly, I have sent 3 tickets to help desk and hasn’t received a single reply.

Scamscam

1. Do you want to withdraw money from sold coins or bonuses?

2. Did you have 15 EUR left on your cash account for a withdrawal fee?

3. Is you KYC approved or pending/conditionally approved?

is this fake too?

youtu.be/8lZ2zoj4C_4

Chris Principe, the publisher of financial it talking about onecoin and ruja.

Of course not. Footage of FinancialIT staff reading off a script is part of OneCoin’s paid advertising package…

In an interview, someone has to ask questions. This is obviously just a read-out OneCoin press-release. It’s the same crap Ignatova goes on about at OneCoin events.

Seriously guys, FinancialIT a paid advert book published four times a year. Anything from them is paid content.

Of course it’s not fake. It really shows the embarrassing depths Chris Principe and Financial It are willing to go for a fat stack of ponzi money.

@Belal

I KNEW this had to be fake. Ben Zmith compared .pdf copies from the January and Feb. issues, but Onecoiners, the mystified sceptics of the truth they are, called it photoshopped, or made other excuses saying it wasn’t real.

So, since the Ruja issue is THE ONLY ISSUE on Financial IT which you can’t view in .pdf, I PURCHASED MY OWN COPY AND MADE THE FOLLOWING, UNEDITED VIDEO COMPARING THE TWO ISSUES!

HERE is the link to the unedited video, from the moment I open it in the mail, to where I go onto Financial IT’s OWN WEBSITE and compare it page for page: youtube.com/watch?v=cODVlxpe964

Ruja simply re-commissioned the January issue by paying Chris Principe an undisclosed sum to REPRINT the January issue, and simply change the cover to one of Ruja, and to include the PAID advertorial.

EVERY OTHER PAGES, as you can see in the video, IS EXACTLY THE SAME AND IN THE EXACT SAME ORDER AS JANUARY!!

What if you subscribed to Time or LIFE and your January and February issues mimicked this LIE? Lol

So, Who’s bought and paid, Belal?!?!

I like to check in on our Ponzi Promoters Facebook Pages from time to time just to see if they have finally “got the memo”!

Here is an update:

Kevin Foster – now posting pictures of ladies’ breasts

Ken Labine – one post today and it was the lie about IT Financial – it got only lukewarm response from others.

Tom McMurrain – nothing, nada, zilch

Glenn Smith – no pics of expensive cars, houses, watches, champagne today

I think it was Andrew Carnegie who said, “As I get older, I pay less attention to what people say; I just watch what they do” .

Judging by their FB activity, I’d say these 3 Ponzi Pumpers got the message.

It will be interesting to watch and see how they try and justify their actions – – convincing their friends, family members and FB connections to send their money to Romania for personal profits.

Does anyone know about Sarah McGee? It sounds like they think they are running a legit business. She even talked her husband into early retirement & they can’t seem to spend the money fast enough.

If they want to live off friends & family, why not just ask or beg for the money. Either way their friends & family are gonna lose it, so why give the FAKE Dr. Fat Ruja half of it?

Is a new car really worth losing all your friends and family over? Also they don’t have to worry about vacation…

It is my understanding that her and her husband may be getting a nice LONG one paid for by the state.

Money ruined more than a few big shots in MLM, esp. Ponzi money.

In a way, this needs to happen, as these guys are getting away with it too long. it’s just too bad that the fallout will take out a lot more people with it.

Just look at the Zeek aftermath. Nehra and Waak pretty much ruined, Grimes got his name cut off of the firm he started and had to go work for KT’s firm as a regular attorney instead of partner.

Our friendly advocate revealed to be double-dealing all along and nothing more than a PR man and I doubt he’s quite recovered yet. And soon, we may see the same sort of fallout in Europe when OneCoin finally topples, which may be a few months away yet.

The question basically is will Europol step in and get Bulgaria to shut the whole thing down now, or will they just wait and pick up the pieces after the whole thing implodes?

That depends on whether they have gathered enough evidence of wrongdoing, and who will take the lead in the prosecution.

But given the cross-national nature of this scheme, we’re looking at YEARS of prosecution when this finally go down.

I have a feeling the London event will be a big turning point. Either they will never actually hold the event out of fear or they do show up and arrests are made.

I wouldn’t be surprised if they already have no intention of holding the event at all – just a way to build more hype and trust and then they’ll come up with some excuse why they have to cancel it.

@Rockfish — how would you come by info pertaining to someone going to jail? Just curious…

SMH – I believe she is located in Oklahoma. I have copied their law below…

The following chart highlights Oklahoma’s main pyramid scheme law.

The London event will probably go ahead. TelexFree were holding their shindigs right up until the end.

100% my opinion. London event is their suicide event.

Thanks Rockfish. As far, as I can tell she is VERY sincere as are many.

Yes, many are just plain greedy and don’t care who they hurt, but so many more are oblivious and VERY trusting. Guess that’s what it takes for these schemes to work.

That’s the part I can’t get past — the deceit and then the pain that follows all for the love of money, for greed.

Seeing good people hurt bothers me, a lot! You can lead a horse to water…

financialit.net/sites/default/files/fit7_january.pdf

It used to be very easy to compare the above link with the slideshow of the february issue of Financial IT which USED to be freely available HERE: onecoinnorway.com/index.php?p=1_58_Dr-Ruja-Ignatova-on-the-cover-of-Financial-IT

Onecoin has since scrubbed the internet, as far as I can tell, of any remaining evidence of the slideshow of February, so as to not be so easily exposed. Bummer. Lol.

I still have this tedious video: youtube.com/watch?v=cODVlxpe964

….which I compare side-by-side with the top link, from the moment I opened my mail to when I pulled up the Financial IT official website. (the video is tedious and long [17min.] – sorry, but documents in real time me receiving it and then coparing the two, to reveal thaat of the 52 pages in the magazine, there are exactly 3: Cover and the 2-page advertorial [and slight modification of Table of Contents] which are at all different).

Ruja’s Feb issue was very simply a REPRINT of Jan, with 2 pages and a cover slapped in.