Andrew Eaton claims GSPartners settling with US regulators

Andrew Eaton has claimed GSPartners is on the verge of negotiating settlements with US regulators.

Andrew Eaton has claimed GSPartners is on the verge of negotiating settlements with US regulators.

Eaton, a top earner in the fraudulent investment scheme, leads a group of South African promoters under “GIHugeness” branding.

Speaking on an April 3rd “GIHugeness” GSPartners call, Eaton claimed;

Once everything is settled everything goes back to normal. But we need to settle.

In the settlement, what we have is a situation where eleven of the twelve states are happy to.

Florida are digging their heels in. Ironically Florida um… which the Florida regulators don’t know… we do have something. The thing that they’re accusing us of not having we do have but they don’t know that yet.

And once we settle guys … things pretty much go back to normal. I’m not going to obviously talk about here what that means but everyone who’s in the business knows what that means.

No supporting evidence for Eaton’s claims exist.

The only US state regulator GSPartners is known to have responded to is Arizona. A hearing on the matter is scheduled for September 16th, 2024 (ref: “Case Schedule”).

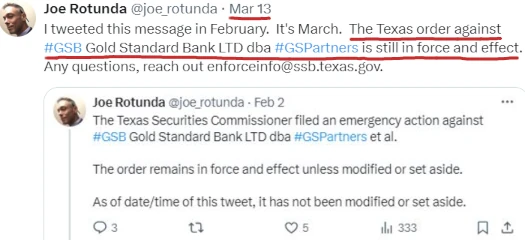

Last month Joe Rotunda, Enforcement Director at the Texas State Securities Board (TSSB), confirmed the TSSB’s emergency cease and desist against GSPartners remained in place.

Following a detailed undercover investigation, Florida’s Office of Financial Regulation, citing “unlawful activities”, issued a cease and desist against GSPartners, parent company GSB Gold Standard Corporation and owner Josip Heit (right) last November.

Following a detailed undercover investigation, Florida’s Office of Financial Regulation, citing “unlawful activities”, issued a cease and desist against GSPartners, parent company GSB Gold Standard Corporation and owner Josip Heit (right) last November.

OFR detailed “unauthorized use of the term “bank” and securities fraud.

Typically a securities fraud settlement results in a permanent injunction being issued prohibiting further acts of securities fraud, disgorgement of ill-gotten gains and a monetary penalty.

Even if settlements were on the table (there is no evidence of any settlement negotiations between GSPartners and US regulators), how GSPartners could go “back to normal” as Eaton claimed is unclear.

There is also an ongoing federal US regulatory investigation into GSPartners simmering in the background.

Getting back to the GIHugeness call, Eaton went on to claim one regulator was giving GSPartners a hard time.

We really just need to play a game of chess with the regulators.

There is one regulator in particular outside of Florida, I’m not going to mention names or mention anything on this call either, but there is one regulator that is a bit of an asshole.

A single person who keeps coming back. Once we think we’re [indecipherable] he keeps coming back with another question etcetera.

But they’re literally a thousand percent certain of settlements. Once we’ve settled it pretty much goes back to normal.

Eaton claims he spoke to Josip Heit “over the weekend”. Eaton reports Heit “was in a very, very, really bad mood because of lack of sales.”

In a February filing as part of Arizona proceedings, Heit acknowledged that, as a result of US regulatory action, GSPartners’ “entire business has been effectively shuttered”.

Despite that, Eaton urged GIHugeness members to participate in a “two week burst” of recruitment of new victims.

The aim of the recruitment drive is to provide existing GSPartners victims with “cashflow”, with the campaign primarily directed at South Africa and Asia.

South Africa’s FSCA issued a GSPartners securities fraud warning last November. GSPartners and South African promoters like Eaton appear to be ignoring the warning.

Whether Eaton’s targeting of South Africa and Asia results in new victims being recruited into the collapsed scheme remains to be seen.

GSPartners’ December 2023 GSPro reboot was a flop, with website traffic going into decline from January 2024.

Billionico, a suspected planned backdoor for US and Canadian GSPartners investors, is scheduled to launch on April 19th.

Eaton states Heit will hold a GSPartners corporate call later today (April 4th). This follows a March 2024 corporate call that was cancelled hours prior for unknown reasons.

Social media posts suggest Heit travelled from Dubai to the Maldives for Easter weekend. Neither Dubai or The Maldives has an extradition treaty with the US.

Yeah, looks like they are still going strong in South Africa despite the FSCA’s warning.

If only South African authorities were competent enough to go after these ponzi promoters.

And I honestly thought they would’ve jumped to the next scam already. I guess they love rubbing shoulders with JH.

GSP bringing out the big guns in SA ;p Weirdly no mention of the company’s name in this video though… it’s as if they don’t want him to mention it, not sure why?

youtu.be/pxnzslhb3j8?si=YEIK479xaQTnJWnA

I assume they are only selling their new mining game?

This is a classic move from Eaton and we’ve seen it in every one of his previously collapsed ponzis. When it flops, he has an angry call with his followers/downline with some unsubstantial claims about regulators.

His followers should be asking some very simple questions such as:

Why do we need to play chess with the regulators if we are a “legitimate” “investment opportunity”?

Why is Josip angry about sales if this isn’t a pyramid scheme?

But instead they blindly listen to him whilst JH pisses away their money on business class flights to Maldives with his new GF and Alex Bodi. Sad.

Josip Heit looks in a “really terrible mood” here – instagram.com/p/C5Nt7VSLvGt/?img_index=1

I love that JH is only holidaying to countries without extradition treaties with the US. He must be internally crapping himself.

I wonder how long he thinks that he can play this game before he gets a call to meet his mafia bosses in Europe again?

This is exactly what the upline I am familiar with as said over and over.

That states have backed off their positions and GSP is close to re-opening normal operations. This again continues to get pushed back farther and farther.

As it was suppose to happen in February, then again middle of march, and here it is april and still have no heard anything.

They’ve also stated again like the article, that GSP is trying to figure out ways around the laws in the US. Assuming that is getting rid of certificates and moving towards Gold, Real Estate, and Crypto.

Regardless, this article, and that “call” is exactly what the upline I am dealing with is saying as well, with more details.

For anyone thinking that Andrew Eaton didn’t say what BehindMLM reported in this article, Spaadi got hold of an audio recording of his part of the call (no video though):

drive.google.com/file/d/1SWRcAQL2DysLvGWopbmpyVt0J61ojZ3R

I feel so sad for the poor victims that keeps attending the scam events and weekly Zoom calls.

They actually believe these corrupt, deceiptful upline that fully know their downline are going to lose everything. These scammers and fraudsters belong in jail.

I spend time in ZA and have seen Andrew Eaton’s impact first hand.

The “man” (if you can call him that) is a parasite who is thriving off the country’s troubles by preying on desperation. He is in desperate need of being taken into custody as the amount of harm he does is horrendous.

Obviously he didn’t make himself enough money in Mirror Trading International or cannot physically stop being a fraudster.

I had a listen of that recording, thanks for posting that Inga. Josip’s love language is “Trust and Loyalty.” Hahaha.

Somebody needs to send that voice clip to the FSCA a they are continuing to solicit investments.

The whole of Salt Rock talks about Andrew Eaton and Russell Jacob being serial ponzi scammers. I feel sorry for their families. The two of them are a joke in the town.

The Karatbars “gold” pyramid turned crypto Ponzi goes pretty far back.

That doggone Texas Joe is at it again, contradicting Andrew Eaton! Who does he think he is? Doesn’t he listen to his GSP upline?

x.com/joe_rotunda/status/1779219844077961247

Looks like it’s a done deal in Texas for all the nay-sayers. Maybe Josip should sue Joe Rotunda for “defamation”?

B-b-b-but Andrew Eaton said everyone was going to settle a few weeks ago.

WUTS GOING ON GUYZ?

Why does Eaton say that he’s “not part of” Billionico in the leaked call?

His downline is promoting the upcoming launch.

Guess time will tell.

One of the South African promoters is talking about going into gold. Looks like they want to revert back to Karatbars success with the fake gold.

Took a few months instead of weeks, but hey there is a “refund settlement” now for some US states and Canadian provinces.

Too bad that Bruce Hughes, that old buddy of Andrew Eaton, is specifically excluded from the settlement. See footnote 1 of the Texas SSB full press release PDF on 9 September 2024: