MTI to restrict withdrawals with KYC in November

Following on from the FSCA conducting raids on Mirror Trading International’s offices and residences of its executives, CEO Johann Steynberg has fronted affiliates desperate for answers.

Following on from the FSCA conducting raids on Mirror Trading International’s offices and residences of its executives, CEO Johann Steynberg has fronted affiliates desperate for answers.

Unfortunately all they got was bad news. Starting next month, MTI is planning to restrict withdrawals by implementing KYC.

The webinar in question was hosted by serial scammer and MTI promoter Luciano Inzunza.

Earlier this year and alongside MTI, Inzunza was also promoting the Crowd1 Ponzi scheme. I was able to

KYC, one of the many three-letter acronyms feared by scammers. KYC stands for “Know Your Customer” and is a legal framework within the financial industry.

In the MLM underbelly, KYC only surfaces when a company wants to reduce withdrawals.

Well, at least that’s the factual reason. Here’s the baloney Johann Steynberg served up on yesterday’s MTI webinar;

[13:28] The KYC is something that I’m personally excited about. I think it’s important to remind everyone in MTI the sole purpose of the KYC implementation is to make sure that we eliminate the duplicate accounts in the system.

That is causing some issues. People taking advantage of our referral bonus in the system with having multiple accounts.

Last month a data leak revealed a number of MTI’s executives and top earners had multiple accounts. Like everyone else doing it, this is done to stack accounts and maximize the compensation plan.

Considering account stacking within MTI is rife from the top down, Steynberg citing as a reason to implement KYC is hilarious.

About as close as Steynberg gets to telling the truth is the second reason Steynberg gives for implementation; to prevent “members withdrawing early”.

So close. As previously stated, the only reason MLM scams start going on about KYC is to prevent members withdrawing at all.

As per the September data leak, at the time MTI was operating at a ~$80 million dollar deficit.

Beyond some time in November a specific implementation date hasn’t been provided yet.

When MTI does implement its new policy though, expect the usual delays and excuses (here’s an example from an article coincidentally published earlier today)

Of course miraculously none of the KYC delays and problems will affect MTI executives and top promoters from quietly continuing to withdraw.

One loophole touted was permission to use business names for multiple accounts owned by the same MTI affiliate. Cue registration of shell companies and business as usual.

Of course before any of this is implemented MTI executives and top promoters will already have their companies set up and read to go, if they haven’t already.

For rank and file MTI affiliates, it’s worth considering whether they even want to hand over personal details. According to Steynberg, MTI will expect affiliates to hand over either a birth certificate or passport details.

And yes, whatever information is provided to MTI will be seized by the FSCA or relevant authorities when the time comes. It could also be obtained through other channels (e.g. subpoena), should it come to that.

MTI’s top non-executive net-winners of course already know this. Either exceptions will be made or they’ll just quietly move onto other scams.

Naturally rank and file MTI affiliates who don’t provide KYC will be, as intended, not permitted to withdraw.

In response to a question from Luciano Inzunza about the status of the Texas securities fraud cease and desist, Steynberg dodged the question.

[21:08] *nervous laughter* We are excited about all members across the world. Um, and uh, especially a big thank you to our international leaders for the diverse leadership and skillset that they do bring to MTI.

I think it’s very important to note that, y’know, although MTI is a South African company at heart, we sincerely appreciate our international members.

And we are very proud to say we help anybody to grow their bitcoin, regardless of where they are in the world.

A total non-answer if ever I saw one.

Reading between the lines, it seems clear Mirror Trading International failed to provide the TSSB with evidence of external revenue being used to pay withdrawal requests.

Texas’ securities fraud cease and desist was issued against MTI 114 days ago. The deadline for a response was 31 days from July 7th.

Confirmation that Mirror Trading International is permanently banned in Texas is expected any day now.

Considering securities law in Texas is near identical to federal securities law, short of an SEC lawsuit, a ban in Texas is as good as a ban across the US.

At the time of publication Alexa ranks the US as the third largest source of traffic to MTI’s website.

Steynberg deferred enquiries about FSCA raids this week to MTI’s attorneys, who were not present on the webinar.

After dodging questions about regulatory action against MTI, Steynberg scurried off the call. Cheri Ward then proceeded to ramble on about how “MTI cannot be shut down”.

The FSCA meanwhile has doubled down on financial crime being well within its jurisdiction.

MTI previously indicated that they were trading in foreign exchange and that they now trade in crypto assets. We wish to point out that both these trading operations were and are implemented by means of derivative financial instruments.

The FSCA has jurisdiction over all derivative instruments regardless of what asset or commodity forms the basis for the trades. We thus reject the statement that we do not have jurisdiction to investigate the matter.

Our earlier warning remains in place where we advised the public to exercise extreme care when ‘investing’ with any person or organisation not properly registered as Financial Service Providers.

The FSCA are a civil regulatory agency (SEC equivalent), however they are able to share information with their police and other authorities.

Speaking on behalf of corporate, Cherry Marks maintains South African financial laws don’t apply to herself or MTI. She has also threatened to sue the FSCA and seek damages.

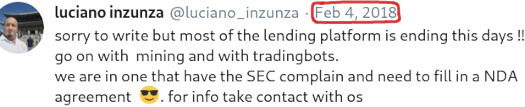

Footnote: The MTI webinar referenced in this article was hosted by serial scammer and MTI promoter Luciano Inzunza.

Earlier this year and alongside MTI, Inzunza was also promoting the Crowd1 Ponzi scheme.

Inzunza’s Twitter account backdates his promotion of scams to at least February 2018:

“Lending platforms” were a niche of MLM crypto Ponzi schemes that were rampant at the time.

Luciano Inzunza is a hangaround of Andreas Kartrud. I believe he was in Kartrud’s gang promoting SwissCoin in 2016.

My recommendation to everybody is to take their money out because this will not end up good. Everybody involved even the promoters are serial scammers.

The KYC is coming so they can minimize withdrawals and have people stuck, I agree with you on that.

The FSCA will keep pushing these people until they actually flee. For them to enter the household and take electronics, they definitely have something on them and they won’t stop until they prove that they are a fraud, and the lady Cheri Mark and her boyfriend are pure scammers.

I agree with you on your last article about them, They have Johann as a donkey and are hiding behind him running the real show. Things will turn ugly.

I was quite surprised that they still honored my withdrawal request and it was processed in about 24 hours.

Good luck to anyone who still wishes to ride this thing.

It seems actually that most of Kartrud’s old SwissCoin gang in Malmö are promoting MTI besides Inzunza:

Blerim Shabani

Stefan Hoeing

Richard Brorman

They’ll keep processing withdrawals and ride this till the last second.

They have no other choice but to bet against the hurricane of shit coming at them now

I have been with MTI since February 2020. I checked the company out and found it to be 100% legitimate.

They are registered with the CIPC, meaning all investors are protected at least according to two South African laws, i.e. The Companies Act and the Consumer Protection Act.

The FSCA has jurisdiction over entities handling financial assets. MTI does not handle financial assets at all as they only trade in cryptos.

The FSCA itself has acknowledged that they have seen live trading done by MTI.

South Africa is a highly regulated country and government often loses cases. For the FSCA to win against MTI they must clearly demonstrate that MTI has violated legislation.

Right now there is no promulgated law in South Africa regulating the access, use, storage or distribution of crypto currencies. Therefore MTI has not violated any South African law in this regard and the FSCA will not win its case.

(Ozedit: whacky conspiracy theories removed)

There is nothing legitimate about securities fraud committed by serial Ponzi scammers.

Which means nothing with respect to securities regulation and MTI running a Ponzi scheme.

MTI commits securities fraud. Securities in South Africa are regulated by the FSCA.

If you’re an MLM company in South Africa marketing passive returns (the medium doesn’t matter), then you need to be registered with the FSCA.

MTI isn’t registered with the FSCA because it’s a Ponzi scheme.

And? “Live trading” isn’t evidence of external revenue being used to pay MTI affiliates.

More importantly, it isn’t a substitute for registering with the FSCA and providing legally required periodic audited financial reports.

That’s nice but the issue is MTI committing securities fraud because it’s a Ponzi scheme.

Both securities fraud and running a Ponzi scheme is illegal in South Africa (and everywhere else in the world).

Finally what you do and don’t think about “the banks” and other whacky conspiracy theories, has nothing to do with MTI committing securities fraud because it’s a Ponzi scheme.