Josh Denne & Jeremy Roma sued for RICO fraud

Utherverse Inc. and founder Brian Shuster have sued Joshua Denne, Jeremy Roma and Blockchain Alliance.

Utherverse Inc. and founder Brian Shuster have sued Joshua Denne, Jeremy Roma and Blockchain Alliance.

In their January 10th filed suit, Utherverse Inc. and Shuster allege violations of the Racketeer Influenced and Corrupt Organizations Act (RICO).

There are nine named defendants in Shuster’s suit;

- Brian Quinn

- Joshua Denne

- Blockchain Funding Inc. (Wyoming)

- Blockchain Alliance LLC (Arizona)

- Masternode Partners LLC (Wyoming)

- Lynne Martin, Josh Denne’s mother and a member of Masternode

- NIYA Holdings LLC (Nevada)

- Nima Momayez, sole member of NIYA and

- Jeremy Roma

Denne and Roma both have prior appearances on BehindMLM.

Denne launched Blockchain Alliance in 2023. Prior to Blockchain Alliance Denne was promoting Daisy Forex, part of the collapsed Daisy Global/Daisy AI Ponzi run by Jeremy Roma.

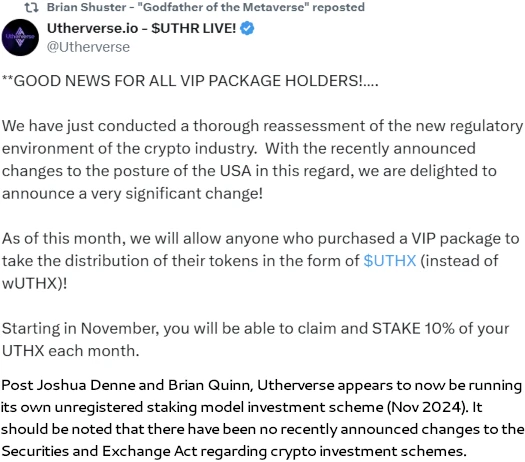

Both Blockchain Alliance and Daisy Global have collapsed. Today Denne and Roma are running BioLimitless, an MLM supplement company built around investment in $5 million dollar clinics.

Outside of MLM Denne is a twice convicted felon on drug and gun charges in 1998, and insurance fraud in 2011. Denne was also tied to COVID-19 mask contract grifting in California in 2020.

Utherverse’s and Shuster’s lawsuit pertains to Denne and Blockchain Alliance, with Roma accused of also being involved.

This case is about an elaborate and premeditated scheme by Defendants acting in concert to defraud Plaintiffs, embezzle and extort money from them and others, and eventually bankrupt UI and Utherverse Digital, Inc. (“UDI”) to cover up their scheme.

To keep thing simple, from here on I’ll be referring to Plaintiffs Utherverse Inc. and Shuster (Right) as “UI”.

To keep thing simple, from here on I’ll be referring to Plaintiffs Utherverse Inc. and Shuster (Right) as “UI”.

At the center of UI’s alleged scheme to defraud is Brian Quinn. UI claims Quinn and his conspirators targeted them

because of their involvement in virtual world environments capable of utilizing cryptocurrency within a metaverse, and their vulnerability resulting from the need for cash for development of the virtual world environments.

Quinn is not known to BehindMLM but does have a history of securities fraud. In October 2022, Quinn settled allegations pertaining to a “fraudulent microcap manipulation scheme” with the SEC for $230,464.

Utherverse was part of Blockchain Alliance’s marketing pitch, which allegedly came about after

Quinn and Denne convinced Shuster they were trustworthy, could infuse millions of dollars of investments into UI and UDI for virtual world development, and could assist in the launching of a cryptocurrency for trading and use in those virtual worlds.

Quinn and Denne are skilled at the art of deception, using a variety of methods to maintain Shuster’s trust, including presenting themselves as honest family men by texting photos of activities and time spent with their children.

The deception by Denne and Quinn continued when, in a further attempt to control UI, Denne convinced Shuster that UI should purchase stock in Blockchain Alliance.

In a nutshell, Shuster was desperate for funds to keep Utherverse alive and Quinn and Denne presented themselves as financial saviours.

Through allegedly reached agreements, Quinn and Denne “promised to”

- pay up to $5 million US dollars to cover all the costs of to prepare

- market and rapidly launch a top cryptocurrency that would fund all the expansion and development costs of UDI’s virtual world software

- identify and bring to UI investors interested in purchasing UI stock and

- market and presell cryptocurrency tokens, to be known as “UTHER” tokens

What actually happened is the typical “behind the scenes” crypto project shenanigans.

Quinn and Denne sold stock in UI that they had no right to sell, presold UTHER tokens under falsified Simple Agreements for Future Tokens (“SAFTs”) and pocketed the money due to UI from the sales.

They also convinced Shuster to enter into a variety of loans and agreements that were ultimately determinantal to UI and UDI, based on false and misleading statements, among numerous other misdeeds and violations of the law.

UI alleges that while Quinn and Denne did inject cash into Utherverse, they did so with only enough to keep it “on the verge of bankruptcy”.

To make the plan work, Defendants needed UI to stay solvent, but also to be close enough to insolvency that UI would not make any public announcements about ceasing investment rounds.

As I understand it, Blockchain Alliance was the vehicle through which Denne and Quinn solicited Utherverse investment from consumers.

Blockchain Alliance was pitched to Shuster as a massive network marketing company that would sell UI’s digital assets, including but not limited to cryptocurrency, nonfungible tokens (NFTs) and membership packages to its network members with a substantial portion of the revenue going to UI as earned income, to increase the earnings of UI and make the IPO more

successful.However, UI never received any income from Blockchain Alliance, and on information and belief, Blockchain Alliance did not have a massive network of members, and either never completed setting up for the sale of UI’s digital assets or sold a portion of UI’s digital assets and pocketed the money.

Additionally, on information and belief, and in breach of its fiduciary duty, Blockchain Alliance sold UI stock that it was not authorized to sell to “investors” who then appeared on UI’s Cap Table. UI never received money from the investors to whom Blockchain Alliance sold stock.

Quinn and Denne sold shares in UI and “rights” to purchase cryptocurrency that they did not own or have the right to sell.

Quinn and Denne, acting in concert, collected millions of dollars, and diverted the funds from UI to their personal bank accounts and/or cryptocurrency wallets.

The defrauded investors were left believing that they had purchased and now owned stock in UI, rights to future tokens, or both, and UI and UDI were left without investment dollars, believing the tales of Quinn, Denne, and the other defendants that for one reason or another, the investors chose not to invest.

As alleged by UI, investment solicited by Quinn and Denne was diverted to Blockchain Funding Inc., a company owned by Denne.

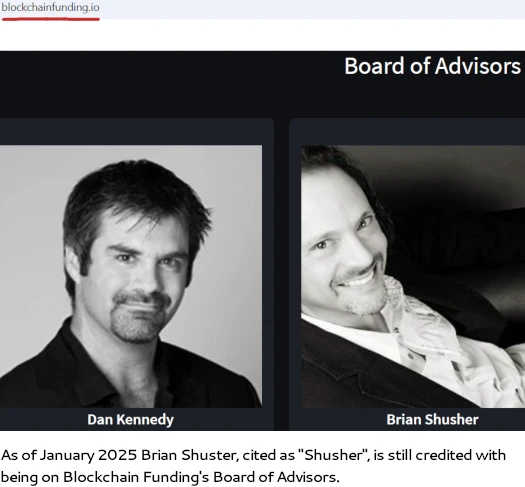

Blockchain Funding is owned by Denne and is still active today. On its website, Blockchain Funding claims it “secure[s] solutions for unlimited web3, metaverse, blockchain and NFT projects”.

We can assist with cutting-edge technologies, including financing, architectural design, planning, and deployment using our network of professionals and accredited investors.

Curiously, Shusher is still presented as being on Blockchain Funding’s Board of Advisors:

Getting back to Utherverse, it and Blockchain Funding

entered into a Consulting Agreement pursuant to which Blockchain Funding was to provide certain services in connection with the launch and release of UTHER tokens, including paying up to $5 million toward all expenses relating to the token launch and ongoing token maintenance in exchange for 12% (360 million) of the 3 billion tokens to be minted.

Pursuant to the Consulting Agreement, most of the tokens Blockchain Funding was to receive were to be used for the benefit of UDI for the promotion of, and to add value to the token.

Consequently, Denne insisted that Blockchain Funding’s 360 million tokens have no vesting schedule and be immediately unlocked, allowing Blockchain Funding to immediately transfer its tokens.

This term was atypical for the presale of tokens in the cryptocurrency market.

Pursuant to Blockchain Funding’s Utherverse Consulting Agreement;

At the time the Consulting Agreement was executed, Quinn promised that if UI/UDI needed money, all Shuster had to do was pick up the phone and call him and the money would be available the next day.

However, when UI/UDI needed money for token development and/or launch, the money was not forthcoming.

Blockchain Funding failed to provide the agreed to funding for the launch and release of UTHER tokens.

Although initial payments were made, in 2023, Blockchain Funding, at Quinn and Denne’s instruction, ceased making payments for legal, public relations, and management fees related to the launch of tokens.

Instead, to keep the launch of tokens moving forward, Shuster was forced to pay out of pocket for these legal, public relations, and management fees.

And pursuant to Denne making demands about his presale tokens;

On information and belief, Blockchain Funding sold a portion of the tokens it was allocated under the Consulting Agreement.

Such tokens were restricted and not permitted to be offered, sold or otherwise transferred, pledged or hypothecated, especially because they carried no vesting or release schedule.

Further, instead of the proceeds from Blockchain’s unauthorized token sales being used for the benefit of UI and UDI, the funds from the token sales were diverted to Denne, Quinn, or Blockchain Funding’s bank accounts and/or crypto wallets and used for Defendants’ personal benefit.

UTHER tokens did eventually enter presale in July 2022.

However as of July 25, 2022, UI had not received any funds and Shuster questioned the delay in receiving funds, but Denne falsely assured Shuster that nothing was wrong, the accreditation process takes time, and investments would be forthcoming.

Shuster later learned that Denne had instructed the developer of the presale software to change the digital wallet that was to receive funds such that the funds would be wrongfully diverted to Quinn and/or Denne, who then received and pocketed the funds from the IDO instead of UI.

Specific to Shuster personally getting allegedly defrauded, a scheme is detailed wherein Quinn and Denne presented

potential investors [who] were interested in buying UI or UDI stock.

Quinn and Denne would then pump up the investor as having large amounts of money and being very interested in investing in UI.

Shuster would then conduct meetings with one or both of Quinn and Denne and the potential “investors”. It was not uncommon for the potential investors to say that they very much wanted to invest after attending one or more meetings.

However, with very few exceptions, the potential investors would just evaporate, with Quinn and Denne telling Shuster they had lost interest.

One of the presented investors who didn’t “evaporate” was Disruptive Technologies, a defunct Estonian shell company allegedly owned by Jeremy Roma.

In exchange for fifteen percent (15%) of the outstanding shares of UDI, 300 million UTHER tokens, and other consideration, Disruptive Technology agreed to distribute $30 million to Sellers, $2.5 million of which was to be paid in September 2022, $2 million in October 2022, $2.5 million in November 2022, and the balance of $23 million in April 2023.

However, the money was never distributed.

Right before the first payment was to be made, Quinn, Denne and Roma met, and shortly thereafter, Quinn told Shuster that a disgruntled former associate of UDI contacted Disruptive Technologies, telling Disruptive Technologies that Shuster was a fraud, among other lies.

Quinn also said that the former associate indicated he would soon be suing Shuster, which caused Disruptive Technologies to pull out of the deal.

On information and belief, the story that the former associate contacted Disruptive Technologies was fabricated by Quinn, Denne, and Roma to keep UDI in a weak position financially while continuing to divert funds to themselves.

On information and belief, the communication from the former associate never occurred and instead the deal between Disruptive Technologies and Sellers was a sham and part of the scheme to defraud UI, UDI and Shuster.

I’m not 100% sure on this but the direct involvement of Disruptive Technologies and Roma could tie into Daisy Global investors being funnelled into Quinn and Denne’s alleged UI investment grift.

On information and belief, Disruptive Technologies and other investors transferred funds (either cash or cryptocurrency) to Quinn, Denne, or one of the other Defendants (e.g., Blockchain Funding, Masternode, etc.), who in turn provided the investors with forged documents and false promises that they were now investors.

As a result of the alleged theft of investor funds, UI claims it was left “heavily compromised”.

Quinn, Denne and other Defendants consistently reassured Shuster that funding was imminent, that huge investment opportunities were around the corner, and they would personally fund UI should the opportunities fall through.

These misrepresentations were repeated as part of nearly every communication Defendants had with Shuster.

Examples of representations made are detailed in UI’s Complaint;

- On or about April 14, 2022, Quinn represented that he had created a “massive opportunity to bring together the blockchain entertainment consortium BEC” and “Worst case, you have 8 – 10 metaverse clients who will license your

IP/use your token” and “Best case we find a way to combine forces and go big for more like 150 mil [$150 million dollar] raise…”- On or about April 16, 2022, Quinn advised that he could connect UI to a portal service with 300 million members. He also advised that he would bring in Tong Soo Chung who “can grab all the Asia money”.

- On June 17, 2022, Quinn told Shuster that Quinn was at a dinner with investors capable of investing $50 billion.

- On July 7, 2022, Quinn told Shuster that he was with people at dinner who were worth “Maybe 18b[illion dollars]”. On information and belief, Quinn knew at the time that they were not going to transfer any funds to UI.

- On July 12, 2022, Quinn stated that “Josh [Denne] and I just off ! Got the whole advisor, partnership, exchanges, new deck etc deal inked”, and that Denne, Quinn and UI would get cryptographic tokens in another company. Such tokens were never delivered to Shuster or UI.

- On or about July 17, 2022, Quinn falsely promised that “Koreans” would take UI public.

- On or about July 25, 2022, Quinn promised that “I have a lot of money and I have a fund we will never go short of money just stick to the plan I promise you if we ever get in a tight spa [SIC, should be spot] I will bail us out”. This statement was false.

- On or about August 10, 2022, Quinn falsely promised he would wire to UI $0.50 million in two tranches of $250K each. The amounts were never wired.

- On or about August 23, 2022, Quinn falsely represented that an investor (Disruptive Technologies) “Agreed to the 2.5m[illion] then 2m[illion] then 2.5m[illion].” The payments were part of what was to be a $30 million deal.

- On August 25, 2022, Quinn told Shuster that the Binding Letter had been signed, locking in the $30 million deal. However, other than a $66 “test” payment, none of the $30 million was ever received by UI. Instead, Shuster

was told by Quinn and Denne that a third party had caused the investor to withdraw from the deal.The myriad of false representations by both Quinn and Denne about having investment deals continued into late 2022, throughout 2023 and into early 2024.

As alleged by UI, Quinn’s and Denne’s exit-scam plan was to bankrupt Utherverse and make

the defrauded third-party putative investors believe that the stock that Defendants “sold” to them was valueless so that the investors would never discover that they had been defrauded and did not hold stock.

With respect to selling investors Utherverse crypto tokens that didn’t exist;

An analogous plan was used by Defendants related to future tokens, with the goal of causing UI to bankrupt without ever minting the tokens.

When Defendants realized that bankruptcy might not happen in time to prevent minting of tokens, they resorted to extorting Shuster to not mint the tokens that Defendants pretended to have sold to the third-party victims.

It’s not worth getting into specifics because it’s all incredibly boring (sold UTHER crypto tokens that didn’t exist are referred to as “Simple Agreement for Future Tokens” or SAFT etc.), but it should be noted the “SAFT” scheme is where Lynn Martin and MasterNode Partners LLC fit into the alleged scheme to defraud.

On or about March 18, 2022, Denne confirmed that he was exchanging information about his work with Shuster and UI with his mother, Lynne Martin.

Martin, working in concert with Denne and Quinn in furtherance of the scheme, and on behalf of Masternode, represented in writing that Masternode had the full legal capacity and authority to execute the Masternode SAFT and perform its obligations thereunder.

On information and belief, this statement was false and was made with intent to deceive because at the time of execution of the Membership Agreement, Masternode was not in good standing with the State of Wyoming and was or was soon to be an administratively dissolved company.

On information and belief, the Masternode SAFT was just another way for Defendants to put UI into further debt, thereby aiding in driving them to bankruptcy in furtherance of the scheme.

Additionally, on information and belief, Masternode sold tokens to investors that it was not authorized to sell and Martin and/or Masternode pocketed the funds received from such token sales.

When Shuster eventually pushed back on the sale of non-existent tokens and stock, he requested “documentation of stock and token transactions”.

Quinn allegedly responded;

“we don’t care about any of the stock… The point is that as you know, between Josh [Denne] and I, we have all those tokens… It’s really none of your business of who we gave tokens to.”

At the time Quinn made these statements, no tokens had been minted, and Defendants refused to provide information about the putative transferees.

Regardless, Shuster repeatedly asked for documentation of stock and token transactions, but Quinn and Denne refused

to provide it.

Shuster further alleges attempts were made to “compromise” him, by way of presenting unaccredited to him as accredited investors.

Additionally, and in conjunction with the $1.35 million loan from NIYA, Quinn attempted to get UI to pay commissions for arranging the loan to unlicensed brokers.

While no commission had been discussed or agreed to, on April 13, 2022, Quinn sent an invoice to Shuster asking that UI “send mark and Frankie commission $67,500” and included wiring instructions to Luxury Asset Lending LLC.

However, Luxury Asset Lending LLC was not owned by “mark” or “Frankie”, but instead listed Quinn as “Chief Executive Officer”, “Owner”, “Member”, and “Managing Member”.

On information and belief, this was an attempt to defraud Utherverse out of $67,500 and entrap Shuster and UI into making payments to brokers not licensed in accordance with the law.

Shuster did make a payment to Quinn for $67,500 but the payment was for expenses related to social media marketing.

Nima Momayez and MIYA Holdings fit into the alleged scheme by way of “convinc[ing] Shuster to enter into loan agreements on behalf of UI and UDI based on false promises.”

On information and belief, the purpose of this loan, while providing initial funding to continue the development of the software, was part of the scheme to create a large liability for UI/UDI and provide an avenue by which Quinn, Denne, and Momayez could cause UI/UDI to go bankrupt when the loan was called in or otherwise became due.

Additionally, in keeping with the conspirators’ insistence that there was an urgency to speed development, to accelerate development of the software, UDI also expanded staff, thereby increasing costs, on reliance of conspirators’ promises that additional funding was forthcoming.

To that end;

Following the expiration of the term of the NIYA Note (August 1, 2024), Momayez, on behalf of NIYA, began demanding that NIYA be repaid immediately and in full.

Defendants knew the fraud would soon be discovered, so they attempted to bankrupt UI/UDI by doing what they had promised they would not do – demanding immediate repayment of the NIYA Note instead of converting part or all of the Note.

Subsequently, Denne and Quinn attempted to negotiate an exit that would leave them with substantial, unearned compensation. However, because their demands were so high and involved cash of which UI was short of because of Defendants’ fraud, the negotiations failed.

Quinn then became combative, telling Shuster that he “had close friends at the SEC” and would ensure that Shuster was bankrupted and imprisoned if he minted the token. Quinn also made numerous statements to Peter Gantner of Nexus saying he would destroy UI, take UI shares to zero and have Shuster prosecuted.

This extortion failed, however, as Shuster was not guilty of wrongdoing and not dissuaded from minting the tokens by Quinn’s threats of law enforcement intervention.

Peter Gantner is the co-founder of the collapsed KulaBrands MLM company and was “secretly” involved in Blockchain Alliance.

UTHER tokens were eventually minted “on or about September 28, 2024.

Shortly after minting the tokens, “investors” began contacting Plaintiffs asking when they would receive their tokens.

At that point, it became clear that Quinn, Denne, and the other Defendants had diverted money from SAFTs and UI stock to their own bank accounts and/or cryptocurrency wallets, and all the promises of huge investments, minting of tokens, and promises of taking UI public was nothing more than an elaborate scheme by Defendants to defraud Plaintiffs so that Defendants could line their own pockets at the expense of Plaintiffs.

With respect to victim losses as a result of Quinn’s and Denne’s alleged fraud;

To date, Quinn and/or Denne have misappropriated at least $1,410,500.00, from no less than sixteen (16) investors, the investors signing doctored SAFTs, expecting to receive tokens when such tokens were minted.

Plaintiffs expect to discover that the number of defrauded investors and the total amount of funds misappropriated by Quinn and Denne are much larger than they currently realize.

In addition, on information and belief, Quinn and Denne sold stock in UI to third parties, whose names then appeared on UI’s Cap Table, but from whom UI received no investment funds.

On information and belief, Quinn, Denne, and the other Defendants pocketed in excess of $1 million from the sale of these stock certificates.

Between Blockchain Alliance and suspected Daisy Global investor funneling, I too believe the amount misappropriated to be much higher.

Across eight counts, UI’s suit alleges:

- violation of the RICO Act (all defendants);

- fraud in the inducement (Quinn, Denne, Blockchain Funding, Masternode, Martin and Blockchain Alliance);

- fraud (Quinn, Denne, Blockchain Funding, Masternode, Martin and Blockchain Alliance);

- conversion (Quinn, Denne, Blockchain Funding, Masternode, Martin and Blockchain Alliance);

- breach of fiduciary duty (Blockchain Funding);

- aiding and abetting breach of fiduciary duty (Quinn and Denne);

- tortious interference with contract (Quinn and Denne);

- tortious interference with contract (Quinn, Denne and Roma);

An injunction against additional unlawful acts, including wire fraud, damages and legal costs are sought.

It should be noted that Denne “and some of the Defendants” named in UI’s suit filed their own suit against Shuster in November 2024.

The suit is referenced in UI’s lawsuit as a “frivolous” action and an “abuse of process”. And addressing why a separate lawsuit was filed instead of a response, UI writes;

The action has multiple deficiencies including that the court lacks jurisdiction over Shuster, his companies and the other defendants, and therefore, rather than counter-complain in the Orange County case, Shuster and UI chose to bring their action here, in an appropriate forum.

Unfortunately Orange County doesn’t provide public access to state-level filed suits so I can’t provide any suit specifics.

As per UI’s Nevada case docket, summons for the defendants were issued on January 15th.

Stay tuned for updates as BehindMLM continues to track the case.

Update 18th January 2024 – A BehindMLM reader provided us with a copy of Denne’s California filed complaint. BehindMLM published an article covering the Complaint earlier today.

Update 8th February 2026 – A counterclaim filed the defendants was dismissed on January 26th. The original Complaint filed against the defendants continues to play out.

I presume this is a tagline field for a missing photo:

Best practice to wait maybe 10 mins after an article goes live before clicking. Crypto related articles in particular as they tend to put me to sleep.

Most editing errors I missed are caught during a few refreshes :D. That one I caught, cache should update eventually.

If Josh is involved. Toan Nugyen, John Barksdale, Mo Kumarsi, Rabu Gary is part of the scam too.

I`m can`t Understand how so many people let them get frauded by this so Called cryptocurrency experts, founders & alliances.

for 30years i been hunting down persons that have done fraud run & hide all over the world. they are easy to find. They are easy to document. And its easy to vet (document there past) them before you get scammed today. By some online investigation.

Today every thing people do leave a digital footprint. You cant hide your location by use VPN service. Your IP Adress is possibel to read with right tool. your voice on any digital service is to be traced it got digital footprint like your fingerprint and dna. your face & body movement id & can be traced by any camera in any place its camera in the world. and its not only Intelligence Agency do have the tools to do this.

So even if run stay away from digital payment services live of cash y can be found. And most of the times this peoples location are given to people like use. By family, friends ore former coworkers.

So my advise to day is do not involve yourself any finance with out vet them first and if you cant find proof of previous finance history. DO NOT ACCEPT THERE OFFERS.

Jeremy Roma used to work with the career criminal and convicted scammer John Barkdsdale from the scam Ormeus Coin and iQ.

Tousens of people lost the money in Norway.