iX Global securities fraud continues with CloudX

Following the collapse of its short-lived IN8 NFT Ponzi scheme, iX Global has tripled down on securities fraud with CloudX.

Following the collapse of its short-lived IN8 NFT Ponzi scheme, iX Global has tripled down on securities fraud with CloudX.

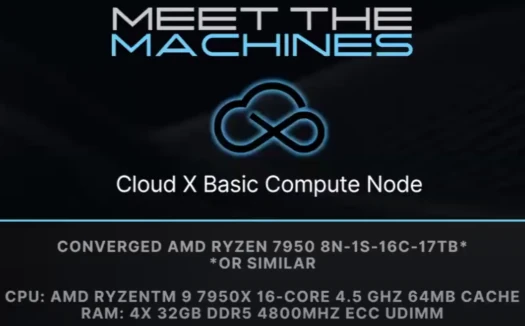

In a nutshell, iX Global’s CloudX is a variation of the “node positions” model, except blockchain has been swapped out for web hosting.

The ruse this time around is CloudX hosting services:

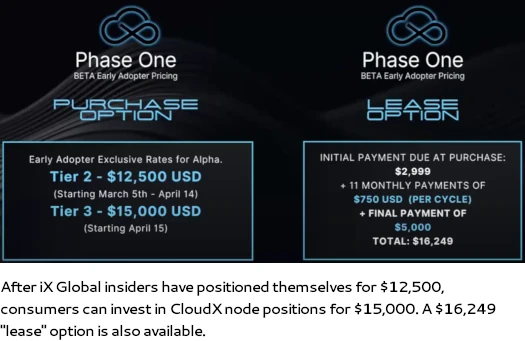

iX Global affiliates can invest in CloudX node positions for $15,000 outright or $16,249 leased.

Outside of the US, iX Global affiliates can invest as little as $250 for a smaller node investment position.

iX Global markets CloudX as a “hybrid cloud” service, “powered by IN8 Tech”.

IN8 is a company owned by iX Global owner and wanted fugitive Joe Martinez.

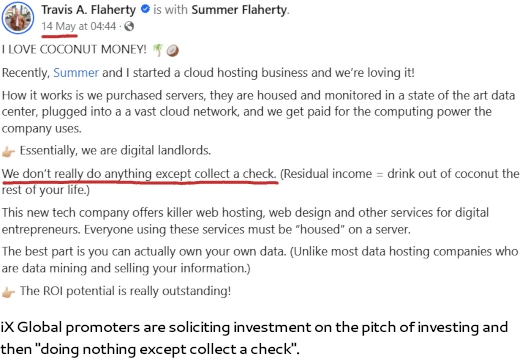

Here’s the pitch from top iX Global promoter Travis Flaherty (right);

Here’s the pitch from top iX Global promoter Travis Flaherty (right);

[11:01] It’s a hybrid cloud with decentralized ownership [editor’s note: CloudX is “powered by IN8 Tech” which is owned by Joe Martinez, there’s nothing decentralized about it].

So instead of us going in and spending hundreds of millions of dollars to build some data center somewhere, and then fill it with racks upon racks of servers, what we are doing is we are giving the average person the ability to be able to be an owner of that equipment. And be able to house it in one of our data storage centers.

We provision the equipment. We monitor the equipment and ultimately help you even fill the equipment.

And guess what? You generate a revenue as a “digital landlord”.

[11:57] Once you own or lease to own and you have your equipment, it’s shipped over to our data centers.

They rack it and stack it, they get it plugged into our cloud, and then we start helping you load your server with tenants. And you get paid based on the usage.

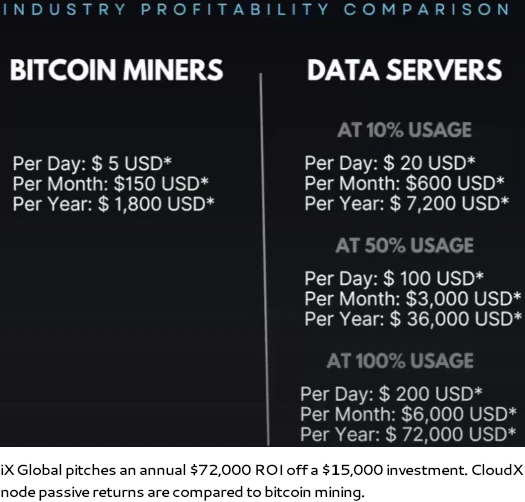

Passive returns pitched by iX Global top out at $72,000 annually of a single $15,000 investment.

So that’s iX Global’s CloudX marketing pitch. Now lets get into the problems.

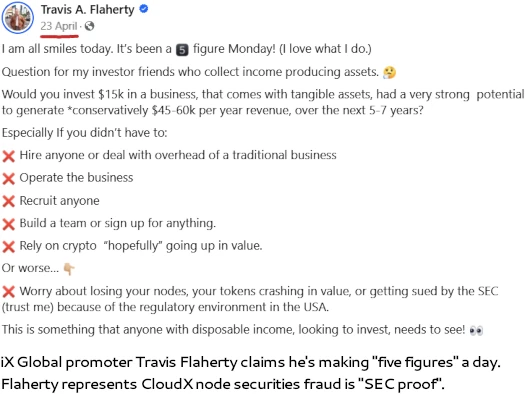

First and foremost, as per the Howey Test, iX Global’s CloudX node investment scheme constitutes a securities offering.

The Howey Test is four criteria an asset must meet to qualify as an “investment contract.”

If the asset is an “investment of money in a common enterprise, with a reasonable expectation of profits to be derived from the efforts of others” it is considered a security.

It is then subject to disclosure and registration requirements under the Securities Act of 1933 and the Securities Exchange Act of 1934.

iX Global affiliates invest $15,000 into iX Global/CloudX/IN8 Tech (a “common enterprise”).

This is done on the promise of daily passive returns (“a “reasonable expectation of profits”), represented to be funded through the efforts of others (“derived from the efforts of others”).

All an iX Global affiliate does is invest $15,000 per node investment position they want. iX Global populates each node investment position with “usage”, corresponding to the daily ROI rate paid out ($2 a day per 1% of claimed usage).

Neither iX Global, CloudX or IN8 Tech or owner Joe Martinez (right) are registered with the SEC. This constitutes securities fraud.

Neither iX Global, CloudX or IN8 Tech or owner Joe Martinez (right) are registered with the SEC. This constitutes securities fraud.

Tellingly, there is no mention of the CloudX node investment scheme on iX Global’s website.

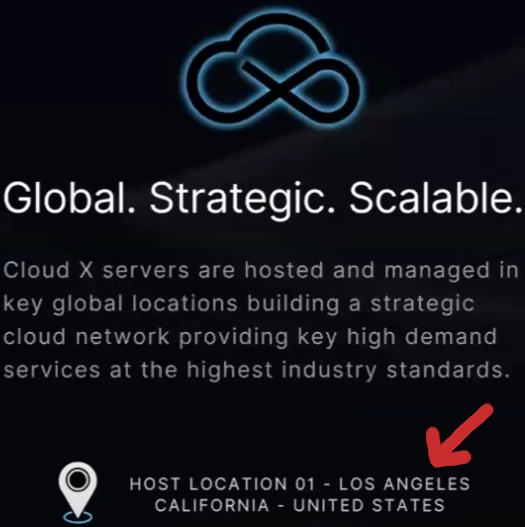

As to iX Global’s node investment scheme model itself, iX Global marketing represents CloudX’s/IN8 Tech’s “data storage center” is based out of Los Angeles, California.

Consumers have no way to verify if this information is accurate. Furthermore, neither CloudX or IN8 Tech appear to exist outside of iX Global’s marketing.

There are a few “CloudX” companies but none of them have anything to do with iX Global. IN8 Tech doesn’t have any digital footprint to speak of.

This brings us to the “we’ll populate your hosting node with clients” section of iX Global’s marketing. If neither IN8 Tech or CloudX have a verifiable web presence, how on Earth are they marketing anything to anyone? Who are these clients and how are they being solicited?

Furthermore, if iX Global can generate $72,000 annually off a $15,000 investment, and they’ve already got a data center up and running, what do they need your money for?

At even 10% of iX Global’s claimed “usage” you’re still looking at a $7200 annual ROI. If iX Global can’t utilize more than 10% of its web hosting capacity after a year of operation I’d suggest the business isn’t viable.

So if we assume usage will be more than 10% within a year, that more than likely brings iX Global into profit per node investment position.

So again, why bog that down with an MLM compensation plan paying commissions if iX Global is doing all the work (buying the equipment, hosting the equipment and generating usage tied to the daily ROI rate)?

From a regulatory and common-sense angle, iX Global’s CloudX node investment scheme makes no sense. Well, only if taken at face value.

If you factor in iX Global’s securities fraud in the US with Debt Box (pegged at $110 million), securities fraud and money laundering in India which is the subject of an ongoing criminal investigation, and the short-lived IN8 NFT Ponzi scheme… things become more obvious.

- iX Global –> AI trading bot –> run through Debt Box

- iX Global –> forex trading bot –> run through TP Global FX

- iX Global –> NFT token staking Ponzi scheme –> run through Debt Box

- iX Global –> web hosting investment scheme –> run through CloudX and IN8 Tech

As of May 2024 SimilarWeb tracked ~6500 monthly visits to iX Global’s website.

The top three sources of traffic are India (23%), Turkey (18%) and the US (14%). So once again we can see iX Global is targeting Indian and US consumers with another fraudulent investment scheme.

Following voluntary dismissal of the SEC’s $110 million dollar fraud case against iX Global last month, it’s expected the federal regulator will refile at some point.

Through continued securities fraud efforts iX Global have demonstrated that, unless stopped by a regulator, consumers in the US and elsewhere will continue to be harmed.

great report. you are a great value to the community oz!!! STEF

I read somewhere where troy doodly mentioned that ix global was more of an incompetence than a malice.

1. imagine online education and signal where a subscriber has 2 pay USD 115/145/180 per 28 days – who do you think will pay for it ?

2. investment in unauthorised forex trading platforms where high returns for your investments in forex or gold – 5-25% per month ?

3. buy a piece of land or avatar in USD 1750 which will give you 20-50 Usd per day

4. invest in “decentralised” cryptocurrency (generated by debt box /ix global) USD 750-12000 per licence which will increase overtime

now this

WHO SEES NO MALICE IN THIS IS A GREAT MAN .