CashFlow NFT fraud continues with MetaTerra & the SEC

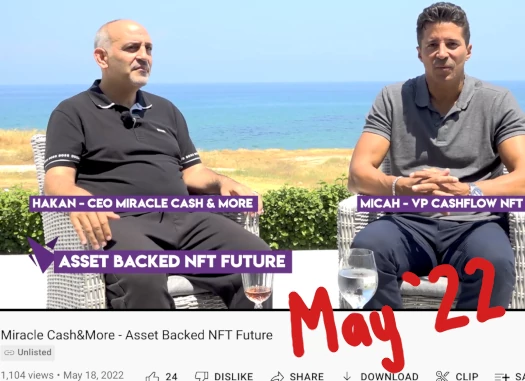

Following a webinar last month that detailed securities fraud through NFTs, CashFlow NFT co-founder Micah Theard wanted to “get more detail on certain things and less detail on others”.

Following a webinar last month that detailed securities fraud through NFTs, CashFlow NFT co-founder Micah Theard wanted to “get more detail on certain things and less detail on others”.

Micah held another webinar on November 8th, this time covering MetaTerra.

Theard claims MetaTerra is owned by Miracle Technologies Holding SGPS, LDA, a Portuguese shell company.

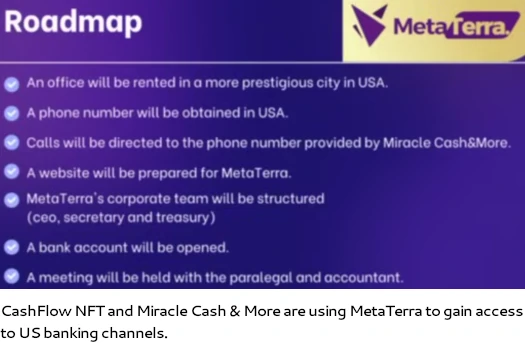

MetaTerra Corp is a repurposed Nevada shell company that was registered with the SEC in March 2022. MetaTerra’s SEC filings provide a corporate address in the Dominican Republic.

This is from MetaTerra’s Form S-1 filing from March 23rd, 2022;

Metaterra Corp. is a development stage company and has recently started its operation. To date we have been involved primarily in organizational activities. We do not have sufficient capital for operations.

We are a development stage company that plans to engage in the business of selling auto parts that we purchase in the United States to customers in the Dominican Republic.

MetaTerra’s Form S-1 detailed plans to sell two million MetaTerra shares for 5 cents each.

There are 2,000,000 shares of common stock issued and outstanding as of the date of this prospectus, held by our sole officer and director, Anyoline De Jesus De Perez.

In March 2023, MetaTerra filed its Annual 10K Report. Needless to say the “auto parts” business had flopped. After a year, MetaTerra didn’t even have a website to sell on.

We plan to develop a website that will display a variety of auto parts and their prices, and will advertise our services and fees.

A Quarterly 10-Q Report filed in July 2023 provided insight into MetaTerra’s financials;

The Company has accumulated loss from inception (January 20, 2021) to June 30, 2023, of $48,044.

These factors among others raise substantial doubt about the ability of the company to continue as a going concern for a reasonable period of time.

An 8K Current Report filed on October 16th, details CashFlow NFT’s Portuguese shell company purchasing MetaTerra.

On October 13, 2023, Anyoline De Jesus De Perez, the previous majority shareholder of the Company, entered into a stock purchase agreement for the sale of 2,000,000 shares of Common Stock of the Company, to Miracle Technologies Holding SGPS, LDA.

Also on October 13, 2023, the previous sole officer and director of the company, Anyoline De Jesus De Perez, resigned her positions with the Company.

Upon such resignations, Ebru Törehan was appointed as Chief Executive Officer, Chairman of the Board, Treasurer and Secretary, and Director of the Company.

Ebru Torehan is President of Miracle Cash & More.

She’s also the wife of Hakan Torehan. And what’s interesting here is the attempt to keep Micah Theard and Hakan Torehan, the actual owners and primary beneficiaries, off MetaTerra’s SEC reports.

Torehan has ties to organized crime:

And Micah Theard is a former promoter of the notorious OneCoin Ponzi scheme.

A month after the acquisition, MetaTerra filed a 10-Q Quarterly Report on November 14th. And they’re still going with the failed auto parts business ruse;

The Company sells auto parts in the Dominican Republic.

As of September 30, 2023, the Company total inventory was $35,495. The inventory comprised of two automobiles.

The report spans the quarter ending September 30th, so there’s no mention of

- CashFlow NFT or Miracle Cash & More;

- Micah Theard or Hakan Torehan;

- the original real-estate passive returns investment scheme; or

- virtual shares sold through Boogie Gopher NFTs

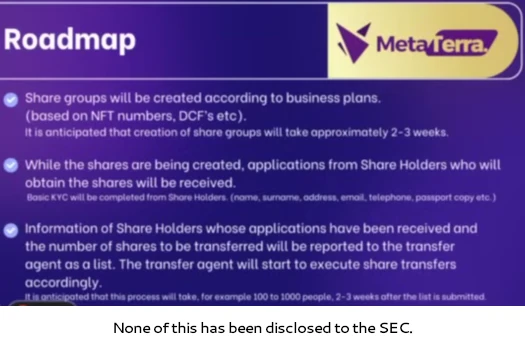

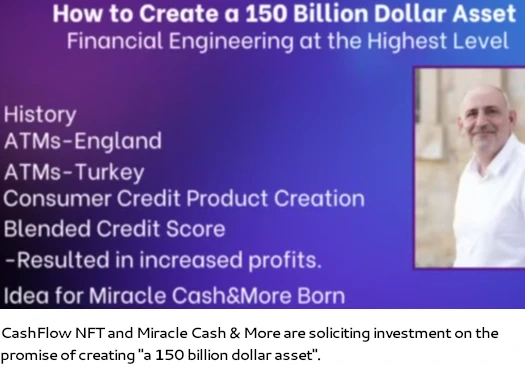

With respect to securities law in the US, the primary problem is that CashFlow NFT has already been soliciting investment since mid 2022. And virtual shares have already been sold through Boogie Gopher NFTs.

CashFlow NFT or Miracle Cash & More disclosed their crypto investment scheme securities offering to the SEC. And buying a failed auto parts shell company with existing shares doesn’t undo securities fraud.

From what I can tell the plan is to distribute MetaTerra’s existing shares (or virtual representations) to CashFlow NFT affiliate investors.

One final thing to note is Miracle Cash & More’s Lithuanian shell companies, under Miracle Technologies, referencing an already revoked financial license.

Miracle Pay, part of Miracle Technologies, provides this on the “about” section of their website;

Miracle PAY, the innovative face of the financial world, is a subsidiary of the Lithuanian Miracle Technologies group Miracle Technologies, which has made significant investments in digital financial services in Europe and Turkey.

Miracle technology group operates in the Netherlands, England, Turkey, and the TRNC. Miracle PAY holds an EU Authorized Financial institution license.

It will start its activities related to electronic payment and Margin trade transactions under the Miracle share brand with the License Number: FVT000438.

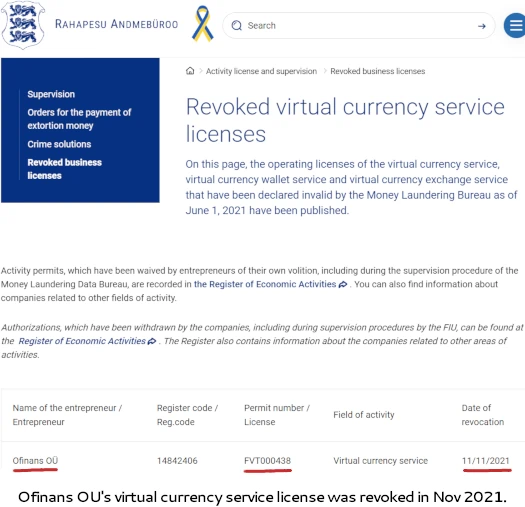

FVT000438 corresponds to the Estonian shell company Ofinans OU, who had their virtual currency service license revoked in November 2021:

Why Miracle Pay is referencing an already revoked virtual currency service license is unclear. It would certainly be of concern is banks or other financial institutions have been deceived with the revoked “FVT000438” license.

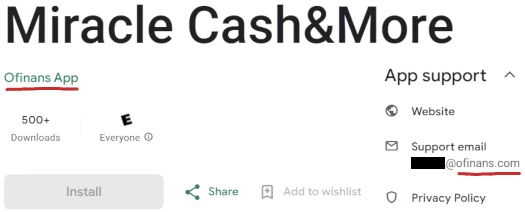

Miracle Cash & More’s revoked EU crypto license was first spotted by the website “Miracle Cash Facts“. The site also claims Miracle Cash & More’s app was recently removed from the Apple Store.

The app is still available on Google’s Play Store, with “Ofinans App” listed as the developer.

Pending any further updates, we’ll keep you posted.

Update 23rd November 2023 – Following publication of this article, Micah Theard’s MetaTerra webinar has been marked private.

The video was publicly viewable on CashFlow NFT’s official YouTube channel at time of publication.

Update 9th January 2024 – Shortly after this article was published, the YouTube video of Miah Theard’s November 8th, 2023 webinar was marked private.

This article originally contained a link to the video. Due to the video no longer being available, the link has now been disabled.

Update 22nd August 2024 – Miracle Cash & More’s apps have been removed from the Google App Store.

Article updated to note Micah Theard’s MetaTerra webinar has been marked private.

Hide the evidence!

Here is the video they CANNOT take down……. All your slides are in it from this article!

Miracle Estates Ponzi Scheme Exposed! How @miraclecashmore5458 @boogiegopherclub Keep Scamming!

youtu.be/cf1lgMKA788

It seems like Miracle Estate, another of Miracle Technologies’s shell companies, is about to launch. Linda Hallberg, known from eXer and other scams, is the CEO.

I’ve been keeping an eye on MetaTerra’s SEC filings.

On April 1st MetaTerra filed a form 12b-25, advising;

The specified “grace period” is 10 to 15 days. We are now in mid June, some 72 days later, with no annual 10-K filing.

In other words, MetaTerra has been stalling with SEC filings ever since it was integrated into the CashFlow NFT Ponzi scheme.

Still no MetaTerra SEC filings as of July 12th, 2024.

Noting Miracle Cash & More’s app has been removed from the Google Play Store.

Also still no new MetaTerra SEC filings as of August 22nd, 2024.

Noting MetaTerra still hasn’t filed anything with the SEC.

MetaTerra’s 10-K annual report ending Dec 2023 is now 222 days overdue.

Still no filings. We’re coming up on MetaTerra’s required SEC filings being 9 months overdue.