Uulala & Batched reboot collapses, SEC investigation confirmed

Both Uulala and its Batched reboot have collapsed.

Both Uulala and its Batched reboot have collapsed.

Affiliate investors can’t log in, meaning withdrawals are effectively disabled.

There’s a bit of unreported history we need to catch up on with Uulala, so let’s recap with a brief rundown of how we got here.

Uulala launched in 2017 as a crypto scam built around UULA and EUULA tokens.

In August 2021 the SEC filed suit against Uulala and co-founders Oscar Garcia (right) and Matthew Loughran.

In August 2021 the SEC filed suit against Uulala and co-founders Oscar Garcia (right) and Matthew Loughran.

Uulala, Garcia, and Loughran made materially false and misleading statements to investors throughout their offering of UULA about having “patent pending” technology that had been incorporated into their app and having a proprietary algorithm to assign credit scores to users of their app.

Uulala, Garcia and Loughran settled the lawsuit and paid respective civil penalties of $300,000, $192,768 and $50,000.

Rather than cease committing securities fraud, Garcia doubled down and relaunched Uulala as a “validation node” Ponzi scheme.

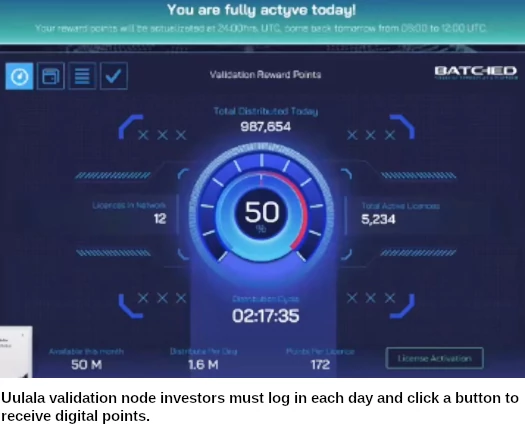

Uulala validation node investment positions cost $1100. Affiliates had to log in daily and click a button to generate points.

These points were locked up in Uulala until they decided to let affiliates cash out (subsequently invested funds).

BehindMLM published its Uulala review in October 2021. By the end of 2021 Uulala’s website had been abandoned.

Uulala’s “validation node” Ponzi scheme had been merged into Batched, although Batched’s website wouldn’t reflect this until early to mid 2022.

Prior to the merger, Batched was a payment processor Garcia has been running for years.

Uulala’s continuation through Batched seems to indicate while the pyramid side of the business was paying out, node points, for the most part, remained locked up in the system.

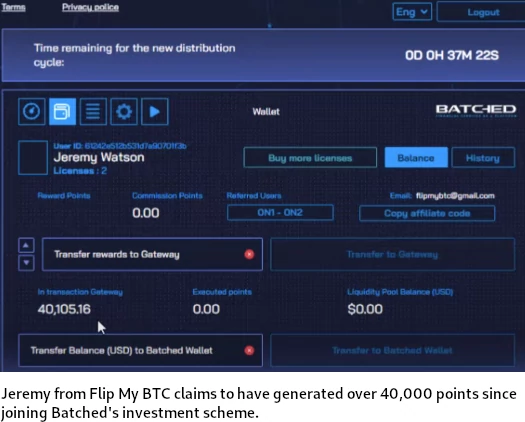

In a June 2022 YouTube video, Jeremy from Flip My BTC provides insight into how Batched was doing mid last year:

Right now the only people making money in this program are people that are referring others.

I have 40,000 points in here. That means I’ve been going in here, clicking the start button, doing everything that I’m supposed to be doing, and I still haven’t made any money.

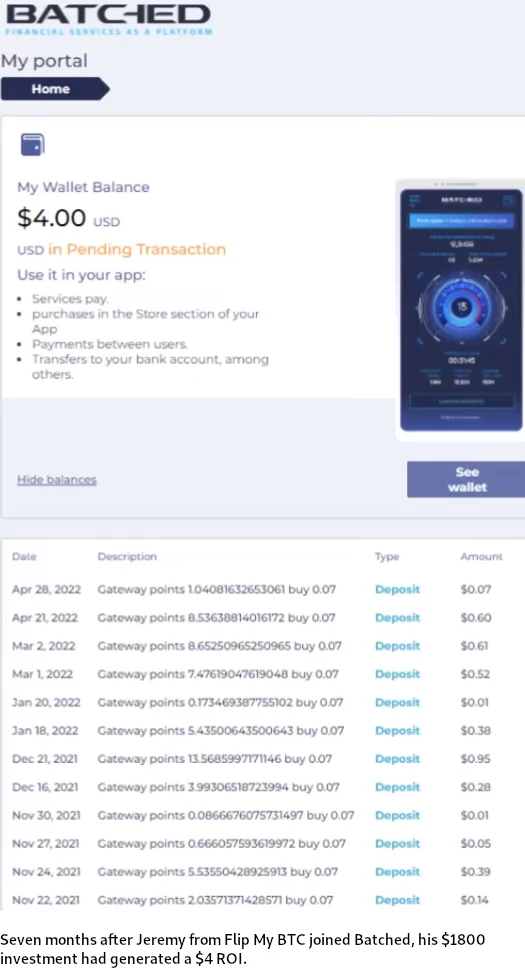

If you want to see how much money I’ve actually made, here it is … I’ve made $4 since I joined in 2021.

I have two nodes, I paid $1800 for them total.

Comments left on Flip My BTC’s video reveal investors complaining about not being able to withdraw since 2021.

On January 19th BehindMLM reader Ray revealed things have since further deteriorated with Batched.

As of January 2022 (confirmed typo, supposed to read 2023), many that purchased Nodes with Batched (formerly known as Uulala) are unable to log on and click “start” to run their node and generate points because the 2-Factor verification won’t work.

You never receive the email with the code so you can’t log in to click “start.”

Also, there was a telegram group ran by Oscar right hand person (Kathy), and everyone could post and reply, but about a week ago, she suddenly blocked everyone and now she’s the only one that can post and reply.

She cited too much negativity (which I get) and not having the time to keep up.

In a recent Batched Zoom, Oscar Garcia is alleged to have stated the current state of Batched is “a mountain of shit”.

Long story short allegedly Oscars partner the COO altered financials, stole some of the technology for personal gain and sold the company.

The Batched technology and software is proprietary so they will be trying to revamp the company and keep all existing partners

They are in the midst of a legal battle.

The COO of both Uulala and Batched is/was Frank DiCrisi (right).

The COO of both Uulala and Batched is/was Frank DiCrisi (right).

Mention of a legal battle sent me to Pacer. I couldn’t find anything at the federal level, but that’s not to say litigation may not have been filed at a state-level.

Given the fraudulent nature of the business model though, I’m not inclined to give Batched or Garcia any benefit of the doubt. To the best of my knowledge this is no litigation.

Uulala/Batched investors have been locked out of their accounts, thus disabling withdrawals.

Here’s where things get particularly juicy. In looking up Uulala and Batched related litigation, what I did find is confirmation of an SEC investigation.

On November 9th, 2022 Oscar Garcia filed a motion in California. Through the motion, Garcia sought

an order preventing the government from obtaining access to (his) financial records.

The agency seeking access is the United States Securities and Exchange Commission.

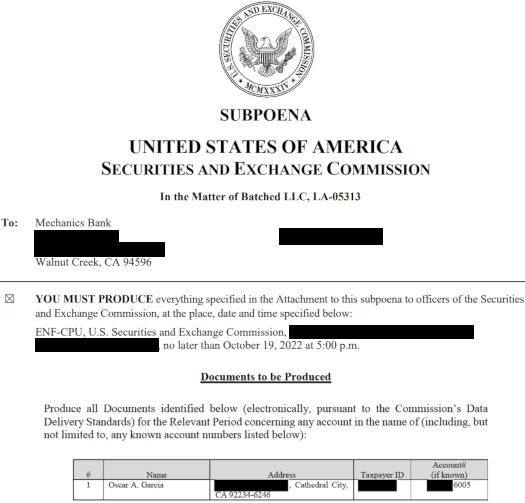

Sometime prior to Garcia’s September filing, the SEC subpoenaed Mechanics Bank for financial records. In an accompanying filed statement for Garcia, we learn the SEC are investigating Batched.

I, Oscar Garcia, am a customer of Mechanics [sic] Bank … and I am the customer whose records are being requested by the United States Securities and Exchange Commission.

The financial records sought by the United States Securities and Exchange Commission are not relevant to the legitimate law enforcement inquiry stated in the Customer Notice that was sent to me because or should not be disclosed because there has not been substantial compliance with the Right to Financial Privacy Act of 1978 in that or should not be disclosed on the following other legal basis:

The government’s demand is overly broad, oppressive and lacks particularity. The request does not limit itself to documents which pertain to the subject matter of the investigation concerning “In the Matter of Batched LLC, LA-05313.”

The Subpoena seeks all personal financial records about me in the possession of the bank from “for the time period beginning October 1, 2021, or the earliest time for which records exist, whichever is earlier, and continuing to the present, unless otherwise specified.”

There has been no showing that there is any relevance of my financial documents from the beginning of the opening of the account.

Any funds from licenses sold by Batched were not transferred to my Merchants [sic] Bank account.

The SEC Subpoena is simply a “fishing expedition” undertaken by the SEC.

I believe “Batched LLC, LA-05313” is the internal investigation number the SEC are using (I’m not 100% sure on this).

I’ve also bolded Garcia’s claim that no Batched funds were transferred to his Mechanics Bank account. We’ll circle back to that in a bit.

The SEC’s Batched subpoena was issued a few months prior to Garcia’s motion, on September 30th, 2022.

On December 2nd, the SEC filed its opposition against Garcia’s motion.

The SEC served the subpoena on the Mechanics Bank (“Mechanics”) to obtain Garcia’s bank records.

Garcia has invoked the customer challenge provisions of the Right to Financial Privacy Act of 1978 (“RFPA”), 12 U.S.C. § 3401 et seq., to quash the subpoena.

This Court should deny the motion and enforce the subpoena because the subpoenaed documents are relevant to a legitimate law enforcement investigation.

The SEC goes on to confirm its investigation is looking into “whether Batched, LLC violated federal securities laws.” We also learn the SEC’s investigation formally began on September 19th.

On September 19, 2022, the SEC issued an Order Directing a Private Investigation and Designating Officers to Take Testimony in In the Matter of Batched, LLC, LA-05313.

The Formal Order found that “Batched, LLC, its officers, directors, employees, partners, subsidiaries, and/or affiliates, and/or other [related persons] or entities” may have engaged in acts in violation of … the Securities Act of 1933 and … Securities Exchange Act of 1934.

The Formal Order authorizes “a private investigation [to] determine whether any persons or entities have engaged in, or are about to engage in” violations of federal securities laws.

The SEC’s opposition filing goes on to note Garcia’s 2021 securities fraud settlement, and states;

the SEC has found evidence that Garcia may have failed to comply with this court’s injunction against him and Uulala.

The Staff of the SEC’s Enforcement Division (“Staff”) has evidence that Garcia is using Batched to promote sales of “validation node licenses.”

Staff believes that these licenses may be investment contracts that come within the definition of “securities” in the Exchange Act and that, consequently, Garcia may be using Batched to engage in another unregistered securities offering that would likely violate the federal securities laws and the Court’s August 19, 2021 injunction.

The Staff has also found evidence suggesting that, in offering such licenses, Batched and Garcia may be making misleading statements of material fact to investors.

These misstatements include the nature of Batched’s business, how it planned to use investors’ money, and the likely return its investors could expect their investments would generate.

With respect to the Mechanics Bank subpoena, the SEC asserted “the subpoenaed documents are relevant to (their) investigation”.

The SEC is entitled to the records it has subpoenaed because the Staff has a “reasonable belief that the records are relevant” to their investigation of how Batched uses investor funds.

The subpoenaed records may help identify those who engaged in possibly illicit conduct, locate any improperly diverted investor funds, and determine if Garcia benefited from those funds.

Documents dating back to the time Garcia opened the account are relevant because the SEC has reason to believe that Garcia has only been a customer of Mechanics since October 2021.

The Staff has reason to believe that since fall 2021, funds have flowed from Batched to Garcia’s personal account at Mechanics.

The SEC is not required to accept Garcia’s assertion that “funds from licenses sold by Batched were not transferred to my Merchants Bank account.”

Indeed, the Staff has received information that tends to show that Batched funds have flowed into Garcia’s account at Mechanics.

Thus, contrary to Garcia’s claim, the SEC is not conducting an improper fishing expedition. It is seeking documents that it reasonably believes are relevant to an ongoing law enforcement investigation.

On December 9th Magistrate Judge Pym filed a report and recommendation on Garcia’s motion.

Magistrate Judge Pym found the SEC’s investigation was “part of a legitimate law enforcement enquiry”, and that the regulator had

adequately demonstrated there is reason to believe the bank records sought by the subpoena are relevant to a legitimate law enforcement inquiry.

As a result of these findings;

The court recommends that Garcia’s motion be denied and the government’s subpoena be enforced.

On January 10th, 2023, the court adopted Magistrate Judge Pym’s report and recommendation.

IT IS THEREFORE ORDERED that movants motion to quash the subpoena at issue pursuant to the customer challenge provisions of the Right to Financial Privacy Act of 1978 is denied.

This particular case has been closed, as it only pertained to Garcia’s attempts to thwart the SEC’s investigation into Batched.

Federal regulatory investigations are non-public, so I’m not likely going to be able to provide any further updates till the SEC files an enforcement action.

I’d expect that to happen by the end of 2023.

BehindMLM identified an unregistered securities offering in our October 2021 Uulala review. I stand by that research.

Coming back to Batched affiliate investors being unable to log in to their accounts and withdraw, I strongly suspect this is a result of the SEC’s ongoing investigation.

Pending any further developments, we’ll keep you posted.

Update 14th February 2023 – In a February 10th webinar, Oscar Garcia elaborated on Frank DiCrisi’ alleged role in Batched’s collapse.

Thanks for your good research my man. I am interested in any updates especially with regard to litigation against these people.

I have other friends in my network in Canada and the US who will be willing to testify and get involved as well.

Someone just posted this on Reddit regarding Oscar’s COO (Frank Dicrisi) from Batched. I thought it would be a great read for you as you continue to investigate Batched (formerly UULALA).

It discusses how Frank may be stealing money. There is an informant apparently and a case document is listed. Check it out.

reddit.com/r/TradersDomain/comments/10y4yhx/the_smoking_gun_savvy_wallet_owners_frank_dicrisi/

If I’m not mistaken that’s a filing from the Oscar Garcia OC Superior Court case, purportedly against Frank DiCrisi.

I don’t have a case number to look the case up unfortunately.

I’m not familiar with Traders Domain or purported owner Ted Safranko.

In looking into some of those other subreddit posts though, I came across Holton Buggs –

reddit.com/r/TradersDomain/comments/10x94vz/leaking_the_pdf_heres_how_ted_safranko_runs_his/

Traders Domain sounds like a 20% to 40% a month (collapsed) Ponzi scheme. Is Holton Buggs involved as a promoter?

Fuck this is a rabbithole. Traders Domain is purportedly tied to Buggs’ Meta Bounty Hunters and Meta Bounty Huntresses Ponzi schemes.

behindmlm.com/companies/meta-bounty-huntresses-mbhs-2nd-round-of-securities-fraud/#comment-459158

So Traders Domain collapses, Meta Bounty Hunters and Meta Bounty Huntresses stops paying returns – and Buggs is one of the top Traders Domain promoters?

Traders Domain isn’t MLM so I didn’t look into it when it first came up last October. As I understand it Traders Domain collapsed January 2023.

And apparently, according to a filing by Oscar Garcia in the OC Superior Court case (against DiCrisi?), at least $20 million plus of Traders Domain investor funds has been laundered through one of Uulala/Batched’s payment processors?

Man OZ, you are awesome at investigative journalism. Great job on this entire journey.

Feel like I’m stumbling a bit in the dark here. Would appreciate anyone able to connect some of the dots.

My BehindMLM security protocols stop me from creating an account on the OC Superior Court website to search for the Batched lawsuit by party name.

namesearch.occourts.org/

If anyone’s able to pull up the case number that’d be appreciated. Or better still provide a copy of the OC court case complaint. It’s out there as per the originally linked Reddit post.

Here is the link below to the full court document from the Superior Court of California.

This document explains how BATCHED was formed and a lot of history and what is going on now. Sorry I didn’t post it before.

docdro.id/wK3OCHo

Thanks for that. Looks like there’s a lot to cover tomorrow.

Update: so apparently Oscar has found a new company willing to invest in his technology.

The telegram group has now been unblocked and everyone on there was asked to email Kathy directly if you want to go with this new company or opt out.

If you opt out, it just means that you can claim that you lost your investment for tax purposes, and you can always choose to file what may be a class-action law suit against Oscar’s former partner for scamming everyone and taking off.

If you opt in, then you will be onboarded with the new company. However, zero details have been released about who the new company is and what that means for all previous Batched Node holders.

The contract is “still in negotiations” and no info has been released. So we have zero idea what it means for us and what we will be asked to do; if we will still get to keep our previous nodes; if our investment is brought over; if we have to invest more money…. Nothing has been told to us yet. So that’s where we stand.

Also, apparently, this new investing company will be a total “shock” or “huge surprise” to us all; someone big we would never dream of.

Batched investors are being asked to agree to have their info shared with a new company, with no information about the new company shared? Um, what?

Is the new company the NextGen Ponzi scheme?

https://behindmlm.com/companies/oscar-garcia-providing-payment-processing-to-nextgen-ponzi/

Screenshots of the Telegram group would be appreciated (either post public links here or reach out via contact form).

Relating to your last post…. YES, that’s pretty much exactly correct. We have zero information on this new company, if we lose our nodes, I’d we will be asked to pay more money, etc…

Here is the latest update by the Telegram group leader, which is very vague by the way, but this is what it said:

If this “co-owner” (MICAH) is the same person I am familiar with, he is notorious for being involved in -and leading the charge- in multi-level marketing projects. The type of projects in which everyone buys in under him and then they invite five, and they invite five, etc….

He’s a very soft spoken and handsome guy and he runs a crypto group in which they interview and look for the next up and coming project, and then when he finds it, he uses the group to push it and sign up.

I don’t know if it’s the same Micah, but if it is, I don’t see how this is big and exciting news. In fact, it would be a massive disappointment considering the leader of the Batched telegram group said we’d be shocked by who was looking to be an investor and owner.

Guess I’ll wait and see.

Thanks for the update. Not sounding like NextGen but I guess we’ll have to wait for more information.

So This was the big news? the big investor? we were waiting for? That gives me zero confidence that this new direction for Batched will amount to anything at all.

When I learn more about the zoom meeting and they have another one open to those haven’t heard it yet, I’ll get back and post more on here.

YUP!!! TOLD YOU!!! I was right.

So the zoom video was released to the rest of the Batched Telegram Group which is now called (NEW COMPANY-HOLDING ROOM).

I’ll sum it up:

You listen to smooth talking Micah Theard. He tells you all about Miracle Cash and More…. And basically it comes down to this… if you were with Batched (which doesn’t exist anymore), then you can buy a Node at a discount into Micah’s Miracle Cash. If you buy a node right now, it’s about $800. But regular people will be paying about $2000 per node.

So there is NO Batched merger with a new company, that was misleading. Your investment and old Batched Node(s) are gone, and there is no indication that Oscar’s Batched technology is even coming over to Miracle Cash and More; there would be no need for it.

My guess is that Oscar will get a nice commission from Micah for handing him over all these old Batched customers that sign up.

You all may as well start a new thread following Miracle Cash and More Batched is officially dead.

Yo… so Batched node positions = sorry for your loss.

But Micah Theard is selling the same thing as Miracle Cash & More node positions for $800.

Why the f. would anyone invest in the same Ponzi model they already lost money in once?

Why would anyone invest? Because Micah is pitching that he bought Oscar’s Batched Technology and that it’s now a part of MIRACLE CASH AND MORE (AKA Cash Flow NFT), and that if you buy the $800 Node, you own a “share” and will be entitled to a portion of money that is being held in a specific account.

Yeah… it all sounds like another Ponzi Scheme. And I’d bet that Micah simply just bought access to all of OSCAR’s node holders that will now spend money on this new company.

Folks. My suggestion is this. Don’t get cute… if you have money and want to get into crypto, then simply by Bitcoin, or any other major platform such as Ethereum, Matic, Cardano, or VeChain.

Odds are, any so-called token created by Miracle Cash, will likely run on Ethereum’s platform anyways, just like all the other thousand of crypto projects out there that will fail.

Don’t try to get cute with your money thinking you’re going to score a million off a thousand dollar investment. And remember, even the blockchains I just mentioned above, will likely have huge returns over the years anyways.

Thanks for info.

Hey guys ,

I recently met up with one or several of the individuals connected to this case .. they were offering me services pertaining to NFT technology as well as asset backing.

I have a direct connection with them due to the nature of our new relationship (Micah as well as some others).

Upon closer look I found out that they raised 20+ millions from the US and funneled it into Europe . I can’t give more details but I would like to report this issue to the authorities .. which would be appropriate avenue?

Seeing as the SEC are investigating probably best to file a complaint through their website.

I am a SEC attorney reviewing the Batched matter. You can reach out to me directly. Look forward to hearing from you.