Court orders Bank of Namibia to fund CBI Global Ponzi

A court has ordered the Bank of Namibia to fund CBI Global.

A court has ordered the Bank of Namibia to fund CBI Global.

The Bank of Namibia is Namibia’s top financial regulator. CBI Global is a Ponzi scheme.

Oh dear.

As part of their efforts to shut down CBI Global, run by serial Ponzi scammer Coenie Botha (below), the BoN froze Botha’s assets in March.

This included CBI Global, which is incorporated as CBI Exchange in Namibia. Assets in question primarily pertained to stolen CBI Global investor funds, held in Bank Windhoek accounts.

Botha attempted to thwart regulation of his Ponzi scheme by suing BoN, essentially arguing he had a right to scam people.

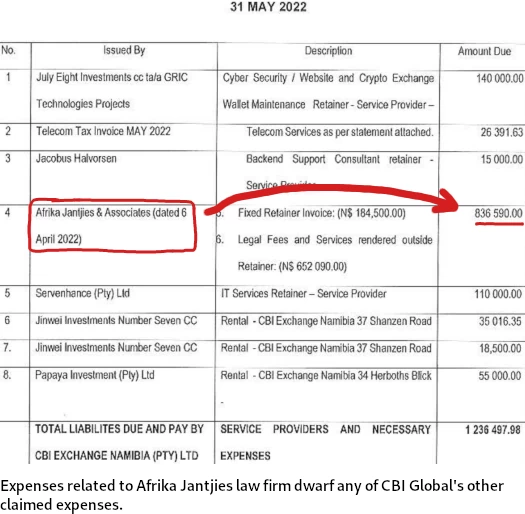

As part of those proceedings, Botha secured the right to claim operational expenses from frozen funds.

Botha submitted claims topping $62,150, most of which would be laundered through Afrika Jantjies’ law firm.

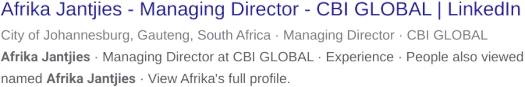

Afrika Jantjies (right), was introduced to CBI Global investors in a March 21st webinar. He represented himself to be CBI Global’s attorney and Compliance Officer;

Afrika Jantjies (right), was introduced to CBI Global investors in a March 21st webinar. He represented himself to be CBI Global’s attorney and Compliance Officer;

We are the attorneys for CBI. Plus I act as the compliance officer for CBI Exchange Namibia.

If there is anything that is done unlawful or is not in line with the law, then it is my duty to advise my client to desist and stop and comply.

Rather than do just that upon learning CBI Global was a Ponzi scheme, Jantjies’s role changed to accomplice with remarkable quickness.

Unsurprisingly, Botha’s inflated expenses prompted push back from BoN;

The legal costs are not considered necessary day-to-day expenses but also simply appear unreasonable.

If considered together with the retainer, it would mean that the entire month is dedicated only to (CBI Global’s) legal work.

If one assumes a combined hourly fee of N$5000 for Mr Jantjies and instructed counsel for April 2022, it would mean that they both spent about 6 hours a day from Monday to Friday for the entire month of April 2022 on (CBI Global’s) legal work (including the holidays).

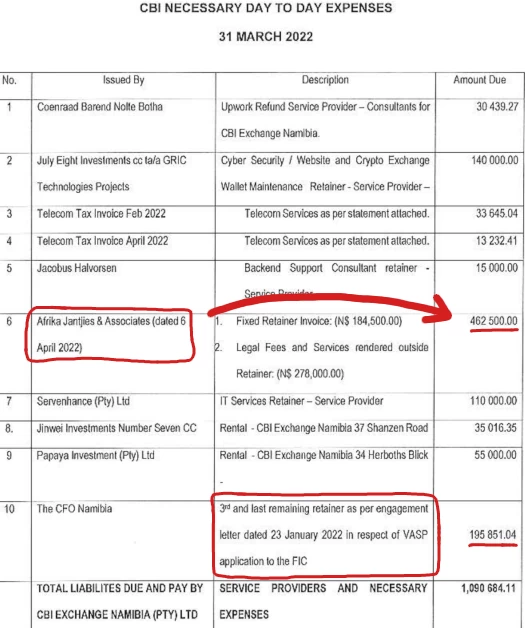

It is also rather concerning that amongst the expenses there is what is referred to as the “3rd and last remaining retainer … in respect of VASP application to FIC”. This is an application fo the Financial Intelligence Centre.

I enquired from the FIC what the cost is for such a registration.

I am informed by Mr. Kristian Hamutenya, who is the Deputy Director of Compliance at the FIC and who deals with these applications that no registration fee is payable.

He indicated that the process is so simple that small estate agencies, churches, second hand goods retailers and other NPO’s have been able to register without the assistance of a consultant.

There was therefore no need for the application to appoint a consultant and certainly not at a cost of N$559,574.40.

That cost cannot be considered a necessary day-to-day business expense.

CBI Global pushed the matter through the courts, which brings us to the 7th July decision by the High Court of Namibia.

Despite the obvious attempt to launder stolen investor funds and circumvent attempts to regulate CBI Global, the court opted to turn a blind eye.

The (Bank of Namibia and Bank Windhoek Limited) must … release payments/funds from (CBI Global’s) bank account which is necessary for the day-to-day running of (CBI Global’s) business.

The (Bank of Namibia and Bank Windhoek Limited) must … pay (CBI Global’s) cost.

The matter is finalized and removed from the roll.

Evidence submitted by the Bank of Namibia pertaining to inflated and unnecessary claimed expenses were ignored.

The court noted it

cannot issue an interdict restraining (the Bank of Namibia and Bank Windhoek Limited) from imposing reasonable conditions for the payments to be released, conditions in this case meaning that (CBI Global) must substantiate the expenses with the required documents.

The court effectively forbade the Bank of Namibia, again Namibia top financial regulator, from questioning claimed expenses from CBI Global.

If that sounds utterly absurd, it’s because it is.

I think the major problem with this case is the court not recognizing the basis of the asset freeze.

(CBI Global) submits that it suffers massively both operationally and financially.

To ameliorate the devastating effect of a total freeze of the applicant’s account, this court granted an order for the payment of necessary day-to-day business expenses whilst the investigation by (Bank of Namibia) continues.

(CBI Global) states that it needs its day-to-day expenses in order to continue to operate and exist pending the resolution of the dispute between the parties.

(CBI Global) further submits that if (CBI Global) is refused a hearing on urgent basis it will be deprived of its rright to have its necessary day-to-day expenses released and will in the process not survive financially.

(CBI Global) continues to suffer irreparable financial and operational harm as a result of the unlawful interference of (the Bank of Namibia and Bank Windhoek Limited).

The court is treating CBI Global as a legitimate business. It’s not, it’s a blatant Ponzi scheme that’s now collapsed four times.

I get that the BoN’s regulatory case against CBI Global still has to play out, but in the meantime allowing a Ponzi scheme to further launder stolen investor funds, through the assistance of an attorney no less, is reprehensible.

Not surprisingly, the Bank of Namibia has appealed the High Court’s decision. An appeal was filed with the Supreme Court of Namibia on July 7th, the same day the High Court’s decision was filed.

Unfortunately the Namibian High Court’s decision is just the latest example of regulators in Africa being unable to combat MLM related securities fraud.

In South Africa we have the Mirror Trading International mess. Suspected owners of the $1.7 billion dollar Ponzi scheme, Clynton and Cheri Marks (right), have been and continue to be ignored by South African authorities.

In South Africa we have the Mirror Trading International mess. Suspected owners of the $1.7 billion dollar Ponzi scheme, Clynton and Cheri Marks (right), have been and continue to be ignored by South African authorities.

The Marks crime family remains at large in South Africa. They’ve remained free to launder stolen MTI investor funds for almost two years.

Then there’s Cameroon and Emile Simb’s Liyeplimal Ponzi scheme.

After ignoring Liyeplimal for two years, despite multiple securities fraud warnings across Africa, Cameroonian authorities finally moved to arrest Simb in late May.

A court saw fit to release Simb, prompting him to immediately flee the country. Simb is suspected of fleeing with the assistance of Cameroonian government officials, on a diplomatic passport issued by neighbouring Central African Republic.

Simb remains at large.

Between Namibia, South Africa and Cameroon, depressingly enlightening insight reveals just how much of an uphill battle authorities face combatting MLM related securities fraud.

Even if authorities do take action (a unicorn event in and of itself), as we’ve seen in Cameroon and now Namibia, African courts then actively work against authorities to vindicate and eventually free scammers.

Such to the extent running Ponzi schemes carries any criminal liability in Namibia, Namibian authorities continue to turn a blind eye to Coenie Botha’s fraud.

Pending a decision on the Bank of Namibia’s Supreme Court appeal, stay tuned…

Update 1st July 2023 – BoN prevailed in its appeal against the High Court funding order.

Botha has also filed a new lawsuit against BoN in April 2023, again seeking the release of frozen CBI Global Ponzi funds.

The mind boggles. Are these courts that stupid, or are they compromised?

It’s hard to believe they are so dense as to not recognize such an obvious Ponzi enterprise, but depressing to accept they love money over justice.

I am absolutely shocked that Namibian Courts so easily turn a blind eye. I myself have had the court turn its face away from imposing justice!

Namibia claim to be lawful, but its walk is one of unlawfulness.

What about the BoN own law manigests that vlearly states that no crypto and mining is allowed, specifically to protect against terrorism and laundering and scams?? What about the tax invasion!?

None of these apparent businessess or investors comply with the tax regulations! How can the court permit him to continue business… if there is zero tax compliance??

Is Namibia becoming a haven for cooks while the poor and lawfull must sustain the government?? This is a shame!

Update to this:

Bank of Namibia succeeded in their appeal against this order:

namiblii.org/akn/na/judgment/nasc/2022/46/eng@2022-12-23

They have since gone the High Court route:

bnn.network/breaking-news/crypto-firm-seeks-high-court-intervention-to-release-frozen-funds/

“Oh hai there. We’re being sued by a Ponzi scammer.

Do we team up with the police and railroad them? Nah. Let’s go on the defensive and fight them in court.”

-the guy running BoN, probably

Boggles the mind they don’t go after Botha with more than a freeze-order. Thanks for the update.