Blockchain Capital Review: WBT & BCT token securities fraud

Blockchain Capital operates in the cryptocurrency MLM niche.

Blockchain Capital operates in the cryptocurrency MLM niche.

The company provides a corporate address in St. Vincent and the Grenadines on its website.

The address belongs to Wilfred International Services, who provide “International Business Formation” (shell companies) and a virtual office address service.

Needless to say Blockchain Capital exists in St. Vincent and the Gernadines in name only.

Blockchain Capital actually appears to be run from Russia.

Supporting this is Kazan, Russia provided as a posting location on Blockchain Capital’s official Twitter profile (lit: Казань, Россия).

Blockchain Capital has a VK profile. vKontakte is a Russian social media Facebook clone.

Marketing videos on Blockchain Capital’s official YouTube channel are primarily in… you guessed it, Russian:

Blockchain Capital’s website source-code is also riddled with Russian:

Heading up Blockchain Capital are co-founders Zinnat and Arthur Husnullin.

No information about either Husnullin is provided on Blockchain Capital’s website.

I went looking for independent information and came up blank. This could be a language barrier but neither Zinnat or Arthur Husnullin appear to exist outside of Blockchain Capital.

Both Husnullins feature in Blockchain Capital’s marketing videos.

Arthur seems to know what he’s talking about but Zinnat comes across as a Boris CEO.

Blockchain Capital’s website domain (“blockchaincapital.pro”), was privately registered in October 2017.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money.

Blockchain Capital’s Products

Blockchain Capital has no retailable products or services, with affiliates only able to market Blockchain Capital affiliate membership itself.

Blockchain Capital’s Compensation Plan

Blockchain Capital affiliates invest in WBT and BCT tokens on the expectation of a passive return.

Funds can be invested one-time or periodically over fifteen individual deposits.

Commissions are paid when Blockchain Capital affiliates recruit new affiliates who also invest.

Blockchain Capital Affiliate Ranks

There are eight affiliate ranks within Blockchain Capital’s compensation plan.

Along with their respective qualification criteria, they are as follows:

- Agent – sign up and invest in WBT and/or BCT tokens

- Silver Agent – convince others to invest $5000

- Manager – convince others to invest $35,000

- Group Manager – convince others to invest $150,000

- Region Manager – convince others to invest $500,000

- Director – convince others to invest $2,500,000

- Group Director – convince others to invest $5,000,000

- Region Director – convince others to invest $10,000,000

Direct Commissions

Blockchain Capital pays a 12.67% commission on funds invested in WBT and BCT tokens.

This is either paid upfront if a single-deposit investment is used, or tiered down with the fifteen deposit payment model.

Commissions paid if the fifteen deposit model is used are as follows:

- Agents receive 12% on the first deposit, 8% on the second deposit, 5% on the third deposit, 2% on the fourth deposit and 1% on the fifth deposit

- Silver Agents receive 16% on the first deposit, 10% on the second deposit, 6% on the third deposit, 3% on the fourth deposit and 2% on the fifth deposit

- Managers receive 20% on the first deposit, 12% on the second deposit, 8% on the third deposit, 4% on the fourth deposit and 2.5% on the fifth deposit

- Group Managers receive 25% on the first deposit, 15% on the second deposit, 10% on the third deposit, 5% on the fourth deposit and 3% on the fifth deposit

- Region Managers receive 30% on the first deposit, 18% on the second deposit, 12% on the third deposit, 6% on the fourth deposit and 3.5% on the fifth deposit

- Directors receive receive 35% on the first deposit, 21% on the second deposit, 14% on the third deposit, 7% on the fourth deposit and 4% on the fifth deposit

- Group Directors receive 40% on the first deposit, 24% on the second deposit, 16% on the third deposit, 8% on the fourth deposit and 4.5% on the fifth deposit

- Region Directors receive 50% on the first deposit, 30% on the second deposit, 20% on the third deposit, 10% on the fourth deposit and 5% on the fifth deposit

Note that no referral commissions are paid from the sixth deposit onward.

The MLM side of the compensation sees Blockchain Capital pay out the Region Director rate on all periodic commissions paid out.

This is paid out as the difference between the referring affiliate’s rank and that of their upline.

E.g. a Region Director will earn a 15% override on the first payment commission a Director generates (50% – 35% = 15%).

There doesn’t appear to be an override paid on the single payment 12.5% commission. If there is one, it’s not mentioned in Blockchain Capital’s compensation material.

Joining Blockchain Capital

Blockchain Capital affiliate membership costs are not disclosed.

Blockchain Capital fail to provide the current WBT or BCT token value on their website.

Examples in the company’s whitepaper cite investment payments of $100 made periodically.

Conclusion

Blockchain Capital markets itself as

a next generation banking & investment services platform.

Blockchain Capital in actuality is a simple Ponzi points scheme, buried in mountains of crypto waffle (aren’t they all).

WBT and BCT are ERC-20 shit tokens that took five minutes to set up at little to no cost.

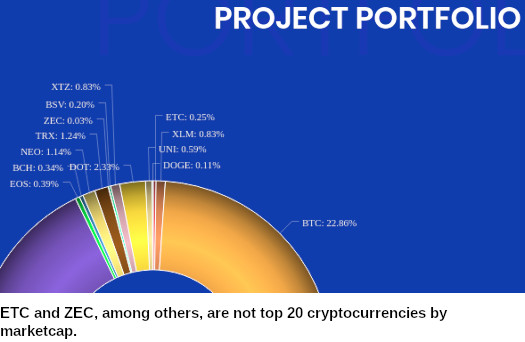

Blockchain Capital represents the value of WBT is pegged to the value of other cryptocurrencies.

Wealth Builder Token (WBT) is an index token that repeats the movement (volatility) of the TOP 20 (by capitalization) of altcoins in the cryptocurrency market. The WBT token reflects the cost of each cryptocurrency included in it and averages the total cost.

The value of the WBT token is expressed in dollars and changes on a daily basis.

A speculative token the value of which is determined by the value of other speculative tokens.

Why does this need to exist?

Because blockchain. Now hand over your money please.

Supposedly WBT’s internal value is set through a smart-contract algorithm, which makes no sense seeing as the “TOP 20” altcoins are subject to change at any time.

You can see this in action on Blockchain Capital’s website, where a “portfolio” of altcoins is provided:

A lot of the listed cryptocurrencies might have been top 20 when the chart was drawn up, but that’s no longer the case.

Yet this is the information Blockchain Capital are presenting to potential investors.

Not withstanding there is no evidence of WBT’s internal value being actually based on anything other than what Blockchain Capital sets it at.

Oh and a smart-contract is also used to issue commissions:

Blockchain Capital LTD maintains relationships with customers on the basis of a smart contract for the Ethereum blockchain.

All operations with assets become absolutely transparent: each user of the platform sees how funds are distributed.

Other than allowing Blockchain Capital to rattle off some more crypto bro buzzwords, this is meaningless with respect to due-diligence.

As to BCT, I don’t know why it exists. Ditto TSA, which is another token mentioned in Blockchain Capital’s marketing material.

**crypto bro speak suicide trigger warning**

The company was included in the list of successful ICO, because it was really able to sell the product on the collected funds and fulfilled all promises to investors.

After the ICO, the Blockchain Capital team launched a service for automated management of digital assets of its clients and developed appropriate technologies based on a smart contract.

At the same time, an index token WBT appeared, which includes a portfolio of the main crypto-currencies. In July 2018, the project team launched SCO (secondary coin offering) in order to expand into international markets and achieve high liquidity of TSA tokens.

On August 1, 2018, 20.8 million BT 2.0 tokens were issued to attract new non-borrowed funds.

Users who bought BCT tokens before August 31, 2018, received as a bonus the opportunity to double the number of their tokens.

The cost of TSA 2.0 tokens until August 31, 2018 was $ 2.1, then from September to October $ 5, currently, TSA 2.0 tokens are traded at a price of $ 7.5.

After the withdrawal of the BCT 2.0 token on the national stock exchanges, a sharp increase of 3-5 times is forecasted, and with timely withdrawal to the international stock exchange, the price can increase tenfold from the initial cost.

If you’re wondering about the “2.0”, it’s because WBT has already collapsed once.

In the period from October 2017 to February 2018, ICO was successfully implemented to launch the platform. During the ICO, the first BCT investment tokens (in the amount of 200,000) were issued, which gave the right to a share in the company’s profits.

On August 1, 2018, the release of 20.8 million BCT 2.0 tokens to attract new funds took place.

To prove any of what they’re saying with respect to external value, Blockchain Capital needs to provide regulators and investors with audited financial reports.

They don’t do this, which is a major red flag in and of itself.

Another red flag is new investment being the only verifiable source of revenue entering Blockchain Capital.

Regardless of how the internal value of WBT and BCT is set, withdrawals through the company’s internal exchange are funded via new investment.

This makes Blockchain Capital a Ponzi scheme.

Referral commissions are also tied to new investment, adding a pyramid layer to the scheme.

Indicative of not wanting to be pursued by the SEC, the most active securities regulator on the planet, here’s Blockchain Capital’s final red flag:

You are not allowed to purchase BCT / WBT tokens if you are a US citizen or a permanent US resident.

By purchasing BCT / WBT tokens, you acknowledge and warrant that you are not an authorized employee of a company that is owned by US citizens or US permanent residents.

Read that as “We’re running a Ponzi scheme and don’t want the regulatory heat scamming Americans brings with it”.

Russia for their part doesn’t care about MLM crypto Ponzi schemes, so long as Russians aren’t getting scammed. And even then the odds of Russian authorities doing anything is pretty low.

Know of any Russian regulatory efforts to curb MLM cryptocurrency fraud? Yeah, me neither.

As with all MLM Ponzi schemes once affiliate recruitment dries up so too will new investment.

This will leave Blockchain Capital unable to pay withdrawal requests through their internal exchange.

Short of launching WBT 3.0 and restarting their Ponzi once again (infinite forks because blockchain), ultimately the majority of Blockchain Capital investors will be left with a loss.

The name “Blockchain Capital” also belongs to an existing US firm, who haven’t taken kindly to imitators.

Late last year Blockchain Capital, a Californian company, went after Blockchain Capital Marketing, a Florida company, for trademark infringement.

Blockchain Capital Marketing responded by dissolving itself, thus ending the lawsuit.

Will Blockchain Capital go after a Russian Ponzi scheme bearing the same name? Probably not.

The US Blockchain Capital has been around since 2013. The Russian Ponzi scheme claims it was launched in late 2017.

Like MLM crypto fraud, its not like Russian authorities give a crap about trademark infringement either.

Update 18th September 2022 – Blockchain Capital has collapsed. The company has also deleted their official YouTube channel.

This review originally contained links to videos on Blockchain Capital’s YouTube channel. Due to the deletion I’ve now disabled the previously accessible links.

The only Russian regulatory effort I can think about right now is not connected to the crypto Ponzis.

There was this Russian Ponzi called Cashbury. Launched in 2011 as a legitimate microloan company (basically you take a small loan without visiting a bank after only providing your ID, it is due to be paid off in a few days), it was purchased by some other owners in 2016, and then it began operating as a Ponzi.

Though still positioning itself as a microloan company, in fact no loans were given out. Two years later, in October 2018, the Central Bank of Russia declared that Cashbury was a Ponzi scheme, with withdrawal problems starting a couple of months earlier.

Scammers responded by first disabling withdrawals and blaming authorities for their collapse.

In December, the Ponzi was gone. Website went offline, scammers returning with another Ponzi which never really took off.

^^ If you’re scamming Russians they might come after you. So long as you stick to international scamming nobody in Russia cares.

Blockchain Capital Member of the Enterprise Ethereum Alliance! If it was a ponzi, it couldn’t have been included as a member!

The owners are of Russian origin true but do not live there, the company moves to Switzerland or Luxembourg from the Grenadines.

Why not? Whatever Enterprise Ethereum Alliance is it isn’t a regulator.

Sounds like another stupid cryptoboi fuck club, i.e. it has no legal relevance.

Not withstanding legitimacy via association isn’t a thing.

Prove it. Scammers in Russia setting up shell companies in scam-friendly jurisdictions doesn’t mean Blockchain Capital moved anywhere.

Article updated to note Blockchain Capital’s collapse and YouTube channel deletion.

BUH MUH ENTERPRISE ETHERIUM ALLIANCE!