iX Global & Debt Box continue securities fraud with IN8 NFT grift

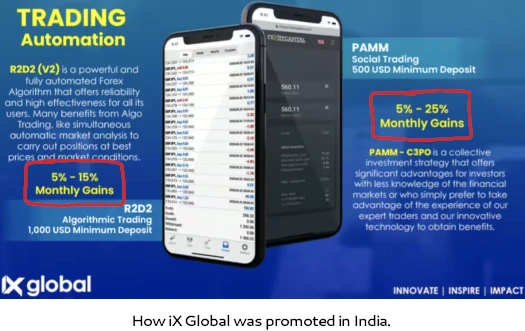

Between the SEC suing it for securities fraud and Indian authorities arresting money launderers, iX Global’s original forex and crypto mining ruses are dead.

Between the SEC suing it for securities fraud and Indian authorities arresting money launderers, iX Global’s original forex and crypto mining ruses are dead.

In an effort to continue violating US federal securities law, iX Global has announced a new NFT “rewards” grift.

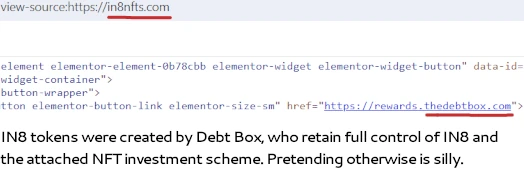

iX Global’s new NFT grift is run through IN8 tokens. IN8 is a BEP-20 token, created by Debt Box.

BEP-20 tokens can be created in a few minutes at little to no cost.

Despite having clear ownership, “decentralization” is a key IN8 marketing point. This is from IN8’s whitepaper;

iX believes that the decentralization movement is the future, and that it’s a movement happening on many fronts.

The IN8 NFT project, powered by D.E.B.T., is a global decentralized rewards program in sync with the entire iX ecosystem in support of the iN8 tokenomics.

This is of course baloney. iX Global is owned by Joseph Martinez (right).

This is of course baloney. iX Global is owned by Joseph Martinez (right).

Debt Box (aka D.E.B.T) is owned by Jason Anderson, Jacob Anderson, Schad Brannon and Roydon Nelson.

These individuals centrally control all aspects of IN8 and its attached NFT “rewards program”.

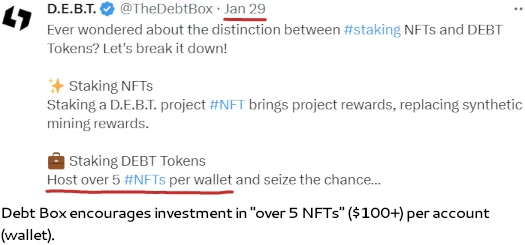

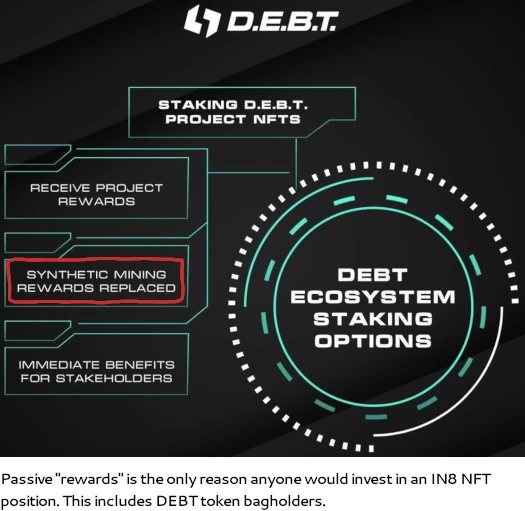

iX Global is selling 200,000 IN8 investment positions as NFTs. Each IN8 NFT costs $25 and provide access to a staking investment scheme.

At the launch of the IN8 project, 200,000 NFTs will be made available to wallets that have staked a DEBT token.

In order to participate in the IN8 project, all NFTs are required to be minted and staked.

A minting fee of $25 per NFT is required to mint NFTs.

Reward distributions to NFT owners will begin only after all IN8 NFTs have been minted.

Users must manually “stake” their NFT to a third-party platform, such as the D.E.B.T. platform, in order to receive reward distributions.

In a nutshell; purchase DEBT tokens (another centrally controlled cryptocurrency), use DEBT tokens to invest in $25 NFT positions, stake NFTs (park them with Debt Box), get paid passive rewards.

DEBT tokens are leftover from a previous Debt Box investment scheme, tied to various fictional revenue generating ruses (as alleged by the SEC).

Passive rewards are paid in IN8, which is generated on demand (up to 888 million). All of this is coordinated through a smart-contract, owned and set up by Debt Box.

Cashing out IN8 occurs through Debt Box. The only identified sources of funding are

a portion of the corporate revenue from lifestyle products, mentorship programs, and other services provided by iX.

After the SEC filed suit in August iX Global tried to reboot as an education platform. That flopped hence the NFT investment scheme grift.

Part of iX Global’s “services” includes selling $25 NFTs. 200,000 NFTs sold for $25 comes to a quick $5 million.

Oh and IN8 NFT investors are also slugged with all sorts of hefty fees:

- 10% passive rewards fee

- 10% transaction fee

- $1 withdrawal fee

- “additional fees may apply”

Beyond that there doesn’t seem to be a plan to allow investors to keep cashing out.

There is a plan to launch an endless parade of NFT investment schemes however – and this is tied to existing DEBT token bagholders;

By staking DEBT token, users will be rewarded an opportunity to receive free NFTs from each upcoming Version 2 project.

Each wallet can stake up to 5 DEBT tokens*. When a wallet stakes a DEBT token, that wallet is eligible to receive one free NFT per future project per DEBT token staked (for example: 3 DEBT tokens staked = 3 free NFTs from all future projects while staked and while supplies last).

All NFTs must be minted (for a fee) and staked to receive reward distributions.

Seemingly aware it is violating US securities law, the IN8 NFT investment scheme whitepaper states;

DEBT token staking is not ROI staking.

NFT owners are NOT making an investment into iX Ventures, the IN8 project, third-party partners, affiliates, or parents.

As explained above, this is clearly nonsense. Calling a passive return a “reward” doesn’t change what it is.

Specifically, with respect to US securities law, we can apply the Howey Test to iX Global’s IN8 NFT investment scheme.

The U.S. Supreme Court’s Howey case and subsequent case law have found that an “investment contract” exists when there is the investment of money in a common enterprise with a reasonable expectation of profits to be derived from the efforts of others.

With respect to iX Global’s IN8 NFT investment scheme:

- a $25 investment is required to obtain an NFT investment position

- the $25 investment is made into Debt Box (through iX Global), both of which constitute common enterprises

- the only reason anyone would invest into an IN8 NFT investment position is the advertised “IN8 Rewards Program”

- rewards paid out through the IN8 Rewards Program are passive in nature and derived via the efforts of Debt Box and iX Global (“others”).

As you can see, iX Global’s IN8 investment positions satisfy every prong of the Howey Test.

Like the passive returns forex scheme before it, once again iX Global and Debt Box are violating US securities law.

As it stands the SEC intends voluntarily dismiss the $110 million securities fraud case it brought against iX Global and Debt Box.

This is due to original attorneys handling the case mixing up some dates when applying for a TRO. It has nothing to do with iX Global’s and Debt Box’s alleged securities fraud.

With a new group of “experienced trial attorneys” assigned the case, it’s expected the SEC will refile at some point. Aligning with ongoing parallel criminal proceedings in India, the DOJ might also file criminal charges.

Whether iX Global’s new IN8 NFT investment scheme factors into a refiled lawsuit or criminal charges, remains to be seen.

Update 29th March 2024 – IN8 NFT has collapsed.

Idiots will still fall in line to buy. No amount of evidence can convince someone who’s delusional.

IX Global must know it’s customer base are delusional idiots. You’d think they’ll sail off in the wind while they can, not continue another ponzi.

The crypto community is using this to push for regulations lol.

Regulations are needed, but to only see this case as one sided while not investigating IX Global, and Debt Box to see why the SEC made these claims seems like an agenda at play for the attorneys in the crypto space who covered this update.

Victims are fooled into investing when the fraudsters and their cronies misguide them with examples of bitcoin and other cryptos (which are actually decentralised).

Investigations are currently on with other agency (in the US) checking the connection between ix global and debt box (in Dubai and UAE) .

@MJ

Securities regulations in the US have been around since 1933. You can offer a security in any medium, it still falls under the same laws.

Unfortunately crypto is full of financially illiterate dumb fucks who are completely ignorant of securities law. Bitconned on NetFlix is a good watch.

If you want to run an investment scheme in crypto, register with the SEC and file periodic audited financial reports. It’s not hard.

Reason nobody does is because every crypto investment scheme = Ponzi.

@OZ The crypto community has been calling over regulatory oversight by congress for crypto, not necessarily securities.

The crypto community wants to use the attorneys misrepresenting of facts for the ix global/debt box TRO as a way to go after the SEC, so congress steps in to regulate crypto.

I think them using this ponzi scheme as a way to demand that the SEC stop’s over sighting crypto is an unethical approach without actually researching into this ponzi.

That’s like calling for regulatory oversight of USD. The US already has laws that cover what is being done with crypto.

Problem is crypto bros don’t like the laws, because running scams is illegal.

With the new crypto divisions in the SEC and DOJ things are only going to ramp up. That and governments around the world are probably sick of the crypto scam complaints from consumers.

Crimmy charges against CZ then go after Paulo and the tether pumpers (only reason crypto hasn’t collapsed at the moment).

Popcorn stonks rising.

@Don We What other agencies in the U.S are investigating IX Global?

@Oz I agree with that 100% Hopefully the judge doesn’t go through with sanctions against the SEC, so a refiling can occur.

I can’t imagine ix global and debt box getting off the hook with this, especially with the connections to money laundering in India.

Debt box charging Usd 25-100 for letting the investors access their accounts. payment via binance.

should we pay more ? what say ?

No reason for them to be charging you to access your money.

Pay up if you want to contribute to legal fees I guess.

After the recent court orders against the SEC, what are your thoughts now?

With respect to IN8? The SEC getting sanctioned for getting some dates wrong and doesn’t change the underlying securities fraud – both in the SEC’s original case and the recent IN8 NFT grift.