Is Achieve Community committing credit card fraud?

Following the termination processing services by Payoneer, Achieve affiliates waited nervously for the company to acquire new ewallet services to pay them with.

Following the termination processing services by Payoneer, Achieve affiliates waited nervously for the company to acquire new ewallet services to pay them with.

Purportedly Achieve has found a company willing to take on the risk of providing services to a matrix cycler Ponzi scheme, but who it is they’re not ready to say just yet.

In the meantime deposits have been opened up via a different processor, iPayDNA.

Money is now supposedly flowing into Achieve, but not everything is as it seems…

On their website, iPayDNA advertise themselves as focused on “high-risk” clientele:

iPayDNA’s main mission is to provide a one stop center for high risk and mainstream merchants to conduct their e-commerce by providing credit card and non-card payment processing services.

Evidently Achieve Community was unable to procure ewallet services of a “regular” payment processor.

Meta keywords used to describe the site include “high risk credit card processing services” and “high risk credit card processors”.

With great risk comes great fees though, with at least one Achieve Community affiliate reporting a 1.9% fee for depositing money with the company.

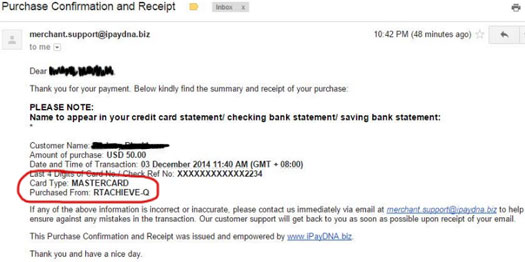

Initial reports from affiliates suggested that, hefty deposit fees aside, things were working as they should. As the screenshot below from an Achieve affiliate shows, payments to Achieve Community were being made out to “RTAchieve-Q”:

Achieve Community style their website “readytoachieve.com”, so the abbreviation “RTAchieve-Q” isn’t too much of a stretch.

Soon after however things began to deteriorate, with affiliates reporting charges appearing on their credit cards from a string of unfamiliar merchants.

OMG!! My bank account was hacked this morning at 1 pm by WEIWEISHOP365*COM for two payments of $509.

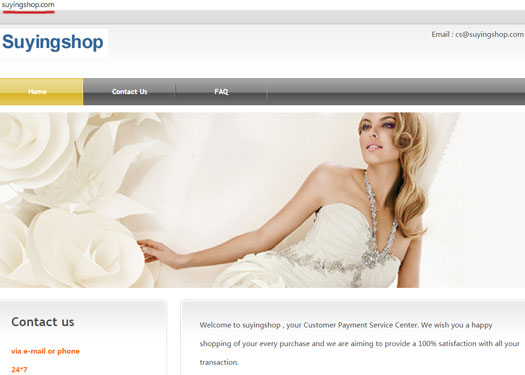

Other merchants appearing on Affiliate Community affiliate’s credit card statements include a “lawn care in Canada”, a “nursery in china” and something called “suyingshop”.

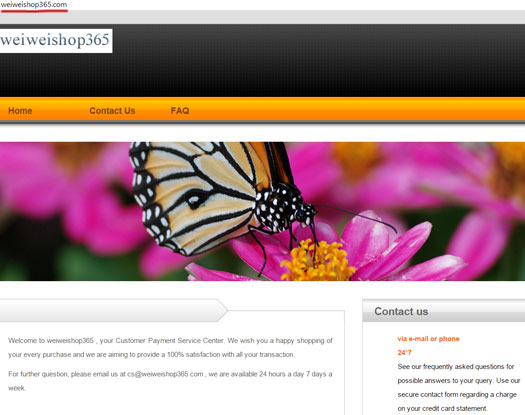

Visits to the website domains of weiweishop365 and suyingshop reveal similar looking websites:

Both domains registration details are set to private, both websites are hosted in Hong Kong (China) and both websites are powered by a “free business website template”:

Neither website offers anything of value, nor are they actual businesses. If I had to guess, these websites exist only to fulfill an online presence requirement in order to be perceived as a legitimate merchant.

On their website iPayDNA state they have ‘offices and representative offices in Hong Kong, Malaysia, Philippines, Mauritius, UK and Gibraltar.‘

When combined with the merchants above who are appearing on Achieve Community affiliate’s credit card statement, it’s highly probably that iPayDNA are using Chinese banking channels.

Why is any of this important?

Credit card laundering, sometimes referred to as “factoring,” works like this: A company that does not have a credit card merchant account with a bank or credit card company recruits another company (that does have a merchant account) to process credit card transactions through its account.

In the above scenario, Achieve Community is the company “that does not have a credit card merchant account”, and iPayDNA is the recruited company who does.

When the processing merchant receives payment for the credit card charges, it turns the money over to the company that doesn’t have an account, but it keeps a previously agreed-upon percentage or other fee.

So what’s the problem you ask?

The reasons why some companies need other companies to process their credit card transactions are most often not the “hard luck” stories that the company representatives might tell you.

In many cases, these companies need other merchants to process their credit card transactions because investigations and credit checks by banks and/or credit card companies revealed that these companies are bad risks and may end up having excessive charge-backs.

Banks and some credit card companies investigate and evaluate businesses before they give them merchant accounts.

One reason they do this is to avoid doing business with merchants they consider to be at potentially high risk for incurring losses, excessive charge-backs, or harm to the reputations of the credit card companies and their members.

Once an account is opened, regulations provide that a member bank may not accept deposits from any person or entity with which there is no merchant agreement.

Therefore, merchants can legally deposit only those drafts generated by their own businesses.

Shell merchants like weiweishop365 and suyingshop are obviously not legitimate operations, nor do they have anything to do with Achieve Community. Yet there they are appearing on Achieve Community affiliate’s credit card statements.

The banks in China are being told the money is coming in from weiweishop365 and suyingshop, and everybody is none the wiser.

Or as Achieve Community owner Kristi Johnson put it last Wednesday,

You will get an odd code as the payee instead of Achieve on your card statement – that is just how these clusters of overseas merchants work – and it gives Achieve our higher limits so that everyone can continue to sign up all day and night.

Please make note of it from your receipt so you know what the charge is when you get or look at your statement. Your bank may also charge you a small processing fee now as the accounts are overseas.

It was only a few months ago that a grand jury indicted the owners of eAdGear on a felony charge of conspiracy. eAdGear’s owners also ran a Ponzi scheme and, in an attempt to fly under the radar, limited transactions within the company to less than $10,000.

Here with Achieve Community the methodology is slightly different but the motive is the same. We have multiple shell merchants tied to Chinese banking channels being used to “give Achieve higher limits” with processors who specialize in “high risk” clients.

Exactly how long do you think this is going to go undetected by credit card and banking institutions (not to mention regulators) in the US?

And what’s going to happen when bogus companies start appearing on transfer statements of Ponzi withdrawals from Achieve Community flowing into the US?

At the time of publication, Alexa estimates that a quarter of all traffic to the Achieve Community website originates from the US. Australia, Ireland and the UK make up 37% which, when combined with US traffic, accounts for well over 50% of the total traffic to the Achieve Community domain.

Whether or not the shell merchants appearing on Achieve Community affiliate’s credit card statements were set up by Achieve, iPayDNA or an unnamed third-party is not clear.

Looking at iPayDNA’s Chinese connections though, it would seem the company is simply following through on their promise to deliver advertised processor services to what they deem are “high risk” clients.

As it stands now Achieve Community are claiming they’ll have a withdrawal processor hooked up sometime next week. Whether or not this will be through iPayDNA or another company is not known.

A recent update yesterday claims that Achieve Community has signed up 2500 new affiliate investors since last Tuesday. If each of these new investors purchased just one position in the cycler queue that would mean $125,000 in new position investment was made.

Not withstanding any additional new investment made by existing affiliate investors (in the same update Achieve Community claim they now have 12,500 affiliates).

On the backend, at a bare minimum these new signups have generated at least $1 million in additional ROI liability for the company. And that doesn’t include existing liabilities already generated by investors prior to Payoneer pulling the plug.

$1 million in payouts alone would require Achieve investors to purchase another 20,000 positions. The liabilities generated by those positions in turn would… well, you get the picture.

Whether financial regulations or the unsustainable nature of Ponzi schemes does them in, Achieve Community is on the fast track to either being shut down or collapsing.

Stay tuned for an update next week, when Achieve Community reveal who they are going to be making withdrawal payments through.

Not to mention the big fraud players who sign up using stolen or their own Credit Cards then hit the chargeback button! They cant pay out all these new positions so people start hitting chargeback.

I wonder what the excuses will be regarding payouts?

The credit card money laundering fraud committed by IpayDNA is ridicolous, the shell websites designed to trick the banks etc – even IpayDNA might pull the plug on achieve with all the extra heat for them.

This program by definition is a PONZI and a horrific one at that … My heart goes out to the innocent suckers who believe this is real.

This needs to be closed down ASAP before more people lose their money.

Has anyone got videos of Troy and Kristi? Without sounding ridiculous maybe they aren’t real people?

Its a ponzi – a clear cut Ponzi – Please people wake up!!

Join something legitimate instead!

IpayDNA might even keep all the money for themselves and not pass it on to “Troy and Kirsti” , they are in bed with REAL criminals now!

I hope this analysis is objective –

And the reason is?

Because he is a ponzi jumper. I googled he name and he promoted at least four dubious opportunities including this one.

I think we need a better term. I was considering “ponzi hopper” (as in bunny hops) as it implies there are multiple hops, where as “ponzi jumper” doesn’t have that context and sounds too much like “claim jumper”. 🙂

And “ponzi popper” doesn’t make sense. 😀

Why not call them what they are: Ponzi Pimps?

Kristi and Troy need to be put where they deserve (behind bars).

Don’t imply the “serial” nature of their actions, Lynndel… Maybe we’ll just combine the two: ponzi hopping pimp. 🙂

Actually there is a Ponzi hierarchy.

From bottom to top.

1) Sheapee – Regular people dreaming to get rich quickly.

2) Ponzi Jumpers – They learned rules of “business” but have no connections. They have to guess when to jump on a Ponzi and where to jump off.

3) Ponzi Pimps – Those are guys and gals that you can hear explaining stuff on conference calls. They definitely have connections and they are hired to “professionally” promote these scams and sound “exciting”. They are mostly paid in advance.

4) Ponzi owners. Their names often not real or somebody is just manipulating them like a Sockpuppet, but there is definitely an owner out there.

5) One-Man Crimewaves – “Marketers” with huge following that lead their followers from one Ponzi to another. They are definitely paid in advance in addition of percentage from the profits.

Not for anything but did you all see the guy in NZ boasting about making $87K? I don’t know how he can sleep at night knowing he took all that money from others.

Well said guys. it is buyer beware

@Kasey

Seasoned Ponzi pimp?

Ponzi veteran?

Serial scammer?

because thieves never think about it.

Isn’t Achieve Community about achieving stuff?

Maybe stealing $87,000 from gullible idiots was what he set out to achieve in the first place…

just not paying processors.

The achieve mailing address just changed from a 900 sq ft house troy supposedly just bought to a fake address a short distance away.

The vnetelly site that is very much like achieve had the mailing address and also changed to a fake. Someone is on the run!

Keep in mind that these shell merchants also process payments for porn, esp. the REALLY illegal stuff like rape porn and child porn, i.e. stuff that nobody with a legitimate merchant account would dare touch.

These are fly-by-night ops that expect to be discon’ed ASAP, so they charge HUGE markups for their services.

Expect Ach to announce “fees” and such for withdrawals, if they don’t pull a delay till NYD.

In Kristi’s latest update today she said that payments would resume the second week of SEPTEMBER!

I bet Kristi wishes it was still September. Either that or she has been drinking too much from the still.

I think what she meant is that they are paying out those who joined the second week of September.

Lulz….

Only in the delusional mind of an Achiever does 1pm occur in the morning.

Wow this review was very insightful. So many people just wanna make money fast without being patient smh.

Never again will I fall for a scheme like this again.

Well,the big confernce call was held last night. All the members were excited about learning who the new payment processor was going to be.

But Troy and Kristi had other great news for them. Instead of announcing the new payment processor, they announced that Achieve would have its own forum, and of course the members could access their back office to post their banners, or learn how to make banners, and of course sign up for the private forum.

Now the members are going to realize that there will be no payments for the Holidays. Will be interesting to see how “excited” they will be with this new news.

They clam the new forum will allow the members to ask anything and make any comments they want to make about the Achieve Community. Yeah, right!

The first time someone asks a serious question or complains, they will be banned for being a trouble-maker, negative person, troll, etc, etc..

This is going to be fun to watch dissolve before our eyes. Of course this has been dead since Payoneer cancelled them, the members just hadn’t figured it out. Maybe this latest non-event will wake them up.

Well I just contacted my credit company to get my money. And on top of that they are going to report and run a investigation on achive.

I know a few people who reported Kristi to the SEC.

Well, Kristi has informed the members today that the new payment processor will be announced next week, and that there would be a lot of payments next week.

She also said that people from Pakistan will now be able to join Achieve as she had worked out with the new payment processor to allow members from there.

And just think, still not registered to do business anywhere except as Work With Troy Barnes, LLC in Michigan.

Any bets there won’t be another problem and there won’t be any payments until after Christmas?

I doubt they can pay anything until they get all the new fees from the payment processor. I will be surprised if they pay anything before Christmas.

GO TO JAIL TROY BARNES

They at No Achieve are simply waiting for enough stupid sheep to put more money in so they can collect enough ponzi money to do a few select payouts OR run with more of your money so they can buy more new cars and houses and defraud more 86 year old ladies.

DO NOT FALL FOR THIS SCAM YPU WILL NEVER EARN A DIME HERE. CALL THE SEC AND STOP THESE IDENTITY STEALINT SCAMMERS NOW.

So I started getting referral traffic from “theachievecommunityinternational.net”.

Punched it in and it’s a redirect loop (actual link). The base domain is running BBPress so it’s a wordpress forum installation.

Figure that was the new forum they’d set up.

Wanted to see if there was a cache perhaps to punched in “site:theachievecommunityinternational.net” into Google and…

…

…are you serious? Cmon guys. Security fail much?

With the achieve I made not dime but over $26K …the best business ever 🙂

Biggest and funniest one line joke of the year

Fixed it for you, as we believe in truth in advertising on this forum.

Oz, there’s reports of a mysterious Russian malware that’s infecting WordPress sites. Beware.

Well, well, well. Kristi made her big update announcement today and surprise, surprise, surprise. Still no payment processor to announce. Wonder if the faithful now realize it is over?

But Kristi is promising that they will payout over $700,000. Only problem is will it be before spring?

I just wanted to personally thank you guys here on BMLM and another site that mentioned this crap going on.

I have been a marketer online for 5 years but never really got into cyclers etc. This was the first time.

I was duped by these stories on fB and screen shots. I had over 5k to invest and so i did, not knowing these things were illegal and prey on the innocent/ignorant.

I read comment from the cheerleaders over there asking why the “haters” where posting the same thing over and over and the reply was that they wanted to warn the public.

Well, you guys warned me, i took action and requested a refund from Achieve or I would do a chargeback. Guess what? They gave it to me to my surprise. (i guess they have enough to give it back with no worries.)

But this was BEFORE the new payment merchant from Malaysia was connected. On there new sign up, they talk about “no refunds or charge backs, etc etc” and say they will try to prosecute you if you try it and hunt you down via your IP address, etc.

When i read that, i really knew these guys were up to no good. As the weeks went on I read more and more posts from you guys and kept just learning more and more about how organized this stuff is and SMH that i made a foolish mistake.

If anyone else has made the mistake of putting your $$$ into TAC, ask Troy for a refund and/or call your bank and charge back your account. But i think the people that sign up with the new merchants won’t get a refund.. but i hope you can.

Thanks again guys and keep it up.

^^ CUUUUUUUUUUUUUUUUUUUUUUUUUUUUUUUUUULT!

I’ll be glad when Kristi and Troy end up in prison and charges are filed against the “netwinners” who participated in this illegal scheme. Some people have to learn the hard way that just because everyone else is doing it doesn’t make it legal.

The cult mentality really is sickening…

Hey guys, I am so glad they refunded my money, again learning alot or more than I wish to even know. I read the updates and can clearly see that the founders are not making much sense. She keeps saying 14,000 people paid members but only (at most) 200+ people comment in the main FB group under her updates?

Think about that.. so 13,800 people that have invested there money are silent? Now I know there are other FB groups that are international, but still the majority of the numbers are inside the MAIN group and English speaking.

Look at this guy (i hope this link is ok to post), imagine how much money he will lose. this can bring on a serious type of depression.. boy i hope more people wake up and get out before it’s to late.

(Ozedit: Link removed, private post on Facebook not available)

What’s more likely is 13,800 POSITIONS have been bought, but since people can buy multiple positions, and who knows how many positions the leaders (and top shills) have (and who knows how much did they REALLY pay) actual number of people who keep active is probably well less than 1000, and then only a few hundred are on FB.

@KChang, when i still had my money inside the matrix, that is what kept going through my head was, that it had to be around 1k- 2k paid members ONLY, because of the poll vote she took and there was AT THE MOST about 1-2k Votes and that was for the whole community??

Even foreigners where in there writing in their language to other members at times.

I thought about how they could easily purchase 1000’s of fake FB accounts and run up the numbers in the membership?? (outsource workers,etc.).

I know these are just my personal assumptions, but its probable based on how far off the percentage of comments there are in any given update or vote vs. the membership count (grows like 1-2k daily) but the comments have not grown since i joined..SMH

…..when the numbers don’t add up you would have to go down this road of thought.

How could 22k+ members be inside a CLOSED fb group and there only be 200+ post on the last update that AGAIN announced the same exact things she announced in NOV, about waiting on code and it will be up sometime soon.

The New forum: There was ONLY 20-200 post per 14 threads. (so similar to the FB group). Where are all these members? She doesn’t say paid positions, she said PAID MEMBERS!

Quote: “We have over 14,000 paid members, and that already keeps us going…unlike MLM’s where you constantly need new members…our program is self sustaining just as it is.”

This was one of the major things that convinced me she was lying and that you guys had to be correct. Numbers are numbers and they don’t add up at all.

If 14k positions have been paid out, that is 700k that needs to be paid? NO SIR, that is 700k x’s the 800% that each $50 position would yield.

Again her numbers are so far off and there is absolutely no way for her to pay each person that has INVESTED in TAC to get there investment (800%), let alone the original money they put in.

She says its self containing? wth?? they don’t need other members to make it work? wow.. TAC is going to go down like the titanic. Thank God (and u guys) i jumped in the dinghy…

I bought into this what a fool I was. Trying to get my money back, just tonight I had a fraudulent charge on my card last time I used it was back in October. Can’t do anything till morning. They authorities need to hurry up and do something.

This is one of those “you say po-tay-to, I say po-tah-to” situations.

To AC, there is no difference between paid member and paid position. Each position is treated separately for cycling. You thought she’d count actual people, but she didn’t have to. You assumed she did.

Not making excuses for her, but I’m pointing out the “doublespeak” often employed by scammers… fallacy of equivocation. You thought the word meant one thing, when they are actually using it in a very different context.

If corners, they’ll claim they didn’t lie, you merely “misunderstood” (never mind they intended you to do so).

Happy for you. Did they threaten you or plead with you about not telling anybody? About “a lot of good people will be hurt” if you do?

Payout processor in place:

On the same day Oz gives an update on Plastic Cash International’s post ponzi fallout Global Cash Card steps into the ring. Someone really aught to give them a heads up on their newest customer. 😉

Of note, Kristi is giving people time to make sure their back office info is correct and then they will start applying for the debit cards which will then be mailed to Achieve members. After that happens they can then begin making payouts.

Any guesses as to the time line on this deal?

Global Cash Card is a wage payment processor, not a general payment processor.

Wonder if they care about their services used for paying Ponzi payouts, not wages? 🙂

@Kchang, I see what your suggesting about the word play and I agree. Its all a magic trick of illusions (verbal). They are going to make money appear and then disappear if you catch my drift.

They simply closed my account. I believe that they gave me a refund because the chargeback would have hurt the credibility with “stripe/MC/V” accounts he has processing payment with “working with troy”.

I believe they had complaint or started to have complaints so rather than just keep accepting payments with MC/V via stripe they decided to revamp the system altogether and get a new merchant processor/payment processors.

That is where the malaysia account came from, because remember they just needed to payout when payoneer left. But they came back with a new way to pay in..

@notforme I would do a chargeback after you simply ask for it back and explain about the money stolen from your account. I would also close that account/card and open a new one before another amount is stolen.

@Glim

If I had to guess, not long after the money starts flowing.

Global Cash Card are based out of California in the US. Shouldn’t take long for their alarm bells to start going off once transaction volume is pushed through.

And if Global Cash Card have conducted due diligence and approved a Ponzi matrix cycler, best of luck to them. NxPay and PCI can advise them of what they’re in store for should the SEC come knocking…

Fresh Update:

My bolding.

At first I thought that Global Cash Card was just being used to transfer money from Achieve to affiliates (sorta like their payroll service) but now it seems you can transfer money from Global Cash Card to Achieve as well.

I’ve seen where a Mr. Marco Reyna is listed as Global Cash Card’s Fraud Risk Supervisor. Let’s hope he’s better at his job than whoever filled the same role at Plastic Cash.

It’s basically a debit card, and if that Asian processor takes debit card, it’ll take ANYBODY’s debit card, including GCC’s (unless GCC coded it to have security measures preventing it from being used at some merchants, and debit cards have a lot less safeguards than credit cards).

Which is why Kristi had to say “you have to reenter your card details”. They can populate the GCC database by pretending they’re an ’employer’ paying out wages, but they don’t know what card numbers GCC will issue and thus pre-populate that.

Well – another update – delay, check with lawyers, and oh look – Troy Barnes is back.

Well, if you’d like a Facebook group that’s been discussing this for a little while now (along with possible solutions), check out: facebook.com/NonOfficialAchieveCommunity

Even if you want to post one of those “Kristi loves us” postings on that FB page, go ahead. It is uncensored. Troy even posted there (although he was Not Amused).

And below is the link to the Colorado Attorney General’s securities fraud website.

You have a couple of choices. If you’ve lost $50, don’t worry about it. If you have lost more, see if your credit card company can still get the money back – there is some sort of time limit – a month or two, maybe – but it would really pay to check.

You might be able to recover at least some of your money. And, by reporting to the Attorney General of Kristi’s state (she lives in Denver), you’ll help get them rolling. If the money is still around somewhere, the attorney general would probably end up adjudicating how much each claimant gets back.

If the money is gone, then that’s the breaks. That’s why you want to recover your recent losses through your own bank or credit card company.

Colorado AG

stopfraudcolorado.gov/about-consumer-protection/complaint-forms/securities-fraud-report-form

One last thing. If you gave them your real Social Security number and date of birth, you need to get identity theft insurance pretty quickly.

Lots of people in this Forum are finding that people are stealing from their credit card accounts. This is probably because the credit card that Kristi switched to is in Shenzen, China.

So let’s think this through: your SS number, DOB and a live credit card in a Chinese credit card company. Could that end badly?

Even if you completely believe in Kristi, no one here disputes the thefts that are mounting up from the Chinese credit card place. And another warning – all those declined credit card attempts?

I have no evidence in this case, but some sketchy credit card companies have been known to do multiple declines in order to get even more credit card numbers. So you must keep an eye on your declined cards too.

Lot of bad news? Sure. Ponzi schemes always end up hurting many people.

One helpful hint I can close with is this: the Auto Club, at least in Southern California, offers free identity theft insurance. But you have to sign up for it.

If you’re a member, that will help somewhat. Otherwise make sure you get Lifelock or one of those.

I am investigator with the Colorado Division of Securities seeking anyone from CO who has put money in with The Achieve Community. Email me at michaelc.williams@state.co.us

Hi Michael, can you email me from the address you provided so I can confirm that’s actually you? Contact form button is at the top of every page.

I just want to verify someone else hasn’t posed as you.

Once I’ve verified I’ll reinstate the email address and probably do a separate writeup.

edit: actually scratch that, I’ve sent an email to the address provided. Awaiting your reply.

It is real. And if you’re doing a new writeup, there are some pretty well-equipped resource people over at that Facebook page mentioned above.

facebook.com/NonOfficialAchieveCommunity

One of the things that has come to amaze me – and cause great sadness – is the level of belief – of Faith – that lots of folks show. Achieve was to be The Way Out. Finally, a glimpse of freedom!

What the Achieve overseers are doing, are about to conclude doing, is crushing Hope itself. This is a special crime all its own.

Still waiting on confirmation from the investigator. That will probably come tomorrow.

The IP address the comment was left from does belong to the Colorado government though so that’s promising.

Not new at all. EVERY scam was always *the* way out of the rat race, blah blah blah. That’s why it’s so… sad and pathetic. They accuse you of not seeing, yet it is they that do not see.

Zeek had a secretary in a lawyer’s office claiming she knows what’s a security and SEC had to be mistaken… and another posted on Zeek’s window “please reorganize and save our dreams”

TVI Express had a conspiracy theorist who called anyone criticizing TVI Express pyramid scheme as “conspiracy of the rich to keep the poor poor”…

Nope, only makes me sadder and wiser on how the human mind can be twisted. Desperate people take desperate measures… and scammers know how to take advantage of desperate people, wolf in sheep’s clothing and all that.

Let’s hope our fine SEC investigator in beautiful Colorado gathers enough evidence to put away Troy, Kristi, Mike, and Rodney before another senior citizen loses her life savings on this scam.

Not only her money but her social security number, dob address, and her credit card are lingering in China with some identity theft scammers with ipaydna.

You’re right. This is the first really visceral contact I’ve had with them. A great many postings in their internal Forum site have a religious dimension. They literally talk of Faith in Kristi.

K Chang Nope, only makes me sadder and wiser on how the human mind can be twisted. Desperate people take desperate measures… and scammers know how to take advantage of desperate people