CBI Global investigation by BoN justified, rules court

The Namibian High Court has ruled that the Bank of Namibia was justified in investigating Coenie Botha’s CBI Global Ponzi scheme.

The Namibian High Court has ruled that the Bank of Namibia was justified in investigating Coenie Botha’s CBI Global Ponzi scheme.

As reported by The Namibian on March 26th;

The Bank of Namibia had reason to believe the company CBI Exchange Namibia, which was involved in a multimillion-dollar cryptocurrency investment scheme, did not comply with the Banking Institutions Act before the central bank had the company’s bank account frozen, a High Court judge has found.

Evidence presented by the Bank of Namibia showed Botha as using CBI Global investor funds as a personal piggybank.

The bank’s investigation also showed that when Botha’s own bank account, had a low balance, money was transferred to it from accounts including those of CBI Exchange Namibia and a related company, CBI X SA, which is registered in South Africa.

Botha is claimed to have pilfered at least $8.59 million from CBI Global accounts.

The central bank also informed the court its analysis of transactions on the company’s bank account revealed several loans ostensibly made to Botha, and that no funds were being paid back by Botha.

In his defense, Botha claimed CBI Global “did not collect funds or take deposits from the public”.

“This is exactly what happened in [CBI Exchange Namibia’s] accounts”, the judge remarked.

With BoN’s freezing of CBI Global’s and Botha’s accounts in 2022 in the clear, all that’s left to resolve in Namibia is Botha’s criminal case.

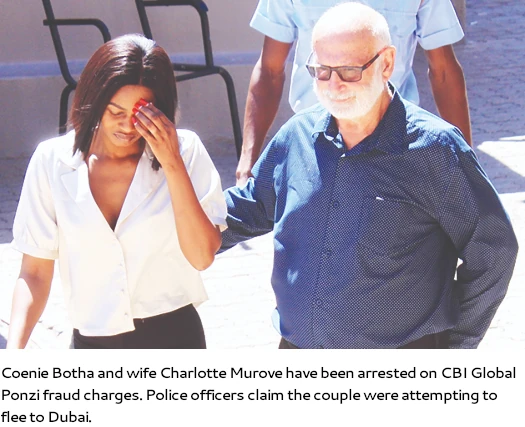

Botha and wife Charlotte Murove are facing 64 criminal charges. Proceedings are still playing out but, as of June 2024, Namibian police didn’t seem too interested.

Meanwhile over in South Africa, in November 2024 the FSCA set aside Botha’s previously imposed R216 million fine ($12.1 million USD).

The FSCA didn’t provide an official reason for the decision.