My Advertising Pays TRO against VX Gateway denied

![]() Following a hearing on December 7th, the Temporary Restraining Order My Advertising Pays had sought against VX Gateway has been denied. [Continue reading…]

Following a hearing on December 7th, the Temporary Restraining Order My Advertising Pays had sought against VX Gateway has been denied. [Continue reading…]

Amazing Living Review: Soursop tea and autoship recruitment

An Amazing Living press-release identifies Robert Aveyard as CEO of the company.

An Amazing Living press-release identifies Robert Aveyard as CEO of the company.

No information about Aveyard is provided on the Amazing Living website.

My own research didn’t turn up anything, which is a bit suspicious.

The Amazing Living website domain (“myamazingliving.com”) was registered on September 2nd, 2016. Thomas Nash is listed as the owner, with an address in Ontario, Canada also provided.

Again, I wasn’t able to find any information on Nash specific to Amazing Living.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

My Crypto World Review: MyCryptoCoin pump & dump scheme

There is no information on the My Crypto World website indicating who owns or runs the business.

There is no information on the My Crypto World website indicating who owns or runs the business.

Both My Crypto World website domains (“mycryptoworld.com” and “mycryptoworld.net”) were registered privately on September 15th, 2015.

Alexa currently estimate that traffic to the My Crypto World dotcom domain is primarily sourced from the US (37%) and Germany (32%).

This suggests that whoever is running My Crypto World is likely based out of one or both of these countries.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

VX Gateway respond to MyAdvertisingPays’ lawsuit

![]() I checked the docket earlier and as of yet there’s no news regarding today’s TRO and preliminary injunction hearing.

I checked the docket earlier and as of yet there’s no news regarding today’s TRO and preliminary injunction hearing.

In the last twenty-four hours however, VX Gateway has filed a response in opposition to My Advertising Pay’s motion. [Continue reading…]

Passive Crypto Review: Seven tiers of bitcoin cash gifting

![]() There is no information on the Passive Crypto website indicating who owns or runs the business.

There is no information on the Passive Crypto website indicating who owns or runs the business.

The Passive Crypto website domain (“passivecrypto.com”) was privately registered on November 28th, 2016.

If you visit the Passive Crypto website without a referral code, the site informs you that you’ve been “invited by Passive Crypto”.

If you then click “register”, the site informs you that your referring affiliate is Muhammad Shakeel.

This is a static name, with Muhammad Shakeel appearing to be the owner of the Passive Crypto admin account.

Muhammad Shakeel is a common name in Pakistan, however I wasn’t able to conclusively narrow down the owner of Passive Crypto.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

AmeriPlan Review: Discount medical plans

AmeriPlan launched in 1992 and are based out of Texas in the US.

AmeriPlan launched in 1992 and are based out of Texas in the US.

So the story goes;

In the early 90’s, identical twin brothers Dennis and Daniel Bloom saw the need for a value-oriented discount fee-for-service dental program, and founded AmeriPlan Corporation.

Soon Dennis and Daniel expanded their vision to include a broad array of high quality, affordable healthcare programs.

To provide greater value to the consumer, they added prescription medication, vision and chiropractic care to the program at no additional charge.

Through research, trial and error and perseverance, the brothers determined that by using the best features of the direct sales marketing model, they could provide financial opportunity to thousands of people and bring these needed healthcare programs to the public.

In addition to co-founding AmeriPlan, Dennis Bloom (left) serves as CEO and Chairman of the Board. Daniel Bloom (right) is President and COO.

In addition to co-founding AmeriPlan, Dennis Bloom (left) serves as CEO and Chairman of the Board. Daniel Bloom (right) is President and COO.

According to a 2001 article published in Network Marketing Lifestyles Magazine, the Bloom’s corporate experience began with providing marketing services for independent accountants.

As their CPA customer base grew, the Blooms wanted to be able to provide them with one-stop shopping, offering hospitalization, life insurance, mutual funds – whatever they needed.

Soon they started getting requests for a good dental program that independents could afford.

This eventually lead to the formation of a discounted fee-for-service provider access organization.

Their CPA customers loved the program … and so did their customers – The CPA’s were bringing them referrals!

Dennis and Daniel soon realized they were making more money from their little $15-per-month dental program than from everything else they were doing.

Now they knew they had found their niche.

They sold their CPA services company and in November 1992 formally incorporated AmeriPlan to market their own dental program.

On the regulatory side of things, AmeriPlan ran into problems with the Montana State Auditor.

In July, 2006

Montana State Auditor John Morrison issued a cease and desist order after charging AmeriPlan USA, its founding officers, Dennis and Daniel Bloom, and Shirl Shelley, a Montana resident, with numerous violations of both the Montana Insurance Code and the Montana Securities Act.

AmeriPlan settled the allegations a few months later for $200,000.

Under the agreement, AmeriPlan must pay an administrative fine of $200,000 and create a restitution fund for Montana customers who were duped by the company.

Montana customers of AmeriPlan can expect to receive a letter informing them that they are eligible to submit a claim to the restitution fund.

In addition, AmeriPlan is banned from marketing and selling its products in Montana for two years.

The problem, as it were, was AmeriPlan had been signing up customers in Montana despite most customers being

unable to use the discount cards because there were few, if any, providers in Montana.

Additionally, AmeriPlan (was) charged with conducting an illegal pyramid promotional scheme because it sold “broker packages” for the purpose of recruiting memberships.

Because the memberships were for discounts that did not exist, Morrison alleged there was no actual product being sold.

That, as far as I can see, is the only run-in AmeriPlan has had with regulators in twenty-four years.

Read on for a full review of the AmeriPlan MLM opportunity. [Continue reading…]

My Advertising Pays sues VX Gateway for $59.6 million dollars

![]() While scammers are happy to defraud the general public out of millions of dollars each year, turns out they themselves don’t like being scammed.

While scammers are happy to defraud the general public out of millions of dollars each year, turns out they themselves don’t like being scammed.

Yeah I know, shocking… [Continue reading…]

Sport Social Market Review: Bitcoin based virtual share trading

Sport Social Market provide no corporate contact details on their website.

Sport Social Market provide no corporate contact details on their website.

The Sport Social Market Terms and Conditions however state the company is owned by “YOKA TÉCNICA S.L” and that the agreement is bound to the ‘legislation and jurisdiction of Barcelona, Spain‘.

Yoka Tecnica is a Spanish corporation who cite their primary business as the “development of recreation, entertainment and investment”.

The Sport Social Market website identifies Toni Freixia (President) and Rafael Moya (CEO) as co-founders of the company. Presumably the two also co-own Yoka Tecnica.

The Sport Social Market website identifies Toni Freixia (President) and Rafael Moya (CEO) as co-founders of the company. Presumably the two also co-own Yoka Tecnica.

Freixia has a legal background with a practice that specializes in Civil, Merchant, Procedural and Sports law.

Freixa doesn’t appear to have an MLM history, which is where Rafael Moya comes in.

In 2013 Moya was promoting the Lucrazon Global Ponzi scheme. He seems to have taken a break from MLM after Lucrazon Global collapsed in 2014.

Read on for a full review of the Sport Social Market MLM opportunity. [Continue reading…]

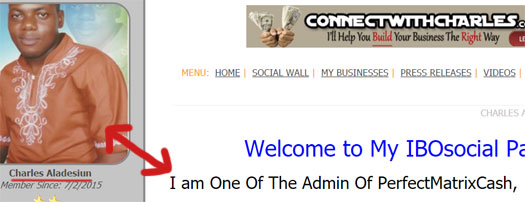

Perfect Matrix Cash Review: $2.50 chain-recruitment scheme

There is no information on the Perfect Matrix Cash website indicating who owns or runs the business.

There is no information on the Perfect Matrix Cash website indicating who owns or runs the business.

The Perfect Matrix Cash website domain (“perfectmatrixcash.com”) was privately registered on October 2nd, 2016.

The official Perfect Matrix Cash Facebook markets the opportunity using the Nigerian Naira. Alexa also currently estimate that 84% of all traffic to the Perfect Matrix Cash website originates out of Nigeria.

The admin referral link used to promote Perfect Matrix Cash on the group is “oluseunsina”.

Further research reveals this referral link belongs to Charles Aladesiun, who identifies himself as “one of the admin [sic] of Perfect Matrix Cash”:

Aladesiun, who is based out of Nigeria, appears to have been scamming people in Ponzi schemes since at least 2012.

Recently Aladesiun was promoting the FutureNet Ponzi scheme. He also promoted the Helping Hands International pyramid scheme in 2014.

In April of 2015 Aladesiun launched Touching Lives International, a daily ROI Ponzi scheme. By July Touching Lives International had crashed.

Rather than admit he’d run out of newly invested funds to pay off existing investors, Aladesiun came up with the following story:

Last night i was robbed by Armed Robbers and my system and Phones are all gone.

They contain all the site login details. But hope the hosting company can help retrieve them.

Touching Lives International never came back up.

Read on for a full review of the Perfect Matrix Money MLM opportunity. [Continue reading…]

OneCoin now laundering funds directly through affiliates

OneCoin’s ongoing banking problems have taken a sinister turn, with the company potentially shifting criminal liability onto some of its affiliates. [Continue reading…]

OneCoin’s ongoing banking problems have taken a sinister turn, with the company potentially shifting criminal liability onto some of its affiliates. [Continue reading…]