Cashflow NFT Review: NFT real estate themed securities fraud

CashFlow NFT’s website is currently nothing more than an signin/signup form:

To the right is an unlisted marketing video, which leads to CashFlow NFT’s official YouTube channel.

There you’ll find two additional CashFlow NFT marketing videos.

One of them, titled “Cashflow NFT – An Amazing Opportunity”, his narrated by someone going by Daniel Wood.

Wood claims to have a history in real-estate. He claims he’s done with real-estate though (for now), and instead wants to focus on being a crypto bro “for the next five years”.

Wood is a co-founder of Momentum Property Education, a company selling property investment guides:

Wood also runs the Swedish Wealth Institute with his wife.

The Swedish Wealth Institute was founded by Daniel and Gisela Wood to promote entrepreneurs, investors and people who want to develop.

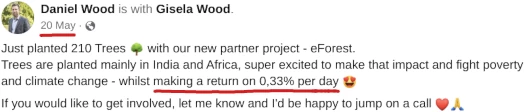

Wood appears to have begun his crypto bro career, at least publicly, earlier this year with E-Forest:

eForest is a crypto “pay to play” Ponzi scheme, wrapped up in “save the Earth” marketing:

eForest has gone nowhere and, evidently bitten by the crypto fraud bug, Wood has come up with his own real estate crypto grift.

If I had to guess, Wood’s private crypto bro journey probably began with crypto infecting Swedish Wealth Institute.

And so the well-trod process of the founder of an established business running it into the ground because crypto begins.

Update 16th August 2022 – While David Wood might be the public face of CashFlow NFT, in May 2022 marketing video, Micah Theard introduces himself as the company’s founder.

Theard has a long documented history of promoting MLM scams and Ponzi schemes. /end update

Read on for a full review of CashFlow NFT’s MLM opportunity.

CashFlow NFT’s Products

CashFlow NFT has no retailable products or services.

Affiliates are only able to market CashFlow NFT affiliate membership itself.

CashFlow NFT’s Compensation Plan

CashFlow NFT affiliates invest $5000 to $10,000 on the promise of “high returns”.

The MLM side of CashFlow NFT pays on recruitment of affiliate investors down two levels of recruitment (unilevel):

- 10% on level 1 (personally recruited affiliates)

- 5% on level 2

CashFlow NFT Conclusion

Invest $5000 or $10,000 in an NFT, something something, passively generated riches.

CashFlow NFT represents it plans to generate revenue by “finding revenue-yielding companies”.

To that end CashFlow NFT represents it is partnered with Miracle Cash & More.

Miracle Cash & More is a crypto wallet company, launched in December 2021.

As per SimilarWeb tracking, Miracle Cash & More had a dead website until May 2022, around the time CashFlow NFT included it in its marketing.

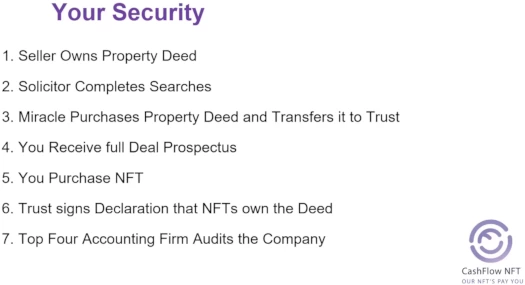

Part of CashFlow NFT’s marketing pitch is Miracle Cash & More buying real-estate, affiliates invest $10,000, something something and “high returns”.

The property side of CashFlow NFT is being run through a “Property NFT” Telegram group.

The property side of CashFlow NFT is being run through a “Property NFT” Telegram group.

Beyond that, I don’t want to waste time on Miracle Cash & More as ultimately it doesn’t matter.

CashFlow NFT is soliciting investment on the promise of passive returns.

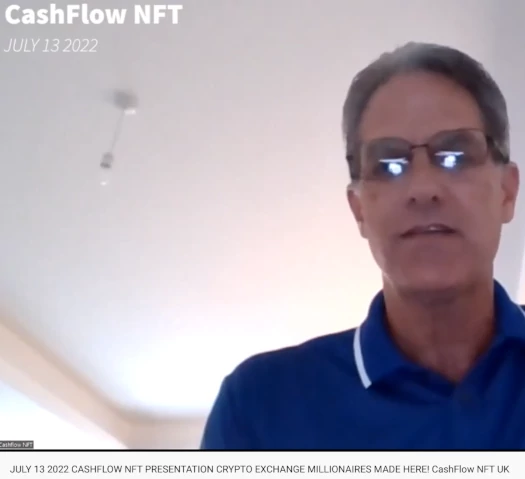

On July 13th Daniel Petrucelli stated on an official CashFlow NFT webinar;

In a matter of days we’re going to release our NFT. It’s gonna be the coolest NFT you’ve ever seen.

And without a doubt, it in itself will be worth a lot of money. Way more than what you paid for it initially here for $5000.

Petrucelli, a former Hempworx distributor, is a CashFlow NFT FaceBook group admin.

Beyond Daniel Wood living out his crypto executive fantasy, that CashFlow NFT investments are purportedly tracked through NFTs is neither here nor there.

What matters is CashFlow NFT’s passive investment opportunity constitutes a securities offering.

This requires CashFlow NFT to register with financial regulators and periodically file audited financial reports. There is no substitute for these legal requirements.

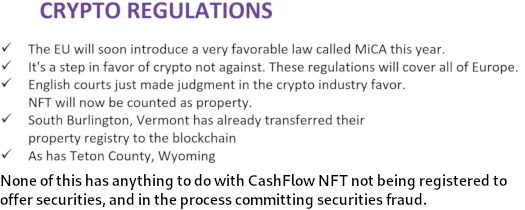

As opposed to operating legally and like many a crypto bro before him, Wood ignores securities laws being well established globally for decades.

Instead he trots out some irrelevant waffle about “coming soon” crypto laws.

Again I don’t want to waste time on this because it has nothing to do with securities law, which CashFlow NFT’s MLM opportunity falls under.

Securities in Sweden are regulated by the Swedish Financial Supervisory Authority.

Such to the extent Miracle Cash & More is tied to CashFlow NFT’s passive investment scheme, they’d need to register it with the Financial Conduct Authority.

Broadly speaking, CashFlow NFT needs to register with financial regulators in any jurisdiction it solicits investment in.

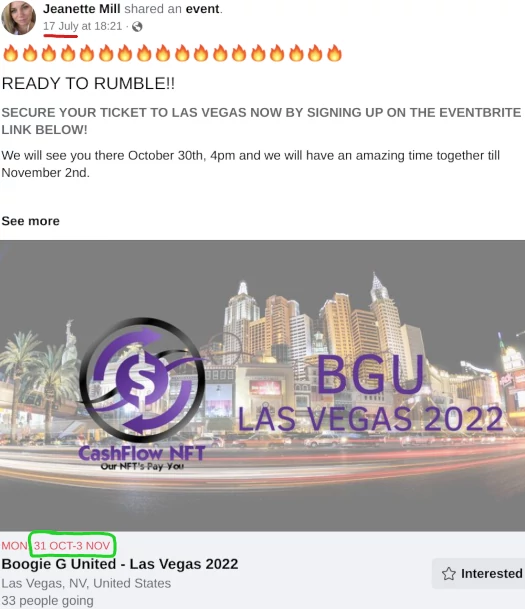

As above, CashFlow NFT is planning to hold a promo event in Las Vegas in late October.

Securities in the US are regulated by the SEC. A search of the SEC’s Edgar database reveals neither CashFlow NFT or Daniel Wood are registered to offer securities in the US.

MLM companies committing securities fraud lends itself to operation of a Ponzi scheme.

The math behind Ponzi schemes guarantees that the majority of investors lose money.

Assuming he didn’t pillage his real estate group for referral commissions, Daniel Wood blowing who knows how much on eForest is a great example of losing money to a Ponzi scheme in action.

Update 25th October 2023 – CashFlow NFT’s original real-estate ruse has flopped.

The company is now selling illegal virtual shares through Boogie Gopher NFTs.

A poor woman rent her apartment to Miracle Cash. It doesn’t take long before they stop paying the rent, but still use the apartment.

I guess it is the mindset of scammers: (Ozedit: link to private FaceBook group removed)

^^ The FaceBook group you linked to is private.

A screenshot from the Facebook group: ibb.co/tqR13NH.

Thanks. So someone rented a property through “Busy Bees”. Busy Bees had somebody surnamed Ezel as a client, who is purportedly linked to Miracle Cash & More (???).

Ezel stopped paying rent, vacated but apparently there’s still someone from Miracle Cash & More living there (???).

Bit of an odd story.

Miracle Cash and more does not pay their rent on Cyprus but they rent Miami Convention Center and pay Marc Accetta to convince more people.

ibb.co/tqR13NH (post from July 8).

Will Miami Convention Center and Marc Accetta get paid? And does Miami Convention Center know that they have scammers using their center?

Interesting update on this program. Looks like a very similar situation that Nui had with Kala and then iX Global with DEBT Box.

(Ozedit: link removed, see below)

27 minute marketing video. Didn’t see anything “interesting” as I skimmed through it.

Feel free to point out what was interesting or spam.

just been exposed to eForest scam.

So few attendees, they had to get their office staff on the zoom to make up numbers.