HyperFund withdrawals disabled, HyperTech’s new Boris CEO

November was an interesting month for the HyperTech and its HyperFund Ponzi scheme:

November was an interesting month for the HyperTech and its HyperFund Ponzi scheme:

- HyperTech owner Ryan Xu has disappeared;

- one of Ryan Xu’s and Sam Lee’s Australian shell companies collapsed;

- HyperFund withdrawals have been disabled;

- HyperTech has a new Boris CEO;

- Hyperverse was announced; and

- HyperFund’s website has been pulled offline.

Ruh-roh…

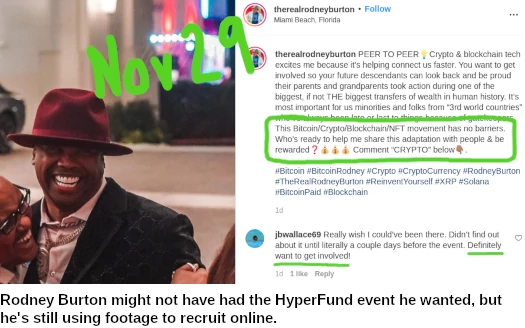

What was originally supposed to be a HyperFund promotional extravaganza in the US, instead went ahead as just another cryptobro snorefest.

To the best of my knowledge HyperTech owner Ryan Xu was a no-show at Rodney Burton’s “Reinvent Yourself With Crypto” event.

HyperTech is the umbrella shell company Xu runs his various crypto Ponzi schemes through.

If Xu (aka Zijing Xu) attended Burton’s event, it was kept extremely low-key. Ditto any mention of HyperTech and/or HyperFund.

Perhaps more concerning to HyperFund’s investors, is that Xu hasn’t been seen since he announced plans to attend Burton’s event.

That was now two months ago.

Xu, along with the rest of HyperTech/HyperFund management, are believed to be hiding out in Dubai.

To explain away Xu’s disappearance, HyperTech revealed a new Boris CEO:

“Steven Reece Lewis” introduces himself as HyperTech’s “new executive officer”.

Lewis’ Boris CEO cover story is that he “joined HyperTech Group in the beginning of 2021”.

Nobody in or outside of HyperTech and HyperFund has ever seen Lewis until now. Naturally Lewis doesn’t exist outside of this one HyperTech marketing video either.

There was a LinkedIn profile featuring what appeared to be a younger Lewis, however that was recently deleted.

There was a LinkedIn profile featuring what appeared to be a younger Lewis, however that was recently deleted.

Probably around the time Xu hired Lewis to play HyperTech CEO.

In his introduction video, Lewis suggests Xu disappeared due to crypto regulations in China:

It is unfortunate with the China crypto ban, Chinese leaders in our management team have to step down a little bit.

Seeing as Xu is hiding out in Dubai since at least Q1 2021, this of course makes no sense.

Xu disappearance and Lewis’ appointment as Boris CEO, HyperFund MOF withdrawals have been disabled.

I noted this in the comments of BehindMLM’s HyperFund review on November 22nd.

The timing of HyperFund disabling withdrawals was the week before the holiday shopping season commenced in the US.

This is obviously not a coincidence.

The official excuse though is that HyperTech is switching MOF from an ERC-20 shit token to a TRC-20 shit token.

Again, this ruse makes no sense.

Setting up an ERC-20 token takes 5 minutes. Setting up a TRX-20 token is as trivial an undertaking.

After spending five minutes to create a MOF TRX-20 token, all that’s left is switching out MOF ERC-20 from HyperFund’s database to MOF TRX-20.

This certainly wouldn’t take almost two weeks and counting.

In related news, November also saw Blockchain Global shell company collapse.

Blockchain Global was co-founded by Ryan Xu and Sam Lee (aka Xue Lee), as “BitCoin Group” in 2014.

Blockchain Global was a the precursor to Xu’s and Lee’s HyperTech crypto Ponzi empire.

Blockchain Global effectively became a shell company in 2017, following the failure of its “blockchain exchange platform” ACX.

To distract everyone from all of this, HyperFund’s top promoters began pitching “HyperFund 2.0” late last month.

HyperFund 2.0 is supposed to launch on December 6th and has something to do with “Hyperverse”.

As far as I can tell this is an attempt to cash in on Facebook recent rebranding, and founder Mark Zuckerberg’s “metaverse” vision.

Details are sketchy. There’s a few promo videos out there showcasing some VR game (again ripping off Facebook and their Oculus platform).

Rodney Burton is banging on about NFTs so it could be a tie-in.

There’s no shortage of Ponzi schemes integrating NFTs into shitty mobile games and pretending it’s technological innovation.

Stay tuned for whatever’s announced on December 6th I guess.

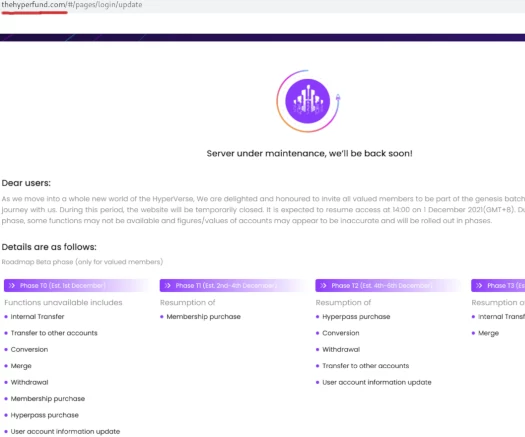

In the meantime, HyperFund’s website has been pulled offline for “maintenance”:

HyperFund claims withdrawals will be re-enabled between December 4th and 6th.

Alexa traffic estimates suggest HyperFund investor recruitment is currently taking place in the US (44%), Canada (10%) and Saudi Arabia (6%).

To date US authorities have taken no public action against HyperFund, its executives or promoters.

Update 11th August 2022 – The Steven Reece Lewis reveal video has been deleted from the official Hyperverse YouTube channel.

Lewis last appeared on a Hyperverse marketing video, uploaded to YouTube on April 20th, 2022.

The Hyperverse Twitter spam account in Lewis’ name was abandoned on June 25th.

Update 7th January 2023 – Hyperverse’s Steven Reece Lewis has been outed as UK national Steve Harrison.

Let’s not forget the failed FomoEX merger. Probably why a Boris CEO was needed.

First of all, I love this blog! keep up the great work! Can I just ask, what is a Boris CEO?!!

A Boris CEO is an actor playing an executive.

I coined the term because 99.9% of Boris CEOs are Russian and/or working for Russians (also Ukraine/Ukrainians).

I’m not part of HyperFund but if I send that review to HyperFund distributors, they would freak out. They would go like “It’s all a lie!!!”.

So are they brain washed so hard or did you made this all up? I have no idea.

I made it all up bro.

Steven Lewis is some guy I met down at the pub last night. Paid him $10 and shot the video in my kitchen.

Then I called up Ryan Xu and got him to take down HyperFund’s website for shits and giggles.

Me and Mark Zuckerberg have been working on integrating HyperFund into Meta’s Metaverse VR experience for months.

It’s going to be the next multi-trillion dollar company yo.

Now it makes sense LOL. No, seriously.

They would buy the shit that HyperFund is performing a lot of upgrades. Hence, some of the services might be currently interrupted.

They would. MLM Ponzi schemes don’t work unless someone eats up the bullshit.

Well, in fairness to Boris, the Chinese are not above a bit of extraordinary rendition. Whether they would bother over a guy targeting mostly Americans is another thing.

The big question is why Xu thought it was ever a good idea to do a Konstantin Ignatov and set foot in the US.

Quite possibly he had no intention of doing so; saying “Yes” to Bitcoin Rodney and then doing a no-show was better to keep the money rolling in than saying “No”.

Love these comedy posts they are so funny.

One day you might even do some real research but hey keep up the comedy show.

Glad you find Ponzis collapsing as entertaining as the rest of us!

Just go easy on the copium; too much and your popcorn is ruined.

Ponzi baby cry harder mwe mwe mwe.

First time I’m seeing this lulz. Stand in for “wah wah wah”?

Local thing, similar yes.

“Hyperverse”. Not a lucky name to change to. Imagine advertisers promoting the site like:

Hey do you want to join The High Perverse?

The High Perverse gives you a lot of benefits I’m sure you will love it, because we all love The High Perverse.

Btw, gj with the follow up. I’m having fun reading these articles.

Lawl, HyperFund’s Hyperverse website is up @ “thehyperverse.net”

It’s the biggest crypto fuckboi wankfest I’ve seen in a while:

Which is just a cringey way of saying Hyperverse is just another NFT Ponzi scam:

Y’all about nine months late jumping on the NFT scam bandwagon.

Not that it matters I guess, Hyperverse is just a “new shiny” to get people to invest more.

edit: Hyperverse’s official game “trailer” is a stolen 2019 CGI video from ISART Digital.

That is glorious.

Can also only read it now as Hy Perverse.

NFT’s are on their way out with regards to price. Although paying millions for an NFT never did make any sense.

NFT’s are definitely the new thing for scanners to try and entice people with. I only know what they are after my 18 year old gave me an explanation.

what was the original url for hyperfund? I went to waybackmachine and in August, the page said

MOF withdrawals are switching to TRC20, so cheaper withdrawals, that’s great news.

The original URL was “thehyperfund.com”. “hyperfund.com” belongs to an unrelated entity that changed its name after HyperFund launched.

Yeah, until you remember HyperFund is a Ponzi scheme in which only a small percentage of early investors are stealing everyone else’s money.

Except it’s not an investment it’s a rewards platform. I’ve done pretty well out of it and learnt a lot along the way. Change the record dude.

Calling an investment a “rewards platform” doesn’t not change the fact you dump money into HyperFund on the expectation of a passive return. That’s an investment.

Run HyperFund through the Howey Test, it’s an investment contract and therefore an unregistered security.

Securities regulators have already taken notice, why would you waste your time towing the pseudo-compliance line?

Hyperfund.com is an approved Venture Capital company, with, unlike Hyperfund, a registered address and contact details, so by registering thehyperfund.com they are riding on the back of this legitimate company.

This is called “passing off” in legal terms.

It is no wonder they re-directed their hyperfund.com site? Type in hyperfund.com and you get to nfund.com/

I was planning to join Hyperfund (now Hyperverse). I entered a zoom meeting very late tonight and just managed to hear they have a name change.

I had questions in my head and decided to do some research. So I stumbled upon your platform. Very informative. Ty

Hello I need help here. Some guy talked my sister to joining hyper verse which she did and know called me too enticing me.

With all what am reading am confused. Is it viable?

HyperFund/Hyperverse is a Ponzi scheme.

Ponzi schemes are not a viable business model. Early investors scam those who join after them out of money.

Thankyou.

Same name. Is very strange. decentology.com/

Hyperverse is a common enough term. Facebook pushed it along with their Meta rebranding announcement (Zuckerberg’s VR vision = metaverse), but hyperverse is/was being used by multiple entities even before that.

From movies to video games to business in general, *verse branding is a marketing trend.

To paraphrase WC Fields, “I would never want to belong to a club that would accept someone like “Bitcoin Rodney” as a member.”

Why don’t they just take the money and run now?

why all the extra work to build another website etc?

Because there’s plenty more suckers out there that they can still scam. I’m sure they fully intend to milk this for all they can.

If Xu is still in charge, he obviously feels there’s more to be stolen.

If he’s cashed out and sold HyperTech to someone else (hence the Boris CEO), they obviously feel there’s more to be stolen.

Ponzi scammers will continue to steal until collapse or regulators step in. The latter is unlikely in Dubai.

The hyperverse launch is today. Is it ok to post the link on here?

I covered the website launch when it first appeared a few days ago.

https://behindmlm.com/companies/hyperfund/

If you’ve got a copy of Hyperverse’s comp plan that’s something I could sink my teeth into.

2pm uk time.

(Ozedit: link expired, removed)

i was going to join this but after reading the comments im unsure now as the comments are confusing, so is it a scam or is it not a scam is the question?

All Ponzi schemes are scams.

Wait 30-60 days. With all the bad reviews they’re getting, they may well be out of business by that is it.

I’ve been involved with it for 7 months and the only bad things I’ve heard about it is from websites like this.

Not one person within the community has anything bad to say about it.

Once the Ponzi victim complaints start flooding in it’s too late. See Ryan Xu’s and Sam Lee’s Blockchain Global and ACX victims.

Because of this, you’ll often see me adopt a “hOw Do I gEt My MoNeY bAcK? = spambin” approach post collapse.

Go ahead and read other reviews for collapsed schemes.

While it’s running – this is amazing, nobody is complaining, i’m getting paid.

When it collapses – please help us recover, please stop these criminals.

It *always* ends the same way.

Do you actually bother researching or do you just click promoted reviews by paid participants and ignore the litany of confirmed red flags?

Thats called Dunning-kruger effect.

I’ve watched a bit of the launch event video. It’s some actor host and a series of pre-recorded videos shot who knows where and who knows when.

I’ll probably skim the rest of it.

Doing the lord’s work

Wasn’t much else to it. Lee spoke for thirty seconds. Then Xu blabbed on in Chinese. Cue cheerleaders and randoms.

No Coup de tat? No mysterious hackers from mars?

Boring.

Not wanting to nitpick, just for future reference, it’s coup d’état 😉

Pick away, hyperlazy to open special chars on the mobile at that moment haha.

Looking at the user ID value that Hyperfund/Hyperverse assign each user, it looks like 2.1m people have signed up on it so far.

Just throwing and assuming some numbers – if we say 40% went on to make deposits and averaged $2,000 then that’s just under $2b collected so far.

Just a guess – but certainly seems plausible.

They say their ultimate goal is 30 million members / customers so they can apply for HK stock exchange IPO.

I didn’t know HK had an exchange for Ponzi’s. Must be the same exchange that listed Evergrande then.

From what I can recall their 30 mil members/customers smeg is just their standard spin with their previous ventures, in reality it’s not how that process works.

“Please, sir, I have my 30 mil members, can I have my made up currency legitimised now? Exchange it for real stocks, sir?”

Ugh, everything Hyperbleh frustrates me.

Complete Scam – Another Ponzi Like Omega Pro.

Complete Scam – No Real Business Model – Money Rotational Program – Take From Paul Give To Marry – Take From Marry Give To Ian – And So On Until Recruitment Stops.

These Guys Do This Over And Over Again – Scam World – Clear Ponzi.

The Only People Who Join These Business Are Disparate And Broke Looking For A Dream Come To True – Don’t Believe What People Say To You – Believe What Is Actually True – No Easy Way To Create Wealth – Facts!

Thanks for sharing this I warn a few people I know to beware some will and some won’t…

I bought a $300 package in September 2020 and since November 2021 i’ve withdrawn about $1100 in total.

i couldn’t withdraw anything for a few weeks in Nov/Dec it was saying their server is currently under maintenance.

But now i can withdraw again with HDAO and not MOF to my Okex account.

I doubt if it’s a scam.The website is now up. No one seems to have ever been scammed.

Just perceptions and predictions of what people think may happen in the future.

I agree Charles the website is up and running members are able to withdrawal funds and I no of No one who can honestly say they was scam….

Scams aren’t recognized as scams until they collapse. Until then, everyone is happy to believe whatever the company says.

Keep in mind that a new website with fancy graphics can be thrown up in a few days at a cost of a few thousand dollars.

Every Ponzi scheme is a scam. No exceptions.

Except that that’s exactly what happens. Cut your BS.

It’s not a perception or prediction of the future. This is the reality right now.

Except that they are not.

Either you’re blind or dumb. Or maybe both.

You naysayers are sad! We are IN, you are OUT! We see what is happening! We withdraw! We see Ryan at work doing what The Martian does.

You do YOU. and live your best life and we will live ours while we continue to expand!

You can doubt it all you want but this is a Ponzi and has been nothing but a Ponzi. Just because some are getting paid does not mean it is not a Ponzi. They all pay for a period of time until they don’t.

If you think this is real you have your head buried in the sand. The facts clearly prove this is a Ponzi. It is not speculation or perception, it is reality.

Typical Ponzi defenders. Facts are facts.

Yes, you are in a Ponzi, and I am not. I’m not talking about all the visitors and commenters.

Except that you don’t. A blind person can see better than you do.

Except that you don’t. And even if YOU do, that doesn’t mean every affiliate can. Moreover, evidence proves that nobody can withdraw.

Not happening. At least not in a significant way.

People on the telegram group continue to report (multiple) failed withdrawal attempts. Plenty of pissed off people, but a lot of the chat content is censored, with admin deleting many posts and people getting kicked off.

There has been no official communication since the 10th (when the migration was estimated to be completed) on when the systems glitches will be fixed etc. Those with failed withdrawals are just told to keep trying, one poster said they had had 20 failures.

Many of the hyper worshipers lap up the bullshit about the 1000 IT developers working around the clock to fix the withdrawal issue. They really are as thick as fuck.

I will not engage with you people who are not personally members of the platform because if you were you would KNOW the credibility, the performance, the delivered promises.

You stay out and miss out as you did with Facebook now Meta. The blockchain ecosystem is growing fast and there is not getting around it as it has become with the computer.

An adult person should be free to make their own decisions and accept their own risks. The biggest legal Ponzi scam is the Social Security Administration.

A person convinced against their will is of the opinion skill so their in no point in trying to have a civil debate.

No one leaves! This is not a Ponzi scam (they are illegal and you go to jail) for that.

The compliance department is excellent! So keep your little 0.006% APR and we’ll keep our minimum 0.5% HU as DAILY rewards as per contract.

You WILL deal with cryptocurrency so you might as well be in a safe, compliant, regulated, credible environment where you earn DAILY, 100 % of the members do.

Go spew your nonsense elsewhere cultist, and take this word vomit with you.

Multiple companies of Xu have collapsed in the past due to financial misdeeds, this one will too.

If compliance is so good where’s the audited financials of Hyperfund – not unrelated companies selling radio components at a loss? Isn’t any? Strange that.

How about their financial services registration and securities registrations? Isn’t any? Strange.

Only ones getting rich from it are the ones ontop of the pyramid scam. So you’re either a pyramid scammer or a victim. Congrats.

No, it is based on the fact that hyperverse shares the same “business model” as other failed ponzis that we have seen come and go.

It is the same nonsense over and over.

You might be new to all of this. And if you are, then you are likely clueless about previous ponzis such as…

JSS tripler/Just Been Paid

Traffic Monsoon

Zeek Rewards

Bit-CON-nect

Onecoin

Beaurax

(And MANY more)

However, if you ARE aware of those scams and joined hyperfund anyway, then you haven’t learned your lesson.

…But even worse, if you promoted them, and are now promoting hyperverse, then you are a Proven, Pitiful, Pathetic, (hy)Perverse Ponzi Pimp.

Ponzi pimps operate out of the same ol’ ponzi playbook:

1) Promote scam with unsustainable returns.

2) Deny OBVIOUS red flags about ponzi…which are usually the same red flags previous ponzis had.

3) Crawl back under rock when ponzi collapses.

4) Rinse

5) Repeat

This is a perfect example of the ignorance of a true believer.

It starts off with “I will not engage with you people who are not members” and then engages with people who are not members.

Duh.

If cult members like this possessed a shred of intelligence they could carry on an intelligent debate. Unfortunately, that’s not the case.

You can always tell when this forum is having an impact on recruiting for the Ponzi de Jour being exposed here by the promoters of said Ponzi. They come out of the woodwork to try and discredit the forum article and the “haters.”

Not once do they provide any “FACTS” to support their claims, but instead they resort to the standard Ponzi-speak used by Charles and Loretta naming just two defending this Ponzi.

What is sad is they truly think their response was brilliant and really showed all of us being ignorant and the review being false. They won’t and can’t debate their position so they claim they won’t discuss anything with us non-believers.

When all you have is name-calling, denigrating the article without specific facts to prove it wrong, and won’t engage in a discussion with the “haters,” you have lost the argument.

Been hearing this same argument that Loretta has spouted for 18 years. They can’t even come up with something new and original to say.

Except that it is. Not the SSA, though. Or any government’s agency to that extent.

It’s funny how the most gullible affiliates try to defend their scam by “but we got paid, so it can’t be a scam”.

What’s more, all these efforts occure only before the inevitable collapse. Either it’s a last ditch effort to recruit new people to get paid at least something, or it’s done because the upline said so.

In that case affiliates are given freedom to express themselves as they wish, but they have to follow some sort of a script: it’s not a Ponzi, everybody got paid, we are absolutely legal without any problems, others must shut up and invest, banks and governments are Ponzi, they are to blame.

Thanks for holding the fort guys. I’m going through a furry friend nearing the end of their journey (16yo cat I’ve raised since a kitten).

It is difficult to focus on anything at the moment. I’ll try to keep up with the comments.

Give your pets a hug for me. It’s never enough time together.

Sorry to hear Oz. Thinking of you all.

It would be great if that was always the case. But the sad fact is that the overwhelming majority of these ponzi scammers get away with their crimes.

Dealing with cryptocurrency isn’t the issue.

Dealing with a ponzi like hyperverse is.

There have been several countries that issued warnings about hyperfund NOT being safe, compliant, regulated or credible. And the UK has already done so with hyperverse.

Unfortunately, you WILL have to learn the hard way.

And now withdraw has been literally stopped.

I’ve been arguing with my mom for MONTHS about Hyperfund. She’s finally coming around after MOFs value dropped and I told her about Blockchain Global collapsing.

I sent her some links from a few sub-reddits and websites including this one. I appreciate your work, you really helped drive the point across.

It is called ‘selective payments’. They are counting on members seeing a few successful withdrawals.

This illusion is the cause of the delusion that things are okay.

As your post proves, gullible people will then ignore the MANY complaints of members not being able to withdraw funds.

1. Not safe,see 2.

2. Not compliant:

they aren’t registered to provide securities

they aren’t registered to provide financial services

they aren’t registered to take deposits across borders

they don’t have publicly available financial audits for the actual hyperfund/hyperverse/hypershitsverse

3. See 2 for why they aren’t regulated

4. See 1-3 on why they aren’t credible,also multiple other liquidated/failed ventures

Did you even try Loretta?

I was on a WhatsApp group and they threw me out for questioning why withdrawals are still failing for people.

Horrible people.

They also have Kalpesh Patel involved with this, that guy has a serious history of scams, ponzis and fraud. He even served time in Prison for it.

Also the “compliance officer” is using a fake name lol this is crazy Hope Hill is a fake name, her real name is Ronae Jull. What legit company does that lol there are so many red flags it’s unbelievable

Luckily I only invested a few hundred, will try and see if I can withdraw it when it builds up.

I left the telegram group I was part of after I shared all youtube, Google and FCA links. I can’t be part of something knowing full well people will eventually lose their money.

Like any ponzi if you’re in it early yes you will get money, but that will dry up as soon as new members don’t join. It’s the only source of revenue.

The fact multiple fraud warnings from multiple countries keep appearing coupled with Googles 1st page result for Hyperfund shows tons websites detailing its a ponzi scheme is going to eventually stop new members joining.

Actually, it IS believable that there are a lot of red flags. In fact, they are the very same red flags a lot of ponzis had/have.

Same ol’ red flags.

Same ol’ excuses.

(Claiming they have over 1,000 IT pros trying to fix a glitch might be a new one though)

Same ol’ scam…again…and again…and again.

Unfortunately, people don’t do any due diligence before getting suckered into these ponzis. There will likely be people joining right up to the very last minute, just as these scammers finally exit scam.

I’m doing withdrawals on a constant basis… I’ve been doing withdrawals for investors all December … I really can’t understand all these comments…

HyperFund/Hyperverse withdrawal failures are documented fact.

Not sure why you’d bother lying but hey, you do you.

Publicly admitting to theft? Naughty naughty.

You and I both know if they wholesale stopped 100% of withdrawals they would be shut down in a day no questions asked.

The leaky taps like you keep the illusion running trying to prevent total collapse.

You are a sack of sad shit and should feel ashamed.

I’m able to draw on a downline bunch of accounts. Mine continue to fail.

This is the trend. To keep people happy to post in the watsapp /telegram groups.

Just to make sure somewhere is still good business… Then make people positive to sign up new members….

The ship sails perfectly, until it plunges into the iceberg.

While the withdrawals passed, it was not a ponsi.

It’s not trustworthy

If a platform is sucsessful, why should you change the plan….

Im scammed for sure. Im just trying to milk the cow for other members.

That’s my concern. Their stakes are big.

Ponzi pimps definitely belong in the Hall Of Shame.

Reading these comments are the funniest. I’ll just sit back and watch how it all plays out.

Do you see it as stealing everyone else’s money while this is not a regular currency where you can kick yourself to work just to earn too much money?

Crypto is done through digital mining and this Hyperverse is created by King of Crypto miners. Do you think they will run out of cryptos? It’s all digital. Leave a comment below.

All Ponzi schemes shuffle funds from later investors to earlier investors. So does the pyramid component of MLM Ponzi schemes.

What medium the currency is measured in is irrelevant.

There is no evidence Hyperverse has generated external revenue of any kind dating back to HyperCapital.

Feel free to provide audited financial reports proving otherwise. We both know they don’t exist.

Now Hyper one Token (HOT) launching next week. With same team Sam Lee and Kalpesh Patel.

More victims coming up ??!!

New token, new investment plan… I’ll have a look into this tomorrow.

Re-re-re-re-re-re-re-re-re-re-re-re-re-reboooooooooooooot

Hyperfund HAS to be legit. She’s a “pastor”, isn’t she?

Hyperverse is making fool of upgrading system.

I received this info today

Hyper verse

Withdrawal Stats for 3rd June 2022

566 withdraws for 3rd June 2022

173 transactions over 2 million MOF (640+ USDT)

105 transactions over 4 million MOF (1200+ USDT)

69 transactions over 6 million MOF (1800+ USDT)

Total MOF Distributed – 1,437,448,446 (approx $460,558.48)

1st largest – 22,357.32 USDT

2nd largest – 11,828.21 USDT

3rd largest – 10,065.19 USDT

4th largest – 7,641.68 USDT

5th largest – 7,496.01 USDT

1,440,000,000.66666667 MOF was deposited into the wallet address this morning that Hyperverse uses for MOF withdrawals. The wallet held approx a total MOF value of $528,441,94 this morning.

Source: tronscan.org

Wallet Address – TCBB95HSr6kjHsUgqH8yrFB8rygsbi6TnJ

Article updated noting Lewis’ reveal video has been deleted. The Hyperverse Twitter spam account in his name has also been abandoned.

Aww, but I liked him.

That feeling you get when you’re replaced by masked clowns. *sad scammer noises*