CashFlowNFT bans promoters from sharing MLM opp

CashFlowNFT has banned affiliate promoters from sharing information about the company.

CashFlowNFT has banned affiliate promoters from sharing information about the company.

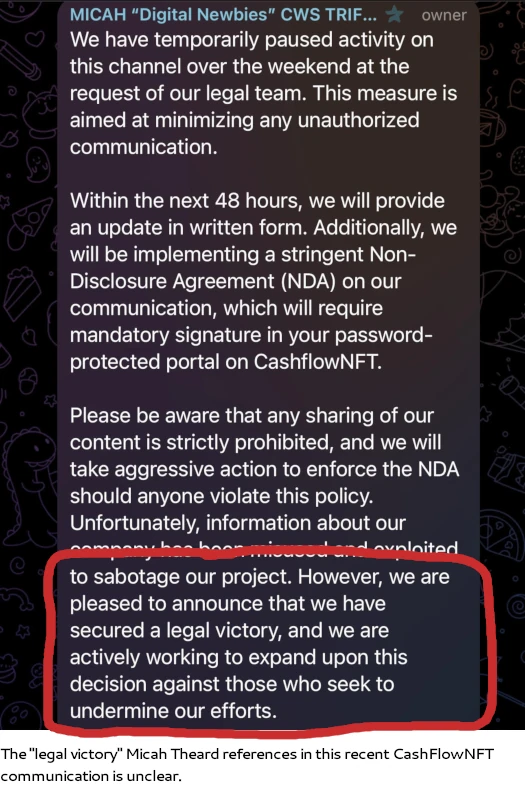

As per a recent communication sent out by founder Micah Theard;

We will be implementing a stringent Non-Disclosure Agreement (NDA) on our communication, which will require mandatory signature in your password-protected portal on CashFlowNFT.

Please be aware that any sharing of our content is strictly prohibited, and we will take aggressive action to enforce the NDA should anyone violate this policy.

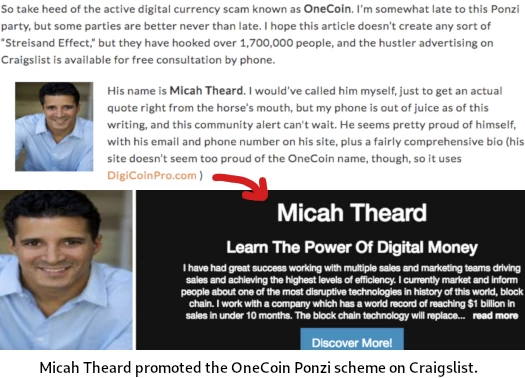

Theard (right), a former promoter of the OneCoin Ponzi scheme, goes on to claim that information shared with affiliates “has been misused and exploited to sabotage our project”.

Theard doesn’t provide any examples. We’re certainly curious what CashFlowNFT promoters are banned from sharing.

Unfortunately for Theard, now that he’s initiated that whole MetaTerra Corp circus, he doesn’t have a choice. Either full disclosure is made public through SEC filings, or he and CashFlowNFT continue to commit securities fraud in the US.

MetaTerra Corp’s next SEC filing, it’s annual 10-K, is due 90 days from December 31st, 2023 (~March 31st, 2024).

Anything less than full disclosure to the SEC of CashFlowNFT’s complete audited financials and MLM investment opportunity will constitute ongoing securities fraud.

Of particular interest will be MetaTerra Corp disclosing to the SEC that CashFlowNFT has already been committing securities fraud by selling virtual shares to US residents.

CashFlowNFT’s continued acts of securities fraud reflect Theard’s continuing to demonstrate a lack of understanding of US securities law.

In typical crypto bro fashion, Theard frames regulation of cryptocurrency securities to “attacks”. He also incorrectly seems to think cryptocurrency doesn’t fall under US securities law.

[1:49:42] Many companies are doing things, that they don’t know for sure, if they’re going to get in trouble. Because America has no crypto regulations in place. They only have (the) SEC.

It’s not, there’s no institution saying, “Hey, we are the crypto regulatory body. And here are the crypto regulations”.

As far as cryptocurrency investment schemes running afoul of US securities law, there doesn’t need to be a “crypto regulatory body” or separate “crypto regulations”.

The US Securities and Exchange Act has been around since 1933. The Howey Test, commonly used to determine an investment contract for the purpose of applying securities law, was a US Supreme Court decision dating back to 1946.

Common-sense aside, the SEC has made it very clear that it doesn’t matter what you use to violate securities law.

Cryptocurrency is just a new vehicle for fraud and, as demonstrated by the increasing number of regulatory lawsuits and DOJ criminal enforcement actions, isn’t exempt from existing US securities law.

The above quote from Theard is from a two hour “truth” video, uploaded to Theard’s Boogie Gopher Club YouTube channel on January 29th, 2024.

Most of the video is Theard rambling on about irrelevant talking points (he doesn’t address CashFlowNFT committing securities fraud), but there are some interesting points to note.

Back in May 2023 BehindMLM reported on investors in Oscar Garcia’s collapsed Batched Ponzi being funneled into CashFlowNFT.

Since then things have fallen apart.

Theard now refers to Garcia (right) as “the biggest scammer I’ve ever met”. Both parties are claiming the other side doesn’t have what they represented they did.

Theard now refers to Garcia (right) as “the biggest scammer I’ve ever met”. Both parties are claiming the other side doesn’t have what they represented they did.

In his own words, this is Garcia’s take on the failed deal;

[20:20] So I got involved like many investors, where I was introduced to Micah and they promised me and they told me they had several things already in place.

I was contracted to make all their stuff look phenomenal. And a lot of people got really excited when I started working for the first 90 days.

But after that I found out really quickly that a lot of things that they promised was just lies. And I’m fulfilling people’s… I’m fulfilling my contract more than anything else.

Here’s Theard’s version of events;

[17:24] We did a contract with Oscar to purchase technology from him. He also got sort of a consultancy agreement with us, to consult.

And so that was for $10,000 a month, which was really about UI, UX, helping us with websites.

Then there was, y’know, a um, certain amount of money for buying his technology. Which means that it would have to be worth money and it would have to be technology.

Not like a front-end website. Not some kind of … basically front-end user experience, front-end whatever. It was technology called nodes, that would do something. That had a function, validating transactions – which he ended up not having.

Theard also reiterates CashFlowNFT’s MetaTerra virtual shares scheme.

[1:10:12] That is something that I said on a video call. I said, “Hey we’ll call them Nasdaq Filing Tokens.” Right?

That is not the actual definition, because they do not actually exist. What exists is MetaTerra shares.

That’s what they’re getting, so it doesn’t matter what was said. It was kind of a “pun joke”.

Because people were saying that we sold NFTs to American investors. Not true. What we sold was shares. What they’re getting is shares.

The other tidbit worth noting from Theard’s video is Theard claiming Ofinans OU, an Estonian shell company ties to CashFlowNFT, lost its Estonian virtual currency license in 2021 because it stopped paying fees.

Theard doesn’t explain why fees weren’t paid. He also doesn’t address why, in November 2023, Miracle Pay (another company tied to CashFlowNFT), to this day still references the suspended license number on its website.

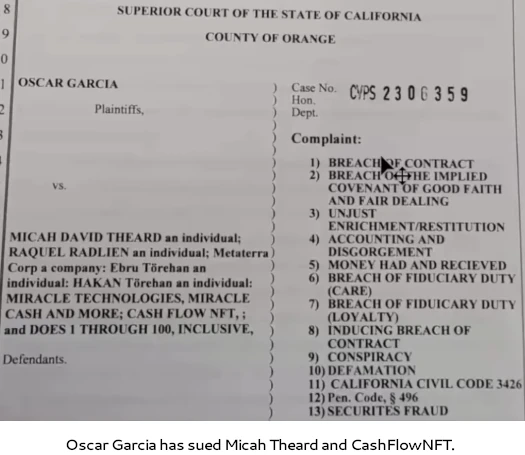

Oh and apparently Garcia has sued CashFlowNFT and Theard. And Theard reckons he has or is about to sue Garcia back in kind.

Unfortunately, at least as far as Garcia’s lawsuit goes, these are state filings and I don’t have access to them.

Pending filing of MetaTerra’s annual 10-K next month, stay tuned…

Update 20th July 2024 – MetaTerra has still not filed its annual 10-K. The filing is now very much overdue.

This update is to note Micah Theard has marked his cited ” two hour “truth” YouTube video as private.

This article originally contained a link to the video. As a result of Theard taking it down, the link has now been disabled.

They also filed a trademark dispute against the domain MiracleCashFacts.com. When the domain was redirected to. MTRCStock.com, they filed a trademark dispute against that domain name as well.

In the wording of their dispute, they seem to think that the content of a webpage is somehow tied to a domain name.

Yep! These fools just keep going…. Here are a few of the latest updates AFTER this…. You forgot to share their 3.2 Billion dollar valuation!

From $0 to Triple Unicorn: Metaterra (MTRC) Valued by Rödl & Partner #tothemoon #nasdaq #stocks

youtu.be/rMct6j5MR4k

Miracle Cash & More And Metaterra (MTRC) Q1, 2024 Explained! $3.2 Billion Rödl & Partner Valuation!

youtu.be/L_eRclfid1E

Shocking News: Hakan Törehan Alive! Metaterra (MRTC) And Boogie Gopher Club Announce 2 New Ponzis!

youtu.be/hog0vF6uerY

Love Ya OZ! You the OG…. Original gangster and not Oscar Garcia!

Metaterra MtRC still has not filed their end of year financial reports with the SEC.