CBI Global collapses again (Coenie Botha’s 4th Ponzi collapse)

CBI Global has collapsed for a third time, marking owner Coenie Botha’ fourth Ponzi collapse.

CBI Global has collapsed for a third time, marking owner Coenie Botha’ fourth Ponzi collapse.

Rather than just admit he’s spend invested funds, Botha is sticking to his regulatory coverup.

CBI Global collapsed for a second time last November. At the time Botha (right) trotted out a story about South African regulators.

CBI Global collapsed for a second time last November. At the time Botha (right) trotted out a story about South African regulators.

This is because of the constant investigations regarding our presence and activities in South Africa while there are no regulations regarding crypto currencies in place.

While it’s believable South African regulators might investigate CBI Global and Botha (the vast majority of CBI Global investors are from South Africa), no confirmation of an investigation has surfaced.

Given inaction in relation to Mirror Trading International and Finalmente Global, it’s also unlikely.

Now Botha claims authorities in Namibia are onto him.

We all knew this was about to happen sometime, just not when, and neither are we surprised or taken back.

The CBI Exchange Namibia Bank Account in Namibia, as well as my personal bank account, are now restricted with various other crypto related organisations and/or people.

The “what”, the “who” and the “how” is not important at this stage.

That last sentence is of particular significance. Botha doesn’t want any questions.

So what does this mean for CBI Global affiliate investors?

It means that, once again, they can’t withdraw.

You will not be able to load your CBI wallets by buying CBI, BTC or ETH through the CBI Exchange platform or to sell your CBI Tokens through that platform until after the High Court has made a ruling regarding this matter.

Botha’s March 11th email doesn’t elaborate any further on purported CBI Global High Court proceedings.

In a follow up email sent on March 14th, Botha provided a temporary workaround to CBI Global withdrawal problems.

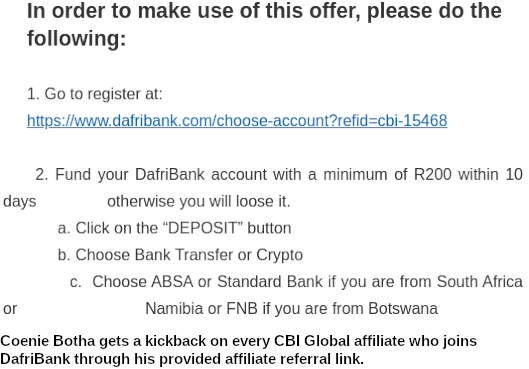

Botha’s solution involves laundering CBI Global Ponzi funds through Dafri Bank.

Fund your DafriBank account with a minimum of R200 within 10 days otherwise you will loose [sic] it.

a. Click on the “DEPOSIT” button

b. Choose Bank Transfer or Crypto

c. Choose ABSA or Standard Bank if you are from South Africa or Namibia or FNB if you are from Botswana

d. Make sure you use the 10-digit Reference number when you make an EFT/Deposit

Then go to your CBI Account and Click on Bank and Card Details under Profile settings

Choose “CARD DETAILS”

Submit the email address that you used to register with DafriBank above

Click in the ”Accept” box

Click on SAVE

We will unlock the Card Button to make a withdrawal and will then transfer your funds to your email address in the DafriBank account

Maximum daily withdrawals via EFT to your bank are $15,000 per account once you are fully verified.

DafriBank is an an offshore bank based out Comoros Island. Comoros Island is a sketchy tax haven off the coast of Africa.

As per their website;

DafriBank Digital is part of DafriGroup PLC a public company duly registered in South Africa, Nigeria and Botswana.

All DafriBank Digital customers are required to undergo a whitelisting process that includes KYC (Know Your Customer) and AML (Anti Money Laundering) and fulfill other criteria we deem necessary.

With CBI Global now using DafriBank to power their Ponzi scheme, whether that’s taken seriously remains to be seen.

For his part Botha doesn’t sound all that confident.

We have done as much research as we could, and it seems that they are a legitimate bank operating from the Comoros.

They do have businesses registered in both South Africa, Nigeria, and Botswana.

We cannot find that they have banking licences in these countries, but they do have bank accounts within these jurisdictions as well as many other places and countries.

You can do your own research on the internet regarding this bank and its founder of which some information might be very interesting.

FOR NOW, we would not recommend that you put huge amounts in this bank, but rather open your account, use it as a funnel or gateway to make deposits/withdrawals into your CBI Account.

Unfortunately, this is the only way we see a solution for now.

DafriBank is owned by founder and CEO Xolane Ndhlovu.

I couldn’t place the year but Ndhlovu was convicted on attempted murder and weapons charges. The charges were connected to drug related gang violence.

Through continuing to launder money through DafriBank, Botha maintains

CBI will continue to render the various services as we have done over the last 4 years, and all those prophets of doom will, in the end, see what it means to be victorious in the midst of all their negative and false accusations.

We’ll keep you posted on any updates.

Update 16th April 2022 – The Bank of Namibia’s investigation into CBI Global and Botha continues.

Botha meanwhile has filed suit against the BoN for millions in lost income related damages.

Can confirm the South African FSCA has requested investors of CBI to contact them regarding withdrawal issues

Given the hostile CBI Global numpties that show up on here, I wonder how many of them have?

Stupids gonna stupid.

At least FSCA are “aware” for what it’s worth.

In January 2022 Dafribank was instructed “to cease and desist from transacting the illegal deposit taking activities” by the Bank of Botswana which regulates banking activities in Botswana.

bankofbotswana.bw/sites/default/files/press-release-files/Illegal%20Deposit-Taking%20Activities%20%20-%20Dafritech.pdf

This keeps getting better by the day doesn’t it.

Would love to hear what the court has to say about this matter and that it is not about “crypto regulation” but rather just your plain old vanilla ponzi scheme with crypto sprinkles on top.

Frontpage news on Confidente News Namibia:

facebook.com/www.confidente.com.na/photos/a.750318771672306/4980981665272641

Lololol. What does it take to get a securities fraud investigation rolling in Namibia?

neweralive.na/in/posts/crypto-company-wants-day-to-day-funds

Thanks for the heads up.

I hope you people have proof about your allegations against Mr Botha and CBI. This is the worst case of defemation of character I have ever seen.

Bring proof of anybody that has lost 1 cent because of their CBI dealings.

CBI has enabled people to provide for themselves a form of income. But now because somebody has an unsolicited beef has put a freeze on members accounts in a certain bank and the members can’t get their funds because the certain bank has frozen their source of income, and CBI gets the blame. Hogwash

Marie Kirsten

All the proof you need is in CBI Global’s business model.

It’s a Ponzi scheme, and math guarantees the majority of investors in Ponzi schemes lose money.

Pretending regulation of illegal Ponzi schemes comes down to “beef” speaks volumes about your personal integrity.

Many people claimed BTC (Ozedit: snip, derails removed)

What bitcoin is or isn’t has nothing to do with CBI Global being a Ponzi scheme.

Ponzi business model = Ponzi scheme.

If you want to discuss bitcoin do it somewhere else.

CBI never froze accounts, (Ozedit: snip, derails removed)

Nobody said they did. If you have to invent fantasy to defend your Ponzi scheme, do it somewhere else.

Facts only or GTFO.

That’s not what that means you idiot potato. How can anyone take you seriously if you don’t even understand the basics of financial crime and yet try to defend it?

Everything posted is public information, are you denying the information cited directly from CBI? That’s rude calling CBI liars?

We have established earlier you do not understand what a ponzi or pyramid scheme is, so you missing the “imformation” confirming it is indeed a scam is not surprising.

Can I please sum it up for all South Africans and Namibians in language they will understand? COENIE BOTHA IS A CRIMINAL POES (think of a four letter word in English starting a C). Would you like it in Afrikaans? HY’S ‘N V’KN DIEF

And you are all stupid if you don’t see and understand that with the evidence in front of you.

This is what four hundred years of sunburn, incest and alcohol abuse does to your brain if you can’t see it.

En voordat jy begin, ek is ook Suid-Afrikaans.

I need to kow what hs happened to the money I invested with CBI. My husband says when he checks its NIL?

The money you invested into CBI Global was stolen by Coenie Botha and friends.

Sorry for your loss.

Good day do you have the contact info of CBI I invested some money. The person that assisted me from Namibie does not respond to my mails.

Are there any money left ect. Thank you regards.

You invested in a Ponzi scheme and your money is gone.

Botha hangs out in Namibia. You’d have known this is if you did any due-diligence prior to investing.

Yah no, we do not believe that there is any of your funds left.

General Update: CBI is now trying to raise more funds by creating their own DAO token “CBID” and is already promising 300% returns by mid year next year for people who get in early.

This is just a further trap as nothing about CBI is decentralized and Coenie controls everything.

When he shows you things during the webinars you must remember that he is in control of what he shows you and that it is according to his narrative – for instance he is artificially creating “demand” for these new tokens by showing you that there are only a few left (this after the buying opened only in the morning!) – thus making it seem that if you want to get those 100% – 300% returns you must buy now…

CBI is not a crypto exchange and does not offer crypto products. Coenie fakes this through the use of his websites – Its all just funds into his bank account which he uses for himself and marketing/website design to fool you.

This is also why the site / services are down so much – it is to make it difficult for you to submit any withdrawal requests and communicate with them etc.

Eventually when he is charged criminally and he will have to show his operations and how the funds were used will it finally come to an end.

Also an Investor.

When Bidcoin Drops, Cbi Freezes all withdrawals. Months later we were allowed to with draw at a Fraction of what we put in ( nearly 30 % ).

Had to Withdraw, Looses R 600 000.00.

Meetings and Communication channels is there but NOBODY allowed to asking questions.

They Change things as they like, and Investers havr to Accept and all Loosing money. Needs to be Investigated as MTI as well !

I am truly shocked of what I read now .. CBI …we were tall that funds were been frozen ..now I read ..ther is scam taking place …where is our investment and fraction …to be found

…I am amazed…CRAZY WORLD …now it means we lost all tha t we save and invest…