UK authorities close CashFX Group investigation

UK authorities investigating the collapsed CashFX Group Ponzi scheme have completed their investigation.

UK authorities investigating the collapsed CashFX Group Ponzi scheme have completed their investigation.

Essex Police have opted to drop the case, owing to there being “no evidence anyone in the UK has committed criminal offenses”.

News of Essex Police investigating CashFX Group broke back in August. At the time Essex Police were soliciting information from CashFX Group victims, as part of “Operation Hent”.

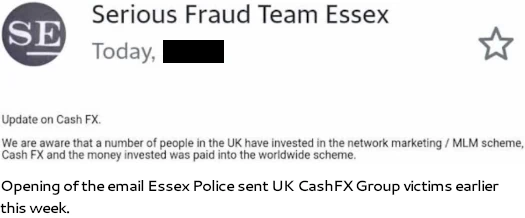

As per an email sent out to those same victims earlier this week;

We are aware that a number of people in the UK have invested in the network marketing / MLM scheme, Cash FX and the money invested was paid into the worldwide scheme.

We have completed numerous enquiries and at this time we are not aware, nor is there any prima facie evidence to support allegations that anyone in the UK has committed criminal offenses, however we would suggest that certain ethics within the scheme are questionable, including the business model.

Essex Police’s investigation appears to have been limited to operation of CashFX Group.

The network marketing / MLM scheme is located outside of the UK and the process is cyber enabled, this presents cross bounder [sic] jurisdiction issues.

While it’s true CashFX Group had no physical operations in the UK, when it launched back in 2019, CashFX Group falsely claimed it was “regulated by (the) Financial Conduct Authority of London” (FCA).

The FCA would go on to issue a CashFX Group securities fraud warning in December 2019. Beyond that, the FCA categorically refused to investigate CashFX Group in 2021.

CashFX Group was also openly promoted across the UK by local promoters; James Curtis, Richard Maude Martin Orena, Donal McCrossan, Emmanuel Kuye, Roy J. Maurice, Lee Oshea, Brian Chittick, Neil Slinn and Jojar Dhinsa come to mind.

In the US promoters of Ponzi schemes face civil and criminal wire fraud, securities fraud and money laundering charges.

Speaking of the US, Essex Police suggest they are deferring to US authorities.

We have liaised with international Law Enforcement partners in the US, they have an interest in the working mechanics of the scheme and certain enablers with significant control of the company.

Nothing further with respect to a US investigation into CashFX Group is disclosed. Regardless it appears to be a repeat of OneCoin.

Following their own criminal investigation, UK authorities shamelessly announced they were leaving it up to the US to clean up OneCoin in 2019.

Even then things haven’t gone smoothly. Recently the UK refused to extradite two OneCoin money launderers to the US.

This followed the seizure and return of £30 million in stolen money to one of the wanted suspects in 2017.

Opting likewise to turn a blind eye to CashFX Group related fraud in the UK, Essex Police close their email by stating;

Our position in the UK will remain the same unless we receive further information or evidence of criminal offences being committed in the UK.

To the continued detriment of their victims, what it takes to get MLM Ponzi scammers arrested in the UK remains a mystery.

Unfortunately, financial fraud is one of the UK’s biggest crimes and one of the least investigated.

Why are all the scammers hiding out in Dubai? Just go to London!

Ridiculous email both in terms of content and language command.

How ridiculous is it that participants in a global fraud are not prosecuted despite plenty of evidence on videos and social media posts to verify their involvement!

If the law won’t do it . Then others measures will be taken.

On the same day it’s confirmed that the police in Leicester have made arrests regarding ITP, we get this from the police in Essex?

Is the UK now the 52nd state of the US or something where the completely fragmented local police forces in England and Wales do the work and then defer to the DoJ and FBI? In Scotland the police could go on strike and nobody committing financial crime would notice.

How is it possible that everyone in the UK in police automatically defers to the City of London Police for financial things when there isn’t a protocol to do so and CoLP is understaffed and under resourced to the point where it is broken and reliant on seconded Americans for major investigations?

The guys behind CashFx have gotten away with it if the English police don’t do anything

When did this actually happen? Someone mentioned an arrest a few days ago. No supporting evidence so I eventually nuked the comment.

Brian Chittick listed above is a well known MLM SCAMMER from the North of Ireland. See him on FB. Lets hope he faces the law.

Tony Lynam. Kalpesh Patel. Ger Geary. Mick Mulcahy. John Barrett. Simon Stepsys all pushing SCAMS year on year..

Is anyone surprised??..